In the fast-evolving technology sector, Informatica Inc. (INFA) and Arqit Quantum Inc. (ARQQ) stand out as innovators in software infrastructure, each pursuing distinct yet overlapping paths in data management and cybersecurity. Informatica excels in AI-powered enterprise data integration, while Arqit focuses on cutting-edge quantum encryption solutions. This article will analyze both companies’ strengths and risks to help you decide which may be the more promising addition to your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Informatica Inc. and Arqit Quantum Inc. by providing an overview of these two companies and their main differences.

Informatica Inc. Overview

Informatica Inc. develops an AI-powered platform that connects, manages, and unifies data across multi-cloud and hybrid systems at an enterprise scale. Positioned in the software infrastructure industry, Informatica offers a comprehensive suite of data management products including integration, quality, master data management, and governance solutions. Headquartered in Redwood City, CA, the company serves large enterprises primarily in the US and employs about 5,200 people.

Arqit Quantum Inc. Overview

Arqit Quantum Inc. operates in the software infrastructure sector with a focus on cybersecurity services via satellite and terrestrial platforms. Based in London, UK, Arqit offers QuantumCloud, a product enabling devices to generate encryption keys securely across networks. The company is much smaller, with 82 employees, and targets cybersecurity solutions through innovative quantum encryption technology.

Key similarities and differences

Both companies operate in the software infrastructure sector and provide technology solutions addressing data security and management. Informatica focuses on broad enterprise data integration and governance with a large-scale platform, while Arqit specializes narrowly in quantum encryption cybersecurity. Informatica has a significantly larger market cap and workforce, whereas Arqit is smaller and more specialized with higher beta, reflecting higher volatility.

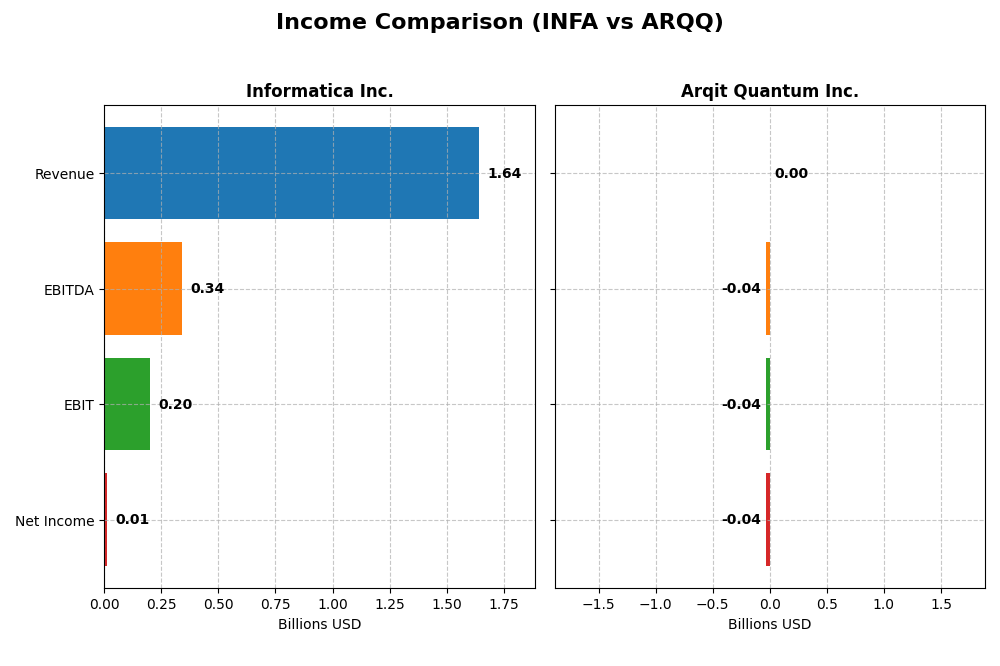

Income Statement Comparison

The table below presents a factual comparison of key income statement metrics for Informatica Inc. (INFA) and Arqit Quantum Inc. (ARQQ) based on their most recent fiscal year data.

| Metric | Informatica Inc. (INFA) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Market Cap | 7.54B | 416M |

| Revenue | 1.64B | 530K |

| EBITDA | 339M | -36.8M |

| EBIT | 199M | -37.6M |

| Net Income | 9.93M | -35.3M |

| EPS | 0.033 | -2.56 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Informatica Inc.

Informatica’s revenue grew steadily by 23.95% from 2020 to 2024, reaching $1.64B in 2024. Net income reversed from losses to a modest profit of $9.9M in 2024, reflecting a 105.92% growth overall. Margins remained stable with a gross margin at 80.11% and an improving EBIT margin of 12.15%, signaling efficient cost management. The latest year saw slower revenue growth at 2.81%, yet EBIT surged 168.42%, boosting net margin and EPS notably.

Arqit Quantum Inc.

Arqit’s revenue expanded dramatically by 1006.24% over 2021-2025, hitting $530K in 2025, though still small in absolute terms. Net income, though improving by 86.99% overall, remained deeply negative at -$35.3M in 2025. Margins are heavily unfavorable, with gross margin at -43.4% and EBIT margin at -7088.3%, reflecting high operating expenses relative to revenues. The latest year showed strong revenue and gross profit growth but a significant EBIT decline of 58.15%.

Which one has the stronger fundamentals?

Informatica displays stronger fundamentals with sustained revenue growth, positive net income turnaround, and healthy margins. Arqit exhibits rapid top-line growth but continues to incur large losses and negative margins, indicating early-stage operational challenges. Informatica’s stable profitability contrasts with Arqit’s volatile earnings, suggesting more consistent income statement strength for Informatica based on the provided data.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Informatica Inc. (INFA) and Arqit Quantum Inc. (ARQQ) based on their most recent fiscal year data.

| Ratios | Informatica Inc. (INFA) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| ROE | 0.43% | -129.77% |

| ROIC | 0.56% | -127.45% |

| P/E | 788 | -15.12 |

| P/B | 3.39 | 19.62 |

| Current Ratio | 1.82 | 2.69 |

| Quick Ratio | 1.82 | 2.69 |

| D/E (Debt-to-Equity) | 0.81 | 0.03 |

| Debt-to-Assets | 35.24% | 1.68% |

| Interest Coverage | 0.87 | -802.90 |

| Asset Turnover | 0.31 | 0.01 |

| Fixed Asset Turnover | 8.75 | 0.74 |

| Payout ratio | 0.12% | 0% |

| Dividend yield | 0.00015% | 0% |

Interpretation of the Ratios

Informatica Inc.

Informatica’s key financial ratios indicate challenges, with low returns on assets (0.19%) and equity (0.43%) and a high net debt to EBITDA ratio of 2.8, suggesting leverage concerns. The company maintains a solid current ratio of 1.82, reflecting decent short-term liquidity. Informatica does not pay dividends, likely focusing on reinvestment and R&D, as evidenced by a substantial 19.2% revenue allocation to research and development.

Arqit Quantum Inc.

Arqit Quantum shows mostly unfavorable ratios, including a highly negative net margin (-6668%) and return on equity (-130%), alongside a high price-to-book ratio (19.62), signaling valuation concerns. However, liquidity appears strong with a current ratio of 2.69 and low debt levels (debt to assets 1.68%). The company does not pay dividends, consistent with its high-risk profile and focus on growth and development in cybersecurity.

Which one has the best ratios?

Based on the evaluations, Informatica presents a more balanced financial profile despite some leverage and low profitability issues. Arqit Quantum’s ratios are predominantly unfavorable, with extreme losses and valuation concerns, although it maintains strong liquidity and minimal debt. Overall, Informatica’s ratios are comparatively stronger than Arqit’s in this assessment.

Strategic Positioning

This section compares the strategic positioning of Informatica Inc. and Arqit Quantum Inc. across market position, key segments, and exposure to technological disruption:

Informatica Inc.

- Established player in software infrastructure with 7.5B market cap and moderate competitive pressure.

- Focuses on AI-powered data management platform, subscription revenues over 1B, and professional services.

- Operates in evolving AI and cloud data integration but no explicit disruption risk detailed.

Arqit Quantum Inc.

- Smaller UK-based cybersecurity firm with 416M market cap facing higher competitive volatility.

- Provides QuantumCloud encryption software via satellite and terrestrial platforms, niche cybersecurity segment.

- Operates in quantum encryption, a highly innovative but disruptive technology sector.

Informatica Inc. vs Arqit Quantum Inc. Positioning

Informatica’s diversified data platform and large scale contrast with Arqit’s concentrated focus on quantum cybersecurity. Informatica benefits from subscription and services revenue streams, while Arqit’s niche technology carries higher risk and growth uncertainty.

Which has the best competitive advantage?

Arqit’s MOAT evaluation is slightly unfavorable due to value destruction despite improving profitability, while Informatica lacks sufficient data for MOAT assessment, making direct advantage comparison inconclusive.

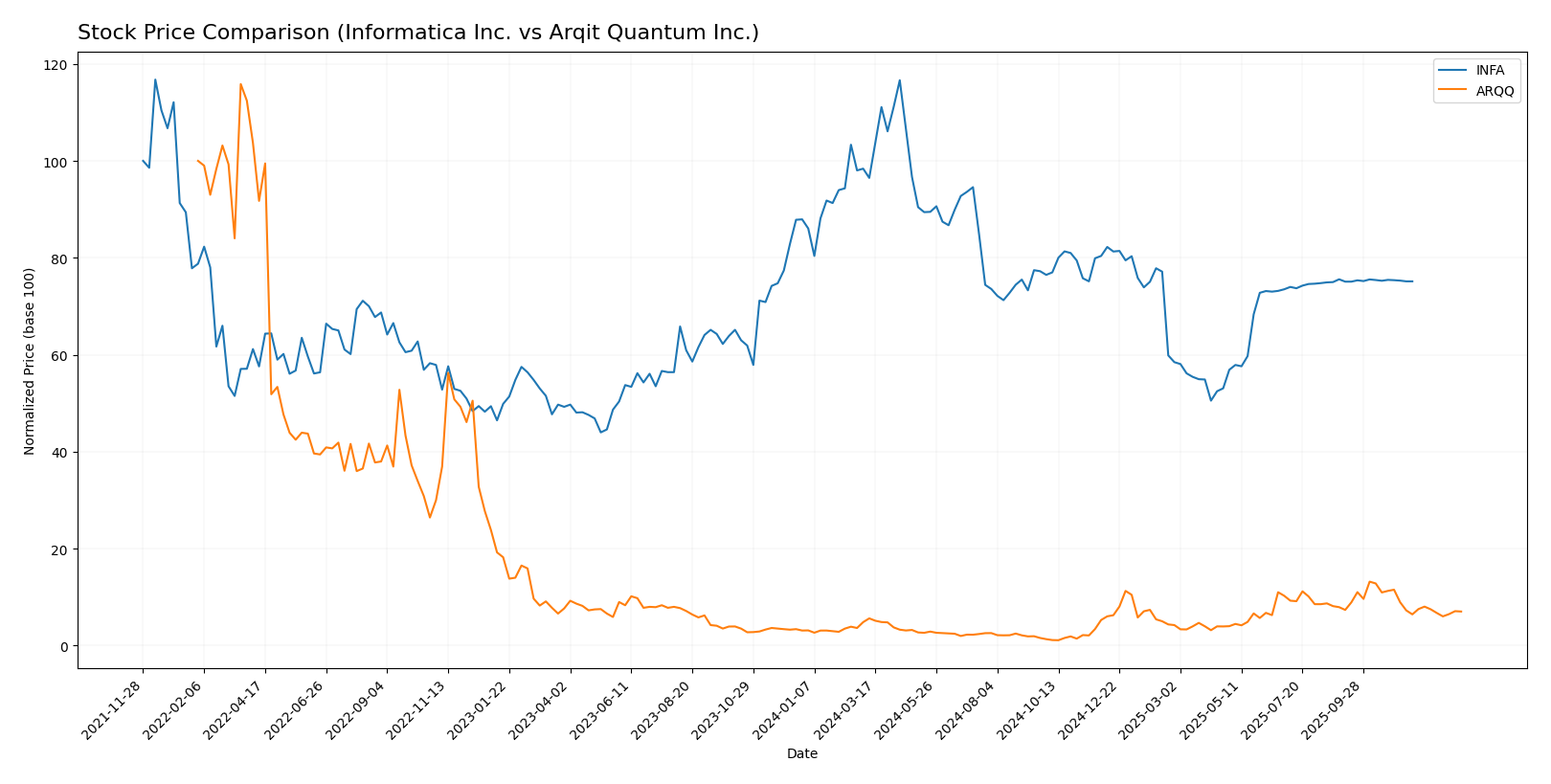

Stock Comparison

The stock price movements over the past 12 months reveal divergent trends, with Informatica Inc. experiencing a notable decline while Arqit Quantum Inc. saw substantial gains despite recent volatility and deceleration phases.

Trend Analysis

Informatica Inc. showed a bearish trend over the past year with a -12.68% price change and accelerating decline; recent months indicate a neutral trend with minimal price movement and very low volatility.

Arqit Quantum Inc. demonstrated a strong bullish trend over the same period, gaining 93.6% despite decelerating momentum; however, recent weeks reveal a sharp -39.03% drop and increased volatility.

Comparing both, Arqit Quantum Inc. delivered the highest market performance with significant overall gains, whereas Informatica Inc. faced a sustained loss despite recent stabilization.

Target Prices

Analysts present a clear consensus on target prices for Informatica Inc. and Arqit Quantum Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Informatica Inc. | 27 | 27 | 27 |

| Arqit Quantum Inc. | 60 | 60 | 60 |

The target consensus for Informatica at $27 is slightly above its current price of $24.79, indicating moderate upside potential. Arqit’s consensus target of $60 significantly exceeds its current price of $26.60, suggesting strong expected growth.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Informatica Inc. and Arqit Quantum Inc.:

Rating Comparison

INFA Rating

- No rating data provided by analysts.

- No Discounted Cash Flow Score available.

- No ROE Score available.

- No ROA Score available.

- No Debt to Equity Score available.

ARQQ Rating

- Rated C with an overall score of 2, considered moderate.

- Discounted Cash Flow Score is 2, indicating moderate valuation based on future cash flows.

- Return on Equity Score is 1, reflecting very unfavorable efficiency in generating profit.

- Return on Assets Score is 1, showing very unfavorable asset utilization.

- Debt to Equity Score is 4, indicating a favorable financial risk profile with low reliance on debt.

Which one is the best rated?

Based on the available data, Arqit Quantum Inc. has a full set of ratings with a moderate overall score of 2, while Informatica Inc. lacks rating data. Thus, Arqit Quantum is the better rated company among the two by default.

Scores Comparison

The following table presents a comparison of the Altman Z-Score and Piotroski Score for Informatica Inc. and Arqit Quantum Inc.:

INFA Scores

- Altman Z-Score: 1.94, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 6, classified as average financial strength.

ARQQ Scores

- Altman Z-Score: -0.22, in the distress zone indicating high bankruptcy risk.

- Piotroski Score: 2, classified as very weak financial strength.

Which company has the best scores?

Based strictly on provided data, INFA shows better scores with a grey zone Altman Z-Score and average Piotroski Score, whereas ARQQ is in distress with very weak financial strength.

Grades Comparison

Here is the comparison of recent grades given to Informatica Inc. and Arqit Quantum Inc.:

Informatica Inc. Grades

This table summarizes recent grades and changes issued by reputable grading companies for Informatica Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Guggenheim | Downgrade | Neutral | 2025-08-07 |

| UBS | Maintain | Neutral | 2025-08-07 |

| Baird | Maintain | Neutral | 2025-05-28 |

| JP Morgan | Downgrade | Neutral | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-28 |

| Wolfe Research | Downgrade | Peer Perform | 2025-05-28 |

| Wells Fargo | Maintain | Equal Weight | 2025-05-28 |

| Truist Securities | Downgrade | Hold | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-27 |

| UBS | Maintain | Neutral | 2025-05-16 |

Most recent grades for Informatica Inc. show a general trend toward neutral or hold ratings, with several downgrades from previously more positive ratings.

Arqit Quantum Inc. Grades

The following table presents recent grades from a recognized grading company for Arqit Quantum Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-10-13 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-18 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-31 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-06 |

| HC Wainwright & Co. | Maintain | Buy | 2024-07-11 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-29 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-15 |

| HC Wainwright & Co. | Maintain | Buy | 2023-11-22 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-27 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-26 |

Arqit Quantum Inc. consistently receives “Buy” ratings from HC Wainwright & Co., with no recent changes in assessment.

Which company has the best grades?

Arqit Quantum Inc. holds better grades overall, consistently rated as “Buy,” while Informatica Inc. has predominantly “Hold” or “Neutral” grades with recent downgrades. Investors might perceive Arqit’s stronger grades as reflecting higher confidence in growth or stability compared to Informatica.

Strengths and Weaknesses

Below is a comparative overview of the strengths and weaknesses of Informatica Inc. (INFA) and Arqit Quantum Inc. (ARQQ) based on the most recent data available.

| Criterion | Informatica Inc. (INFA) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Diversification | Moderate: Strong Subscription revenue (1.1B in 2024), some Professional Services (78M) | Low: Limited product/revenue diversification visible |

| Profitability | Data unavailable for detailed analysis | Weak: Negative net margin (-6668%), ROE (-130%), ROIC (-127%) |

| Innovation | Established data management solutions | Emerging quantum encryption technology; innovation potential but unproven profitability |

| Global presence | Significant, as a known data management player | Smaller scale, niche quantum tech market presence |

| Market Share | Solid in data integration and cloud services | Early-stage, limited market penetration |

Key takeaways: Informatica shows stable revenue streams with a strong subscription base but lacks recent detailed profitability data. Arqit Quantum, while innovative with growing ROIC, currently destroys value and faces significant profitability challenges, indicating higher investment risk.

Risk Analysis

Below is a comparative table of key risks for Informatica Inc. (INFA) and Arqit Quantum Inc. (ARQQ) based on the most recent 2025 data.

| Metric | Informatica Inc. (INFA) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Market Risk | Moderate (Beta 1.14) | High (Beta 2.41) |

| Debt level | Data unavailable | Low (Debt/Equity 0.03) |

| Regulatory Risk | Moderate (US tech sector) | Moderate (UK, cybersecurity sector) |

| Operational Risk | Moderate (5,200 employees) | High (82 employees, early stage) |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate (US market exposure) | Elevated (UK-based, quantum tech) |

Informatica’s moderate market risk and average financial distress score (Altman Z 1.94, grey zone) suggest cautious optimism but some vulnerability. Arqit faces higher market and operational risks, with a distressed Altman Z score (-0.22) and weak financial health (Piotroski 2), making it a riskier investment. The greatest concerns are Arqit’s financial instability and market volatility, while Informatica’s risks are more balanced but still warrant monitoring.

Which Stock to Choose?

Informatica Inc. (INFA) shows a generally favorable income statement with stable profitability and modest revenue growth. Its financial ratios reflect moderate debt levels (net debt to EBITDA at 2.8) and a current ratio of 1.82, indicating reasonable liquidity. However, profitability metrics such as return on equity remain low at 0.43%, and the Altman Z-Score places it in the grey zone for financial distress, with an average Piotroski score of 6, suggesting moderate financial health.

Arqit Quantum Inc. (ARQQ) exhibits strong revenue growth and improving income metrics but suffers from unfavorable profitability ratios, including a deeply negative return on equity (-130%) and net margin. The company carries low debt levels (debt to equity at 0.03) and solid liquidity (current ratio 2.69). Its Altman Z-Score indicates financial distress, and the Piotroski score is very weak at 2, reflecting significant financial challenges despite a very favorable overall rating of C.

For investors, the choice might depend on risk tolerance and strategy: those with higher risk tolerance and a focus on growth could find ARQQ’s rapid revenue expansion and improving income growth appealing despite its financial fragility. Conversely, investors prioritizing stability and moderate profitability might view INFA’s more balanced financial profile and consistent income statement as more favorable, albeit with lower returns.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Informatica Inc. and Arqit Quantum Inc. to enhance your investment decisions: