In today’s fast-evolving technology landscape, Arista Networks, Inc. and D-Wave Quantum Inc. represent two compelling players pushing innovation in computer hardware. Arista focuses on cloud networking solutions, powering data centers globally, while D-Wave pioneers quantum computing systems with potential to revolutionize industries. Their market overlap and cutting-edge strategies make them intriguing investment candidates. This article will help you decide which company offers the most promising opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Arista Networks and D-Wave Quantum by providing an overview of these two companies and their main differences.

Arista Networks Overview

Arista Networks, Inc. develops, markets, and sells cloud networking solutions across multiple regions including the Americas, Europe, and Asia-Pacific. Its offerings include extensible operating systems, network applications, and gigabit Ethernet switching and routing platforms. The company supports diverse industries such as internet companies, financial services, and government agencies, positioning itself as a key player in high-performance cloud networking.

D-Wave Quantum Overview

D-Wave Quantum Inc. specializes in developing and delivering quantum computing systems, software, and services globally. Its product lineup features advanced quantum computers, cloud-based access, and programming tools tailored for industries like artificial intelligence, drug discovery, and financial modeling. The company serves sectors including manufacturing, logistics, and life sciences, emphasizing innovation in quantum computing applications.

Key similarities and differences

Both Arista Networks and D-Wave Quantum operate in the technology sector within the computer hardware industry and trade on the New York Stock Exchange. While Arista focuses on cloud networking solutions with a broad industry reach and larger scale, D-Wave targets quantum computing with specialized products and services for niche markets. The companies differ significantly in size, employee count, and technological focus but share a commitment to advancing complex computing technologies.

Income Statement Comparison

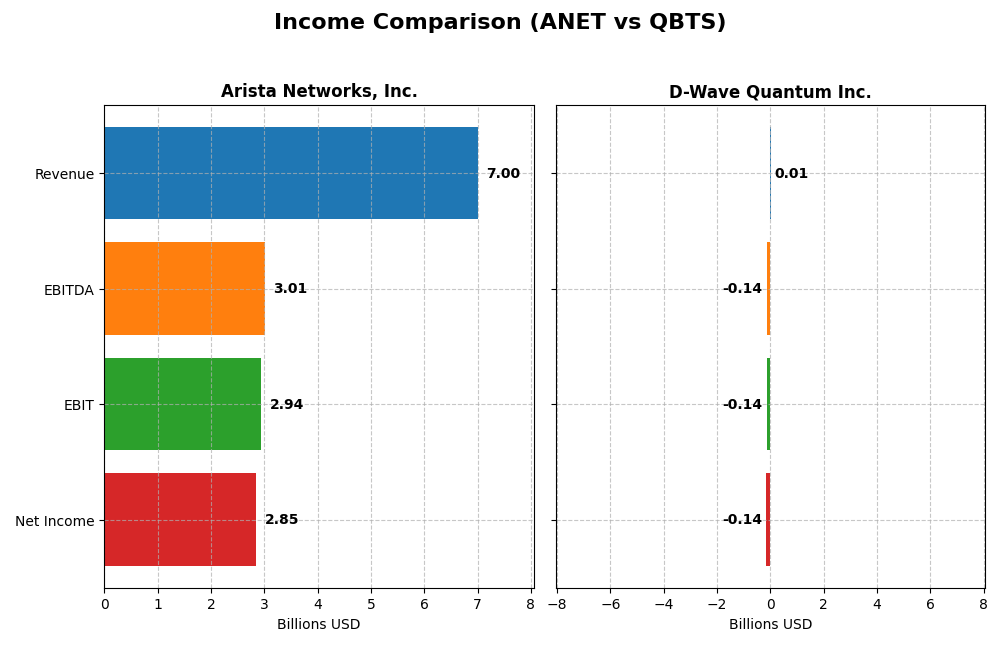

Below is a side-by-side comparison of the most recent fiscal year income statement metrics for Arista Networks, Inc. and D-Wave Quantum Inc.

| Metric | Arista Networks, Inc. (ANET) | D-Wave Quantum Inc. (QBTS) |

|---|---|---|

| Market Cap | 163.5B | 10.0B |

| Revenue | 7.00B | 8.83M |

| EBITDA | 3.01B | -138.1M |

| EBIT | 2.94B | -140.0M |

| Net Income | 2.85B | -143.9M |

| EPS | 2.27 | -0.75 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Arista Networks, Inc.

Arista Networks has demonstrated strong revenue growth, rising from $2.3B in 2020 to $7B in 2024, with net income increasing from $635M to $2.85B in the same period. Margins have improved consistently, with a gross margin of 64.13% and net margin of 40.73% in 2024. The year 2024 saw favorable growth, including a 19.5% revenue increase and a 14.34% net margin expansion.

D-Wave Quantum Inc.

D-Wave Quantum’s revenue grew from $5.16M in 2020 to $8.83M in 2024, showing modest progress. However, net income remains negative, widening to a $144M loss in 2024. Gross margin remains favorable at 63.02%, but EBIT and net margins are deeply negative, reflecting ongoing operational losses. The latest year showed a slight revenue increase of 0.79%, but net margin and EPS deteriorated.

Which one has the stronger fundamentals?

Considering the income statements, Arista Networks exhibits robust growth and healthy profitability with all key margin metrics favorable and improving. In contrast, D-Wave Quantum struggles with significant net losses and unfavorable margin metrics despite revenue growth. Arista’s consistent positive earnings and margin expansion indicate stronger financial fundamentals based solely on income statement analysis.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Arista Networks, Inc. (ANET) and D-Wave Quantum Inc. (QBTS) based on their most recent fiscal year data for 2024.

| Ratios | Arista Networks, Inc. (ANET) | D-Wave Quantum Inc. (QBTS) |

|---|---|---|

| ROE | 28.5% | -229.7% |

| ROIC | 22.7% | -45.0% |

| P/E | 48.7 | -11.2 |

| P/B | 13.9 | 25.8 |

| Current Ratio | 4.36 | 6.14 |

| Quick Ratio | 3.69 | 6.08 |

| D/E | 0.00 | 0.61 |

| Debt-to-Assets | 0.00 | 19.2% |

| Interest Coverage | 0 | -19.8 |

| Asset Turnover | 0.50 | 0.04 |

| Fixed Asset Turnover | 70.8 | 0.77 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Arista Networks, Inc.

Arista Networks shows strong profitability with favorable net margin (40.73%), ROE (28.54%), and ROIC (22.74%) ratios. However, it faces challenges with a high P/E of 48.69, elevated P/B of 13.89, and a current ratio of 4.36 flagged as unfavorable. The company does not pay dividends, likely prioritizing growth and reinvestment over shareholder distributions.

D-Wave Quantum Inc.

D-Wave Quantum reports weak financial health, with significantly negative net margin (-1629.99%), ROE (-229.67%), and ROIC (-45.01%). It has a high P/B of 25.76 and poor asset turnover metrics, signaling operational inefficiencies. The company also pays no dividends, reflecting its ongoing investment in R&D and growth during this early stage.

Which one has the best ratios?

Arista Networks exhibits a more favorable overall ratio profile with 57.14% favorable metrics and strong profitability, despite some valuation concerns. D-Wave Quantum’s ratios are predominantly unfavorable, with 71.43% negative indicators highlighting financial and operational weaknesses. Arista thus presents a comparatively stronger ratio set.

Strategic Positioning

This section compares the strategic positioning of Arista Networks and D-Wave Quantum, focusing on Market position, Key segments, and Exposure to technological disruption:

Arista Networks, Inc.

- Leading cloud networking provider with strong competitive presence in multiple global regions.

- Focuses on cloud networking hardware and software for diverse industries including internet, finance, and government.

- Positioned in established networking tech with moderate exposure to evolving cloud and networking technologies.

D-Wave Quantum Inc.

- Emerging quantum computing firm with niche market presence and growing competitive challenges.

- Develops quantum computing systems and services targeting AI, materials science, and financial sectors.

- Operates in a highly disruptive quantum computing sector with rapid technological advancements.

Arista Networks, Inc. vs D-Wave Quantum Inc. Positioning

Arista Networks shows a diversified approach targeting multiple industries with mature cloud networking solutions, while D-Wave concentrates on quantum computing innovation in emerging fields. Arista’s scale contrasts with D-Wave’s specialized, early-stage market focus.

Which has the best competitive advantage?

Arista Networks holds a very favorable moat with consistent value creation and growing profitability. D-Wave Quantum’s moat is slightly unfavorable, reflecting value destruction despite improving profitability trends.

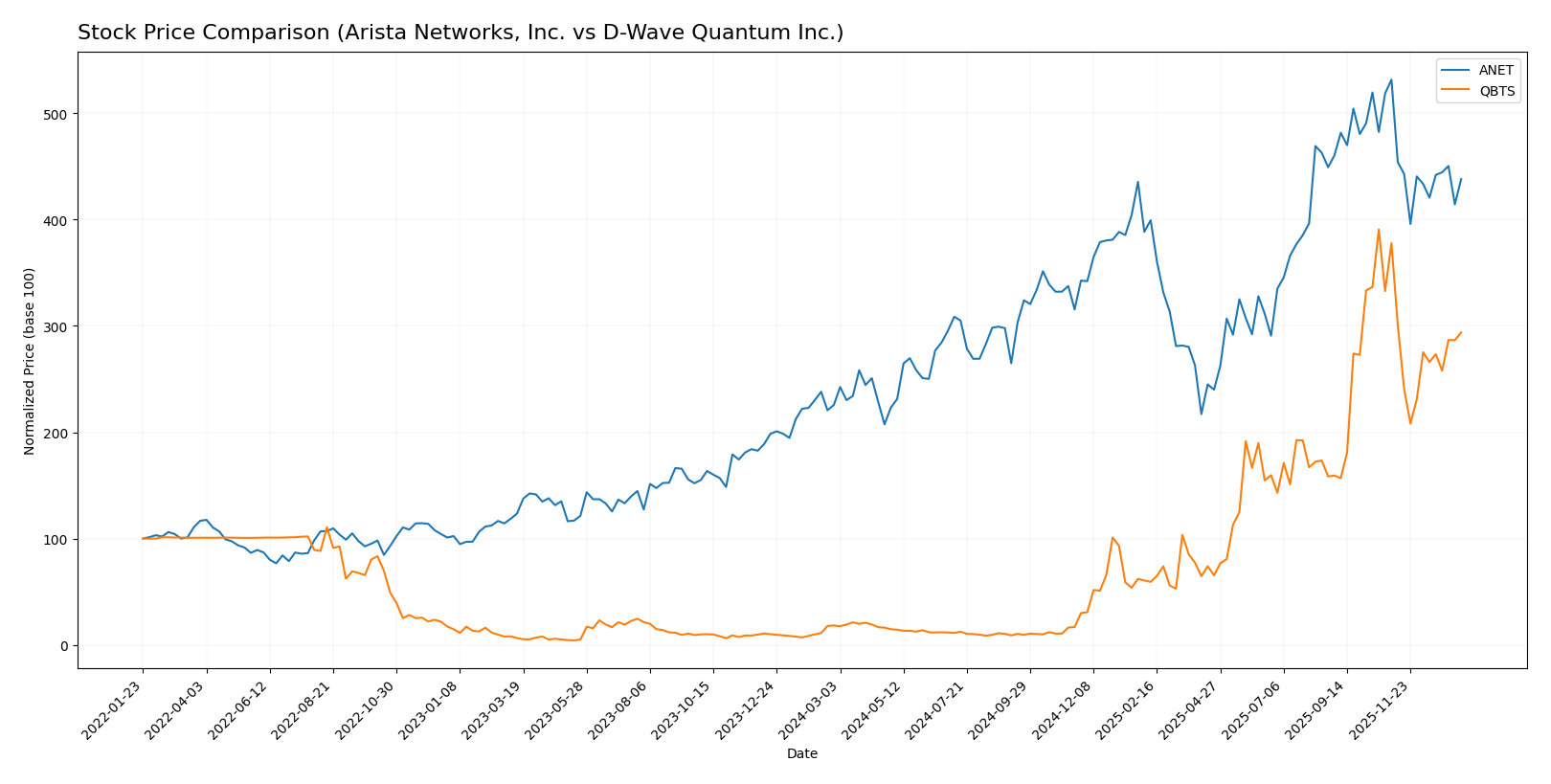

Stock Comparison

The stock price charts over the past 12 months reveal significant bullish trends for both Arista Networks, Inc. and D-Wave Quantum Inc., with notable deceleration in momentum and recent downward corrections in their price trajectories.

Trend Analysis

Arista Networks, Inc. (ANET) displayed a strong bullish trend over the past year with a 94.16% price increase, though the trend shows deceleration. The stock ranged from a low of 61.52 to a high of 157.69, with recent weakness marked by a -17.6% decline.

D-Wave Quantum Inc. (QBTS) experienced an exceptionally bullish trend with a 1510.06% price rise over the past year, also decelerating. The stock fluctuated between 0.84 and 38.33, but recently fell by -22.23%, showing slight seller dominance.

Comparing the two, QBTS delivered the highest market performance with a much larger price gain, though both stocks recently faced downward pressure in the same timeframe.

Target Prices

Analysts present a clear target consensus for Arista Networks, Inc. and D-Wave Quantum Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Arista Networks, Inc. | 183 | 150 | 163 |

| D-Wave Quantum Inc. | 46 | 26 | 38.88 |

The consensus target prices suggest upside potential for both stocks compared to their current prices of 129.93 for Arista Networks and 28.84 for D-Wave Quantum. Analysts expect moderate to strong growth prospects in the technology sector.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Arista Networks, Inc. and D-Wave Quantum Inc.:

Rating Comparison

ANET Rating

- Rating: B, indicating a very favorable overall assessment by analysts.

- Discounted Cash Flow Score: Moderate at 3, reflecting balanced cash flow valuation.

- ROE Score: Very favorable at 5, showing high efficiency in generating profits from equity.

- ROA Score: Very favorable at 5, demonstrating excellent asset utilization to generate earnings.

- Debt To Equity Score: Very unfavorable at 1, implying a high financial risk due to debt levels.

- Overall Score: Moderate at 3, representing a balanced but not outstanding overall financial health.

QBTS Rating

- Rating: C-, also marked as very favorable overall despite a lower letter grade.

- Discounted Cash Flow Score: Very unfavorable at 1, suggesting potential overvaluation risks.

- ROE Score: Very unfavorable at 1, indicating low efficiency in profit generation from equity.

- ROA Score: Very unfavorable at 1, reflecting poor asset utilization effectiveness.

- Debt To Equity Score: Favorable at 4, indicating relatively lower financial risk from debt load.

- Overall Score: Very unfavorable at 1, pointing to weak overall financial standing.

Which one is the best rated?

Based strictly on the provided data, Arista Networks (ANET) holds a higher letter rating and superior scores in profitability and overall assessment, despite weaker debt metrics. D-Wave Quantum (QBTS) shows strength in debt management but scores poorly in key profitability and valuation areas.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Arista Networks, Inc. and D-Wave Quantum Inc.:

ANET Scores

- Altman Z-Score: 18.45, indicating a safe zone.

- Piotroski Score: 5, classified as average.

QBTS Scores

- Altman Z-Score: 28.11, indicating a safe zone.

- Piotroski Score: 4, classified as average.

Which company has the best scores?

Both companies show a strong Altman Z-Score in the safe zone, with QBTS scoring higher. ANET has a slightly better Piotroski Score than QBTS, but both are average.

Grades Comparison

The following is a comparison of recent grades assigned to Arista Networks, Inc. and D-Wave Quantum Inc. by established grading companies:

Arista Networks, Inc. Grades

This table presents the latest available grades from recognized financial institutions for Arista Networks, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Upgrade | Overweight | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Piper Sandler | Maintain | Neutral | 2025-11-05 |

| Barclays | Maintain | Overweight | 2025-11-05 |

| Rosenblatt | Maintain | Neutral | 2025-11-05 |

| Morgan Stanley | Maintain | Overweight | 2025-10-10 |

| Needham | Maintain | Buy | 2025-09-16 |

| Wells Fargo | Maintain | Overweight | 2025-09-12 |

| JP Morgan | Maintain | Overweight | 2025-09-12 |

| Goldman Sachs | Maintain | Buy | 2025-09-12 |

Overall, the grades for Arista Networks show a consistent positive trend with multiple Overweight and Buy ratings maintained by top-tier firms.

D-Wave Quantum Inc. Grades

This table shows the recent grades issued by reputable firms for D-Wave Quantum Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rosenblatt | Maintain | Buy | 2026-01-08 |

| Rosenblatt | Maintain | Buy | 2026-01-07 |

| Benchmark | Maintain | Buy | 2025-11-10 |

| Rosenblatt | Maintain | Buy | 2025-11-07 |

| Canaccord Genuity | Maintain | Buy | 2025-11-07 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-11-07 |

| B. Riley Securities | Maintain | Buy | 2025-09-22 |

| Piper Sandler | Maintain | Overweight | 2025-08-08 |

| Benchmark | Maintain | Buy | 2025-08-04 |

| B. Riley Securities | Maintain | Buy | 2025-07-23 |

Grades for D-Wave Quantum indicate a stable Buy consensus with repeated Buy and Overweight recommendations from multiple respected analysts.

Which company has the best grades?

Both Arista Networks and D-Wave Quantum have received predominantly positive grades, with Arista showing a mix of Overweight and Buy ratings and D-Wave maintaining a strong Buy consensus. Arista’s broader coverage and recent upgrade suggest slightly stronger analyst confidence, potentially impacting investor sentiment and market positioning.

Strengths and Weaknesses

Below is a comparison table highlighting key strengths and weaknesses of Arista Networks, Inc. (ANET) and D-Wave Quantum Inc. (QBTS) based on the most recent financial and operational data.

| Criterion | Arista Networks, Inc. (ANET) | D-Wave Quantum Inc. (QBTS) |

|---|---|---|

| Diversification | Strong product and service revenue growth; broad market solutions | Limited revenue, mostly professional services; narrow product scope |

| Profitability | High net margin (40.7%), strong ROIC (22.7%) | Negative net margin (-1630%), negative ROIC (-45%) |

| Innovation | Durable competitive advantage with growing ROIC | Improving ROIC trend but overall value destroying; early-stage tech |

| Global presence | Established global presence with large product sales | Smaller scale with limited global footprint |

| Market Share | Significant market share in networking equipment | Emerging player in quantum computing sector |

Arista Networks demonstrates robust profitability, a durable competitive advantage, and strong diversification between products and services. In contrast, D-Wave Quantum is still developing its business model with negative profitability but shows improving operational efficiency, reflecting the risks and potential rewards of an early-stage quantum computing company. Investors should weigh Arista’s stability against D-Wave’s growth prospects and higher risk.

Risk Analysis

Below is a comparative table highlighting key risks for Arista Networks, Inc. (ANET) and D-Wave Quantum Inc. (QBTS) based on the latest available data from 2024:

| Metric | Arista Networks, Inc. (ANET) | D-Wave Quantum Inc. (QBTS) |

|---|---|---|

| Market Risk | Moderate (Beta 1.41) | High (Beta 1.56) |

| Debt level | Very Low (Debt-to-Equity 0) | Moderate (Debt-to-Equity 0.61) |

| Regulatory Risk | Moderate (US tech sector) | Moderate (Quantum tech, evolving regulations) |

| Operational Risk | Low (Established operations) | High (Emerging tech with scaling challenges) |

| Environmental Risk | Low (Data center energy use) | Low (Limited physical operations) |

| Geopolitical Risk | Moderate (US-based, global sales) | Moderate (Canadian base, global customers) |

The most impactful risks are QBTS’s operational and market volatility risks, given its emerging quantum computing technology and negative profitability metrics. ANET faces moderate market risk with strong financial stability but high valuation ratios suggest caution.

Which Stock to Choose?

Arista Networks, Inc. (ANET) shows strong income growth with a 2024 revenue increase of 19.5% and a net margin of 40.73%. Its financial ratios are mostly favorable, highlighting high profitability, zero debt, and a very favorable rating of B. The company demonstrates a very favorable moat with ROIC well above WACC and growing profitability.

D-Wave Quantum Inc. (QBTS) exhibits a modest 0.79% revenue growth in 2024 but suffers significant net margin losses at -1629.99%. Its financial ratios are largely unfavorable, with negative returns and moderate debt levels. Despite a very favorable overall rating of C-, QBTS shows a slightly unfavorable moat, indicating value destruction despite improving ROIC.

Investors focused on quality and stable profitability may find ANET’s consistent income growth, strong profitability, and durable competitive advantage more favorable. Conversely, those with a tolerance for high risk and potential growth in emerging technologies might see QBTS’s improving ROIC and large price appreciation as indicative of speculative opportunity.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Arista Networks, Inc. and D-Wave Quantum Inc. to enhance your investment decisions: