In the fast-evolving technology sector, Arista Networks, Inc. and Rigetti Computing, Inc. represent two compelling yet distinct players in computer hardware. While Arista excels in cloud networking solutions with a strong market presence, Rigetti innovates in quantum computing, aiming to revolutionize computational power. This comparison explores their market overlap and innovation strategies to help investors identify which company offers the most promising opportunity for growth and value. Let’s dive into the analysis to find out which stock deserves a spot in your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Arista Networks and Rigetti Computing by providing an overview of these two companies and their main differences.

Arista Networks Overview

Arista Networks, Inc. develops, markets, and sells cloud networking solutions globally, including extensible operating systems and gigabit Ethernet switching platforms. The company serves diverse industries such as internet companies, financial services, and government agencies. Headquartered in Santa Clara, California, Arista is a well-established player in the computer hardware sector with a market cap of approximately 163.5B USD.

Rigetti Computing Overview

Rigetti Computing, Inc. operates as an integrated systems company focused on building quantum computers and superconducting quantum processors. Its products are accessible via its Quantum Cloud Services platform. Founded in 2013 and based in Berkeley, California, Rigetti is smaller with a market cap near 8.1B USD and concentrates on pioneering quantum computing hardware within the technology industry.

Key similarities and differences

Both Arista and Rigetti operate in the computer hardware industry within the technology sector and are US-based companies. However, Arista focuses on cloud networking solutions for diverse industries, whereas Rigetti specializes in quantum computing systems and processors. Arista is significantly larger in market capitalization and employee count, reflecting its established market position compared to Rigetti’s emerging quantum technology focus.

Income Statement Comparison

The table below compares key income statement metrics for Arista Networks, Inc. and Rigetti Computing, Inc. for the fiscal year 2024, providing a snapshot of their financial performance.

| Metric | Arista Networks, Inc. (ANET) | Rigetti Computing, Inc. (RGTI) |

|---|---|---|

| Market Cap | 164B | 8.1B |

| Revenue | 7.0B | 11M |

| EBITDA | 3.0B | -191M |

| EBIT | 2.9B | -198M |

| Net Income | 2.9B | -201M |

| EPS | 2.27 | -1.09 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Arista Networks, Inc.

Arista Networks demonstrated strong growth in revenue and net income from 2020 to 2024, with revenues increasing from $2.3B to $7.0B and net income rising from $635M to $2.85B. Margins remained robust, with gross margin at 64.13% and net margin improving to 40.73%. The latest fiscal year showed accelerated growth, including a 19.5% revenue increase and a 14.34% net margin expansion.

Rigetti Computing, Inc.

Rigetti Computing’s revenue grew overall from $5.5M in 2020 to $10.8M in 2024 but declined by 10.14% in the latest year. The company consistently reported net losses, with net income worsening to -$201M in 2024. Despite a favorable gross margin of 52.8%, its EBIT and net margins are deeply negative, reflecting high operating expenses and interest costs, worsening significantly in the recent fiscal year.

Which one has the stronger fundamentals?

Arista Networks exhibits stronger fundamentals, with consistent revenue and net income growth, healthy and improving margins, and favorable evaluations across all income statement metrics. In contrast, Rigetti’s financials reveal ongoing losses, negative margins, and deteriorating profitability, despite moderate revenue growth over the period. The risk profile is considerably higher for Rigetti given its unfavorable income statement trends.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Arista Networks, Inc. and Rigetti Computing, Inc. based on their latest fiscal year data as of 2024.

| Ratios | Arista Networks, Inc. (ANET) | Rigetti Computing, Inc. (RGTI) |

|---|---|---|

| ROE | 28.5% | -158.8% |

| ROIC | 22.7% | -24.9% |

| P/E | 48.7 | -14.0 |

| P/B | 13.9 | 22.3 |

| Current Ratio | 4.36 | 17.42 |

| Quick Ratio | 3.69 | 17.42 |

| D/E | 0 | 0.07 |

| Debt-to-Assets | 0 | 3.1% |

| Interest Coverage | 0 | -21.0 |

| Asset Turnover | 0.50 | 0.04 |

| Fixed Asset Turnover | 70.8 | 0.20 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Arista Networks, Inc.

Arista Networks shows strong profitability with a net margin of 40.73% and return on equity at 28.54%, indicating efficient capital use. However, valuation ratios like PE at 48.69 and PB at 13.89 are high, suggesting premium pricing. The current ratio of 4.36 is unusually high, possibly indicating excess liquidity. The company does not pay dividends, focusing on growth and reinvestment.

Rigetti Computing, Inc.

Rigetti Computing exhibits weak financial health with a negative net margin of -1862.72% and return on equity at -158.77%, reflecting substantial losses. Its valuation remains challenging, with a negative PE but a high PB ratio of 22.26. The extremely high current ratio of 17.42 signals cash accumulation or low operational efficiency. Rigetti does not pay dividends, likely due to ongoing development and investment focus.

Which one has the best ratios?

Arista Networks presents a generally favorable ratio profile, with 57.14% of ratios positive, highlighting profitability and capital efficiency despite some valuation concerns. In contrast, Rigetti shows predominantly unfavorable ratios at 71.43%, driven by losses and weak operational metrics. Based purely on ratio analysis, Arista holds a stronger financial position.

Strategic Positioning

This section compares the strategic positioning of Arista Networks, Inc. and Rigetti Computing, Inc. in terms of market position, key segments, and exposure to technological disruption:

Arista Networks, Inc.

- Leading cloud networking solutions provider with large market cap (163B USD), facing typical tech sector competition.

- Focuses on cloud networking hardware and software; revenues mainly from products (5.88B USD) and services (1.12B USD).

- Operates in established computer hardware sector; exposed to incremental innovation but less vulnerable to sudden disruption.

Rigetti Computing, Inc.

- Small quantum computing startup with 8B USD market cap, operating in a highly specialized and emerging market.

- Concentrated on quantum computing systems and cloud access; revenues mostly from quantum system access and research services.

- Involved in advanced quantum technology, facing high disruption potential as industry evolves rapidly.

Arista Networks, Inc. vs Rigetti Computing, Inc. Positioning

Arista offers a diversified portfolio in cloud networking with stable product and service revenues, benefiting from scale and market reach. Rigetti operates a concentrated business focused on cutting-edge quantum computing, with smaller scale and higher disruption risk, but growing profitability.

Which has the best competitive advantage?

Arista demonstrates a very favorable moat with ROIC well above WACC and increasing profitability, indicating a durable competitive advantage. Rigetti shows a slightly unfavorable moat, currently shedding value despite rising ROIC and improving profitability.

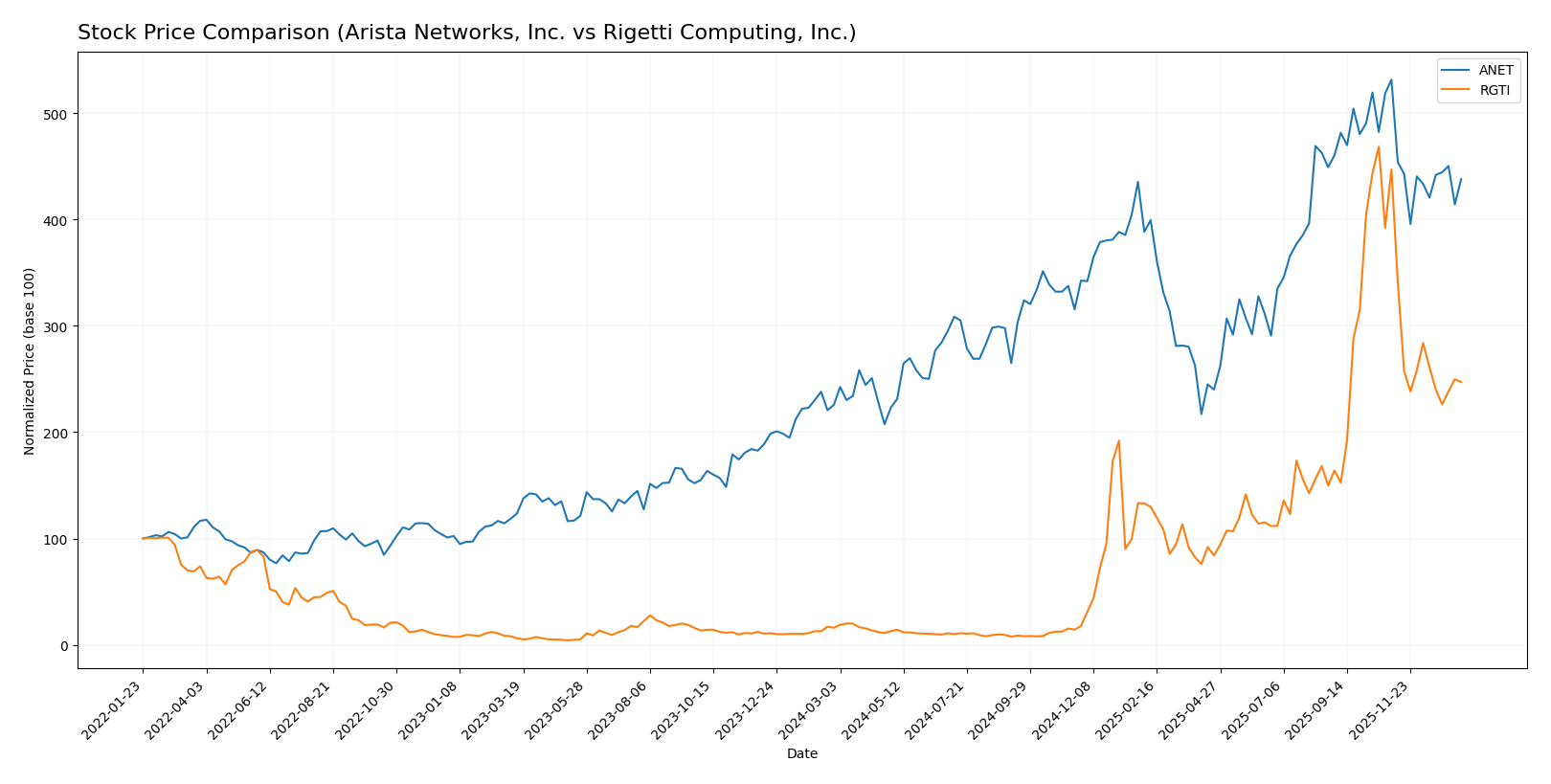

Stock Comparison

The stock price movements of Arista Networks, Inc. (ANET) and Rigetti Computing, Inc. (RGTI) exhibit significant gains over the past year, with both showing deceleration in bullish trends and recent downward price adjustments.

Trend Analysis

Arista Networks, Inc. (ANET) recorded a 94.16% price increase over the past 12 months, classifying its trend as bullish with deceleration. Recent weeks show a -17.6% decline indicating a short-term bearish phase.

Rigetti Computing, Inc. (RGTI) achieved a 1448.73% price rise over the same period, also bullish with deceleration. Its recent trend shows a sharper -44.73% drop, signaling increased short-term weakness.

Comparing the two, RGTI outperformed ANET with the highest overall market performance despite both experiencing recent downward corrections.

Target Prices

The consensus target prices for these companies indicate bullish sentiment from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Arista Networks, Inc. | 183 | 150 | 163 |

| Rigetti Computing, Inc. | 50 | 18 | 35.83 |

Analysts expect Arista Networks’ stock to appreciate significantly from its current price of $129.93, while Rigetti Computing’s target consensus suggests strong upside potential above the current $24.47 price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Arista Networks, Inc. (ANET) and Rigetti Computing, Inc. (RGTI):

Rating Comparison

ANET Rating

- Rating: B, classified as Very Favorable overall.

- Discounted Cash Flow Score: 3, indicating a moderate valuation outlook.

- ROE Score: 5, showing very favorable efficiency in generating shareholders’ profit.

- ROA Score: 5, reflecting very favorable asset utilization.

- Debt To Equity Score: 1, very unfavorable, suggesting higher financial risk.

- Overall Score: 3, moderate overall financial standing.

RGTI Rating

- Rating: C, classified as Very Favorable overall.

- Discounted Cash Flow Score: 1, indicating a very unfavorable valuation outlook.

- ROE Score: 1, showing very unfavorable efficiency in generating shareholders’ profit.

- ROA Score: 1, reflecting very unfavorable asset utilization.

- Debt To Equity Score: 4, favorable, indicating lower financial risk.

- Overall Score: 2, moderate but lower overall financial standing.

Which one is the best rated?

Based strictly on the provided data, Arista Networks, Inc. (ANET) has a better overall rating (B vs. C) and stronger scores in ROE and ROA. Rigetti Computing, Inc. (RGTI) has a more favorable debt-to-equity score but weaker performance elsewhere.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Arista Networks and Rigetti Computing:

Arista Networks Scores

- Altman Z-Score: 18.45, well within the safe zone

- Piotroski Score: 5, classified as average

Rigetti Computing Scores

- Altman Z-Score: 101.71, indicating a safe zone

- Piotroski Score: 2, categorized as very weak

Which company has the best scores?

Based on the provided scores, Rigetti Computing has a much higher Altman Z-Score, indicating stronger bankruptcy safety. However, Arista Networks has a significantly better Piotroski Score, reflecting stronger overall financial health.

Grades Comparison

Here is a comparison of the most recent reliable grades for Arista Networks, Inc. and Rigetti Computing, Inc.:

Arista Networks, Inc. Grades

The following table summarizes recent analyst grades for Arista Networks, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Upgrade | Overweight | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Piper Sandler | Maintain | Neutral | 2025-11-05 |

| Barclays | Maintain | Overweight | 2025-11-05 |

| Rosenblatt | Maintain | Neutral | 2025-11-05 |

| Morgan Stanley | Maintain | Overweight | 2025-10-10 |

| Needham | Maintain | Buy | 2025-09-16 |

| Wells Fargo | Maintain | Overweight | 2025-09-12 |

| JP Morgan | Maintain | Overweight | 2025-09-12 |

| Goldman Sachs | Maintain | Buy | 2025-09-12 |

Arista Networks shows consistent overweight and buy ratings, with a recent upgrade indicating positive analyst sentiment.

Rigetti Computing, Inc. Grades

The following table summarizes recent analyst grades for Rigetti Computing, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B. Riley Securities | Maintain | Neutral | 2025-11-12 |

| Benchmark | Maintain | Buy | 2025-11-12 |

| B. Riley Securities | Downgrade | Neutral | 2025-11-03 |

| Benchmark | Maintain | Buy | 2025-10-07 |

| B. Riley Securities | Maintain | Buy | 2025-09-22 |

| Benchmark | Maintain | Buy | 2025-08-13 |

| Needham | Maintain | Buy | 2025-08-04 |

| B. Riley Securities | Maintain | Buy | 2025-07-23 |

| Benchmark | Maintain | Buy | 2025-05-15 |

| Needham | Maintain | Buy | 2025-05-14 |

Rigetti Computing mostly holds buy ratings with some neutral adjustments, reflecting mixed but generally favorable analyst views.

Which company has the best grades?

Arista Networks has received more consistent and higher grades, notably several “Overweight” and “Buy” ratings, compared to Rigetti’s mix of “Buy” and “Neutral.” This suggests Arista’s outlook is viewed more positively by analysts, potentially indicating lower risk and stronger growth expectations for investors.

Strengths and Weaknesses

Below is a comparison table highlighting the strengths and weaknesses of Arista Networks, Inc. (ANET) and Rigetti Computing, Inc. (RGTI) based on the most recent financial and operational data.

| Criterion | Arista Networks, Inc. (ANET) | Rigetti Computing, Inc. (RGTI) |

|---|---|---|

| Diversification | Strong product and service mix; product revenue of $5.88B, service $1.12B in 2024 | Limited revenue sources mainly from quantum system access ($0.36M in 2024) |

| Profitability | High profitability with 40.7% net margin and 22.7% ROIC; positive value creation | Negative profitability; net margin -1862.7%, ROIC -24.9%, shedding value |

| Innovation | Leading in network technology with durable competitive advantage and growing ROIC | Early-stage quantum computing with growing ROIC but still value destructive |

| Global presence | Established global presence with substantial market share in networking | Emerging company with limited global footprint |

| Market Share | Strong and growing market position in networking infrastructure | Small market share in emerging quantum computing market |

Key takeaways: Arista Networks shows robust profitability, diversified revenue streams, and a durable competitive moat, making it a strong candidate for investment. Rigetti Computing, while innovative with a growing ROIC trend, remains unprofitable and riskier due to its early-stage status and narrow revenue base. Investors should weigh risk tolerance carefully.

Risk Analysis

Below is a comparison table of key risks for Arista Networks, Inc. (ANET) and Rigetti Computing, Inc. (RGTI) based on the most recent 2024 financial and operational data:

| Metric | Arista Networks, Inc. (ANET) | Rigetti Computing, Inc. (RGTI) |

|---|---|---|

| Market Risk | Moderate (Beta 1.41) | High (Beta 1.71) |

| Debt level | Very Low (D/E = 0) | Low (D/E = 0.07) |

| Regulatory Risk | Moderate (Tech sector) | Moderate (Quantum tech, emerging regulations) |

| Operational Risk | Low (Established, 4.4K employees) | High (Early stage, 137 employees) |

| Environmental Risk | Low (Standard industry impact) | Low (Standard industry impact) |

| Geopolitical Risk | Moderate (Global supply chains) | Moderate (Global tech dependencies) |

The most likely and impactful risks are market volatility for both companies, with Rigetti facing higher beta and operational risks due to its early-stage quantum computing focus and weaker profitability metrics. Arista’s low debt and strong financial health mitigate leverage risks, while Rigetti’s weak margins and negative returns highlight financial vulnerability.

Which Stock to Choose?

Arista Networks, Inc. (ANET) shows strong income growth, with a 2024 net margin of 40.73% and favorable profitability ratios including ROE at 28.54% and ROIC at 22.74%. It carries no net debt and holds a very favorable moat rating, reflecting durable competitive advantage.

Rigetti Computing, Inc. (RGTI) reports negative profitability metrics in 2024, including a net margin of -1862.72% and ROE of -158.77%. Despite a growing ROIC trend, it is shedding value and has an unfavorable overall income statement and financial ratios profile, though it maintains a moderate debt level.

Considering credit ratings and financial health, ANET’s very favorable rating and consistent value creation contrast with RGTI’s unfavorable financial standing despite some improving profitability trends. Investors focused on stability and quality might find ANET more aligned with their objectives, while those with a tolerance for high risk and interest in emerging technologies could interpret RGTI’s situation differently.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Arista Networks, Inc. and Rigetti Computing, Inc. to enhance your investment decisions: