Arista Networks, Inc. (ANET) and Super Micro Computer, Inc. (SMCI) are two leading players in the competitive computer hardware sector. Both companies innovate in high-performance networking and server solutions, targeting cloud computing, data centers, and emerging technologies like AI and 5G. Their overlapping markets and distinct strategies make them compelling investment candidates. In this article, I will help you determine which company holds the most promise for your portfolio in 2026.

Table of contents

Companies Overview

I will begin the comparison between Arista Networks and Super Micro Computer by providing an overview of these two companies and their main differences.

Arista Networks Overview

Arista Networks, Inc. focuses on developing and marketing cloud networking solutions globally, including extensible operating systems, network applications, and gigabit Ethernet switching and routing platforms. Serving industries such as internet companies, financial services, and government agencies, Arista supports its products with post-contract customer services. Headquartered in Santa Clara, California, Arista is positioned as a key player in the computer hardware industry with a market cap of $163.5B.

Super Micro Computer Overview

Super Micro Computer, Inc. designs and manufactures high-performance server and storage solutions based on modular and open architecture offered internationally. Its product range includes servers, storage systems, networking devices, and management software, targeting enterprise data centers, cloud computing, AI, and 5G markets. Headquartered in San Jose, California, Super Micro has a market cap of $17B, serving customers through direct and indirect sales channels worldwide.

Key similarities and differences

Both companies operate in the computer hardware sector, providing technology solutions to enterprise and cloud markets with global reach. Arista specializes in cloud networking infrastructure, while Super Micro emphasizes modular server and storage systems with extensive software management tools. Arista’s market cap is significantly larger, reflecting its focus on networking, whereas Super Micro’s broader product base includes hardware and software integration services.

Income Statement Comparison

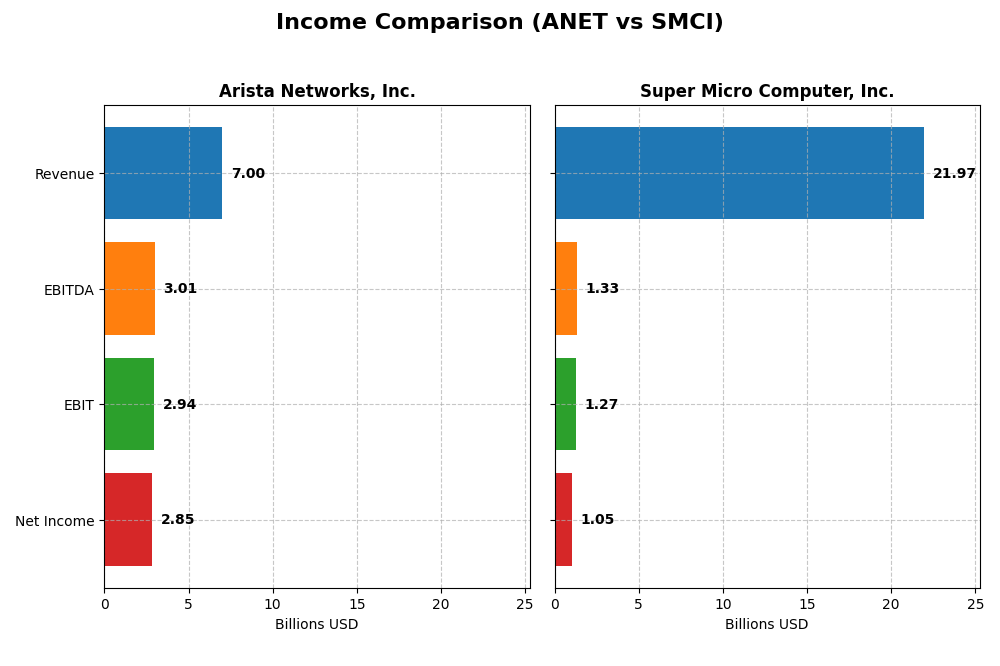

This table presents a side-by-side comparison of key income statement metrics for Arista Networks, Inc. and Super Micro Computer, Inc. for their most recent fiscal years.

| Metric | Arista Networks, Inc. (ANET) | Super Micro Computer, Inc. (SMCI) |

|---|---|---|

| Market Cap | 164B | 17B |

| Revenue | 7.00B (2024) | 21.97B (2025) |

| EBITDA | 3.01B | 1.33B |

| EBIT | 2.94B | 1.27B |

| Net Income | 2.85B | 1.05B |

| EPS | 2.27 | 1.77 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Arista Networks, Inc.

From 2020 to 2024, Arista Networks demonstrated strong revenue and net income growth, with revenue rising from $2.3B to $7B and net income increasing over fourfold. Margins remained robust and improved, with a gross margin of 64.13% and net margin of 40.73% in 2024. The latest year showed continued favorable expansion, with revenue growth of 19.5% and net margin growth of 14.34%.

Super Micro Computer, Inc.

Between 2021 and 2025, Super Micro Computer’s revenue and net income surged significantly, from $3.6B to $22B and from $112M to $1.05B respectively. However, margins were relatively low and stable, with a 2025 gross margin of 11.06% and net margin of 4.77%. The most recent year saw strong revenue growth of 46.59% but a decline in net margin by 37.92%, indicating some margin pressure despite top-line gains.

Which one has the stronger fundamentals?

Arista Networks exhibits stronger fundamentals with consistently high and improving margins, balanced growth across revenue and net income, and zero interest expense. Super Micro Computer shows impressive top-line growth but weaker profitability metrics and some recent margin contraction. Overall, Arista’s stable and high margins contrast with Super Micro’s lower, more volatile profitability, reflecting differing income statement strengths.

Financial Ratios Comparison

This table presents a side-by-side comparison of key financial ratios for Arista Networks, Inc. (ANET) and Super Micro Computer, Inc. (SMCI) based on their most recent fiscal year data available.

| Ratios | Arista Networks, Inc. (2024) | Super Micro Computer, Inc. (2025) |

|---|---|---|

| ROE | 28.5% | 16.6% |

| ROIC | 22.7% | 9.3% |

| P/E | 48.7 | 27.7 |

| P/B | 13.9 | 4.6 |

| Current Ratio | 4.36 | 5.25 |

| Quick Ratio | 3.69 | 3.25 |

| D/E (Debt to Equity) | 0 | 0.76 |

| Debt-to-Assets | 0 | 34.1% |

| Interest Coverage | 0 | 21.0 |

| Asset Turnover | 0.50 | 1.57 |

| Fixed Asset Turnover | 70.85 | 27.53 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Arista Networks, Inc.

Arista Networks shows strong profitability with a high net margin of 40.73% and robust returns on equity (28.54%) and invested capital (22.74%). However, its valuation ratios like P/E of 48.69 and P/B of 13.89 appear stretched. The company carries no debt, and liquidity is ample though the current ratio is considered unfavorable. Arista does not pay dividends, likely focusing on growth and reinvestment.

Super Micro Computer, Inc.

Super Micro Computer presents mixed financial ratios with a low net margin of 4.77% but a decent return on equity at 16.64%. Its valuation metrics such as P/E of 27.74 and P/B of 4.62 are more moderate compared to Arista. The company has some debt, reflected in neutral leverage ratios, and a strong interest coverage. It also does not pay dividends, possibly prioritizing growth and R&D investments.

Which one has the best ratios?

Arista Networks holds a more favorable overall ratio profile, driven by higher profitability and returns despite some valuation concerns and liquidity flags. Super Micro Computer shows neutrality with balanced strengths and weaknesses but lower profitability. Thus, Arista’s ratios are generally stronger, while Super Micro’s are more mixed and neutral.

Strategic Positioning

This section compares the strategic positioning of Arista Networks, Inc. and Super Micro Computer, Inc., including market position, key segments, and exposure to technological disruption:

Arista Networks, Inc.

- Leading cloud networking provider with strong competitive pressure in multiple global regions.

- Focused on cloud networking solutions and services serving internet, financial, government, and media sectors.

- Moderate exposure to technological disruption through evolving cloud networking and Ethernet switching innovations.

Super Micro Computer, Inc.

- High-performance server and storage manufacturer facing intense competition worldwide.

- Concentrated on server and storage systems, subsystems, and accessories for data centers, AI, 5G, and edge computing.

- Exposure to technological disruption in modular server and storage solutions amid AI and 5G growth.

Arista Networks, Inc. vs Super Micro Computer, Inc. Positioning

Arista Networks pursues a diversified position across cloud networking and various industry sectors, while Super Micro Computer concentrates on modular server and storage solutions. Arista’s broader industry reach contrasts with Super Micro’s focused product portfolio, reflecting distinct strategic approaches.

Which has the best competitive advantage?

Arista Networks shows a very favorable moat with growing ROIC above WACC, demonstrating durable competitive advantage and value creation. Super Micro Computer has a slightly unfavorable moat, shedding value despite improving profitability.

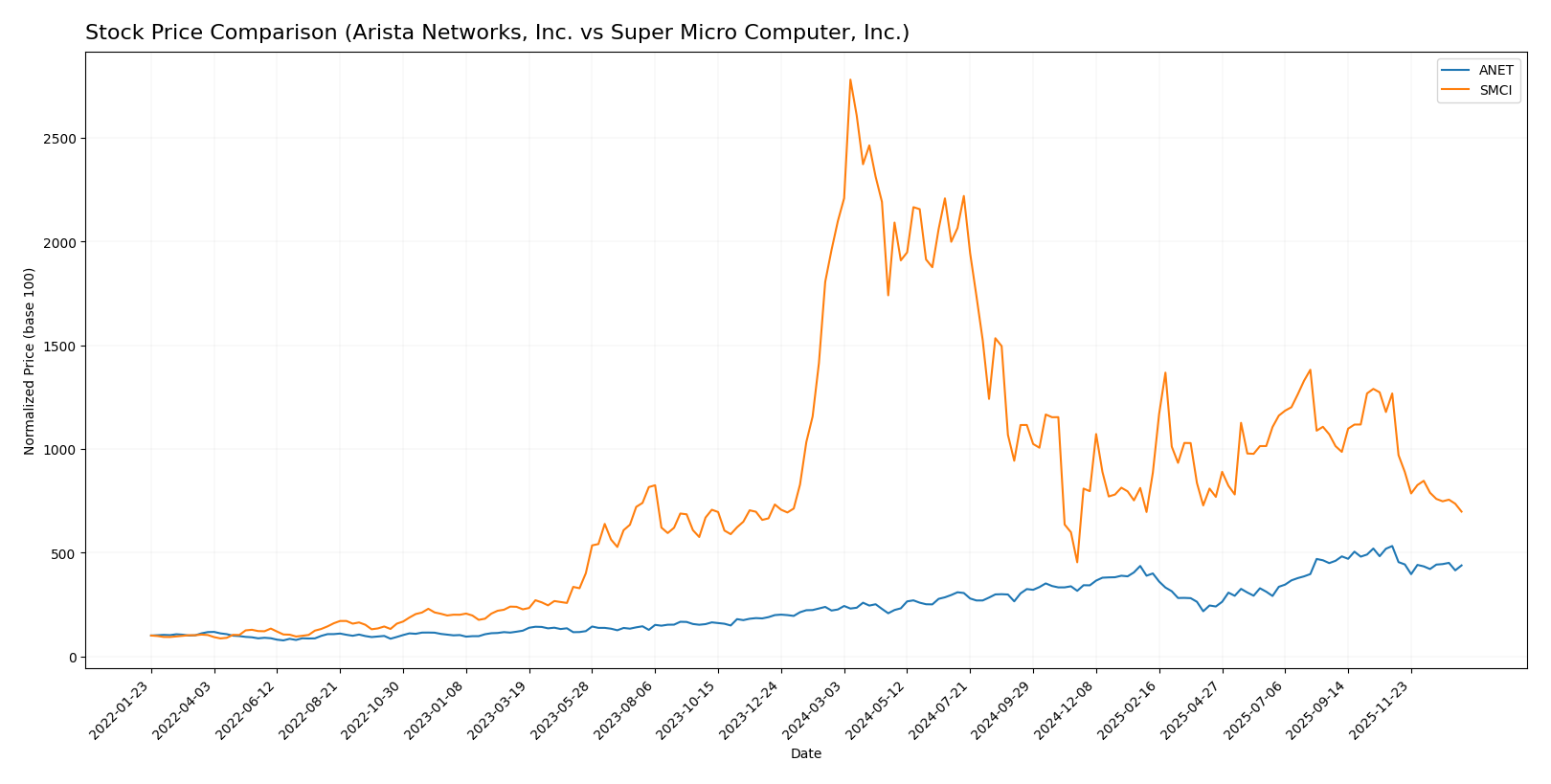

Stock Comparison

The stock prices of Arista Networks, Inc. (ANET) and Super Micro Computer, Inc. (SMCI) have exhibited contrasting movements over the past 12 months, with ANET showing a strong overall gain and SMCI experiencing a significant decline.

Trend Analysis

Arista Networks, Inc. (ANET) demonstrated a bullish trend with a 94.16% price increase over the past year, though the trend shows deceleration and a recent short-term decline of 17.6%.

Super Micro Computer, Inc. (SMCI) exhibited a bearish trend with a 66.74% price decrease over the past year, also experiencing deceleration and a sharper recent decline of 44.96%.

Comparing both, ANET delivered the highest market performance with a strong positive gain, while SMCI faced a significant downward trend throughout the same period.

Target Prices

The current analyst target consensus for Arista Networks, Inc. and Super Micro Computer, Inc. indicates potential upside from their present stock prices.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Arista Networks, Inc. | 183 | 150 | 163 |

| Super Micro Computer, Inc. | 64 | 26 | 49.71 |

Analysts expect Arista Networks to trade significantly above its current price of $129.93, suggesting positive growth prospects. Super Micro Computer’s consensus target at $49.71 also implies substantial upside from its present $28.60, reflecting favorable market expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Arista Networks, Inc. and Super Micro Computer, Inc.:

Rating Comparison

Arista Networks, Inc. Rating

- Rating: B, considered very favorable by analysts.

- Discounted Cash Flow Score: 3, indicating a moderate view.

- ROE Score: 5, reflecting a very favorable profitability.

- ROA Score: 5, reflecting very efficient asset use.

- Debt To Equity Score: 1, indicating very unfavorable risk.

- Overall Score: 3, a moderate overall assessment.

Super Micro Computer, Inc. Rating

- Rating: B-, also considered very favorable.

- Discounted Cash Flow Score: 1, indicating a very unfavorable view.

- ROE Score: 4, reflecting a favorable profitability.

- ROA Score: 4, reflecting favorable asset use.

- Debt To Equity Score: 1, also indicating very unfavorable risk.

- Overall Score: 2, a moderate but lower overall assessment.

Which one is the best rated?

Based strictly on the provided data, Arista Networks holds a higher rating (B vs B-) and stronger scores in discounted cash flow, ROE, ROA, and overall score, while both share equally unfavorable debt-to-equity scores.

Scores Comparison

Here is the comparison of the Altman Z-Score and Piotroski Score for both companies:

Arista Networks, Inc. Scores

- Altman Z-Score: 18.45, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 5, classified as average financial strength.

Super Micro Computer, Inc. Scores

- Altman Z-Score: 4.70, also in the safe zone with low bankruptcy risk.

- Piotroski Score: 4, also classified as average financial strength.

Which company has the best scores?

Arista Networks shows a significantly higher Altman Z-Score, indicating stronger financial safety, while both companies have similar average Piotroski Scores. Based strictly on the provided data, Arista Networks has the better overall scores.

Grades Comparison

Here is a comparison of the latest grades assigned by recognized grading companies for both Arista Networks, Inc. and Super Micro Computer, Inc.:

Arista Networks, Inc. Grades

The following table summarizes recent grades and rating actions from leading financial institutions for Arista Networks, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Upgrade | Overweight | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Piper Sandler | Maintain | Neutral | 2025-11-05 |

| Barclays | Maintain | Overweight | 2025-11-05 |

| Rosenblatt | Maintain | Neutral | 2025-11-05 |

| Morgan Stanley | Maintain | Overweight | 2025-10-10 |

| Needham | Maintain | Buy | 2025-09-16 |

| Wells Fargo | Maintain | Overweight | 2025-09-12 |

| JP Morgan | Maintain | Overweight | 2025-09-12 |

| Goldman Sachs | Maintain | Buy | 2025-09-12 |

Arista Networks shows a consistent pattern of buy and overweight ratings, with recent upgrades indicating positive analyst sentiment.

Super Micro Computer, Inc. Grades

Below is a summary of the grading actions by reputable firms for Super Micro Computer, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2024-10-02 |

| Loop Capital | Maintain | Buy | 2024-09-23 |

| JP Morgan | Downgrade | Neutral | 2024-09-06 |

| Barclays | Downgrade | Equal Weight | 2024-09-04 |

| Wells Fargo | Maintain | Equal Weight | 2024-08-28 |

| CFRA | Downgrade | Hold | 2024-08-28 |

| Barclays | Maintain | Overweight | 2024-08-28 |

| Goldman Sachs | Maintain | Neutral | 2024-08-08 |

| Rosenblatt | Maintain | Buy | 2024-08-07 |

| B of A Securities | Downgrade | Neutral | 2024-08-07 |

Super Micro Computer displays a mixed trend, with several downgrades and a majority of hold, neutral, and equal weight ratings.

Which company has the best grades?

Arista Networks, Inc. has received notably stronger and more consistent buy and overweight ratings compared to Super Micro Computer, Inc., which shows more moderate to cautious assessments. This divergence may influence investor perceptions of potential growth and risk profiles for each company.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Arista Networks, Inc. (ANET) and Super Micro Computer, Inc. (SMCI), based on recent financial and operational data.

| Criterion | Arista Networks, Inc. (ANET) | Super Micro Computer, Inc. (SMCI) |

|---|---|---|

| Diversification | Moderate; product and service revenues growing steadily, with products dominating (~$5.88B product vs. $1.12B service in 2024) | Moderate; mainly focused on server and storage systems (~$21.3B) and subsystems (~$660M) in 2025 |

| Profitability | High profitability; net margin 40.7%, ROIC 22.7%, ROE 28.5%, value creator with ROIC > WACC by 12.3% | Low profitability; net margin 4.8%, ROIC 9.3%, ROE 16.6%, value destroyer with ROIC slightly below WACC |

| Innovation | Strong innovation evidenced by a very favorable moat and growing ROIC trend (+50%) | Improving innovation with growing ROIC trend (+42%), but still slightly unfavorable moat status |

| Global presence | Established global presence with consistent revenue growth in products and services | Expanding global footprint with significant growth in server/storage systems revenue |

| Market Share | Solid market position in networking hardware with increasing revenues | Growing market share in server/storage hardware, but profitability challenges persist |

Key takeaways: Arista Networks stands out with strong profitability, a durable competitive advantage, and efficient capital use, making it a more attractive investment. Super Micro shows growth potential and improving profitability but currently faces profitability and value creation challenges, warranting cautious consideration.

Risk Analysis

The table below summarizes key risk factors for Arista Networks, Inc. (ANET) and Super Micro Computer, Inc. (SMCI) based on the most recent financial and market data.

| Metric | Arista Networks, Inc. (ANET) | Super Micro Computer, Inc. (SMCI) |

|---|---|---|

| Market Risk | Beta 1.41, high valuation risk (PE 48.7) | Beta 1.53, moderate valuation risk (PE 27.7) |

| Debt level | No debt, very low financial risk | Moderate debt (D/E 0.76), moderate financial risk |

| Regulatory Risk | Moderate, global operations in tech sector | Moderate, global supply chain exposure |

| Operational Risk | Dependence on cloud networking innovation | Complex manufacturing and supply chain dependencies |

| Environmental Risk | Moderate, industry focus on energy-efficient tech | Moderate, manufacturing environmental impact |

| Geopolitical Risk | Exposure to global markets, especially Asia | Exposure to trade tensions affecting supply chains |

The most significant risks for ANET are its high market valuation and sensitivity to tech sector shifts, whereas SMCI faces moderate financial leverage and supply chain vulnerabilities. Both companies operate globally, exposing them to geopolitical and regulatory uncertainties.

Which Stock to Choose?

Arista Networks, Inc. (ANET) shows a strong income evolution with consistent revenue growth of 19.5% in the last year and a 202% increase over five years. Its profitability metrics such as net margin at 40.73% and ROE at 28.54% are favorable. The company maintains zero debt and a very favorable rating, despite some high valuation ratios like PE and PB.

Super Micro Computer, Inc. (SMCI) experienced substantial revenue growth of 46.6% last year and over 517% overall, yet its net margin remains modest at 4.77%. The financial ratios present a mixed picture with favorable ROE but neutral debt levels. Its rating is very favorable but with moderate scores and some unfavorable valuation metrics.

Investors seeking durable competitive advantage and strong profitability might find ANET’s very favorable rating and value-creating moat appealing. Conversely, those open to moderate profitability with higher revenue growth potential might consider SMCI, given its neutral rating and improving ROIC trend. The choice could depend on the investor’s risk tolerance and growth versus stability preference.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Arista Networks, Inc. and Super Micro Computer, Inc. to enhance your investment decisions: