AppLovin Corporation and PagerDuty, Inc. are two influential players in the software application industry, each driving innovation in distinct but overlapping markets. AppLovin focuses on mobile app marketing and monetization, while PagerDuty leads in digital operations management with advanced machine learning. Comparing these companies reveals insights into their growth strategies and market positioning. In this article, I will help you determine which stock might be the most promising addition to your portfolio.

Table of contents

Companies Overview

I will begin the comparison between AppLovin Corporation and PagerDuty, Inc. by providing an overview of these two companies and their main differences.

AppLovin Overview

AppLovin Corporation focuses on building a software platform for mobile app developers to enhance app marketing and monetization globally. Its offerings include AppDiscovery for matching advertisers with publishers, Adjust for app analytics and campaign optimization, and MAX for in-app bidding to maximize ad inventory value. Founded in 2011, AppLovin is headquartered in Palo Alto, CA, and operates in the software application industry.

PagerDuty Overview

PagerDuty, Inc. provides a digital operations management platform that collects and analyzes data from software-enabled systems using machine learning to predict issues and opportunities. Serving diverse industries such as technology, telecommunications, retail, and finance, PagerDuty was founded in 2009 and is based in San Francisco, CA. It also operates within the software application sector and offers services internationally.

Key similarities and differences

Both companies operate in the software application industry, targeting technology-driven clients and offering platforms that support digital workflows. AppLovin centers on mobile app marketing and monetization, while PagerDuty specializes in digital operations management with machine learning analytics. AppLovin is significantly larger by market capitalization and employee count, reflecting its broader scale and focus on advertising technology compared to PagerDuty’s specialized operational software.

Income Statement Comparison

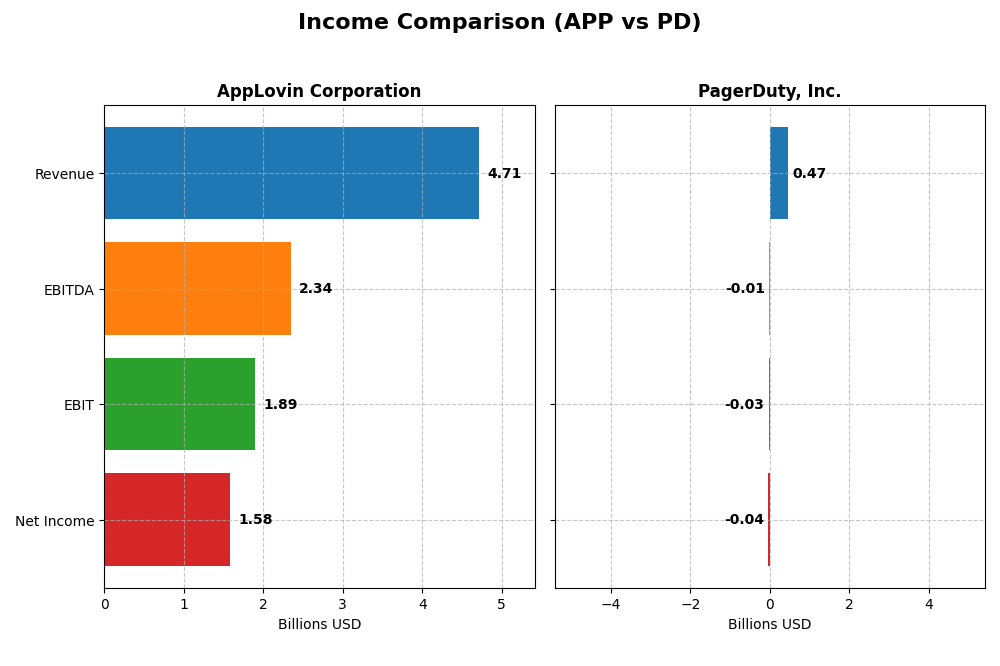

This table presents a side-by-side comparison of key income statement metrics for AppLovin Corporation and PagerDuty, Inc. for their most recent fiscal years.

| Metric | AppLovin Corporation (APP) | PagerDuty, Inc. (PD) |

|---|---|---|

| Market Cap | 193B | 1.04B |

| Revenue | 4.71B | 467M |

| EBITDA | 2.34B | -12M |

| EBIT | 1.89B | -32M |

| Net Income | 1.58B | -43M |

| EPS | 4.68 | -0.59 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

AppLovin Corporation

AppLovin’s revenue and net income have shown strong growth from 2020 to 2024, with revenue increasing by 224.53% and net income rising by 1361.93%. Margins improved significantly, with a gross margin of 75.22% and net margin at 33.55% in 2024. The recent year saw a favorable surge in profitability and margin expansion, indicating robust operational efficiency.

PagerDuty, Inc.

PagerDuty’s revenue doubled over 2021-2025, with a 118.91% growth, while net income increased more modestly by 37.98%. Gross margin remains high at 82.96%, but EBIT and net margins are negative at -6.95% and -9.14%, respectively, reflecting ongoing operating losses. The latest year shows improvement in margins and earnings growth, yet profitability remains under pressure.

Which one has the stronger fundamentals?

AppLovin exhibits stronger fundamentals with substantial margin expansion, positive EBIT, and net income growth, reflecting efficient cost management and scalable revenue. PagerDuty shows favorable revenue growth and gross margins but struggles with negative operating and net margins. AppLovin’s consistent profitability and margin improvements position it with more robust income statement fundamentals.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for AppLovin Corporation (APP) and PagerDuty, Inc. (PD) based on the most recent fiscal year data available.

| Ratios | AppLovin Corporation (APP) 2024 | PagerDuty, Inc. (PD) 2025 |

|---|---|---|

| ROE | 1.45 | -0.33 |

| ROIC | 0.39 | -0.10 |

| P/E | 69.1 | -39.9 |

| P/B | 100.1 | 13.1 |

| Current Ratio | 2.19 | 1.87 |

| Quick Ratio | 2.19 | 1.87 |

| D/E (Debt-to-Equity) | 3.26 | 3.57 |

| Debt-to-Assets | 0.61 | 0.50 |

| Interest Coverage | 5.89 | -6.46 |

| Asset Turnover | 0.80 | 0.50 |

| Fixed Asset Turnover | 23.71 | 16.61 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

AppLovin Corporation

AppLovin shows a mixed picture with strong profitability ratios, including a high net margin of 33.55% and an impressive ROE of 144.96%, indicating effective equity use. However, concerns arise from its high debt-to-equity ratio of 3.26 and a heavy debt-to-assets level at 60.59%. The company currently does not pay dividends, likely reflecting a reinvestment strategy to support growth and innovation.

PagerDuty, Inc.

PagerDuty’s ratios reveal several weaknesses, such as a negative net margin of -9.14% and a deeply negative ROE of -32.92%, signaling ongoing losses and inefficient capital use. Although it maintains a reasonable current ratio of 1.87, its interest coverage is negative, indicating struggles with debt servicing. PagerDuty does not pay dividends, consistent with its negative earnings and focus on research and development.

Which one has the best ratios?

AppLovin’s ratios are generally stronger, with favorable profitability and coverage metrics despite high leverage, while PagerDuty faces multiple unfavorable profitability and solvency ratios. AppLovin’s balanced current and quick ratios further support its relative stability, contrasting with PagerDuty’s broader financial challenges and negative returns.

Strategic Positioning

This section compares the strategic positioning of AppLovin Corporation and PagerDuty, Inc. including Market position, Key segments, and disruption:

AppLovin Corporation

- Large market cap of 193B with high beta indicating strong competitive pressure

- Focuses on mobile app marketing and monetization software, key drivers are advertising and apps segments

- Exposed to technological disruption through real-time auctions and analytics platforms

PagerDuty, Inc.

- Small market cap near 1B with low beta indicating moderate pressure

- Specializes in digital operations management using machine learning across diverse industries

- Exposure through machine learning to manage digital signals and predict IT issues

AppLovin Corporation vs PagerDuty, Inc. Positioning

AppLovin has a diversified approach centered on app marketing and monetization, leveraging multiple software solutions. PagerDuty concentrates on digital operations management with AI-driven insights, serving varied sectors but with a narrower product scope.

Which has the best competitive advantage?

AppLovin demonstrates a very favorable moat with ROIC significantly above WACC and growing profitability, indicating a durable competitive advantage. PagerDuty shows a slightly unfavorable moat with value destruction despite improving ROIC, reflecting weaker competitive positioning.

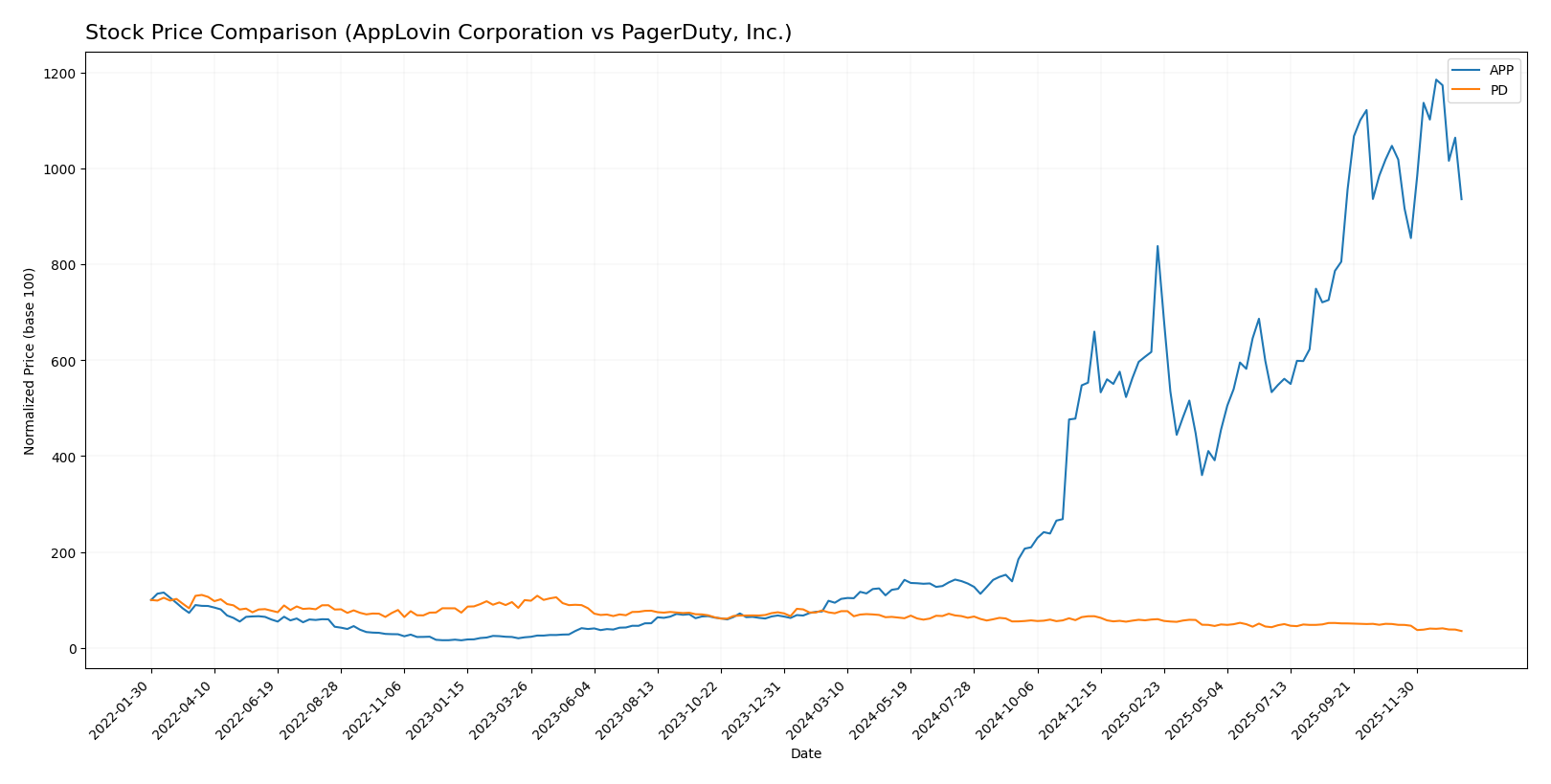

Stock Comparison

The past year showed a striking contrast in stock performance between AppLovin Corporation and PagerDuty, Inc., with AppLovin demonstrating a strong bullish trend despite recent deceleration, while PagerDuty experienced a pronounced bearish trend.

Trend Analysis

Over the past 12 months, AppLovin’s stock price surged by 892.51%, marking a bullish trend with deceleration. It reached a high of 721.37 and a low of 57.39, showing significant volatility with a standard deviation of 201.07.

PagerDuty’s stock declined by 51.18% over the same period, indicating a bearish trend with deceleration. Its price fluctuated between 11.36 and 24.66, with low volatility reflected by a 2.91 standard deviation.

Comparing the two, AppLovin’s stock vastly outperformed PagerDuty’s, delivering the highest market gains and demonstrating stronger overall market performance.

Target Prices

The current analyst consensus provides a clear outlook on the target prices for AppLovin Corporation and PagerDuty, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| AppLovin Corporation | 860 | 630 | 756.33 |

| PagerDuty, Inc. | 19 | 15 | 16.2 |

Analysts expect AppLovin’s stock to appreciate significantly from its current price of $569.39, while PagerDuty’s consensus target of $16.2 also suggests moderate upside from its current price of $11.36.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for AppLovin Corporation (APP) and PagerDuty, Inc. (PD):

Rating Comparison

APP Rating

- Rating: B, categorized as Very Favorable by analysts.

- Discounted Cash Flow Score: Moderate at 3, showing balanced valuation outlook.

- ROE Score: Very Favorable at 5, indicating efficient profit generation.

- ROA Score: Very Favorable at 5, showing effective asset utilization.

- Debt To Equity Score: Very Unfavorable at 1, highlighting financial risk.

- Overall Score: Moderate at 3, reflecting balanced overall performance.

PD Rating

- Rating: A-, also Very Favorable, indicating stronger analyst sentiment.

- Discounted Cash Flow Score: Very Favorable at 5, indicating strong valuation.

- ROE Score: Very Favorable at 5, matching APP’s strong profitability metric.

- ROA Score: Very Favorable at 5, equally strong in asset efficiency.

- Debt To Equity Score: Very Unfavorable at 1, same financial risk concern.

- Overall Score: Favorable at 4, indicating a stronger overall standing.

Which one is the best rated?

PagerDuty (PD) holds a superior overall rating of A- and a higher overall score of 4 compared to AppLovin’s (APP) B rating and score of 3. PD also outperforms APP notably in discounted cash flow and overall evaluation, despite similar financial risk levels.

Scores Comparison

This section compares the Altman Z-Score and Piotroski Score of AppLovin Corporation and PagerDuty, Inc.:

AppLovin Scores

- Altman Z-Score: 30.7, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial health and value potential.

PagerDuty Scores

- Altman Z-Score: 1.26, indicating distress zone with high bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial health and value potential.

Which company has the best scores?

AppLovin shows a significantly stronger Altman Z-Score in the safe zone, while both companies share an identical Piotroski Score of 7, indicating strong financial health. AppLovin’s scores suggest a more stable financial position overall.

Grades Comparison

Here is a comparison of the recent grades assigned to AppLovin Corporation and PagerDuty, Inc.:

AppLovin Corporation Grades

This table shows recent grades and actions from recognized financial institutions for AppLovin Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2026-01-13 |

| Wells Fargo | Maintain | Overweight | 2026-01-08 |

| Jefferies | Maintain | Buy | 2025-12-11 |

| Benchmark | Maintain | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-11-12 |

| Wells Fargo | Maintain | Overweight | 2025-11-07 |

| Goldman Sachs | Maintain | Neutral | 2025-11-07 |

| JP Morgan | Maintain | Neutral | 2025-11-06 |

| Wedbush | Maintain | Outperform | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

AppLovin’s grades generally indicate a positive outlook, with a majority of “Buy” and “Overweight” ratings maintained by multiple reputable institutions.

PagerDuty, Inc. Grades

The following table lists recent grades and actions from recognized financial institutions for PagerDuty, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Buy | 2026-01-07 |

| RBC Capital | Downgrade | Sector Perform | 2026-01-05 |

| TD Cowen | Maintain | Buy | 2025-11-26 |

| Craig-Hallum | Downgrade | Hold | 2025-11-26 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-26 |

| RBC Capital | Maintain | Outperform | 2025-11-26 |

| Truist Securities | Maintain | Buy | 2025-11-19 |

| Baird | Maintain | Neutral | 2025-09-04 |

| RBC Capital | Maintain | Outperform | 2025-09-04 |

| Canaccord Genuity | Maintain | Buy | 2025-09-04 |

PagerDuty’s ratings show a mixed trend, with several downgrades and a balance between “Buy,” “Hold,” and “Neutral” grades across respected grading companies.

Which company has the best grades?

AppLovin Corporation holds a stronger consensus with predominately “Buy” and “Overweight” grades, while PagerDuty presents a more cautious outlook with mixed ratings and recent downgrades. This contrast may affect investor confidence and portfolio strategy.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for AppLovin Corporation (APP) and PagerDuty, Inc. (PD) based on the most recent financial and strategic data.

| Criterion | AppLovin Corporation (APP) | PagerDuty, Inc. (PD) |

|---|---|---|

| Diversification | Diverse revenue streams: $3.22B Advertising, $1.49B Apps (2024) | Limited product segmentation; mainly software platform services |

| Profitability | High net margin (33.55%), ROIC 38.7%, strong ROE (144.96%) | Negative net margin (-9.14%), negative ROIC (-9.66%), negative ROE (-32.92%) |

| Innovation | Strong innovation with growing ROIC (+1173%) indicating durable competitive advantage | Improving ROIC trend (+3.3%) but still value-destroying overall |

| Global presence | Established global footprint with significant market share in mobile advertising | Smaller global footprint, more niche in IT operations management |

| Market Share | Leading position in mobile app advertising and software platforms | Smaller market share, competing in a specialized SaaS segment |

Key takeaways: AppLovin demonstrates robust profitability, diversification, and a durable competitive moat with growing returns on capital. PagerDuty shows improving fundamentals but remains unprofitable and less diversified, indicating higher risk for investors seeking stable returns.

Risk Analysis

Below is a comparative risk table for AppLovin Corporation (APP) and PagerDuty, Inc. (PD) based on the latest available data from 2025-2026.

| Metric | AppLovin Corporation (APP) | PagerDuty, Inc. (PD) |

|---|---|---|

| Market Risk | High beta at 2.5 indicates elevated volatility | Lower beta at 0.63 suggests less market volatility |

| Debt level | High debt-to-equity ratio of 3.26; debt-to-assets 60.6% (unfavorable) | Debt-to-equity 3.57; debt-to-assets 50% (unfavorable) |

| Regulatory Risk | Moderate, typical for US tech sector | Moderate, similar US tech sector exposure |

| Operational Risk | Moderate; strong operational metrics but high leverage | Moderate; negative interest coverage indicates operational stress |

| Environmental Risk | Low; software industry with minimal direct environmental impact | Low; primarily digital operations, minimal environmental footprint |

| Geopolitical Risk | Moderate; international exposure but primarily US-based | Moderate; serves global clients, some exposure to geopolitical issues |

Synthesis: AppLovin faces high market risk due to its elevated beta and significant leverage, which may amplify losses during downturns. PagerDuty, while less volatile, shows operational risk with negative interest coverage and financial distress indicators, including an Altman Z-score in the distress zone. Both companies have moderate regulatory and geopolitical risks typical of US-based tech firms. Investors should weigh AppLovin’s growth potential against its leverage risks, while PagerDuty’s financial instability requires cautious assessment.

Which Stock to Choose?

AppLovin Corporation (APP) has shown strong income growth with a 43.44% revenue increase in 2024 and a 33.55% net margin, supported by highly favorable ROE (144.96%) and ROIC (38.7%). Despite a debt-to-equity ratio considered unfavorable, its overall rating is very favorable, reflecting solid profitability and a very favorable economic moat with growing ROIC exceeding WACC.

PagerDuty, Inc. (PD) reports modest revenue growth of 8.54% in 2025 but suffers from negative net margin (-9.14%) and unfavorable returns on equity (-32.92%) and invested capital. Its financial ratios are mostly unfavorable, with a slightly unfavorable economic moat indicating value destruction, though its rating remains very favorable, supported by a strong DCF score but challenged by financial leverage and profitability issues.

For investors, APP might appear more favorable for those seeking growth and robust profitability backed by a durable competitive advantage, while PD could be of interest to those tolerating higher risk in pursuit of potential turnaround opportunities, given its improving income growth but weaker financial health and value creation metrics.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of AppLovin Corporation and PagerDuty, Inc. to enhance your investment decisions: