In today’s rapidly evolving technology landscape, Rubrik, Inc. and Arqit Quantum Inc. stand out as pioneers in the software infrastructure and cybersecurity sectors. Both companies focus on data protection but approach innovation differently—Rubrik emphasizes enterprise cloud security, while Arqit leverages quantum encryption technology. For investors seeking growth in cutting-edge security solutions, this comparison will reveal which company offers the most promising opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Rubrik and Arqit Quantum by providing an overview of these two companies and their main differences.

Rubrik Overview

Rubrik, Inc. delivers comprehensive data security solutions globally, focusing on enterprise, cloud, and SaaS data protection. Founded in 2013 and headquartered in Palo Alto, it serves diverse sectors including financial, healthcare, retail, and public services. With a market cap of 13.4B USD and 3,200 employees, Rubrik emphasizes cyber recovery and threat analytics to safeguard unstructured and structured data.

Arqit Quantum Overview

Arqit Quantum Inc. is a UK-based cybersecurity firm specializing in quantum encryption technologies delivered via satellite and terrestrial platforms. Its flagship product, QuantumCloud, enables secure key generation between devices. Founded earlier and publicly listed in 2021, Arqit operates with a smaller workforce of 82 employees and holds a market cap near 416M USD, focusing on innovation in quantum-safe encryption.

Key similarities and differences

Both Rubrik and Arqit Quantum operate in the software infrastructure sector within cybersecurity, emphasizing advanced data protection. Rubrik offers broad enterprise-scale solutions across multiple industries, while Arqit focuses on quantum encryption technology primarily through satellite systems. Their market caps and employee counts differ significantly, reflecting Rubrik’s larger scale and diversified client base versus Arqit’s niche specialization.

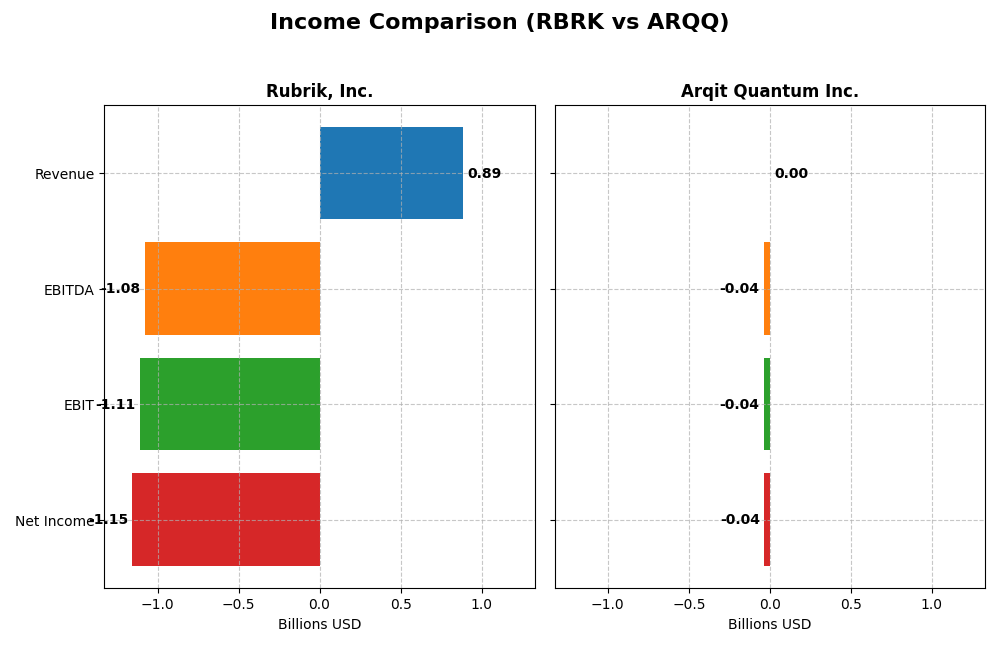

Income Statement Comparison

The table below compares the most recent fiscal year income statement metrics of Rubrik, Inc. and Arqit Quantum Inc., highlighting their financial performance indicators.

| Metric | Rubrik, Inc. (RBRK) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Market Cap | 13.4B | 416M |

| Revenue | 887M | 530K |

| EBITDA | -1.08B | -37M |

| EBIT | -1.11B | -38M |

| Net Income | -1.15B | -35M |

| EPS | -7.48 | -2.56 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Rubrik, Inc.

Rubrik’s revenue showed strong growth of 41.2% in the most recent year, reaching $887M, with an overall increase of 129% from 2021 to 2025. Despite a favorable gross margin of 70.0%, the company posted significant net losses, with net income dropping to -$1.15B in 2025. Margins deteriorated, particularly EBIT and net margin, indicating profitability challenges amid rising operating expenses.

Arqit Quantum Inc.

Arqit experienced rapid revenue growth of 80.9% in 2025, reaching $530K, and a remarkable 1006% increase over five years. Despite unfavorable gross and EBIT margins, the company improved net margin and EPS growth significantly in the latest year. Operating expenses remain high relative to revenue, but overall income statement trends suggest improving fundamentals with growing net income.

Which one has the stronger fundamentals?

Arqit’s income statement exhibits more favorable growth and margin improvements overall, with 64.3% favorable metrics compared to Rubrik’s 35.7%. Rubrik shows stronger gross margins but suffers from steep net losses and deteriorating profitability ratios. Arqit’s improving net margin growth and positive EPS trends suggest stronger fundamentals despite ongoing operating cost pressures.

Financial Ratios Comparison

The table below presents the most recent key financial ratios for Rubrik, Inc. and Arqit Quantum Inc., offering a side-by-side view of their financial performance and stability as of their latest fiscal year.

| Ratios | Rubrik, Inc. (RBRK) 2025 | Arqit Quantum Inc. (ARQQ) 2025 |

|---|---|---|

| ROE | 2.09% | -1.30% |

| ROIC | -2.35% | -1.27% |

| P/E | -9.79 | -15.12 |

| P/B | -20.42 | 19.62 |

| Current Ratio | 1.13 | 2.69 |

| Quick Ratio | 1.13 | 2.69 |

| D/E | -0.63 | 0.03 |

| Debt-to-Assets | 24.65% | 1.68% |

| Interest Coverage | -27.49 | -802.90 |

| Asset Turnover | 0.62 | 0.01 |

| Fixed Asset Turnover | 16.67 | 0.74 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Rubrik, Inc.

Rubrik shows a mixed ratio profile with strong return on equity (208.55%) and favorable price-to-earnings and price-to-book ratios, but faces challenges such as a negative net margin (-130.26%) and weak return on invested capital (-234.85%). Liquidity is adequate with a current ratio of 1.13. The company does not pay dividends, likely due to ongoing investments and reinvestment priorities.

Arqit Quantum Inc.

Arqit exhibits predominantly weak financial ratios, including a deeply negative net margin (-6668.49%), negative returns on equity and invested capital, and a high weighted average cost of capital (15.16%). While liquidity ratios like current and quick ratios are favorable, asset turnover remains very low. Arqit does not pay dividends, which aligns with its high growth and reinvestment focus.

Which one has the best ratios?

Rubrik, Inc. holds a more favorable ratio profile overall, evidenced by more positive return metrics and better leverage management. Arqit’s ratios show significant weaknesses, particularly in profitability and asset efficiency, despite stronger liquidity. Therefore, Rubrik’s financial ratios appear comparatively stronger than Arqit’s in 2025.

Strategic Positioning

This section compares the strategic positioning of Rubrik, Inc. and Arqit Quantum Inc. across Market position, Key segments, and Exposure to technological disruption:

Rubrik, Inc.

- Established market presence with $13.4B market cap, facing moderate competitive pressure in software infrastructure.

- Focuses on enterprise data protection, cloud, SaaS, and data security for diverse sectors including finance, healthcare, and public sectors.

- Positioned in traditional software infrastructure with no explicit mention of disruption exposure.

Arqit Quantum Inc.

- Smaller market cap of $416M, higher beta at 2.41, indicating more volatility and competitive pressure in cybersecurity.

- Provides quantum encryption cybersecurity via satellite and terrestrial platforms, targeting device encryption with QuantumCloud software.

- Engages in quantum cybersecurity, a potentially disruptive technology in encryption and data security.

Rubrik, Inc. vs Arqit Quantum Inc. Positioning

Rubrik has a diversified business model across multiple sectors with significant revenue from subscriptions, while Arqit is more concentrated on quantum cybersecurity technology. Rubrik’s broad sector coverage contrasts with Arqit’s niche innovation focus, each presenting distinct strategic advantages and risks.

Which has the best competitive advantage?

Both companies are currently shedding value with ROIC below WACC; however, Arqit shows improving profitability trends, while Rubrik’s profitability is deteriorating, suggesting Arqit’s competitive advantage may strengthen over time despite current challenges.

Stock Comparison

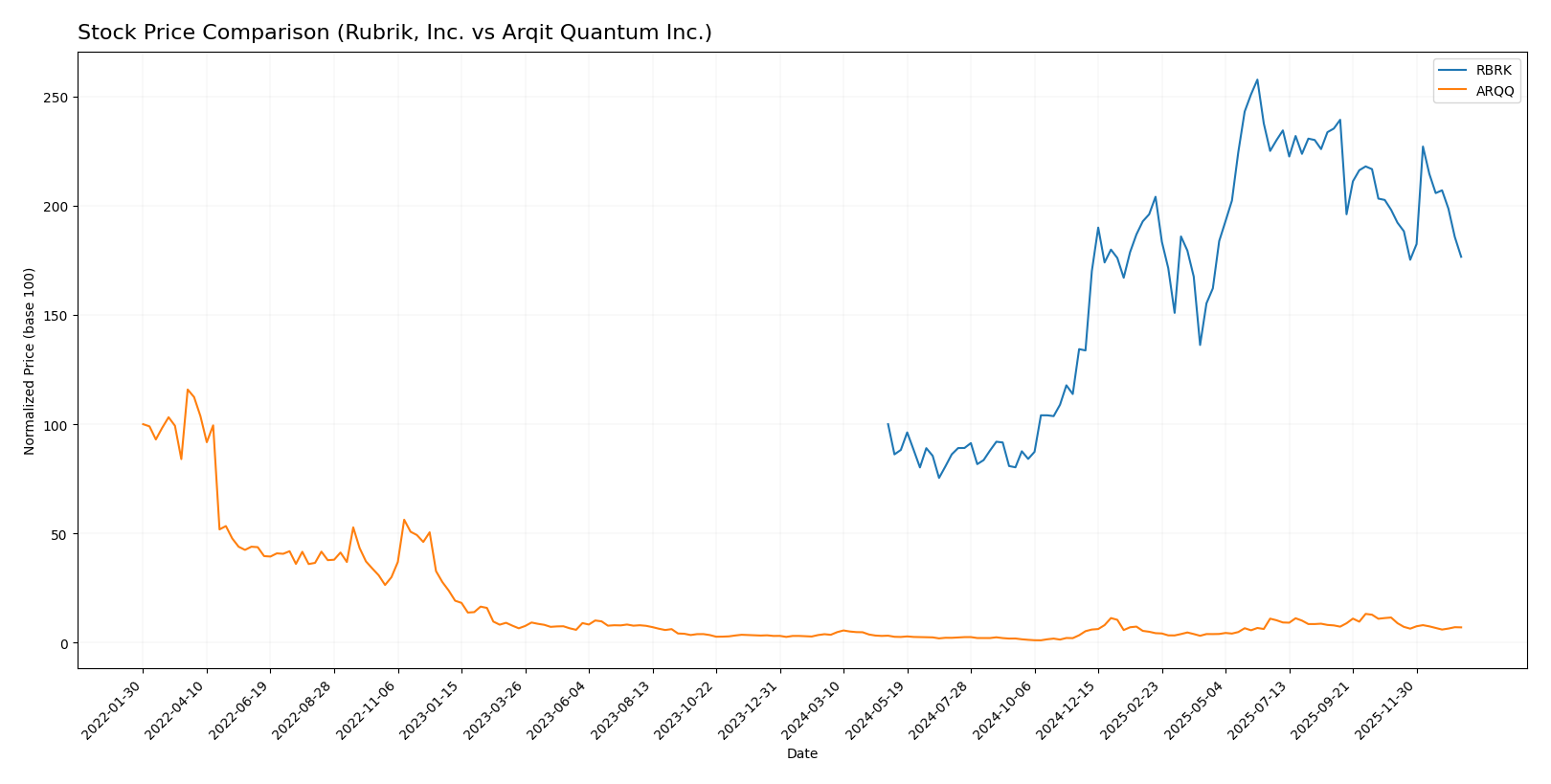

The stock price chart highlights significant bullish gains over the past year for both Rubrik, Inc. (RBRK) and Arqit Quantum Inc. (ARQQ), with recent periods showing downward corrections amid seller dominance in trading volumes.

Trend Analysis

Rubrik, Inc. (RBRK) exhibited a strong bullish trend over the past 12 months with a 76.58% price increase, though the trend shows deceleration and recent short-term decline of -10.85%. Price volatility remains high with a 21.4 std deviation.

Arqit Quantum Inc. (ARQQ) delivered a 93.6% price increase over the last year, also bullish but decelerating. Recent short-term performance weakened sharply with a -39.03% drop, accompanied by moderate volatility at 11.75 std deviation.

Comparing both, ARQQ outperformed RBRK in total yearly price appreciation, but recent months indicate stronger correction pressure on ARQQ’s stock relative to RBRK.

Target Prices

Analyst consensus indicates promising upside potential for both Rubrik, Inc. and Arqit Quantum Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Rubrik, Inc. | 113 | 105 | 109.33 |

| Arqit Quantum Inc. | 60 | 60 | 60 |

The target consensus for Rubrik, Inc. suggests a significant upside from its current price of 67.1 USD, indicating strong analyst confidence. Arqit Quantum’s target of 60 USD also implies substantial growth potential compared to its current 26.6 USD share price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Rubrik, Inc. and Arqit Quantum Inc.:

Rating Comparison

RBRK Rating

- Rating: Both companies hold a “C” rating, classified as Very Favorable.

- Discounted Cash Flow Score: Very Unfavorable with a score of 1, indicating poor valuation from future cash flows.

- ROE Score: Very Favorable at 5, showing strong profit generation from equity.

- ROA Score: Very Unfavorable at 1, reflecting poor asset utilization.

- Debt To Equity Score: Very Unfavorable at 1, suggesting high financial risk.

- Overall Score: Moderate with a score of 2, reflecting an average overall financial standing.

ARQQ Rating

- Rating: Both companies hold a “C” rating, classified as Very Favorable.

- Discounted Cash Flow Score: Moderate at 2, suggesting a somewhat better valuation outlook.

- ROE Score: Very Unfavorable at 1, indicating weak efficiency in generating profit from equity.

- ROA Score: Very Unfavorable at 1, also showing poor asset utilization.

- Debt To Equity Score: Favorable at 4, implying lower financial risk.

- Overall Score: Moderate with a score of 2, also reflecting an average financial standing.

Which one is the best rated?

Both Rubrik and Arqit Quantum share the same overall rating “C” and moderate overall scores of 2. Rubrik excels in ROE but has weak debt and cash flow scores, while Arqit shows better debt management and cash flow but poor equity returns.

Scores Comparison

Here is a comparison of the key financial scores for Rubrik, Inc. and Arqit Quantum Inc.:

Rubrik, Inc. Scores

- Altman Z-Score: 1.41, indicating financial distress zone risk of bankruptcy

- Piotroski Score: 4, reflecting average financial strength

Arqit Quantum Inc. Scores

- Altman Z-Score: -0.22, indicating financial distress zone risk of bankruptcy

- Piotroski Score: 2, reflecting very weak financial strength

Which company has the best scores?

Based on the provided data, Rubrik, Inc. has a higher Altman Z-Score and Piotroski Score than Arqit Quantum Inc., indicating relatively stronger financial health. Both companies are in the distress zone by Altman standards, but Rubrik’s scores are comparatively better.

Grades Comparison

Here is a comparison of the recent grades and ratings assigned to Rubrik, Inc. and Arqit Quantum Inc.:

Rubrik, Inc. Grades

This table summarizes recent grades assigned by reputable financial institutions for Rubrik, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-08 |

| Piper Sandler | Maintain | Overweight | 2025-12-05 |

| Baird | Maintain | Outperform | 2025-12-05 |

| William Blair | Upgrade | Outperform | 2025-12-05 |

| Keybanc | Maintain | Overweight | 2025-12-05 |

| Wedbush | Maintain | Outperform | 2025-12-05 |

| BMO Capital | Maintain | Outperform | 2025-12-05 |

| Rosenblatt | Maintain | Buy | 2025-12-05 |

Rubrik’s grades show a strong consensus around “Buy,” “Overweight,” and “Outperform” ratings, with one recent upgrade from William Blair indicating growing confidence.

Arqit Quantum Inc. Grades

This table shows recent grades for Arqit Quantum Inc. from a single grading company:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-10-13 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-18 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-31 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-06 |

| HC Wainwright & Co. | Maintain | Buy | 2024-07-11 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-29 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-15 |

| HC Wainwright & Co. | Maintain | Buy | 2023-11-22 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-27 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-26 |

Arqit Quantum’s ratings are consistent but come exclusively from HC Wainwright & Co., all maintaining a “Buy” rating over several years.

Which company has the best grades?

Rubrik, Inc. benefits from multiple grading companies providing “Buy,” “Overweight,” and “Outperform” ratings, showing broader analyst support compared to Arqit Quantum Inc., which has consistent but single-source “Buy” ratings. This broader consensus may offer investors a more diversified perspective on risk and opportunity.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Rubrik, Inc. (RBRK) and Arqit Quantum Inc. (ARQQ) based on recent financial and operational data.

| Criterion | Rubrik, Inc. (RBRK) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Diversification | Moderate: Majority revenue from subscriptions (828.7M USD), plus maintenance and services | Limited: No detailed revenue segmentation available |

| Profitability | Weak: Negative net margin (-130.26%) and ROIC (-234.85%), but strong ROE (208.55%) | Very weak: Deeply negative net margin (-6668.49%), ROIC (-127.45%), and ROE (-129.77%) |

| Innovation | Strong fixed asset turnover (16.67) suggests efficient asset use | Weak fixed asset turnover (0.74) and asset turnover (0.01) indicate poor utilization |

| Global presence | Reasonable liquidity and moderate debt (debt/assets 24.65%) | Strong liquidity (current ratio 2.69), low debt (1.68%) but struggling profitability |

| Market Share | Favorable P/E and P/B ratios, but value destruction indicated by declining ROIC | Unfavorable P/B and WACC, slight ROIC growth but still value shedding |

Rubrik shows moderate diversification and efficient asset use but is currently destroying value with declining profitability. Arqit Quantum exhibits weak profitability and asset use despite improving ROIC, signaling high risk. Investors should be cautious and weigh these factors carefully before investing.

Risk Analysis

Below is a comparative risk table for Rubrik, Inc. and Arqit Quantum Inc. based on the most recent available data from 2025.

| Metric | Rubrik, Inc. (RBRK) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Market Risk | Low beta (0.28) indicates low volatility | High beta (2.41) indicates high volatility |

| Debt level | Moderate debt-to-assets at 24.65% | Very low debt-to-assets at 1.68% |

| Regulatory Risk | Moderate, US tech regulations apply | Moderate, UK and international compliance needed |

| Operational Risk | Medium, 3200 employees and global operations | High, small team of 82 and niche quantum tech |

| Environmental Risk | Low, primarily software-based operations | Low, software and satellite-based |

| Geopolitical Risk | US-based with global clients, some exposure | UK-based, potential Brexit and international trade impact |

The most likely and impactful risks are operational and market-related. Rubrik’s low beta and larger scale reduce market risk but its moderate debt and operational complexity add risk. Arqit faces higher market volatility and operational risk due to its small size and cutting-edge quantum technology focus, compounded by geopolitical uncertainties in the UK. Both companies are in the technology sector, which demands vigilance on regulatory changes.

Which Stock to Choose?

Rubrik, Inc. (RBRK) shows a favorable income evolution in revenue growth (+41.19% in one year, +128.64% over 2021-2025), but its profitability and net margin remain unfavorable with significant losses. Financial ratios are mostly favorable (57.14%) including a strong ROE (208.55%), low debt, and a moderate current ratio, yet the company is shedding value per a very unfavorable MOAT rating and declining ROIC. Its market cap is around 11.3B USD with a bullish but recently decelerating stock trend.

Arqit Quantum Inc. (ARQQ) exhibits stronger revenue growth (+80.89% in one year, +1006.24% overall) and improving net margin growth, but income statement profitability is negative and ratios are predominantly unfavorable (64.29%), with weak ROE and ROIC below WACC. It holds low debt and a high current ratio, with a slightly unfavorable MOAT indicating value destruction but improving profitability. Market cap stands near 0.53B USD, with a bullish yet sharply declining recent price trend.

Investors focused on growth and revenue expansion may find Arqit Quantum’s improving profitability and higher revenue growth more appealing, while those prioritizing stronger financial ratios and moderate debt might see Rubrik as relatively more stable despite its value destruction and losses. Risk-averse investors could interpret both companies’ unfavorable profitability and MOAT ratings as signals to monitor developments cautiously.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Rubrik, Inc. and Arqit Quantum Inc. to enhance your investment decisions: