In the rapidly evolving technology landscape, Arm Holdings (ARM) and MicroStrategy (MSTR) stand out as two innovative companies, albeit in different segments. As a leader in semiconductors, Arm architects and licenses cutting-edge technologies essential for various industries, while MicroStrategy specializes in enterprise analytics software that empowers businesses with data-driven insights. This comparison will delve into their market strategies, growth potential, and overall innovation trajectories, ultimately helping you discern which company might be the more compelling investment opportunity.

Table of contents

Company Overview

Arm Holdings plc Overview

Arm Holdings plc is a leading player in the semiconductor industry, dedicated to architecting, developing, and licensing central processing unit (CPU) products and associated technologies. Founded in 1990 and headquartered in Cambridge, UK, Arm’s innovative solutions cater to a diverse range of markets, including automotive, computing infrastructure, consumer technology, and the Internet of Things (IoT). With a market capitalization of approximately $142.68B, Arm operates globally and provides essential microprocessors, graphics processing units, and intellectual property systems that empower semiconductor companies and OEMs to create cutting-edge products. The company, now a subsidiary of Kronos II LLC, has positioned itself as a critical enabler of technological advancements across various sectors.

MicroStrategy Incorporated Overview

MicroStrategy Incorporated, established in 1989 and based in Tysons Corner, Virginia, specializes in enterprise analytics software and services. With a market cap of about $50.89B, MicroStrategy offers a comprehensive platform that enhances data analytics experiences through hyperintelligence, visualization, and reporting capabilities. The company serves a wide array of industries, including finance, healthcare, and telecommunications, by providing tailored solutions that facilitate data-driven decision-making. Additionally, MicroStrategy’s consulting and educational services further empower organizations to maximize their analytics investments, ensuring they leverage data effectively for competitive advantage.

Key similarities and differences

Both Arm and MicroStrategy operate within the technology sector but focus on distinct areas: Arm specializes in semiconductor architecture, while MicroStrategy centers on enterprise analytics software. They share a commitment to innovation and provide crucial solutions that drive advancements in their respective fields. However, their business models differ significantly, with Arm primarily licensing technology to hardware manufacturers and MicroStrategy offering software solutions and consulting services to a diverse client base.

Income Statement Comparison

The following table presents a comparison of the most recent income statements of Arm Holdings (ARM) and MicroStrategy (MSTR) to assist in evaluating their financial performances.

| Metric | Arm Holdings (ARM) | MicroStrategy (MSTR) |

|---|---|---|

| Market Cap | 143B | 51B |

| Revenue | 4.01B | 463M |

| EBITDA | 902M | -1.85B |

| EBIT | 720M | -1.87B |

| Net Income | 792M | -1.17B |

| EPS | 0.75 | -6.06 |

| Fiscal Year | 2025 | 2024 |

Interpretation of Income Statement

In the latest fiscal year, Arm Holdings significantly increased its revenue to 4.01B, reflecting a robust growth trend compared to previous years. Net income also rose to 792M, indicating strong profitability. In contrast, MicroStrategy reported declining performance with a revenue decrease to 463M and a substantial net loss of 1.17B. The widening losses and negative EBITDA signal underlying challenges, mainly driven by high operating expenses. Overall, while Arm is on an upward trajectory, MicroStrategy is struggling to maintain stability, emphasizing the need for careful evaluation before investment.

Financial Ratios Comparison

In this section, I will provide a comparative overview of the most recent financial ratios for Arm Holdings (ARM) and MicroStrategy (MSTR). These metrics help us assess the companies’ financial health and operational efficiency.

| Metric | ARM | MSTR |

|---|---|---|

| ROE | 11.58% | -6.40% |

| ROIC | 11.31% | -4.38% |

| P/E | 141.58 | -20.12 |

| P/B | 16.40 | -4.19 |

| Current Ratio | 5.20 | 0.71 |

| Quick Ratio | 5.20 | 0.83 |

| D/E | 0.05 | 1.04 |

| Debt-to-Assets | 0.04 | 0.47 |

| Interest Coverage | 0 | -29.92 |

| Asset Turnover | 0.45 | 0.10 |

| Fixed Asset Turnover | 5.61 | 5.73 |

| Payout ratio | 0.00% | 0.00% |

| Dividend yield | 0.00% | 0.00% |

Interpretation of Financial Ratios

Arm Holdings demonstrates strong financial health with positive ROE and ROIC, indicating effective capital utilization. The P/E and P/B ratios suggest overvaluation relative to earnings and book value. In contrast, MicroStrategy’s negative metrics raise concerns, as it struggles with profitability and high debt levels, reflecting significant financial risk. Investors should exercise caution when considering MSTR due to these issues.

Dividend and Shareholder Returns

Arm Holdings (ARM) does not pay dividends, reflecting its focus on reinvestment for growth, evident in its negative dividend payout ratio. Instead, the company emphasizes share buybacks, creating potential value for shareholders. MicroStrategy (MSTR) also refrains from dividends, primarily due to negative net income and a strategy prioritizing acquisitions and research. Both firms aim for long-term shareholder value creation, though their lack of dividends could pose risks if growth falters. Ultimately, their approaches may support sustainable value, provided they manage risks effectively.

Strategic Positioning

Arm Holdings (ARM) holds a significant market share in the semiconductor industry, driven by its advanced CPU architectures and licensing model. Its competitive edge lies in strong partnerships across various markets, including automotive and IoT. MicroStrategy (MSTR), primarily focused on enterprise analytics software, faces competitive pressure from other analytics platforms but leverages its unique offerings in hyperintelligence and data visualization. Both companies must navigate ongoing technological disruptions to maintain their market positions.

Stock Comparison

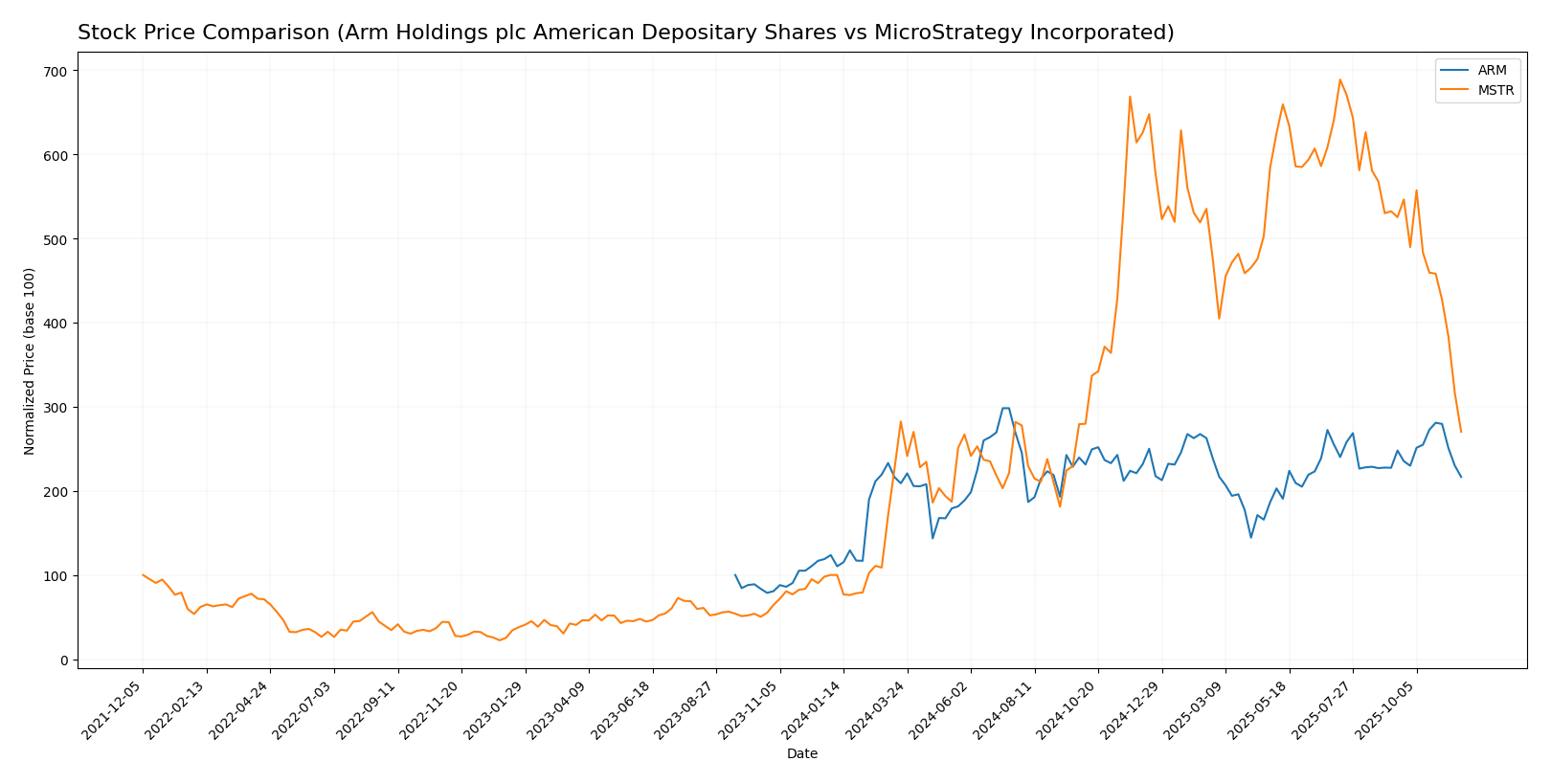

In this section, I will analyze the weekly stock price movements of Arm Holdings plc (ARM) and MicroStrategy Incorporated (MSTR) over the past year, highlighting their key price dynamics and trading activities.

Trend Analysis

For Arm Holdings plc (ARM), the overall trend shows a remarkable price change of +102.18% over the past year, indicating a bullish trend. However, in the recent period from September 14, 2025, to November 30, 2025, the stock experienced a decline of -10.01%, with notable price fluctuations between a high of 181.19 and a low of 67.05. The acceleration status is marked as deceleration, suggesting a slowing momentum despite the overall bullish trend. The standard deviation of 23.44 reveals a moderate level of volatility in the stock’s price.

On the other hand, MicroStrategy Incorporated (MSTR) has demonstrated a substantial price increase of +180.75% over the same timeframe, also reflecting a bullish trend. Recently, however, MSTR faced a significant downturn of -46.54% since mid-September, with a highest price of 434.58 and a lowest of 48.10. Similar to ARM, the acceleration status indicates deceleration in the upward trend, accompanied by a standard deviation of 113.23, which points to high volatility in its price movements.

Both companies exhibit distinct trading dynamics, with ARM experiencing a decreasing volume trend, while MSTR’s trading volume is on the rise. This analysis should aid investors in making informed decisions about these stocks.

Analyst Opinions

Recent analyst recommendations for Arm Holdings (ARM) reflect a cautious stance, with a grade of B-. Analysts highlight strong return on assets and manageable debt levels, making it a hold for now. In contrast, MicroStrategy (MSTR) received a C rating, suggesting potential concerns over profitability and cash flow, leading analysts to recommend a sell. Overall, the consensus for ARM is to hold, while MSTR leans towards a sell.

Stock Grades

Recently, several companies have received updated stock ratings from reputable grading firms. Here’s a look at the grades for Arm Holdings and MicroStrategy.

Arm Holdings plc American Depositary Shares Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Loop Capital | maintain | Buy | 2025-11-12 |

| Benchmark | maintain | Hold | 2025-11-06 |

| Keybanc | maintain | Overweight | 2025-11-06 |

| Needham | maintain | Hold | 2025-11-06 |

| Mizuho | maintain | Outperform | 2025-11-06 |

| Barclays | maintain | Overweight | 2025-11-06 |

| UBS | maintain | Buy | 2025-11-06 |

| TD Cowen | maintain | Buy | 2025-11-06 |

| Rosenblatt | maintain | Buy | 2025-11-06 |

| JP Morgan | maintain | Overweight | 2025-11-06 |

MicroStrategy Incorporated Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Monness, Crespi, Hardt | upgrade | Neutral | 2025-11-10 |

| HC Wainwright & Co. | maintain | Buy | 2025-11-03 |

| Canaccord Genuity | maintain | Buy | 2025-11-03 |

| BTIG | maintain | Buy | 2025-10-31 |

| TD Cowen | maintain | Buy | 2025-10-31 |

| Cantor Fitzgerald | maintain | Overweight | 2025-10-31 |

| Wells Fargo | downgrade | Equal Weight | 2025-09-30 |

| TD Cowen | maintain | Buy | 2025-09-16 |

| Canaccord Genuity | maintain | Buy | 2025-08-26 |

| Mizuho | maintain | Outperform | 2025-08-11 |

Overall, Arm Holdings maintains a strong position with consistent “Buy” and “Overweight” ratings across multiple firms. In contrast, MicroStrategy has seen a recent upgrade to “Neutral,” but it also faced a downgrade from “Overweight” to “Equal Weight,” indicating a more cautious sentiment among analysts.

Target Prices

The current analyst consensus indicates optimistic target prices for both Arm Holdings and MicroStrategy.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Arm Holdings | 210 | 190 | 200 |

| MicroStrategy | 705 | 175 | 478.5 |

For Arm Holdings, the consensus target price of 200 is significantly above its current trading price of 135.11, suggesting potential upside. In contrast, MicroStrategy’s consensus of 478.5 also reflects a strong expectation against its current price of 177.18, indicating considerable growth potential.

Strengths and Weaknesses

This table summarizes the strengths and weaknesses of Arm Holdings plc and MicroStrategy Incorporated based on the most recent data.

| Criterion | Arm Holdings (ARM) | MicroStrategy (MSTR) |

|---|---|---|

| Diversification | High | Medium |

| Profitability | Strong margins | Negative margins |

| Innovation | High R&D investment | Moderate |

| Global presence | Strong presence | Limited |

| Market Share | Significant | Niche |

| Debt level | Low debt | High debt |

Key takeaways include Arm’s strong profitability and low debt levels, making it a robust investment option, while MicroStrategy struggles with profitability and higher debt, indicating a more risky investment profile.

Risk Analysis

The following table outlines the key risks associated with Arm Holdings plc and MicroStrategy Incorporated:

| Metric | Arm Holdings plc (ARM) | MicroStrategy Incorporated (MSTR) |

|---|---|---|

| Market Risk | High volatility (Beta: 4.13) | Significant fluctuations in earnings and valuation |

| Regulatory Risk | Moderate (Tech sector regulations) | High due to software compliance requirements |

| Operational Risk | Moderate (supply chain dependencies) | High (recent operational inefficiencies) |

| Environmental Risk | Low (minimal impact) | Moderate (data center energy consumption) |

| Geopolitical Risk | Moderate (global presence) | High (exposure to global economic conditions) |

In summary, MicroStrategy faces significant operational and geopolitical risks, reflected in its negative profit margins and high leverage. Meanwhile, Arm Holdings grapples with market volatility and regulatory pressures but maintains lower operational and environmental risks.

Which one to choose?

In comparing Arm Holdings (ARM) and MicroStrategy (MSTR), the fundamentals reveal significant differences. ARM demonstrates strong profitability with a net profit margin of 20% and an impressive gross profit margin of 95%, supported by a solid rating of B-. In contrast, MSTR is struggling with negative margins and a C rating, indicating a less favorable outlook. The stock trend for ARM is bullish, with a price increase of 102% over the past year, while MSTR has seen a decline of 46% in recent months.

For investors focused on growth, ARM appears to be the more attractive choice due to its solid financial metrics and positive market trends. Conversely, if stability and sustainability are your priorities, ARM’s lower debt levels and strong cash flow management make it the preferable option.

It’s essential to note the risks associated with ARM’s competition in the semiconductor industry and MSTR’s reliance on cryptocurrency market volatility.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Arm Holdings plc American Depositary Shares and MicroStrategy Incorporated to enhance your investment decisions: