Arm Holdings plc and Lattice Semiconductor Corporation are two prominent players in the semiconductor industry, each offering unique innovation strategies and market approaches. Arm focuses on microprocessor architectures and licensing, powering diverse sectors like automotive and consumer tech, while Lattice specializes in field programmable gate arrays and IP licensing for communications and industrial markets. This article will help you decide which company presents the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Arm Holdings plc American Depositary Shares and Lattice Semiconductor Corporation by providing an overview of these two companies and their main differences.

Arm Holdings plc Overview

Arm Holdings plc develops and licenses central processing unit products and related technologies for semiconductor companies and original equipment manufacturers. Its portfolio includes microprocessors, intellectual property, graphics processing units, and software tools. The company serves diverse markets such as automotive, computing infrastructure, consumer technologies, and the Internet of Things. Founded in 1990, Arm is headquartered in Cambridge, UK, with a market capitalization of about 111B USD.

Lattice Semiconductor Corporation Overview

Lattice Semiconductor Corporation designs and sells semiconductor products, including field programmable gate arrays and video connectivity solutions. It licenses technology through IP core licensing and patent monetization. The company primarily serves original equipment manufacturers in communications, computing, consumer, and industrial sectors. Founded in 1983 and based in Hillsboro, Oregon, Lattice has a market cap near 11.7B USD and operates globally across Asia, Europe, and the Americas.

Key similarities and differences

Both companies operate in the semiconductor industry, focusing on innovative technologies and licensing models, though Arm emphasizes CPU architectures and systems IP while Lattice specializes in programmable logic devices and connectivity products. Arm’s market cap is almost ten times larger, reflecting its broader global reach and diverse end markets. Lattice maintains a smaller workforce and targets more niche applications, showing a distinct scale and market approach despite overlapping technology sectors.

Income Statement Comparison

The table below compares key income statement metrics for Arm Holdings plc American Depositary Shares (ARM) and Lattice Semiconductor Corporation (LSCC) for their most recent fiscal years.

| Metric | Arm Holdings plc American Depositary Shares (ARM) | Lattice Semiconductor Corporation (LSCC) |

|---|---|---|

| Market Cap | 111B | 11.7B |

| Revenue | 4.01B | 509M |

| EBITDA | 903M | 107M |

| EBIT | 720M | 61M |

| Net Income | 792M | 61M |

| EPS | 0.75 | 0.44 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Arm Holdings plc American Depositary Shares

Arm Holdings showed strong revenue growth from $2.03B in 2021 to $4.01B in 2025, nearly doubling over five years. Net income improved markedly from $388M to $792M, with gross margins stable around 95%. The 2025 fiscal year saw a significant boost in earnings, with net margin rising to 19.77%, reflecting both revenue acceleration and margin improvement.

Lattice Semiconductor Corporation

Lattice Semiconductor’s revenue grew moderately from $408M in 2020 to $509M in 2024, a 25% increase over the period. Net income increased from $47M to $61M, but the latest year saw a 31% revenue decline and a 66% net margin drop, signaling a recent downturn. Despite this, gross margin remained favorable at 66.82%, with net margin at 12% for 2024.

Which one has the stronger fundamentals?

Arm Holdings exhibits stronger fundamentals with consistent revenue and net income growth, high and stable gross margins near 95%, and improving net margins. Lattice Semiconductor, while showing overall growth, faced a notable recent decline in revenue and net income, resulting in weaker margin trends. Arm’s robust profitability and growth metrics outweigh Lattice’s recent volatility.

Financial Ratios Comparison

The table below presents the most recent key financial ratios for Arm Holdings plc and Lattice Semiconductor Corporation, providing a snapshot of their profitability, liquidity, leverage, and efficiency.

| Ratios | Arm Holdings plc (2025 FY) | Lattice Semiconductor Corp (2024 FY) |

|---|---|---|

| ROE | 11.6% | 8.6% |

| ROIC | 10.3% | 4.6% |

| P/E | 142 | 133 |

| P/B | 16.4 | 11.4 |

| Current Ratio | 5.20 | 3.66 |

| Quick Ratio | 5.20 | 2.62 |

| D/E (Debt-to-Equity) | 0.05 | 0.02 |

| Debt-to-Assets | 4.0% | 1.8% |

| Interest Coverage | 0 | 130 |

| Asset Turnover | 0.45 | 0.60 |

| Fixed Asset Turnover | 5.61 | 7.62 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Arm Holdings plc American Depositary Shares

Arm Holdings shows a mixed financial profile with a favorable net margin of 19.77% but an unfavorable return on invested capital (10.28%) and high weighted average cost of capital (24.3%). Its price-to-earnings (PE) ratio is very high at 141.58, indicating expensive valuation. The company has a strong quick ratio (5.2) and low debt levels, but a weak current ratio (5.2) and asset turnover (0.45). Arm does not pay dividends, likely prioritizing reinvestment and growth given its high research and development intensity.

Lattice Semiconductor Corporation

Lattice Semiconductor has a favorable net margin of 12.0% but faces challenges with a low return on equity (8.6%) and return on invested capital (4.59%). The PE ratio is also high at 132.74, suggesting elevated valuation. Its liquidity ratios are moderate with a quick ratio of 2.62 and current ratio of 3.66, both flagged as unfavorable. The company does not pay dividends, likely focusing on reinvestment, R&D, and acquisitions to fuel growth, consistent with its semiconductor industry positioning.

Which one has the best ratios?

Both Arm and Lattice Semiconductor have an equal proportion of favorable and unfavorable ratios, each with 42.86% favorable and 50.0% unfavorable metrics. While Arm has a higher net margin and stronger quick ratio, Lattice shows better fixed asset turnover and interest coverage. The global evaluation for both is slightly unfavorable, indicating neither company distinctly outperforms the other in financial ratio strength.

Strategic Positioning

This section compares the strategic positioning of Arm Holdings plc and Lattice Semiconductor Corporation, focusing on market position, key segments, and exposure to technological disruption:

Arm Holdings plc

- Leading semiconductor architect with significant market cap, facing high competitive pressure.

- Key segments include licensing microprocessors, IPs, and software for automotive, computing, and IoT markets.

- Exposure includes licensing and royalty models with technological reliance on IP development.

Lattice Semiconductor Corporation

- Smaller semiconductor firm with moderate market cap, operating in competitive markets.

- Focuses on field programmable gate arrays and video connectivity products for communications and industrial markets.

- Relies on product sales and IP licensing, with potential disruption in FPGA and connectivity technologies.

Arm Holdings plc vs Lattice Semiconductor Corporation Positioning

Arm displays a diversified approach through broad licensing and royalty streams across multiple technology sectors. Lattice concentrates on FPGA and video connectivity products, leading to narrower market exposure but focused business drivers. Arm’s scale contrasts with Lattice’s more specialized portfolio.

Which has the best competitive advantage?

Both companies are currently shedding value with ROIC below WACC, but Arm maintains stable profitability while Lattice faces declining returns, indicating Arm’s competitive position may be relatively less disadvantageous.

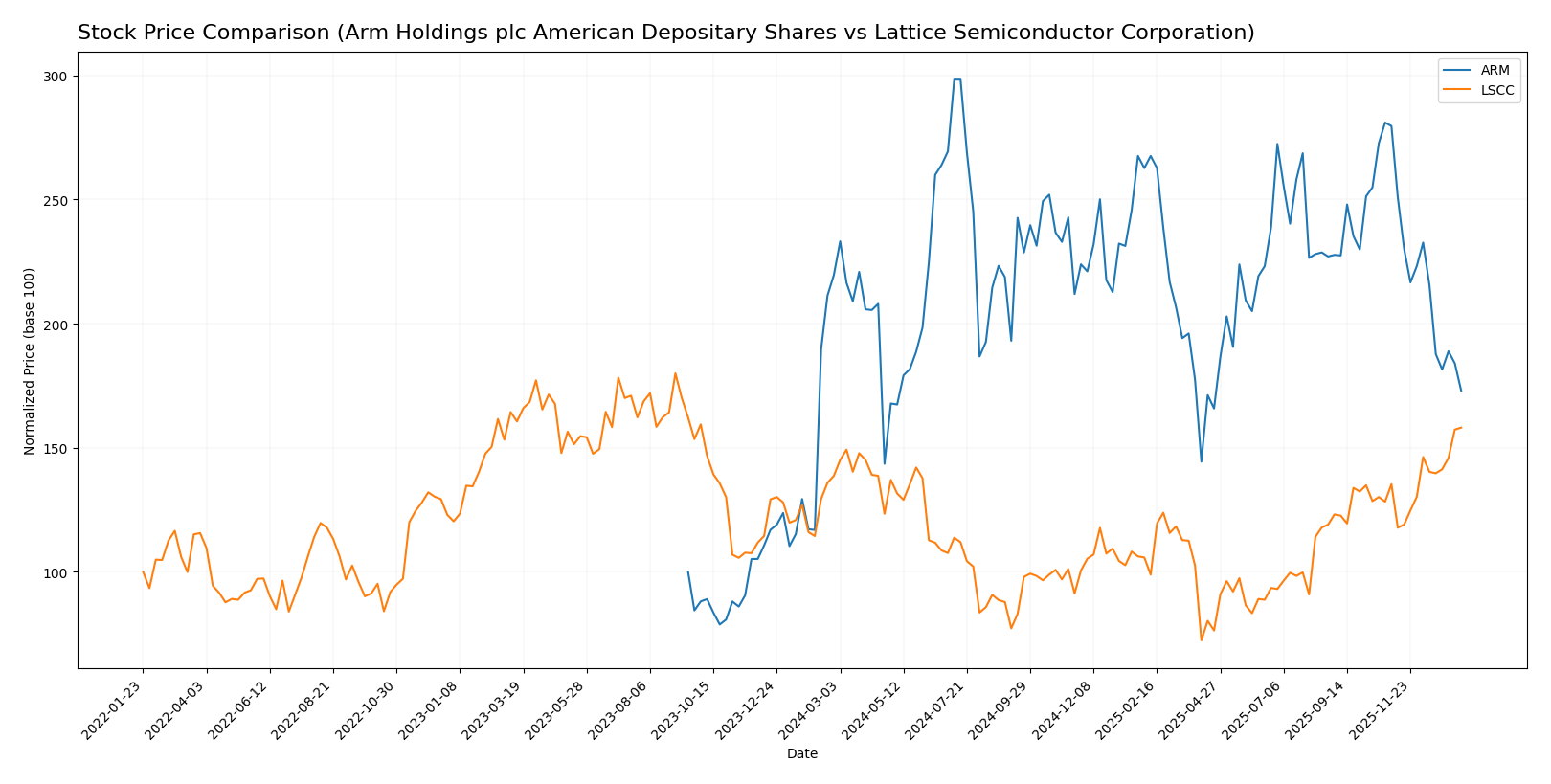

Stock Comparison

The stock price chart highlights contrasting trajectories over the past 12 months, with Arm Holdings experiencing a marked decline while Lattice Semiconductor shows sustained growth and increasing momentum.

Trend Analysis

Arm Holdings plc American Depositary Shares (ARM) displayed a bearish trend with a -21.17% price change over the past year, accompanied by decelerating decline and elevated volatility (std deviation 19.31). The stock reached a high of 181.19 and a low of 87.19.

Lattice Semiconductor Corporation (LSCC) demonstrated a bullish trend with a 14.02% price increase, showing acceleration and lower volatility (std deviation 11.01). The stock price ranged between 39.03 and 85.23 during this period.

Comparing both, LSCC delivered the highest market performance over the past year, contrasting with ARM’s significant negative return.

Target Prices

Analysts provide a clear target price consensus for both Arm Holdings plc and Lattice Semiconductor Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Arm Holdings plc American Depositary Shares | 210 | 120 | 166 |

| Lattice Semiconductor Corporation | 105 | 65 | 83 |

The consensus targets suggest significant upside potential for Arm Holdings, currently priced at $105.11, and moderate upside for Lattice Semiconductor, trading near $85.23. Both stocks show room for growth based on analyst expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Arm Holdings plc American Depositary Shares (ARM) and Lattice Semiconductor Corporation (LSCC):

Rating Comparison

ARM Rating

- Rated B, indicating a very favorable overall rating.

- Discounted Cash Flow Score of 3, showing moderate valuation assessment.

- Return on Equity Score of 3, reflecting moderate profit efficiency.

- Return on Assets Score of 4, a favorable measure of asset utilization.

- Debt to Equity Score of 4, indicating favorable financial stability.

- Overall Score of 3, representing a moderate overall financial standing.

LSCC Rating

- Rated B-, also very favorable but slightly lower.

- Same DCF score of 3, indicating moderate valuation.

- Lower ROE score of 2, suggesting less efficient profit generation.

- ROA score of 3, moderate asset utilization efficiency.

- Equal Debt to Equity score of 4, also favorable financial health.

- Overall Score of 2, somewhat lower moderate financial standing.

Which one is the best rated?

Based strictly on the provided data, ARM is better rated than LSCC. ARM holds higher scores in Return on Equity, Return on Assets, and Overall Score, although both companies share similar Debt to Equity and Discounted Cash Flow scores.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Arm Holdings plc (ARM) and Lattice Semiconductor Corporation (LSCC):

ARM Scores

- Altman Z-Score: 32.43, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

LSCC Scores

- Altman Z-Score: 52.69, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 5, classified as average financial health.

Which company has the best scores?

Both ARM and LSCC are in the safe zone for Altman Z-Score, but LSCC has a higher Altman Z-Score. ARM, however, has a stronger Piotroski Score than LSCC, indicating better overall financial strength based on the provided data.

Grades Comparison

Here is a comparison of the most recent grades from recognized grading companies for Arm Holdings plc and Lattice Semiconductor Corporation:

Arm Holdings plc Grades

The table below summarizes Arm’s recent grades from major financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Downgrade | Neutral | 2026-01-13 |

| B of A Securities | Maintain | Buy | 2025-12-16 |

| Goldman Sachs | Downgrade | Sell | 2025-12-15 |

| Loop Capital | Maintain | Buy | 2025-11-12 |

| TD Cowen | Maintain | Buy | 2025-11-06 |

| Rosenblatt | Maintain | Buy | 2025-11-06 |

| Wells Fargo | Maintain | Overweight | 2025-11-06 |

| Mizuho | Maintain | Outperform | 2025-11-06 |

| Barclays | Maintain | Overweight | 2025-11-06 |

| UBS | Maintain | Buy | 2025-11-06 |

Overall, Arm’s grades show a mix of strong buy-side support with some recent downgrades, indicating a cautious stance from some analysts.

Lattice Semiconductor Corporation Grades

The table below lists Lattice Semiconductor’s recent grades from reputable analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-13 |

| Stifel | Maintain | Buy | 2025-11-04 |

| Baird | Maintain | Outperform | 2025-11-04 |

| Needham | Maintain | Buy | 2025-11-04 |

| Rosenblatt | Maintain | Buy | 2025-11-04 |

| Benchmark | Maintain | Buy | 2025-11-04 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Keybanc | Maintain | Overweight | 2025-09-30 |

| Needham | Maintain | Buy | 2025-09-22 |

| Benchmark | Maintain | Buy | 2025-09-11 |

Lattice Semiconductor’s grades consistently reflect a buy or better consensus with stable positive outlooks from multiple firms.

Which company has the best grades?

Both Arm and Lattice Semiconductor carry a consensus “Buy” rating, but Lattice shows more consistent buy and outperform grades without recent downgrades. This steadier positive grading could influence investors seeking stability in analyst sentiment, while Arm’s recent mixed signals may suggest a more cautious approach.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Arm Holdings plc (ARM) and Lattice Semiconductor Corporation (LSCC) based on the most recent financial and operational data.

| Criterion | Arm Holdings plc (ARM) | Lattice Semiconductor Corporation (LSCC) |

|---|---|---|

| Diversification | Moderate: Revenue mainly from licensing and royalties (approx. $4.0B combined in 2025) | Limited: Primarily semiconductor products and licensing, smaller revenue base (~$17M license in 2022) |

| Profitability | Mixed: Net margin favorable at 19.77%, but ROIC (10.28%) below WACC (24.3%) indicates value destruction | Lower profitability: Net margin 12%, ROIC (4.59%) below WACC (11.86%), declining returns |

| Innovation | Strong IP portfolio in chip design fueling licensing growth | Focus on niche programmable logic devices, but innovation impact less pronounced |

| Global presence | Extensive due to licensing model serving global chip manufacturers | More regional, smaller footprint compared to ARM |

| Market Share | Leading in chip architecture licensing | Smaller share in specialized semiconductor segments |

In summary, ARM demonstrates strong revenue generation through its licensing model and maintains a favorable profit margin, but struggles to generate returns above its capital costs, signaling value destruction. LSCC shows lower scale and profitability with declining returns, reflecting challenges in sustaining competitive advantage. Both companies require cautious evaluation due to profitability and economic moat concerns.

Risk Analysis

Below is a comparative table of key risks for Arm Holdings plc (ARM) and Lattice Semiconductor Corporation (LSCC) based on the most recent data available:

| Metric | Arm Holdings plc American Depositary Shares (ARM) | Lattice Semiconductor Corporation (LSCC) |

|---|---|---|

| Market Risk | High beta of 4.36 indicates strong volatility and sensitivity to market swings. | Moderate beta of 1.72 suggests moderate market volatility exposure. |

| Debt Level | Very low debt-to-equity ratio at 0.05, indicating strong balance sheet and low leverage. | Even lower debt-to-equity ratio at 0.02, reflecting very conservative debt management. |

| Regulatory Risk | Operating in multiple geopolitical regions including China and Taiwan, facing potential regulatory and trade tensions. | Primarily US-based but with global markets exposure, less regulatory complexity than ARM. |

| Operational Risk | Large scale operations with 8,330 employees; complexity may increase operational risks. | Smaller workforce of 1,110, potentially lower operational complexity but reliant on niche FPGA market. |

| Environmental Risk | Technology sector exposure with potential risks related to supply chain sustainability and energy usage. | Similar semiconductor industry environmental challenges but on a smaller scale. |

| Geopolitical Risk | Significant exposure to geopolitical tensions in Asia, especially China and Taiwan issues. | Less exposed geopolitically, primarily US-based with some international sales. |

In synthesis, ARM faces substantial market and geopolitical risks due to high volatility and presence in politically sensitive regions. Its operational scale also adds complexity. LSCC shows moderate market risk and lower geopolitical exposure but still faces industry-specific operational and regulatory challenges. Both companies have strong balance sheets with minimal debt, reducing financial risk. Investors should weigh ARM’s higher return potential against its elevated risks, while LSCC offers steadier risk but potentially lower growth.

Which Stock to Choose?

Arm Holdings plc’s income shows strong growth, with a 24% rise in revenue last year and favorable profitability metrics including a 19.77% net margin. Its financial ratios are mixed, showing solid debt management but unfavorable valuation multiples and asset turnover. The company carries low debt and holds a very favorable overall rating of B, yet its economic moat is unfavorable as it currently destroys value.

Lattice Semiconductor Corporation’s income has declined recently, with a 31% drop in revenue last year, though it maintains a favorable net margin of 12%. Its financial ratios reveal a balanced debt position and moderate profitability but unfavorable valuation multiples. The company exhibits a very favorable rating of B- and a very unfavorable moat, reflecting decreasing profitability and value destruction.

Investors prioritizing growth and strong income statement trends might find Arm Holdings more appealing, given its robust revenue growth and profitability. Conversely, those favoring companies with moderate financial stability and a bullish recent price trend could see Lattice Semiconductor as more suitable, despite its recent income decline and unfavorable moat. The choice might depend on the investor’s tolerance for risk and preference for growth versus recovery potential.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Arm Holdings plc American Depositary Shares and Lattice Semiconductor Corporation to enhance your investment decisions: