Arista Networks, Inc. and NetApp, Inc. are two leading players in the computer hardware industry, each specializing in advanced cloud networking and data management solutions. Both companies compete in overlapping markets, focusing on innovation to address the growing demand for cloud infrastructure and storage technologies. In this analysis, I will help you uncover which company presents the most compelling investment opportunity in today’s dynamic tech landscape.

Table of contents

Companies Overview

I will begin the comparison between Arista Networks and NetApp by providing an overview of these two companies and their main differences.

Arista Networks Overview

Arista Networks, Inc. develops and sells cloud networking solutions globally, including extensible operating systems and gigabit Ethernet switching and routing platforms. It serves diverse industries such as internet companies, financial services, and government agencies. Headquartered in Santa Clara, California, Arista operates through distributors, resellers, OEM partners, and a direct sales force, emphasizing post-contract customer support services.

NetApp Overview

NetApp, Inc. specializes in cloud-led and data-centric services for managing data across on-premises, private, and public clouds worldwide. The company offers software solutions like NetApp ONTAP and storage infrastructure including all-flash arrays and cloud storage services. Based in San Jose, California, NetApp serves sectors such as energy, healthcare, and telecommunications through a direct sales force and a partner ecosystem.

Key similarities and differences

Both companies operate in the computer hardware industry and focus on cloud-related technologies. Arista emphasizes cloud networking solutions and hardware platforms, while NetApp concentrates on data management software and storage infrastructure. Arista’s customer base is broader in networking segments, whereas NetApp’s services are more data-centric, targeting hybrid and public cloud environments. Their sales models include direct sales and partner networks, but with different product and service scopes.

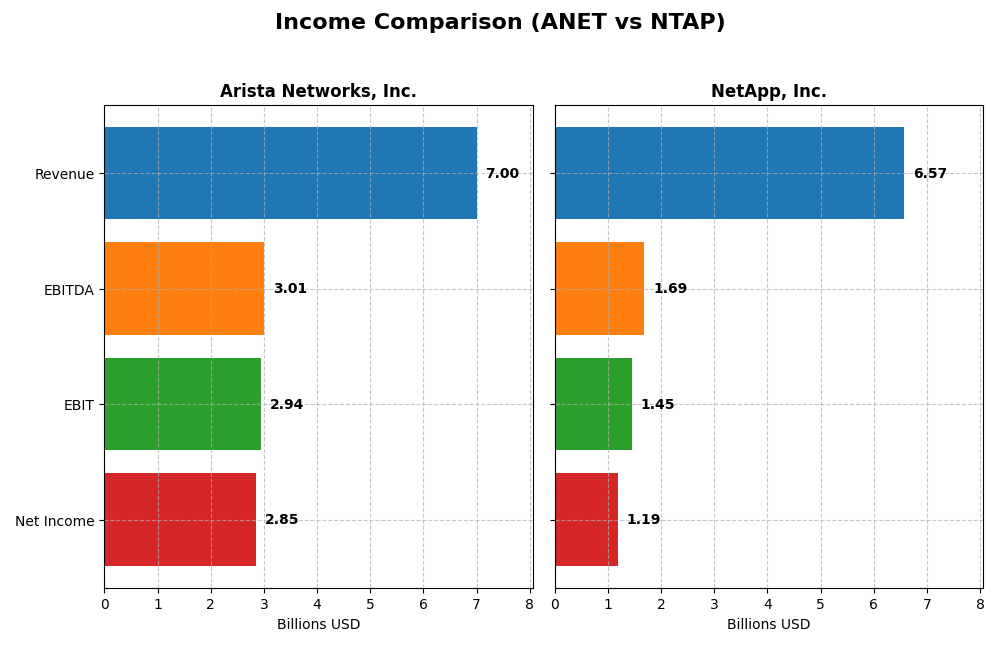

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for Arista Networks, Inc. and NetApp, Inc. based on their most recent fiscal year financial data.

| Metric | Arista Networks, Inc. (ANET) | NetApp, Inc. (NTAP) |

|---|---|---|

| Market Cap | 163.5B | 21.4B |

| Revenue | 7.00B | 6.57B |

| EBITDA | 3.01B | 1.69B |

| EBIT | 2.94B | 1.45B |

| Net Income | 2.85B | 1.19B |

| EPS | 2.27 | 5.81 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Arista Networks, Inc.

Arista Networks has shown strong revenue growth from 2020 to 2024, surging from $2.3B to $7B, with net income rising sharply from $635M to $2.85B. Margins have improved notably, with a gross margin of 64.13% and net margin of 40.73% in 2024. The latest year saw a 19.5% revenue increase and a significant 14.34% net margin expansion, reflecting robust profitability and operational efficiency.

NetApp, Inc.

NetApp’s revenue grew moderately from $5.7B in 2021 to $6.57B in 2025, while net income increased from $730M to $1.19B over the same period. Despite a higher gross margin of 70.19%, its net margin remains lower at 18.05%. In 2025, revenue growth slowed to 4.85%, but net margin improved by 14.72%, supported by disciplined expense control and a 22.46% EPS growth, indicating steady operational progress.

Which one has the stronger fundamentals?

Arista Networks demonstrates stronger fundamentals with higher revenue and net income growth rates, alongside superior margins across the board. Its net margin and EPS growth outpace NetApp’s significantly, suggesting more robust profitability. Although NetApp benefits from a higher gross margin, its slower revenue expansion and lower net margin provide a more cautious outlook on its income statement strength relative to Arista.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Arista Networks, Inc. (ANET) and NetApp, Inc. (NTAP) based on their most recent fiscal year data.

| Ratios | Arista Networks, Inc. (2024) | NetApp, Inc. (2025) |

|---|---|---|

| ROE | 28.5% | 114.0% |

| ROIC | 22.7% | 16.5% |

| P/E | 48.7 | 15.4 |

| P/B | 13.9 | 17.6 |

| Current Ratio | 4.36 | 1.26 |

| Quick Ratio | 3.69 | 1.22 |

| D/E | 0 | 3.36 |

| Debt-to-Assets | 0 | 32.3% |

| Interest Coverage | 0 | 20.9 |

| Asset Turnover | 0.50 | 0.61 |

| Fixed Asset Turnover | 70.8 | 8.17 |

| Payout ratio | 0% | 35.8% |

| Dividend yield | 0% | 2.32% |

Interpretation of the Ratios

Arista Networks, Inc.

Arista Networks exhibits strong profitability with favorable net margin (40.73%) and return on equity (28.54%) ratios, indicating efficient profit generation and shareholder value creation. However, valuation metrics like P/E (48.69) and P/B (13.89) ratios are high, suggesting potential overvaluation. The company has no debt and strong interest coverage, but a low dividend yield of 0% reflects no dividend payments, likely due to reinvestment in growth and R&D.

NetApp, Inc.

NetApp shows solid financial health with favorable net margin (18.05%) and an exceptionally high return on equity (114.04%), pointing to effective capital use. Debt levels are moderate with a debt-to-equity ratio of 3.36, which is unfavorable, but interest coverage is strong (22.61). Valuation ratios are mixed, with a neutral P/E (15.44) and unfavorable P/B (17.6). The company pays dividends, with a 2.32% yield supported by steady free cash flow.

Which one has the best ratios?

Arista Networks presents a more favorable overall ratio profile with 57.14% favorable ratios versus 42.86% unfavorable, mainly due to superior profitability and zero debt. NetApp holds a slightly favorable rating with 50% favorable ratios but carries higher leverage and mixed valuation signals. The choice depends on investors’ focus on growth versus dividend income and leverage tolerance.

Strategic Positioning

This section compares the strategic positioning of Arista Networks, Inc. and NetApp, Inc., focusing on market position, key segments, and exposure to technological disruption:

Arista Networks, Inc.

- Leading cloud networking provider with strong presence across Americas, EMEA, and APAC; faces competitive pressure in cloud hardware.

- Key segments include cloud networking hardware and post-contract services; business driven by internet, financial, government, and media sectors.

- Exposure to disruption through evolving cloud networking technologies and customer demand for scalable, software-driven network solutions.

NetApp, Inc.

- Provides cloud-led, data-centric services with presence in hybrid and public cloud markets; competes in storage and data management.

- Operates mainly in hybrid and public cloud segments; business driven by software, storage infrastructure, and cloud operations services.

- Exposure to disruption from cloud data management advancements and hybrid cloud adoption trends in various industries.

Arista Networks, Inc. vs NetApp, Inc. Positioning

Arista focuses on diversified cloud networking hardware and services, targeting multiple industries globally, while NetApp concentrates on cloud data management and storage solutions with a hybrid and public cloud emphasis. Arista’s broader hardware focus contrasts with NetApp’s software-centric offerings, each with distinct competitive dynamics.

Which has the best competitive advantage?

Both companies demonstrate a very favorable moat with growing ROIC and sustainable profitability. Arista shows a higher ROIC spread and faster ROIC growth, indicating a potentially stronger competitive advantage based on efficient capital use and value creation.

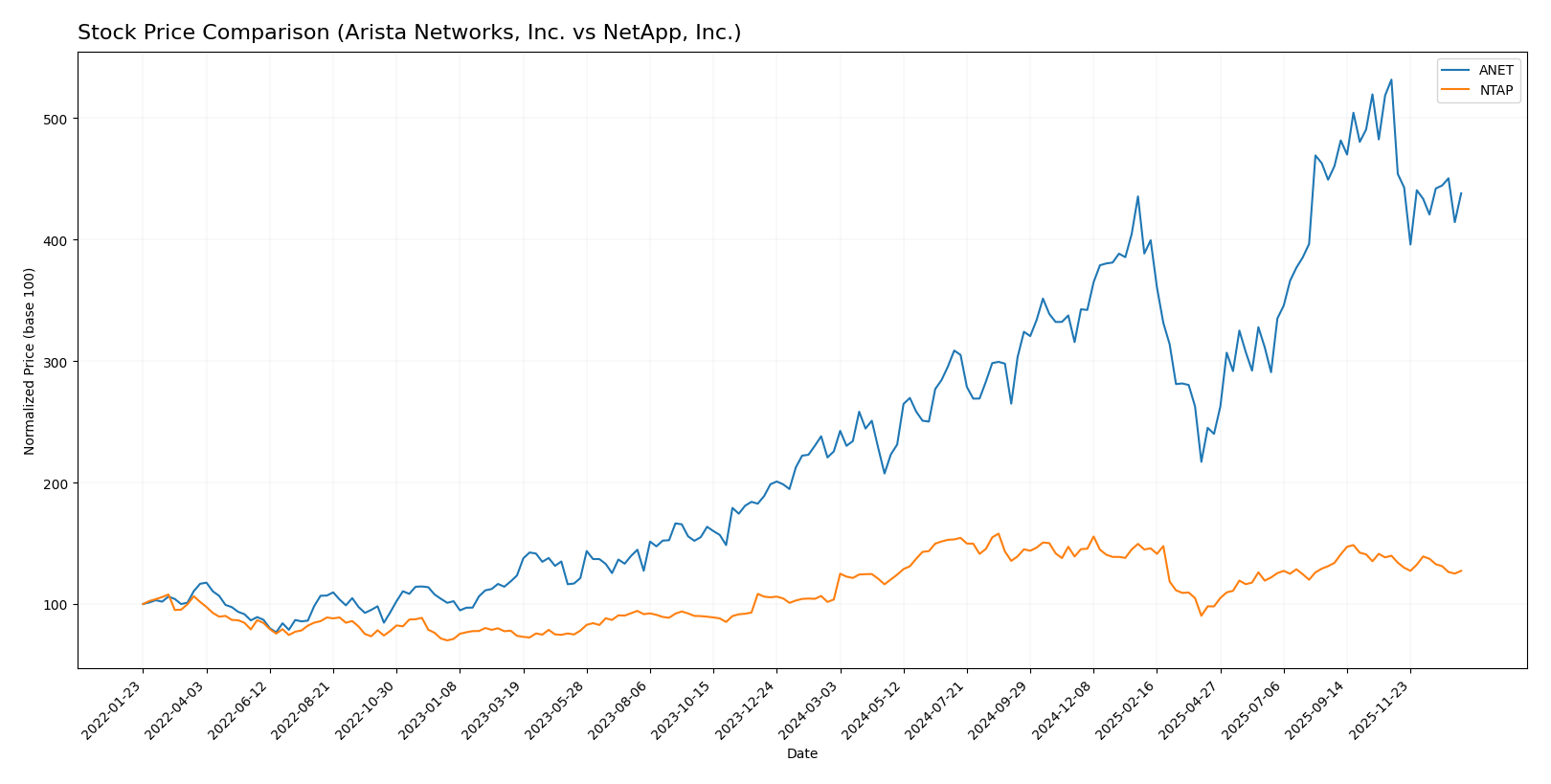

Stock Comparison

The stock price dynamics over the past 12 months reveal significant bullish momentum for both Arista Networks, Inc. and NetApp, Inc., with recent downward adjustments marking a deceleration phase in their trends.

Trend Analysis

Arista Networks, Inc. (ANET) exhibited a strong bullish trend with a 94.16% price increase over the past year, though recent weeks show a 17.6% decline indicating a deceleration phase amid high volatility (std deviation 24.64).

NetApp, Inc. (NTAP) posted a bullish gain of 22.75% over the same period, also experiencing recent weakness with an 8.91% drop and reduced volatility (std deviation 12.21), signaling a slowing upward momentum.

Comparing both, Arista Networks delivered the highest market performance with a substantially larger price increase, despite both stocks facing short-term corrections and decelerating trends.

Target Prices

Analysts present a positive target price consensus for both Arista Networks, Inc. and NetApp, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Arista Networks, Inc. | 183 | 150 | 163 |

| NetApp, Inc. | 137 | 115 | 125.17 |

The target consensus for Arista Networks at 163 suggests a potential upside from the current price of 129.93, while NetApp’s consensus of 125.17 also indicates room for growth above its current price of 107.28. Overall, analysts expect moderate appreciation in both stocks.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Arista Networks, Inc. and NetApp, Inc.:

Rating Comparison

Arista Networks, Inc. Rating

- Rating: B, considered very favorable by analysts.

- Discounted Cash Flow Score: Moderate at 3, indicating balanced valuation.

- ROE Score: Very favorable at 5, showing high profit efficiency.

- ROA Score: Very favorable at 5, reflecting strong asset use.

- Debt To Equity Score: Very unfavorable at 1, indicating high financial risk.

- Overall Score: Moderate at 3, summarizing average financial standing.

NetApp, Inc. Rating

- Rating: B+, considered very favorable by analysts.

- Discounted Cash Flow Score: Favorable at 4, suggesting better valuation.

- ROE Score: Very favorable at 5, also showing high profit efficiency.

- ROA Score: Very favorable at 5, reflecting strong asset use.

- Debt To Equity Score: Very unfavorable at 1, indicating high financial risk.

- Overall Score: Moderate at 3, summarizing average financial standing.

Which one is the best rated?

NetApp holds a slightly better valuation score with a favorable discounted cash flow score of 4 compared to Arista’s moderate 3. Both share very favorable returns and financial risk concerns, with identical overall moderate scores.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Arista Networks and NetApp:

Arista Networks Scores

- Altman Z-Score: 18.45, indicating a safe zone.

- Piotroski Score: 5, indicating average strength.

NetApp Scores

- Altman Z-Score: 2.86, indicating a grey zone.

- Piotroski Score: 7, indicating strong strength.

Which company has the best scores?

Arista Networks shows a much higher Altman Z-Score, signaling stronger bankruptcy safety, while NetApp has a higher Piotroski Score, suggesting better financial strength. Each company leads in one metric based on the data provided.

Grades Comparison

The following summarizes the latest available grades and consensus ratings for Arista Networks, Inc. and NetApp, Inc.:

Arista Networks, Inc. Grades

This table lists recent grades assigned by reputable grading companies for Arista Networks, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Upgrade | Overweight | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Piper Sandler | Maintain | Neutral | 2025-11-05 |

| Barclays | Maintain | Overweight | 2025-11-05 |

| Rosenblatt | Maintain | Neutral | 2025-11-05 |

| Morgan Stanley | Maintain | Overweight | 2025-10-10 |

| Needham | Maintain | Buy | 2025-09-16 |

| Wells Fargo | Maintain | Overweight | 2025-09-12 |

| JP Morgan | Maintain | Overweight | 2025-09-12 |

| Goldman Sachs | Maintain | Buy | 2025-09-12 |

Arista Networks consistently receives overweight and buy ratings, indicating generally positive analyst sentiment over recent months.

NetApp, Inc. Grades

This table lists recent grades assigned by reputable grading companies for NetApp, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2025-11-26 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-26 |

| Northland Capital Markets | Upgrade | Outperform | 2025-11-26 |

| B of A Securities | Maintain | Neutral | 2025-11-26 |

| UBS | Maintain | Neutral | 2025-11-26 |

| Citigroup | Maintain | Neutral | 2025-11-12 |

| Citigroup | Maintain | Neutral | 2025-10-16 |

| Argus Research | Maintain | Buy | 2025-08-29 |

| UBS | Maintain | Neutral | 2025-08-28 |

| Barclays | Maintain | Overweight | 2025-08-28 |

NetApp’s grades are mixed, ranging from neutral to overweight and outperform, reflecting a more cautious analyst stance.

Which company has the best grades?

Arista Networks has garnered stronger and more consistent buy and overweight ratings compared to NetApp’s more varied grades including multiple neutral ratings. This suggests Arista may be viewed as having more robust growth potential, which could influence investor confidence differently between the two.

Strengths and Weaknesses

The table below compares the key strengths and weaknesses of Arista Networks, Inc. (ANET) and NetApp, Inc. (NTAP) based on recent financial performance, market position, and operational metrics.

| Criterion | Arista Networks, Inc. (ANET) | NetApp, Inc. (NTAP) |

|---|---|---|

| Diversification | Moderate: Primarily focused on networking products and services, with 2024 revenues of $5.88B (products) and $1.12B (services). | Moderate: Focused on hybrid and public cloud solutions, with 2025 revenues of $5.91B (Hybrid Cloud) and $665M (Public Cloud). |

| Profitability | High profitability with a 40.7% net margin and 28.5% ROE in 2024; ROIC above WACC by 12.3%, indicating strong value creation. | Solid profitability with 18.1% net margin and exceptionally high 114% ROE in 2025; ROIC above WACC by 7.2%, also creating value. |

| Innovation | Strong innovation evidenced by a very favorable MOAT and growing ROIC trend (+50.3% over 2020-2024). | Good innovation with a very favorable MOAT and growing ROIC trend (+25.6% over 2021-2025), but less pronounced than ANET. |

| Global presence | Established global presence in networking hardware with a strong market niche. | Global presence focused on cloud storage and hybrid solutions, adapting well to cloud market trends. |

| Market Share | Significant market share in high-performance networking. | Competitive presence in cloud storage and related services, though market share is more fragmented. |

Key takeaways: Arista Networks leads in profitability and innovation with a strong and growing competitive moat. NetApp shows robust value creation and adapts well to cloud trends but has lower profitability margins and more moderate diversification. Both companies demonstrate durable competitive advantages but serve somewhat distinct market niches.

Risk Analysis

Below is a comparison of key risks for Arista Networks, Inc. (ANET) and NetApp, Inc. (NTAP) as of 2026.

| Metric | Arista Networks, Inc. (ANET) | NetApp, Inc. (NTAP) |

|---|---|---|

| Market Risk | High beta (1.414) indicating higher volatility | High beta (1.374), moderate volatility |

| Debt level | No debt (D/E = 0), very low financial risk | Moderate debt (D/E = 3.36), moderate financial risk |

| Regulatory Risk | Moderate; operates globally with some exposure to tech regulations | Moderate; global cloud-related regulations impact business |

| Operational Risk | Dependence on cloud networking technology innovation | Dependence on hybrid and public cloud solutions |

| Environmental Risk | Low; limited direct environmental impact | Low; cloud services have indirect environmental footprint |

| Geopolitical Risk | Exposure to global markets, including Asia-Pacific | Exposure to global markets, including sensitive tech regions |

The most likely and impactful risks are market volatility for both companies due to their technology sector exposure. NetApp’s moderate debt level adds financial risk, while Arista’s zero debt enhances its stability. Both face regulatory and geopolitical risks tied to global tech markets, important for risk management consideration.

Which Stock to Choose?

Arista Networks, Inc. (ANET) exhibits strong income growth with a 2024 net margin of 40.73% and consistently favorable profitability ratios. It maintains zero debt, a high return on equity (28.54%), and a very favorable overall rating, supported by a very favorable economic moat and a safe Altman Z-score.

NetApp, Inc. (NTAP) shows moderate income growth with a 2025 net margin of 18.05% and generally favorable financial ratios, including an exceptionally high return on equity (114.04%). However, it carries notable debt (debt-to-equity 3.36), a slightly less favorable overall rating, a very favorable moat, but a grey zone Altman Z-score indicating moderate financial risk.

For investors prioritizing durable competitive advantage and strong profitability, ANET’s very favorable rating and debt-free status might appear more attractive. Conversely, those valuing high return on equity and moderate valuation metrics could see NTAP as a slightly favorable option, albeit with higher leverage and some financial risk considerations.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Arista Networks, Inc. and NetApp, Inc. to enhance your investment decisions: