Investors face an intriguing choice between two innovative players in the computer hardware sector: Arista Networks, Inc. (ANET) and Quantum Computing, Inc. (QUBT). While Arista excels in cloud networking solutions with a robust market presence, Quantum Computing pioneers software tools for emerging quantum technologies. This comparison explores their market strategies and growth potential to help you identify which company could be the smarter addition to your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Arista Networks, Inc. and Quantum Computing, Inc. by providing an overview of these two companies and their main differences.

Arista Networks, Inc. Overview

Arista Networks, Inc. develops and markets cloud networking solutions globally, offering extensible operating systems, network applications, and Ethernet switching and routing platforms. The company serves diverse industries including internet companies, financial services, and government agencies. Headquartered in Santa Clara, California, Arista supports its products with extensive customer services and distributes through multiple channels.

Quantum Computing, Inc. Overview

Quantum Computing, Inc. specializes in software tools and applications for quantum computers, focusing on accelerating quantum-ready application development. Based in Virginia, it provides access to various quantum processing units and targets commercial and government sectors. Founded in 2018, Quantum Computing operates with a small workforce and emphasizes enabling quantum computing technology integration.

Key similarities and differences

Both companies operate in the computer hardware industry within the technology sector and serve commercial and government clients. However, Arista Networks focuses on cloud networking infrastructure with a global footprint and thousands of employees, while Quantum Computing centers on quantum software solutions with a niche market presence and a much smaller team. Their business models differ significantly in scale and technological specialization.

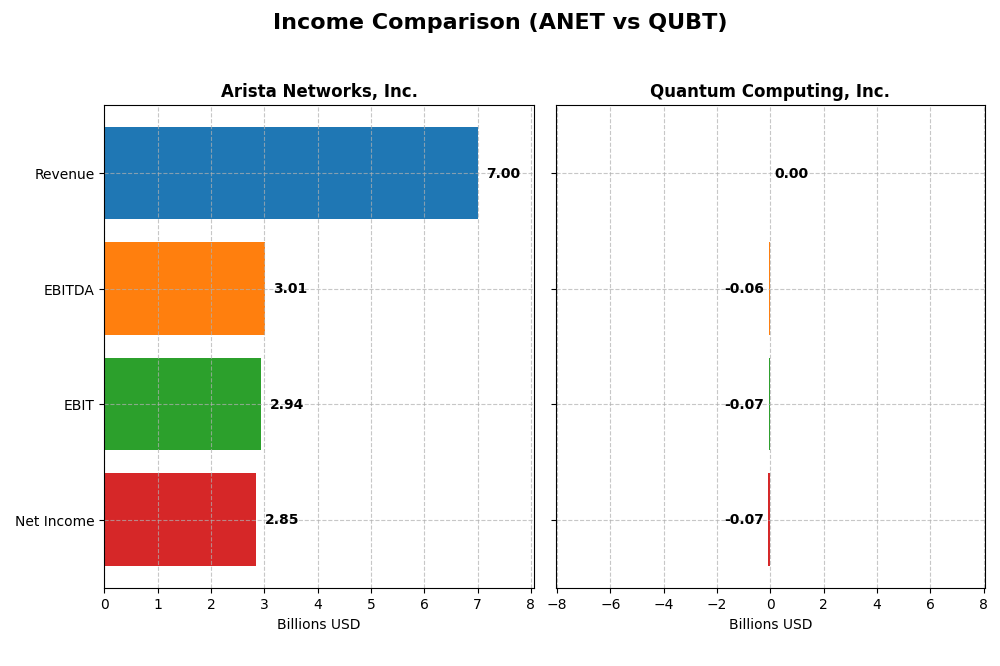

Income Statement Comparison

The table below presents a side-by-side comparison of the most recent fiscal year income statement figures for Arista Networks, Inc. and Quantum Computing, Inc., highlighting key financial metrics.

| Metric | Arista Networks, Inc. | Quantum Computing, Inc. |

|---|---|---|

| Market Cap | 163.5B | 1.6B |

| Revenue | 7.0B | 373K |

| EBITDA | 3.01B | -62.2M |

| EBIT | 2.94B | -66.0M |

| Net Income | 2.85B | -68.5M |

| EPS | 2.27 | -0.73 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Arista Networks, Inc.

Arista Networks has shown strong revenue growth, rising from $2.3B in 2020 to $7B in 2024, with net income increasing from $635M to $2.85B. Margins improved notably, with a gross margin exceeding 64% and net margin near 41% in 2024. The latest year saw revenue growth of 19.5% and a 35.15% rise in EPS, highlighting robust profitability and margin expansion.

Quantum Computing, Inc.

Quantum Computing’s revenue remained minimal, growing slightly from $0 in 2020 to $373K in 2024, while net income stayed negative, reaching a loss of $68.5M in 2024. Margins are deeply negative, with gross and net margins far below zero. The last fiscal year showed a minor 4.19% revenue increase but worsening profitability, including a sharp EPS decline of 73.81%.

Which one has the stronger fundamentals?

Arista Networks exhibits strong fundamentals with consistent revenue and net income growth, favorable margin improvements, and healthy profitability metrics. Conversely, Quantum Computing struggles with sustained losses, negative margins, and insufficient revenue growth. Overall, Arista’s financial metrics indicate more robust income statement health compared to Quantum Computing’s unfavorable earnings profile.

Financial Ratios Comparison

The table below presents the most recent key financial ratios for Arista Networks, Inc. and Quantum Computing, Inc., facilitating a straightforward comparison for investors.

| Ratios | Arista Networks, Inc. (ANET) | Quantum Computing, Inc. (QUBT) |

|---|---|---|

| ROE | 28.5% | -63.9% |

| ROIC | 22.7% | -17.4% |

| P/E | 48.7 | -22.7 |

| P/B | 13.9 | 14.5 |

| Current Ratio | 4.36 | 17.36 |

| Quick Ratio | 3.69 | 17.36 |

| D/E | 0 | 1.1% |

| Debt-to-Assets | 0 | 0.77% |

| Interest Coverage | 0 | -10.4 |

| Asset Turnover | 0.50 | 0.0024 |

| Fixed Asset Turnover | 70.8 | 0.038 |

| Payout Ratio | 0 | -0.31% |

| Dividend Yield | 0% | 0.014% |

Interpretation of the Ratios

Arista Networks, Inc.

Arista Networks shows mostly strong financial ratios, with favorable net margin at 40.73%, ROE of 28.54%, and ROIC of 22.74%, indicating robust profitability and efficient capital use. Some ratios like WACC at 10.42% and P/E of 48.69 are less favorable, suggesting valuation concerns. The company pays no dividends, likely reinvesting earnings for growth.

Quantum Computing, Inc.

Quantum Computing displays weak financial ratios, with a negative net margin of -18375.87% and ROE at -63.89%, reflecting significant losses and poor profitability. Most ratios are unfavorable, including high WACC at 20.42% and poor asset turnover. It does not pay dividends, consistent with its negative earnings and focus on R&D and development.

Which one has the best ratios?

Comparing both, Arista Networks presents a more favorable ratio profile with majority strong profitability and capital efficiency metrics. Quantum Computing’s ratios reveal ongoing financial struggles and negative returns. Overall, Arista Networks demonstrates a healthier financial position based on the evaluated ratios.

Strategic Positioning

This section compares the strategic positioning of Arista Networks, Inc. and Quantum Computing, Inc. regarding market position, key segments, and exposure to technological disruption:

Arista Networks, Inc.

- Large market cap with strong presence in cloud networking, facing typical tech competition.

- Key segments include cloud networking products and services mainly for internet, financial, and government sectors.

- Positioned in a mature networking market with incremental innovation, less exposed to immediate disruption.

Quantum Computing, Inc.

- Small market cap focused on quantum computing software and hardware, operating in a niche market.

- Focuses on quantum application acceleration software and multiple quantum processing units for commercial and government use.

- Operates in a rapidly evolving quantum computing sector, facing high technological disruption risks.

Arista Networks, Inc. vs Quantum Computing, Inc. Positioning

Arista Networks presents a diversified approach with broad industry coverage and established cloud networking solutions, while Quantum Computing is concentrated on emerging quantum computing technologies with limited revenue scale. Arista benefits from stable markets; Quantum Computing faces higher uncertainty but potential growth.

Which has the best competitive advantage?

Arista Networks has the better competitive advantage, demonstrating a very favorable moat with value creation and a growing ROIC. Quantum Computing is slightly unfavorable, shedding value despite improving profitability.

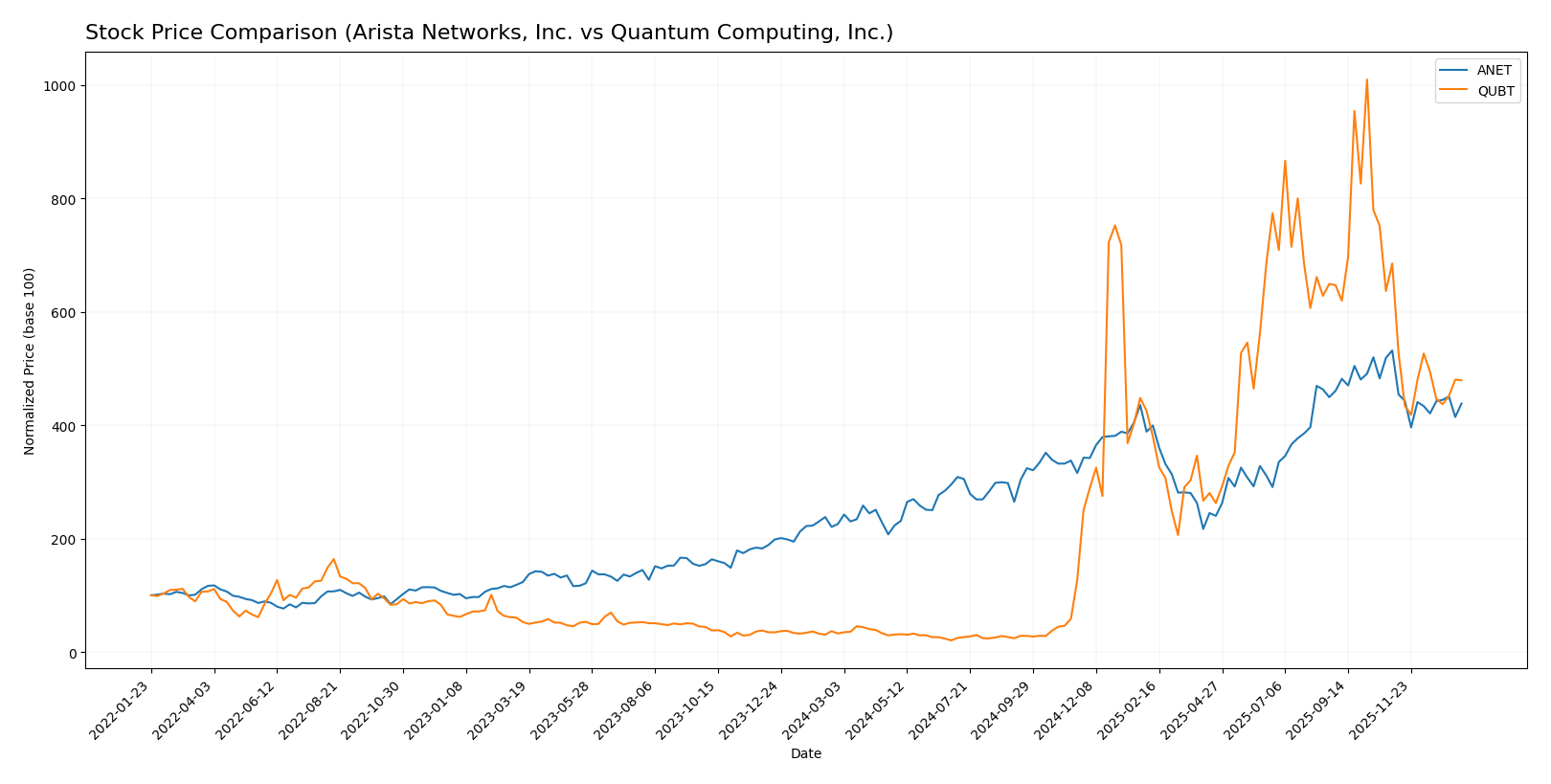

Stock Comparison

The stock price chart reveals significant bullish trends for both Arista Networks, Inc. and Quantum Computing, Inc. over the past 12 months, with notable deceleration and recent downward movements reflecting changing trading dynamics.

Trend Analysis

Arista Networks, Inc. (ANET) exhibited a strong bullish trend over the past year with a 94.16% price increase and high volatility (24.64 std deviation). The trend shows deceleration, with a recent 17.6% price decline from November 2025 to January 2026.

Quantum Computing, Inc. (QUBT) delivered a pronounced bullish trend with a 1362.9% gain over the last year and lower volatility (6.91 std deviation). The trend also decelerated, facing a 30.04% drop in the recent period ending January 2026.

Comparing the two, QUBT outperformed ANET significantly in market performance over the past 12 months despite both experiencing recent declines, reflecting a higher overall price appreciation.

Target Prices

The analyst consensus shows a broad range of target prices for Arista Networks, Inc. and Quantum Computing, Inc., reflecting varied expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Arista Networks, Inc. | 183 | 150 | 163 |

| Quantum Computing, Inc. | 40 | 10 | 19.5 |

Arista Networks’ consensus target of 163 suggests upside potential from the current price of 129.93 USD. Quantum Computing’s target consensus of 19.5 also indicates significant growth potential compared to its current price of 11.69 USD.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Arista Networks, Inc. (ANET) and Quantum Computing, Inc. (QUBT):

Rating Comparison

ANET Rating

- Rating: B, classified as Very Favorable overall rating by analysts.

- Discounted Cash Flow Score: 3, indicating a moderate valuation outlook.

- ROE Score: 5, showing very favorable efficiency in generating equity profits.

- ROA Score: 5, very favorable asset utilization for earnings generation.

- Debt To Equity Score: 1, very unfavorable, indicating higher financial leverage.

- Overall Score: 3, moderate overall financial standing assessment.

QUBT Rating

- Rating: C+, also considered Very Favorable in overall rating.

- Discounted Cash Flow Score: 2, reflecting a moderate but lower valuation score.

- ROE Score: 1, very unfavorable with low profit efficiency from equity.

- ROA Score: 1, very unfavorable asset utilization.

- Debt To Equity Score: 5, very favorable, showing low financial risk from debt.

- Overall Score: 2, moderate but lower overall financial standing.

Which one is the best rated?

Based on the provided data, ANET holds a higher rating (B) compared to QUBT’s C+. ANET scores significantly better on ROE and ROA, while QUBT shows strength only in debt management. Overall, ANET is rated more favorably across key financial metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Arista Networks, Inc. and Quantum Computing, Inc.:

ANET Scores

- Altman Z-Score: 18.45, in the safe zone

- Piotroski Score: 5, indicating average strength

QUBT Scores

- Altman Z-Score: 50.17, in the safe zone

- Piotroski Score: 4, indicating average strength

Which company has the best scores?

Both ANET and QUBT are well within the safe zone for Altman Z-Score, but QUBT’s score is significantly higher. Regarding Piotroski Score, ANET scores slightly better at 5 compared to QUBT’s 4, both reflecting average financial strength.

Grades Comparison

Here is a comparison of the recent professional grades assigned to Arista Networks, Inc. and Quantum Computing, Inc.:

Arista Networks, Inc. Grades

The table below shows recent grades by leading financial institutions for Arista Networks, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Upgrade | Overweight | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Piper Sandler | Maintain | Neutral | 2025-11-05 |

| Barclays | Maintain | Overweight | 2025-11-05 |

| Rosenblatt | Maintain | Neutral | 2025-11-05 |

| Morgan Stanley | Maintain | Overweight | 2025-10-10 |

| Needham | Maintain | Buy | 2025-09-16 |

| Wells Fargo | Maintain | Overweight | 2025-09-12 |

| JP Morgan | Maintain | Overweight | 2025-09-12 |

| Goldman Sachs | Maintain | Buy | 2025-09-12 |

Arista Networks has predominantly received “Overweight” and “Buy” ratings, indicating a generally positive outlook from major analysts.

Quantum Computing, Inc. Grades

The following table summarizes recent grades from financial analysts for Quantum Computing, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Ascendiant Capital | Maintain | Buy | 2025-12-22 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-12-18 |

| Lake Street | Maintain | Buy | 2025-11-17 |

| Ascendiant Capital | Maintain | Buy | 2025-10-03 |

| Ascendiant Capital | Maintain | Buy | 2025-06-06 |

| Ascendiant Capital | Maintain | Buy | 2025-04-28 |

| Ascendiant Capital | Maintain | Buy | 2024-11-13 |

| Ascendiant Capital | Maintain | Buy | 2023-11-24 |

Quantum Computing’s ratings are mostly “Buy” with one “Neutral,” reflecting a stable positive consensus from its analysts.

Which company has the best grades?

Both companies hold a consensus “Buy” rating, but Arista Networks shows a broader range of analyst coverage with more frequent “Overweight” and “Buy” grades from multiple respected firms. This diversity may offer investors greater confidence in the stock’s outlook compared to Quantum Computing, which is primarily covered by one firm with consistent “Buy” ratings.

Strengths and Weaknesses

Below is a comparative table highlighting the key strengths and weaknesses of Arista Networks, Inc. (ANET) and Quantum Computing, Inc. (QUBT) based on recent financial and market data:

| Criterion | Arista Networks, Inc. (ANET) | Quantum Computing, Inc. (QUBT) |

|---|---|---|

| Diversification | Strong product and service mix with $5.88B in products and $1.12B in services (2024) | Limited revenue mainly from services member segment ($346K in 2024) |

| Profitability | High net margin (40.73%), ROE (28.54%), and ROIC (22.74%) indicating strong profitability | Negative net margin (-18,375.87%), ROE (-63.89%), and ROIC (-17.41%), showing significant losses |

| Innovation | High fixed asset turnover (70.85) suggests efficient use of assets and innovation | Very low fixed asset turnover (0.04), indicating underutilized assets and low innovation impact |

| Global presence | Expanding revenue base and growing ROIC trend (+50.25%) signify durable competitive advantage | Growing ROIC trend (+85.15%) but still value destroying, signaling potential but weak current position |

| Market Share | Strong market position with favorable financial ratios overall (57.14% favorable) | Weak market presence with mostly unfavorable ratios (71.43% unfavorable) and value destruction |

Key takeaways: Arista Networks demonstrates a robust and diversified business model with strong profitability and a durable competitive advantage. Quantum Computing shows growth potential but currently suffers from poor profitability and limited market presence, presenting higher risk for investors.

Risk Analysis

Below is a comparative risk table for Arista Networks, Inc. (ANET) and Quantum Computing, Inc. (QUBT) based on the most recent financial year 2024 data and market context.

| Metric | Arista Networks, Inc. (ANET) | Quantum Computing, Inc. (QUBT) |

|---|---|---|

| Market Risk | Moderate (Beta 1.41, sensitive to tech sector swings) | High (Beta 3.49, very volatile stock price) |

| Debt level | Very low (Debt-to-equity 0, strong balance sheet) | Low (Debt-to-equity 0.01, manageable debt) |

| Regulatory Risk | Moderate (Tech industry subject to data/privacy regulations) | Moderate (Emerging tech with evolving regulations) |

| Operational Risk | Low (Established with solid infrastructure and revenue) | High (Small size, early-stage with operational scalability concerns) |

| Environmental Risk | Low (Primarily software/hardware, minimal environmental footprint) | Low (Software-focused, limited environmental impact) |

| Geopolitical Risk | Moderate (Global operations, supply chain exposure) | Moderate (US-based, some government contracts exposure) |

Synthesizing these risks, Quantum Computing, Inc. faces higher market volatility and operational risks due to its nascent stage and volatile financials, despite low debt. Arista Networks exhibits a more stable profile but is not immune to market fluctuations and regulatory pressures. Investors should weigh QUBT’s high potential against its pronounced risk, while ANET offers steadier growth with moderate sector sensitivity.

Which Stock to Choose?

Arista Networks, Inc. (ANET) shows strong income growth with a 2024 revenue increase of 19.5% and a net margin of 40.73%. Its financial ratios are mostly favorable, boasting a 28.54% ROE and zero debt. The company has a very favorable rating and a very favorable economic moat indicating value creation.

Quantum Computing, Inc. (QUBT) presents unfavorable income metrics, including a negative net margin and declining profitability despite slight revenue growth. Its financial ratios are largely unfavorable, with negative ROE and ROIC, though it maintains low debt. The company holds a moderate rating with a slightly unfavorable moat reflecting value destruction.

For investors prioritizing stable profitability and a strong economic moat, Arista Networks might appear more favorable due to its consistent value creation and robust financial health. Conversely, those with a higher risk tolerance and interest in emerging technology could see potential in Quantum Computing’s improving profitability trend despite current challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Arista Networks, Inc. and Quantum Computing, Inc. to enhance your investment decisions: