In today’s fast-evolving technology sector, choosing the right investment requires careful analysis of market leaders and innovative newcomers. Oracle Corporation, a giant in enterprise software and cloud infrastructure, stands alongside Arqit Quantum Inc., a promising cybersecurity firm leveraging quantum technology. Both operate within the software infrastructure industry but differ vastly in scale and innovation approach. This article will help you decide which company presents the most compelling opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Oracle Corporation and Arqit Quantum Inc. by providing an overview of these two companies and their main differences.

Oracle Overview

Oracle Corporation is a major player in the software infrastructure industry, offering a broad range of enterprise IT products and services worldwide. Its portfolio includes cloud software applications, databases, middleware, and hardware solutions tailored for various industries. Headquartered in Austin, Texas, Oracle serves businesses, government agencies, and educational institutions, emphasizing cloud and license business infrastructure technologies.

Arqit Overview

Arqit Quantum Inc. is a UK-based cybersecurity company specializing in satellite and terrestrial platforms. It provides QuantumCloud, a platform enabling devices to securely generate encryption keys via lightweight software agents. Operating with a much smaller workforce and market cap compared to Oracle, Arqit targets advanced security solutions in the software infrastructure sector, focusing on innovative quantum encryption technologies.

Key similarities and differences

Both Oracle and Arqit operate within the software infrastructure industry, focusing on technology solutions that support enterprise needs. However, Oracle has a diverse product range including cloud applications, databases, and hardware, while Arqit concentrates on cybersecurity through quantum encryption. They differ significantly in scale, market capitalization, and geographic focus, with Oracle being a large multinational and Arqit a smaller, specialized UK firm.

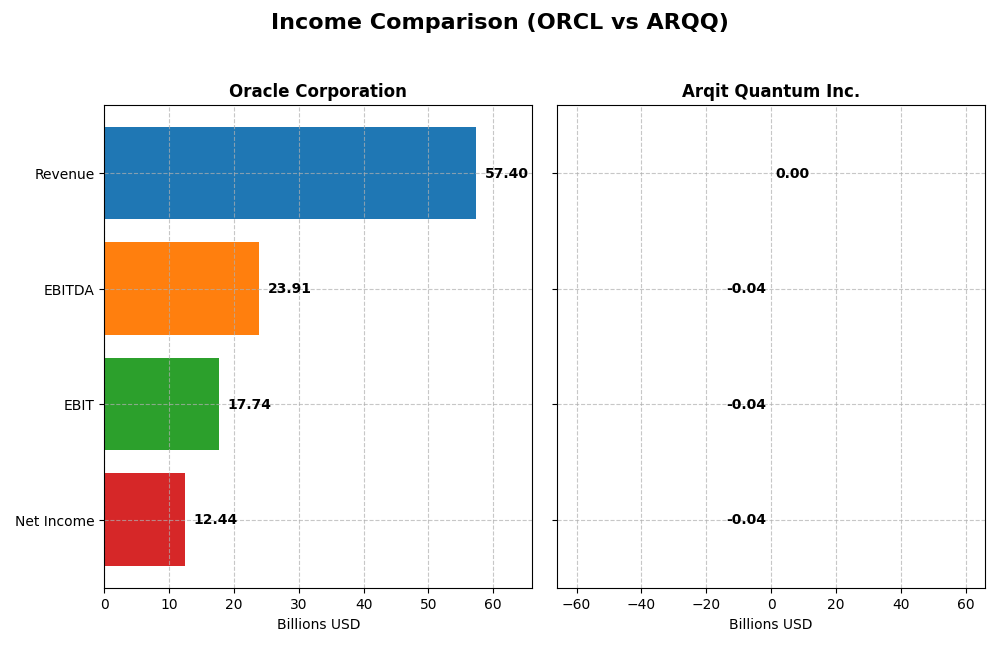

Income Statement Comparison

The table below compares key income statement metrics for Oracle Corporation and Arqit Quantum Inc. for the most recent fiscal year available.

| Metric | Oracle Corporation | Arqit Quantum Inc. |

|---|---|---|

| Market Cap | 549B | 416M |

| Revenue | 57.4B | 530K |

| EBITDA | 23.9B | -36.8M |

| EBIT | 17.7B | -37.6M |

| Net Income | 12.4B | -35.3M |

| EPS | 4.46 | -2.56 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Oracle Corporation

Oracle’s revenue showed steady growth from 40.5B in 2021 to 57.4B in 2025, with net income fluctuating but peaking at 13.7B in 2021 and settling at 12.4B in 2025. Margins remain robust, with a gross margin of 70.51% and net margin at 21.68%. The latest year saw favorable revenue growth of 8.38%, EBIT margin improvement, and EPS up by 16.98%.

Arqit Quantum Inc.

Arqit’s revenue increased sharply from 48K in 2021 to 530K in 2025, while net income remained negative, though losses narrowed from -271.7M to -35.3M. Margins are heavily negative, with a gross margin of -43.4% and net margin at -6668.49%. Despite a 80.89% revenue growth in the last year, EBIT margin remains deeply negative, reflecting ongoing operational challenges.

Which one has the stronger fundamentals?

Oracle demonstrates stronger fundamentals with sustained positive margins, consistent revenue growth, and profitability, despite slight net income and margin declines over five years. Arqit shows rapid revenue expansion but continues to operate at a substantial loss with negative margins. Oracle’s stable earnings and margin improvements contrast with Arqit’s high volatility and ongoing unprofitability.

Financial Ratios Comparison

The table below summarizes the most recent financial ratios for Oracle Corporation and Arqit Quantum Inc., reflecting their fiscal year 2025 performance where available.

| Ratios | Oracle Corporation (2025) | Arqit Quantum Inc. (2025) |

|---|---|---|

| ROE | 60.8% | -129.8% |

| ROIC | 10.9% | -127.5% |

| P/E | 37.1 | -15.1 |

| P/B | 22.6 | 19.6 |

| Current Ratio | 0.75 | 2.69 |

| Quick Ratio | 0.75 | 2.69 |

| D/E (Debt-to-Equity) | 5.09 | 0.03 |

| Debt-to-Assets | 61.8% | 1.7% |

| Interest Coverage | 4.94 | -803 |

| Asset Turnover | 0.34 | 0.01 |

| Fixed Asset Turnover | 1.32 | 0.74 |

| Payout Ratio | 38.1% | 0% |

| Dividend Yield | 1.03% | 0% |

Interpretation of the Ratios

Oracle Corporation

Oracle shows strong profitability with a net margin of 21.68% and an impressive return on equity of 60.84%, indicating efficient use of shareholder capital. However, concerns arise from a high debt-to-equity ratio of 5.09 and a low current ratio of 0.75, suggesting liquidity and leverage risks. Oracle pays dividends with a 1.03% yield, reflecting steady shareholder returns.

Arqit Quantum Inc.

Arqit exhibits weak financial health marked by deeply negative net margin and returns on equity, reflecting operating losses and inefficiency. The company maintains a strong liquidity position with a current ratio of 2.69 and low leverage at 0.03 debt-to-equity. Arqit does not pay dividends, likely due to its early-stage status and reinvestment focus.

Which one has the best ratios?

Both companies have unfavorable overall ratio evaluations, but Oracle’s profitability and dividend payments contrast with Arqit’s negative earnings and lack of dividends. Oracle’s leverage and liquidity weaknesses are notable, while Arqit’s higher liquidity and low debt are offset by poor profitability and negative returns. Neither stands out as clearly superior in financial ratios.

Strategic Positioning

This section compares the strategic positioning of Oracle Corporation and Arqit Quantum Inc. regarding Market position, Key segments, and Exposure to technological disruption:

Oracle Corporation

- Large market cap of 549B; faces competitive pressure in enterprise software and cloud infrastructure sectors.

- Diversified revenue: Cloud & license (49B), Hardware (2.9B), Services (5.2B) drive business growth.

- Operates in established software infrastructure with evolving cloud and blockchain tech, facing moderate disruption.

Arqit Quantum Inc.

- Small market cap of 416M; operates in niche cybersecurity via satellite and terrestrial platforms.

- Focused on QuantumCloud encryption software for device security; limited product diversification.

- Positioned in emerging quantum cybersecurity, exposed to high technological innovation and disruption.

Oracle Corporation vs Arqit Quantum Inc. Positioning

Oracle pursues a diversified strategy across cloud, hardware, and services with broad industry reach, offering scale advantages but facing mature market challenges. Arqit concentrates on quantum encryption cybersecurity, offering innovation potential but limited scale and product breadth.

Which has the best competitive advantage?

Both companies are assessed as slightly unfavorable in MOAT due to ROIC below WACC; Oracle shows declining profitability, while Arqit’s profitability is improving but still negative, indicating neither currently holds a strong competitive advantage.

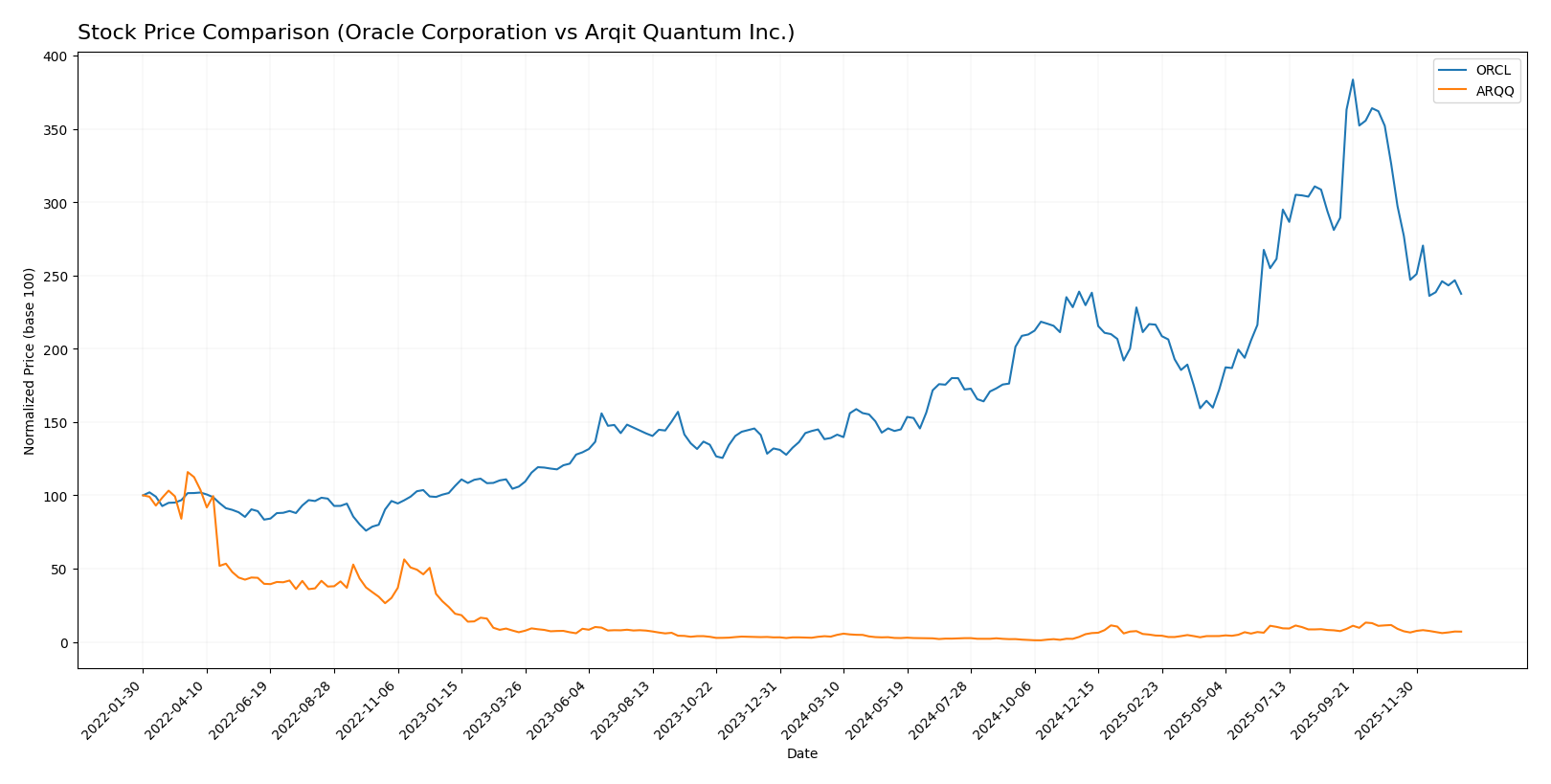

Stock Comparison

The stock price movements of Oracle Corporation and Arqit Quantum Inc. over the past 12 months reveal significant bullish gains with recent decelerations and shifts in trading dynamics, highlighting contrasting volatility and volume trends.

Trend Analysis

Oracle Corporation’s stock posted a strong bullish trend over the past year with a 70.69% price increase, though momentum decelerated; volatility remains high with a 49.0 standard deviation and a peak price near 309. Recent months show a bearish reversal with a -27.23% drop.

Arqit Quantum Inc. exhibited an even stronger bullish trend over 12 months, rising 93.6% with decelerating acceleration and lower volatility at 11.75 standard deviation; the highest price reached 49.92. Recently, it faced a steeper decline of -39.03%, reflecting seller dominance.

Comparing both, Arqit Quantum delivered the highest market performance with a 93.6% gain versus Oracle’s 70.69%, despite both experiencing recent downward corrections and volume shifts favoring sellers.

Target Prices

Analysts present a varied but optimistic consensus on target prices for Oracle Corporation and Arqit Quantum Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Oracle Corporation | 400 | 175 | 314.08 |

| Arqit Quantum Inc. | 60 | 60 | 60 |

Oracle’s target consensus of 314.08 USD suggests considerable upside compared to its current price near 191 USD. Arqit’s consensus target of 60 USD also indicates strong expected growth versus the current price around 26.6 USD.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Oracle Corporation and Arqit Quantum Inc.:

Rating Comparison

Oracle Corporation Rating

- Rating: B, assessed as Very Favorable overall rating.

- Discounted Cash Flow Score: 3, indicating a moderate valuation.

- ROE Score: 5, reflecting very favorable profit generation from equity.

- ROA Score: 4, showing favorable asset utilization.

- Debt To Equity Score: 1, signaling very unfavorable financial risk position.

- Overall Score: 3, representing a moderate overall financial standing.

Arqit Quantum Inc. Rating

- Rating: C, assessed as Very Favorable overall rating.

- Discounted Cash Flow Score: 2, indicating a moderate valuation.

- ROE Score: 1, reflecting very unfavorable profit generation from equity.

- ROA Score: 1, showing very unfavorable asset utilization.

- Debt To Equity Score: 4, signaling a favorable financial risk position.

- Overall Score: 2, representing a moderate overall financial standing.

Which one is the best rated?

Oracle Corporation holds a higher rating of B compared to Arqit Quantum’s C, with stronger ROE and ROA scores, despite weaker debt management. Overall, Oracle’s scores suggest a more favorable analyst assessment than Arqit Quantum’s.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Oracle Corporation and Arqit Quantum Inc.:

Oracle Corporation Scores

- Altman Z-Score of 2.43 places Oracle in the grey zone, moderate risk of bankruptcy.

- Piotroski Score of 5 indicates Oracle has average financial strength.

Arqit Quantum Scores

- Altman Z-Score of -0.22 places Arqit in the distress zone, high bankruptcy risk.

- Piotroski Score of 2 shows Arqit has very weak financial strength.

Which company has the best scores?

Oracle Corporation has better scores than Arqit Quantum, with a higher Altman Z-Score in the grey zone versus distress zone, and a stronger Piotroski Score indicating better financial health.

Grades Comparison

Here is a comparison of the latest available grades from verified grading companies for the two companies:

Oracle Corporation Grades

The following table summarizes the recent grades assigned by reputable firms to Oracle Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-01-05 |

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| Goldman Sachs | Maintain | Neutral | 2025-12-12 |

| Keybanc | Maintain | Overweight | 2025-12-11 |

| UBS | Maintain | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-12-11 |

| JP Morgan | Maintain | Neutral | 2025-12-11 |

| DA Davidson | Maintain | Neutral | 2025-12-11 |

| Scotiabank | Maintain | Sector Outperform | 2025-12-11 |

Oracle’s grades predominantly indicate a positive outlook with many “Buy” and “Overweight” ratings, balanced by several “Neutral” and “Sector Perform” assessments.

Arqit Quantum Inc. Grades

Below is the table of recent grades from a verified grading company for Arqit Quantum Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-10-13 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-18 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-31 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-06 |

| HC Wainwright & Co. | Maintain | Buy | 2024-07-11 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-29 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-15 |

| HC Wainwright & Co. | Maintain | Buy | 2023-11-22 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-27 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-26 |

Arqit Quantum has a consistent “Buy” rating trend from a single grading company over multiple dates.

Which company has the best grades?

Oracle Corporation has a broader range of analyst opinions, with multiple firms assigning “Buy” and “Neutral” ratings, reflecting a balanced yet positive consensus. Arqit Quantum Inc. shows a consistent “Buy” rating but only from one grading company. This wider diversity in Oracle’s grades may offer investors a more nuanced perspective on potential risks and rewards.

Strengths and Weaknesses

Below is a summary table comparing Oracle Corporation (ORCL) and Arqit Quantum Inc. (ARQQ) on key investment criteria based on the latest available data.

| Criterion | Oracle Corporation (ORCL) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Diversification | Strong diversification with $49.2B Cloud & License, $5.2B Services, $2.9B Hardware revenue | Limited product and revenue diversification; mainly early-stage quantum tech |

| Profitability | Favorable profitability: 21.7% net margin, 10.9% ROIC, but declining ROIC trend (-17.7%) | Negative profitability: massive net loss margin (-6668%), negative ROIC |

| Innovation | Established innovation with steady cloud growth; moderate hardware decline | High innovation potential in quantum encryption, but unproven commercial success |

| Global presence | Large global footprint as a leading enterprise software provider | Limited global presence and market penetration |

| Market Share | Significant market share in cloud and enterprise software markets | Emerging player; negligible current market share |

Key takeaways: Oracle demonstrates strong diversification and solid profitability, though its declining ROIC trend demands caution. Arqit Quantum, while innovative with growing ROIC, is currently unprofitable and carries higher risk due to its nascent stage and limited market presence. Investors should weigh Oracle’s established stability against Arqit’s growth potential and volatility.

Risk Analysis

Below is a comparative risk assessment for Oracle Corporation and Arqit Quantum Inc. based on the most recent 2025 data.

| Metric | Oracle Corporation | Arqit Quantum Inc. |

|---|---|---|

| Market Risk | Beta 1.65; moderate volatility | Beta 2.41; high volatility, higher market sensitivity |

| Debt level | High debt-to-equity 5.09; debt-to-assets 61.83% (unfavorable) | Very low debt-to-equity 0.03; debt-to-assets 1.68% (favorable) |

| Regulatory Risk | Moderate, US-based with global operations | Moderate, UK-based with evolving quantum encryption regulations |

| Operational Risk | Large scale with 159K employees; complex legacy integration | Small scale, 82 employees; risk from early-stage tech development |

| Environmental Risk | Moderate; typical for tech hardware and data centers | Low; primarily software and satellite-based services |

| Geopolitical Risk | US-centric but global exposure; moderate risk from trade tensions | Higher; UK base with satellite tech may face export controls and geopolitical scrutiny |

Oracle’s debt levels and moderate market volatility pose notable financial risks, while Arqit faces higher market and geopolitical risks due to its nascent technology and smaller scale. Oracle’s Altman Z-score of 2.43 places it in a grey zone for financial distress, whereas Arqit’s score below 1.8 signals higher bankruptcy risk. Investors should weigh Oracle’s financial leverage against Arqit’s operational and market uncertainties.

Which Stock to Choose?

Oracle Corporation (ORCL) shows favorable income evolution with 8.38% revenue growth in 2025 and strong profitability metrics, including a 21.68% net margin and 60.84% ROE. However, its financial ratios reveal challenges such as high debt-to-equity (5.09) and low liquidity (current ratio 0.75). The company holds a very favorable B rating, though its global ratios evaluation is unfavorable due to leverage concerns.

Arqit Quantum Inc. (ARQQ) exhibits significant revenue growth of 80.89% in 2025 but suffers from negative profitability with a net margin of -6668.49% and negative returns on equity and capital. Despite favorable liquidity ratios (current ratio 2.69) and low debt levels, its global financial ratios evaluation remains unfavorable. The firm’s rating is very favorable C, reflecting high risk and financial instability.

Choosing the most favorable stock depends on investor profile: risk-averse investors might find Oracle’s stable income growth and strong profitability more aligned with quality investing, while risk-tolerant investors focused on growth may see Arqit’s rapid revenue expansion and improving profitability as potential opportunities, despite its current financial weaknesses.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Oracle Corporation and Arqit Quantum Inc. to enhance your investment decisions: