In the fast-evolving semiconductor industry, Arm Holdings plc and Skyworks Solutions, Inc. stand out as influential players driving innovation and market growth. Both companies develop critical technologies powering diverse sectors from automotive to consumer electronics, yet they differ in focus and strategy. This comparison explores their competitive positioning and growth potential, helping you decide which stock could be the better addition to your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Arm Holdings plc American Depositary Shares and Skyworks Solutions, Inc. by providing an overview of these two companies and their main differences.

Arm Holdings plc Overview

Arm Holdings plc architects, develops, and licenses central processing unit products and related technologies for semiconductor companies and original equipment manufacturers. The company offers microprocessors, systems intellectual property, graphics processing units, and software used across markets such as automotive, computing infrastructure, consumer technologies, and the Internet of Things. Headquartered in Cambridge, UK, Arm operates internationally and is a subsidiary of Kronos II LLC.

Skyworks Solutions, Inc. Overview

Skyworks Solutions, Inc. designs, develops, manufactures, and markets proprietary semiconductor products, including intellectual property, for use in aerospace, automotive, broadband, cellular infrastructure, and consumer electronics markets. Its product portfolio is broad, covering amplifiers, tuners, converters, and more. Founded in 1962 and based in Irvine, California, Skyworks sells through direct sales, distributors, and independent representatives globally.

Key similarities and differences

Both companies operate in the semiconductor industry, providing technology and intellectual property to various end markets. Arm primarily focuses on licensing CPU designs and related IP, while Skyworks manufactures and markets a wide range of semiconductor components. Arm has a significant global footprint with a UK base, whereas Skyworks is a US-headquartered company with a diverse product lineup targeting many consumer and industrial applications.

Income Statement Comparison

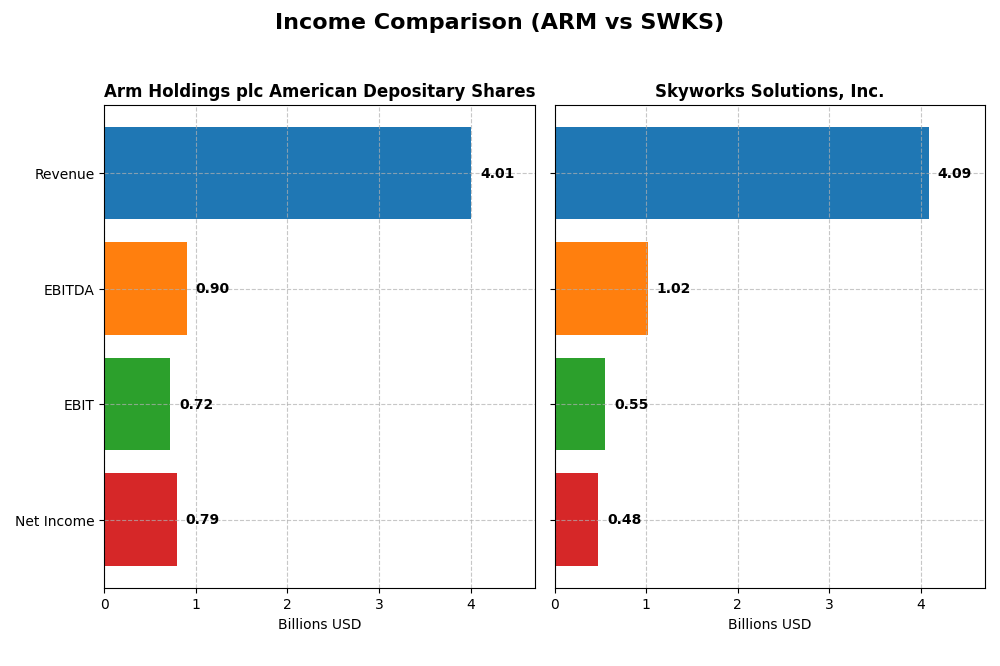

The table below presents a side-by-side comparison of key income statement metrics for Arm Holdings plc American Depositary Shares (ARM) and Skyworks Solutions, Inc. (SWKS) for the most recent fiscal year available.

| Metric | Arm Holdings plc American Depositary Shares (ARM) | Skyworks Solutions, Inc. (SWKS) |

|---|---|---|

| Market Cap | 111B | 8.76B |

| Revenue | 4.01B | 4.09B |

| EBITDA | 903M | 1.02B |

| EBIT | 720M | 554M |

| Net Income | 792M | 477M |

| EPS | 0.75 | 3.09 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Arm Holdings plc American Depositary Shares

Arm Holdings shows a strong upward trajectory from 2021 to 2025, with revenue nearly doubling to $4B and net income more than doubling to $792M. Margins remain robust, with a gross margin near 95% and a net margin close to 20%, reflecting operational efficiency. The latest fiscal year demonstrated significant growth of almost 24% in revenue and over 100% in net income, indicating accelerating profitability.

Skyworks Solutions, Inc.

Skyworks Solutions experienced declining revenue, falling over 20% from 2021 to 2025, with 2025 revenue at approximately $4.1B. Net income followed a downward path, dropping to $477M, accompanied by shrinking margins; the net margin decreased to 11.7%. The most recent year saw a 2.2% revenue decline and nearly 18% net margin contraction, signaling challenges in maintaining profitability.

Which one has the stronger fundamentals?

Arm Holdings demonstrates stronger fundamentals with consistent revenue and net income growth, high and stable margins, and favorable one-year and overall growth metrics. In contrast, Skyworks Solutions faces unfavorable trends, with declining revenues, shrinking margins, and negative growth across key indicators. Arm’s superior profitability and expansion mark it as the financially more robust entity based on the income statement data.

Financial Ratios Comparison

The table below compares key financial ratios for Arm Holdings plc (ARM) and Skyworks Solutions, Inc. (SWKS) based on their most recent fiscal year data, facilitating a straightforward side-by-side financial analysis.

| Ratios | Arm Holdings plc (ARM) FY 2025 | Skyworks Solutions, Inc. (SWKS) FY 2025 |

|---|---|---|

| ROE | 11.58% | 8.29% |

| ROIC | 10.28% | 6.35% |

| P/E | 141.58 | 24.95 |

| P/B | 16.40 | 2.07 |

| Current Ratio | 5.20 | 2.33 |

| Quick Ratio | 5.20 | 1.76 |

| D/E (Debt-to-Equity) | 0.05 | 0.21 |

| Debt-to-Assets | 4.0% | 15.2% |

| Interest Coverage | 0 | 18.45 |

| Asset Turnover | 0.45 | 0.52 |

| Fixed Asset Turnover | 5.61 | 2.95 |

| Payout ratio | 0% | 90.67% |

| Dividend yield | 0% | 3.63% |

Interpretation of the Ratios

Arm Holdings plc American Depositary Shares

Arm Holdings shows a mix of strong and weak ratios. Its net margin of 19.77% is favorable, but a high PE ratio of 141.58 and a PB ratio of 16.4 raise valuation concerns. The company’s current ratio is high at 5.2, signaling low efficiency. Arm pays no dividend, likely due to reinvestment in R&D, reflecting its focus on growth and innovation rather than shareholder payouts.

Skyworks Solutions, Inc.

Skyworks Solutions demonstrates generally balanced ratios with a favorable net margin of 11.67% and solid liquidity (current ratio 2.33). Its PE of 24.95 and PB of 2.07 are moderate, suggesting more reasonable valuation. The company offers a dividend yield of 3.63%, supported by stable payout capacity and free cash flow, indicating consistent shareholder returns with manageable risk.

Which one has the best ratios?

Skyworks holds a slightly more favorable overall ratio profile, with half of its ratios rated positively and only a small fraction unfavorable. Arm, while showing strong profitability, suffers from stretched valuation and liquidity ratios, resulting in a slightly unfavorable overall rating. Skyworks’ dividend yield and balanced metrics enhance its comparative standing.

Strategic Positioning

This section compares the strategic positioning of Arm Holdings plc American Depositary Shares (ARM) and Skyworks Solutions, Inc. (SWKS) based on market position, key segments, and exposure to technological disruption:

Arm Holdings plc American Depositary Shares (ARM)

- Large market cap of 111B with high beta indicating higher volatility and competitive pressure in semiconductors.

- Focuses on licensing and royalties from CPUs, GPUs, and IPs for automotive, computing, IoT, and consumer tech segments.

- Operates globally with broad exposure but no specific mention of adapting to rapid technological disruption.

Skyworks Solutions, Inc. (SWKS)

- Smaller market cap of 8.8B with moderate beta, facing competitive pressure in semiconductors.

- Designs and manufactures a diverse portfolio of proprietary semiconductors across multiple industries including automotive, aerospace, and smartphones.

- Offers a wide range of products including advanced analog and mixed-signal semiconductors, indicating exposure to evolving tech demands.

Arm Holdings plc American Depositary Shares vs Skyworks Solutions, Inc. Positioning

ARM relies on a licensing model concentrated in CPU and IP products, providing steady royalty income but potentially limited diversification. SWKS has a broader product portfolio across many markets, offering wider business drivers but possibly higher operational complexity.

Which has the best competitive advantage?

Both companies are currently shedding value, with ARM showing stable but unfavorable returns and SWKS experiencing declining profitability. ARM’s higher market cap and licensing model suggest a moat under pressure, while SWKS faces worsening returns and a very unfavorable moat status.

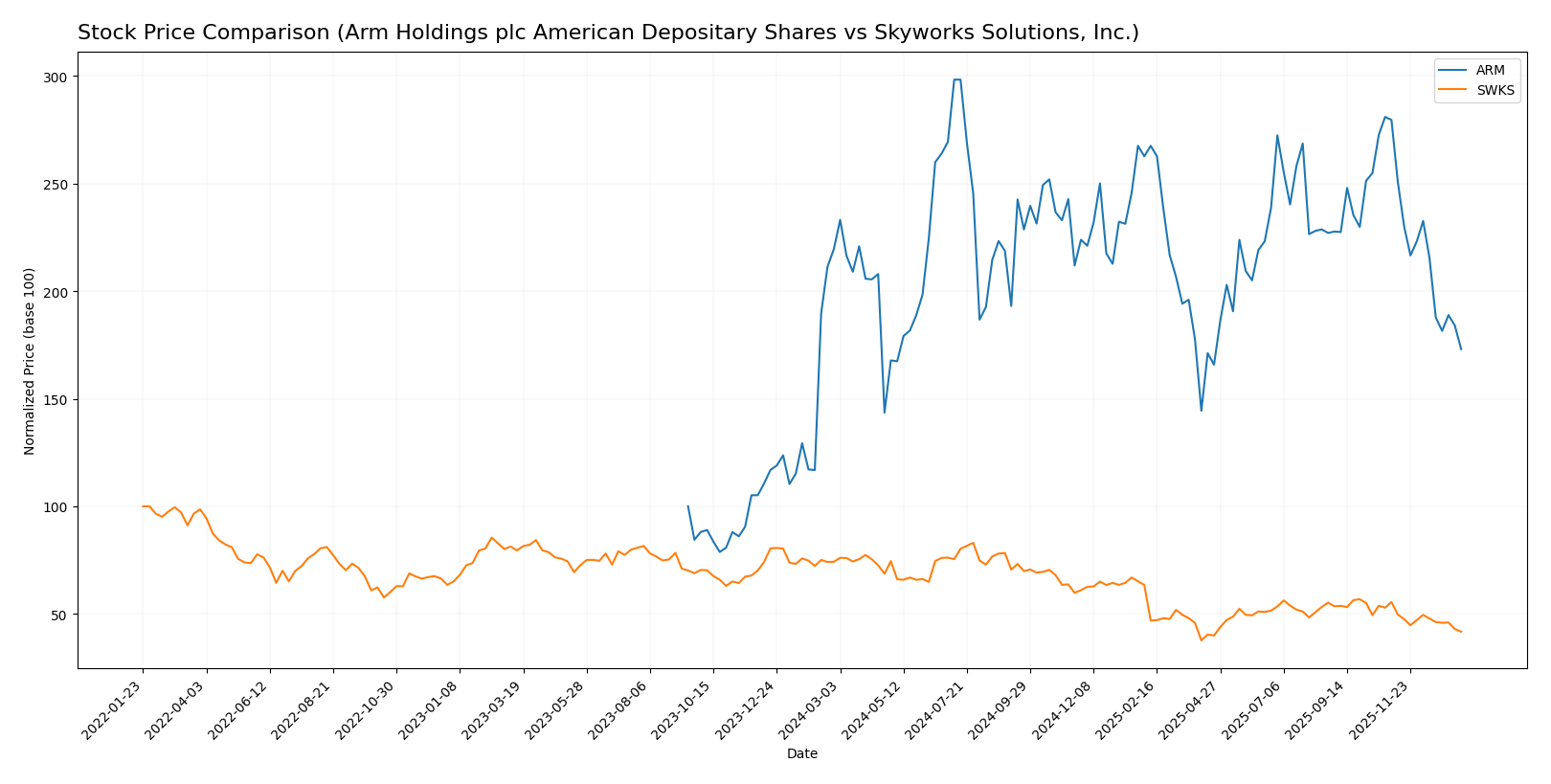

Stock Comparison

The stock price movements of Arm Holdings plc American Depositary Shares (ARM) and Skyworks Solutions, Inc. (SWKS) over the past 12 months reveal marked bearish trends, with significant price declines and varying volatility impacting investor sentiment.

Trend Analysis

Arm Holdings plc’s stock experienced a bearish trend over the past year, declining by 21.17% with decelerating momentum. The price fluctuated between a high of 181.19 and a low of 87.19, showing notable volatility with a standard deviation of 19.31.

Skyworks Solutions, Inc. also showed a bearish trend with a sharper decline of 43.71% over the same period. The trend decelerated, and its price ranged from 116.18 down to 52.78, accompanied by a lower volatility of 16.35 compared to ARM.

Comparing both stocks, ARM delivered the higher market performance with a smaller percentage decrease than SWKS, despite both experiencing decelerating bearish trends over the past 12 months.

Target Prices

The current analyst consensus indicates promising upside potential for both Arm Holdings plc and Skyworks Solutions, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Arm Holdings plc American Depositary Shares | 210 | 120 | 166 |

| Skyworks Solutions, Inc. | 140 | 60 | 85.11 |

Arm Holdings’ target consensus of 166 considerably exceeds its current price of 105.11 USD, suggesting strong growth expectations. Skyworks Solutions shows a target consensus of 85.11 versus its current price of 58.46 USD, indicating moderate upside potential.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Arm Holdings plc American Depositary Shares (ARM) and Skyworks Solutions, Inc. (SWKS):

Rating Comparison

ARM Rating

- Rating: B, considered Very Favorable overall by analysts.

- Discounted Cash Flow Score: 3, indicating moderate valuation based on cash flow projections.

- ROE Score: 3, reflecting moderate efficiency in generating profit from equity.

- ROA Score: 4, signaling favorable effectiveness in asset utilization.

- Debt To Equity Score: 4, indicating favorable financial risk with lower leverage.

- Overall Score: 3, categorized as moderate in overall financial standing.

SWKS Rating

- Rating: B+, also rated Very Favorable by analysts.

- Discounted Cash Flow Score: 4, showing a favorable valuation outlook.

- ROE Score: 3, similarly moderate in profit generation efficiency.

- ROA Score: 4, equally favorable in asset use efficiency.

- Debt To Equity Score: 3, a moderate level of financial risk.

- Overall Score: 3, also moderate in overall financial condition.

Which one is the best rated?

SWKS holds a slightly higher rating of B+ compared to ARM’s B, supported by a stronger discounted cash flow score. Both have equal overall scores, but ARM scores better on debt to equity. Thus, SWKS is marginally better rated based on the available data.

Scores Comparison

The scores comparison of Arm Holdings plc and Skyworks Solutions, Inc. is as follows:

Arm Holdings plc Scores

- Altman Z-Score: 32.43, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial health and investment potential.

Skyworks Solutions, Inc. Scores

- Altman Z-Score: 4.44, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial health and investment potential.

Which company has the best scores?

Both Arm Holdings plc and Skyworks Solutions, Inc. have Altman Z-Scores in the safe zone and identical Piotroski Scores of 7. Arm has a notably higher Altman Z-Score, suggesting comparatively stronger financial stability.

Grades Comparison

The following presents a comparison of recent grades assigned to Arm Holdings plc American Depositary Shares and Skyworks Solutions, Inc.:

Arm Holdings plc American Depositary Shares Grades

This table summarizes recent grades from notable financial institutions for Arm Holdings plc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Downgrade | Neutral | 2026-01-13 |

| B of A Securities | Maintain | Buy | 2025-12-16 |

| Goldman Sachs | Downgrade | Sell | 2025-12-15 |

| Loop Capital | Maintain | Buy | 2025-11-12 |

| TD Cowen | Maintain | Buy | 2025-11-06 |

| Rosenblatt | Maintain | Buy | 2025-11-06 |

| Wells Fargo | Maintain | Overweight | 2025-11-06 |

| Mizuho | Maintain | Outperform | 2025-11-06 |

| Barclays | Maintain | Overweight | 2025-11-06 |

| UBS | Maintain | Buy | 2025-11-06 |

Overall, Arm Holdings exhibits a predominantly positive rating trend with most firms maintaining buy or outperform grades, though recent downgrades indicate some caution.

Skyworks Solutions, Inc. Grades

Below is a summary of recent grades from recognized grading firms for Skyworks Solutions, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Upgrade | Neutral | 2025-11-11 |

| JP Morgan | Maintain | Neutral | 2025-11-05 |

| UBS | Maintain | Neutral | 2025-11-05 |

| Citigroup | Upgrade | Neutral | 2025-10-29 |

| Benchmark | Maintain | Hold | 2025-10-29 |

| Piper Sandler | Upgrade | Overweight | 2025-10-29 |

| Barclays | Upgrade | Equal Weight | 2025-10-29 |

| Keybanc | Upgrade | Overweight | 2025-10-29 |

| UBS | Maintain | Neutral | 2025-10-29 |

| Citigroup | Maintain | Sell | 2025-08-06 |

Skyworks’ grades are mostly neutral to overweight, with several recent upgrades signaling moderate improvement in analyst sentiment.

Which company has the best grades?

Both companies hold a consensus “Buy” rating, but Arm Holdings has a stronger majority of buy and outperform grades compared to Skyworks, which shows more neutral and hold ratings. This difference may influence investors’ perception of Arm as having higher upside potential relative to Skyworks, though risks remain given recent downgrades.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Arm Holdings plc (ARM) and Skyworks Solutions, Inc. (SWKS) based on the latest financial and strategic data.

| Criterion | Arm Holdings plc (ARM) | Skyworks Solutions, Inc. (SWKS) |

|---|---|---|

| Diversification | Moderate, revenues mainly from licensing and royalties | Moderate, focused on semiconductor solutions |

| Profitability | High net margin (19.77%), but value destroying (ROIC < WACC) | Moderate net margin (11.67%), value destroying with declining ROIC |

| Innovation | Strong intellectual property in chip design | Solid R&D, but facing profitability challenges |

| Global presence | Extensive global licensing footprint | Global semiconductor market presence |

| Market Share | Leading in processor IP licensing | Significant in RF and analog semiconductor markets |

Key takeaways: ARM excels in licensing revenue and maintains a strong global presence but struggles with value creation as ROIC is below WACC. SWKS shows steady profitability but faces declining returns on capital, signaling caution despite favorable liquidity and dividend yield. Both require careful risk consideration before investing.

Risk Analysis

Below is a comparative table summarizing key risk factors for Arm Holdings plc (ARM) and Skyworks Solutions, Inc. (SWKS) based on their latest 2025 data.

| Metric | Arm Holdings plc (ARM) | Skyworks Solutions, Inc. (SWKS) |

|---|---|---|

| Market Risk | High beta (4.36) indicating high volatility | Moderate beta (1.30) indicating moderate volatility |

| Debt level | Very low debt-to-equity (0.05), low debt-to-assets (4%) | Moderate debt-to-equity (0.21), debt-to-assets (15%) |

| Regulatory Risk | Medium – global operations including China and UK | Medium – exposure to US and Asia-Pacific regulatory environments |

| Operational Risk | Moderate – high fixed asset turnover but unfavorable asset turnover | Moderate – balanced asset turnover metrics |

| Environmental Risk | Moderate – semiconductor industry exposure to resource and energy demands | Moderate – similar semiconductor sector challenges |

| Geopolitical Risk | High – operations in China, Taiwan, South Korea amid geopolitical tensions | Moderate – exposure to US-China trade tensions and global supply chain risks |

The most impactful risks are ARM’s high market volatility and geopolitical exposure, which may affect supply and licensing in Asia. SWKS faces moderate geopolitical and regulatory risks but benefits from a more stable financial structure and dividend yield, reducing overall financial risk. Investors should monitor ARM’s valuation metrics and market swings closely.

Which Stock to Choose?

Arm Holdings plc American Depositary Shares (ARM) shows a favorable income evolution with strong growth in revenue and net income over 2021-2025, supported by a high net margin of 19.77%. Financial ratios reveal a mixed picture: 42.86% favorable but 50% unfavorable, including high valuation multiples (PE 141.58) and a strong liquidity position (quick ratio 5.2). Profitability is moderate with ROE at 11.58%, low debt levels (debt/equity 0.05), and a very favorable rating of B. However, the company’s MOAT is unfavorable as ROIC is below WACC, signaling value destruction.

Skyworks Solutions, Inc. (SWKS) presents an unfavorable income trend with declining revenue and net income, and a lower net margin of 11.67%. Its financial ratios are slightly favorable overall (50% favorable), featuring moderate valuation multiples (PE 24.95), adequate liquidity (current ratio 2.33), and manageable debt (debt/equity 0.21). Profitability metrics are somewhat weaker than ARM, with ROE at 8.29%. The company holds a very favorable rating of B+ but shows a very unfavorable MOAT due to negative ROIC versus WACC and declining profitability.

For investors, ARM’s strong income growth and favorable rating might appeal to those focused on growth and quality investing despite valuation concerns and value destruction signals. Conversely, SWKS’s stable ratios and moderate valuation could be seen as more suitable for risk-averse investors seeking income stability, although its declining profitability suggests caution. Ultimately, the choice may depend on the investor’s appetite for growth versus stability and their interpretation of the companies’ value creation dynamics.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Arm Holdings plc American Depositary Shares and Skyworks Solutions, Inc. to enhance your investment decisions: