In the rapidly evolving technology sector, Synopsys, Inc. and Arqit Quantum Inc. represent two intriguing players with distinct yet overlapping focuses in software infrastructure and cybersecurity. Synopsys leads with comprehensive electronic design automation solutions, while Arqit pioneers quantum encryption services. Comparing these companies highlights innovation strategies in protecting digital assets. Join me as we analyze which stock might offer the most compelling opportunity for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Synopsys and Arqit Quantum by providing an overview of these two companies and their main differences.

Synopsys Overview

Synopsys, Inc. specializes in electronic design automation software products that facilitate the design and testing of integrated circuits. Its offerings include digital design solutions, verification platforms, FPGA design products, and various intellectual property components. Serving diverse sectors such as electronics, automotive, and medicine, Synopsys is a well-established player headquartered in Mountain View, California, with a market cap near 99B USD.

Arqit Quantum Overview

Arqit Quantum Inc. delivers cybersecurity services via satellite and terrestrial platforms, focusing on encryption through its QuantumCloud software agent. Based in London and operating primarily in the UK, Arqit is a smaller, emerging firm in the technology sector with a market cap of approximately 416M USD. The company went public in 2021 and employs around 82 people.

Key similarities and differences

Both Synopsys and Arqit operate in the technology sector within software infrastructure, emphasizing security and innovation. However, Synopsys offers a broad portfolio of design and verification tools for hardware and software integration, serving global, diverse industries. In contrast, Arqit concentrates narrowly on quantum-based cybersecurity solutions, targeting encryption services primarily in the UK market, reflecting differences in scale, market presence, and product scope.

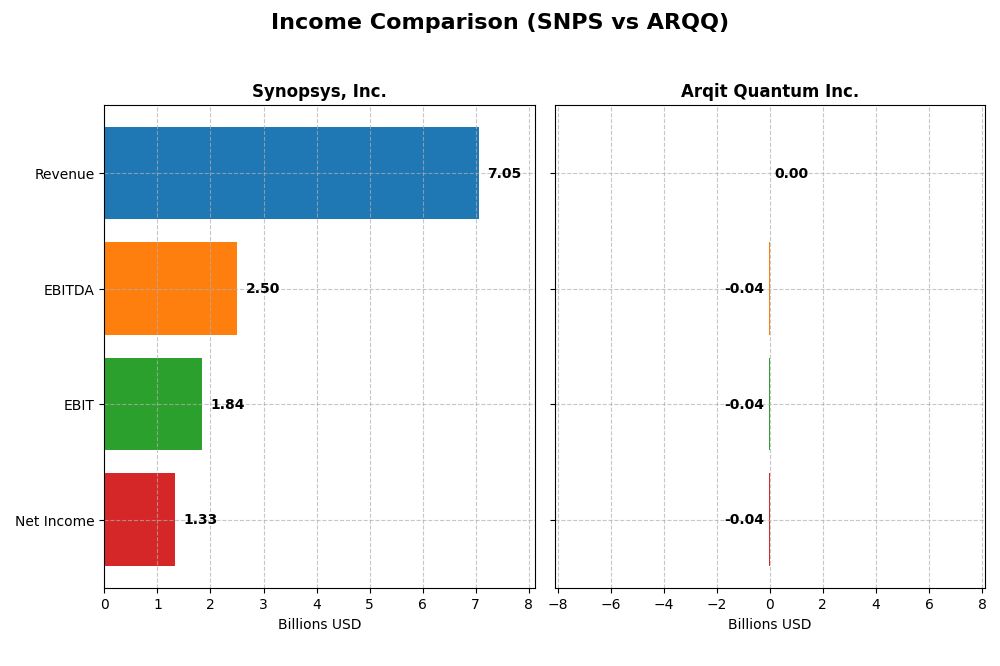

Income Statement Comparison

The table below compares the most recent fiscal year income statement metrics for Synopsys, Inc. and Arqit Quantum Inc., highlighting key financial figures to assist in analysis.

| Metric | Synopsys, Inc. (SNPS) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Market Cap | 98.8B | 416M |

| Revenue | 7.05B | 530K |

| EBITDA | 2.50B | -36.8M |

| EBIT | 1.84B | -37.6M |

| Net Income | 1.33B | -35.3M |

| EPS | 8.13 | -2.56 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Synopsys, Inc.

Synopsys experienced steady revenue growth from 2021 to 2025, rising from 4.2B to 7.1B USD, with net income increasing from 758M to 1.33B USD over the same period. Margins remained robust, with a gross margin near 77% and an EBIT margin above 26% in 2025. Despite a slowdown in net margin and EPS growth recently, overall profitability and revenue trends remain favorable.

Arqit Quantum Inc.

Arqit showed significant revenue growth from 48K USD in 2021 to 530K USD in 2025, with net losses narrowing substantially though still negative at -35M USD in 2025. Margins remain deeply negative, with a gross margin of -43% and an EBIT margin of -7088% in 2025. Notably, revenue and net income growth rates were strong, but operating losses and negative margins continue to challenge the company’s profitability.

Which one has the stronger fundamentals?

Synopsys demonstrates stronger fundamentals with consistent revenue and net income growth, favorable margins, and positive earnings per share, despite some recent margin pressure. Arqit, while showing remarkable growth rates, continues to operate at significant losses with highly negative margins, indicating higher risk and less stable fundamentals relative to Synopsys.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Synopsys, Inc. (SNPS) and Arqit Quantum Inc. (ARQQ) based on their most recent fiscal year data.

| Ratios | Synopsys, Inc. (SNPS) 2025 | Arqit Quantum Inc. (ARQQ) 2025 |

|---|---|---|

| ROE | 4.7% | -129.8% |

| ROIC | 2.0% | -127.5% |

| P/E | 54.4 | -15.1 |

| P/B | 2.57 | 19.6 |

| Current Ratio | 1.62 | 2.69 |

| Quick Ratio | 1.52 | 2.69 |

| D/E | 0.50 | 0.03 |

| Debt-to-Assets | 29.6% | 1.7% |

| Interest Coverage | 2.05 | -802.9 |

| Asset Turnover | 0.15 | 0.012 |

| Fixed Asset Turnover | 5.04 | 0.74 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Synopsys, Inc.

Synopsys displays a mixed ratio profile with a favorable net margin of 18.96% and strong current and quick ratios above 1.5, indicating good liquidity. However, its return on equity (4.72%) and return on invested capital (1.97%) are weak, alongside a high price-to-earnings ratio of 54.36, suggesting valuation concerns. The company does not pay dividends, focusing on reinvestment and growth.

Arqit Quantum Inc.

Arqit shows predominantly unfavorable ratios, including a net margin of -6668.49% and deeply negative returns on equity and capital employed, reflecting significant losses. Liquidity ratios are favorable, with a current ratio of 2.69 and minimal debt levels. It does not pay dividends, likely due to ongoing development and reinvestment in its growth phase.

Which one has the best ratios?

Synopsys has a more balanced and neutral ratio profile, with several favorable liquidity and profitability measures despite some weaknesses in returns and valuation. Arqit’s ratios are largely unfavorable, marked by heavy losses and poor efficiency, though it benefits from strong liquidity and low leverage. Overall, Synopsys presents a comparatively stronger financial ratio set.

Strategic Positioning

This section compares the strategic positioning of Synopsys and Arqit Quantum, including market position, key segments, and exposure to technological disruption:

Synopsys, Inc.

- Established leader in electronic design automation, facing moderate competitive pressure in software infrastructure.

- Key segments include License and Maintenance, Technology Service, and IP products across multiple industries.

- Positioned in a mature market with incremental innovation; exposed to evolving software and semiconductor technology advances.

Arqit Quantum Inc.

- Emerging cybersecurity provider with focus on satellite and terrestrial encryption, operating in a niche market.

- Focused on QuantumCloud software for device encryption, serving cybersecurity through innovative quantum technology.

- Positioned in a disruptive quantum cybersecurity space, leveraging cutting-edge encryption but with higher uncertainty.

Synopsys vs Arqit Quantum Positioning

Synopsys has a diversified portfolio across design automation and IP, benefiting from broad industry exposure but facing mature market challenges. Arqit is concentrated on quantum encryption technology, offering innovative potential but with higher operational risk and limited scale.

Which has the best competitive advantage?

Both companies are currently shedding value relative to their cost of capital. Synopsys shows declining profitability with a very unfavorable economic moat, while Arqit, despite destroying value, exhibits improving ROIC and a slightly unfavorable moat, indicating relatively better potential for future competitive advantage.

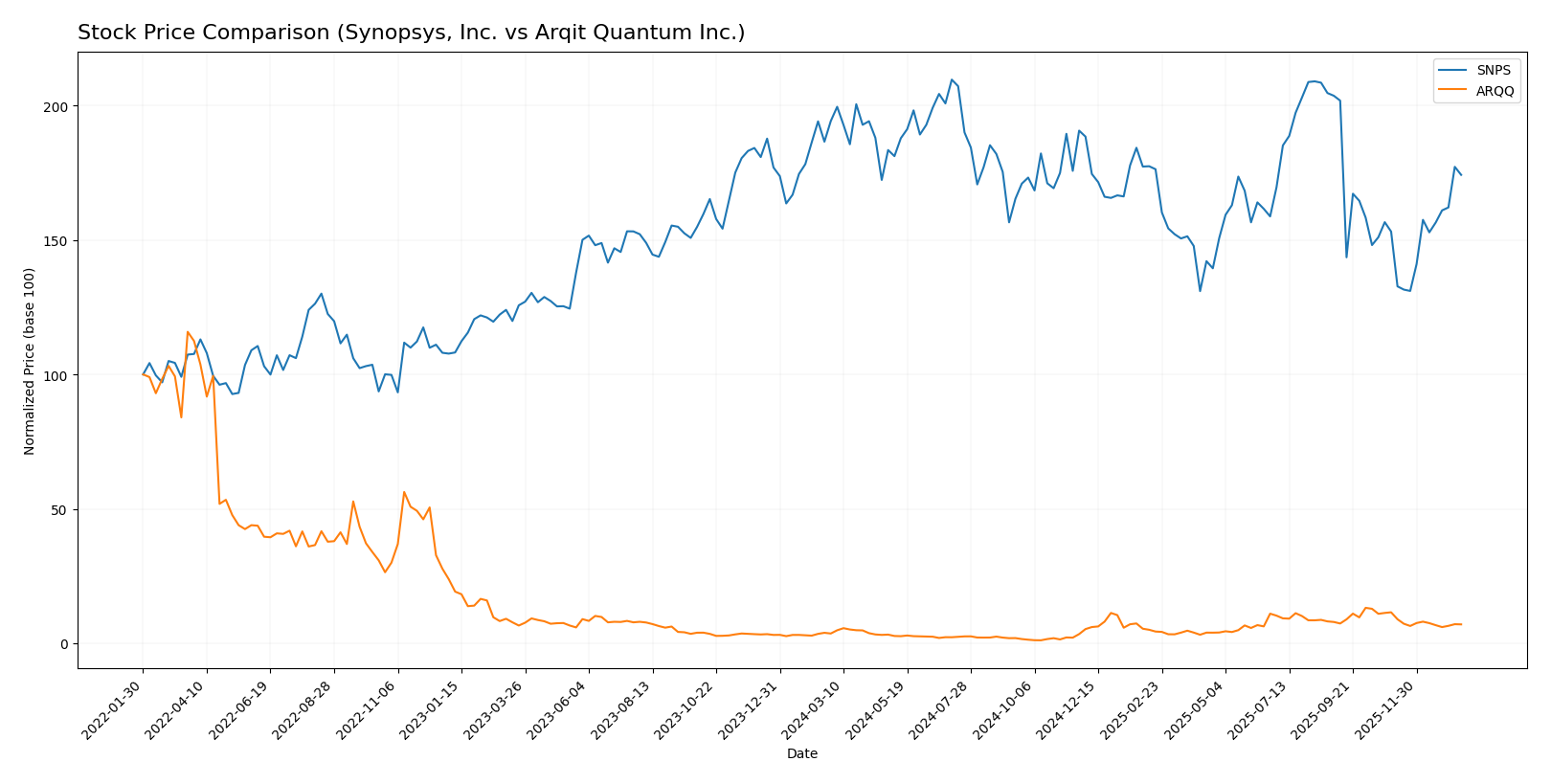

Stock Comparison

The stock price movements over the past 12 months show contrasting dynamics, with Synopsys, Inc. experiencing a notable decline while Arqit Quantum Inc. posted significant gains, although both have faced volatility and shifts in recent trading activity.

Trend Analysis

Synopsys, Inc. (SNPS) displayed a bearish trend over the past year with a -10.31% price change, marked by price acceleration and high volatility, peaking at 621.3 and bottoming at 388.13. However, the recent two-month period shows a 13.77% price rebound.

Arqit Quantum Inc. (ARQQ) delivered a strong bullish trend over the year with a 93.6% increase, though this growth decelerated. The stock ranged from 4.19 to 49.92, but recently declined by 39.03% in the last two months, indicating short-term weakness.

Comparing both, Arqit Quantum Inc. outperformed Synopsys significantly on a 12-month basis, showing the highest market performance despite recent volatility and a recent downturn.

Target Prices

Analysts present a clear consensus on target prices for Synopsys, Inc. and Arqit Quantum Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Synopsys, Inc. | 600 | 425 | 530 |

| Arqit Quantum Inc. | 60 | 60 | 60 |

Synopsys shows a consensus target price of 530, slightly above its current price of 516.31, indicating moderate upside potential. Arqit Quantum’s target consensus at 60 suggests a strong bullish outlook compared to its current price of 26.6.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Synopsys, Inc. and Arqit Quantum Inc.:

Rating Comparison

SNPS Rating

- Rating: B-, considered very favorable by analysts.

- Discounted Cash Flow Score: Moderate with a score of 3.

- ROE Score: Moderate efficiency with a score of 3.

- ROA Score: Moderate asset utilization with a score of 3.

- Debt To Equity Score: Moderate financial risk with a score of 2.

- Overall Score: Moderate overall financial standing with a score of 3.

ARQQ Rating

- Rating: C, also considered very favorable by analysts.

- Discounted Cash Flow Score: Moderate with a score of 2.

- ROE Score: Very unfavorable efficiency with a score of 1.

- ROA Score: Very unfavorable asset utilization with a score of 1.

- Debt To Equity Score: Favorable financial risk with a score of 4.

- Overall Score: Moderate overall financial standing with a score of 2.

Which one is the best rated?

Based strictly on the provided data, Synopsys holds higher ratings and better scores in discounted cash flow, ROE, ROA, and overall evaluation. Arqit scores better only in debt-to-equity, indicating a stronger balance sheet but lower profitability and asset efficiency.

Scores Comparison

Here is the comparison of the Altman Z-Score and Piotroski Score for the two companies:

Synopsys, Inc. Scores

- Altman Z-Score: 3.54, indicating a safe zone.

- Piotroski Score: 4, categorized as average.

Arqit Quantum Inc. Scores

- Altman Z-Score: -0.22, indicating a distress zone.

- Piotroski Score: 2, categorized as very weak.

Which company has the best scores?

Synopsys, Inc. shows stronger financial health with a safe Altman Z-Score and an average Piotroski Score. Arqit Quantum Inc. is in distress with a low Altman Z-Score and a very weak Piotroski Score.

Grades Comparison

The following presents the recent grades assigned by recognized financial institutions for Synopsys, Inc. and Arqit Quantum Inc.:

Synopsys, Inc. Grades

This table summarizes the latest grades and actions from reputable grading companies for Synopsys, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Downgrade | Neutral | 2026-01-13 |

| Morgan Stanley | Maintain | Overweight | 2025-12-12 |

| Rosenblatt | Maintain | Buy | 2025-12-11 |

| Keybanc | Maintain | Overweight | 2025-12-11 |

| Piper Sandler | Maintain | Overweight | 2025-12-11 |

| Needham | Maintain | Buy | 2025-12-11 |

| B of A Securities | Upgrade | Buy | 2025-12-11 |

| JP Morgan | Maintain | Overweight | 2025-12-11 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-11 |

| Rosenblatt | Upgrade | Buy | 2025-12-09 |

The overall grading trend for Synopsys, Inc. is positive with a majority of “Buy” and “Overweight” ratings, although the latest action includes a downgrade to “Neutral.”

Arqit Quantum Inc. Grades

This table presents the consistent grades given by HC Wainwright & Co. for Arqit Quantum Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-10-13 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-18 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-31 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-06 |

| HC Wainwright & Co. | Maintain | Buy | 2024-07-11 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-29 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-15 |

| HC Wainwright & Co. | Maintain | Buy | 2023-11-22 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-27 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-26 |

Grades for Arqit Quantum Inc. show a stable “Buy” rating consistently maintained by a single grading company over an extended period.

Which company has the best grades?

Synopsys, Inc. has received a broader range of grades from multiple firms, mostly positive, with some recent caution. Arqit Quantum Inc. shows a consistent “Buy” rating but only from one source. This diversity and higher frequency of positive grades for Synopsys may provide investors with more robust consensus insights.

Strengths and Weaknesses

Below is a comparative table highlighting the key strengths and weaknesses of Synopsys, Inc. (SNPS) and Arqit Quantum Inc. (ARQQ) based on their recent financial performance and market positioning.

| Criterion | Synopsys, Inc. (SNPS) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Diversification | Strong revenue from License and Maintenance (3.49B USD in 2025) and Technology Services; diversified product lines | Limited product diversification; primarily in quantum encryption technology |

| Profitability | Moderate net margin (18.96%), but low ROIC (1.97%) below WACC | Negative net margin (-6668.49%), negative ROIC (-127.45%), shedding value |

| Innovation | Established player with steady technology services | Emerging technology with growing ROIC trend, indicating improving innovation potential |

| Global presence | Well-established global footprint in semiconductor EDA tools | Early-stage company with limited global market penetration |

| Market Share | Significant share in electronic design automation sector | Small market share in nascent quantum cybersecurity market |

Key takeaways: Synopsys shows solid diversification and steady profitability but struggles with capital efficiency and value creation. Arqit Quantum, while currently unprofitable and shedding value, demonstrates promising improvement in profitability trends and innovation potential, albeit with higher risk due to its early-stage status. Investors should weigh Synopsys’s stability against Arqit’s growth prospects carefully.

Risk Analysis

Below is a comparison table summarizing key risks for Synopsys, Inc. (SNPS) and Arqit Quantum Inc. (ARQQ) based on the latest 2025 data:

| Metric | Synopsys, Inc. (SNPS) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Market Risk | Moderate (Beta 1.12) | High (Beta 2.41) |

| Debt level | Moderate (Debt/Equity 0.5) | Very Low (Debt/Equity 0.03) |

| Regulatory Risk | Moderate (Tech industry exposure) | Moderate (Cybersecurity, UK focus) |

| Operational Risk | Moderate (20K employees, global scale) | High (82 employees, early-stage) |

| Environmental Risk | Low (Software sector) | Low (Software sector) |

| Geopolitical Risk | Moderate (US-based, global exposure) | High (UK-based with satellite tech) |

Synopsys shows moderate market and operational risks with a solid debt level, while Arqit faces higher market and geopolitical risks, reflecting its early-stage status, volatile financials, and niche quantum cybersecurity focus. Arqit’s distress-level bankruptcy score and weak profitability highlight higher investment risk.

Which Stock to Choose?

Synopsys, Inc. (SNPS) shows favorable income evolution with strong gross and EBIT margins and positive net margin around 19%. Its financial ratios are mixed, with favorable liquidity and debt metrics but some unfavorable profitability ratios. Despite a very favorable rating (B-), the company is shedding value as ROIC is below WACC with a declining trend, indicating decreasing profitability.

Arqit Quantum Inc. (ARQQ) has a highly volatile income profile with large negative margins but strong revenue growth. Its financial ratios are mostly unfavorable, though liquidity and low debt stand out positively. Rated C with a slightly unfavorable moat, the company is also shedding value but with improving ROIC, suggesting growing profitability despite challenges.

Investors focused on stability and established profitability might find Synopsys’s favorable income statement and strong rating appealing, while those with a higher risk tolerance and growth orientation could interpret Arqit’s rapid revenue expansion and improving profitability as potential opportunities amid volatility.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Synopsys, Inc. and Arqit Quantum Inc. to enhance your investment decisions: