In the dynamic semiconductor industry, Arm Holdings plc and indie Semiconductor, Inc. stand out as innovators shaping technology’s future. Arm leads with a broad portfolio of CPU architectures and licensing models, while indie focuses on automotive semiconductors and software for advanced driver systems. Both companies overlap in cutting-edge tech but follow distinct innovation strategies. This article will help you decide which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Arm Holdings plc American Depositary Shares and indie Semiconductor, Inc. by providing an overview of these two companies and their main differences.

Arm Holdings plc Overview

Arm Holdings plc designs and licenses central processing unit products and related technologies primarily for semiconductor companies and original equipment manufacturers. Its portfolio includes microprocessors, systems intellectual property (IPs), graphics processing units, and software tools. The company serves various markets such as automotive, computing infrastructure, consumer technologies, and the Internet of Things. Founded in 1990, Arm is headquartered in Cambridge, UK, and operates globally with a market capitalization of approximately 111B USD.

indie Semiconductor Overview

indie Semiconductor, Inc. focuses on automotive semiconductors and software solutions targeting advanced driver assistance systems, connected cars, user experience, and electrification applications. Its product range covers ultrasound sensors, in-cabin wireless charging, infotainment, LED lighting, and photonic components for optical sensing and communication markets. Established in 2007 and based in Aliso Viejo, California, indie Semiconductor holds a market cap near 857M USD and primarily serves the automotive technology sector.

Key similarities and differences

Both companies operate within the semiconductor industry but differ significantly in scale and focus. Arm Holdings is a large, diversified technology licensor with a broad international footprint and a wide product range across several markets. indie Semiconductor is smaller and more specialized, concentrating on automotive semiconductors and related software solutions. While both cater to automotive applications, Arm’s offerings extend far beyond this segment, indicating different business models and market approaches.

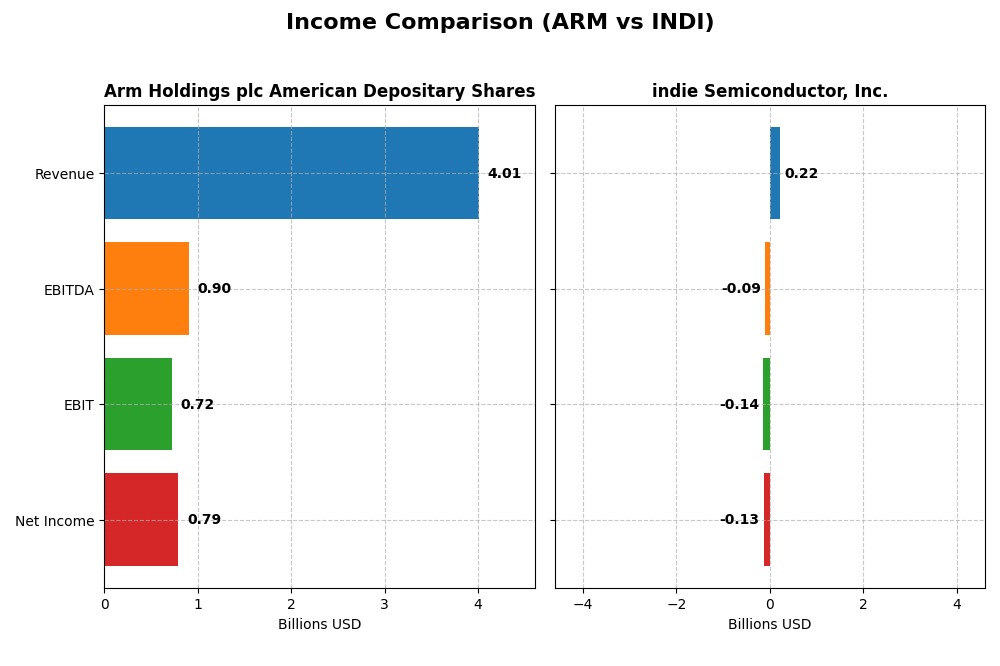

Income Statement Comparison

This table presents a side-by-side comparison of the most recent full fiscal year income statement metrics for Arm Holdings plc American Depositary Shares and indie Semiconductor, Inc.

| Metric | Arm Holdings plc American Depositary Shares | indie Semiconductor, Inc. |

|---|---|---|

| Market Cap | 111B | 857M |

| Revenue | 4.01B | 217M |

| EBITDA | 903M | -94M |

| EBIT | 720M | -137M |

| Net Income | 792M | -133M |

| EPS | 0.75 | -0.76 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Arm Holdings plc American Depositary Shares

Arm Holdings demonstrated strong growth from 2021 to 2025, with revenue nearly doubling to $4.01B and net income tripling to $792M. Margins remained robust, with a gross margin around 95% and a net margin close to 20%. In 2025, Arm showed accelerated revenue growth of 24% and a remarkable 108% increase in net margin, reflecting improved profitability and operational efficiency.

indie Semiconductor, Inc.

Indie Semiconductor experienced volatile performance from 2020 to 2024, with revenue expanding over 850% overall but declining slightly by 2.9% in the most recent year to $217M. Net income remained negative, though losses narrowed to -$133M in 2024. Margins were mixed: gross margin improved favorably to 42%, but EBIT and net margins remained deeply negative, indicating ongoing profitability challenges.

Which one has the stronger fundamentals?

Arm Holdings displays stronger fundamentals with consistent revenue and net income growth, high and stable profitability margins, and favorable income statement metrics across the period. Indie Semiconductor shows high revenue growth but sustained net losses and unfavorable EBIT and net margins, resulting in a neutral overall income statement evaluation.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Arm Holdings plc and indie Semiconductor, Inc. based on their most recent fiscal year data.

| Ratios | Arm Holdings plc (2025) | indie Semiconductor, Inc. (2024) |

|---|---|---|

| ROE | 11.6% | -31.7% |

| ROIC | 10.3% | -19.3% |

| P/E | 141.6 | -5.35 |

| P/B | 16.4 | 1.70 |

| Current Ratio | 5.20 | 4.82 |

| Quick Ratio | 5.20 | 4.23 |

| D/E (Debt-to-Equity) | 0.052 | 0.954 |

| Debt-to-Assets | 4.0% | 42.3% |

| Interest Coverage | N/A | -18.4 |

| Asset Turnover | 0.45 | 0.23 |

| Fixed Asset Turnover | 5.61 | 4.30 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

Arm Holdings plc American Depositary Shares

Arm Holdings shows a mixed profile with strong net margin at 19.77% but unfavorable ROIC at 10.28% and a high WACC of 24.3%. Its valuation multiples such as PE at 141.58 and PB at 16.4 are also unfavorable. The company has a solid liquidity position with a quick ratio of 5.2 but a concerning current ratio. No dividends are paid, reflecting a possible reinvestment strategy in R&D, as indicated by high research expenses.

indie Semiconductor, Inc.

Indie Semiconductor’s ratios are generally weak with a negative net margin of -61.2% and negative returns including ROE at -31.73%. It faces unfavorable interest coverage and asset turnover rates. Valuation metrics like PE at -5.35 are favorable due to negative earnings, while PB is neutral at 1.7. The company pays no dividends, likely due to losses and a focus on growth and R&D investment, supported by a strong quick ratio of 4.23.

Which one has the best ratios?

Arm Holdings displays a more balanced ratio profile with several favorable liquidity and profitability indicators, despite some valuation concerns. Indie Semiconductor struggles with consistent negative profitability and coverage metrics, reflecting financial stress. Overall, Arm’s ratios are relatively stronger, whereas indie Semiconductor’s remain mostly unfavorable.

Strategic Positioning

This section compares the strategic positioning of Arm Holdings plc and indie Semiconductor, Inc. regarding market position, key segments, and exposure to technological disruption:

Arm Holdings plc American Depositary Shares

- Leading semiconductor IP licensor with global presence and strong competitive pressure on NASDAQ.

- Key segments include licensing microprocessors, GPUs, and IPs for automotive, computing, consumer tech, and IoT markets.

- Exposure to disruption through evolving semiconductor architectures and software tools essential for OEMs worldwide.

indie Semiconductor, Inc.

- Smaller semiconductor provider focused on automotive niche under NASDAQ Capital Market competition.

- Focuses on automotive semiconductors and software for ADAS, connected car, electrification, and optical technologies.

- Faces disruption in automotive tech and photonics, with innovations in sensing, connectivity, and user experience.

Arm Holdings plc vs indie Semiconductor, Inc. Positioning

Arm demonstrates a diversified business model spanning multiple tech sectors with significant licensing and royalty revenues. Indie Semiconductor is more concentrated on automotive semiconductor products and software, which may limit market breadth but focuses on growing automotive technology trends.

Which has the best competitive advantage?

Both companies are shedding value with ROIC below WACC; however, Arm’s stable profitability contrasts with indie Semiconductor’s declining returns, indicating Arm’s moat is unfavorable but more stable compared to indie’s very unfavorable and worsening position.

Stock Comparison

The stock prices of Arm Holdings plc American Depositary Shares (ARM) and indie Semiconductor, Inc. (INDI) have shown significant bearish trends over the past year, marked by notable declines and decelerating momentum in trading activity.

Trend Analysis

Arm Holdings plc’s stock price declined by 21.17% over the past 12 months, reflecting a bearish trend with decelerating downward momentum and high volatility, ranging from a high of 181.19 to a low of 87.19.

indie Semiconductor, Inc. experienced a 28.67% decrease in stock price during the same period, also bearish with deceleration and lower volatility, with prices fluctuating between 7.43 and 1.60.

Comparing the two, indie Semiconductor’s stock underperformed Arm Holdings plc, delivering the larger percentage loss over the last year despite lower volatility levels.

Target Prices

Analysts present a clear consensus on target prices for Arm Holdings plc and indie Semiconductor, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Arm Holdings plc American Depositary Shares | 210 | 120 | 166 |

| indie Semiconductor, Inc. | 8 | 8 | 8 |

The consensus target price for Arm Holdings is significantly above its current price of 105.11 USD, indicating strong expected upside. indie Semiconductor’s target price aligns with a modest increase from its current 4.23 USD, reflecting cautious optimism among analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Arm Holdings plc American Depositary Shares (ARM) and indie Semiconductor, Inc. (INDI):

Rating Comparison

ARM Rating

- Rating: B, considered very favorable overall.

- Discounted Cash Flow Score: 3, moderate indication of valuation.

- ROE Score: 3, moderate efficiency in generating profit from equity.

- ROA Score: 4, favorable asset utilization to generate earnings.

- Debt To Equity Score: 4, favorable financial risk profile with low debt.

- Overall Score: 3, moderate overall financial standing.

INDI Rating

- Rating: C-, also marked very favorable overall.

- Discounted Cash Flow Score: 1, very unfavorable valuation metric.

- ROE Score: 1, very unfavorable efficiency in generating profit from equity.

- ROA Score: 1, very unfavorable asset utilization.

- Debt To Equity Score: 1, very unfavorable financial risk with high debt.

- Overall Score: 1, very unfavorable overall financial standing.

Which one is the best rated?

Based strictly on the provided data, ARM holds a superior rating and higher scores across all key financial metrics compared to INDI, indicating a stronger overall financial profile.

Scores Comparison

The comparison of Altman Z-Score and Piotroski Score for ARM and INDI is as follows:

ARM Scores

- Altman Z-Score: 32.4, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial health and value potential.

INDI Scores

- Altman Z-Score: 0.12, indicating distress zone with high bankruptcy risk.

- Piotroski Score: 2, indicating very weak financial strength and investment potential.

Which company has the best scores?

Based on the provided scores, ARM has a significantly higher Altman Z-Score and Piotroski Score than INDI. ARM is in the safe zone with strong financial health, while INDI is in financial distress with very weak strength.

Grades Comparison

Here is a comparison of the recent grades assigned to the two companies by reputable grading firms:

Arm Holdings plc American Depositary Shares Grades

This table summarizes recent grades from well-known financial institutions for Arm Holdings plc:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Downgrade | Neutral | 2026-01-13 |

| B of A Securities | Maintain | Buy | 2025-12-16 |

| Goldman Sachs | Downgrade | Sell | 2025-12-15 |

| Loop Capital | Maintain | Buy | 2025-11-12 |

| TD Cowen | Maintain | Buy | 2025-11-06 |

| Rosenblatt | Maintain | Buy | 2025-11-06 |

| Wells Fargo | Maintain | Overweight | 2025-11-06 |

| Mizuho | Maintain | Outperform | 2025-11-06 |

| Barclays | Maintain | Overweight | 2025-11-06 |

| UBS | Maintain | Buy | 2025-11-06 |

Overall, Arm Holdings shows a majority of Buy and Overweight ratings, with some recent downgrades to Neutral and Sell, indicating mixed sentiment.

indie Semiconductor, Inc. Grades

This table displays recent ratings from recognized grading companies for indie Semiconductor, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2025-11-10 |

| Benchmark | Maintain | Buy | 2025-06-25 |

| Benchmark | Maintain | Buy | 2025-06-11 |

| Benchmark | Maintain | Buy | 2025-05-21 |

| Benchmark | Maintain | Buy | 2025-05-13 |

| Craig-Hallum | Maintain | Buy | 2025-05-13 |

| Keybanc | Maintain | Overweight | 2025-05-13 |

| Benchmark | Maintain | Buy | 2025-04-09 |

| Benchmark | Maintain | Buy | 2025-02-21 |

| Keybanc | Maintain | Overweight | 2025-02-21 |

indie Semiconductor has predominantly Buy and Overweight grades, with a single Neutral rating, reflecting generally positive analyst views.

Which company has the best grades?

Both companies have consensus Buy ratings, but indie Semiconductor maintains consistently positive Buy and Overweight grades without downgrades, unlike Arm Holdings which has recent Neutral and Sell ratings. This suggests indie Semiconductor currently enjoys a steadier positive sentiment, which investors may interpret as a lower risk profile in terms of analyst outlook.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Arm Holdings plc (ARM) and indie Semiconductor, Inc. (INDI) based on the latest financial and strategic data.

| Criterion | Arm Holdings plc American Depositary Shares (ARM) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Diversification | Moderate: Primarily licensing and royalty streams, focused on semiconductor IP | Limited: Mainly product and service revenue in semiconductor components |

| Profitability | Moderate profitability with 19.77% net margin; however, ROIC below WACC indicates value destruction | Negative profitability with -61.2% net margin and declining ROIC; value destroying |

| Innovation | Strong IP portfolio driving royalty revenues, but innovation not reflected in ROIC growth | Innovation struggling to translate into profitability; declining ROIC trend |

| Global presence | Significant global licensing footprint, diversified customer base | More limited global reach, focused on niche semiconductor markets |

| Market Share | Leading position in semiconductor IP licensing | Smaller player with limited market penetration |

Key takeaways: Arm Holdings benefits from a strong global licensing model and moderate profitability but struggles with value creation as ROIC lags behind WACC. indie Semiconductor faces severe profitability challenges with declining returns and limited diversification, making it a higher risk investment at present.

Risk Analysis

Below is a comparison of key risk factors for Arm Holdings plc (ARM) and indie Semiconductor, Inc. (INDI) based on the most recent data available.

| Metric | Arm Holdings plc (ARM) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Market Risk | High beta at 4.36, indicating significant price volatility | Elevated beta at 2.54, moderate price volatility |

| Debt level | Very low debt/equity ratio of 0.05, low financial leverage | High debt/equity ratio of 0.95, indicating high leverage |

| Regulatory Risk | Moderate, operates globally including China and UK with tech regulations | Moderate, US-based with automotive semiconductor regulatory scrutiny |

| Operational Risk | Exposure to semiconductor supply chain and innovation cycles | High due to smaller size and automotive sector dependency |

| Environmental Risk | Moderate, industry impact and compliance requirements | Moderate, automotive semiconductor production impacts |

| Geopolitical Risk | Significant, with operations in China, Taiwan, South Korea | Moderate, predominantly US-focused but affected by global supply chains |

The most critical risks are ARM’s high market volatility and geopolitical exposure due to its broad international footprint, while INDI faces substantial financial risk from its heavy debt load and operational risks linked to its smaller scale and automotive market dependence. ARM’s strong Altman Z-score indicates low bankruptcy risk, whereas INDI’s financial distress signals caution. Investors should weigh these factors carefully.

Which Stock to Choose?

Arm Holdings plc American Depositary Shares (ARM) has shown strong income growth with a 24% revenue increase in the last year and consistent profitability marked by a 19.77% net margin. Its financial ratios reveal a mixed picture: favorable debt metrics and interest coverage contrast with high valuation multiples and a slightly unfavorable overall ratio assessment. ARM’s return on equity stands at 11.58%, though its return on invested capital trails its cost of capital, indicating value destruction despite stable profitability. The company holds a very favorable overall rating of B and strong financial health scores.

indie Semiconductor, Inc. (INDI) displays a weaker income profile with negative net margin at -61.2% and revenue declining slightly by 2.9% last year. Its financial ratios are predominantly unfavorable, including negative returns on equity and assets, high debt levels, and poor interest coverage. The company is in a very unfavorable moat position with declining profitability and value erosion. INDI’s overall rating is C-, reflecting significant financial distress and very weak financial health scores, with Altman Z-Score in the distress zone.

Investors prioritizing growth and profitability may find ARM’s strong income statement and stable rating more aligned with their goals, despite its high valuation. Conversely, those with a tolerance for financial risk and a focus on potential turnaround opportunities might consider INDI’s current low valuation and growth in gross profit, though its financial ratios and moat status suggest caution. Overall, the choice could depend heavily on the investor’s risk profile and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Arm Holdings plc American Depositary Shares and indie Semiconductor, Inc. to enhance your investment decisions: