Home > Comparison > Financial Services > ARES vs NTRS

The strategic rivalry between Ares Management Corporation and Northern Trust Corporation shapes the evolving landscape of financial services. Ares operates as an alternative asset manager focusing on private equity, credit, and real estate investments. Northern Trust, by contrast, delivers wealth management and asset servicing for high-net-worth clients and institutions. This analysis explores which firm’s operational model and capital allocation strategy offer superior risk-adjusted returns for a diversified portfolio in this competitive sector.

Table of contents

Companies Overview

Ares Management Corporation and Northern Trust Corporation both hold pivotal roles in the asset management sector.

Ares Management Corporation: Alternative Asset Specialist

Ares Management Corporation dominates alternative asset management with a diversified revenue model spanning credit markets, direct lending, private equity, and real estate investments. Its strategic focus in 2026 emphasizes control or majority investments in under-capitalized companies and middle-market real estate financing, leveraging its expertise across the US, Europe, and Asia to deliver complex financing solutions.

Northern Trust Corporation: Comprehensive Wealth & Asset Manager

Northern Trust Corporation excels in wealth management and asset servicing for high-net-worth individuals and institutions. It generates revenue through asset servicing, investment management, and banking services, focusing in 2026 on enhancing multi-manager advisory capabilities and risk management solutions. Its client base includes corporations, retirement funds, and private families worldwide, supported by a broad spectrum of financial products.

Strategic Collision: Similarities & Divergences

While both firms operate in asset management, Ares pursues a control-oriented, alternative asset strategy, contrasting with Northern Trust’s client-centric wealth and asset servicing approach. They primarily compete in institutional asset management but differ in product focus and client segmentation. Ares offers high-conviction private market investments, whereas Northern Trust targets comprehensive fiduciary services, reflecting distinct risk and growth profiles for investors.

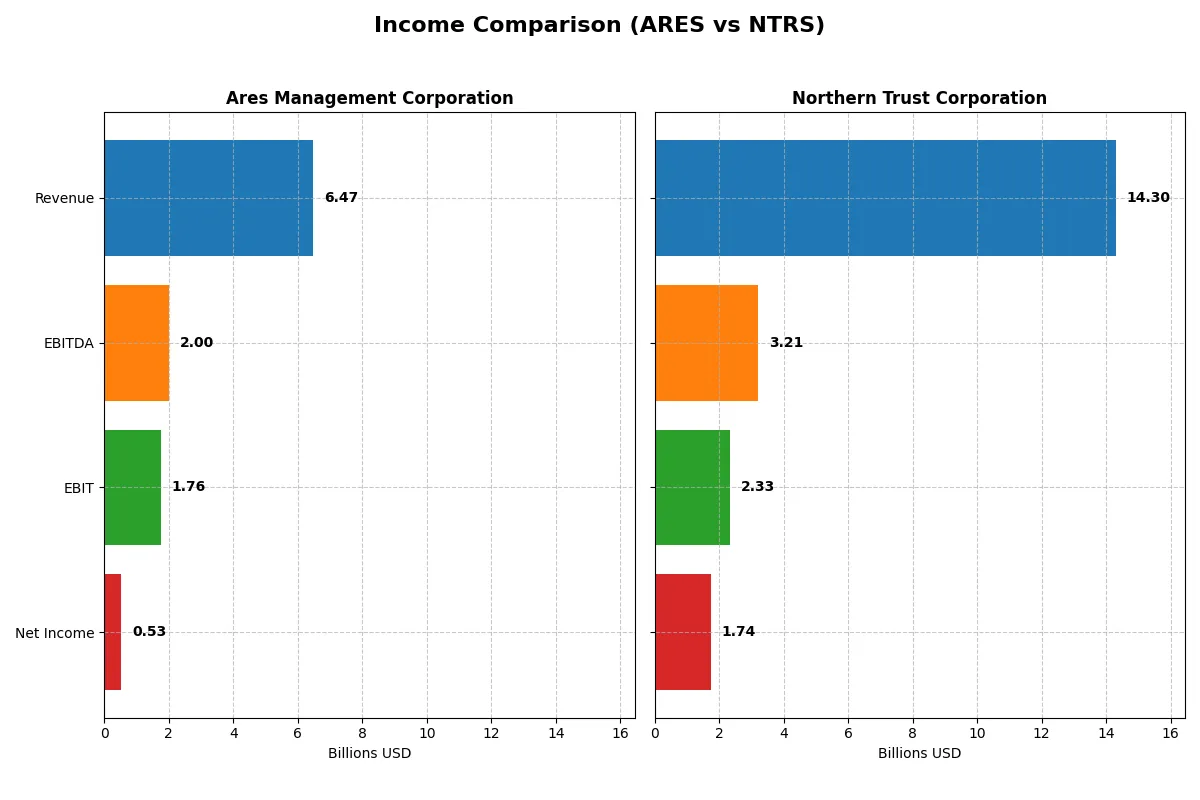

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Ares Management Corporation (ARES) | Northern Trust Corporation (NTRS) |

|---|---|---|

| Revenue | 6.47B | 14.30B |

| Cost of Revenue | 1.39B | 6.21B |

| Operating Expenses | 1.05B | 5.75B |

| Gross Profit | 1.94B | 8.09B |

| EBITDA | 2.00B | 3.21B |

| EBIT | 1.76B | 2.33B |

| Interest Expense | 0 | 6.21B |

| Net Income | 527M | 1.74B |

| EPS | 1.96 | 8.79 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals how efficiently each company transforms revenue into profit, highlighting their operational strength and financial discipline.

Ares Management Corporation Analysis

Ares shows a strong revenue climb, surging 67% in 2025 to $6.47B, with net income at $527M despite a one-year net margin dip to 8.15%. Gross margins remain healthy near 30%, but EBIT and net margin declines signal margin pressure. Recent momentum slows, reflecting operational challenges amid revenue growth.

Northern Trust Corporation Analysis

Northern Trust commands scale with $14.3B revenue in 2025, though down nearly 10% year-over-year. Its robust gross margin exceeds 56%, sustaining solid profitability with a 12.15% net margin. However, declining top-line and net margin trends highlight margin compression. Despite this, Northern Trust’s earnings remain substantially larger than Ares’.

Scale Dominance vs. Margin Resilience

Northern Trust’s sheer revenue and net income scale dwarf Ares, despite recent declines. Ares impresses with strong revenue growth and favorable margin stability but struggles with earnings momentum. For investors, Northern Trust offers size and margin power, while Ares presents a growth-driven, margin-challenged profile.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Ares Management Corporation (ARES) | Northern Trust Corporation (NTRS) |

|---|---|---|

| ROE | – | 13.40% |

| ROIC | – | 5.04% |

| P/E | 66.62 | 14.75 |

| P/B | 9.89 | 1.98 |

| Current Ratio | 0.98 | 0.41 |

| Quick Ratio | 0.98 | 0.41 |

| D/E | 3.71 | 1.27 |

| Debt-to-Assets | 52.84% | 9.27% |

| Interest Coverage | 0.97 | 0.38 |

| Asset Turnover | 0.16 | 0.08 |

| Fixed Asset Turnover | 5.64 | 30.78 |

| Payout ratio | 283% | 33% |

| Dividend yield | 3.74% | 2.27% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, revealing hidden risks and operational excellence beneath surface-level performance.

Ares Management Corporation

Ares posts a neutral net margin at 8.15%, but its ROE and ROIC stand at zero, signaling profitability concerns. The stock trades at an expensive P/E of 66.6, suggesting a stretched valuation. Ares offers a 2.77% dividend yield, supporting shareholder returns despite mixed operational efficiency.

Northern Trust Corporation

Northern Trust delivers a stronger 12.15% net margin with a solid 13.4% ROE and 5.04% ROIC, reflecting efficient capital use. Its P/E of 14.75 indicates a fair valuation. The company sustains shareholder returns through a 2.27% dividend yield, balancing profitability with prudent risk management.

Valuation Stretch vs. Operational Efficiency

Northern Trust offers a more balanced risk-reward profile with healthier profitability and reasonable valuation. Ares appears stretched on price and struggles on key returns. Investors seeking operational safety may prefer Northern Trust’s profile, while those tolerating valuation risk might study Ares more closely.

Which one offers the Superior Shareholder Reward?

I compare Ares Management Corporation (ARES) and Northern Trust Corporation (NTRS) by their dividend yields, payout ratios, and buyback intensity. ARES yields 3.7% with a high payout ratio above 280%, suggesting aggressive dividends possibly exceeding free cash flow. NTRS yields 2.3% with a conservative 33% payout ratio, signaling sustainable dividends supported by strong net income. ARES’s buyback activity is implied given its high leverage and payout, but sustainability is questionable. NTRS shows balanced capital allocation with steady dividends and buybacks, supported by solid margins and lower leverage. I find NTRS offers a more sustainable, attractive total return profile for 2026 investors prioritizing long-term value.

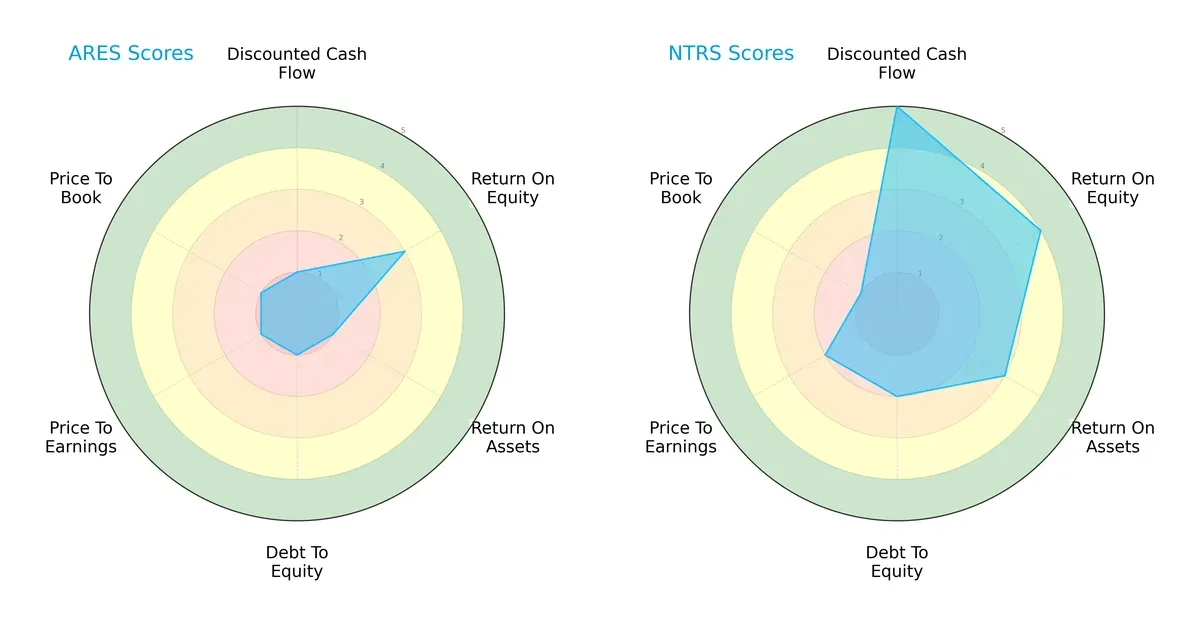

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of both firms, highlighting their financial strengths and vulnerabilities:

Northern Trust Corporation (NTRS) holds a more balanced profile with strong DCF (5) and ROE (4) scores, showing efficient capital use and valuation strength. Ares Management Corporation (ARES) relies heavily on moderate ROE (3) but suffers across DCF, ROA, debt, and valuation, signaling a fragile financial footing with concentrated weaknesses.

—

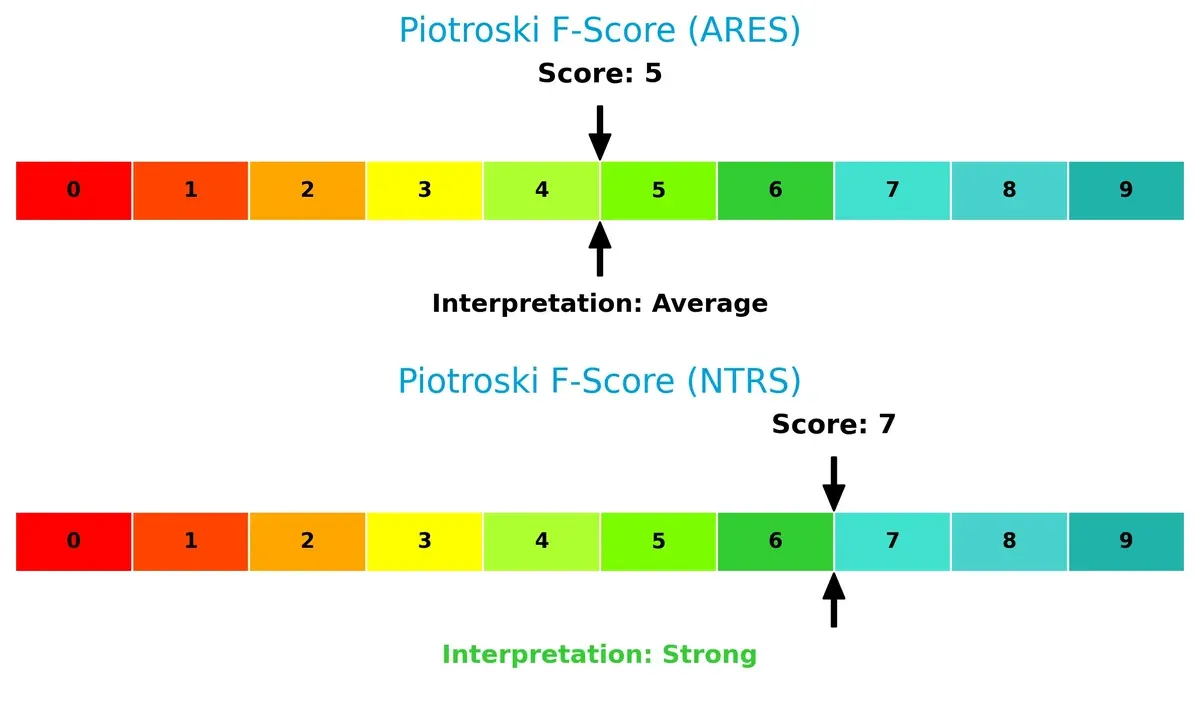

Financial Health: Quality of Operations

Northern Trust’s Piotroski F-Score of 7 reflects strong internal financial health, while Ares Management’s score of 5 signals average quality with some operational red flags:

How are the two companies positioned?

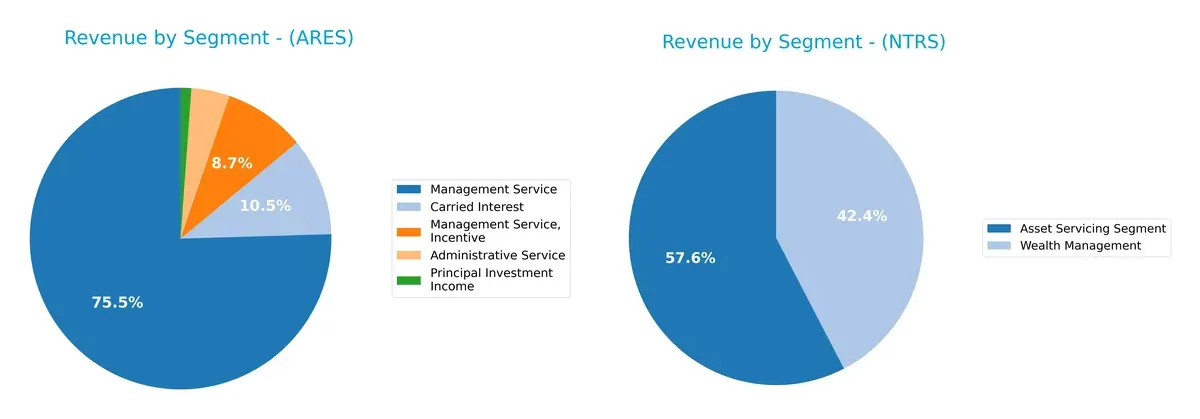

This section dissects the operational DNA of ARES and NTRS by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats to identify which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

The following visual comparison dissects how Ares Management Corporation and Northern Trust Corporation diversify their income streams and where their primary sector bets lie:

Ares Management anchors revenue in Management Service with $2.99B, complemented by significant Carried Interest at $417M, showing a strong focus on asset management fees and performance incentives. Northern Trust dwarfs with Asset Servicing at $4.37B and Wealth Management at $3.21B, revealing a more balanced, two-pronged approach. Ares’s concentration on management fees signals dependency on fund performance and client mandates, while Northern Trust’s diversified services reduce concentration risk and enhance ecosystem lock-in.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Ares Management Corporation and Northern Trust Corporation:

ARES Strengths

- Diverse revenue streams across management, carried interest, and principal investments

- Favorable debt to equity and debt to assets ratios

- Strong interest coverage

- Dividend yield at 2.77%

NTRS Strengths

- Higher net margin at 12.15%

- Strong fixed asset turnover of 30.78

- Favorable dividend yield of 2.27%

- Significant global presence with 2.24B foreign and 6.05B domestic revenue

ARES Weaknesses

- Unfavorable ROE and ROIC at 0%

- Poor liquidity ratios (current and quick ratio at 0)

- High P/E ratio at 66.62

- Unfavorable asset and fixed asset turnover

NTRS Weaknesses

- Unfavorable WACC at 16.65%

- Debt to equity ratio of 1.27 flagged as unfavorable

- Low current and quick ratios at 0.41

- Interest coverage below 1 at 0.38

Ares shows strengths in capital structure and dividend yield but struggles with profitability and liquidity. Northern Trust demonstrates better profitability and global scale but faces challenges in leverage and liquidity management. These differences highlight contrasting strategic focuses and operational risks.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only true shield protecting long-term profits from relentless competition erosion. Let’s dissect the fortresses of Ares Management and Northern Trust:

Ares Management Corporation: Diversified Alternative Asset Moat

Ares leverages broad alternative asset expertise, creating switching costs through tailored credit, private equity, and real estate solutions. Its stable 27% EBIT margin signals strong operational control. New market expansions in Asia could deepen its advantage despite recent margin pressures.

Northern Trust Corporation: Institutional Trust and Wealth Management Moat

Northern Trust’s moat rests on entrenched client relationships and asset servicing scale, contrasting Ares’s alternative focus. Despite a solid 56% gross margin, its declining ROIC and 43% interest expense reveal margin compression risks. Opportunities lie in digital wealth platforms and global custody services.

Asset Management Moats: Diversification Edge vs. Institutional Entrenchment

Ares’s diversified alternative asset base offers a wider moat with operational flexibility. Northern Trust’s moat is narrower, weakened by declining returns and higher financing costs. I see Ares better equipped to defend and grow market share amid evolving industry dynamics.

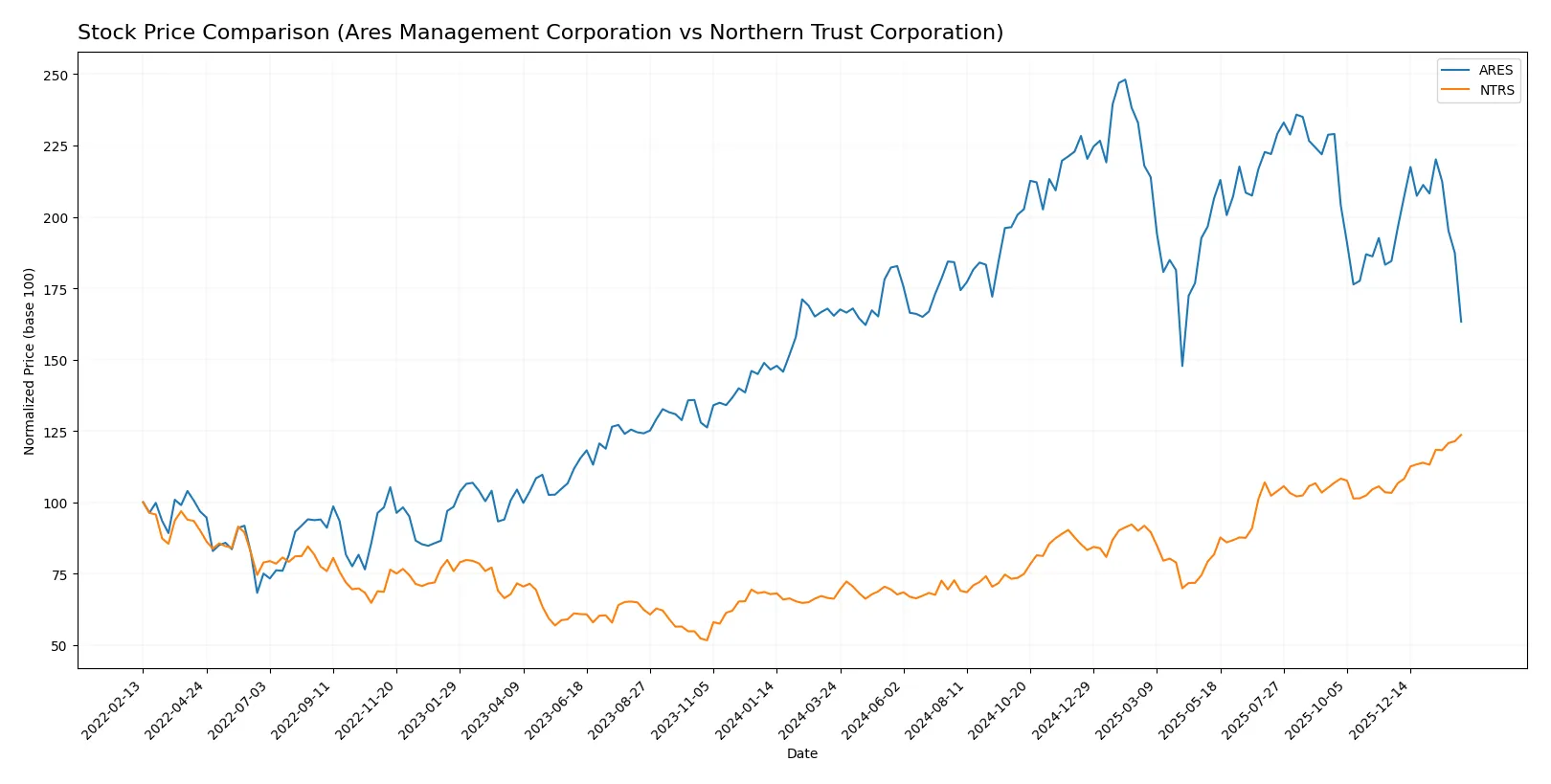

Which stock offers better returns?

The past year shows contrasting price dynamics: Ares Management Corporation declined slightly, while Northern Trust Corporation posted robust gains with accelerating momentum.

Trend Comparison

Ares Management Corporation’s stock fell 1.25% over the past 12 months, marking a bearish trend with deceleration. The price ranged between 118.04 and 198.22, showing moderate volatility.

Northern Trust Corporation’s stock rose 86.78% over 12 months, indicating a strong bullish trend with acceleration. The price fluctuated between 81.45 and 152.15, reflecting higher volatility than Ares.

Northern Trust clearly outperformed Ares, delivering substantially higher returns and accelerating positive momentum over the past year.

Target Prices

Analysts present a bullish consensus for Ares Management Corporation and Northern Trust Corporation with notable upside potential.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Ares Management Corporation | 155 | 215 | 187.29 |

| Northern Trust Corporation | 131 | 160 | 146.17 |

The consensus targets for both companies exceed their current prices, signaling strong analyst confidence in growth potential despite recent market volatility.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Ares Management Corporation Grades

Here are the latest institutional grades for Ares Management Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Oppenheimer | Maintain | Outperform | 2026-02-06 |

| Barclays | Maintain | Overweight | 2026-02-06 |

| TD Cowen | Maintain | Buy | 2026-01-14 |

| UBS | Maintain | Neutral | 2026-01-13 |

| Barclays | Maintain | Overweight | 2026-01-09 |

| Barclays | Maintain | Overweight | 2025-12-12 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-11-04 |

| TD Cowen | Maintain | Buy | 2025-11-04 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-21 |

| Oppenheimer | Upgrade | Outperform | 2025-10-14 |

Northern Trust Corporation Grades

Here are the latest institutional grades for Northern Trust Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Neutral | 2026-01-28 |

| Goldman Sachs | Maintain | Sell | 2026-01-28 |

| TD Cowen | Maintain | Buy | 2026-01-26 |

| RBC Capital | Maintain | Outperform | 2026-01-23 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-23 |

| Evercore ISI Group | Maintain | In Line | 2026-01-23 |

| Morgan Stanley | Maintain | Underweight | 2026-01-23 |

| TD Cowen | Maintain | Buy | 2026-01-07 |

| Barclays | Maintain | Equal Weight | 2026-01-05 |

| Citigroup | Maintain | Neutral | 2025-12-30 |

Which company has the best grades?

Ares Management Corporation consistently receives higher ratings such as Outperform and Overweight. Northern Trust shows mixed grades, including Sell and Underweight. Ares’s superior institutional grades suggest stronger market confidence, potentially attracting more investor interest.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Ares Management Corporation

- Operates in alternative asset management with intense competition from private equity and credit funds.

Northern Trust Corporation

- Diversified financial services face competition in wealth management and asset servicing from large banks and fintech disruptors.

2. Capital Structure & Debt

Ares Management Corporation

- Favorable debt levels with strong interest coverage, indicating low financial risk.

Northern Trust Corporation

- Higher debt-to-equity ratio and weak interest coverage signal potential leverage concerns.

3. Stock Volatility

Ares Management Corporation

- Beta of 1.54 suggests higher volatility than the market, increasing risk in turbulent times.

Northern Trust Corporation

- Beta of 1.28 indicates moderate volatility but more stable than Ares.

4. Regulatory & Legal

Ares Management Corporation

- Exposure to regulatory scrutiny in multiple jurisdictions due to global credit and private equity activities.

Northern Trust Corporation

- Faces complex regulations in wealth management and asset servicing, especially with fiduciary duties and compliance costs.

5. Supply Chain & Operations

Ares Management Corporation

- Operations depend heavily on deal flow and capital deployment efficiency; disruptions could impair earnings.

Northern Trust Corporation

- Relies on technology infrastructure and operational efficiency; cyber risks and system failures could impact trust.

6. ESG & Climate Transition

Ares Management Corporation

- ESG integration critical due to investment in real estate and private equity, facing rising investor demands.

Northern Trust Corporation

- Strong emphasis on sustainable investing and ESG risk management, but transition costs could pressure margins.

7. Geopolitical Exposure

Ares Management Corporation

- Global presence in US, Europe, Asia exposes firm to geopolitical tensions and currency risks.

Northern Trust Corporation

- Also globally diversified but with larger workforce and operations possibly more sensitive to geopolitical disruptions.

Which company shows a better risk-adjusted profile?

Ares’s most impactful risk lies in market volatility and valuation pressure, given its high beta and unfavorable valuation metrics. Northern Trust’s critical risk is its leveraged capital structure combined with weak interest coverage. Despite these, Northern Trust’s stronger profitability and operational diversification support a better risk-adjusted profile. The recent data show Northern Trust’s higher Piotroski score (7 vs. 5) and Altman Z-Score placing it in distress zone, indicating caution but more stability compared to Ares’s unfavorable financial ratios and very unfavorable ratings. Overall, Northern Trust balances risks better amid 2026 market uncertainties.

Final Verdict: Which stock to choose?

Ares Management Corporation’s superpower lies in its ability to generate strong operating margins despite a challenging macro environment. Its efficiency in managing expenses supports solid cash flow generation. However, I view its weak liquidity position as a point of vigilance. Ares suits investors targeting aggressive growth with a tolerance for short-term volatility.

Northern Trust Corporation boasts a strategic moat rooted in its consistent recurring revenue and strong asset turnover, underscoring operational excellence. Relative to Ares, it offers better stability and a more appealing valuation multiple. Northern Trust fits well with investors seeking growth at a reasonable price and a more balanced risk profile.

If you prioritize high-margin cash flow and can weather liquidity risks, Ares appears compelling for aggressive growth seekers. However, if you seek better stability and valuation discipline, Northern Trust outshines as a more balanced choice with a durable strategic moat. Both represent distinct analytical scenarios aligned with different investor appetites.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Ares Management Corporation and Northern Trust Corporation to enhance your investment decisions: