Palo Alto Networks, Inc. and Arqit Quantum Inc. represent two dynamic players in the cybersecurity sector, each leveraging distinct technologies to secure digital environments. While Palo Alto Networks offers comprehensive infrastructure security solutions with a strong global footprint, Arqit Quantum focuses on pioneering quantum encryption via satellite platforms. Their shared industry and innovation-driven approaches make this comparison essential for investors seeking to understand which company holds the most promising potential in the evolving cybersecurity landscape. Let’s explore which presents the best investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between Palo Alto Networks and Arqit Quantum by providing an overview of these two companies and their main differences.

Palo Alto Networks Overview

Palo Alto Networks, Inc. is a leading cybersecurity provider headquartered in Santa Clara, California. Established in 2005, it offers a wide range of firewall appliances, security management solutions, and subscription services aimed at threat prevention and data loss protection. The company serves medium to large enterprises, service providers, and government sectors globally, employing over 15,700 professionals.

Arqit Quantum Overview

Arqit Quantum Inc. is a UK-based cybersecurity firm specializing in quantum encryption services via satellite and terrestrial platforms. Founded recently and based in London, Arqit offers QuantumCloud, a software enabling devices to create encryption keys securely. With a workforce of 82 employees, the company focuses on innovative quantum security solutions within the infrastructure software industry.

Key similarities and differences

Both Palo Alto Networks and Arqit operate in the software infrastructure and cybersecurity sector, focusing on protecting data and networks. Palo Alto Networks has a broad product and service portfolio targeting diverse industries worldwide with a large employee base, while Arqit’s niche is quantum encryption technology with a smaller scale and workforce. Their business models differ significantly in scope and technology focus, reflecting their market positioning and maturity.

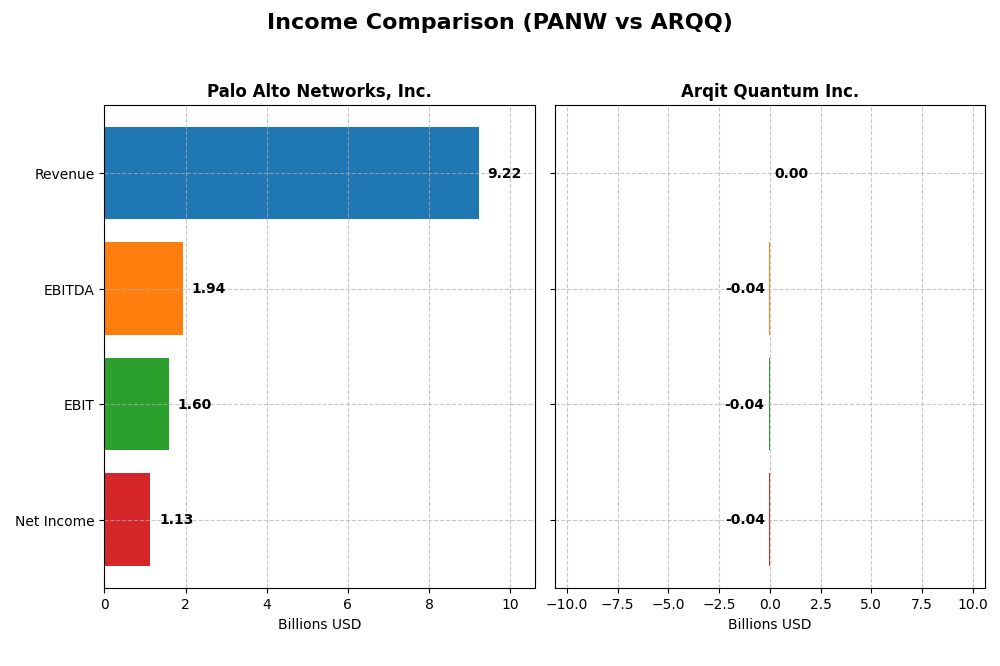

Income Statement Comparison

The table below presents a clear comparison of the most recent fiscal year income statement metrics for Palo Alto Networks, Inc. and Arqit Quantum Inc.

| Metric | Palo Alto Networks, Inc. | Arqit Quantum Inc. |

|---|---|---|

| Market Cap | 128.4B | 416.3M |

| Revenue | 9.22B | 530K |

| EBITDA | 1.94B | -36.8M |

| EBIT | 1.60B | -37.6M |

| Net Income | 1.13B | -35.3M |

| EPS | 1.71 | -2.56 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Palo Alto Networks, Inc.

From 2021 to 2025, Palo Alto Networks exhibited strong revenue growth, reaching $9.22B in 2025 with a 117% increase overall. Net income improved significantly, though it declined in 2025 to $1.13B from $2.58B in 2024. Margins remain favorable, with a gross margin of 73.4% and EBIT margin of 17.3%. The latest year showed slower net margin and EPS growth despite robust revenue and EBIT gains.

Arqit Quantum Inc.

Arqit Quantum’s revenue grew sharply by over 1000% from 2021 to 2025, reaching just $530K in 2025. However, it reported negative net income of -$35.3M in 2025, although showing improvement from prior years. Margins remain deeply negative, with gross and EBIT margins at -43.4% and -7088.3%, respectively. The recent year had favorable revenue and EPS growth but continuing high losses and negative profitability.

Which one has the stronger fundamentals?

Palo Alto Networks demonstrates stronger fundamentals with consistent revenue and net income growth, high and stable margins, and a predominantly favorable income statement evaluation. Arqit Quantum, while showing rapid revenue growth, continues to struggle with sustained losses and negative margins, indicating less financial stability despite some recent improvements.

Financial Ratios Comparison

The table below compares the most recent financial ratios of Palo Alto Networks, Inc. and Arqit Quantum Inc. for the fiscal year 2025, providing insight into their profitability, liquidity, leverage, and efficiency metrics.

| Ratios | Palo Alto Networks, Inc. (PANW) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| ROE | 14.49% | -129.77% |

| ROIC | 5.67% | -127.45% |

| P/E | 101.43 | -15.12 |

| P/B | 14.70 | 19.62 |

| Current Ratio | 0.89 | 2.69 |

| Quick Ratio | 0.89 | 2.69 |

| D/E | 0.04 | 0.03 |

| Debt-to-Assets | 1.43% | 1.68% |

| Interest Coverage | 414.3 | -802.90 |

| Asset Turnover | 0.39 | 0.01 |

| Fixed Asset Turnover | 12.56 | 0.74 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Palo Alto Networks, Inc.

Palo Alto Networks shows a mix of favorable and unfavorable ratios. Its net margin of 12.3% is strong, and low debt-to-equity at 0.04 signals financial stability. However, the high PE ratio of 101.43 and low current ratio of 0.89 raise concerns. The company does not pay dividends, likely focusing on growth and reinvestment instead.

Arqit Quantum Inc.

Arqit Quantum’s financial ratios are mostly unfavorable, with a deeply negative net margin and returns, reflecting operational losses. Its high current ratio of 2.69 and low leverage indicate liquidity strength but poor profitability and efficiency. The company also does not pay dividends, consistent with its early-stage, high-growth investment strategy.

Which one has the best ratios?

Comparing the two, Palo Alto Networks has a slightly favorable overall ratio profile with better profitability and financial stability, despite valuation concerns. In contrast, Arqit Quantum’s ratios are largely unfavorable, reflecting significant operational challenges and negative returns, though it maintains strong liquidity.

Strategic Positioning

This section compares the strategic positioning of Palo Alto Networks and Arqit Quantum, including market position, key segments, and exposure to technological disruption:

Palo Alto Networks

- Large market cap of 128B in cybersecurity; faces broad competition in software infrastructure.

- Diverse revenue streams from products, subscriptions, and support across multiple industries worldwide.

- Operates in established cybersecurity with gradual innovation; potential pressure from emerging quantum tech.

Arqit Quantum

- Small market cap of 416M; niche player in quantum cybersecurity via satellite platforms.

- Focused on QuantumCloud software encryption services, targeting device-level cybersecurity.

- Positioned in cutting-edge quantum encryption, directly linked to emerging technological disruption.

Palo Alto Networks vs Arqit Quantum Positioning

Palo Alto Networks pursues a diversified global cybersecurity strategy with extensive product and service lines, offering scale advantages but broad competition. Arqit Quantum concentrates on innovative quantum encryption technology, presenting focused potential but higher risk due to niche exposure and smaller scale.

Which has the best competitive advantage?

Both companies are currently shedding value with slightly unfavorable MOAT status but show growing ROIC trends. Palo Alto Networks’ larger scale and diversified revenues contrast with Arqit’s niche innovation, reflecting different competitive advantage profiles.

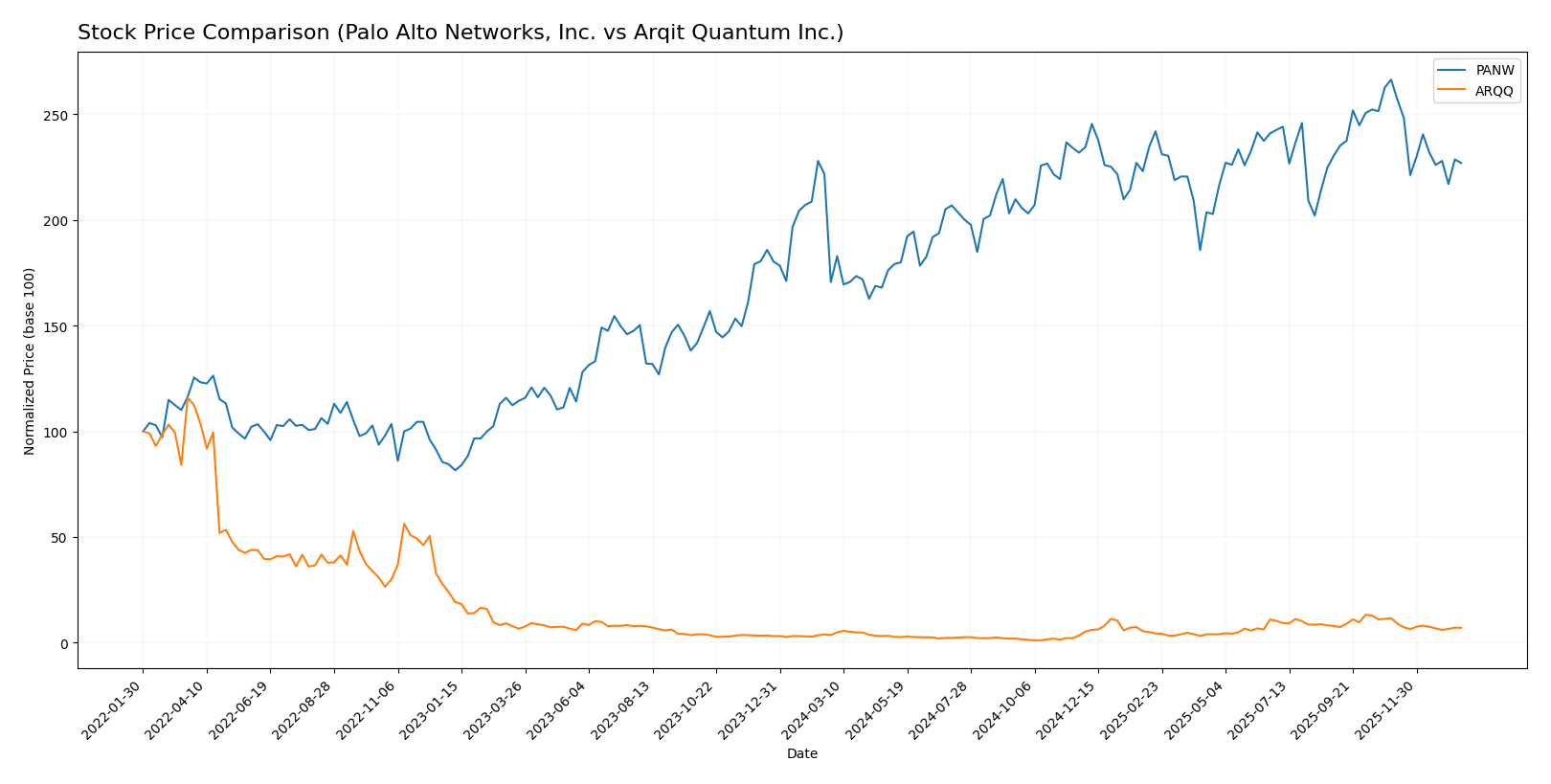

Stock Comparison

The stock prices of Palo Alto Networks, Inc. and Arqit Quantum Inc. exhibited strong bullish trends over the past 12 months, with both showing notable price increases but recent declines in the last quarter.

Trend Analysis

Palo Alto Networks, Inc. (PANW) recorded a 33.05% price increase over the past year, indicating a bullish trend with deceleration. The stock peaked at 220.24 and bottomed at 134.51, showing moderate volatility (std deviation 19.95). Recent months reveal a -14.79% decline with increased selling pressure.

Arqit Quantum Inc. (ARQQ) experienced a 93.6% price rise over the same period, also bullish with deceleration. Its price ranged from 4.19 to 49.92, with lower volatility (std deviation 11.75). However, the recent period shows a sharper -39.03% drop, suggesting short-term weakness.

Comparing both, ARQQ delivered the highest market performance over 12 months with a 93.6% gain versus PANW’s 33.05%, despite both facing significant recent downward corrections.

Target Prices

Analysts provide a clear target consensus reflecting growth potential for both Palo Alto Networks, Inc. and Arqit Quantum Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Palo Alto Networks, Inc. | 265 | 157 | 231.07 |

| Arqit Quantum Inc. | 60 | 60 | 60 |

The target consensus for Palo Alto Networks at 231.07 USD is significantly above its current price of 187.66 USD, indicating bullish analyst expectations. Arqit Quantum’s consensus target of 60 USD is more than double its current 26.6 USD price, suggesting potential high upside despite elevated volatility risks.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Palo Alto Networks, Inc. and Arqit Quantum Inc.:

Rating Comparison

Palo Alto Networks, Inc. Rating

- Rating: B, evaluated as Very Favorable

- Discounted Cash Flow Score: 4, favorable, indicates strong future cash flow projections

- ROE Score: 4, favorable, showing efficient profit generation from equity

- ROA Score: 3, moderate, reflecting average asset utilization

- Debt To Equity Score: 4, favorable, showing strong balance sheet

- Overall Score: 3, moderate financial standing

Arqit Quantum Inc. Rating

- Rating: C, evaluated as Very Favorable

- Discounted Cash Flow Score: 2, moderate, indicates less favorable cash flow projections

- ROE Score: 1, very unfavorable, indicating weak profit generation from equity

- ROA Score: 1, very unfavorable, reflecting poor asset utilization

- Debt To Equity Score: 4, favorable, also showing strong balance sheet

- Overall Score: 2, moderate financial standing

Which one is the best rated?

Palo Alto Networks holds a higher overall rating and stronger scores in discounted cash flow, ROE, and ROA compared to Arqit Quantum. Both share a favorable debt-to-equity score, but PANW is clearly better rated based on the available data.

Scores Comparison

The comparison of scores between Palo Alto Networks, Inc. and Arqit Quantum Inc. is as follows:

Palo Alto Networks Scores

- Altman Z-Score: 5.95, indicating a safe financial zone

- Piotroski Score: 6, reflecting average financial strength

Arqit Quantum Scores

- Altman Z-Score: -0.22, indicating financial distress

- Piotroski Score: 2, reflecting very weak financial strength

Which company has the best scores?

Palo Alto Networks, Inc. demonstrates stronger financial stability with a safe Altman Z-Score and an average Piotroski Score. Arqit Quantum Inc. falls in financial distress with a very weak Piotroski Score, indicating higher risk based on these scores.

Grades Comparison

Here is the comparison of recent grades and ratings for Palo Alto Networks, Inc. and Arqit Quantum Inc.:

Palo Alto Networks, Inc. Grades

The following table summarizes recent grades issued by reputable financial institutions for Palo Alto Networks, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2026-01-13 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Guggenheim | Upgrade | Neutral | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-18 |

| Goldman Sachs | Maintain | Buy | 2025-11-21 |

| HSBC | Downgrade | Reduce | 2025-11-21 |

| Needham | Maintain | Buy | 2025-11-20 |

| WestPark Capital | Maintain | Hold | 2025-11-20 |

| Bernstein | Maintain | Outperform | 2025-11-20 |

| DA Davidson | Maintain | Buy | 2025-11-20 |

Grades mostly range from Neutral to Buy, with a few Hold and one Reduce downgrade, indicating a generally positive but cautious sentiment.

Arqit Quantum Inc. Grades

The table below shows grades from HC Wainwright & Co. for Arqit Quantum Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-10-13 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-18 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-31 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-06 |

| HC Wainwright & Co. | Maintain | Buy | 2024-07-11 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-29 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-15 |

| HC Wainwright & Co. | Maintain | Buy | 2023-11-22 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-27 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-26 |

All grades are consistently “Buy,” reflecting a stable positive outlook from this single grading company.

Which company has the best grades?

Palo Alto Networks shows a varied grading landscape with mostly Buy and Overweight ratings but some Hold and Reduce grades, suggesting mixed analyst views. Arqit Quantum’s grades are uniformly Buy from one source, indicating consistent bullish sentiment. Investors may interpret Palo Alto’s broader analyst coverage and mixed grades as reflecting a more nuanced risk-reward profile, while Arqit’s uniform Buy ratings suggest confidence but limited grading diversity.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses between Palo Alto Networks, Inc. (PANW) and Arqit Quantum Inc. (ARQQ) based on recent financial and strategic data.

| Criterion | Palo Alto Networks, Inc. (PANW) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Diversification | Strong subscription-based recurring revenue (4.97B in 2025) with product and support growth | Limited revenue diversification, primarily early-stage with no reported product revenue |

| Profitability | Positive net margin (12.3%), ROIC at 5.67%, slightly unfavorable moat but improving profitability | Negative margins and ROIC, shedding value though showing improving ROIC trend |

| Innovation | Consistent investment in cybersecurity innovation, strong fixed asset turnover (12.56) | Early-stage quantum tech with innovation potential but unproven commercial success |

| Global presence | Established global footprint in cybersecurity markets | Limited current global presence, still developing market reach |

| Market Share | Significant in cybersecurity with growing subscription base and support services | Small market share, niche quantum encryption focus |

Key takeaways: Palo Alto Networks demonstrates strong recurring revenue and improving profitability despite some valuation concerns, making it more stable. Arqit, while innovative in quantum encryption, faces significant profitability and scale challenges, implying higher investment risk.

Risk Analysis

Below is a comparison of key risks for Palo Alto Networks, Inc. (PANW) and Arqit Quantum Inc. (ARQQ) based on the most recent data from 2025.

| Metric | Palo Alto Networks, Inc. (PANW) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Market Risk | Moderate (Beta 0.75) | High (Beta 2.41) |

| Debt level | Low (Debt/Equity 0.04) | Low (Debt/Equity 0.03) |

| Regulatory Risk | Moderate (Cybersecurity focus) | Moderate (Quantum encryption, UK regulations) |

| Operational Risk | Moderate (Large scale operations, 15,758 employees) | High (Small company with 82 employees, early stage) |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate (US-based, global clients) | Moderate (UK-based, sensitive tech sector) |

The most impactful and likely risks are market volatility for Arqit due to its high beta and small size, combined with operational challenges typical of a young company. Palo Alto Networks shows stronger financial stability but faces moderate regulatory and operational risks inherent in the cybersecurity industry. Investors should weigh ARQQ’s high growth potential against its financial distress signals, while PANW offers safer exposure with moderate risk.

Which Stock to Choose?

Palo Alto Networks, Inc. (PANW) shows a favorable income evolution with strong revenue and net income growth over 2021-2025. Financial ratios are slightly favorable overall, with solid profitability, low debt, and a very favorable rating of B. However, its ROIC remains below WACC, indicating slight value destruction despite improving profitability.

Arqit Quantum Inc. (ARQQ) exhibits rapid revenue growth but suffers from deeply negative profitability and mostly unfavorable financial ratios. Its debt levels are low, and it has a very favorable C rating, yet its ROIC is substantially below WACC, signaling value destruction even as ROIC trends improve modestly.

For investors prioritizing stability and profitability, PANW’s consistent income growth and stronger financial health might appear more favorable. Conversely, those focused on high-growth potential and willing to accept significant risk could see ARQQ’s trajectory as more appealing despite its current financial weaknesses.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Palo Alto Networks, Inc. and Arqit Quantum Inc. to enhance your investment decisions: