In the rapidly evolving technology sector, CoreWeave, Inc. (CRWV) and Arqit Quantum Inc. (ARQQ) stand out as innovative players in software infrastructure. CoreWeave focuses on scalable cloud platforms for AI workloads, while Arqit pioneers quantum-based cybersecurity solutions. Despite their different approaches, both target cutting-edge infrastructure challenges, making their comparison essential. In this article, I will analyze which company presents the most compelling investment opportunity for your portfolio in 2026.

Table of contents

Companies Overview

I will begin the comparison between CoreWeave and Arqit Quantum by providing an overview of these two companies and their main differences.

CoreWeave Overview

CoreWeave, Inc. operates a cloud platform focused on scaling, support, and acceleration for GenAI workloads. It builds infrastructure supporting GPU and CPU compute, storage, networking, and managed services, alongside specialized offerings like VFX rendering and AI model training. Founded in 2017 and based in Livingston, NJ, CoreWeave has positioned itself as a key player in software infrastructure with a market cap of about 50.4B USD.

Arqit Quantum Overview

Arqit Quantum Inc. delivers cybersecurity solutions via satellite and terrestrial platforms, primarily through its QuantumCloud software that enables secure encryption key generation across devices. Based in London, UK, Arqit operates within the technology sector with a focus on software infrastructure. The company is smaller in scale, employing 82 people, and has a market cap near 416M USD.

Key similarities and differences

Both companies operate in the technology sector under software infrastructure but target distinct niches: CoreWeave emphasizes cloud computing infrastructure for AI and rendering, while Arqit specializes in quantum-based cybersecurity. CoreWeave is significantly larger in market capitalization and workforce. Their geographic bases differ, with CoreWeave in the US and Arqit in the UK, reflecting divergent operational focuses within a broadly related industry segment.

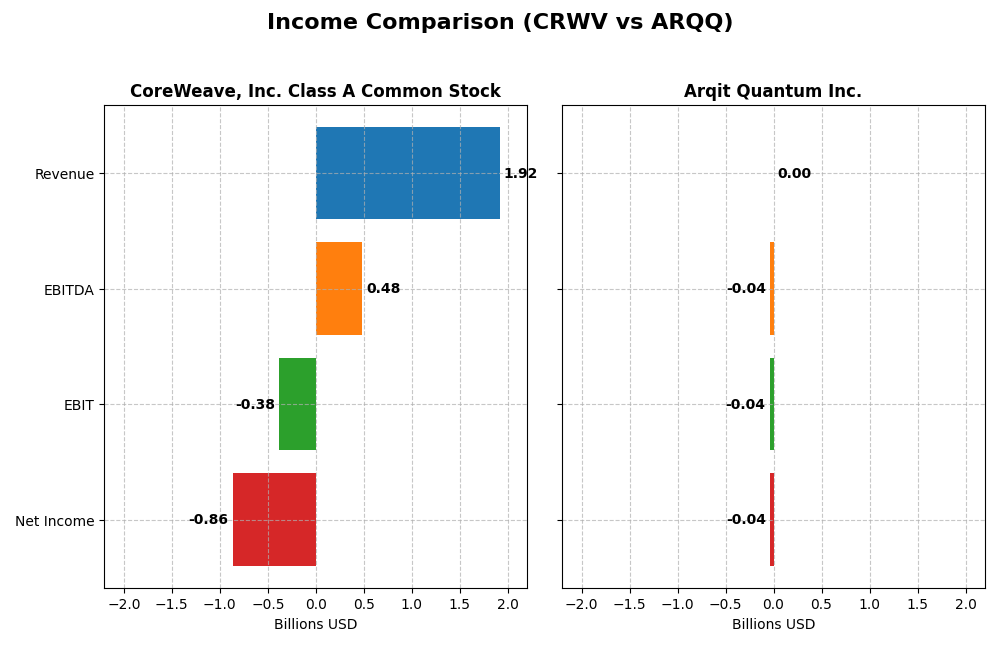

Income Statement Comparison

The table below compares the most recent fiscal year income statement metrics for CoreWeave, Inc. Class A Common Stock and Arqit Quantum Inc., highlighting scale and profitability differences.

| Metric | CoreWeave, Inc. Class A Common Stock | Arqit Quantum Inc. |

|---|---|---|

| Market Cap | 50.4B | 416M |

| Revenue | 1.92B | 530K |

| EBITDA | 480M | -36.8M |

| EBIT | -383M | -37.6M |

| Net Income | -863M | -35.3M |

| EPS | -2.33 | -2.56 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

CoreWeave, Inc. Class A Common Stock

CoreWeave’s revenue surged dramatically from $15.8M in 2022 to $1.92B in 2024, showing strong expansion. Gross margins remained robust at 74.24% in 2024, though EBIT and net margins stayed negative, reflecting high costs and interest expenses. The latest year saw revenue growth slow but overall margin improvements, despite a net loss of $863M in 2024.

Arqit Quantum Inc.

Arqit’s revenue increased from $47.9K in 2021 to $530K in 2025, with noticeable volatility in gross profit and persistent negative margins. Gross margin was deeply negative at -43.4% in 2025, and EBIT margin worsened. However, recent year revenue and gross profit growth were favorable, with net margin and EPS improvements indicating some operational progress despite ongoing losses.

Which one has the stronger fundamentals?

Both companies face challenges with negative net margins and losses, but CoreWeave exhibits larger scale and far stronger gross margins, despite high interest expenses. Arqit shows improving income growth trends and EPS but struggles with deeply negative margins and smaller revenue. CoreWeave’s income statement reflects more favorable overall revenue growth and margin stability, while Arqit presents mixed signals with ongoing operational losses.

Financial Ratios Comparison

This table presents the most recent fiscal year-end financial ratios for CoreWeave, Inc. Class A Common Stock (CRWV) and Arqit Quantum Inc. (ARQQ), facilitating a direct comparison of key performance and financial health metrics.

| Ratios | CoreWeave, Inc. (CRWV) 2024 | Arqit Quantum Inc. (ARQQ) 2025 |

|---|---|---|

| ROE | 2.09% | -129.77% |

| ROIC | 2.08% | -127.45% |

| P/E | -18.73 | -15.12 |

| P/B | -39.11 | 19.62 |

| Current Ratio | 0.39 | 2.69 |

| Quick Ratio | 0.39 | 2.69 |

| D/E (Debt to Equity) | -25.68 | 0.03 |

| Debt-to-Assets | 59.56% | 1.68% |

| Interest Coverage | 0.90 | -802.90 |

| Asset Turnover | 0.11 | 0.01 |

| Fixed Asset Turnover | 0.13 | 0.74 |

| Payout Ratio | -6.69% | 0% |

| Dividend Yield | 0.36% | 0% |

Interpretation of the Ratios

CoreWeave, Inc. Class A Common Stock

CoreWeave presents mostly unfavorable ratios, including a weak current ratio of 0.39 and high debt-to-assets at 59.56%, suggesting liquidity and leverage concerns. Positive indicators include a strong return on equity of 208.77% and favorable price-to-earnings and price-to-book ratios. The company does not pay dividends, likely reinvesting earnings for growth given negative net margin and free cash flow.

Arqit Quantum Inc.

Arqit’s financial ratios reveal mixed strength, with a solid current ratio of 2.69 and low debt-to-assets at 1.68%, indicating liquidity and low leverage. However, it suffers from a deeply negative net margin (-6668.49%) and poor returns, such as a -129.77% ROE. Arqit also does not pay dividends, reflecting its high-growth or reinvestment phase, typical for a loss-making technology firm.

Which one has the best ratios?

Both companies show predominantly unfavorable financial ratios, but Arqit demonstrates better liquidity and lower leverage compared to CoreWeave. CoreWeave’s strong ROE contrasts with its poor liquidity, while Arqit’s profitability metrics are weaker. Overall, neither company exhibits a fully favorable financial profile based on the latest ratio evaluations.

Strategic Positioning

This section compares the strategic positioning of CoreWeave and Arqit Quantum, focusing on market position, key segments, and exposure to technological disruption:

CoreWeave, Inc. Class A Common Stock

- Large market cap of 50B with high competitive pressure in cloud infrastructure software.

- Focused on cloud platform services, including GPU/CPU compute, storage, AI model training, and VFX rendering.

- Operates in a fast-evolving tech infrastructure sector with potential disruption from emerging AI and cloud technologies.

Arqit Quantum Inc.

- Small market cap of 416M, facing moderate competition in cybersecurity software.

- Specializes in cybersecurity via quantum encryption software and satellite platforms.

- Positioned in quantum cybersecurity, a highly innovative field with disruptive encryption technology.

CoreWeave, Inc. Class A Common Stock vs Arqit Quantum Inc. Positioning

CoreWeave operates a diversified business across cloud infrastructure and AI workloads, offering broad market exposure but facing intense competition. Arqit has a more concentrated focus on quantum cybersecurity, presenting unique innovation opportunities but limited scale.

Which has the best competitive advantage?

Both companies are currently shedding value with ROIC below WACC; CoreWeave’s moat status is unfavorable and stable, while Arqit’s is slightly unfavorable but improving due to growing profitability.

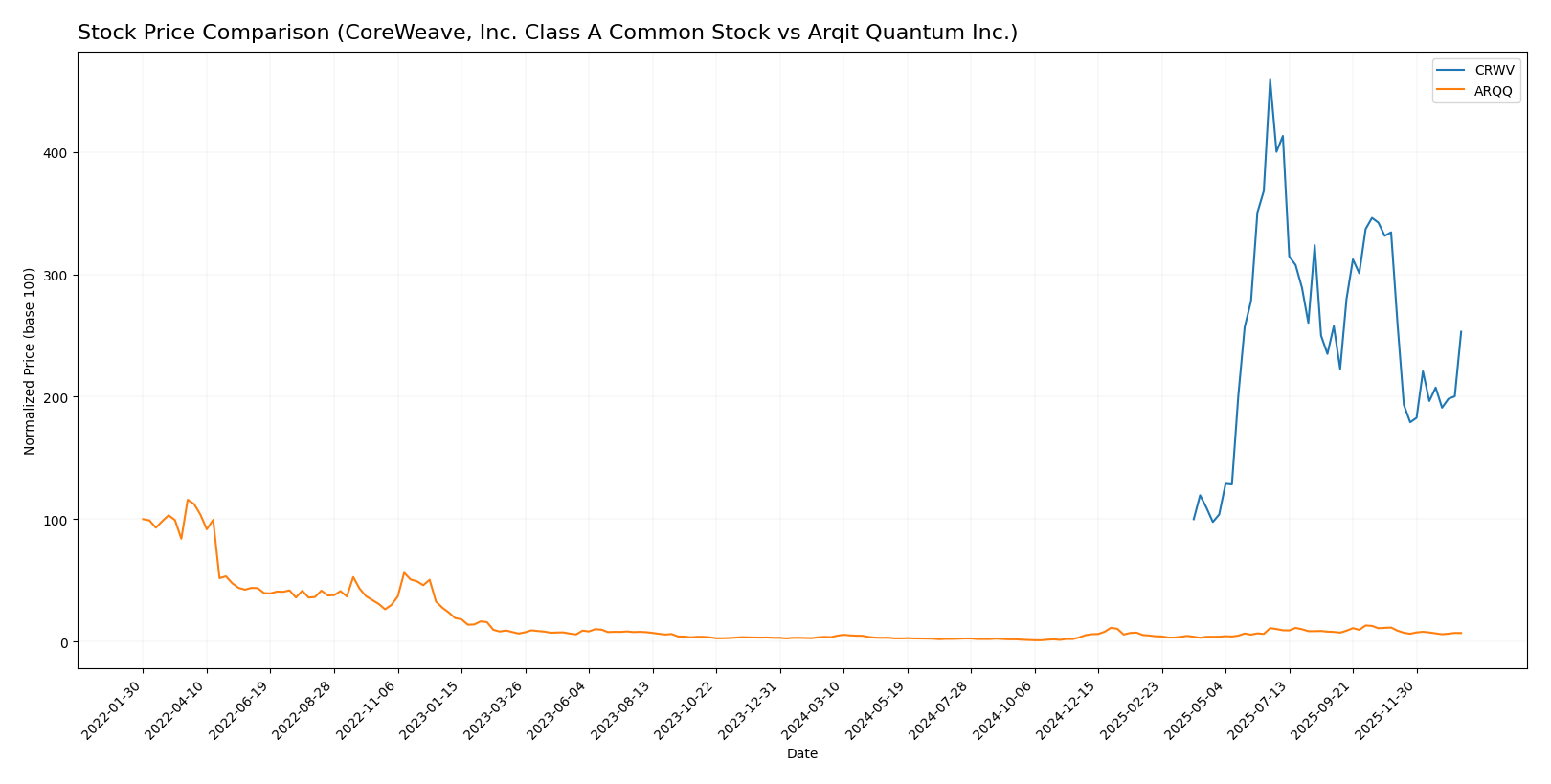

Stock Comparison

The stock price movements of CoreWeave, Inc. Class A Common Stock (CRWV) and Arqit Quantum Inc. (ARQQ) over the past 12 months reveal significant bullish trends with notable deceleration and recent downward corrections in both securities.

Trend Analysis

CoreWeave’s stock gained 153.08% over the past year, indicating a strong bullish trend with decelerating momentum. The price ranged from a low of 39.09 to a high of 183.58, with recent declines of 24.29% signaling short-term weakness.

Arqit Quantum’s stock rose 93.6% over the last 12 months, also showing a bullish trend with deceleration. Its price fluctuated between 4.19 and 49.92, but a recent drop of 39.03% suggests increased selling pressure in the short term.

Comparing the two, CoreWeave delivered the higher overall market performance with a 153.08% gain versus Arqit’s 93.6%, despite both experiencing recent downward trends.

Target Prices

The consensus target prices for CoreWeave, Inc. Class A Common Stock and Arqit Quantum Inc. reflect analyst expectations for potential upside.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CoreWeave, Inc. Class A Common Stock | 175 | 68 | 115.79 |

| Arqit Quantum Inc. | 60 | 60 | 60 |

For CoreWeave, the consensus target of 115.79 USD is above the current price of 101.23 USD, suggesting moderate upside potential. Arqit’s target of 60 USD significantly exceeds its current 26.6 USD price, indicating strong bullish expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for CoreWeave, Inc. Class A Common Stock (CRWV) and Arqit Quantum Inc. (ARQQ):

Rating Comparison

CRWV Rating

- Rating: D+ indicating a very favorable status despite low scores

- Discounted Cash Flow Score: 1, very unfavorable indicating weak future cash flow

- ROE Score: 1, very unfavorable, low efficiency in generating shareholder profit

- ROA Score: 1, very unfavorable, poor asset utilization

- Debt To Equity Score: 1, very unfavorable, high financial risk

- Overall Score: 1, very unfavorable, overall weak financial standing

ARQQ Rating

- Rating: C with a very favorable status, showing better overall evaluation than CRWV

- Discounted Cash Flow Score: 2, moderate, suggesting better valuation prospects than CRWV

- ROE Score: 1, very unfavorable, same as CRWV, indicating weak profit generation

- ROA Score: 1, very unfavorable, equal to CRWV, showing limited asset efficiency

- Debt To Equity Score: 4, favorable, reflecting stronger balance sheet and lower financial risk

- Overall Score: 2, moderate, better overall financial health compared to CRWV

Which one is the best rated?

Based on the provided ratings, ARQQ holds a better overall rating (C) and higher scores in discounted cash flow and debt-to-equity metrics. CRWV’s ratings are uniformly very unfavorable, making ARQQ the better rated company strictly from these data points.

Scores Comparison

Here is a comparison of the financial scores for CoreWeave (CRWV) and Arqit Quantum (ARQQ):

CRWV Scores

- Altman Z-Score: 0.8, indicating financial distress.

- Piotroski Score: 3, categorized as very weak financial health.

ARQQ Scores

- Altman Z-Score: -0.22, indicating financial distress.

- Piotroski Score: 2, categorized as very weak financial health.

Which company has the best scores?

Both companies are in the distress zone for Altman Z-Score and have very weak Piotroski Scores. CRWV has slightly higher scores than ARQQ, but both indicate significant financial risk.

Grades Comparison

Here is the comparison of recent grades issued by recognized financial institutions for the two companies:

CoreWeave, Inc. Class A Common Stock Grades

The following table summarizes recent grades and actions from reputable grading companies for CoreWeave, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | maintain | Equal Weight | 2026-01-12 |

| Wells Fargo | maintain | Overweight | 2026-01-08 |

| Jefferies | maintain | Buy | 2026-01-05 |

| DA Davidson | upgrade | Neutral | 2026-01-05 |

| Goldman Sachs | maintain | Neutral | 2025-11-17 |

| HC Wainwright & Co. | maintain | Buy | 2025-11-12 |

| Wells Fargo | maintain | Overweight | 2025-11-12 |

| Barclays | maintain | Equal Weight | 2025-11-12 |

| Loop Capital | maintain | Buy | 2025-11-12 |

| B of A Securities | maintain | Neutral | 2025-11-11 |

CoreWeave’s grades show a mix of Buy, Overweight, Neutral, and Equal Weight ratings with mostly maintained or upgraded actions, indicating a generally positive but cautious stance.

Arqit Quantum Inc. Grades

The following table summarizes recent grades from a recognized grading company for Arqit Quantum Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | maintain | Buy | 2025-10-13 |

| HC Wainwright & Co. | maintain | Buy | 2025-09-18 |

| HC Wainwright & Co. | maintain | Buy | 2024-12-31 |

| HC Wainwright & Co. | maintain | Buy | 2024-12-06 |

| HC Wainwright & Co. | maintain | Buy | 2024-07-11 |

| HC Wainwright & Co. | maintain | Buy | 2024-05-29 |

| HC Wainwright & Co. | maintain | Buy | 2024-05-15 |

| HC Wainwright & Co. | maintain | Buy | 2023-11-22 |

| HC Wainwright & Co. | maintain | Buy | 2023-09-27 |

| HC Wainwright & Co. | maintain | Buy | 2023-09-26 |

Arqit Quantum Inc. consistently received a “Buy” grade from HC Wainwright & Co. over multiple years, reflecting strong confidence from this grading company.

Which company has the best grades?

CoreWeave displays a broader range of grades including Buy, Overweight, Neutral, and Equal Weight, while Arqit Quantum Inc. has a consistent Buy rating from one grading company. Arqit’s uniform Buy grades may signal stronger endorsement, potentially influencing investors seeking consistent analyst support.

Strengths and Weaknesses

The table below summarizes the key strengths and weaknesses of CoreWeave, Inc. Class A Common Stock (CRWV) and Arqit Quantum Inc. (ARQQ) based on their latest financial performance, profitability, innovation, and market positioning.

| Criterion | CoreWeave, Inc. (CRWV) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Diversification | Limited product segmentation, focused | Limited product segmentation, focused |

| Profitability | Negative net margin (-45.08%), ROIC 2.08% but below WACC, value destroying | Negative net margin (-6668.49%), negative ROIC, but improving ROIC trend, slightly unfavorable |

| Innovation | Moderate innovation with tech focus; no distinct product diversification | Strong focus on quantum technology innovation with growing profitability potential |

| Global presence | Limited disclosed global footprint | Limited disclosed global footprint |

| Market Share | Small market share in niche computing | Small market share in quantum security |

Key takeaways: Both companies are currently value destroyers with unfavorable profitability metrics. CoreWeave shows stable but negative returns, while Arqit Quantum has a growing ROIC trend despite deep losses. Neither company demonstrates strong diversification or market dominance, warranting cautious investment consideration.

Risk Analysis

Below is a comparison table highlighting key risk factors for CoreWeave, Inc. (CRWV) and Arqit Quantum Inc. (ARQQ) as of the most recent fiscal years.

| Metric | CoreWeave, Inc. (CRWV) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Market Risk | Very High (Beta 21.65) | High (Beta 2.41) |

| Debt level | High (Debt to Assets 59.56%) | Low (Debt to Assets 1.68%) |

| Regulatory Risk | Moderate (US tech regulations) | Moderate (UK cybersecurity laws) |

| Operational Risk | High (Low liquidity ratios) | Moderate (Small workforce, 82 employees) |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Low (US-based) | Moderate (UK, potential Brexit-related uncertainties) |

The most significant risks for CoreWeave are its extreme market volatility (beta 21.65) and high leverage (nearly 60% debt to assets), combined with poor liquidity ratios, which may pressure operational stability. Arqit Quantum faces high market risk and weak profitability, but benefits from low debt and moderate operational risks. Both companies show financial distress signs, with bankruptcy risk in the distress zone and weak Piotroski scores, warranting cautious risk management.

Which Stock to Choose?

CoreWeave, Inc. Class A (CRWV) shows strong revenue growth with a 12,000% increase over three years and a favorable income statement overall. However, it struggles with negative net margins, high debt ratios, and an unfavorable global financial ratio evaluation, reflecting value destruction and a very weak financial health score.

Arqit Quantum Inc. (ARQQ) exhibits moderate revenue and net income growth, but suffers from severe profitability issues with extremely negative net margins and returns. Despite a better current ratio and lower debt levels, its financial ratios and scores remain mostly unfavorable, indicating ongoing value destruction, though with a slightly improving profitability trend.

For risk-tolerant investors focused on growth, CRWV’s rapid revenue expansion and improving income metrics might appear more attractive despite financial weaknesses. Conversely, more cautious investors may view ARQQ’s stronger liquidity and gradually improving profitability as signals of potential recovery, though both companies currently present notable financial challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CoreWeave, Inc. Class A Common Stock and Arqit Quantum Inc. to enhance your investment decisions: