Home > Comparison > Technology > CPAY vs ARQQ

The strategic rivalry between Corpay, Inc. and Arqit Quantum Inc. shapes the evolving landscape of the technology sector. Corpay operates as a diversified payments company with a broad, capital-intensive infrastructure serving global business clients. In contrast, Arqit Quantum pursues a niche, high-margin cybersecurity model with cutting-edge quantum encryption technology. This analysis aims to identify which firm’s trajectory offers superior risk-adjusted returns for investors seeking balanced exposure in technology infrastructure.

Table of contents

Companies Overview

Corpay, Inc. and Arqit Quantum Inc. stand as key players in the evolving software infrastructure landscape and digital security arena.

Corpay, Inc.: Global Payments Infrastructure Leader

Corpay dominates business payments with a broad portfolio servicing vehicle, lodging, and corporate expenses worldwide. Its revenue engine centers on payment solutions, including fuel cards, tolls, and accounts payable automation. In 2026, Corpay sharpened its strategic focus on expanding cross-border payment capabilities and streamlining corporate travel expense management.

Arqit Quantum Inc.: Pioneering Quantum Cybersecurity

Arqit Quantum leads in quantum encryption technology, offering cybersecurity solutions via satellite and terrestrial platforms. The core revenue model hinges on QuantumCloud software, enabling secure key generation across devices. In 2026, Arqit emphasized scaling its encryption platform to meet rising global cybersecurity demands, particularly in government and enterprise sectors.

Strategic Collision: Similarities & Divergences

Corpay and Arqit pursue software infrastructure but diverge sharply in business philosophy: Corpay builds a comprehensive payments ecosystem, while Arqit focuses on disruptive quantum security. Their primary battleground is digital trust—payments versus encryption. Corpay’s scale and cash flow contrast with Arqit’s innovation-driven, higher-risk growth profile, defining distinct investment narratives.

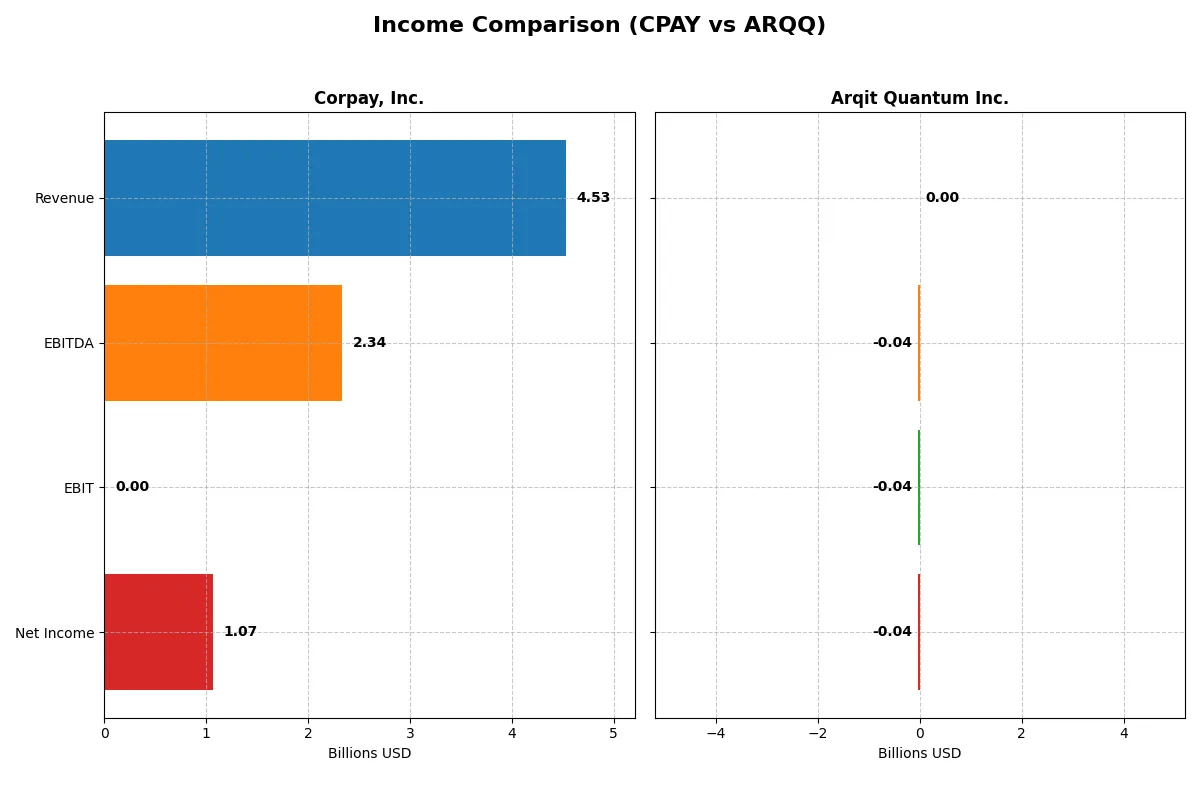

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Corpay, Inc. (CPAY) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Revenue | 4.53B | 530K |

| Cost of Revenue | 0 | 760K |

| Operating Expenses | 2.53B | 38.7M |

| Gross Profit | 0 | -230K |

| EBITDA | 2.34B | -36.8M |

| EBIT | 0 | -37.6M |

| Interest Expense | 404M | 48K |

| Net Income | 1.07B | -35.3M |

| EPS | 15.03 | -2.56 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs its business more efficiently and generates better profits relative to its revenue.

Corpay, Inc. Analysis

Corpay, Inc. steadily grows revenue from 2.8B in 2021 to 4.5B in 2025, with net income rising from 839M to 1.07B. Its net margin remains healthy at 23.6% in 2025, though gross profit data is incomplete for the latest year. The company maintains strong operational momentum, with EPS increasing 7.6% year-over-year, reflecting solid earnings growth despite some margin pressure.

Arqit Quantum Inc. Analysis

Arqit Quantum’s revenue remains minuscule, rising from 48K in 2021 to just 530K in 2025, while net income stays deeply negative, though losses have narrowed from -271M to -35M. Gross and net margins are deeply unfavorable, reflecting ongoing heavy operating losses. However, revenue and EPS growth rates are impressive, signaling early-stage expansion but still far from profitability.

Scale and Profitability vs. Growth and Recovery

Corpay dominates with strong revenue scale and profitable margins, delivering consistent net income growth and attractive EPS increases. Arqit shows remarkable top-line growth but remains loss-making with weak margin control. For investors prioritizing stable profits and margin health, Corpay’s profile offers clearer fundamental strength and earnings reliability.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Corpay, Inc. (CPAY) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| ROE | 32.1% (2024) | -129.8% (2025) |

| ROIC | 10.8% (2024) | -127.5% (2025) |

| P/E | 23.7 (2024) | -15.1 (2025) |

| P/B | 7.62 (2024) | 19.6 (2025) |

| Current Ratio | 1.00 (2024) | 2.69 (2025) |

| Quick Ratio | 1.00 (2024) | 2.69 (2025) |

| D/E | 2.56 (2024) | 0.03 (2025) |

| Debt-to-Assets | 44.5% (2024) | 1.7% (2025) |

| Interest Coverage | 4.67 (2024) | -803 (2025) |

| Asset Turnover | 0.22 (2024) | 0.01 (2025) |

| Fixed Asset Turnover | 10.5 (2024) | 0.74 (2025) |

| Payout ratio | 0% (2024) | 0% (2025) |

| Dividend yield | 0% (2024) | 0% (2025) |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as the company’s DNA, exposing hidden risks and operational strengths behind headline figures.

Corpay, Inc.

Corpay posts a strong 32.15% ROE and a healthy 25.25% net margin, signaling solid profitability. Its P/E of 23.71 suggests a fairly valued stock, though a high P/B of 7.62 flags potential overvaluation. Corpay pays no dividends, instead focusing on reinvestment to sustain growth, but its leverage and current ratio paint a cautious liquidity picture.

Arqit Quantum Inc.

Arqit shows deeply negative profitability metrics: ROE at -129.77% and net margin at -6668.49%, reflecting severe losses. Its P/E is negative but low, which can mislead valuation. The firm maintains a strong liquidity profile with a current ratio of 2.69 and minimal debt, yet its operational efficiency is weak, and it delivers no dividends, relying on cash preservation amid losses.

Profitability Strength vs. Liquidity Cushion

Corpay balances solid profitability with stretched valuation and moderate leverage, posing moderate risk for growth-focused investors. Arqit offers strong liquidity and low debt but suffers from extreme profitability deficits and operational inefficiency. Investors prioritizing earnings stability may prefer Corpay, while those emphasizing balance sheet safety might consider Arqit’s liquidity profile.

Which one offers the Superior Shareholder Reward?

Corpay, Inc. (CPAY) and Arqit Quantum Inc. (ARQQ) both offer distinct shareholder reward strategies. CPAY pays no dividends but maintains zero payout ratio, focusing on strong free cash flow generation (25.1/share in 2024) and robust buybacks, sustaining a price-to-free-cash-flow ratio near 13.5. Their operating margins exceed 44%, reflecting consistent profitability supporting sustainable capital returns. ARQQ pays no dividends and posts negative margins, with losses exceeding 60%, and relies on reinvestment in R&D and growth, showing no buyback activity. ARQQ’s high price-to-book (19.6) and negative free cash flow per share (-2.1) signal speculative risk. I conclude CPAY offers a more attractive total return profile in 2026 due to its sustainable cash flow-driven buybacks and solid profitability versus ARQQ’s unproven growth and persistent losses.

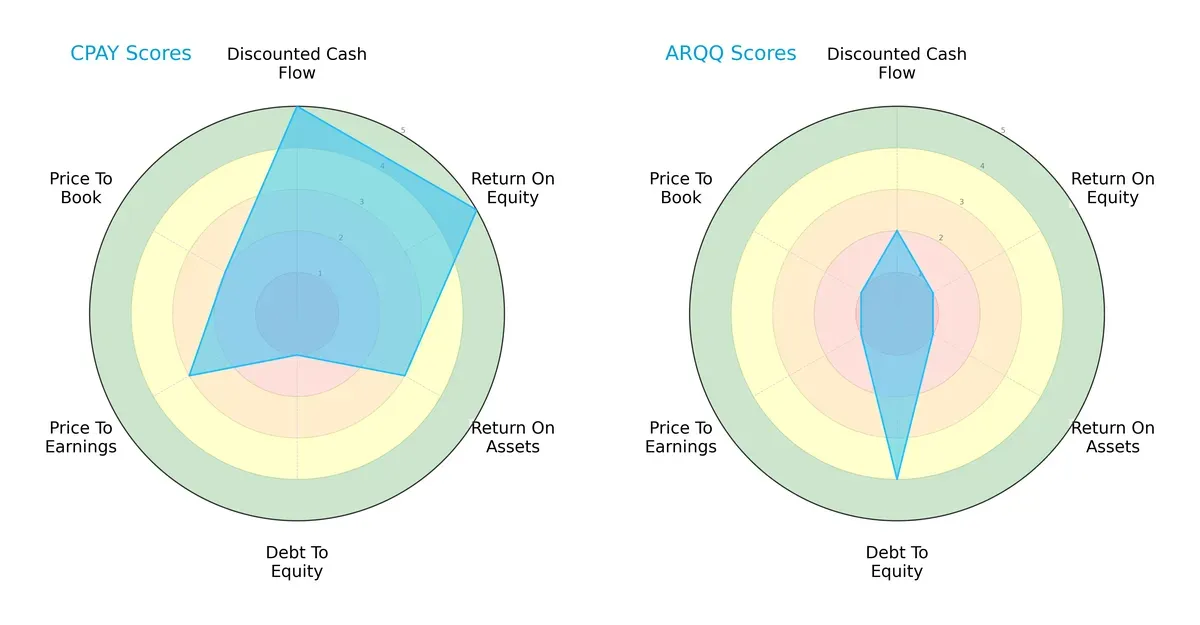

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Corpay, Inc. and Arqit Quantum Inc., highlighting their distinct financial strengths and weaknesses:

Corpay excels in Discounted Cash Flow (5) and Return on Equity (5), signaling strong profitability and cash generation. Arqit shows a modest Debt/Equity advantage (4), indicating better leverage management. However, Corpay’s poor Debt/Equity score (1) is a red flag. Overall, Corpay presents a more balanced profile relying on operational efficiency, while Arqit leans on conservative leverage but struggles with profitability and valuation metrics.

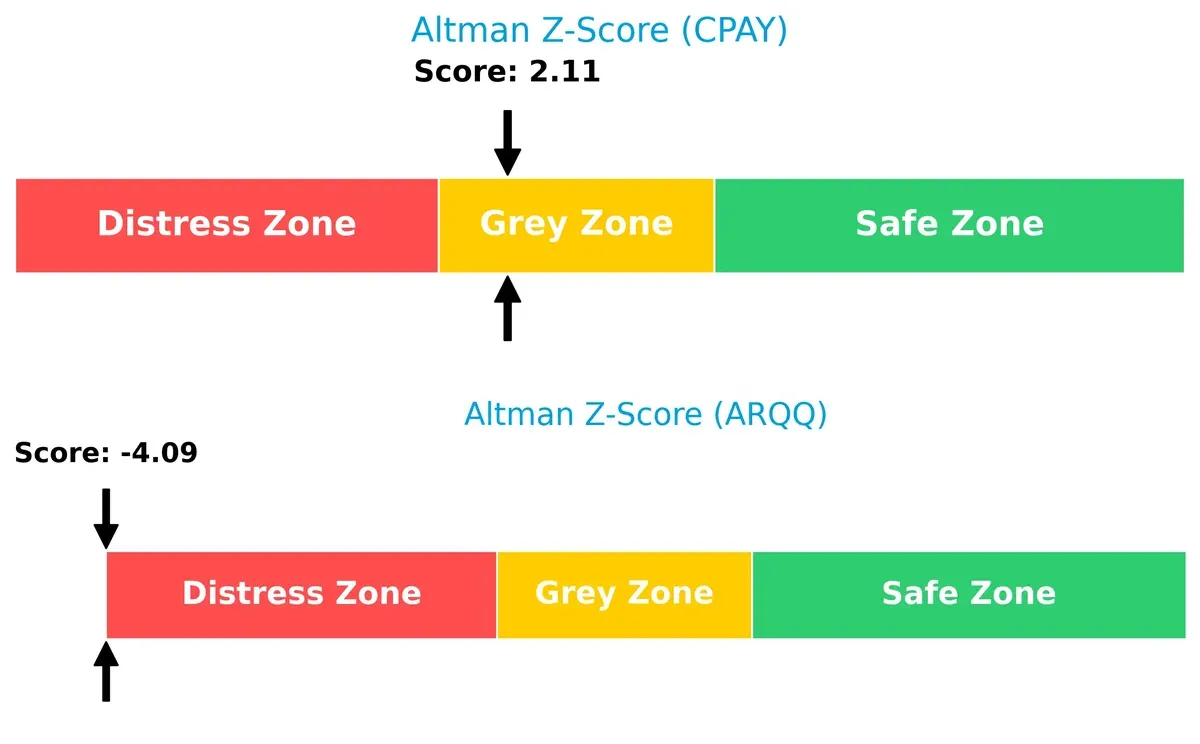

Bankruptcy Risk: Solvency Showdown

Corpay’s Altman Z-Score of 2.11 places it in the grey zone, suggesting moderate bankruptcy risk. Arqit’s -4.09 score signals distress and high insolvency risk in this cycle:

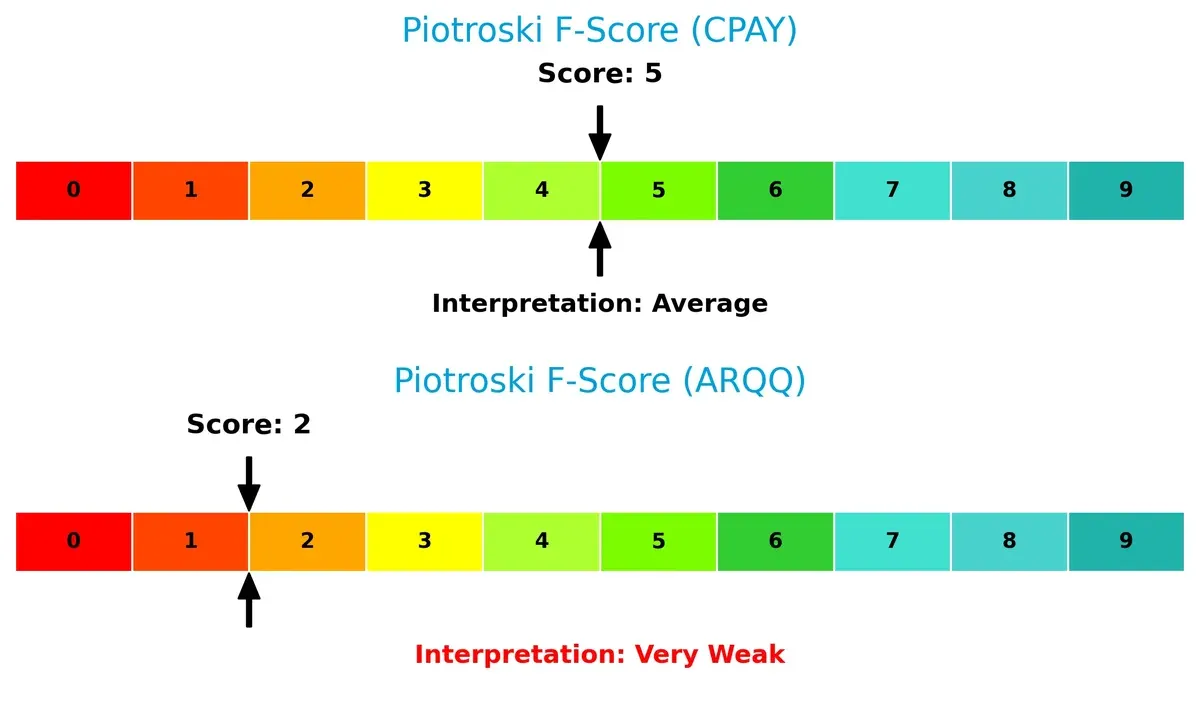

Financial Health: Quality of Operations

Corpay’s Piotroski F-Score of 5 indicates average financial health with no immediate red flags. Arqit’s low score of 2 flags significant operational and financial weaknesses compared to its peer:

How are the two companies positioned?

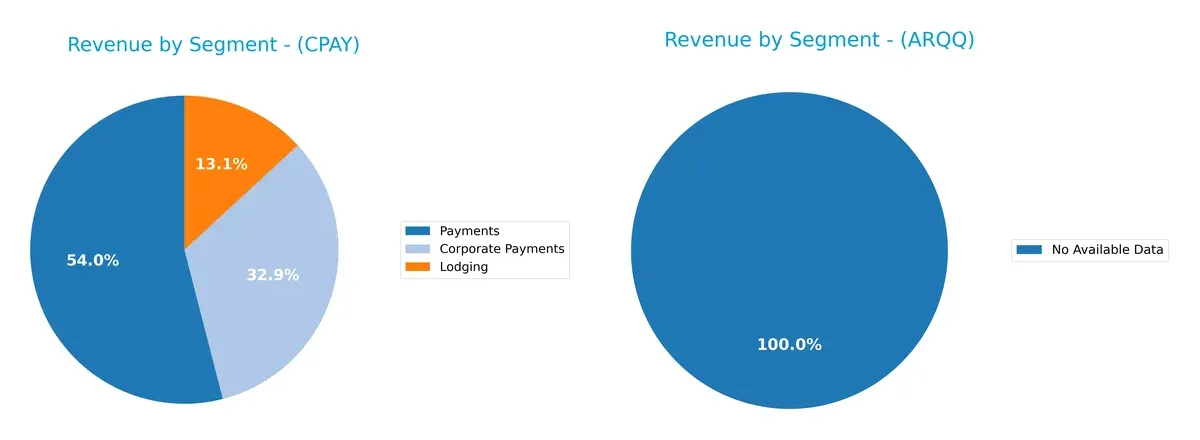

This section dissects the operational DNA of Corpay and Arqit by comparing their revenue distribution by segment and internal dynamics. The goal is to confront their economic moats to identify which model offers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

The following visual comparison dissects how both firms diversify their income streams and where their primary sector bets lie:

Corpay, Inc. anchors revenue in Payments with $2B, followed by Corporate Payments at $1.22B and Lodging at $489M. Arqit Quantum Inc. lacks sufficient data for comparison. Corpay’s focus on payments infrastructure suggests ecosystem lock-in but exposes it to sector-specific risks. Its segment diversity, however, mitigates reliance on any single revenue stream.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Corpay, Inc. and Arqit Quantum Inc.:

Corpay, Inc. Strengths

- Diversified revenue streams across corporate payments, lodging, and payments

- Strong presence in major markets: US, UK, Brazil

- Favorable net margin (25.25%) and ROE (32.15%)

- Efficient fixed asset turnover (10.52)

Arqit Quantum Inc. Strengths

- Strong liquidity with current and quick ratios at 2.69

- Low debt-to-equity ratio (0.03) and debt-to-assets (1.68%)

- Favorable price-to-earnings despite losses

Corpay, Inc. Weaknesses

- Unfavorable high debt-to-equity (2.56) and interest coverage (0.0)

- Weak liquidity with current ratio at 1.0

- Unfavorable asset turnover (0.22) and no dividend yield

- High price-to-book ratio (7.62)

Arqit Quantum Inc. Weaknesses

- Negative profitability metrics: net margin (-6668.49%), ROE (-129.77%), ROIC (-127.45%)

- High weighted average cost of capital (15.16%)

- Poor asset and fixed asset turnover

- Negative interest coverage (-782.67) and no dividend yield

Corpay shows solid profitability and geographic diversification but carries financial leverage and liquidity risks. Arqit exhibits strong liquidity and conservative leverage but struggles with severe profitability deficits and operational efficiency. These profiles suggest contrasting strategic challenges and financial health.

The Moat Duel: Analyzing Competitive Defensibility

Structural moats protect long-term profits from competitive erosion. Only durable advantages stand the test of time and market pressure:

Corpay, Inc.: Cost Advantage and Scale Moat

Corpay leverages scale and cost efficiencies in vehicle and corporate payments, reflected in stable net margins near 24%. Its broad geographic reach solidifies market control. New digital payment solutions could deepen this moat by 2026.

Arqit Quantum Inc.: Intangible Asset Moat via Quantum Encryption

Arqit’s moat centers on proprietary quantum encryption software, unlike Corpay’s cost-driven edge. Despite current value destruction, its growing ROIC signals improving capital efficiency. Expansion in cybersecurity markets offers significant upside.

Verdict: Scale Cost Leadership vs. Cutting-Edge Intangibles

Corpay’s wide moat derives from scale and cost advantages with proven margin stability. Arqit’s moat is narrower but potentially deeper if quantum tech gains traction. Corpay is better positioned today to defend market share amid competitive pressures.

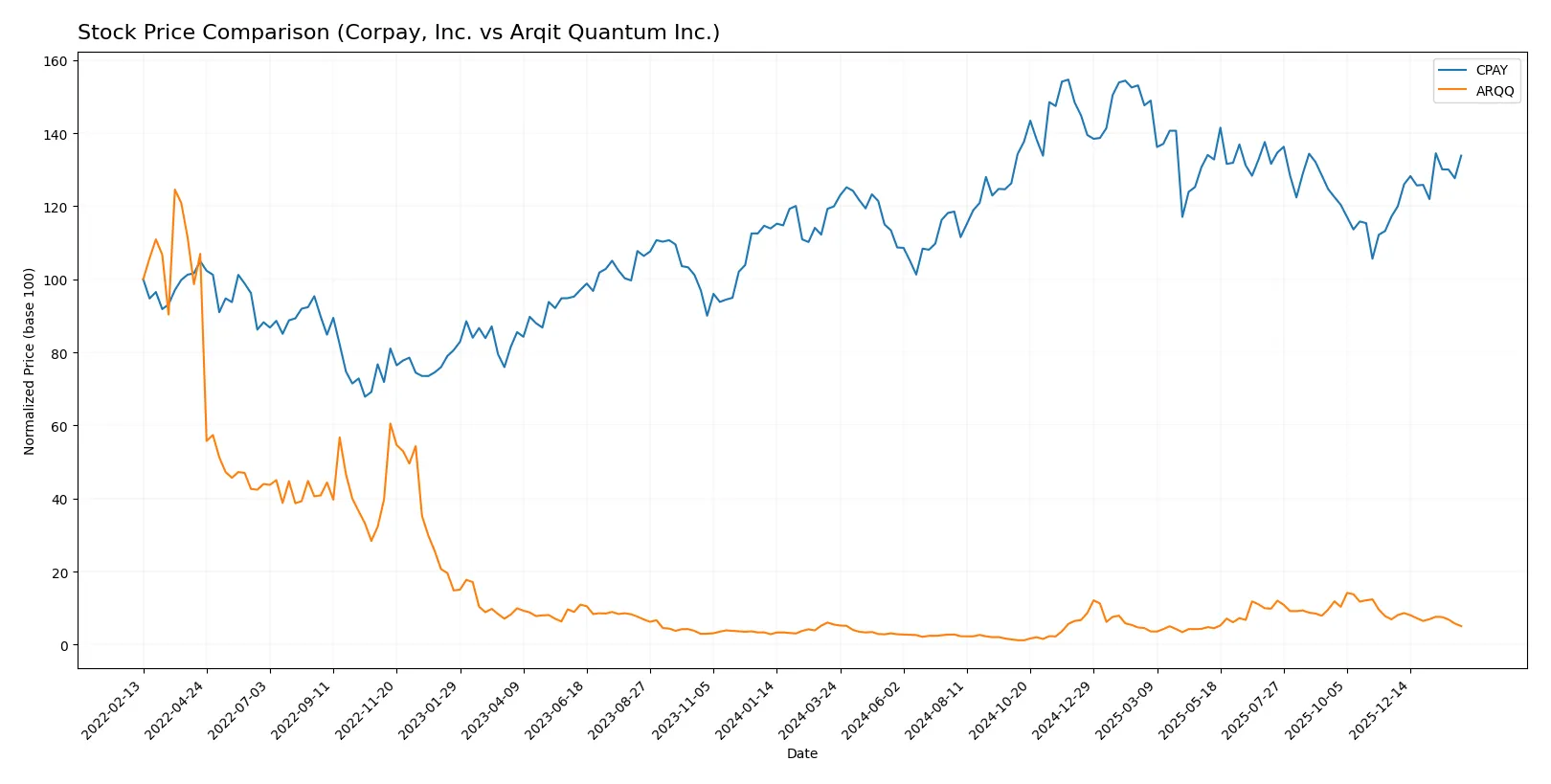

Which stock offers better returns?

Over the past year, Corpay, Inc. showed a strong upward price movement with accelerating gains. Arqit Quantum Inc. experienced a sustained decline, marked by decelerating losses and weakening buyer interest.

Trend Comparison

Corpay, Inc. posted an 11.58% price increase over 12 months, indicating a bullish trend with accelerating momentum and high volatility, hitting a peak of 381.18. Arqit Quantum Inc. fell 7.99% over the same period, reflecting a bearish trend with deceleration and lower volatility, with prices ranging from 4.19 to 49.92. Corpay outperformed Arqit, delivering the strongest market return and a clear upward trajectory during the past year.

Target Prices

Analysts present a clear bullish consensus for Corpay, Inc. and Arqit Quantum Inc., indicating substantial upside potential.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Corpay, Inc. | 300 | 392 | 369.4 |

| Arqit Quantum Inc. | 60 | 60 | 60 |

Corpay’s consensus target of 369.4 exceeds its current price of 328, signaling expected appreciation. Arqit’s target at 60 is more than triple its current 17.57, implying high growth expectations but also elevated risk.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Corpay, Inc. Grades

Below are recent official grades from major financial institutions for Corpay, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Upgrade | Overweight | 2026-01-26 |

| Oppenheimer | Maintain | Outperform | 2026-01-12 |

| Oppenheimer | Upgrade | Outperform | 2025-12-05 |

| JP Morgan | Maintain | Overweight | 2025-11-06 |

| RBC Capital | Maintain | Sector Perform | 2025-11-06 |

| UBS | Maintain | Neutral | 2025-11-06 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-10-01 |

| Morgan Stanley | Maintain | Equal Weight | 2025-08-11 |

| UBS | Maintain | Neutral | 2025-08-07 |

| Raymond James | Maintain | Outperform | 2025-08-07 |

Arqit Quantum Inc. Grades

These are the latest reliable institutional grades for Arqit Quantum Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-10-13 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-18 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-31 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-06 |

| HC Wainwright & Co. | Maintain | Buy | 2024-07-11 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-29 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-15 |

| HC Wainwright & Co. | Maintain | Buy | 2023-11-22 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-27 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-26 |

Which company has the best grades?

Corpay shows a broad mix of Outperform and Overweight ratings from multiple top-tier firms, indicating diverse institutional confidence. Arqit holds consistent Buy ratings, but solely from HC Wainwright & Co., suggesting narrower analyst coverage. Investors may view Corpay’s wider endorsement as a sign of stronger institutional support.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Corpay, Inc.

- Established payments firm with diversified global footprint but faces intense competition in fintech and corporate payments.

Arqit Quantum Inc.

- Early-stage cybersecurity player in quantum encryption, operating in a niche yet highly competitive tech sector with rapid innovation cycles.

2. Capital Structure & Debt

Corpay, Inc.

- High debt-to-equity ratio (2.56) signals significant leverage, increasing financial risk and interest burden.

Arqit Quantum Inc.

- Very low debt-to-equity (0.03) indicates minimal leverage, supporting financial flexibility but possibly limited growth capital.

3. Stock Volatility

Corpay, Inc.

- Beta of 0.81 reflects lower volatility than the market, suggesting relative stability.

Arqit Quantum Inc.

- Beta of 2.41 signals high stock price sensitivity, exposing investors to greater market swings and risk.

4. Regulatory & Legal

Corpay, Inc.

- Operates in multiple jurisdictions with complex payments regulations, increasing compliance costs and legal risks.

Arqit Quantum Inc.

- Faces evolving cybersecurity and data privacy regulations in the UK and globally, with potential for regulatory scrutiny on quantum tech.

5. Supply Chain & Operations

Corpay, Inc.

- Established operational processes support large volumes but exposed to disruptions in cross-border payments infrastructure.

Arqit Quantum Inc.

- Relies on advanced quantum technologies and satellite networks, vulnerable to technological and supply chain bottlenecks.

6. ESG & Climate Transition

Corpay, Inc.

- As a payments firm, faces moderate ESG risks linked to data security and corporate governance.

Arqit Quantum Inc.

- Quantum cybersecurity is energy-intensive; transitioning to sustainable operations is critical to meet rising ESG standards.

7. Geopolitical Exposure

Corpay, Inc.

- Significant exposure to US, Brazil, UK markets, with risks from trade policies and currency fluctuations.

Arqit Quantum Inc.

- UK base with global ambitions; geopolitical tensions could impact satellite operations and international collaborations.

Which company shows a better risk-adjusted profile?

Corpay’s principal risk lies in its high leverage and interest coverage issues, which threaten financial stability despite steady market positioning. Arqit Quantum struggles with extreme earnings volatility and distress-level bankruptcy risk, reflecting its early-stage, high-growth profile. Corpay’s lower beta and larger scale provide a more balanced risk-return tradeoff. Recent financial scores place Corpay in a “grey zone” for bankruptcy risk, while Arqit remains in the “distress zone,” confirming greater vulnerability. Investors seeking stability should favor Corpay, while risk-tolerant traders may consider Arqit’s disruptive potential but with caution.

Final Verdict: Which stock to choose?

Corpay, Inc. leverages its core strength as a robust cash generator, delivering solid returns on equity and a steadily growing ROIC. Its challenge lies in a tight liquidity position and elevated leverage, posing a point of vigilance. Corpay suits investors targeting disciplined, aggressive growth with a tolerance for balance sheet risk.

Arqit Quantum Inc. stands out for its strategic moat in quantum encryption technology, with a strong balance sheet and low leverage enhancing its safety profile versus Corpay. However, it still faces profitability headwinds and negative returns on capital. Arqit fits well within a growth-at-a-reasonable-price (GARP) portfolio focused on emerging technologies with patience for recovery.

If you prioritize consistent profitability and capital efficiency, Corpay presents a compelling choice due to its proven cash machine model and accelerating price trend. However, if you seek exposure to innovative, high-potential tech with better financial stability, Arqit offers superior balance sheet strength despite current losses. Both represent analytical scenarios for distinct investor profiles balancing growth and risk tolerance carefully.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Corpay, Inc. and Arqit Quantum Inc. to enhance your investment decisions: