In the dynamic world of technology, Arista Networks, Inc. (ANET) and Dell Technologies Inc. (DELL) stand out as prominent players in computer hardware, each with unique innovation strategies. Arista specializes in cloud networking solutions, while Dell offers a broad range of IT infrastructure products and services. This comparison explores their market positions and growth potential to help you decide which company is the more attractive investment opportunity today.

Table of contents

Companies Overview

I will begin the comparison between Arista Networks, Inc. and Dell Technologies Inc. by providing an overview of these two companies and their main differences.

Arista Networks Overview

Arista Networks, Inc. focuses on developing and selling cloud networking solutions across multiple regions including the Americas, Europe, and Asia-Pacific. Its offerings include extensible operating systems, network applications, and gigabit Ethernet switching and routing platforms. The company serves diverse sectors such as internet companies, financial services, and government agencies, marketing through direct sales and partners from its headquarters in Santa Clara, California.

Dell Technologies Overview

Dell Technologies Inc. designs, manufactures, and supports IT solutions globally, operating through three segments: Infrastructure Solutions Group, Client Solutions Group, and VMware. Its wide product range includes storage solutions, servers, desktops, laptops, and cloud software services. Headquartered in Round Rock, Texas, Dell focuses on helping customers modernize infrastructure and manage multi-cloud environments, supported by a workforce of 108,000 employees.

Key similarities and differences

Both companies operate in the computer hardware sector and provide networking products and IT solutions. Arista Networks specializes in cloud networking with a strong focus on high-performance switching, while Dell offers a broader portfolio including client devices and cloud infrastructure software. Arista’s market cap stands at $163.5B with 4,412 employees, compared to Dell’s $80.2B market cap and 108,000 employees, indicating different scales and business scopes.

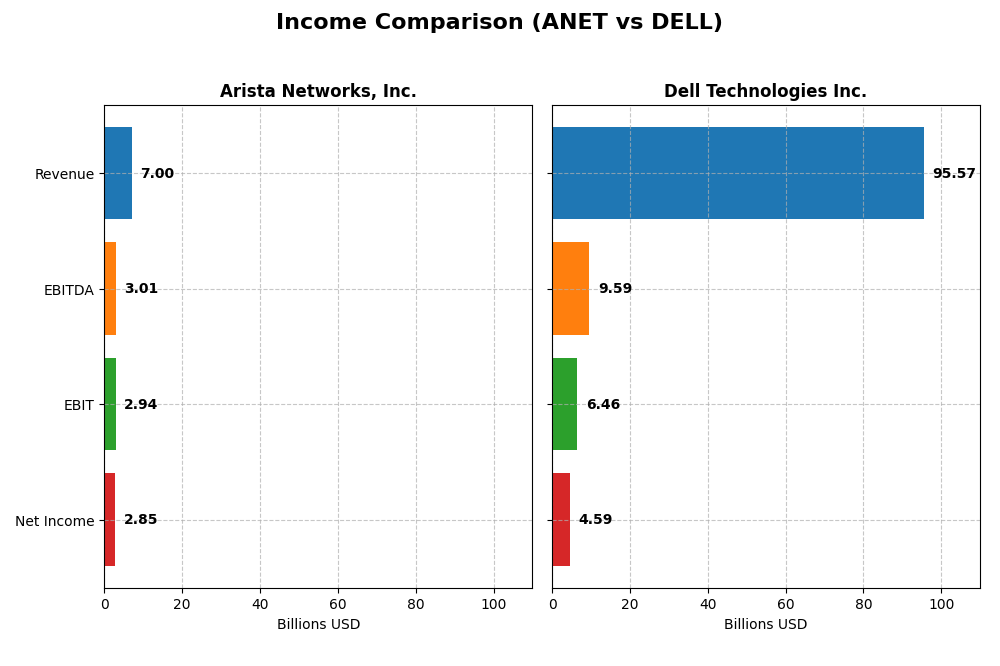

Income Statement Comparison

The following table presents a side-by-side comparison of key income statement metrics for Arista Networks, Inc. and Dell Technologies Inc. for their most recent fiscal years.

| Metric | Arista Networks, Inc. | Dell Technologies Inc. |

|---|---|---|

| Market Cap | 164B | 80B |

| Revenue | 7.0B | 95.6B |

| EBITDA | 3.0B | 9.6B |

| EBIT | 2.9B | 6.5B |

| Net Income | 2.9B | 4.6B |

| EPS | 2.27 | 6.51 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Arista Networks, Inc.

Arista Networks demonstrated robust revenue and net income growth from 2020 to 2024, with revenue increasing over 200% and net income rising nearly 350%. The company maintained strong margins, with a gross margin exceeding 64% and a net margin above 40%. In 2024, Arista’s growth accelerated, with revenue up 19.5% and net margin improving by 14.34%, reflecting effective cost management and expanding profitability.

Dell Technologies Inc.

Dell’s revenue showed moderate growth of about 10% over 2021–2025, while net income increased by 41%. Gross margin remained stable near 22%, whereas EBIT and net margins were lower, around 6.76% and 4.81%, respectively, showing more moderate profitability. In 2025, revenue grew 8.08% with net margin advancing 25.41%, signaling solid but less dynamic expansion compared to prior years.

Which one has the stronger fundamentals?

Arista Networks exhibits stronger fundamentals with significantly higher margins and faster growth in revenue, net income, and earnings per share. Dell shows favorable but more modest improvements and lower profitability ratios. While both companies are evaluated positively overall, Arista’s superior margin profiles and rapid growth present a more robust income statement performance for investors to consider.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Arista Networks, Inc. (ANET) and Dell Technologies Inc. (DELL) based on their most recent fiscal year data.

| Ratios | Arista Networks, Inc. (2024) | Dell Technologies Inc. (2025) |

|---|---|---|

| ROE | 28.5% | -310% |

| ROIC | 22.7% | 14.7% |

| P/E | 48.7 | 15.7 |

| P/B | 13.9 | -48.7 |

| Current Ratio | 4.36 | 0.78 |

| Quick Ratio | 3.69 | 0.63 |

| D/E | 0 | -16.6 |

| Debt-to-Assets | 0 | 30.8% |

| Interest Coverage | 0 | 4.41 |

| Asset Turnover | 0.50 | 1.20 |

| Fixed Asset Turnover | 70.8 | 15.1 |

| Payout ratio | 0 | 27.8% |

| Dividend yield | 0 | 1.77% |

Interpretation of the Ratios

Arista Networks, Inc.

Arista Networks demonstrates strong profitability with a net margin of 40.73% and return on equity at 28.54%, indicating efficient asset use. However, valuation ratios like P/E of 48.69 and P/B of 13.89 appear stretched. Liquidity is solid, though a high current ratio of 4.36 suggests excess assets. The company does not pay dividends, likely prioritizing growth and reinvestment.

Dell Technologies Inc.

Dell shows weaker profitability, with a net margin of 4.81% and a negative return on equity of -309.85%, signaling operational challenges. The firm’s liquidity ratios are low, with a current ratio of 0.78, which may raise short-term risk concerns. Dell pays dividends, yielding 1.77%, but coverage by free cash flow is negative, reflecting potential sustainability risks in shareholder returns.

Which one has the best ratios?

Arista Networks holds a more favorable ratio profile overall, with superior profitability and liquidity metrics despite some valuation concerns. Dell’s ratios indicate operational and liquidity weaknesses, though it offers a dividend with modest yield. The balance of strengths and weaknesses suggests Arista’s financial ratios are generally more robust than Dell’s at this time.

Strategic Positioning

This section compares the strategic positioning of Arista Networks, Inc. and Dell Technologies Inc., focusing on market position, key segments, and exposure to technological disruption:

Arista Networks, Inc.

- Leading cloud networking provider with strong competitive pressure in tech hardware market.

- Focused on cloud networking products and services for internet, finance, government sectors.

- Positioned in networking hardware and software with focus on cloud networking solutions.

Dell Technologies Inc.

- Large IT solutions provider with diversified competitive pressures across segments.

- Operates three segments: Client Solutions, Infrastructure Solutions, and VMware.

- Exposed to disruption through hybrid cloud, multi-cloud, and digital workspace innovations.

Arista Networks, Inc. vs Dell Technologies Inc. Positioning

Arista Networks is highly specialized in cloud networking, offering focused products and services, while Dell has a diversified portfolio across IT hardware, software, and cloud segments. Arista’s niche focus contrasts with Dell’s broad market coverage, implying different risk and growth profiles.

Which has the best competitive advantage?

Both companies show a very favorable moat with growing ROIC above WACC. Arista’s 12.3% ROIC premium and Dell’s 6.6% indicate durable competitive advantages, with Arista showing a higher excess return but Dell demonstrating stronger ROIC growth.

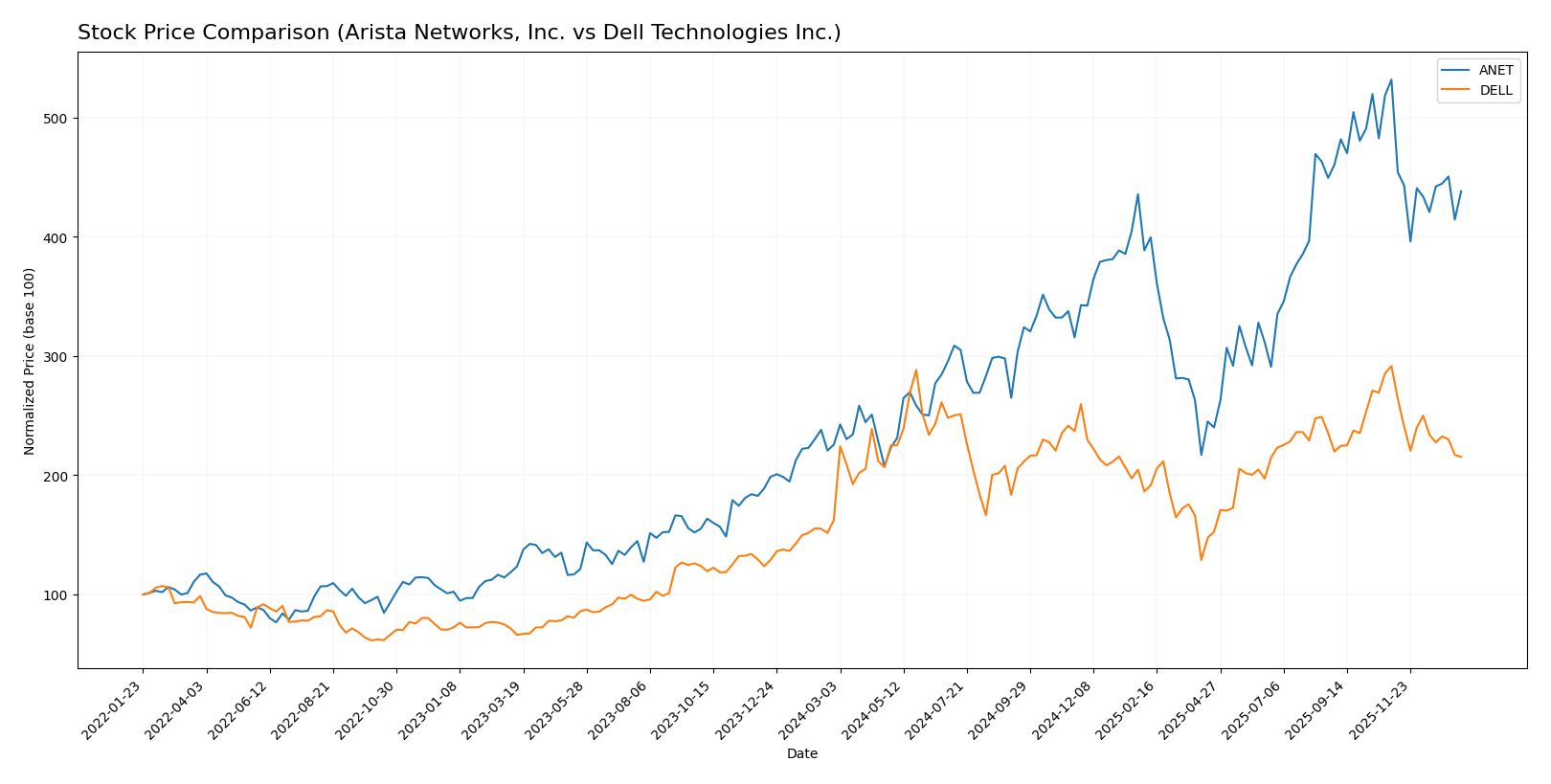

Stock Comparison

The stock price movements of Arista Networks, Inc. (ANET) and Dell Technologies Inc. (DELL) over the past 12 months reveal strong overall gains with recent downward pressure, reflecting decelerating bullish trends and shifting trading dynamics.

Trend Analysis

Arista Networks, Inc. displayed a bullish trend over the past year, with a 94.16% price increase. The trend shows deceleration, with recent price declines of 17.6% and reduced volatility at 9.26 std deviation.

Dell Technologies Inc. also experienced a bullish trend over the last 12 months, rising 32.44%. This trend is decelerating as well, with a recent 26.14% drop and increased volatility measured at 11.54 std deviation.

Comparing both, Arista Networks delivered a significantly higher market performance over the past year, despite recent downward corrections impacting both stocks.

Target Prices

Here is the consensus target price outlook from verified analysts for Arista Networks, Inc. and Dell Technologies Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Arista Networks, Inc. | 183 | 150 | 163 |

| Dell Technologies Inc. | 200 | 113 | 163.83 |

Analysts expect both stocks to trade significantly above current prices, with Arista’s consensus target about 25% above its $129.93 price and Dell’s target roughly 37% above its $119.70 price, indicating positive growth potential.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Arista Networks, Inc. and Dell Technologies Inc.:

Rating Comparison

Arista Networks, Inc. Rating

- Rating: B, considered very favorable by analysts

- Discounted Cash Flow Score: 3, indicating moderate valuation

- ROE Score: 5, very favorable efficiency in equity use

- ROA Score: 5, very favorable asset utilization

- Debt To Equity Score: 1, very unfavorable financial risk

- Overall Score: 3, moderate overall financial standing

Dell Technologies Inc. Rating

- Rating: C+, also considered very favorable

- Discounted Cash Flow Score: 3, indicating moderate valuation

- ROE Score: 1, very unfavorable efficiency in equity use

- ROA Score: 4, favorable asset utilization

- Debt To Equity Score: 1, very unfavorable financial risk

- Overall Score: 2, moderate overall financial standing

Which one is the best rated?

Based strictly on the provided data, Arista Networks, Inc. holds a better overall rating (B) and superior ROE and ROA scores compared to Dell Technologies Inc., which has a lower overall rating (C+) and weaker ROE performance.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Arista Networks and Dell Technologies:

Arista Networks Scores

- Altman Z-Score: 18.45, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 5, reflecting average financial strength.

Dell Technologies Scores

- Altman Z-Score: 1.93, placing Dell in the grey zone with moderate bankruptcy risk.

- Piotroski Score: 7, indicating strong financial health.

Which company has the best scores?

Arista Networks has a much higher Altman Z-Score, signaling strong financial stability, while Dell shows stronger Piotroski performance. Arista is safer from bankruptcy, but Dell demonstrates better overall financial strength.

Grades Comparison

The following is a comparison of the latest available grades and ratings for Arista Networks, Inc. and Dell Technologies Inc.:

Arista Networks, Inc. Grades

This table summarizes recent grades and actions from reputable grading companies for Arista Networks, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Upgrade | Overweight | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Piper Sandler | Maintain | Neutral | 2025-11-05 |

| Barclays | Maintain | Overweight | 2025-11-05 |

| Rosenblatt | Maintain | Neutral | 2025-11-05 |

| Morgan Stanley | Maintain | Overweight | 2025-10-10 |

| Needham | Maintain | Buy | 2025-09-16 |

| Wells Fargo | Maintain | Overweight | 2025-09-12 |

| JP Morgan | Maintain | Overweight | 2025-09-12 |

| Goldman Sachs | Maintain | Buy | 2025-09-12 |

Overall, Arista Networks demonstrates a consistent trend towards positive ratings, predominantly maintaining Overweight and Buy grades from well-known firms.

Dell Technologies Inc. Grades

This table summarizes recent grades and actions from reputable grading companies for Dell Technologies Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Outperform | 2025-11-26 |

| B of A Securities | Maintain | Buy | 2025-11-26 |

| Morgan Stanley | Maintain | Underweight | 2025-11-26 |

| UBS | Maintain | Buy | 2025-11-26 |

| Barclays | Maintain | Equal Weight | 2025-11-26 |

| B of A Securities | Maintain | Buy | 2025-11-20 |

| JP Morgan | Maintain | Overweight | 2025-11-17 |

| Morgan Stanley | Downgrade | Underweight | 2025-11-17 |

| Raymond James | Maintain | Outperform | 2025-10-21 |

| Argus Research | Maintain | Buy | 2025-10-09 |

Dell Technologies’ grades are mixed with several Buy and Outperform ratings but also include Underweight and Equal Weight opinions, indicating a more varied analyst outlook.

Which company has the best grades?

Arista Networks holds generally more favorable and stable grades, with multiple Overweight and Buy ratings and no negative grades reported. Dell shows a wider range of opinions, including some downgrades and Underweight ratings. This difference may influence investor perception of Arista as the more consistently rated stock between the two.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses of Arista Networks, Inc. (ANET) and Dell Technologies Inc. (DELL) based on their latest financial and operational data.

| Criterion | Arista Networks, Inc. (ANET) | Dell Technologies Inc. (DELL) |

|---|---|---|

| Diversification | Focused on high-growth networking products and services; limited product range | Broad portfolio including client solutions, infrastructure, and other segments |

| Profitability | High net margin (40.7%), strong ROE (28.5%), and ROIC (22.7%) | Lower net margin (4.8%), negative ROE (-309.9%), but favorable ROIC (14.7%) |

| Innovation | Very favorable economic moat with growing ROIC indicating durable competitive advantage | Also has a very favorable moat with rapidly growing ROIC, but lower profitability suggests margin pressures |

| Global presence | Operates globally but with more niche market focus | Extensive global footprint with diverse client base and infrastructure offerings |

| Market Share | Strong in cloud networking equipment with increasing revenues | Large market share in multiple technology segments but facing margin and liquidity challenges |

Key takeaways: Arista Networks excels in profitability and innovation with a focused product strategy, while Dell offers greater diversification and global scale but with weaker profitability metrics. Investors should weigh Arista’s high-margin niche leadership against Dell’s broader but more margin-pressured business model.

Risk Analysis

Below is a comparison of key risks for Arista Networks, Inc. (ANET) and Dell Technologies Inc. (DELL) based on the most recent 2025-2026 data.

| Metric | Arista Networks, Inc. (ANET) | Dell Technologies Inc. (DELL) |

|---|---|---|

| Market Risk | High beta (1.414) indicates higher volatility vs. market | Moderate beta (1.112) suggests moderate volatility |

| Debt level | No debt reported, very low financial leverage | Moderate debt with debt-to-assets ~31%, some financial risk |

| Regulatory Risk | Moderate, tech sector exposure to evolving data/privacy laws | Moderate, operates globally with compliance complexity |

| Operational Risk | Focus on cloud networking, dependency on tech innovation | Diverse IT solutions, operational complexity due to size |

| Environmental Risk | Moderate, standard tech industry footprint | Moderate, sustainability initiatives but large manufacturing base |

| Geopolitical Risk | Exposure to global markets, supply chain sensitivities | Similar exposure, with broader global footprint |

In synthesis, Dell’s moderate debt and operational complexity pose notable risks, especially given its “grey zone” Altman Z-Score signaling moderate financial distress probability. Arista’s risks lie more in market volatility and high valuation multiples, despite a strong balance sheet and “safe zone” bankruptcy risk. Investors should weigh Dell’s leverage and profitability challenges against Arista’s growth and valuation risks.

Which Stock to Choose?

Arista Networks, Inc. (ANET) has shown strong income growth with a 2024 revenue increase of 19.5% and a favorable net margin of 40.73%. Its financial ratios reveal robust profitability, low debt, and a “Very Favorable” rating, despite some valuation concerns on P/E and P/B ratios.

Dell Technologies Inc. (DELL) presents moderate income growth of 8.1% in 2025 with a lower net margin of 4.81%. Financial ratios indicate mixed performance with some favorable asset turnover but challenges in profitability and liquidity, yet it maintains a “Very Favorable” overall rating.

Investors seeking growth and strong profitability might find Arista’s consistent value creation and higher returns appealing, whereas those prioritizing established market presence and asset efficiency could see Dell as a slightly favorable choice, depending on risk tolerance and investment goals.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Arista Networks, Inc. and Dell Technologies Inc. to enhance your investment decisions: