In the dynamic world of technology, MongoDB, Inc. and Arqit Quantum Inc. stand out as innovators in the software infrastructure sector. While MongoDB leads with its versatile database solutions, Arqit pioneers quantum-enhanced cybersecurity. Both companies target cutting-edge markets with significant growth potential, yet their strategies and scales differ markedly. This article will guide you through their strengths and risks to help identify the more compelling investment opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between MongoDB, Inc. and Arqit Quantum Inc. by providing an overview of these two companies and their main differences.

MongoDB, Inc. Overview

MongoDB, Inc. operates as a general-purpose database platform provider worldwide. Its offerings include MongoDB Enterprise Advanced for enterprise clients, MongoDB Atlas, a multi-cloud database-as-a-service, and a free Community Server version. The company also delivers consulting and training services. Founded in 2007 and headquartered in New York City, MongoDB holds a strong position in the software infrastructure industry with a market cap of about 32.5B USD.

Arqit Quantum Inc. Overview

Arqit Quantum Inc. delivers cybersecurity solutions using satellite and terrestrial platforms, primarily in the United Kingdom. Its key product, QuantumCloud, enables secure encryption key generation across devices via lightweight software agents. Established with headquarters in London, Arqit is a smaller player in the technology sector with a market cap around 416M USD and a focus on cryptographic security services.

Key similarities and differences

Both MongoDB and Arqit operate in the software infrastructure industry, targeting technology-driven solutions. MongoDB focuses on database management platforms with a global footprint and extensive enterprise services, while Arqit specializes in quantum encryption and cybersecurity primarily in the UK. The companies differ significantly in scale, market capitalization, and workforce size, reflecting distinct business models within the technology sector.

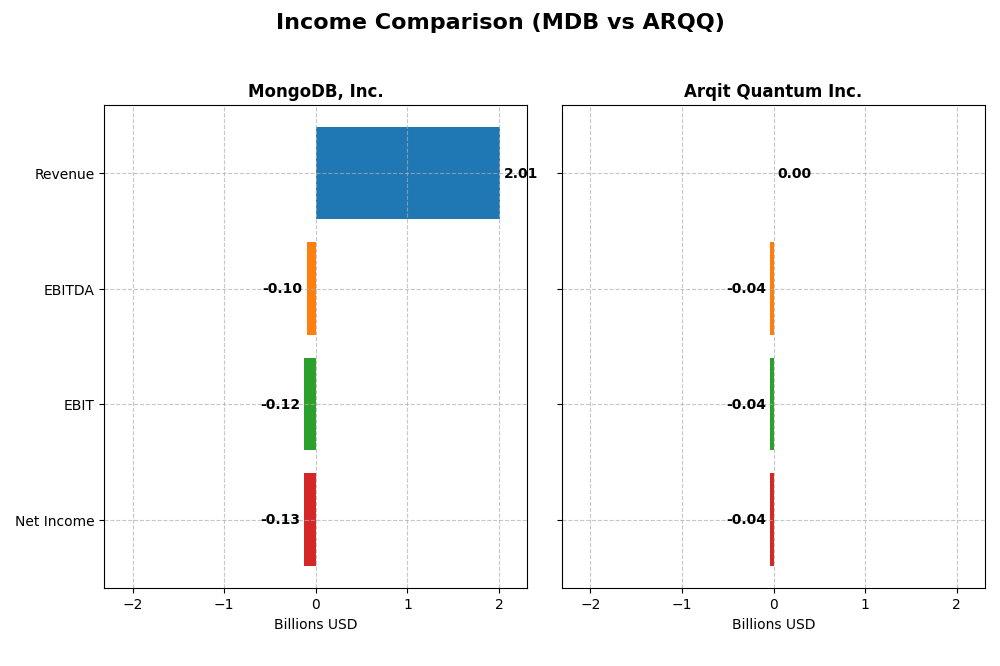

Income Statement Comparison

This table compares the key income statement metrics for MongoDB, Inc. and Arqit Quantum Inc. for their most recent fiscal year, providing a snapshot of their financial performance.

| Metric | MongoDB, Inc. (MDB) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Market Cap | 32.5B | 416M |

| Revenue | 2.01B | 530K |

| EBITDA | -96.5M | -36.8M |

| EBIT | -123.5M | -37.6M |

| Net Income | -129.1M | -35.3M |

| EPS | -1.73 | -2.56 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

MongoDB, Inc.

MongoDB’s revenue has shown consistent growth from $590M in 2021 to $2B in 2025, with net income losses steadily decreasing from -$267M to -$129M. Gross margins remain strong around 73%, while EBIT and net margins are negative but improving. The latest fiscal year shows a 19.2% revenue increase and a 38.7% net margin improvement, indicating recovering profitability trends.

Arqit Quantum Inc.

Arqit’s revenue expanded substantially from $48K in 2021 to $530K in 2025, though still very small scale. Net losses fluctuate significantly, with a recent net loss of -$35M improving from -$54M the prior year. Gross and EBIT margins remain deeply negative, reflecting heavy operating expenses. Despite an 80.9% revenue growth in 2025, margins continue to show substantial weaknesses.

Which one has the stronger fundamentals?

MongoDB presents stronger fundamentals with higher scale and consistent revenue growth paired with improving margins, despite ongoing net losses. Arqit exhibits rapid growth but remains at a much smaller scale with very negative margins and volatile net income. MongoDB’s favorable margin and profitability improvements suggest a more stable income statement profile compared to Arqit’s continued heavy losses and margin challenges.

Financial Ratios Comparison

The table below presents a side-by-side comparison of the most recent key financial ratios for MongoDB, Inc. and Arqit Quantum Inc., reflecting their fiscal year 2025 data where available.

| Ratios | MongoDB, Inc. (MDB) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| ROE | -4.64% | -129.77% |

| ROIC | -7.36% | -127.45% |

| P/E | -158x | -15.12x |

| P/B | 7.32 | 19.62 |

| Current Ratio | 5.20 | 2.69 |

| Quick Ratio | 5.20 | 2.69 |

| D/E (Debt to Equity) | 0.013 | 0.026 |

| Debt-to-Assets | 1.06% | 1.68% |

| Interest Coverage | -26.7x | -803x |

| Asset Turnover | 0.58 | 0.012 |

| Fixed Asset Turnover | 24.78 | 0.74 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

MongoDB, Inc.

MongoDB shows several unfavorable financial ratios in 2025, including negative net margin at -6.43% and negative returns on equity and invested capital, indicating profitability and efficiency challenges. The company has a high current ratio of 5.2, which is unfavorable, but a favorable quick ratio of 5.2 and low debt levels. MongoDB pays no dividends, likely reflecting reinvestment in growth and R&D, consistent with its high operating expenses.

Arqit Quantum Inc.

Arqit Quantum’s 2025 ratios reflect significant struggles, with a deeply negative net margin of -6668.49% and very weak returns on equity and capital employed, signaling severe profitability issues. Low asset turnover and fixed asset turnover ratios are unfavorable, while liquidity ratios like current and quick ratios are favorable. The company does not pay dividends, likely due to ongoing investment in development and operational expansion.

Which one has the best ratios?

Both companies have unfavorable global ratio evaluations with 35.71% favorable metrics each, but Arqit Quantum faces more severe profitability and efficiency issues, reflected in much worse net margin and returns. MongoDB, while also unprofitable, demonstrates stronger operational liquidity and lower leverage, suggesting relatively better financial stability between the two.

Strategic Positioning

This section compares the strategic positioning of MongoDB, Inc. and Arqit Quantum Inc., including market position, key segments, and exposure to technological disruption:

MongoDB, Inc.

- Leading database platform with $32.5B market cap, facing competitive pressure in software infrastructure.

- Key segments: MongoDB Atlas cloud DB service, other subscriptions, and professional services driving growth.

- Exposure to disruption from cloud and database technology advances; offers multi-cloud and hybrid solutions.

Arqit Quantum Inc.

- Smaller $416M market cap cybersecurity provider, niche focus with higher beta and volatility.

- Focused on QuantumCloud encryption software delivered via satellite and terrestrial platforms.

- Positioned in quantum cybersecurity, a potentially disruptive technology, but with early-stage scale.

MongoDB, Inc. vs Arqit Quantum Inc. Positioning

MongoDB’s strategy is diversified across cloud database services and subscriptions with a strong market presence; Arqit concentrates on quantum encryption technology with a niche cybersecurity focus. MongoDB benefits from scale, while Arqit faces higher market and technology uncertainty.

Which has the best competitive advantage?

Both companies are currently shedding value relative to their cost of capital, though profitability is improving. MongoDB’s larger scale and growing ROIC trend suggest a more stable economic moat than Arqit’s smaller, earlier-stage business.

Stock Comparison

The stock price movements for MongoDB, Inc. (MDB) and Arqit Quantum Inc. (ARQQ) over the past 12 months reveal contrasting trends, with significant shifts in momentum and trading volumes shaping their market dynamics.

Trend Analysis

MongoDB, Inc. (MDB) experienced a bearish trend over the past year, with a price decline of -11.46%. The trend showed acceleration, reaching a high of 451.52 and a low of 154.39, alongside elevated volatility (std deviation 72.49).

Arqit Quantum Inc. (ARQQ) posted a strong bullish trend over the same period, gaining 93.6%. This trend decelerated recently, with a notable peak at 49.92 and a trough at 4.19, and exhibited lower volatility (std deviation 11.75).

Comparing both, ARQQ delivered the highest market performance with a 93.6% gain, outperforming MDB’s -11.46% loss over the past 12 months.

Target Prices

Analysts present a clear consensus on target prices for MongoDB, Inc. and Arqit Quantum Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| MongoDB, Inc. | 500 | 375 | 445.2 |

| Arqit Quantum Inc. | 60 | 60 | 60 |

The consensus target price for MongoDB at 445.2 USD is notably above its current price of 399.76 USD, indicating potential upside. Arqit’s target of 60 USD is more than double its current price of 26.6 USD, suggesting strong growth expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for MongoDB, Inc. and Arqit Quantum Inc.:

Rating Comparison

MDB Rating

- Rating: C, considered Very Favorable overall.

- Discounted Cash Flow Score: 2, indicating a Moderate valuation based on future cash flows.

- ROE Score: 1, reflecting Very Unfavorable efficiency in generating profit from equity.

- ROA Score: 1, showing Very Unfavorable asset utilization to generate earnings.

- Debt To Equity Score: 4, rated as Favorable, indicating lower financial risk.

- Overall Score: 2, categorized as Moderate overall financial standing.

ARQQ Rating

- Rating: C, considered Very Favorable overall.

- Discounted Cash Flow Score: 2, indicating a Moderate valuation based on future cash flows.

- ROE Score: 1, reflecting Very Unfavorable efficiency in generating profit from equity.

- ROA Score: 1, showing Very Unfavorable asset utilization to generate earnings.

- Debt To Equity Score: 4, rated as Favorable, indicating lower financial risk.

- Overall Score: 2, categorized as Moderate overall financial standing.

Which one is the best rated?

Both MongoDB and Arqit Quantum share identical ratings and scores across all evaluated metrics, including a C rating and moderate overall scores. Neither company stands out as better rated based on the provided data.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for MongoDB, Inc. and Arqit Quantum Inc.:

MDB Scores

- Altman Z-Score: 30.24, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 4, categorized as average financial strength.

ARQQ Scores

- Altman Z-Score: -0.22, indicating a distress zone with high bankruptcy risk.

- Piotroski Score: 2, categorized as very weak financial strength.

Which company has the best scores?

Based strictly on the provided data, MDB has significantly better scores, with a very high Altman Z-Score and average Piotroski Score, while ARQQ falls into distress and very weak categories.

Grades Comparison

Here is a comparison of the available grades for MongoDB, Inc. and Arqit Quantum Inc.:

MongoDB, Inc. Grades

The following table summarizes recent grades from reputable grading companies for MongoDB, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-12 |

| Needham | Maintain | Buy | 2026-01-12 |

| Truist Securities | Maintain | Buy | 2026-01-07 |

| Needham | Maintain | Buy | 2026-01-06 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-12-04 |

| Goldman Sachs | Maintain | Buy | 2025-12-03 |

| Citigroup | Maintain | Buy | 2025-12-03 |

| Canaccord Genuity | Maintain | Buy | 2025-12-02 |

| Piper Sandler | Maintain | Overweight | 2025-12-02 |

MongoDB’s grades consistently show a strong buy or outperform consensus from multiple well-known financial institutions.

Arqit Quantum Inc. Grades

The following table shows the grading data available for Arqit Quantum Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-10-13 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-18 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-31 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-06 |

| HC Wainwright & Co. | Maintain | Buy | 2024-07-11 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-29 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-15 |

| HC Wainwright & Co. | Maintain | Buy | 2023-11-22 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-27 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-26 |

Arqit Quantum’s grades come exclusively from one grading company, HC Wainwright & Co., consistently maintaining a Buy rating.

Which company has the best grades?

MongoDB, Inc. has a broader range of respected grading companies with mostly Buy and Outperform ratings, while Arqit Quantum’s grades rely solely on one firm but maintain a steady Buy rating. Investors may interpret MongoDB’s diversified and consistently positive grades as a stronger consensus.

Strengths and Weaknesses

Below is a comparative overview of the strengths and weaknesses of MongoDB, Inc. (MDB) and Arqit Quantum Inc. (ARQQ) based on the most recent financial and strategic data available.

| Criterion | MongoDB, Inc. (MDB) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Diversification | Moderate: Revenue mainly from MongoDB Atlas and subscriptions, limited service segment | Low: Primarily focused on quantum encryption technology, limited product diversity |

| Profitability | Negative net margin (-6.43%), ROIC -7.36%, but improving ROIC trend | Highly negative profitability with net margin -6668.49%, ROIC -127.45%, slight improvement trend |

| Innovation | Strong in database and cloud technology innovation, leading market presence | Innovative in quantum encryption, but commercial viability still uncertain |

| Global presence | Solid international market penetration with growing cloud adoption | Emerging presence, still building global footprint |

| Market Share | Significant in the cloud database segment, growing MongoDB Atlas revenue (1.4B in 2025) | Small market share in nascent quantum tech market |

Key takeaways: MongoDB shows steady growth in its core cloud database business, improving profitability despite current losses. Arqit, while highly innovative, faces substantial financial challenges and a less diversified portfolio, indicating higher risk for investors.

Risk Analysis

Below is a comparative table of key risks for MongoDB, Inc. (MDB) and Arqit Quantum Inc. (ARQQ) based on the most recent data from 2025.

| Metric | MongoDB, Inc. (MDB) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Market Risk | Beta 1.38 – Moderate volatility | Beta 2.41 – High volatility |

| Debt Level | Low (Debt/Equity 0.01) – Favorable | Low (Debt/Equity 0.03) – Favorable |

| Regulatory Risk | Moderate – US tech regulations | Elevated – UK and global cybersecurity laws |

| Operational Risk | Medium – Scaling cloud services | High – Early-stage quantum tech deployment |

| Environmental Risk | Low – Software industry standard | Low – Limited physical footprint |

| Geopolitical Risk | Moderate – US-China tech tensions | High – UK geopolitical uncertainties and export controls |

MongoDB shows moderate market and regulatory risks but benefits from low debt and a strong Altman Z-Score indicating financial stability. Arqit faces higher market volatility, operational challenges in nascent quantum tech, and geopolitical risks linked to UK policies, compounded by distress-level bankruptcy scores. Investors should weigh MongoDB’s relative stability against Arqit’s higher risk and growth potential.

Which Stock to Choose?

MongoDB, Inc. (MDB) shows a favorable income statement with strong revenue growth of 19.22% in the last year and an overall period growth of 239.86%. However, profitability ratios such as ROE (-4.64%) and net margin (-6.43%) remain unfavorable. Debt levels are low, with a debt-to-equity ratio of 0.01 and a favorable interest coverage ratio. The company’s rating is very favorable overall but with moderate scores on profitability metrics.

Arqit Quantum Inc. (ARQQ) exhibits a mixed income profile: strong revenue growth of 80.89% last year and over 1000% overall, but deeply negative profitability metrics including a net margin of -6668.49% and ROE of -129.77%. The company maintains a low debt-to-equity ratio (0.03) and favorable liquidity ratios, yet its overall rating is similarly very favorable with moderate overall scores but very weak profitability indicators.

For investors, MDB’s combination of steady income growth, improving profitability, and moderate risk profile might appear more suitable for those prioritizing quality and stability. In contrast, ARQQ’s rapid expansion but extreme profitability challenges could be more aligned with risk-tolerant investors seeking growth exposure despite financial volatility. Both companies show value destruction currently but with rising ROIC trends, suggesting cautious observation.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of MongoDB, Inc. and Arqit Quantum Inc. to enhance your investment decisions: