Home > Comparison > Consumer Cyclical > APTV vs MBLY

The strategic rivalry between Aptiv PLC and Mobileye Global Inc. shapes the future of the automotive parts sector. Aptiv operates as a capital-intensive manufacturer of electrical and safety vehicle components, while Mobileye focuses on high-tech autonomous driving and advanced driver assistance systems. This head-to-head highlights a contest between traditional industrial scale and cutting-edge innovation. This analysis aims to identify which trajectory offers a superior risk-adjusted outlook for a diversified portfolio in this evolving sector.

Table of contents

Companies Overview

Aptiv PLC and Mobileye Global Inc. shape the future of automotive technology with distinct yet overlapping market roles.

Aptiv PLC: Global Auto Parts Innovator

Aptiv PLC leads in advanced vehicle electrical and safety technologies. It generates revenue by designing and manufacturing electrical architectures and safety systems for vehicles. In 2026, Aptiv focuses on expanding its integrated, multi-domain control units and software platforms to enhance vehicle connectivity and autonomous driving.

Mobileye Global Inc.: Autonomous Driving Pioneer

Mobileye Global Inc. dominates the ADAS and autonomous vehicle technology niche. Its revenue stems from advanced driver assistance systems and autonomous driving software solutions. Mobileye’s 2026 strategy centers on refining AI-driven autonomous mobility and cloud-enhanced driver assist technologies to accelerate deployment of Level 4 self-driving systems.

Strategic Collision: Similarities & Divergences

Both companies prioritize vehicle safety and autonomy, but Aptiv leans towards hardware-software integration across vehicle architectures, while Mobileye excels in AI-based autonomous software. Their competition unfolds in the autonomous driving and ADAS market, targeting OEM partnerships. Aptiv offers a diversified auto parts profile; Mobileye presents a high-growth tech-centric investment case.

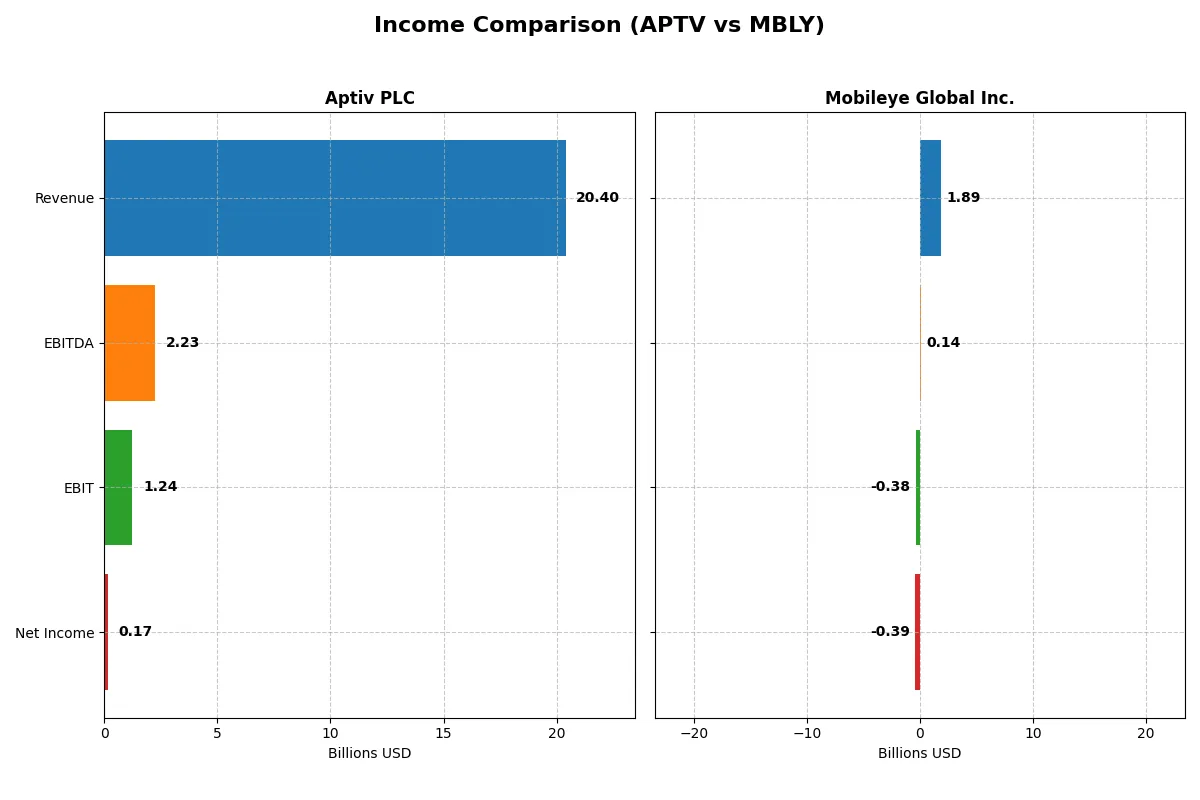

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Aptiv PLC (APTV) | Mobileye Global Inc. (MBLY) |

|---|---|---|

| Revenue | 20.4B | 1.89B |

| Cost of Revenue | 16.5B | 990M |

| Operating Expenses | 2.71B | 1.34B |

| Gross Profit | 3.90B | 904M |

| EBITDA | 2.23B | 140M |

| EBIT | 1.24B | -377M |

| Interest Expense | 361M | 0 |

| Net Income | 165M | -392M |

| EPS | 0.75 | -0.48 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

The income statement comparison reveals the true operational efficiency and profitability momentum of Aptiv PLC and Mobileye Global Inc. over recent years.

Aptiv PLC Analysis

Aptiv’s revenue rose steadily to $20.4B in 2025, up 3.5% year-over-year, but net income plunged sharply to $165M from $1.79B in 2024. Gross margin improved modestly to 19.1%, yet EBIT and net margins collapsed, signaling deteriorating operational efficiency. The sharp net income drop highlights rising costs and weaker profitability despite stable top-line growth.

Mobileye Global Inc. Analysis

Mobileye grew revenue 14.5% to $1.89B in 2025, improving gross margin to a robust 47.7%. However, the company remains unprofitable with a negative EBIT margin of -19.9% and net loss of $392M, though losses narrowed compared to 2024. Mobileye’s improving margins and earnings momentum reflect operational leverage starting to take hold, despite ongoing challenges in achieving profitability.

Growth Momentum vs. Profitability Stability

Mobileye shows stronger revenue and margin growth, benefiting from favorable gross margin expansion and improving EBIT trends. Aptiv offers scale with larger revenues but suffers from deteriorating net margins and a steep income decline. For investors prioritizing growth and margin improvement, Mobileye’s profile is more compelling, while Aptiv presents risks tied to margin compression and profitability erosion.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Aptiv PLC (APTV) | Mobileye Global Inc. (MBLY) |

|---|---|---|

| ROE | 1.79% | -3.30% |

| ROIC | 1.32% | -3.64% |

| P/E | 101.8 | -21.6 |

| P/B | 1.82 | 0.71 |

| Current Ratio | 1.74 | 6.10 |

| Quick Ratio | 1.23 | 5.30 |

| D/E | 0.86 | 0 |

| Debt-to-Assets | 34.0% | 0% |

| Interest Coverage | 3.28 | 0 |

| Asset Turnover | 0.87 | 0.15 |

| Fixed Asset Turnover | 4.77 | 4.00 |

| Payout Ratio | 3.64% | 0% |

| Dividend Yield | 0.04% | 0% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act like a company’s DNA, uncovering hidden risks and operational strengths that raw numbers alone can’t reveal.

Aptiv PLC

Aptiv registers weak profitability with a 1.79% ROE and slim 0.81% net margin, signaling operational challenges. Its P/E ratio at 101.8 marks the stock as heavily stretched relative to earnings. Despite meager 0.04% dividend yield, Aptiv maintains favorable liquidity and reinvests in fixed assets to support long-term stability.

Mobileye Global Inc.

Mobileye shows negative profitability metrics, including a -3.3% ROE and -20.7% net margin, reflecting ongoing losses. The stock’s negative P/E and low P/B at 0.71 suggest undervaluation but highlight fundamental weakness. Mobileye holds zero debt and reinvests aggressively in R&D, emphasizing growth over shareholder payouts with no dividends issued.

Valuation Stretch vs. Growth Risks

Aptiv trades at a premium but faces profitability headwinds, while Mobileye’s attractive valuation masks persistent losses. Aptiv’s liquidity and asset efficiency offer operational safety; Mobileye’s growth focus suits risk-tolerant investors. Aptiv fits those seeking stability; Mobileye appeals to growth-oriented profiles willing to weather volatility.

Which one offers the Superior Shareholder Reward?

I compare Aptiv PLC (APTV) and Mobileye Global Inc. (MBLY) focusing on their shareholder reward models. Aptiv pays a modest dividend yield of 0.036% with a low payout ratio (~3.6%), signaling strong Free Cash Flow (FCF) coverage and sustainability. It combines dividends with consistent buybacks, enhancing shareholder value prudently. Mobileye, by contrast, pays no dividends but aggressively reinvests in growth and acquisitions, evidenced by high gross margins and strong free cash flow conversion (87%). It also executes buybacks, though less intensively. Historically, I’ve observed that mature automotive tech firms like Aptiv balance distributions well, while high-growth innovators like Mobileye prioritize reinvestment. For 2026, I find Aptiv’s dividend-plus-buyback approach offers a more dependable total return profile, especially amid market volatility, whereas Mobileye’s model suits risk-tolerant investors betting on long-term capital appreciation.

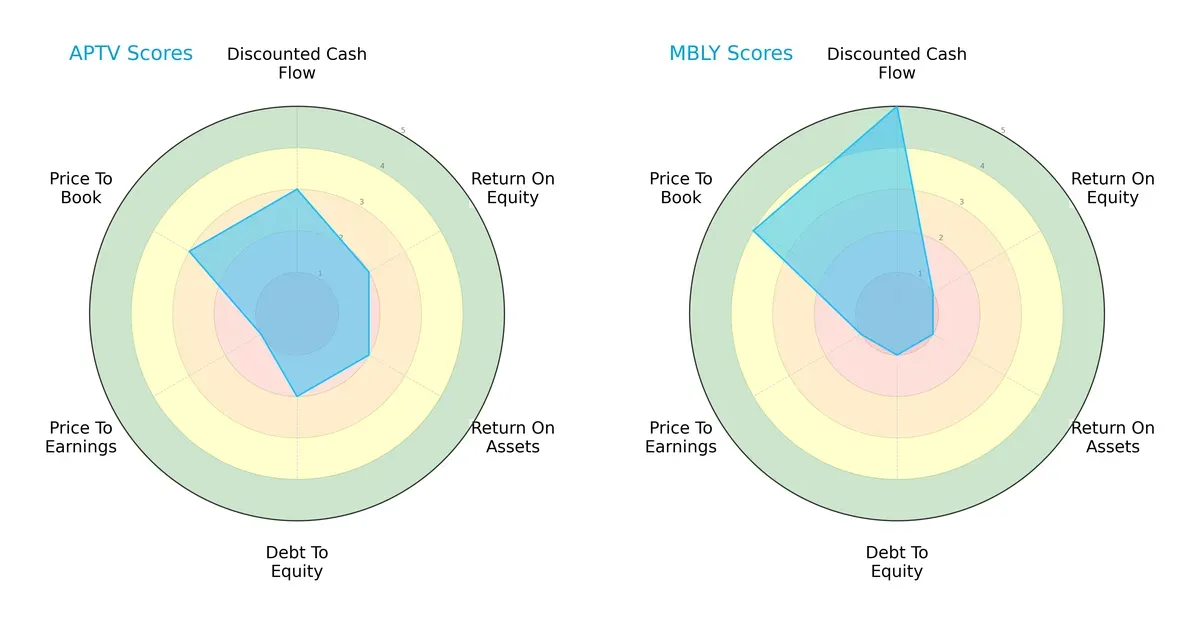

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Aptiv PLC and Mobileye Global Inc., highlighting their financial strengths and weaknesses:

Aptiv shows a more balanced profile with moderate DCF and Price-to-Book scores, despite weak profitability and leverage metrics. Mobileye leans heavily on a strong discounted cash flow score but suffers from very unfavorable profitability and debt ratios. Aptiv’s diversified strengths suggest steadier capital allocation, whereas Mobileye relies mainly on growth potential priced into cash flows.

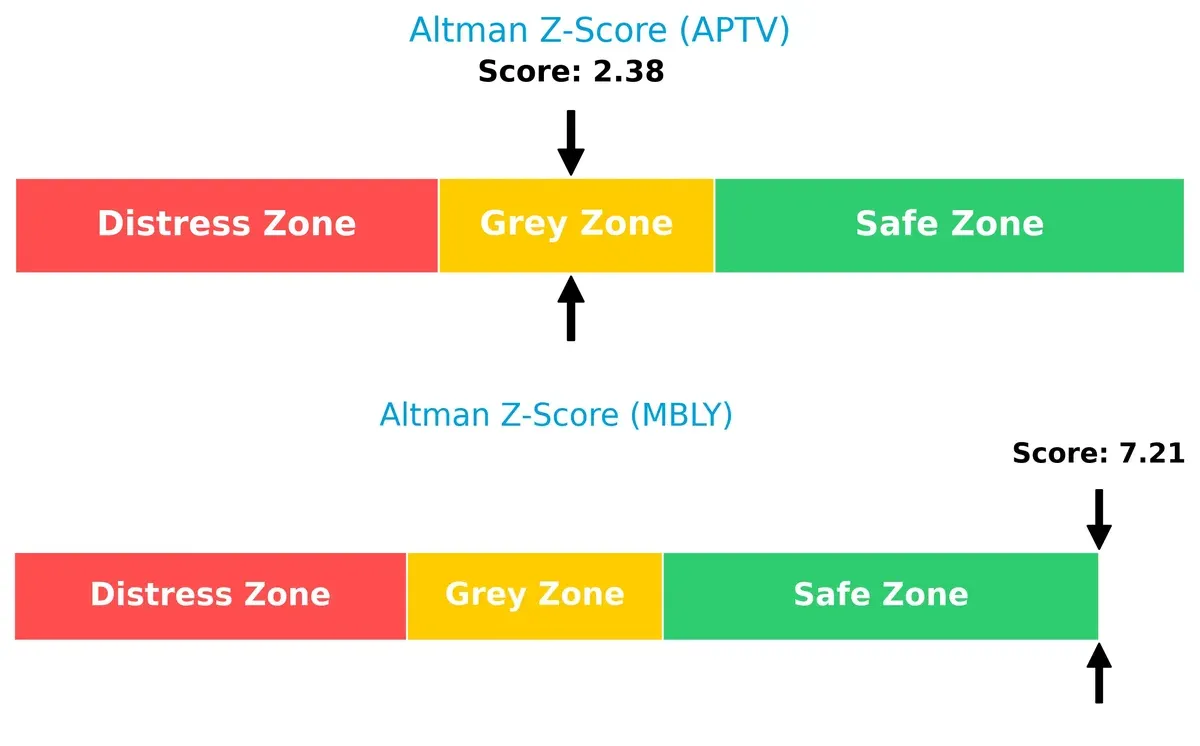

Bankruptcy Risk: Solvency Showdown

Mobileye’s Altman Z-Score of 7.21 firmly places it in the safe zone, signaling strong financial stability. Aptiv’s score of 2.38 is in the grey zone, implying moderate bankruptcy risk under current economic cycles:

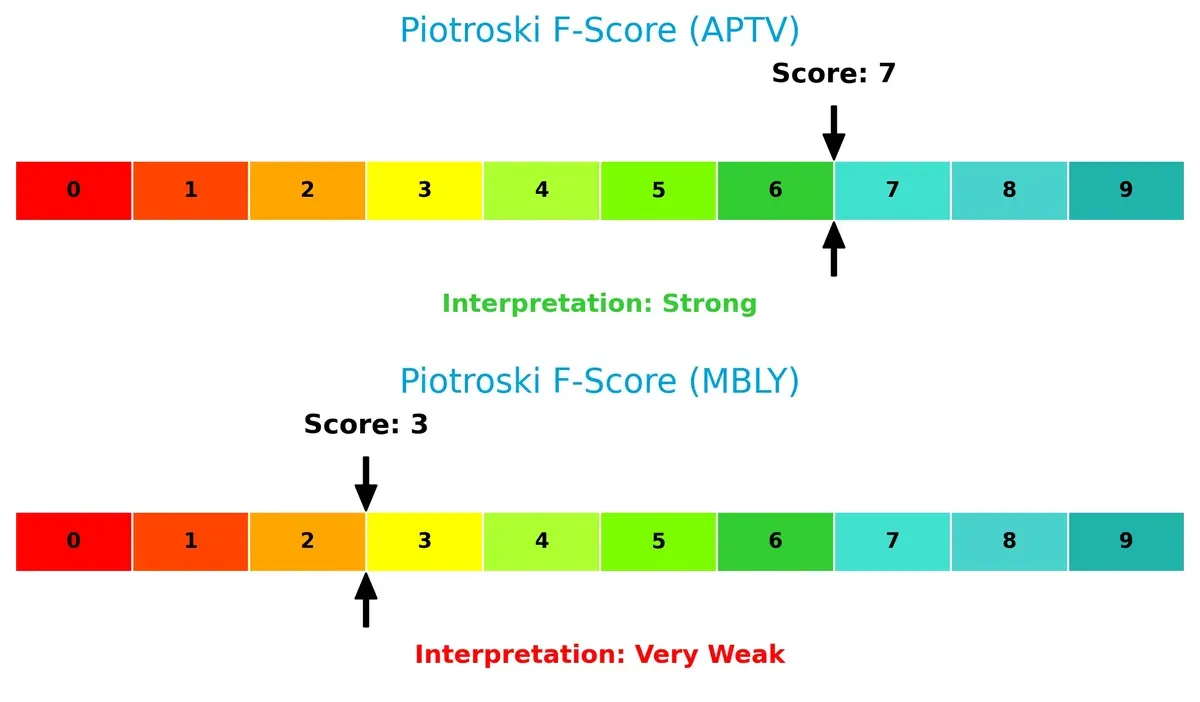

Financial Health: Quality of Operations

Aptiv’s Piotroski F-Score of 7 indicates robust operational quality and financial health. Mobileye’s score of 3 flags concerns over internal metrics and weaker financial strength:

How are the two companies positioned?

This section dissects Aptiv and Mobileye’s operational DNA by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats to identify the most resilient competitive advantage today.

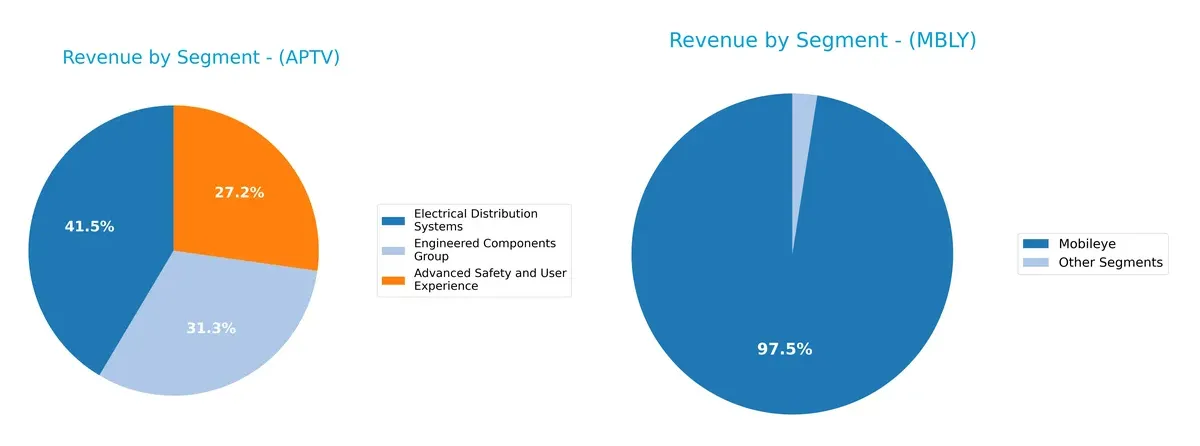

Revenue Segmentation: The Strategic Mix

This comparison dissects how Aptiv PLC and Mobileye Global Inc. diversify their income streams and highlights their primary sector bets:

Aptiv PLC shows a balanced revenue mix in 2025, with Electrical Distribution Systems at $8.8B, Engineered Components Group at $6.7B, and Advanced Safety & User Experience anchoring $5.8B. Mobileye relies heavily on its Mobileye segment, generating $2B in 2023, dwarfing its $34M in Other Segments. Aptiv’s diversification mitigates concentration risk, while Mobileye pivots sharply on its autonomous driving tech, exposing it to sector-specific volatility.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Aptiv PLC and Mobileye Global Inc.:

Aptiv PLC Strengths

- Diversified product segments with strong revenues across three key areas

- Favorable current and quick ratios indicate solid short-term liquidity

- Neutral debt levels support financial stability

- Favorable fixed asset turnover shows efficient use of property

Mobileye Global Inc. Strengths

- Favorable WACC and valuation multiples suggest market confidence

- Favorable quick ratio and no debt enhance financial flexibility

- Favorable fixed asset turnover indicates operational efficiency

- Higher percentage of favorable ratios reflects balanced fundamentals

Aptiv PLC Weaknesses

- Unfavorable profitability metrics with low net margin and ROE

- High P/E ratio signals potential overvaluation

- Low dividend yield may deter income-focused investors

- Slightly unfavorable overall ratio evaluation

Mobileye Global Inc. Weaknesses

- Negative profitability measures with significant net losses

- Unfavorable current ratio raises liquidity concerns

- Zero interest coverage points to risk in debt servicing

- Half of the ratios evaluated unfavorably, indicating operational challenges

Aptiv shows diversification and moderate financial stability but faces profitability and valuation challenges. Mobileye benefits from favorable cost of capital and asset efficiency but struggles with liquidity and profitability, impacting its risk profile and growth strategy.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competition erosion. Let’s dissect two distinct moats in the auto parts sector:

Aptiv PLC: Scale and Integration Moat

Aptiv’s moat stems from its extensive electrical architecture and safety solutions, reflected in stable gross margins near 19%. However, declining ROIC signals eroding value. Expansion into Asia Pacific and Europe may deepen its moat, but margin pressure threatens sustainability in 2026.

Mobileye Global Inc.: Advanced Technology Moat

Mobileye’s moat derives from cutting-edge autonomous driving tech and software platforms, producing a premium gross margin near 48%. Despite negative net margins, revenue and EBIT growth accelerate rapidly. Its innovation pipeline and cloud-based offerings position it well for disruptive expansion this year.

Verdict: Scale Integration vs. Innovation Edge

Both firms face declining ROICs, indicating value destruction, but Mobileye’s superior gross margins and growth momentum reveal a deeper moat. I see Mobileye better equipped to defend and expand market share amid intensifying competitive dynamics in 2026.

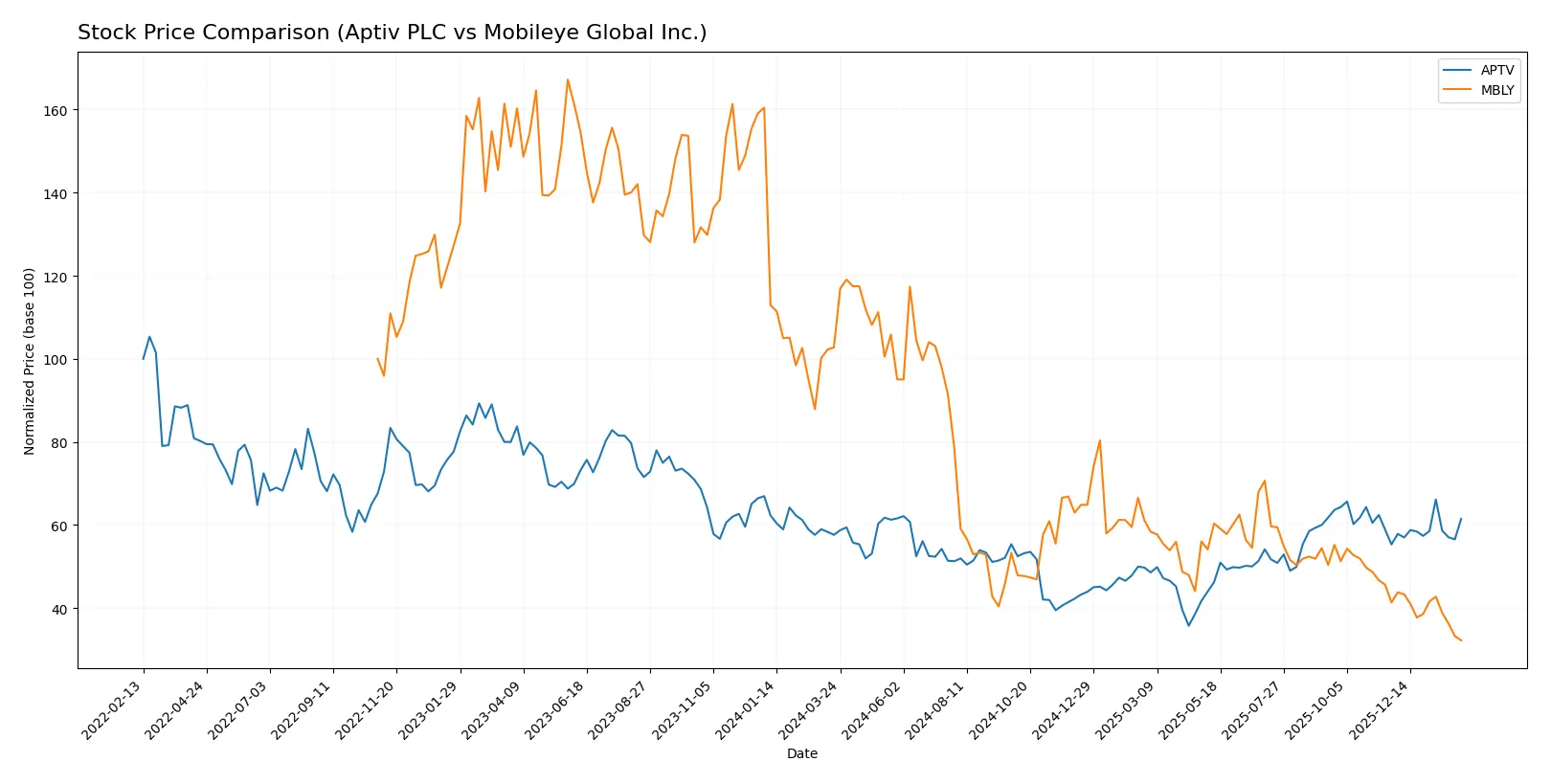

Which stock offers better returns?

The chart highlights Aptiv PLC’s steady ascent with an accelerating bullish trend, contrasting sharply with Mobileye Global Inc.’s sustained and decelerating bearish decline over the past year.

Trend Comparison

Aptiv PLC’s stock price rose 6.65% over the past 12 months, showing an accelerating bullish trend with volatility at 9.13%. It peaked at 88.67 and troughed at 47.92.

Mobileye Global Inc.’s stock fell 68.6% in the same period, reflecting a decelerating bearish trend and moderate volatility of 6.11%. Its high was 32.15 and low 8.71.

Aptiv PLC outperformed Mobileye Global Inc. with positive returns and trend acceleration, while Mobileye posted a sharp decline and ongoing bearish momentum.

Target Prices

The consensus target prices reflect moderate upside potential for both Aptiv PLC and Mobileye Global Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Aptiv PLC | 84 | 110 | 98.89 |

| Mobileye Global Inc. | 11 | 28 | 16.71 |

Analysts expect Aptiv’s price to rise roughly 20% above its current 82.38 level, signaling confidence in its growth. Mobileye’s target consensus suggests almost double its current 8.71 price, indicating strong optimism but also higher volatility risk.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Aptiv PLC Grades

The table below shows recent grades assigned to Aptiv PLC by major grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-02-03 |

| RBC Capital | Maintain | Outperform | 2026-02-03 |

| Oppenheimer | Maintain | Outperform | 2026-02-03 |

| Oppenheimer | Maintain | Outperform | 2026-01-21 |

| UBS | Maintain | Neutral | 2026-01-14 |

| Piper Sandler | Upgrade | Overweight | 2026-01-08 |

| Wells Fargo | Maintain | Overweight | 2025-12-09 |

| Morgan Stanley | Upgrade | Equal Weight | 2025-12-08 |

| RBC Capital | Maintain | Outperform | 2025-11-19 |

| Wells Fargo | Maintain | Overweight | 2025-10-31 |

Mobileye Global Inc. Grades

The table below summarizes recent grades for Mobileye Global Inc. from established grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Tigress Financial | Maintain | Buy | 2026-01-29 |

| RBC Capital | Maintain | Sector Perform | 2026-01-23 |

| Needham | Maintain | Buy | 2026-01-23 |

| UBS | Maintain | Neutral | 2026-01-23 |

| Canaccord Genuity | Maintain | Buy | 2026-01-23 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-23 |

| Wells Fargo | Maintain | Overweight | 2026-01-23 |

| HSBC | Downgrade | Hold | 2026-01-23 |

| UBS | Maintain | Neutral | 2026-01-14 |

| Wolfe Research | Downgrade | Peer Perform | 2026-01-12 |

Which company has the best grades?

Aptiv PLC consistently holds Outperform and Overweight ratings from top firms. Mobileye shows more mixed grades, including downgrades to Hold and Peer Perform. Aptiv’s stronger consensus may suggest more favorable analyst confidence.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Aptiv PLC (APTV)

- Faces intense competition in automotive components with pressure on margins amid shifting industry trends.

Mobileye Global Inc. (MBLY)

- Operates in a highly innovative but volatile ADAS and autonomous driving market with rapid tech evolution and competitive disruption.

2. Capital Structure & Debt

Aptiv PLC (APTV)

- Maintains moderate leverage with debt-to-assets near 34% and interest coverage at 3.44x, reflecting manageable financial risk.

Mobileye Global Inc. (MBLY)

- Zero debt enhances balance sheet strength but interest coverage is zero due to operating losses, highlighting reliance on equity funding.

3. Stock Volatility

Aptiv PLC (APTV)

- Beta of 1.5 signals higher volatility than the market, exposing investors to amplified market swings.

Mobileye Global Inc. (MBLY)

- Beta of 0.56 indicates lower volatility, offering some defensive cushion against market fluctuations.

4. Regulatory & Legal

Aptiv PLC (APTV)

- Exposure to automotive safety regulations globally requires ongoing compliance investments and risk of recalls.

Mobileye Global Inc. (MBLY)

- Faces complex regulatory scrutiny on autonomous vehicle safety and data privacy, increasing operational uncertainty.

5. Supply Chain & Operations

Aptiv PLC (APTV)

- Large-scale manufacturing depends on stable supply chains; global disruptions could impact production and costs.

Mobileye Global Inc. (MBLY)

- Relies heavily on software development and semiconductor supply, vulnerable to chip shortages and tech disruptions.

6. ESG & Climate Transition

Aptiv PLC (APTV)

- Under pressure to improve sustainability in manufacturing and reduce carbon footprint amid automotive electrification trends.

Mobileye Global Inc. (MBLY)

- ESG risks tied to data governance and energy use in cloud services, with increasing stakeholder scrutiny.

7. Geopolitical Exposure

Aptiv PLC (APTV)

- Operations spread globally, sensitive to trade tensions and tariff impacts, especially in Europe and North America.

Mobileye Global Inc. (MBLY)

- Headquartered in Israel with global operations; geopolitical tensions in the Middle East pose potential risks to stability.

Which company shows a better risk-adjusted profile?

Mobileye’s strongest advantage lies in its debt-free capital structure and lower stock volatility, reducing financial and market risks. However, its negative profitability and weak operational metrics flag significant earnings risks. Aptiv’s moderate leverage and stronger operational scale provide more stability, though its higher stock volatility and margin pressures present challenges. Overall, Aptiv shows a slightly better risk-adjusted profile due to steadier cash flow and more balanced financial ratios. Mobileye’s main risk remains sustained unprofitability amid regulatory and tech uncertainties. Aptiv’s key concern is its thin net margin and underwhelming return on invested capital, which demand close monitoring given market competition.

Final Verdict: Which stock to choose?

Aptiv PLC’s superpower lies in its operational resilience and solid liquidity, suggesting it manages working capital effectively amid industry cycles. However, its declining profitability and value destruction pose a clear point of vigilance. Aptiv fits portfolios seeking steady industrial exposure with moderate growth ambitions.

Mobileye Global Inc. commands a strategic moat through cutting-edge R&D and high gross margins, reflecting its innovation edge in autonomous tech. It offers a safer balance sheet relative to Aptiv but struggles with profitability and value creation. Mobileye suits growth-at-a-reasonable-price (GARP) investors willing to tolerate volatility for future upside.

If you prioritize operational stability and liquidity, Aptiv is the compelling choice due to its stronger cash management and less volatile market trend. However, if you seek innovation-driven growth with a tolerance for risk, Mobileye offers superior exposure to emerging tech but at the cost of ongoing profitability challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Aptiv PLC and Mobileye Global Inc. to enhance your investment decisions: