Home > Comparison > Technology > ANET vs WDC

The strategic rivalry between Arista Networks, Inc. and Western Digital Corporation shapes the competitive landscape of the computer hardware sector. Arista operates as a high-margin cloud networking innovator, while Western Digital is a capital-intensive data storage manufacturer. This head-to-head reflects a contrast between cutting-edge network solutions and traditional storage infrastructure. This analysis will identify which company offers a superior risk-adjusted return for a diversified portfolio seeking exposure to technology hardware.

Table of contents

Companies Overview

Arista Networks and Western Digital stand as pivotal players in the computer hardware industry with distinct market focuses.

Arista Networks, Inc.: Cloud Networking Innovator

Arista Networks dominates the cloud networking solutions market, generating revenue through advanced operating systems and Ethernet switching platforms. Its strategic focus in 2026 emphasizes scalable, software-driven network infrastructure for internet companies and service providers. The company leverages direct sales and partnerships to maintain strong market positioning across global regions.

Western Digital Corporation: Data Storage Powerhouse

Western Digital commands the data storage devices sector by manufacturing HDDs, SSDs, and flash memory for consumer and enterprise applications. In 2026, it concentrates on expanding its portfolio of enterprise data solutions and client storage products, aiming to serve diverse markets from PCs to connected home devices. Its brand portfolio supports a wide distribution network worldwide.

Strategic Collision: Similarities & Divergences

Both companies operate in computer hardware but adopt divergent philosophies: Arista pursues a software-centric, cloud-first model, while Western Digital focuses on hardware-integrated storage solutions. Their primary battleground is enterprise infrastructure, where speed and capacity matter. Investors face contrasting profiles—Arista offers growth in networking innovation, Western Digital in diversified storage technologies.

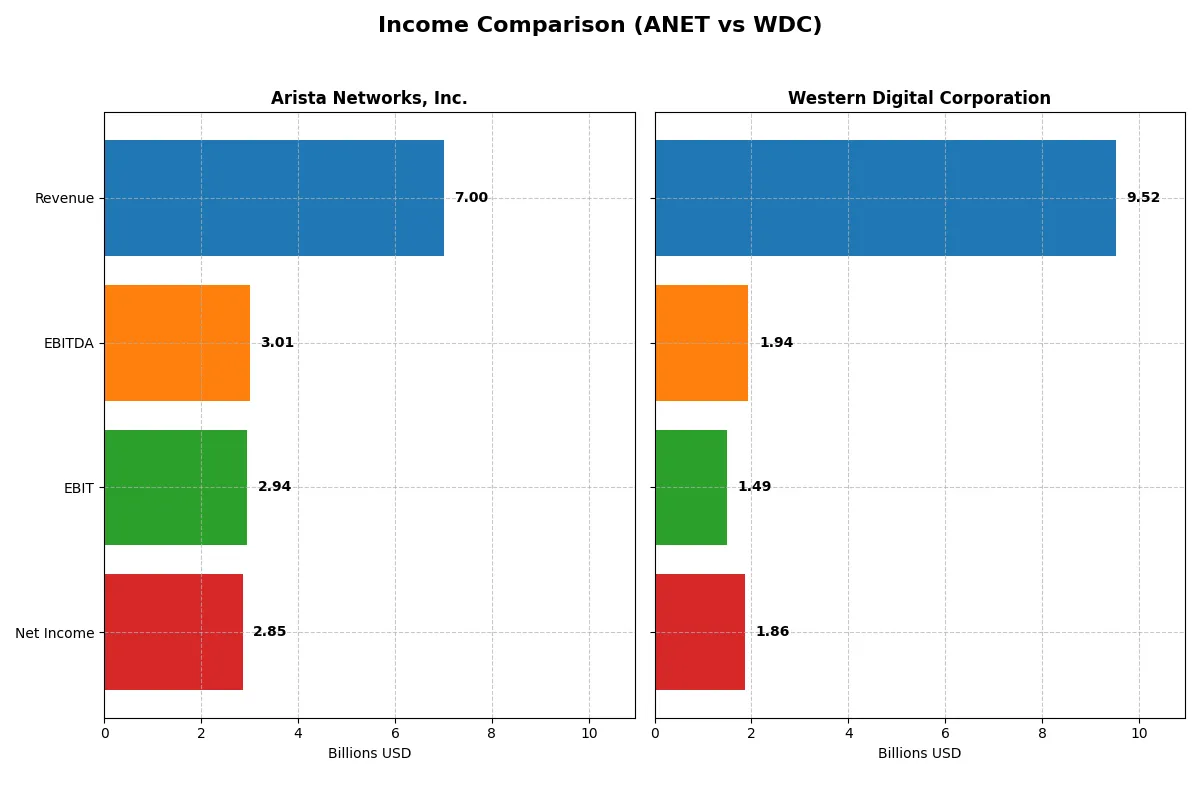

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Arista Networks, Inc. (ANET) | Western Digital Corporation (WDC) |

|---|---|---|

| Revenue | 7B | 9.52B |

| Cost of Revenue | 2.51B | 5.83B |

| Operating Expenses | 1.55B | 1.36B |

| Gross Profit | 4.49B | 3.69B |

| EBITDA | 3B | 1.94B |

| EBIT | 2.94B | 1.49B |

| Interest Expense | 0 | 357M |

| Net Income | 2.85B | 1.84B |

| EPS | 2.27 | 5.31 |

| Fiscal Year | 2024 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates with superior efficiency and momentum in their financial engine.

Arista Networks, Inc. Analysis

Arista Networks displays a robust growth trajectory, with revenue climbing from 2.3B in 2020 to 7B in 2024. Net income surged from 635M to 2.85B, reflecting expanding margins. The 2024 gross margin of 64.1% and net margin of 40.7% highlight strong profitability and operational efficiency, underpinned by zero interest expense and accelerating EPS growth.

Western Digital Corporation Analysis

Western Digital’s revenue shows volatility, peaking at 18.8B in 2022 before dropping to 9.5B in 2025. Despite this, net income recovered sharply to 1.84B in 2025 after losses in prior years. Gross margin improved to 38.8% with a more modest net margin of 19.6%. The 2025 rebound demonstrates impressive earnings momentum, but lower margins signal ongoing cost pressures and interest expenses.

Margin Dominance vs. Recovery Momentum

Arista Networks leads with consistent margin expansion and strong top-line growth, showcasing a high-efficiency model. Western Digital’s recent profit turnaround is remarkable but accompanied by thinner margins and higher leverage costs. For investors prioritizing margin quality and growth stability, Arista presents a more attractive profile, while Western Digital appeals to those focused on recovery potential and scale.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Arista Networks, Inc. (ANET) | Western Digital Corporation (WDC) |

|---|---|---|

| ROE | 28.5% | 35.0% |

| ROIC | 22.7% | 21.5% |

| P/E | 48.7 | 11.8 |

| P/B | 13.9 | 4.1 |

| Current Ratio | 4.36 | 1.08 |

| Quick Ratio | 3.69 | 0.84 |

| D/E | 0.00 | 0.96 |

| Debt-to-Assets | 0.00 | 0.36 |

| Interest Coverage | N/A | 6.54 |

| Asset Turnover | 0.50 | 0.68 |

| Fixed Asset Turnover | 70.85 | 4.06 |

| Payout Ratio | 0 | 2.36% |

| Dividend Yield | 0% | 0.20% |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, exposing hidden risks and operational strengths that shape investor decisions.

Arista Networks, Inc.

Arista commands superior profitability with a 28.54% ROE and 40.73% net margin, signaling operational excellence. Its valuation is stretched, reflected by a high 48.69 P/E and 13.89 P/B ratio. The company reinvests earnings heavily in R&D, foregoing dividends to fuel growth, which suits innovation-driven firms.

Western Digital Corporation

Western Digital shows a robust 35.04% ROE and a solid 19.55% net margin, highlighting strong shareholder returns. Its valuation appears attractive at an 11.8 P/E, but a 4.14 P/B ratio signals some caution. The company offers a modest 0.2% dividend yield, balancing income with moderate reinvestment.

Premium Valuation vs. Operational Safety

Arista’s high profitability comes with a premium valuation and no dividends, appealing to growth-focused investors. Western Digital offers a more balanced risk-reward profile with attractive valuation and steady dividends. Growth seekers may prefer Arista, while income-focused investors might lean toward Western Digital.

Which one offers the Superior Shareholder Reward?

Arista Networks (ANET) pays no dividends but generates robust free cash flow of $2.93/share in 2024, fueling aggressive buybacks that enhance shareholder value. Western Digital (WDC) yields a modest 0.2% dividend with a low 2.4% payout ratio and free cash flow of $3.7/share in 2025 but carries significant debt that weighs on sustainability. I see Arista’s zero-debt balance sheet and high operating margins as a stronger foundation for durable buybacks and total returns. In 2026, Arista’s distribution philosophy offers a superior shareholder reward through capital-efficient growth and share repurchases, outpacing Western Digital’s riskier dividend model.

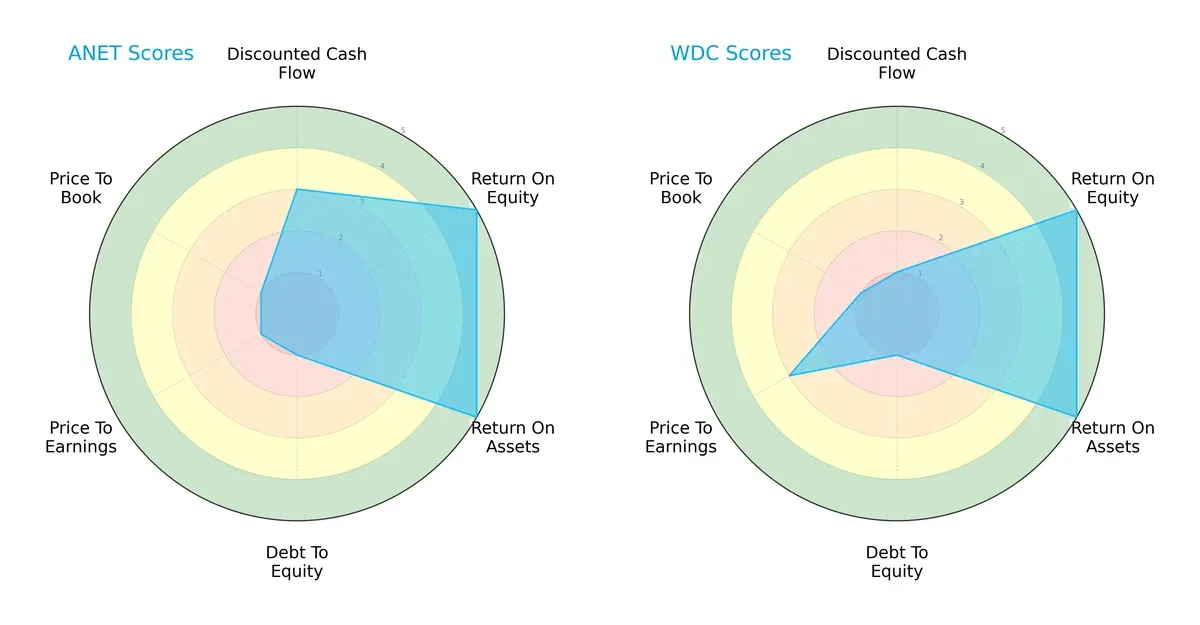

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and strategic trade-offs of Arista Networks and Western Digital Corporation:

Arista Networks excels in profitability with top ROE and ROA scores (5 each), but suffers valuation and leverage issues, scoring very unfavorable (1) on debt-to-equity, P/E, and P/B ratios. Western Digital shares Arista’s profitability strength but shows a weaker discounted cash flow score (1) and a better P/E valuation (3). Western Digital presents a slightly more balanced profile by mitigating valuation risks, whereas Arista relies heavily on operational efficiency amid stretched financial metrics.

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap highlights both firms’ strong solvency, with Arista Networks significantly safer at 20.6 versus Western Digital’s 9.0, signaling robust long-term survival potential in this cycle:

Financial Health: Quality of Operations

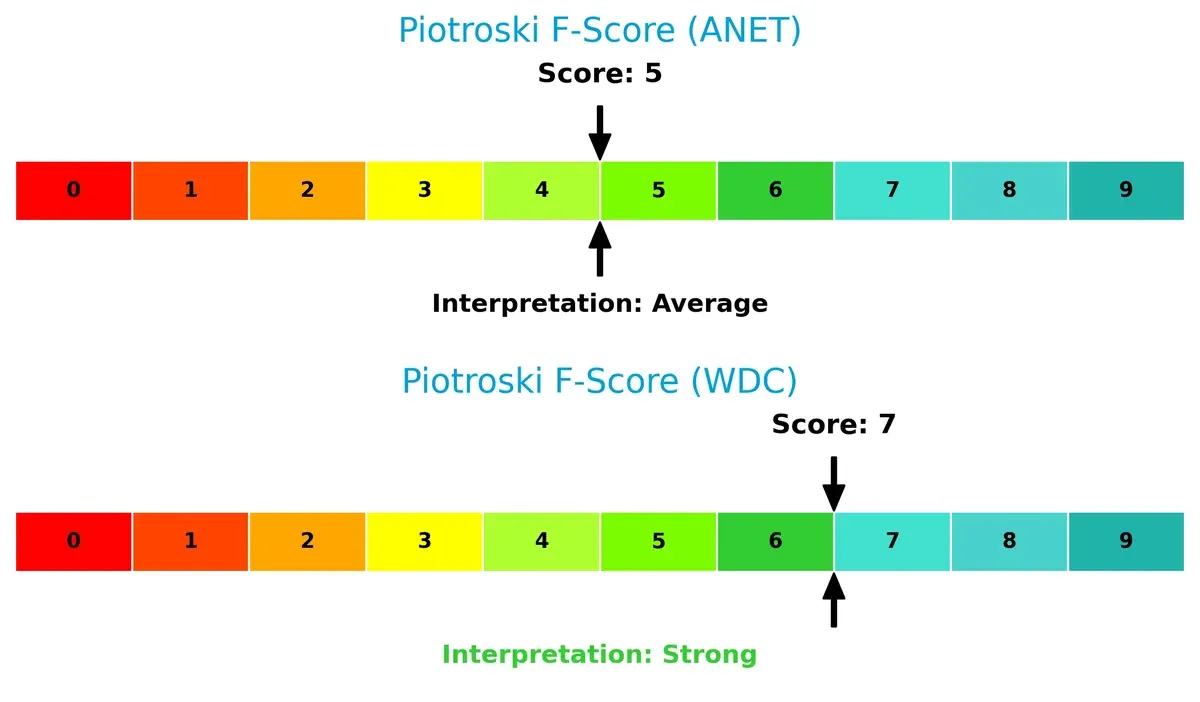

Western Digital’s Piotroski F-Score of 7 surpasses Arista’s 5, indicating stronger internal financial health and fewer operational red flags for Western Digital:

How are the two companies positioned?

This section dissects the operational DNA of Arista Networks and Western Digital by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats and identify which business model offers the most resilient and sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

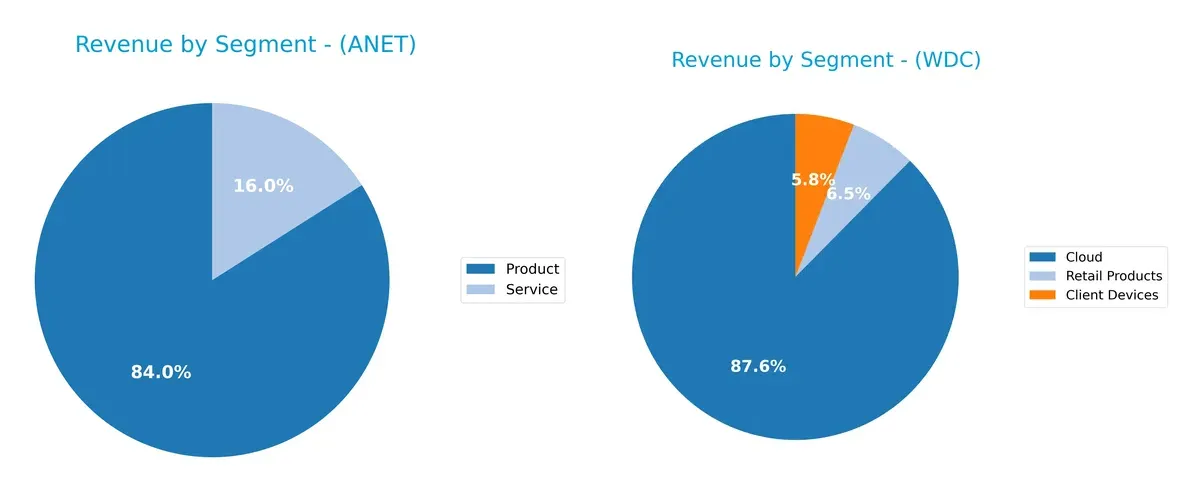

This visual comparison dissects how Arista Networks and Western Digital diversify income streams and reveals their primary sector bets:

Arista Networks anchors most revenue in Products, generating $5.88B in 2024, with Services at $1.12B, showing moderate diversification. Western Digital pivots heavily on Cloud at $8.34B, but Client Devices and Retail Products add $556M and $623M respectively, reflecting broader sector exposure. Arista’s focus highlights infrastructure dominance with less concentration risk, while Western Digital’s mix suggests ecosystem lock-in but higher reliance on volatile cloud demand.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Arista Networks, Inc. and Western Digital Corporation:

Arista Networks, Inc. Strengths

- High net margin at 40.73%

- ROE strong at 28.54%

- ROIC well above WACC at 22.74% vs 10.46%

- Zero debt supports financial stability

- Quick ratio robust at 3.69

- Significant product and service revenue growth

Western Digital Corporation Strengths

- Solid ROE at 35.04%

- Favorable net margin at 19.55%

- ROIC exceeds WACC at 21.53% vs 12.18%

- Diverse revenue streams including Cloud and Client Devices

- Favorable P/E at 11.8

- Positive global presence across Asia, Americas, EMEA

Arista Networks, Inc. Weaknesses

- Elevated P/E of 48.69 indicates high valuation

- High PB ratio at 13.89

- Current ratio very high at 4.36, possibly inefficient use of assets

- Asset turnover low at 0.5

- No dividend yield may deter income investors

- WACC relatively high at 10.46%

Western Digital Corporation Weaknesses

- Moderate debt-to-equity ratio at 0.96 raises leverage concerns

- Current and quick ratios near 1 and 0.84 suggest tight liquidity

- Interest coverage modest at 4.17

- PB ratio unfavorable at 4.14

- Dividend yield negligible at 0.2%

- Asset turnover neutral at 0.68

Both companies exhibit strong profitability with ROIC exceeding WACC, signaling value creation. Arista excels in balance sheet strength and operational efficiency but faces valuation risks. Western Digital shows broader diversification yet carries moderate leverage and liquidity constraints. These factors shape each company’s strategic financial positioning.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only thing protecting long-term profits from relentless competitive erosion. Here’s how these two tech giants defend their turf:

Arista Networks, Inc.: Innovation-Driven Network Effects

Arista’s moat stems from strong network effects and proprietary operating systems. Its 42% EBIT margin and 12% ROIC premium confirm deep value creation. New cloud networking products in 2026 may further entrench its advantage.

Western Digital Corporation: Cost Leadership in Data Storage

Western Digital leverages a cost advantage with scale in HDDs and SSDs. Its 16% EBIT margin and 9% ROIC premium reflect solid capital efficiency, though margin compression risks linger. Expansion into enterprise SSDs offers growth potential in 2026.

Verdict: Network Effects vs. Cost Efficiency

Arista’s wider moat benefits from sticky network effects and higher margin durability. Western Digital’s cost advantage is strong but more vulnerable to commoditization. I see Arista better positioned to defend and grow market share in evolving tech landscapes.

Which stock offers better returns?

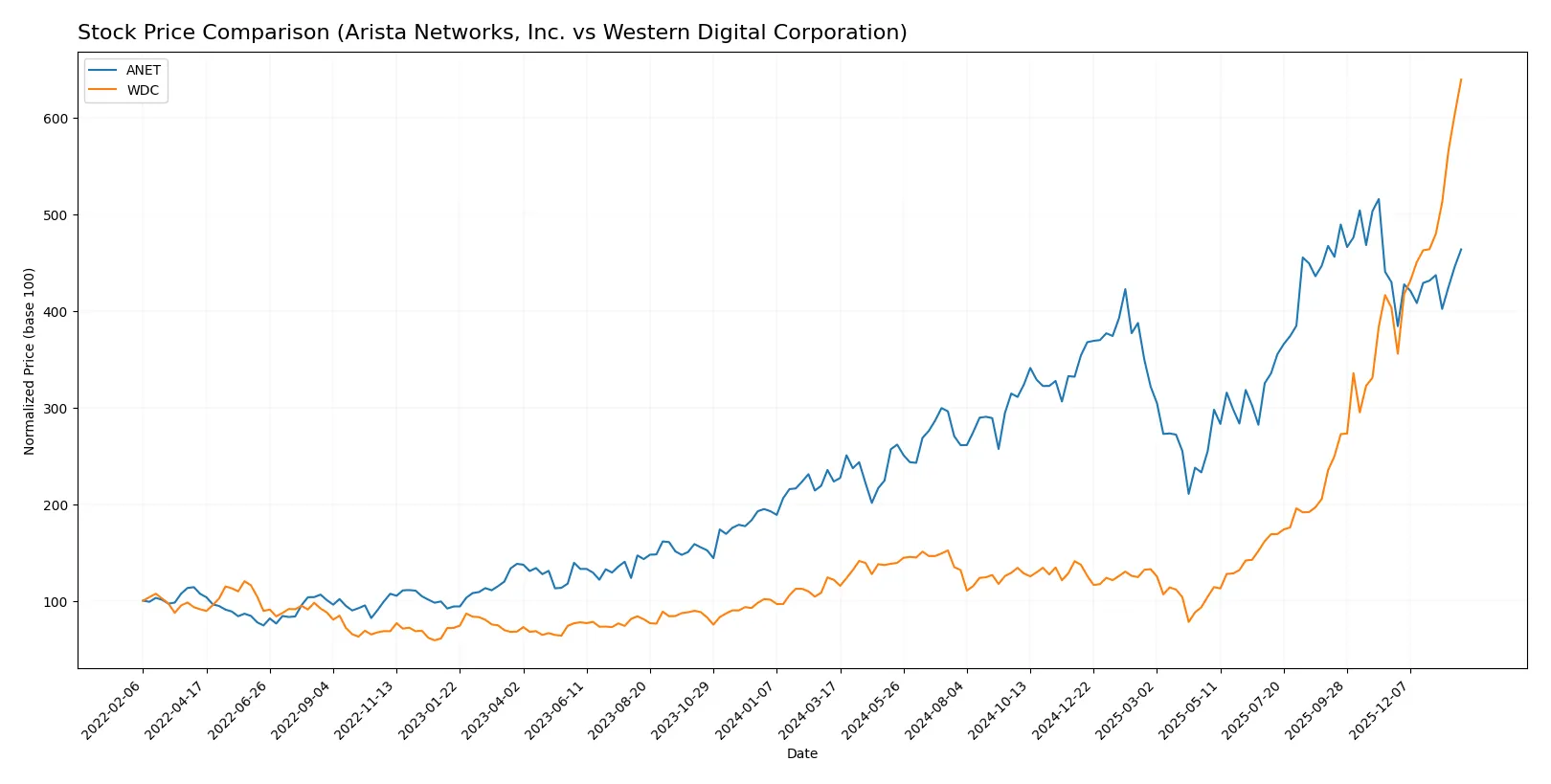

The past year shows strong price surges for both Arista Networks and Western Digital, with Western Digital exhibiting a notably sharper ascent and higher buyer dominance in recent trading.

Trend Comparison

Arista Networks’ stock rose 108% over the past 12 months, reflecting a bullish trend with accelerating momentum and moderate volatility (24.74 std deviation). The price ranged between 61.52 and 157.69.

Western Digital’s stock surged 426% over the same period, also bullish with acceleration and higher volatility (48.92 std deviation). The price moved from 30.54 to 250.23, showing more pronounced strength.

Comparing both, Western Digital clearly outperformed Arista Networks, delivering the highest market returns and stronger recent buyer dominance.

Target Prices

Analysts present a bullish target consensus for both Arista Networks and Western Digital.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Arista Networks, Inc. | 150 | 183 | 163 |

| Western Digital Corporation | 180 | 325 | 268.2 |

The consensus targets for Arista Networks stand roughly 15% above its current price of $141.74, signaling confidence in growth. Western Digital’s targets imply a 7% potential upside from $250.23, reflecting cautious optimism amid recent volatility.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Arista Networks, Inc. Grades

The following table summarizes recent grades assigned by major financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Upgrade | Overweight | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Piper Sandler | Maintain | Neutral | 2025-11-05 |

| Rosenblatt | Maintain | Neutral | 2025-11-05 |

| Barclays | Maintain | Overweight | 2025-11-05 |

| Morgan Stanley | Maintain | Overweight | 2025-10-10 |

| Needham | Maintain | Buy | 2025-09-16 |

| Goldman Sachs | Maintain | Buy | 2025-09-12 |

| Melius Research | Maintain | Buy | 2025-09-12 |

| Wells Fargo | Maintain | Overweight | 2025-09-12 |

Western Digital Corporation Grades

Recent institutional grades for Western Digital Corporation are as follows:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-01-30 |

| Wedbush | Maintain | Outperform | 2026-01-30 |

| Morgan Stanley | Maintain | Overweight | 2026-01-30 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-01-30 |

| Goldman Sachs | Maintain | Neutral | 2026-01-30 |

| TD Cowen | Maintain | Buy | 2026-01-30 |

| Mizuho | Maintain | Outperform | 2026-01-27 |

| Morgan Stanley | Maintain | Overweight | 2026-01-22 |

| UBS | Maintain | Neutral | 2026-01-20 |

| Rosenblatt | Maintain | Buy | 2026-01-20 |

Which company has the best grades?

Western Digital has a consistently strong consensus with multiple “Overweight,” “Outperform,” and “Buy” ratings recently maintained. Arista Networks also holds solid grades but leans more towards “Overweight” and “Buy” without “Outperform.” Investors may interpret Western Digital’s broader institutional confidence as a sign of greater endorsement.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Arista Networks, Inc.

- Faces fierce competition in cloud networking with rapid innovation cycles.

Western Digital Corporation

- Competes in highly commoditized data storage markets with price pressures.

2. Capital Structure & Debt

Arista Networks, Inc.

- Zero debt supports financial flexibility and low risk.

Western Digital Corporation

- Near 1.0 debt-to-equity ratio increases leverage risk and interest burden.

3. Stock Volatility

Arista Networks, Inc.

- Beta of 1.41 indicates above-average volatility but less than WDC.

Western Digital Corporation

- Beta of 1.85 signals high sensitivity to market swings and earnings shocks.

4. Regulatory & Legal

Arista Networks, Inc.

- Operates globally; potential exposure to tech export regulations and data security laws.

Western Digital Corporation

- Faces regulatory scrutiny on data privacy and international trade tariffs.

5. Supply Chain & Operations

Arista Networks, Inc.

- Benefits from direct sales and distributors but vulnerable to semiconductor shortages.

Western Digital Corporation

- Large operations expose it to raw material cost volatility and logistics disruptions.

6. ESG & Climate Transition

Arista Networks, Inc.

- Growing pressure to improve energy efficiency in data center products.

Western Digital Corporation

- Faces challenges reducing carbon footprint in manufacturing and supply chain.

7. Geopolitical Exposure

Arista Networks, Inc.

- Exposure to Asia-Pacific market tensions affecting sales and supply chain.

Western Digital Corporation

- Significant international footprint heightens risk from US-China trade conflicts.

Which company shows a better risk-adjusted profile?

Arista’s zero debt and strong financial ratios underpin a lower financial risk profile. Western Digital’s high leverage and stock volatility amplify its risk exposure. However, WDC’s stronger Piotroski score signals operational resilience. The most impactful risk for Arista is market competition, while Western Digital faces significant capital structure risk. Arista’s superior liquidity and zero debt justify a more favorable risk-adjusted view despite its valuation concerns.

Final Verdict: Which stock to choose?

Arista Networks stands out as a powerhouse of operational efficiency and innovation, delivering consistently high returns on invested capital well above its cost of capital. Its key point of vigilance lies in its premium valuation multiples, which could pressure returns if growth slows. This stock suits investors with an appetite for aggressive growth and confidence in tech-driven market leadership.

Western Digital’s strategic moat lies in its entrenched position within data storage, benefiting from recurring demand and improving profitability metrics. It offers a more balanced risk profile compared to Arista, with a reasonable valuation and strong cash flow potential. This makes it appealing for investors favoring growth at a reasonable price with a tilt toward stability.

If you prioritize high-margin growth and market-leading innovation, Arista Networks is the compelling choice due to its durable competitive advantage and expanding profitability. However, if you seek a blend of growth and resilience backed by a tangible moat in a vital hardware sector, Western Digital offers better stability and superior recent stock price momentum. Both present distinct strategic scenarios tailored to different investor profiles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Arista Networks, Inc. and Western Digital Corporation to enhance your investment decisions: