In the dynamic software industry, AppLovin Corporation and Dayforce Inc stand out as innovative players with distinct yet overlapping market focuses. AppLovin excels in mobile app marketing and monetization, while Dayforce specializes in cloud-based human capital management solutions. Both companies harness advanced technology to drive growth and efficiency. This article will help you determine which company offers the most compelling investment opportunity in today’s fast-evolving tech landscape.

Table of contents

Companies Overview

I will begin the comparison between AppLovin Corporation and Dayforce Inc by providing an overview of these two companies and their main differences.

AppLovin Overview

AppLovin Corporation focuses on building a software platform for mobile app developers to improve app marketing and monetization globally. Its solutions include AppDiscovery for marketing, Adjust for analytics, and MAX for in-app bidding, serving advertisers and publishers. Founded in 2011 and headquartered in Palo Alto, AppLovin operates in the application software industry with a market cap of 193.6B USD.

Dayforce Overview

Dayforce Inc offers human capital management (HCM) software, including HR, payroll, benefits, and workforce management services, primarily through its cloud platform, Dayforce. It also serves small businesses via Powerpay and provides payroll bureau solutions. Incorporated in 2013 and based in Minneapolis, Dayforce trades on the NYSE with a market cap of 11.1B USD in the technology application software sector.

Key similarities and differences

Both companies operate in the technology sector focusing on application software, but AppLovin targets mobile app marketing and monetization, while Dayforce specializes in HCM and payroll solutions. AppLovin has a significantly larger market capitalization and fewer employees compared to Dayforce, which employs 9,600 staff. Their business models differ, with AppLovin providing software tools for advertisers and publishers and Dayforce offering cloud-based HR services to enterprises.

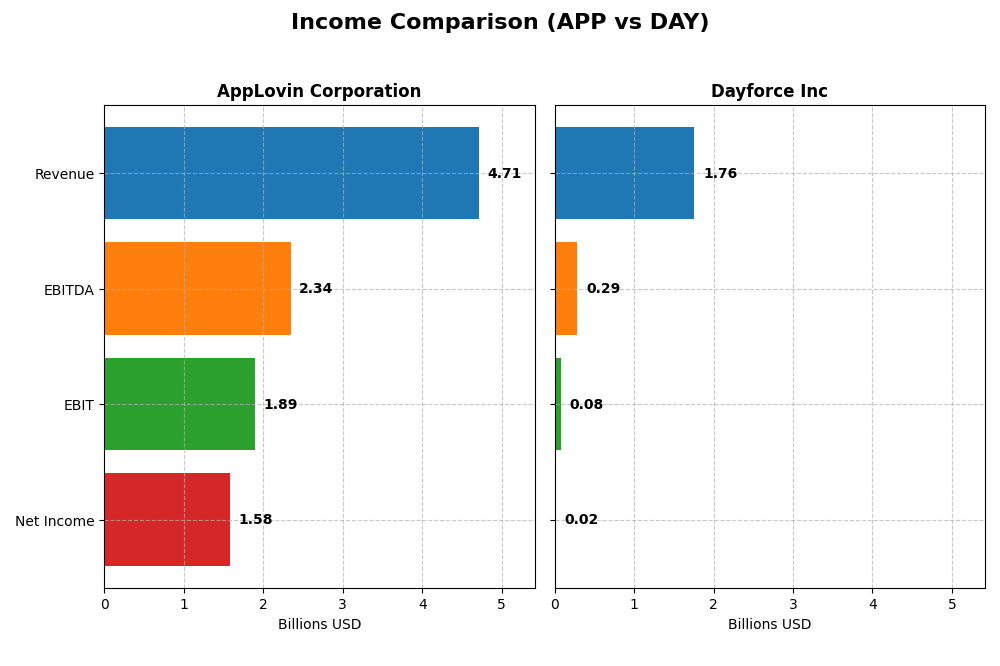

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for AppLovin Corporation and Dayforce Inc for the fiscal year 2024.

| Metric | AppLovin Corporation | Dayforce Inc |

|---|---|---|

| Market Cap | 194B | 11.1B |

| Revenue | 4.71B | 1.76B |

| EBITDA | 2.34B | 288M |

| EBIT | 1.89B | 78.2M |

| Net Income | 1.58B | 18.1M |

| EPS | 4.68 | 0.11 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

AppLovin Corporation

AppLovin demonstrated robust growth from 2020 to 2024, with revenue increasing by 225% and net income surging over 1360%. Margins improved significantly, highlighted by a strong gross margin of 75.22% and a net margin of 33.55% in 2024. The latest year showed exceptional growth, with revenue up 43.44% and net margin more than doubling, reflecting enhanced profitability and operational efficiency.

Dayforce Inc

Dayforce’s revenue rose steadily by 109% over the 2020-2024 period, while net income grew by 553%. Gross margin remained favorable at 46.14%, but EBIT margin was low at 4.44%, with net margin near break-even at 1.03% in 2024. Despite positive revenue growth of 16.27% in the latest year, net margin and EPS declined, indicating some pressure on profitability and cost management.

Which one has the stronger fundamentals?

AppLovin presents stronger fundamentals with higher and improving margins, substantial revenue and net income growth, and favorable operational leverage. Dayforce shows consistent revenue gains but exhibits weaker profitability metrics and recent margin contractions, suggesting more challenges in converting sales growth into earnings compared to AppLovin’s more robust financial performance.

Financial Ratios Comparison

The table below presents the most recent financial ratios for AppLovin Corporation and Dayforce Inc, offering a clear comparison of their key performance and financial health metrics for FY 2024.

| Ratios | AppLovin Corporation | Dayforce Inc |

|---|---|---|

| ROE | 144.96% | 0.71% |

| ROIC | 38.70% | 1.31% |

| P/E | 69.06 | 633.29 |

| P/B | 100.11 | 4.50 |

| Current Ratio | 2.19 | 1.13 |

| Quick Ratio | 2.19 | 1.13 |

| D/E | 3.26 | 0.48 |

| Debt-to-Assets | 60.59% | 13.52% |

| Interest Coverage | 5.89 | 2.56 |

| Asset Turnover | 0.80 | 0.19 |

| Fixed Asset Turnover | 23.71 | 7.46 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

AppLovin Corporation

AppLovin shows strong profitability with a high net margin of 33.55%, ROE of 144.96%, and ROIC of 38.7%, indicating efficient capital use. However, elevated debt levels and a high price-to-book ratio raise caution. The company does not pay dividends, likely prioritizing reinvestment and growth over shareholder payouts.

Dayforce Inc

Dayforce exhibits weak profitability and returns, with net margin at 1.03%, ROE at 0.71%, and ROIC at 1.31%. Debt levels and interest coverage are favorable, but the high price-to-earnings ratio and low asset turnover suggest valuation concerns. Dayforce also does not pay dividends, possibly focusing on growth and operational investments.

Which one has the best ratios?

AppLovin’s ratios are generally stronger, showing robust profitability and capital efficiency despite some leverage concerns. Dayforce’s ratios are less favorable, reflecting lower profitability and return metrics. Overall, AppLovin’s financials appear slightly more favorable compared to Dayforce’s more challenging metrics.

Strategic Positioning

This section compares the strategic positioning of AppLovin Corporation and Dayforce Inc, including Market position, Key segments, and disruption:

AppLovin Corporation

- Leading software platform for mobile app marketing and monetization; faces competitive pressure in ad tech and app sectors.

- Key segments are advertising software and app monetization platforms driving revenue growth internationally.

- Exposure to disruption through real-time bidding and advanced analytics in mobile advertising technology.

Dayforce Inc

- Human capital management software leader with a strong presence in payroll and workforce solutions; competitive in cloud HCM market.

- Focus on cloud HCM services including payroll, benefits, and workforce management targeting businesses across multiple regions.

- Faces technological disruption risks in cloud HR solutions but benefits from recurring revenue in cloud-based services.

AppLovin Corporation vs Dayforce Inc Positioning

AppLovin pursues a diversified approach with advertising and app monetization, leveraging advanced software platforms globally. Dayforce concentrates on cloud HCM solutions with recurring revenue streams. AppLovin’s strategy captures dynamic ad tech markets, while Dayforce focuses on steady human capital management demands.

Which has the best competitive advantage?

AppLovin shows a very favorable moat with strong value creation and growing ROIC, indicating durable competitive advantage. Dayforce, despite growing profitability, has a slightly unfavorable moat, indicating value destruction but improving returns.

Stock Comparison

The stock price movements over the past year reveal contrasting dynamics between AppLovin Corporation and Dayforce Inc, with AppLovin showing substantial gains despite recent deceleration, while Dayforce exhibits mild bearish tendencies with marginal recent improvement.

Trend Analysis

AppLovin Corporation’s stock price surged 897.53% over the past 12 months, indicating a strong bullish trend with decelerating momentum. The price ranged from a low of 57.39 to a high of 721.37, with notable volatility reflected by a 201.11 standard deviation.

Dayforce Inc’s stock declined by 3.14% during the same period, reflecting a bearish trend with decelerating intensity. The price fluctuated between 49.46 and 81.14, with relatively low volatility at a 7.84 standard deviation, and a slight recent uptrend of 0.63%.

Comparatively, AppLovin Corporation delivered the highest market performance, outperforming Dayforce Inc by a wide margin in price appreciation over the past year.

Target Prices

The current analyst consensus on target prices for these companies reflects cautious optimism.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| AppLovin Corporation | 860 | 630 | 756.33 |

| Dayforce Inc | 70 | 70 | 70 |

Analysts expect AppLovin’s stock to appreciate significantly from the current 572.32 USD price, while Dayforce’s target price aligns closely with its current price of 69.17 USD, suggesting limited near-term upside.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for AppLovin Corporation and Dayforce Inc:

Rating Comparison

APP Rating

- Rating: B, considered Very Favorable overall.

- Discounted Cash Flow Score: 3, indicating a Moderate valuation status.

- ROE Score: 5, reflecting Very Favorable profit generation from equity.

- ROA Score: 5, demonstrating Very Favorable asset utilization.

- Debt To Equity Score: 1, signaling Very Unfavorable financial risk profile.

- Overall Score: 3, a Moderate overall financial standing.

DAY Rating

- Rating: C-, marked as Very Favorable overall.

- Discounted Cash Flow Score: 2, indicating Moderate valuation status.

- ROE Score: 1, showing Very Unfavorable profit efficiency.

- ROA Score: 1, indicating Very Unfavorable asset efficiency.

- Debt To Equity Score: 2, suggesting Moderate financial risk.

- Overall Score: 1, a Very Unfavorable overall financial standing.

Which one is the best rated?

Based strictly on provided data, AppLovin (APP) holds higher ratings with Very Favorable ROE and ROA scores and a better overall score than Dayforce (DAY), which shows mostly Very Unfavorable scores except for moderate DCF and debt-to-equity metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

AppLovin Corporation Scores

- Altman Z-Score: 30.7, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

Dayforce Inc Scores

- Altman Z-Score: 1.24, indicating distress zone with high bankruptcy risk.

- Piotroski Score: 5, classified as average financial health.

Which company has the best scores?

AppLovin Corporation has significantly stronger scores, with a very high Altman Z-Score in the safe zone and a strong Piotroski Score. Dayforce Inc shows financial distress and only average Piotroski strength, indicating comparatively weaker financial health.

Grades Comparison

The following is a comparison of recent grades and ratings for AppLovin Corporation and Dayforce Inc:

AppLovin Corporation Grades

This table summarizes recent grades assigned to AppLovin Corporation by major financial institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2026-01-13 |

| Wells Fargo | Maintain | Overweight | 2026-01-08 |

| Jefferies | Maintain | Buy | 2025-12-11 |

| Benchmark | Maintain | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-11-12 |

| Wells Fargo | Maintain | Overweight | 2025-11-07 |

| Goldman Sachs | Maintain | Neutral | 2025-11-07 |

| JP Morgan | Maintain | Neutral | 2025-11-06 |

| Wedbush | Maintain | Outperform | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

Overall, AppLovin’s grades show a consistent positive trend with multiple Buy and Overweight ratings, indicating general analyst confidence.

Dayforce Inc Grades

This table summarizes recent grades assigned to Dayforce Inc by major financial institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Hold | 2025-10-30 |

| Stifel | Downgrade | Hold | 2025-09-19 |

| Citigroup | Downgrade | Neutral | 2025-09-17 |

| Wells Fargo | Upgrade | Equal Weight | 2025-08-22 |

| BMO Capital | Downgrade | Market Perform | 2025-08-22 |

| Keybanc | Downgrade | Sector Weight | 2025-08-22 |

| Needham | Downgrade | Hold | 2025-08-22 |

| Barclays | Maintain | Equal Weight | 2025-08-22 |

| Deutsche Bank | Maintain | Hold | 2025-08-22 |

| Jefferies | Maintain | Hold | 2025-08-21 |

Dayforce’s recent grades reflect a cautious outlook with multiple downgrades and predominantly Hold and Neutral ratings, indicating moderate analyst sentiment.

Which company has the best grades?

AppLovin Corporation has received significantly better grades than Dayforce Inc, with a strong consensus Buy and multiple Overweight ratings. Dayforce shows a consensus Hold and several downgrades. For investors, this disparity may suggest different risk and return profiles based on prevailing analyst confidence.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for AppLovin Corporation (APP) and Dayforce Inc (DAY), based on the most recent financial and operational data.

| Criterion | AppLovin Corporation (APP) | Dayforce Inc (DAY) |

|---|---|---|

| Diversification | Strong diversification with major revenue from Advertising ($3.22B) and Apps ($1.49B) | Moderate diversification focused on recurring cloud services ($1.52B) and professional services ($243M) |

| Profitability | High net margin (33.55%), ROIC (38.7%), and ROE (144.96%) indicating very favorable profitability | Low net margin (1.03%), ROIC (1.31%), and ROE (0.71%) indicating weak profitability |

| Innovation | Demonstrates a durable competitive advantage with very favorable moat and growing ROIC (23.2% above WACC) | Slightly unfavorable moat with growing ROIC but still value destructive (ROIC below WACC by -7.3%) |

| Global presence | Significant global reach through diversified digital advertising and app ecosystem | Focused mostly on cloud-based HR and payroll services with recurring revenue focus |

| Market Share | Strong market share in digital advertising and mobile apps segments | Niche market presence in cloud HR/payroll solutions, smaller scale compared to APP |

Key takeaways: AppLovin exhibits strong profitability, diversification, and a durable competitive moat, making it a more attractive investment option. Dayforce shows improving profitability but remains value destructive with a narrower focus and weaker financial metrics. Investors should weigh risk carefully with DAY.

Risk Analysis

The table below summarizes key risks for AppLovin Corporation (APP) and Dayforce Inc (DAY) based on their 2024 financial data and market environment in 2026.

| Metric | AppLovin Corporation (APP) | Dayforce Inc (DAY) |

|---|---|---|

| Market Risk | High beta at 2.5 indicates volatility; tech sector cyclicality | Moderate beta at 1.18; stable HCM demand but competitive market |

| Debt level | High leverage: Debt-to-Equity 3.26; Debt-to-Assets 60.6% (unfavorable) | Low leverage: Debt-to-Equity 0.48; Debt-to-Assets 13.5% (favorable) |

| Regulatory Risk | Moderate; subject to data privacy laws impacting ad platforms | Moderate; compliance with labor and payroll regulations critical |

| Operational Risk | Medium; reliance on app developers and ad market health | Medium; complexity of cloud HCM platform and integration risks |

| Environmental Risk | Low; software company with limited environmental footprint | Low; similar limited environmental impact |

| Geopolitical Risk | Moderate; international exposure to ad markets | Moderate; international payroll services subject to geopolitical shifts |

In synthesis, AppLovin faces significant market and financial risks due to its high beta and heavy debt load, raising concerns about volatility and financial stability despite strong profitability. Dayforce shows lower financial risk but struggles with profitability and operational efficiency, reflected in its weak returns and distress-level Altman Z-score. Market and regulatory risks are moderate for both, but AppLovin’s leverage and market sensitivity make it the more vulnerable of the two.

Which Stock to Choose?

AppLovin Corporation (APP) shows strong income growth with a 43.44% revenue increase in 2024 and a favorable net margin of 33.55%. Its financial ratios are slightly favorable overall, supported by high ROE (145%) and ROIC (39%), though burdened by high debt levels. APP’s debt-to-equity is unfavorable, but its credit rating is very favorable (B), reflecting solid profitability and liquidity.

Dayforce Inc (DAY) exhibits moderate income growth with 16.27% revenue increase in 2024 and a low net margin of 1.03%. Its financial ratios are generally unfavorable, with weak ROE (0.71%) and ROIC (1.31%), but it maintains lower debt exposure and a very favorable credit rating (C-). The company shows some operational challenges despite improving profitability trends.

For investors prioritizing growth and strong profitability, APP’s very favorable rating and income statement could appear more attractive, whereas risk-averse investors might see DAY’s lower leverage and stable rating as preferable. The contrasting financial profiles suggest the choice depends on the investor’s risk tolerance and strategy focus.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of AppLovin Corporation and Dayforce Inc to enhance your investment decisions: