AppLovin Corporation and Snowflake Inc. are two prominent players in the software application industry, each driving innovation in distinct yet overlapping markets. AppLovin excels in mobile app marketing and monetization, while Snowflake leads in cloud-based data platforms. This comparison explores their market strategies, growth potential, and technological edge to help you decide which company holds the most promise for your investment portfolio. Let’s uncover which stock stands out for investors today.

Table of contents

Companies Overview

I will begin the comparison between AppLovin Corporation and Snowflake Inc. by providing an overview of these two companies and their main differences.

AppLovin Corporation Overview

AppLovin Corporation develops a software platform aimed at mobile app developers to optimize marketing and monetization globally. Its key products include AppDiscovery for marketing, Adjust for analytics, and MAX for in-app bidding to maximize advertising revenue. Founded in 2011 and headquartered in Palo Alto, California, AppLovin operates primarily in the software application industry with a market cap of $194B.

Snowflake Inc. Overview

Snowflake Inc. offers a cloud-based data platform designed to consolidate and analyze data for businesses across various industries. Its Data Cloud enables customers to generate insights, build applications, and share data securely. Incorporated in 2012 and based in Bozeman, Montana, Snowflake is a significant player in the software application sector with a market cap of $71B.

Key similarities and differences

Both companies operate in the technology sector focusing on software applications, serving a broad range of clients internationally. While AppLovin specializes in mobile app marketing and monetization tools, Snowflake centers on cloud data management and analytics. Their business models differ by targeting different software needs—AppLovin in advertising technology and Snowflake in data cloud services—reflecting distinct market niches and customer bases.

Income Statement Comparison

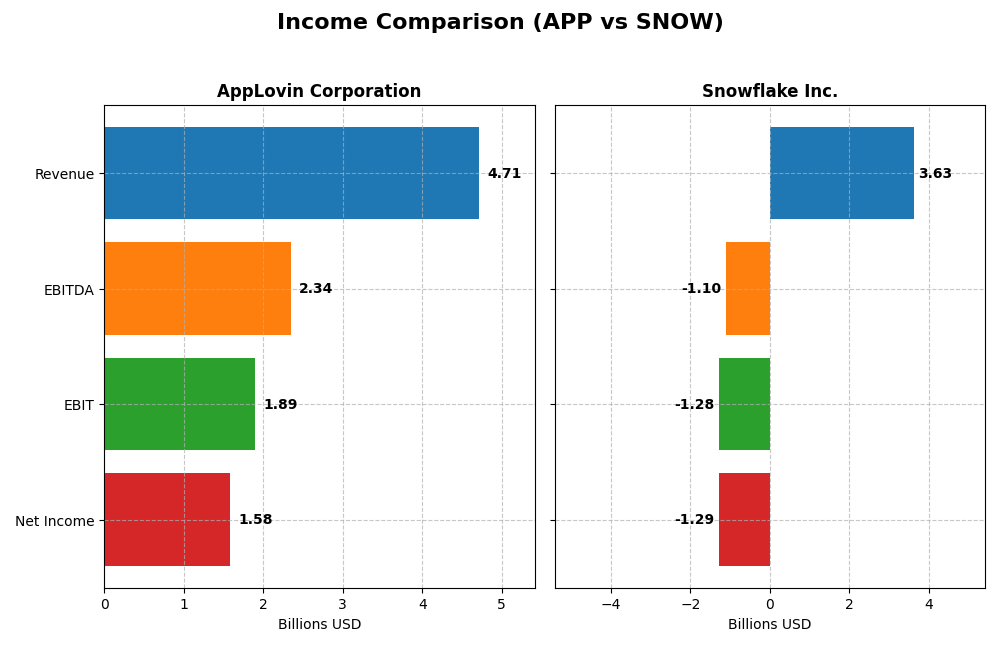

The table below compares the key income statement metrics for AppLovin Corporation and Snowflake Inc. for their most recent fiscal years.

| Metric | AppLovin Corporation | Snowflake Inc. |

|---|---|---|

| Market Cap | 194.1B | 71.3B |

| Revenue | 4.71B | 3.63B |

| EBITDA | 2.34B | -1.10B |

| EBIT | 1.89B | -1.28B |

| Net Income | 1.58B | -1.29B |

| EPS | 4.68 | -3.86 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

AppLovin Corporation

AppLovin has shown strong growth in revenue and net income from 2020 to 2024, with revenue rising from 1.45B to 4.71B and net income turning positive and reaching 1.58B in 2024. Margins improved significantly, with a favorable gross margin of 75.22% and net margin of 33.55%. The latest year highlighted exceptional growth, with revenue up 43.44% and net income growing over 200%.

Snowflake Inc.

Snowflake’s revenue increased substantially from 592M in 2021 to 3.63B in 2025, but net income remained negative, deepening to -1.29B in 2025. While gross margins are favorable at 66.5%, EBIT and net margins remain unfavorable around -35%. The most recent year showed revenue growth of 29.21%, but declines in EBIT and net margin worsened, reflecting ongoing profitability challenges.

Which one has the stronger fundamentals?

AppLovin exhibits stronger fundamentals with consistent revenue and net income growth, high and improving margins, and a predominantly favorable income statement evaluation. In contrast, Snowflake shows impressive top-line growth but persistent net losses and unfavorable EBIT margins, leading to a neutral overall income evaluation. AppLovin’s performance suggests more robust profitability and margin stability.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for AppLovin Corporation (APP) and Snowflake Inc. (SNOW) based on their most recent fiscal year data.

| Ratios | AppLovin Corporation (APP) 2024 | Snowflake Inc. (SNOW) 2025 |

|---|---|---|

| ROE | 1.45 (145%) | -0.43 (-43%) |

| ROIC | 0.39 (39%) | -0.25 (-25%) |

| P/E | 69.1 | -47.0 |

| P/B | 100.1 | 20.1 |

| Current Ratio | 2.19 | 1.75 |

| Quick Ratio | 2.19 | 1.75 |

| D/E (Debt-to-Equity) | 3.26 | 0.90 |

| Debt-to-Assets | 0.61 | 0.30 |

| Interest Coverage | 5.89 | -528 |

| Asset Turnover | 0.80 | 0.40 |

| Fixed Asset Turnover | 23.71 | 5.53 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

AppLovin Corporation

AppLovin shows a mix of strong and weak ratios, with favorable net margin (33.55%), ROE (144.96%), and ROIC (38.7%) indicating solid profitability and capital efficiency. However, the high debt-to-equity (3.26) and debt-to-assets (60.59%) ratios raise concerns about leverage. The company does not pay dividends, likely prioritizing reinvestment and growth.

Snowflake Inc.

Snowflake’s ratios largely indicate weakness, with negative net margin (-35.45%), ROE (-42.86%), and ROIC (-25.24%) reflecting ongoing losses and inefficiencies. Favorable current and quick ratios (1.75) and low debt-to-assets (29.72%) show manageable liquidity and moderate leverage. It also pays no dividends, consistent with a growth-focused strategy.

Which one has the best ratios?

AppLovin’s ratios are slightly favorable overall, supported by strong profitability and returns despite leverage concerns. Snowflake’s ratios are slightly unfavorable, weighed down by negative profitability and returns despite better liquidity and lower leverage. AppLovin currently presents more favorable financial metrics than Snowflake.

Strategic Positioning

This section compares the strategic positioning of AppLovin Corporation and Snowflake Inc., including market position, key segments, and exposure to technological disruption:

AppLovin Corporation

- Large market cap of 194B with high beta of 2.5 indicating significant competitive pressure

- Key segments include Advertising (3.2B) and Apps (1.5B), driven by mobile app marketing and monetization platforms

- Exposure to disruption through software solutions enhancing mobile app marketing and real-time bidding

Snowflake Inc.

- Market cap of 71B with moderate beta of 1.14 reflecting moderate market volatility and pressure

- Focused on Product (3.5B) and Professional Services, driven by cloud-based data platform offerings

- Exposure via cloud data consolidation platform enabling data insights and application development

AppLovin Corporation vs Snowflake Inc. Positioning

AppLovin shows a diversified approach with advertising and app monetization segments, benefiting from a strong mobile focus. Snowflake concentrates on cloud data platforms and services, specializing in data-driven applications. AppLovin faces higher market volatility but broader revenue streams.

Which has the best competitive advantage?

AppLovin demonstrates a very favorable moat with growing ROIC and value creation, indicating durable competitive advantage. Snowflake shows a very unfavorable moat with declining ROIC, reflecting value destruction and weaker competitive positioning.

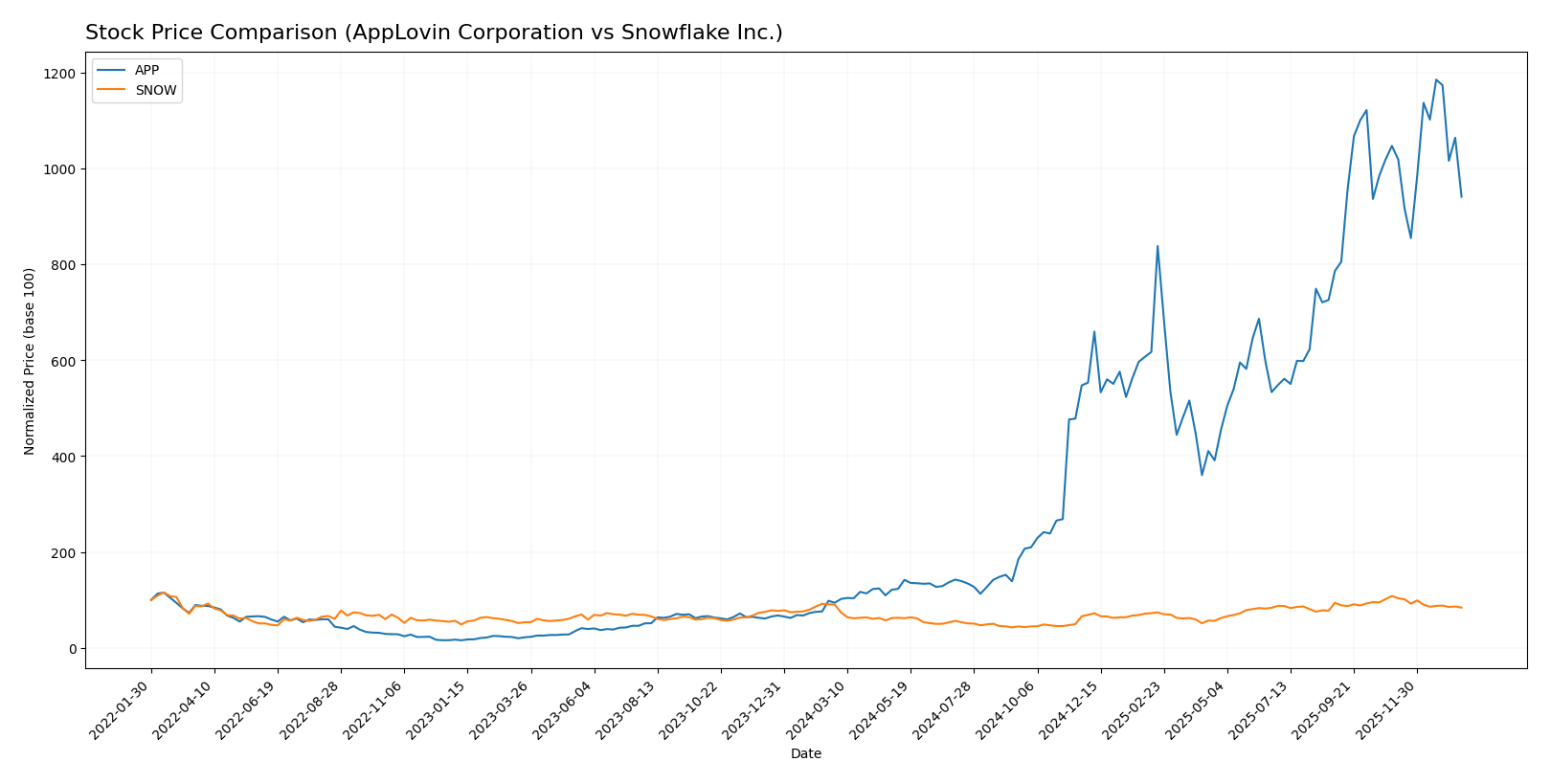

Stock Comparison

The stock price chart highlights significant bullish momentum for AppLovin Corporation over the past 12 months, contrasted with a bearish trend for Snowflake Inc., reflecting divergent trading dynamics and volume shifts.

Trend Analysis

AppLovin Corporation’s stock experienced a strong bullish trend over the past 12 months, with an 897.85% price increase and decelerating acceleration. The price ranged from 57.39 to 721.37, showing high volatility with a standard deviation of 201.11.

Snowflake Inc. showed a bearish trend with a -6.98% price change over the past 12 months and decelerating acceleration. Its price fluctuated between 108.56 and 274.88, with lower volatility indicated by a 42.63 standard deviation.

Comparing the two, AppLovin Corporation outperformed Snowflake Inc. significantly in market performance over the year, delivering a notably higher percentage gain.

Target Prices

The current analyst consensus presents a positive outlook for both AppLovin Corporation and Snowflake Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| AppLovin Corporation | 860 | 630 | 756.33 |

| Snowflake Inc. | 325 | 237 | 281.86 |

Analysts expect AppLovin’s stock to rise significantly from its current price of 573.85, indicating strong growth potential. Snowflake’s consensus target of 281.86 also suggests upside from its current 212.86 price, reflecting bullish sentiment in cloud data platforms.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for AppLovin Corporation and Snowflake Inc.:

Rating Comparison

AppLovin Corporation Rating

- Rating: B, indicating a very favorable overall status.

- Discounted Cash Flow Score: Moderate score of 3.

- ROE Score: Very favorable, high score of 5.

- ROA Score: Very favorable, high score of 5.

- Debt To Equity Score: Very unfavorable, low score of 1.

- Overall Score: Moderate score of 3.

Snowflake Inc. Rating

- Rating: C-, with a very unfavorable overall status.

- Discounted Cash Flow Score: Moderate score of 3.

- ROE Score: Very unfavorable, low score of 1.

- ROA Score: Very unfavorable, low score of 1.

- Debt To Equity Score: Very unfavorable, low score of 1.

- Overall Score: Very unfavorable, low score of 1.

Which one is the best rated?

Based strictly on the provided data, AppLovin has a better overall rating and stronger profitability metrics (ROE and ROA) compared to Snowflake, which scores very low in most categories except DCF.

Scores Comparison

Here is a comparison of the financial scores for AppLovin Corporation and Snowflake Inc.:

APP Scores

- Altman Z-Score: 30.7, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial health and value potential.

SNOW Scores

- Altman Z-Score: 5.36, also in the safe zone, suggesting low bankruptcy risk.

- Piotroski Score: 4, showing average financial strength and investment quality.

Which company has the best scores?

Based strictly on the data, APP has higher scores with a much stronger Altman Z-Score and a stronger Piotroski Score compared to SNOW, indicating better financial health and lower bankruptcy risk.

Grades Comparison

Here is a comparison of the latest available grades for AppLovin Corporation and Snowflake Inc.:

AppLovin Corporation Grades

The table below shows recent grades and actions from notable grading companies for AppLovin Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2026-01-13 |

| Wells Fargo | Maintain | Overweight | 2026-01-08 |

| Jefferies | Maintain | Buy | 2025-12-11 |

| Benchmark | Maintain | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-11-12 |

| Wells Fargo | Maintain | Overweight | 2025-11-07 |

| Goldman Sachs | Maintain | Neutral | 2025-11-07 |

| JP Morgan | Maintain | Neutral | 2025-11-06 |

| Wedbush | Maintain | Outperform | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

AppLovin’s grades predominantly reflect a positive outlook, with multiple “Buy” and “Overweight” ratings and no recent downgrades.

Snowflake Inc. Grades

The table below summarizes recent grades and actions from recognized grading companies for Snowflake Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Downgrade | Equal Weight | 2026-01-12 |

| Argus Research | Upgrade | Buy | 2026-01-08 |

| Citigroup | Maintain | Buy | 2025-12-08 |

| Wells Fargo | Maintain | Overweight | 2025-12-04 |

| Keybanc | Maintain | Overweight | 2025-12-04 |

| Piper Sandler | Maintain | Overweight | 2025-12-04 |

| Morgan Stanley | Maintain | Overweight | 2025-12-04 |

| Wedbush | Maintain | Outperform | 2025-12-04 |

| Deutsche Bank | Maintain | Buy | 2025-12-04 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-12-04 |

Snowflake’s grades indicate mostly favorable ratings with a single recent downgrade to “Equal Weight” by Barclays, balanced by several “Buy” and “Overweight” ratings.

Which company has the best grades?

Both AppLovin and Snowflake have strong buy-side support, but Snowflake commands a broader consensus with 38 “Buy” ratings versus AppLovin’s 22. Investors may interpret Snowflake’s slightly more mixed signals, including a recent downgrade, as a nuance in risk assessment.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for AppLovin Corporation (APP) and Snowflake Inc. (SNOW) based on the most recent financial and operational data.

| Criterion | AppLovin Corporation (APP) | Snowflake Inc. (SNOW) |

|---|---|---|

| Diversification | Moderate: Revenue split mainly between Advertising (3.22B) and Apps (1.49B) segments. | Moderate: Concentrated revenue from Product (3.46B) with smaller Professional Services segment. |

| Profitability | Strong: Net margin 33.55%, ROIC 38.7%, ROE 144.96%, consistently creating value. | Weak: Negative net margin (-35.45%), ROIC (-25.24%), ROE (-42.86%), value destroying. |

| Innovation | Favorable: High fixed asset turnover (23.71) suggests efficient use of assets in tech development. | Mixed: Innovation visible but financials show declining profitability and negative returns. |

| Global presence | Significant: Large and growing revenue base with expanding advertising platform globally. | Expanding: Rapid product revenue growth but profitability challenges may limit scaling. |

| Market Share | Strong in mobile advertising and app monetization markets. | Growing in cloud data platform market but facing strong competition and margin pressure. |

Key takeaways: AppLovin shows a durable competitive advantage with strong profitability and efficient capital use, making it a more favorable investment. Snowflake, despite strong revenue growth, struggles with declining profitability and value destruction, posing higher risk for investors.

Risk Analysis

Below is a comparative risk assessment table for AppLovin Corporation (APP) and Snowflake Inc. (SNOW) based on the most recent data available in 2026:

| Metric | AppLovin Corporation (APP) | Snowflake Inc. (SNOW) |

|---|---|---|

| Market Risk | High beta (2.50) indicates high volatility | Moderate beta (1.14) shows moderate volatility |

| Debt level | High debt-to-equity (3.26) and debt/assets (60.6%) | Moderate debt-to-equity (0.9) and lower debt/assets (29.7%) |

| Regulatory Risk | Moderate, US-based with global operations | Moderate, US-based cloud platform with international exposure |

| Operational Risk | Moderate, reliant on mobile advertising market trends | Moderate to high, dependent on cloud infrastructure and data security |

| Environmental Risk | Low, software sector with limited direct environmental impact | Low, software/cloud sector with limited direct environmental impact |

| Geopolitical Risk | Moderate, subject to US and global tech regulations | Moderate, exposed to US and international data sovereignty laws |

In synthesis, AppLovin faces higher market volatility and financial leverage risks, which could impact stability if market conditions worsen. Snowflake’s main risks stem from operational challenges and weaker profitability metrics, despite lower leverage. Market volatility and debt levels are the most impactful risks for AppLovin, while Snowflake’s operational execution and profitability deficits are critical concerns for investors.

Which Stock to Choose?

AppLovin Corporation (APP) shows strong income growth with a 43.44% revenue increase in 2024 and favorable profitability metrics, including a 33.55% net margin. Its financial ratios are slightly favorable overall, boasting a very favorable ROE of 144.96% but facing high debt levels. The company holds a very favorable “B” rating, supported by a strong Altman Z-score and Piotroski score, indicating solid financial health.

Snowflake Inc. (SNOW) records moderate revenue growth of 29.21% in 2025 but suffers from negative profitability, with a -35.45% net margin and unfavorable returns on equity and invested capital. Its financial ratios are slightly unfavorable, reflecting challenges in operational efficiency and debt management. Despite a “C-” rating classified as very favorable, Snowflake’s Altman Z-score is safe but with average Piotroski strength, signaling mixed financial stability.

Investors focused on growth might find AppLovin’s robust income evolution and strong profitability indicators appealing, while those willing to accept higher risk and volatility could consider Snowflake due to its moderate revenue growth and valuation metrics. The contrasting ratings and financial health suggest the choice could depend on an investor’s risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of AppLovin Corporation and Snowflake Inc. to enhance your investment decisions: