In the dynamic semiconductor industry, NVIDIA Corporation and Arm Holdings plc stand out as influential players shaping the future of technology. NVIDIA leads with cutting-edge graphics and AI computing solutions, while Arm excels in CPU architecture licensing crucial to countless devices. Their market overlap and innovation strategies make comparing them essential for investors seeking growth and stability. Join me as we analyze these tech giants to uncover the most compelling investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between NVIDIA and Arm by providing an overview of these two companies and their main differences.

NVIDIA Overview

NVIDIA Corporation specializes in graphics, compute, and networking solutions with a strong presence in gaming, professional visualization, data centers, and automotive markets. Founded in 1993 and headquartered in Santa Clara, California, NVIDIA offers products such as GeForce GPUs, AI computing platforms, and automotive AI systems. It serves a broad customer base including OEMs, cloud providers, and automotive suppliers.

Arm Overview

Arm Holdings plc designs and licenses CPU products and related technologies for semiconductor companies and OEMs. Headquartered in Cambridge, UK, and founded in 1990, Arm provides microprocessors, IPs, GPUs, software, and tools used across automotive, computing infrastructure, consumer tech, and IoT markets. It operates globally and is a subsidiary of Kronos II LLC following its 2023 IPO.

Key similarities and differences

Both NVIDIA and Arm operate in the semiconductor industry with a focus on technology innovation and global markets. NVIDIA emphasizes end-product solutions like GPUs and AI platforms, while Arm focuses on licensing CPU architectures and related IP. NVIDIA offers direct products to a wide variety of end-users, whereas Arm’s business model centers on licensing technology to semiconductor manufacturers and OEMs.

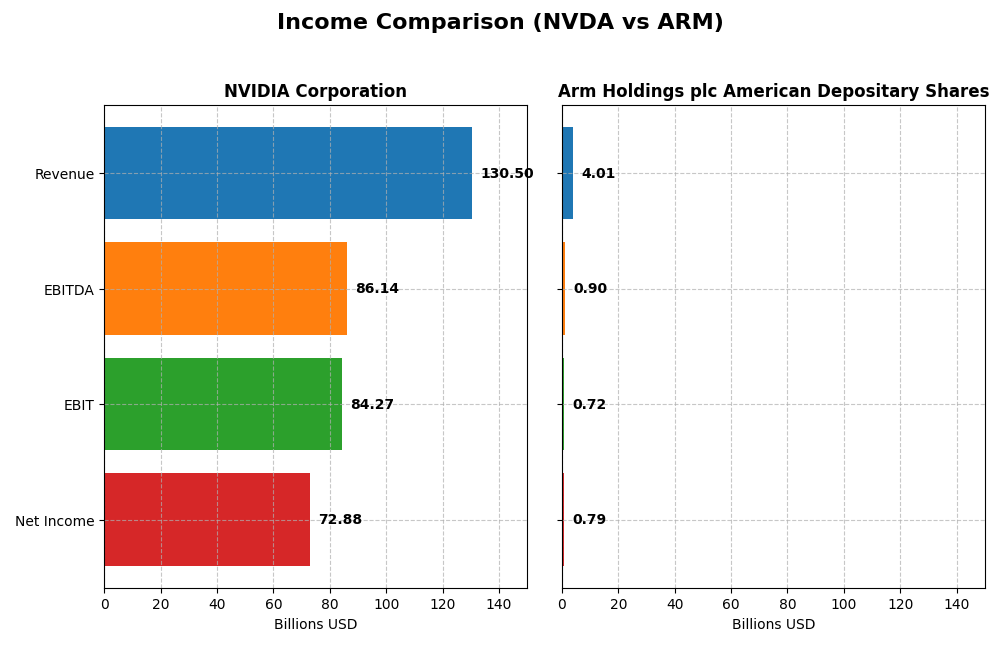

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for NVIDIA Corporation and Arm Holdings plc American Depositary Shares for their respective most recent fiscal years.

| Metric | NVIDIA Corporation | Arm Holdings plc American Depositary Shares |

|---|---|---|

| Market Cap | 4.46T | 111B |

| Revenue | 130.5B | 4.01B |

| EBITDA | 86.1B | 903M |

| EBIT | 84.3B | 720M |

| Net Income | 72.9B | 792M |

| EPS | 2.97 | 0.75 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

NVIDIA Corporation

NVIDIA demonstrated robust growth from 2021 to 2025, with revenue soaring from $16.7B to $130.5B and net income expanding from $4.3B to $72.9B. Margins remained strong, with a gross margin near 75% and net margin improving to 55.85%. The latest fiscal year showed exceptional revenue growth of 114.2%, indicating accelerating business momentum.

Arm Holdings plc American Depositary Shares

Arm’s revenue grew steadily from $2.0B in 2021 to $4.0B in 2025, with net income rising from $388M to $792M. The company maintained a very high gross margin of 94.86%, though its net margin was more modest at 19.77%. The most recent year continued positive trends, with revenue up 23.94% and net margin improving by 108.83%, signaling solid operational performance.

Which one has the stronger fundamentals?

Both NVIDIA and Arm have favorable income statement evaluations, but NVIDIA shows far more pronounced growth and higher margins, particularly in net income and net margin expansion. Arm’s strengths lie in its exceptional gross margin and stable growth, albeit at a smaller scale. NVIDIA’s expansive revenue and profitability gains suggest stronger fundamentals based on the reported period.

Financial Ratios Comparison

The table below presents the most recent fiscal year financial ratios for NVIDIA Corporation and Arm Holdings plc American Depositary Shares, enabling a direct comparison of their operational efficiency, profitability, liquidity, and leverage metrics.

| Ratios | NVIDIA Corporation (2025) | Arm Holdings plc (2025) |

|---|---|---|

| ROE | 91.9% | 11.6% |

| ROIC | 75.3% | 10.3% |

| P/E | 39.9 | 141.6 |

| P/B | 36.7 | 16.4 |

| Current Ratio | 4.44 | 5.20 |

| Quick Ratio | 3.88 | 5.20 |

| D/E | 0.13 | 0.05 |

| Debt-to-Assets | 9.2% | 4.0% |

| Interest Coverage | 330 | 0 |

| Asset Turnover | 1.17 | 0.45 |

| Fixed Asset Turnover | 16.2 | 5.61 |

| Payout ratio | 1.14% | 0% |

| Dividend yield | 0.029% | 0% |

Interpretation of the Ratios

NVIDIA Corporation

NVIDIA shows strong profitability with a net margin of 55.85% and high returns on equity (91.87%) and invested capital (75.28%), despite some unfavorable valuations like a PE of 39.9 and PB of 36.66. The company maintains low debt levels and excellent interest coverage, though a current ratio of 4.44 is considered unfavorable. NVIDIA pays a modest dividend yield of 0.03%, with potential risks from low dividend coverage and limited payout.

Arm Holdings plc American Depositary Shares

Arm’s ratios reveal moderate profitability with a net margin of 19.77% and a neutral ROE of 11.58%, but weaker returns on invested capital at 10.28%. High valuation multiples such as a PE of 141.58 and a PB of 16.4 are unfavorable. The company benefits from low leverage and infinite interest coverage, yet it does not pay dividends, likely reflecting reinvestment priorities during its growth phase.

Which one has the best ratios?

NVIDIA’s ratios are generally more favorable, reflecting superior profitability, efficient asset use, and strong financial health despite some valuation concerns. Arm shows several unfavorable metrics, including high valuation and weaker returns, with a slightly unfavorable overall ratio profile. Based on these evaluations, NVIDIA holds the advantage in ratio strength and financial performance.

Strategic Positioning

This section compares the strategic positioning of NVIDIA Corporation and Arm Holdings plc American Depositary Shares regarding market position, key segments, and exposure to technological disruption:

NVIDIA Corporation

- Leading global semiconductor player with strong competitive pressure in gaming, data center, and automotive.

- Diverse revenue streams from data center ($115B), gaming, automotive, and professional visualization segments.

- Exposure to disruption through cloud computing, AI, autonomous driving, and virtual worlds software platforms.

Arm Holdings plc American Depositary Shares

- Semiconductor technology licensor with competitive pressure from diverse chip manufacturers worldwide.

- Revenue mainly from licensing and royalties linked to CPU and GPU IP used across automotive, computing, and IoT.

- Faces disruption risks linked to evolving semiconductor architectures and licensing models across multiple industries.

NVIDIA Corporation vs Arm Holdings plc American Depositary Shares Positioning

NVIDIA operates a diversified business model across multiple high-growth markets, leveraging hardware and software integration. Arm focuses on licensing intellectual property, concentrating on CPU/GPU designs used broadly. NVIDIA’s scale offers broad market coverage, while Arm’s licensing model depends on ecosystem adoption.

Which has the best competitive advantage?

NVIDIA demonstrates a very favorable moat with growing ROIC well above its WACC, indicating durable competitive advantage and value creation. Arm shows an unfavorable moat with ROIC below WACC, signaling value destruction despite stable profitability.

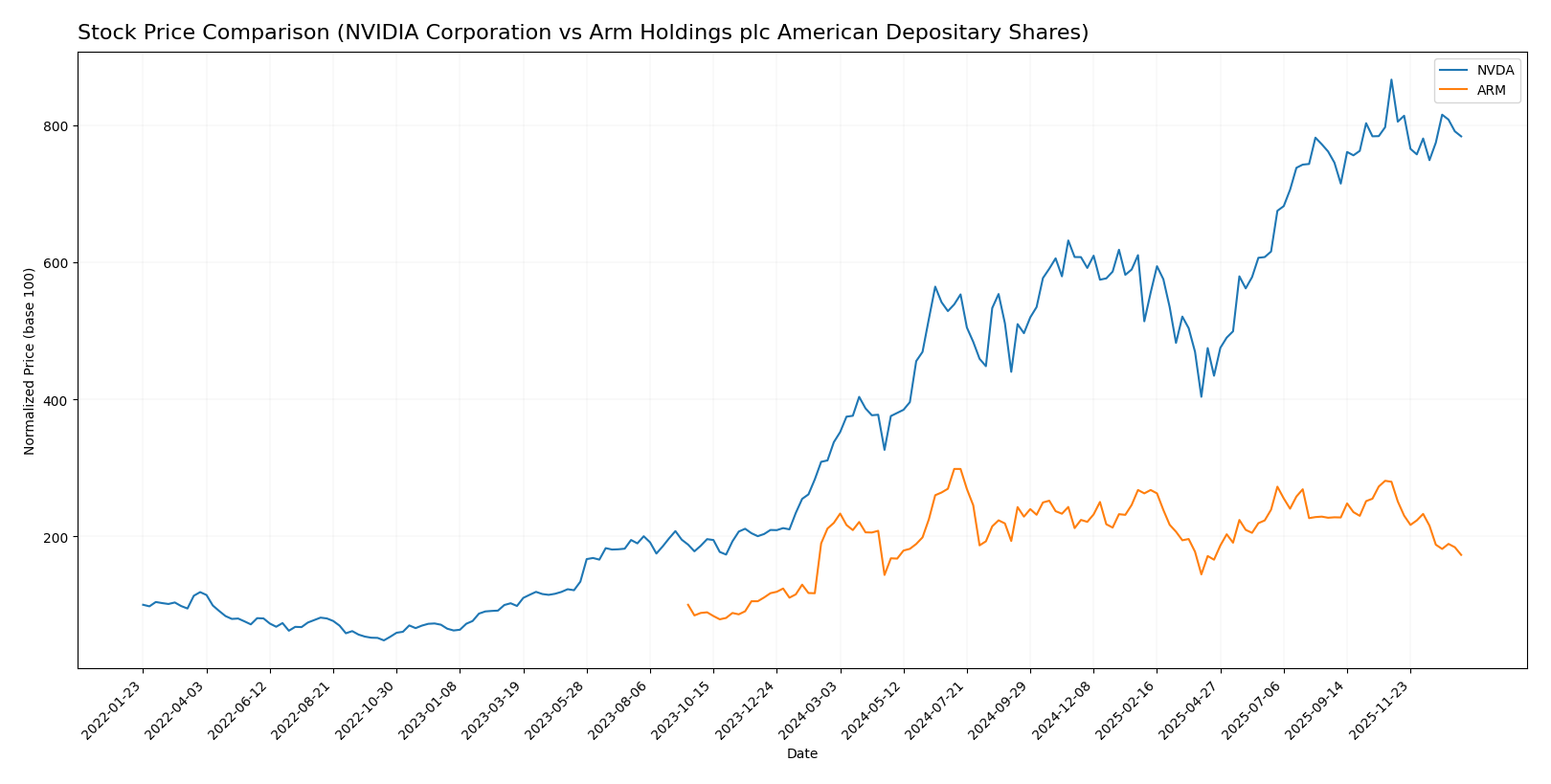

Stock Comparison

The stock price movements over the past 12 months reveal contrasting dynamics between NVIDIA Corporation and Arm Holdings plc American Depositary Shares, with NVIDIA showing strong gains despite recent deceleration, while Arm faced persistent declines and intensified downward pressure.

Trend Analysis

NVIDIA Corporation’s stock posted a 132.35% increase over the past year, indicating a bullish trend with decelerating momentum. The price ranged from a low of 76.2 to a high of 202.49, with volatility reflected by a 32.46 standard deviation.

Arm Holdings plc’s stock declined by 21.26%, marking a bearish trend with deceleration. Its price fluctuated between 87.19 and 181.19, accompanied by a 19.31 standard deviation, signaling moderate volatility over the same period.

Comparing both stocks, NVIDIA delivered the highest market performance with significant positive returns, while Arm experienced notable losses, reflecting divergent investor sentiment and trading outcomes.

Target Prices

Analysts present a clear consensus on target prices for NVIDIA Corporation and Arm Holdings plc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| NVIDIA Corporation | 352 | 140 | 264.34 |

| Arm Holdings plc American Depositary Shares | 210 | 120 | 166 |

The consensus target prices indicate significant upside potential for both NVIDIA and Arm Holdings compared to their current prices of 183.14 and 104.99, respectively, reflecting positive analyst expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for NVIDIA Corporation and Arm Holdings plc American Depositary Shares:

Rating Comparison

NVIDIA Corporation Rating

- Rating: B+, considered very favorable by analysts.

- Discounted Cash Flow Score: 3, indicating moderate valuation assessment.

- ROE Score: 5, very favorable, showing high profit efficiency.

- ROA Score: 5, very favorable, strong asset utilization.

- Debt To Equity Score: 3, moderate financial risk level.

- Overall Score: 3, moderate overall financial standing.

Arm Holdings plc American Depositary Shares Rating

- Rating: B, also considered very favorable by analysts.

- Discounted Cash Flow Score: 3, reflecting moderate valuation assessment.

- ROE Score: 3, moderate, indicating average profit efficiency.

- ROA Score: 4, favorable, good asset utilization.

- Debt To Equity Score: 4, favorable, lower financial risk.

- Overall Score: 3, moderate overall financial standing.

Which one is the best rated?

NVIDIA holds a higher rating (B+) and stronger profitability metrics with very favorable ROE and ROA scores. Arm has a slightly better debt to equity score but a lower overall profitability rating, making NVIDIA better rated based on the provided data.

Scores Comparison

The following table compares the Altman Z-Score and Piotroski Score of NVIDIA and Arm to evaluate their financial health:

NVIDIA Scores

- Altman Z-Score: 68.0, indicating a very safe zone.

- Piotroski Score: 6, reflecting average financial strength.

Arm Scores

- Altman Z-Score: 32.4, indicating a very safe zone.

- Piotroski Score: 7, reflecting strong financial strength.

Which company has the best scores?

Based strictly on the provided data, NVIDIA has a higher Altman Z-Score, indicating very low bankruptcy risk, while Arm has a stronger Piotroski Score, suggesting better overall financial strength.

Grades Comparison

The grades and ratings from reputable grading companies for NVIDIA Corporation and Arm Holdings plc American Depositary Shares are as follows:

NVIDIA Corporation Grades

The following table summarizes recent grades assigned by established financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Outperform | 2026-01-09 |

| Truist Securities | Maintain | Buy | 2025-12-29 |

| Stifel | Maintain | Buy | 2025-12-29 |

| B of A Securities | Maintain | Buy | 2025-12-26 |

| Baird | Maintain | Outperform | 2025-12-26 |

| Bernstein | Maintain | Outperform | 2025-12-26 |

| Truist Securities | Maintain | Buy | 2025-12-19 |

| Tigress Financial | Maintain | Strong Buy | 2025-12-18 |

| Morgan Stanley | Maintain | Overweight | 2025-12-01 |

| Deutsche Bank | Maintain | Hold | 2025-11-20 |

Overall, NVIDIA maintains predominantly positive grades with a consensus leaning toward Buy and Outperform, reflecting strong institutional confidence.

Arm Holdings plc American Depositary Shares Grades

The recent grades from recognized grading companies for Arm Holdings are as follows:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Downgrade | Neutral | 2026-01-13 |

| B of A Securities | Maintain | Buy | 2025-12-16 |

| Goldman Sachs | Downgrade | Sell | 2025-12-15 |

| Loop Capital | Maintain | Buy | 2025-11-12 |

| Rosenblatt | Maintain | Buy | 2025-11-06 |

| TD Cowen | Maintain | Buy | 2025-11-06 |

| Wells Fargo | Maintain | Overweight | 2025-11-06 |

| Mizuho | Maintain | Outperform | 2025-11-06 |

| Barclays | Maintain | Overweight | 2025-11-06 |

| UBS | Maintain | Buy | 2025-11-06 |

Arm’s grades show a mix of Buy and Overweight ratings but recently include some downgrades to Neutral and Sell, indicating cautious sentiment.

Which company has the best grades?

NVIDIA holds consistently stronger grades, with more frequent Buy and Outperform ratings and fewer downgrades than Arm Holdings. This suggests higher analyst confidence in NVIDIA, possibly impacting investors by indicating comparatively lower perceived risk and stronger growth prospects. Arm’s mixed grades imply more uncertainty, which could translate into greater volatility for investors.

Strengths and Weaknesses

The table below summarizes the key strengths and weaknesses of NVIDIA Corporation and Arm Holdings plc based on their latest financial and strategic data.

| Criterion | NVIDIA Corporation | Arm Holdings plc American Depositary Shares |

|---|---|---|

| Diversification | Highly diversified with strong revenue streams from Data Center (115B), Gaming (11.35B), Automotive (1.69B), and Professional Visualization (1.88B) | Less diversified, reliant mainly on License (1.84B) and Royalty (2.17B) revenues |

| Profitability | Exceptional profitability with 55.85% net margin, 91.87% ROE, and 75.28% ROIC | Moderate profitability: 19.77% net margin, 11.58% ROE, and 10.28% ROIC, with ROIC below WACC |

| Innovation | Very strong innovation, reflected in growing ROIC (+339%) and durable competitive advantage | Innovation stable but not translating to value creation; ROIC trend neutral and shedding value |

| Global presence | Extensive global footprint, especially in high-growth markets like data centers and AI | Global presence primarily through licensing, less direct market control |

| Market Share | Leader in GPU and AI processing markets with rapidly growing segments | Strong player in processor IP licensing but facing profitability challenges |

In summary, NVIDIA demonstrates a durable competitive advantage with exceptional profitability and diversification, making it a robust choice for investors. Arm, while a key player in its niche, currently struggles with value creation and faces profitability and diversification challenges.

Risk Analysis

Below is a comparative table of key risks for NVIDIA Corporation and Arm Holdings plc as of 2025.

| Metric | NVIDIA Corporation | Arm Holdings plc American Depositary Shares |

|---|---|---|

| Market Risk | High beta 2.314, sensitive to tech sector volatility | Very high beta 4.363, more volatile than NVIDIA |

| Debt level | Low debt-to-equity 0.13, favorable leverage | Very low debt-to-equity 0.05, very favorable |

| Regulatory Risk | Moderate, operates globally including US and China | Moderate, with exposure to multiple jurisdictions including UK and China |

| Operational Risk | Moderate, large workforce (36K) and complex product lines | Moderate, smaller size (8.3K employees), licensing business model |

| Environmental Risk | Moderate, semiconductor manufacturing impact | Moderate, IP licensing with less direct environmental footprint |

| Geopolitical Risk | Significant, exposure to US-China tensions and global supply chains | Considerable, UK-based with global operations including China and US |

The most impactful risks are market volatility and geopolitical tensions affecting supply chains and regulatory environments. NVIDIA faces higher market risk due to its beta and global presence, while Arm’s high beta and multinational footprint also increase risk. Both maintain low debt, reducing financial risk. Investors should monitor geopolitical developments closely.

Which Stock to Choose?

NVIDIA Corporation (NVDA) shows strong income growth with a 682.59% revenue increase over 2021-2025 and a 55.85% net margin in 2025. Its financial ratios are largely favorable, including a 91.87% ROE and low debt levels. The company’s profitability is high, and it holds a very favorable rating with a B+ grade and a very favorable moat indicating durable competitive advantage.

Arm Holdings plc (ARM) demonstrates moderate income growth with a 97.68% revenue increase over the same period and a 19.77% net margin in 2025. Its financial ratios are mixed, with favorable debt metrics but some unfavorable profitability and valuation ratios. ARM has a favorable rating with a B grade but an unfavorable moat, suggesting stable yet value-destroying profitability.

Investors focused on growth and strong profitability may find NVIDIA’s very favorable rating and robust income evolution more appealing, while those prioritizing financial stability and moderate growth could see ARM’s profile as suitable despite its slightly unfavorable overall ratios and moat. The choice might depend on an investor’s risk tolerance and strategic preferences.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of NVIDIA Corporation and Arm Holdings plc American Depositary Shares to enhance your investment decisions: