In today’s dynamic technology landscape, AppLovin Corporation and DocuSign, Inc. stand out as innovative leaders in the software application sector. While AppLovin excels in mobile app marketing and monetization platforms, DocuSign specializes in digital agreement management and e-signature solutions. Their overlapping focus on software innovation and expanding global footprints makes them compelling candidates for investment. Join me as we analyze these companies to identify which holds the most promise for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between AppLovin Corporation and DocuSign, Inc. by providing an overview of these two companies and their main differences.

AppLovin Overview

AppLovin Corporation operates a software-based platform that supports mobile app developers in marketing and monetizing their applications globally. Their offerings include marketing software, analytics, and in-app bidding solutions designed to optimize ad revenue through real-time auctions. Founded in 2011 and headquartered in Palo Alto, California, AppLovin positions itself as a key player in the mobile app advertising industry with a market cap of approximately 194B USD.

DocuSign Overview

DocuSign, Inc. specializes in electronic signature software and digital agreement management, serving businesses worldwide. Its product suite includes AI-driven contract lifecycle management, automated workflows, and industry-specific cloud services, facilitating secure and efficient agreement processes. Established in 2003 and based in San Francisco, California, DocuSign holds a market cap near 11.5B USD and caters to enterprises, commercial, and small businesses.

Key similarities and differences

Both companies operate within the software application industry in the US technology sector and are listed on NASDAQ. AppLovin focuses on mobile app marketing and monetization, leveraging real-time auctions and analytics, while DocuSign centers on digital agreements and e-signature solutions enhanced by AI and workflow automation. The firms differ significantly in market capitalization and employee count, reflecting their distinct market niches and scale of operations.

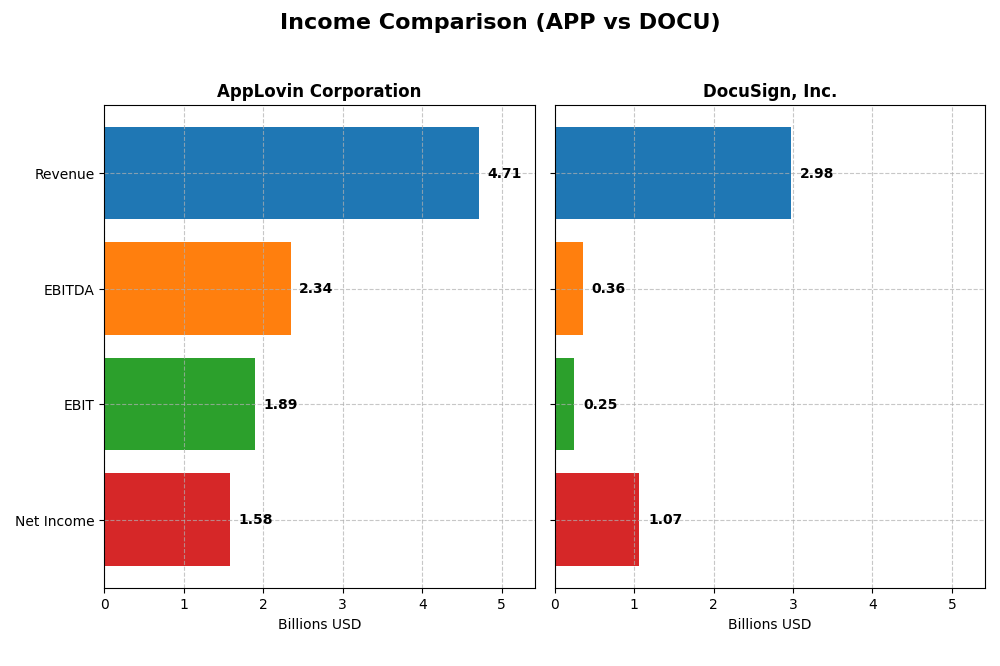

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for AppLovin Corporation and DocuSign, Inc. for their most recent fiscal years.

| Metric | AppLovin Corporation (2024) | DocuSign, Inc. (2025) |

|---|---|---|

| Market Cap | 194B | 11.5B |

| Revenue | 4.71B | 2.98B |

| EBITDA | 2.34B | 357M |

| EBIT | 1.89B | 249M |

| Net Income | 1.58B | 1.07B |

| EPS | 4.68 | 5.23 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

AppLovin Corporation

AppLovin’s revenue surged from 1.45B in 2020 to 4.71B in 2024, showing strong growth. Net income improved dramatically from a loss of 125M in 2020 to a profit of 1.58B in 2024. Margins strengthened significantly, with gross margin at 75.22% and net margin at 33.55% in 2024. The latest year reflected robust growth and margin expansion, signaling operational efficiency.

DocuSign, Inc.

DocuSign’s revenue doubled from 1.45B in 2021 to nearly 3B in 2025, with net income turning positive from a loss of 243M in 2021 to a 1.07B profit in 2025. Gross margin remained favorable at 79.12%, while EBIT margin was moderate at 8.38%. The 2025 fiscal year showed steady revenue growth and a strong rebound in profitability, highlighting improving fundamentals.

Which one has the stronger fundamentals?

Both companies exhibit favorable income statement trends with significant revenue and net income growth. AppLovin shows higher margins and sharper growth rates, especially in net income and EPS, indicating strong profitability and efficiency gains. DocuSign presents consistent revenue increases and improved profitability but with more modest EBIT margins. Overall, AppLovin’s fundamentals appear stronger based on margin and growth metrics.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for AppLovin Corporation (APP) and DocuSign, Inc. (DOCU), based on their most recent fiscal year data.

| Ratios | AppLovin Corporation (APP) 2024 | DocuSign, Inc. (DOCU) 2025 |

|---|---|---|

| ROE | 144.96% | 53.32% |

| ROIC | 38.70% | 9.09% |

| P/E | 69.06 | 18.51 |

| P/B | 100.11 | 9.87 |

| Current Ratio | 2.19 | 0.81 |

| Quick Ratio | 2.19 | 0.81 |

| D/E (Debt-to-Equity) | 3.26 | 0.06 |

| Debt-to-Assets | 60.59% | 3.10% |

| Interest Coverage | 5.89 | 128.99 |

| Asset Turnover | 0.80 | 0.74 |

| Fixed Asset Turnover | 23.71 | 7.28 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

AppLovin Corporation

AppLovin shows strong profitability with a net margin of 33.55% and an exceptional return on equity of 144.96%, signaling effective profit generation for shareholders. The company also maintains a solid current ratio of 2.19, indicating good short-term liquidity, but high debt levels with a debt-to-equity ratio of 3.26 and 60.59% debt-to-assets raise concerns. AppLovin does not pay dividends, likely prioritizing reinvestment and growth.

DocuSign, Inc.

DocuSign demonstrates favorable profitability metrics, including a 35.87% net margin and a 53.32% return on equity, though its return on invested capital is modest at 9.09%. The balance sheet shows low leverage with a debt-to-equity ratio of 0.06 and debt-to-assets of 3.1%, but liquidity is weaker, with a current ratio of 0.81. DocuSign also does not pay dividends, reflecting a focus on growth and reinvestment.

Which one has the best ratios?

Both companies present slightly favorable overall ratios, but AppLovin excels in profitability and liquidity while carrying higher financial leverage, which introduces risk. DocuSign offers lower leverage and strong interest coverage but weaker liquidity and more moderate returns on capital. The choice depends on investor preference for leverage versus liquidity and growth focus.

Strategic Positioning

This section compares the strategic positioning of AppLovin Corporation and DocuSign, Inc., including market position, key segments, and exposure to disruption:

AppLovin Corporation

- Operates in software application with high market cap and beta 2.5, facing competitive pressure in mobile app marketing.

- Key segments include Advertising ($3.22B) and Apps ($1.49B), driven by mobile app marketing solutions and analytics platforms.

- Exposure to technological disruption in mobile advertising and app monetization platforms, leveraging real-time auction and analytics tech.

DocuSign, Inc.

- Focused on electronic signature software with moderate market cap and beta near 1, competing in digital agreement management.

- Revenue mainly from Subscription and Circulation ($2.9B) and Professional Services ($75M), focused on e-signature and contract lifecycle management.

- Faces disruption risk in AI-driven contract management and digital workflow automation, integrating AI and cloud services.

AppLovin vs DocuSign Positioning

AppLovin pursues a diversified approach across advertising and app monetization with significant technology platform components. DocuSign concentrates on digital signature and contract management, emphasizing AI integration. AppLovin’s scale contrasts with DocuSign’s focused product suite.

Which has the best competitive advantage?

AppLovin shows a very favorable moat with strong ROIC growth and value creation, indicating a durable competitive advantage. DocuSign’s slightly favorable moat reflects improving profitability but lacks a strong competitive edge yet.

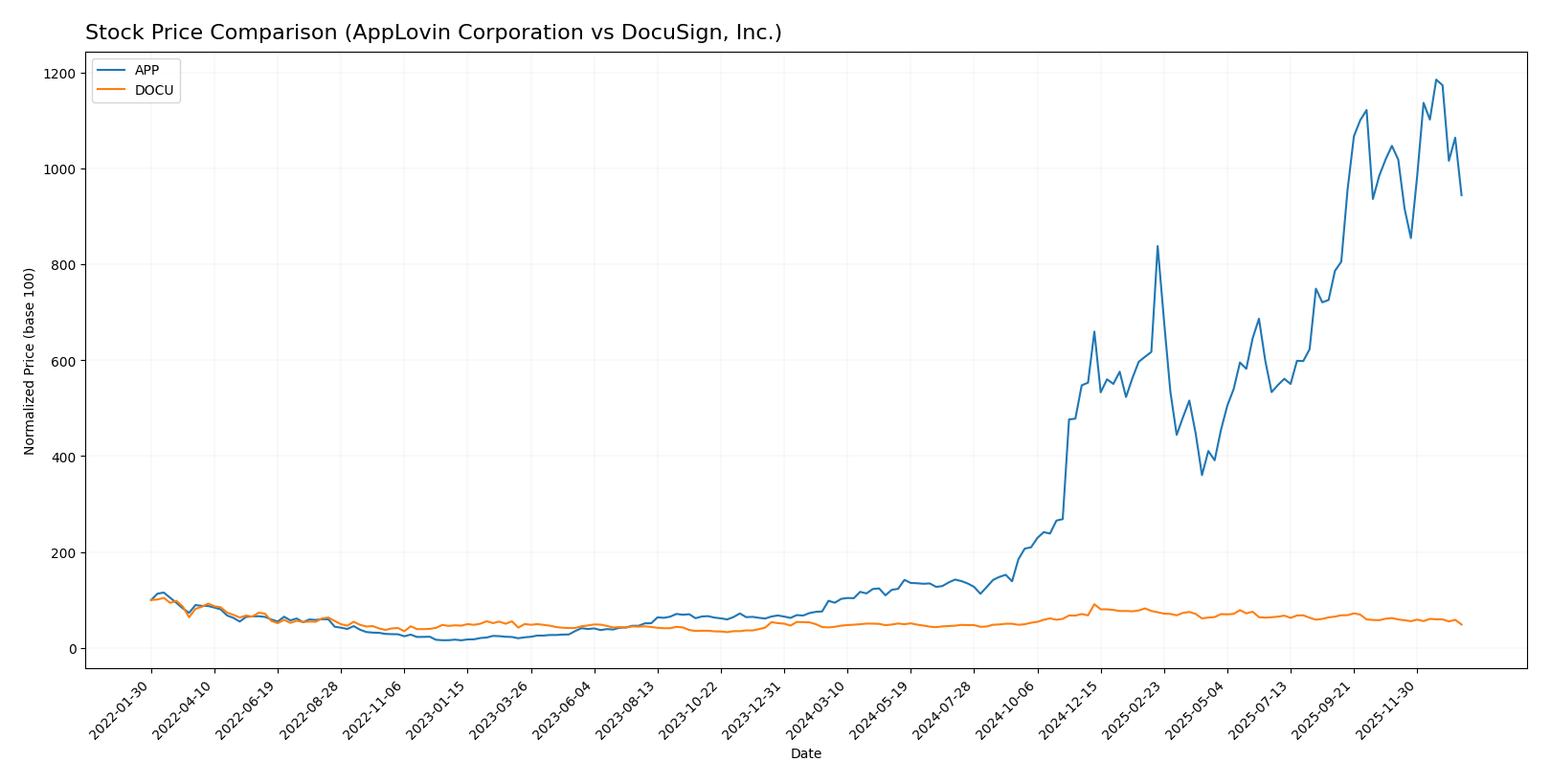

Stock Comparison

The stock price movements of AppLovin Corporation and DocuSign, Inc. over the past year reveal contrasting dynamics, with AppLovin showing a strong long-term rally despite recent pullbacks, while DocuSign demonstrates more modest gains alongside a sharper recent decline.

Trend Analysis

AppLovin Corporation’s stock has exhibited a highly bullish trend over the past 12 months, with a remarkable 901.36% price increase, though the pace of growth has decelerated. The stock reached a high of 721.37 and a low of 57.39, with notable volatility reflected in a 201.14 standard deviation.

DocuSign, Inc.’s stock also experienced a bullish trend over the past year, gaining 10.76%, but with decelerating momentum. Price volatility was lower, with a standard deviation of 12.97, and the stock ranged between 50.84 and 106.99.

Comparing the two, AppLovin has delivered significantly higher market performance with a strong bullish trend, while DocuSign’s gains have been much more moderate.

Target Prices

The current analyst consensus indicates promising upside potential for both AppLovin Corporation and DocuSign, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| AppLovin Corporation | 860 | 630 | 756.33 |

| DocuSign, Inc. | 88 | 70 | 76.86 |

Analysts expect AppLovin’s stock to trade well above its current price of 573.40, indicating strong growth prospects. DocuSign’s target consensus of 76.86 also suggests upside from its current market price of 57.25.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for AppLovin Corporation and DocuSign, Inc.:

Rating Comparison

AppLovin Corporation Rating

- Rating: B, considered very favorable overall by analysts.

- Discounted Cash Flow Score: Moderate at 3, indicating fair valuation.

- ROE Score: Very favorable 5, reflecting efficient equity use.

- ROA Score: Very favorable 5, strong asset utilization.

- Debt To Equity Score: Very unfavorable 1, indicating high leverage risk.

- Overall Score: Moderate 3, balanced but with mixed strengths and weaknesses.

DocuSign, Inc. Rating

- Rating: B+, also very favorable, slightly higher than APP.

- Discounted Cash Flow Score: Very favorable 5, showing strong valuation.

- ROE Score: Favorable 4, good efficiency but below APP.

- ROA Score: Favorable 4, good asset use but less than APP.

- Debt To Equity Score: Moderate 3, better financial risk profile.

- Overall Score: Moderate 3, similar overall rating to APP.

Which one is the best rated?

DocuSign holds a slightly better rating overall with a B+ versus AppLovin’s B, driven by a superior discounted cash flow score and a better debt to equity score. Both have moderate overall scores, but DocuSign’s financial risk appears more controlled.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for the two companies:

AppLovin Corporation Scores

- Altman Z-Score: 30.7, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial health.

DocuSign, Inc. Scores

- Altman Z-Score: 4.43, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 5, reflecting average financial health.

Which company has the best scores?

AppLovin shows a substantially higher Altman Z-Score and a stronger Piotroski Score compared to DocuSign. Both are in the safe zone, but AppLovin’s scores suggest better financial stability and strength based on the provided data.

Grades Comparison

Here is a comparison of the most recent reliable grades for AppLovin Corporation and DocuSign, Inc.:

AppLovin Corporation Grades

This table summarizes the latest grades issued by major financial institutions for AppLovin Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2026-01-13 |

| Wells Fargo | Maintain | Overweight | 2026-01-08 |

| Jefferies | Maintain | Buy | 2025-12-11 |

| Benchmark | Maintain | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-11-12 |

| Wells Fargo | Maintain | Overweight | 2025-11-07 |

| Goldman Sachs | Maintain | Neutral | 2025-11-07 |

| JP Morgan | Maintain | Neutral | 2025-11-06 |

| Wedbush | Maintain | Outperform | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

AppLovin’s grades show a strong positive consensus with multiple Buy and Overweight ratings maintained over several months.

DocuSign, Inc. Grades

This table presents recent grades from credible rating agencies for DocuSign, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Evercore ISI Group | Maintain | In Line | 2025-12-05 |

| UBS | Maintain | Neutral | 2025-12-05 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-05 |

| Piper Sandler | Maintain | Neutral | 2025-12-05 |

| RBC Capital | Maintain | Sector Perform | 2025-12-05 |

| JP Morgan | Maintain | Neutral | 2025-12-05 |

| B of A Securities | Maintain | Neutral | 2025-12-05 |

| Needham | Maintain | Hold | 2025-12-05 |

| Baird | Maintain | Neutral | 2025-12-05 |

DocuSign’s ratings predominantly indicate a Hold or Neutral stance, reflecting more cautious market sentiment.

Which company has the best grades?

AppLovin Corporation has received notably stronger grades, with a consensus Buy and multiple Overweight and Buy ratings, compared to DocuSign’s Hold and Neutral consensus. This difference indicates a more favorable outlook for AppLovin, potentially implying higher growth expectations and investor confidence.

Strengths and Weaknesses

Below is a comparative overview of the key strengths and weaknesses of AppLovin Corporation (APP) and DocuSign, Inc. (DOCU) based on their recent financial and market data.

| Criterion | AppLovin Corporation (APP) | DocuSign, Inc. (DOCU) |

|---|---|---|

| Diversification | Strong revenue mix between Advertising ($3.22B) and Apps ($1.49B) segments | Heavy reliance on Subscription and Circulation ($2.9B), limited Professional Services ($75M) |

| Profitability | High net margin (33.55%) and ROIC (38.7%), creating strong value | Healthy net margin (35.87%), moderate ROIC (9.09%), slightly favorable profitability growth |

| Innovation | Demonstrates durable competitive advantage with growing ROIC and high fixed asset turnover (23.71) | Growing ROIC but no clear moat yet, moderate fixed asset turnover (7.28) |

| Global presence | Strong market presence supported by diversified app portfolio and advertising platform | Expanding global footprint with subscription services but less diversified offerings |

| Market Share | Significant presence in digital advertising and mobile apps, high ROE (144.96%) | Strong in e-signature market with growing subscription base, moderate ROE (53.32%) |

Key takeaways: AppLovin exhibits a robust competitive moat with strong profitability and diversified revenue streams, albeit with some leverage concerns. DocuSign shows promising profitability trends and niche market strength but lacks the broad diversification and durable moat of AppLovin. Both companies present slightly favorable investment prospects with distinct risk profiles.

Risk Analysis

Below is a comparative risk assessment for AppLovin Corporation (APP) and DocuSign, Inc. (DOCU) based on the most recent financial and market data from 2025-2026.

| Metric | AppLovin Corporation (APP) | DocuSign, Inc. (DOCU) |

|---|---|---|

| Market Risk | High beta 2.5, volatile price range (200.5-745.61) | Moderate beta 0.99, narrower price range (57.2-99.3) |

| Debt level | High leverage, Debt/Equity 3.26, Debt/Assets 60.6% (unfavorable) | Low leverage, Debt/Equity 0.06, Debt/Assets 3.1% (favorable) |

| Regulatory Risk | Moderate, operates internationally in software marketing | Moderate, global electronic signature regulations evolving |

| Operational Risk | Moderate, reliant on ad auctions and data analytics platforms | Moderate, dependent on SaaS adoption and cloud infrastructure |

| Environmental Risk | Low, technology sector with minimal direct environmental impact | Low, primarily digital services with limited environmental footprint |

| Geopolitical Risk | Moderate, international client base subject to trade tensions | Moderate, global customer base subject to data sovereignty laws |

AppLovin faces higher market and debt risks due to its elevated beta and leverage, increasing vulnerability during economic downturns. DocuSign’s key risks lie in regulatory changes around digital signatures and SaaS compliance but benefits from a stronger balance sheet and lower leverage, mitigating financial risk. Both companies operate in competitive global markets with moderate operational and geopolitical challenges.

Which Stock to Choose?

AppLovin Corporation (APP) shows a strong income evolution with 224.53% revenue growth over 2020–2024, favorable profitability ratios including a 33.55% net margin, and a very favorable rating of B. However, it carries elevated debt levels with a debt-to-assets ratio of 60.59%, despite a sturdy current ratio of 2.19 and a very favorable moat reflecting durable competitive advantage.

DocuSign, Inc. (DOCU) exhibits steady income growth with 104.86% revenue increase over 2021–2025 and a favorable 35.87% net margin. Its financial ratios are slightly favorable with a B+ rating, supported by low debt-to-assets at 3.1% and strong interest coverage, although liquidity ratios remain below one, indicating some short-term risk.

For an investor, APP might appear to suit growth-focused profiles due to its rapid income growth and robust profitability despite higher leverage, while DOCU could be more aligned with those valuing moderate growth and stronger balance sheet stability, given its lower debt and consistent income quality. Both companies present slightly to very favorable financial profiles but differ in risk exposures and capital structure.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of AppLovin Corporation and DocuSign, Inc. to enhance your investment decisions: