Home > Comparison > Consumer Defensive > ADM vs SFD

The strategic rivalry between Archer-Daniels-Midland Company and Smithfield Foods Inc shapes the Consumer Defensive sector’s landscape. ADM operates as a capital-intensive agricultural commodities processor with diversified nutritional ingredients. In contrast, Smithfield Foods focuses on packaged meats and hog production, blending manufacturing with integrated livestock operations. This analysis evaluates which company’s operational model and growth trajectory offer the superior risk-adjusted return for a diversified portfolio in today’s evolving market environment.

Table of contents

Companies Overview

Archer-Daniels-Midland Company and SMITHFIELD FOODS INC stand as key players in agricultural products, shaping food supply chains globally.

Archer-Daniels-Midland Company: Global Agricultural Commodities Leader

Dominating the agricultural farm products sector, Archer-Daniels-Midland Company generates revenue by procuring, processing, and merchandising agricultural commodities worldwide. Its core business spans oilseeds, corn, and wheat, extending to food ingredients and biofuels. In 2026, the company sharpened its focus on expanding ingredient solutions for food and nutrition markets, leveraging its extensive supply chain to maintain competitive advantage.

SMITHFIELD FOODS INC: Packaged Meats Powerhouse

Smithfield Foods leads in packaged meats, processing fresh pork into branded products like bacon and sausages for retail and foodservice. Its revenue engine combines fresh pork processing with hog production and bioscience operations, including pharmaceutical ingredient manufacturing. In 2026, Smithfield prioritized expanding international exports and optimizing its vertically integrated hog farming to enhance efficiency.

Strategic Collision: Similarities & Divergences

Both companies operate in the consumer defensive sector but differ fundamentally in strategy. Archer-Daniels-Midland relies on a diversified agricultural commodity platform, while Smithfield emphasizes a vertically integrated meat processing and hog production model. They compete primarily in supplying food ingredients and protein products. Their distinct business models create contrasting investment profiles, with ADM offering broad commodity exposure and Smithfield focusing on specialized protein market dominance.

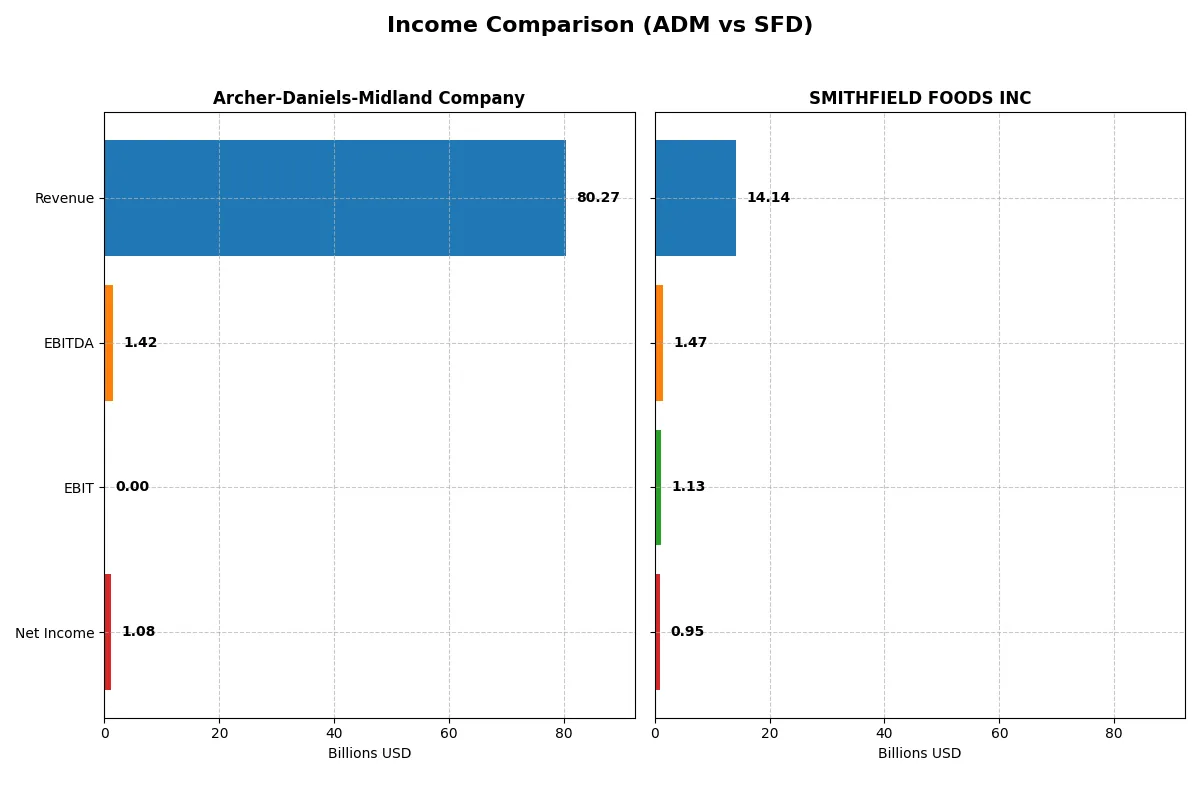

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Archer-Daniels-Midland Company (ADM) | SMITHFIELD FOODS INC (SFD) |

|---|---|---|

| Revenue | 80.3B | 14.1B |

| Cost of Revenue | 75.2B | 12.2B |

| Operating Expenses | 3.6B | 780M |

| Gross Profit | 5.0B | 1.9B |

| EBITDA | 1.4B | 1.5B |

| EBIT | 0 | 1.1B |

| Interest Expense | 118M | 66M |

| Net Income | 1.1B | 953M |

| EPS | 2.23 | 2.42 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison exposes how efficiently each company converts sales into profits, revealing their operational strengths and weaknesses.

Archer-Daniels-Midland Company Analysis

ADM’s revenue steadily declined from 102B in 2022 to 80B in 2025. Net income followed suit, plunging from 4.3B in 2022 to 1.1B in 2025. Gross margin at 6.3% remains thin, and the net margin of 1.3% signals weak profitability. The 2025 collapse in EBIT to zero highlights deteriorating earnings power and efficiency.

SMITHFIELD FOODS INC Analysis

SFD’s revenue dropped mildly from 16.2B in 2022 to 14.1B in 2024, but net income surged from 870M to 953M. Gross margin improved impressively to 13.4%, with net margin at a healthy 6.7%. The company reversed a 2023 loss to generate 1.1B operating income in 2024, showing strong operational momentum and margin expansion.

Margin Resilience vs. Revenue Decline

SFD outperforms ADM fundamentally with superior margin health and net income growth despite a slight revenue dip. ADM’s sharp earnings decline and margin contraction over five years flag serious efficiency issues. SFD’s profile appeals to investors prioritizing profitability and margin resilience over mere scale.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Archer-Daniels-Midland Company (ADM) | SMITHFIELD FOODS INC (SFD) |

|---|---|---|

| ROE | 8.12% (2024) | 16.34% (2024) |

| ROIC | 4.51% (2024) | 8.86% (2024) |

| P/E | 13.42x (2024) | 9.97x (2024) |

| P/B | 1.09x (2024) | 1.63x (2024) |

| Current Ratio | 1.39 (2024) | 2.46 (2024) |

| Quick Ratio | 0.81 (2024) | 1.05 (2024) |

| D/E (Debt-to-Equity) | 0.52 (2024) | 0.40 (2024) |

| Debt-to-Assets | 21.66% (2024) | 21.33% (2024) |

| Interest Coverage | 2.93x (2024) | 16.94x (2024) |

| Asset Turnover | 1.61 (2024) | 1.28 (2024) |

| Fixed Asset Turnover | 7.01 (2024) | 4.03 (2024) |

| Payout ratio | 54.72% (2024) | 30.22% (2024) |

| Dividend yield | 4.08% (2024) | 3.03% (2024) |

| Fiscal Year | 2024 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, exposing hidden risks and operational strengths critical for investment decisions.

Archer-Daniels-Midland Company (ADM)

ADM shows weak profitability with a negligible ROE and a low net margin of 1.34%, signaling operational challenges. Its P/E ratio of 25.81 suggests an expensive valuation relative to earnings. The company supports shareholders through a 3.55% dividend yield, indicating a preference for income distribution over reinvestment.

SMITHFIELD FOODS INC (SFD)

SFD delivers strong profitability with a 16.34% ROE and a solid net margin of 6.74%. Its P/E of 9.97 makes the stock appear attractively valued. SFD maintains a 3.03% dividend yield, balancing shareholder returns with sufficient capital for operational efficiency, as shown by favorable asset turnover ratios.

Robust Profitability Meets Valuation Discipline

SMITHFIELD FOODS offers a better balance of profitability and valuation metrics, with mostly favorable ratios indicating operational efficiency and sustainable returns. ADM’s stretched valuation and weak profitability suggest higher risk. Investors seeking growth with operational safety may prefer SMITHFIELD’s profile.

Which one offers the Superior Shareholder Reward?

Archer-Daniels-Midland Company (ADM) and Smithfield Foods Inc (SFD) both distribute shareholder returns through dividends and buybacks, but their approaches differ markedly. ADM yields a 3.5–4.1% dividend with a payout ratio around 55–90%, signaling strong free cash flow coverage and a commitment to steady income. ADM also maintains solid buyback programs, enhancing total returns while preserving financial flexibility. Conversely, SFD offers a slightly lower dividend yield near 3%, with a 30% payout ratio and modest buybacks. SFD reinvests heavily in operational growth, supported by wider margins and higher operating cash flow ratios. I find ADM’s blend of robust dividend yield, sustainable payout ratios, and disciplined buybacks delivers a superior total return profile for 2026 investors seeking reliable income plus capital appreciation. SFD’s model favors growth but carries more risk due to less cash returned to shareholders.

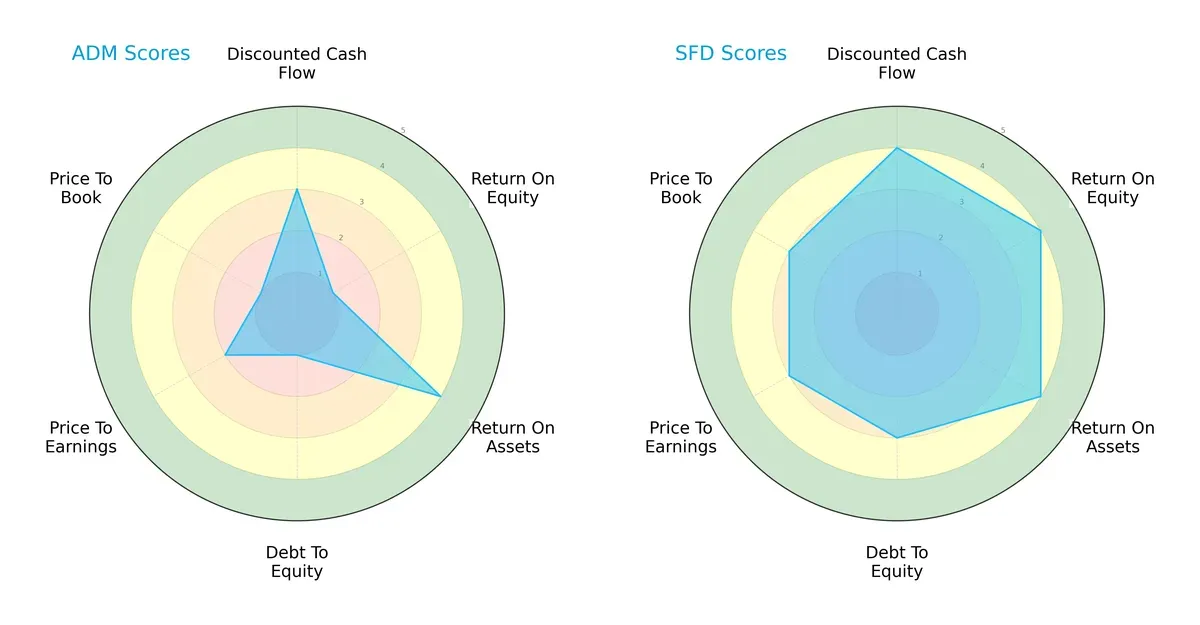

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Archer-Daniels-Midland Company and SMITHFIELD FOODS INC, highlighting their core financial strengths and vulnerabilities:

SMITHFIELD FOODS INC demonstrates a more balanced and favorable profile with strong DCF, ROE, and ROA scores, and moderate leverage and valuation metrics. Archer-Daniels-Midland Company shows strength in asset utilization (ROA) but suffers from weak equity returns, high debt levels, and unfavorable valuation ratios. SMITHFIELD leverages consistent profitability, while ADM relies heavily on asset efficiency amid financial risk.

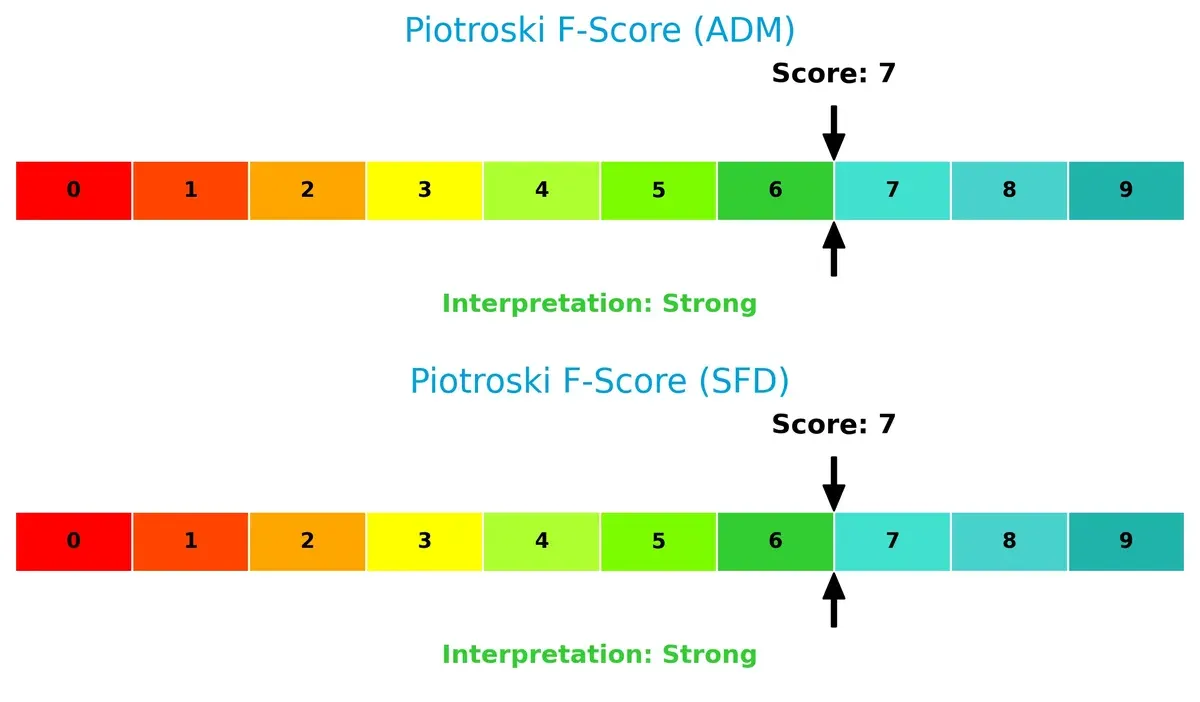

Financial Health: Quality of Operations

Both Archer-Daniels-Midland Company and SMITHFIELD FOODS INC score a strong 7 on the Piotroski F-Score, indicating robust financial health. Their internal metrics show no red flags, reflecting solid profitability, liquidity, and operational efficiency:

How are the two companies positioned?

This section dissects ADM and SFD’s operational DNA by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats to identify the more resilient, sustainable competitive advantage in today’s market.

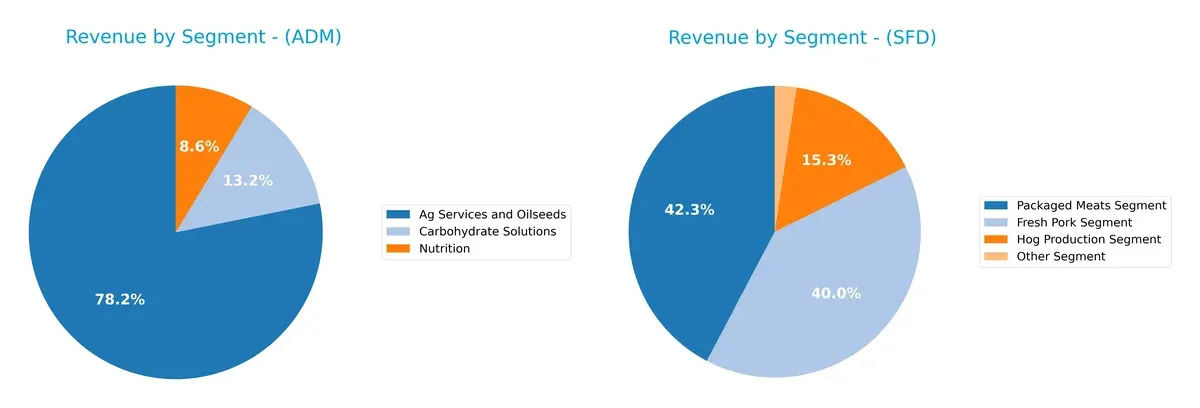

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Archer-Daniels-Midland Company and SMITHFIELD FOODS INC diversify their income streams and where their primary sector bets lie:

ADM anchors its revenue in Ag Services and Oilseeds with $66.5B in 2024, dwarfing Carbohydrate Solutions ($11.2B) and Nutrition ($7.3B). This concentration signals a strategic focus on agricultural commodities and ecosystem dominance. In contrast, SMITHFIELD splits its 2024 revenue more evenly, with Packaged Meats at $8.3B and Fresh Pork at $7.9B, plus Hog Production at $3B. Smithfield’s mix reflects a balanced approach, reducing concentration risk while anchoring in protein supply infrastructure.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of ADM and SFD based on diversification, profitability, financials, innovation, global presence, and market share:

ADM Strengths

- Highly diversified revenue streams across Ag Services, Carbohydrates, and Nutrition

- Strong global footprint with significant sales in U.S., Switzerland, and other countries

- Favorable debt-to-equity and debt-to-assets ratios

- Attractive dividend yield of 3.55%

SFD Strengths

- Strong profitability metrics with favorable ROE and net margin

- Robust liquidity ratios and interest coverage

- Efficient asset turnover ratios

- Favorable valuation metrics with low P/E and stable P/B

- Solid U.S. market presence with diversified meat product segments

ADM Weaknesses

- Unfavorable profitability ratios including ROE, ROIC, and net margin

- Weak liquidity ratios with zero current and quick ratios reported

- Negative interest coverage and asset turnover ratios

- Unavailable WACC and unfavorable P/E ratio

SFD Weaknesses

- Neutral ROIC and P/B ratios indicate room for improvement

- Limited international revenue compared to domestic sales

- Dependence on U.S. market for majority of revenues

Overall, ADM shows broad diversification and a global presence but struggles with profitability and liquidity metrics. SFD delivers strong profitability and financial health, though it relies heavily on the U.S. market and faces some neutral efficiency indicators. These contrasting profiles suggest distinct strategic priorities for each company.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat protects long-term profits from relentless competition erosion. Without it, market share and pricing power vanish quickly:

Archer-Daniels-Midland Company (ADM): Scale and Global Network Moat

ADM leverages vast global sourcing and distribution networks to maintain cost advantages and stable margins. Yet, declining ROIC and shrinking revenue signal mounting pressure on its moat in 2026.

SMITHFIELD FOODS INC (SFD): Brand and Operational Efficiency Moat

Smithfield’s strong brand portfolio and efficient vertical integration yield high ROIC above WACC. Its improving margins and profitability growth suggest a deepening moat with expansion potential in packaged meats.

Scale Network vs. Brand Integration: Who Defends Better?

ADM’s scale is impressive but undermined by declining returns and profitability. Smithfield boasts a wider, growing moat through brand strength and operational efficiency. I see Smithfield as better positioned to defend market share in this cycle.

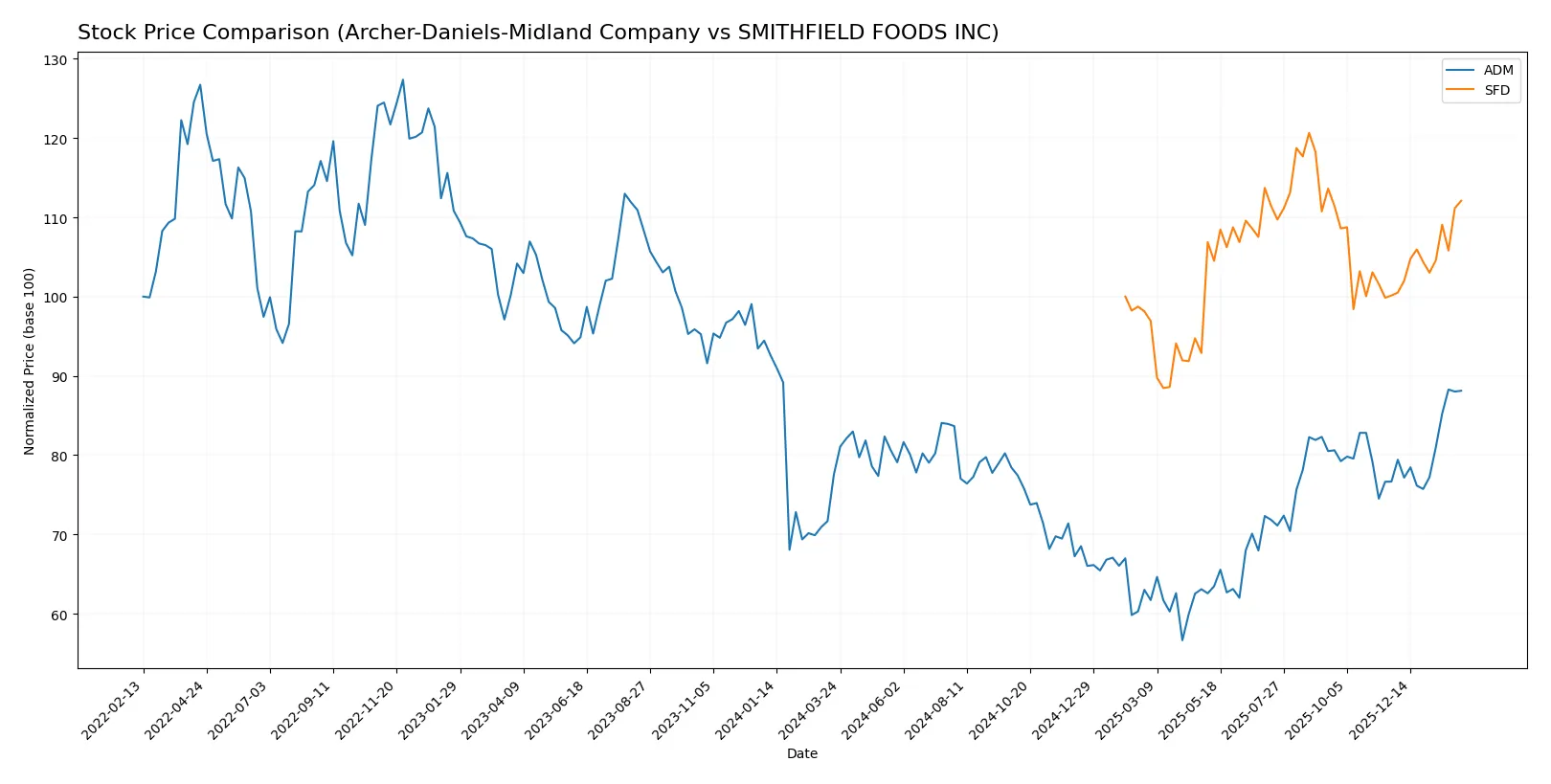

Which stock offers better returns?

The stock prices of Archer-Daniels-Midland Company and Smithfield Foods Inc have shown clear bullish trends over the past 12 months, with notable acceleration phases and distinct trading volume dynamics.

Trend Comparison

Archer-Daniels-Midland Company’s stock rose 13.62% over the past year, showing an accelerating bullish trend with a high volatility of 5.92 and price ranging from 43.32 to 67.51.

Smithfield Foods Inc posted a 12.09% increase in the same period, also accelerating bullish but with lower volatility at 1.67 and prices between 19.02 and 25.94.

ADM’s stronger percentage gain and higher volatility indicate a more dynamic market performance compared to SFD, which showed steadier price appreciation.

Target Prices

Analysts present a cautious consensus on target prices for Archer-Daniels-Midland Company and SMITHFIELD FOODS INC.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Archer-Daniels-Midland Company | 50 | 59 | 54.5 |

| SMITHFIELD FOODS INC | 29 | 30 | 29.5 |

The target consensus for ADM and SFD sits below their current prices, signaling analyst expectations for potential valuation reversion or moderation in share price appreciation.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here are the latest institutional grades for Archer-Daniels-Midland Company and SMITHFIELD FOODS INC:

Archer-Daniels-Midland Company Grades

The table below summarizes recent grades from key financial institutions for ADM.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Underweight | 2026-01-21 |

| Morgan Stanley | Downgrade | Underweight | 2025-12-16 |

| JP Morgan | Downgrade | Underweight | 2025-11-05 |

| Morgan Stanley | Maintain | Equal Weight | 2025-08-12 |

| UBS | Maintain | Buy | 2025-08-11 |

| Barclays | Upgrade | Equal Weight | 2025-08-06 |

| Barclays | Maintain | Underweight | 2025-07-02 |

| UBS | Upgrade | Buy | 2025-05-19 |

| B of A Securities | Downgrade | Underperform | 2025-05-08 |

| Citigroup | Maintain | Neutral | 2025-04-15 |

SMITHFIELD FOODS INC Grades

Below are the recent grades from reputable firms for SFD.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Maintain | Buy | 2025-10-08 |

| Barclays | Maintain | Overweight | 2025-08-13 |

| UBS | Maintain | Buy | 2025-08-13 |

| Morgan Stanley | Maintain | Overweight | 2025-08-13 |

Which company has the best grades?

SMITHFIELD FOODS INC consistently earns Buy and Overweight ratings, reflecting stronger institutional confidence. ADM shows several downgrades to Underweight, signaling caution. Investors may view SFD’s grades as more favorable.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing Archer-Daniels-Midland Company and SMITHFIELD FOODS INC in the 2026 market environment:

1. Market & Competition

Archer-Daniels-Midland Company

- Faces intense competition in global agricultural commodities, impacting margins.

SMITHFIELD FOODS INC

- Operates in a competitive packaged meats sector, leveraging strong brand portfolio.

2. Capital Structure & Debt

Archer-Daniels-Midland Company

- Favorable debt-to-equity metrics but weak interest coverage signals risk in servicing debt.

SMITHFIELD FOODS INC

- Maintains moderate leverage with strong interest coverage and solid liquidity positions.

3. Stock Volatility

Archer-Daniels-Midland Company

- Beta of 0.68 indicates moderate stock volatility relative to the market.

SMITHFIELD FOODS INC

- Extremely low beta (0.15) shows minimal price swings and defensive stock behavior.

4. Regulatory & Legal

Archer-Daniels-Midland Company

- Exposed to international trade policies affecting commodity flows and tariffs.

SMITHFIELD FOODS INC

- Faces regulatory scrutiny in food safety and environmental compliance in multiple jurisdictions.

5. Supply Chain & Operations

Archer-Daniels-Midland Company

- Complex global supply chain vulnerable to geopolitical disruptions and agricultural cycles.

SMITHFIELD FOODS INC

- Relies on contract farmers and owned farms, which can mitigate but also expose operational risks.

6. ESG & Climate Transition

Archer-Daniels-Midland Company

- Agriculture sector faces pressure to reduce emissions and improve sustainability.

SMITHFIELD FOODS INC

- Meat production faces heightened ESG scrutiny, including animal welfare and carbon footprint issues.

7. Geopolitical Exposure

Archer-Daniels-Midland Company

- Significant exposure to global markets, sensitive to trade tensions and export restrictions.

SMITHFIELD FOODS INC

- Export markets include China and Mexico, vulnerable to diplomatic and trade policy shifts.

Which company shows a better risk-adjusted profile?

SMITHFIELD FOODS INC presents a superior risk-adjusted profile. ADM’s most impactful risk lies in weak profitability and debt servicing despite favorable leverage ratios. Conversely, Smithfield benefits from strong financial ratios, low volatility, and robust liquidity. Smithfield’s Altman Z-score firmly places it in the safe zone, while ADM’s financials reflect moderate distress signals. This contrast underlines Smithfield’s more resilient position in the 2026 market environment.

Final Verdict: Which stock to choose?

Archer-Daniels-Midland Company (ADM) stands out for its resilience as a cash-generating powerhouse in the agricultural sector. Its ability to maintain steady free cash flow despite margin pressures is impressive. However, a declining return on capital and subdued profitability are points of vigilance. ADM might suit portfolios focused on income and value with a tolerance for cyclical risk.

Smithfield Foods Inc (SFD) boasts a robust strategic moat, underpinned by strong operational efficiency and improving returns on invested capital. Its healthier balance sheet and favorable earnings growth profile offer greater stability versus ADM. SFD could appeal to investors seeking growth at a reasonable price with a preference for durable profitability.

If you prioritize steady income and deep sector experience, ADM presents a compelling scenario due to its cash flow reliability despite margin headwinds. However, if you seek growth combined with financial strength and a clear value-creating moat, Smithfield Foods outshines ADM by offering better stability and improving profitability metrics. Each aligns with distinct investor profiles balancing risk and reward.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Archer-Daniels-Midland Company and SMITHFIELD FOODS INC to enhance your investment decisions: