In the fast-evolving semiconductor industry, Applied Materials, Inc. (AMAT) and Microchip Technology Incorporated (MCHP) stand out as key innovators shaping the future of technology. Both companies operate in overlapping markets, yet they pursue distinct innovation strategies—AMAT focuses on advanced manufacturing equipment, while MCHP specializes in embedded control solutions. This article will guide you in identifying which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Applied Materials, Inc. and Microchip Technology Incorporated by providing an overview of these two companies and their main differences.

Applied Materials, Inc. Overview

Applied Materials, Inc. delivers manufacturing equipment, services, and software primarily for the semiconductor, display, and related industries. Operating through three segments, it focuses on semiconductor fabrication tools, integrated service solutions, and display technologies. The company serves global markets including the US, Asia, and Europe, positioning itself as a key player in advanced semiconductor manufacturing solutions.

Microchip Technology Incorporated Overview

Microchip Technology Incorporated develops and sells embedded control solutions, including microcontrollers, microprocessors, and analog products, targeting a diverse range of applications from automotive to industrial. It also offers development tools, memory products, and manufacturing services. Headquartered in Chandler, Arizona, Microchip operates globally, focusing on smart, connected, and secure embedded systems.

Key similarities and differences

Both Applied Materials and Microchip operate within the semiconductor industry and serve global markets with advanced technology products. Applied Materials emphasizes manufacturing equipment and services for semiconductor production, whereas Microchip focuses on embedded control solutions and related components. The companies differ in their product scope, with Applied Materials providing fabrication tools and Microchip offering microcontrollers and analog devices.

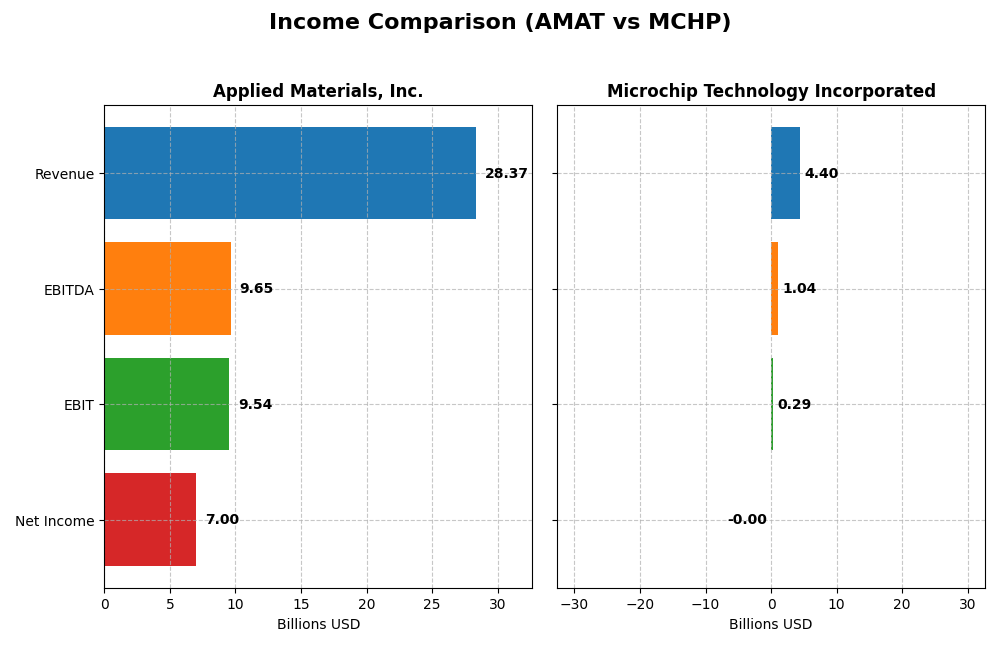

Income Statement Comparison

The table below compares key income statement metrics for Applied Materials, Inc. and Microchip Technology Incorporated for their most recent fiscal years, providing a clear financial snapshot.

| Metric | Applied Materials, Inc. (AMAT) | Microchip Technology Incorporated (MCHP) |

|---|---|---|

| Market Cap | 262.4B | 40.6B |

| Revenue | 28.37B | 4.40B |

| EBITDA | 9.65B | 1.04B |

| EBIT | 9.54B | 0.29B |

| Net Income | 7.00B | -0.5M |

| EPS | 8.71 | -0.005 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Applied Materials, Inc.

Applied Materials showed a steady revenue increase from $23.1B in 2021 to $28.4B in 2025, with net income growing from $5.9B to $7.0B over the same period. Margins remained robust, with a favorable gross margin near 48.7% and EBIT margin of 33.6%. The latest year’s revenue growth slowed to 4.4%, while EBIT expanded by 13.6%, accompanied by a slight net margin contraction.

Microchip Technology Incorporated

Microchip’s revenue declined significantly from $5.4B in 2021 to $4.4B in 2025, with net income turning negative to -$2.7M in 2025 from $349M positive in 2021. Gross margin remained favorable at 56.1%, but the EBIT margin was neutral at 6.6%, and the net margin turned unfavorable at -0.01%. The latest year exhibited sharp declines in revenue (-42.4%) and net income, reflecting persistent margin and profit challenges.

Which one has the stronger fundamentals?

Applied Materials demonstrates stronger fundamentals with consistent revenue and net income growth, stable and favorable margins, and positive earnings per share trends. In contrast, Microchip faces significant declines in revenue and profitability, with worsening margins and a negative net margin. These contrasts highlight a more resilient income statement profile for Applied Materials over the period analyzed.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Applied Materials, Inc. (AMAT) and Microchip Technology Incorporated (MCHP) based on their most recent fiscal year data.

| Ratios | Applied Materials, Inc. (AMAT) FY 2025 | Microchip Technology Inc. (MCHP) FY 2025 |

|---|---|---|

| ROE | 34.3% | -0.01% |

| ROIC | 21.96% | -0.03% |

| P/E | 26.58 | -52,021 |

| P/B | 9.11 | 3.67 |

| Current Ratio | 2.61 | 2.59 |

| Quick Ratio | 1.87 | 1.47 |

| D/E (Debt-to-Equity) | 0.35 | 0.80 |

| Debt-to-Assets | 19.4% | 36.9% |

| Interest Coverage | 30.8x | 1.18x |

| Asset Turnover | 0.78 | 0.29 |

| Fixed Asset Turnover | 5.54 | 3.72 |

| Payout Ratio | 19.8% | -1951.4% (negative earnings) |

| Dividend Yield | 0.74% | 3.75% |

Interpretation of the Ratios

Applied Materials, Inc.

Applied Materials shows predominantly favorable financial ratios, including a strong net margin of 24.67% and robust return on equity at 34.28%. Liquidity is solid with a current ratio of 2.61. However, valuation metrics like P/E at 26.58 and P/B at 9.11 appear elevated, which could concern some investors. The company pays dividends with a modest yield of 0.74%, supported by sustainable free cash flow, but the low yield and high payout ratios warrant monitoring.

Microchip Technology Incorporated

Microchip Technology presents weak profitability ratios, with net margin and ROE near zero or negative, signaling operational challenges. Its liquidity ratios remain favorable, but interest coverage is low at 1.15, highlighting potential debt servicing risks. Despite these issues, Microchip offers a comparatively high dividend yield of 3.75%, though this comes amid an unfavorable overall ratio profile and negative returns, suggesting caution.

Which one has the best ratios?

Applied Materials exhibits a more favorable ratio profile overall, with strong profitability, liquidity, and coverage ratios, despite some valuation concerns. Microchip shows weaker profitability and coverage, with higher debt-related risks, though it offers a higher dividend yield. Considering these factors, Applied Materials has the more solid financial ratio standing as of the latest fiscal year.

Strategic Positioning

This section compares the strategic positioning of Applied Materials, Inc. and Microchip Technology Incorporated, including market position, key segments, and exposure to technological disruption:

Applied Materials, Inc.

- Leading semiconductor equipment provider with significant market cap and competitive pressure.

- Diverse segments: Semiconductor Systems, Applied Global Services, Display and Adjacent Markets drive revenue.

- Provides advanced manufacturing technologies and services; exposed to rapid innovation in semiconductor fabrication.

Microchip Technology Incorporated

- Mid-sized semiconductor firm with moderate competitive pressure in embedded control solutions.

- Focused on embedded microcontrollers, analog products, and technology licensing as main business drivers.

- Faces technological disruption in embedded control and microcontroller markets but maintains niche expertise.

Applied Materials, Inc. vs Microchip Technology Incorporated Positioning

Applied Materials pursues a diversified approach across several semiconductor-related segments, providing equipment and services, while Microchip concentrates on embedded control solutions and licensing, offering a more focused but narrower market scope.

Which has the best competitive advantage?

Applied Materials shows a slightly favorable moat with value creation despite declining profitability, whereas Microchip has a very unfavorable moat with value destruction and sharply declining returns, indicating a weaker competitive advantage.

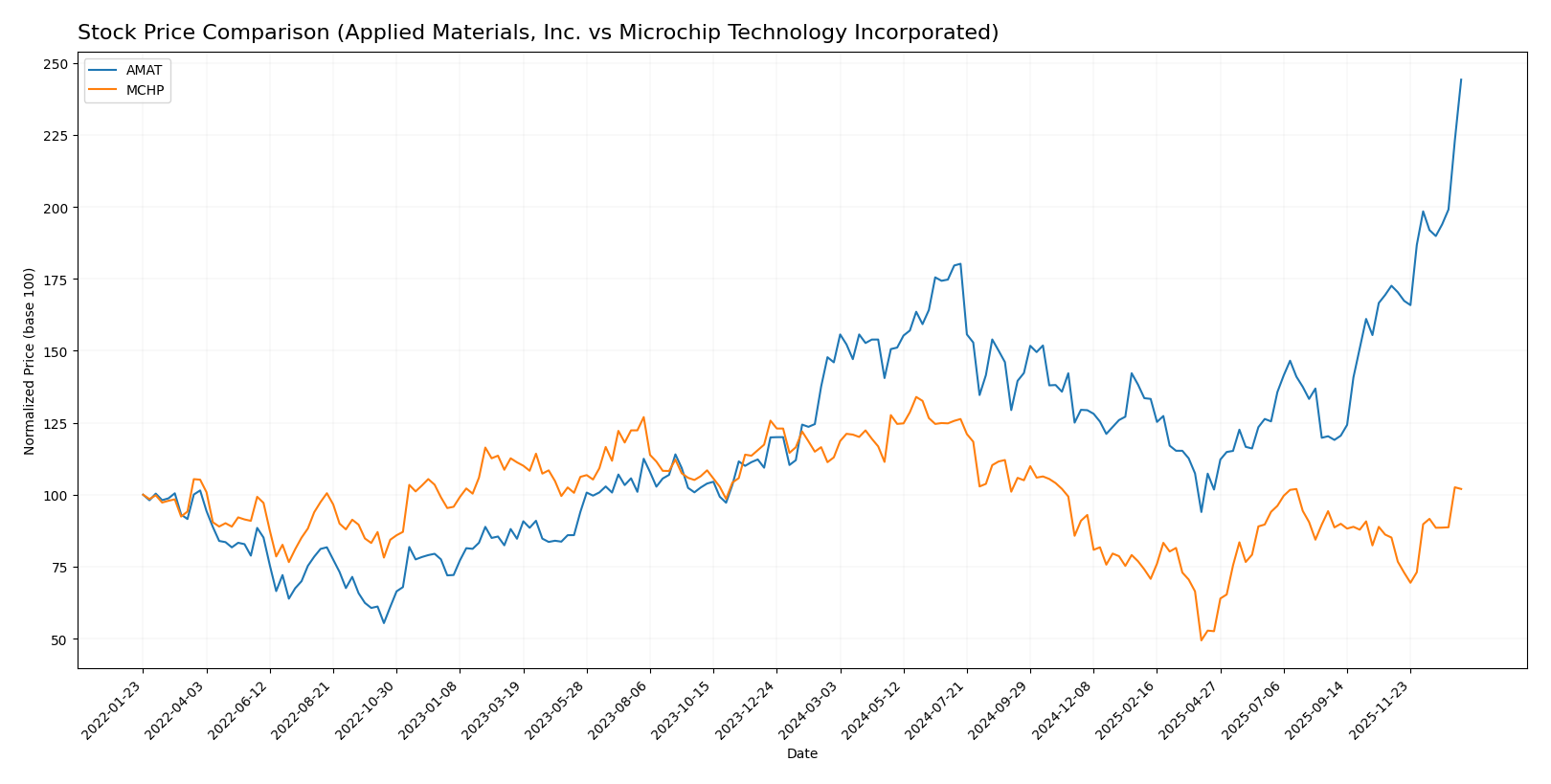

Stock Comparison

The stock prices of Applied Materials, Inc. (AMAT) and Microchip Technology Incorporated (MCHP) have exhibited distinct dynamics over the past 12 months, with AMAT showing strong bullish momentum and MCHP facing a bearish overall trend despite recent recovery signs.

Trend Analysis

Applied Materials, Inc. (AMAT) demonstrated a robust bullish trend over the past year, with a 67.28% price increase and accelerating momentum, reaching a high of 329.8 and a low of 126.95, supported by high volatility (34.82 std deviation).

Microchip Technology Incorporated (MCHP) experienced a bearish trend with a 9.72% price decline over the same period, yet recent months show a 19.82% rebound with decelerating volatility (7.62 std deviation), signaling some recovery.

Comparing both, AMAT delivered the highest market performance with a substantial price gain, while MCHP lagged with an overall negative trend despite recent improvement.

Target Prices

Analysts provide a clear target price consensus for Applied Materials, Inc. and Microchip Technology Incorporated.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Applied Materials, Inc. | 400 | 273 | 323.43 |

| Microchip Technology Incorporated | 85 | 60 | 77.44 |

The consensus target prices suggest moderate upside potential for Applied Materials, currently trading near 329.43 USD, while Microchip Technology’s consensus at 77.44 USD is slightly above its current price of 75.27 USD, indicating cautious optimism among analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Applied Materials, Inc. (AMAT) and Microchip Technology Incorporated (MCHP):

Rating Comparison

AMAT Rating

- Rating: B+, evaluated as Very Favorable

- Discounted Cash Flow Score: 3, considered Moderate

- ROE Score: 5, rated Very Favorable

- ROA Score: 5, rated Very Favorable

- Debt To Equity Score: 2, considered Moderate

- Overall Score: 3, considered Moderate

MCHP Rating

- Rating: C-, evaluated as Very Favorable

- Discounted Cash Flow Score: 3, considered Moderate

- ROE Score: 1, rated Very Unfavorable

- ROA Score: 1, rated Very Unfavorable

- Debt To Equity Score: 1, rated Very Unfavorable

- Overall Score: 1, rated Very Unfavorable

Which one is the best rated?

Based strictly on the provided data, AMAT holds a significantly stronger position with a higher overall score and superior ratings in ROE, ROA, and debt-to-equity metrics compared to MCHP’s lower scores and overall unfavorable ratings.

Scores Comparison

Here is a comparison of the financial scores for Applied Materials, Inc. (AMAT) and Microchip Technology Incorporated (MCHP):

AMAT Scores

- Altman Z-Score: 13.45, indicating a very strong safe zone rating.

- Piotroski Score: 7, representing strong financial strength.

MCHP Scores

- Altman Z-Score: 4.00, indicating a safe zone rating.

- Piotroski Score: 3, indicating very weak financial strength.

Which company has the best scores?

AMAT has a substantially higher Altman Z-Score and a stronger Piotroski Score compared to MCHP. Both companies are in the safe zone for bankruptcy risk, but AMAT demonstrates stronger overall financial health based on the provided scores.

Grades Comparison

The following presents a summary of recent grades for Applied Materials, Inc. and Microchip Technology Incorporated:

Applied Materials, Inc. Grades

This table lists recent grades for Applied Materials from reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Maintain | Buy | 2026-01-13 |

| Susquehanna | Upgrade | Positive | 2026-01-12 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-01-08 |

| B. Riley Securities | Maintain | Buy | 2025-12-18 |

| Mizuho | Maintain | Neutral | 2025-12-17 |

| Wells Fargo | Maintain | Overweight | 2025-12-15 |

| Jefferies | Maintain | Buy | 2025-12-15 |

| Keybanc | Maintain | Overweight | 2025-12-02 |

| UBS | Upgrade | Buy | 2025-11-25 |

| B. Riley Securities | Maintain | Buy | 2025-11-14 |

Overall, Applied Materials exhibits a predominantly positive grading trend, with multiple firms maintaining or upgrading to Buy and Overweight ratings.

Microchip Technology Incorporated Grades

This table shows recent grades for Microchip Technology from verified grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B. Riley Securities | Maintain | Buy | 2026-01-12 |

| Mizuho | Maintain | Outperform | 2026-01-09 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-07 |

| JP Morgan | Maintain | Overweight | 2026-01-06 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-06 |

| Needham | Maintain | Buy | 2026-01-06 |

| Rosenblatt | Maintain | Buy | 2026-01-06 |

| Stifel | Maintain | Buy | 2026-01-06 |

| Cantor Fitzgerald | Upgrade | Overweight | 2025-12-16 |

| B of A Securities | Maintain | Neutral | 2025-12-05 |

Microchip Technology’s grades show a stable to positive outlook, with several Buy and Overweight ratings and no downgrades.

Which company has the best grades?

Both companies hold a consensus Buy rating, but Applied Materials shows a stronger concentration of Buy and Overweight grades, whereas Microchip has more Equal Weight ratings alongside some Buy ratings. This suggests Applied Materials currently receives slightly more bullish analyst sentiment, potentially influencing investor confidence differently.

Strengths and Weaknesses

Below is a comparison table highlighting key strengths and weaknesses of Applied Materials, Inc. (AMAT) and Microchip Technology Incorporated (MCHP) based on their most recent financial and operational data.

| Criterion | Applied Materials, Inc. (AMAT) | Microchip Technology Incorporated (MCHP) |

|---|---|---|

| Diversification | Strong diversification with 3 main segments: Semiconductor Systems (19.9B USD), Applied Global Services (6.2B USD), Display and Adjacent Markets (885M USD) | Less diversified, mostly focused on Semiconductor Products (4.3B USD in 2025) with minor Technology Licensing (131M USD) |

| Profitability | High profitability: net margin 24.67%, ROIC 21.96%, ROE 34.28% | Negative profitability: net margin -0.01%, ROIC -0.03%, ROE -0.01% |

| Innovation | Consistent value creation with favorable ratio evaluations and strong fixed asset turnover (5.54) | Weak innovation impact, reflected by very unfavorable economic moat and declining profitability |

| Global presence | Large global footprint with substantial revenues in multiple segments | More concentrated market focus, smaller revenue base and less global reach |

| Market Share | Significant market share in semiconductor systems and services | Lower market share with declining ROIC and profitability |

Key takeaways: AMAT exhibits strong diversification and profitability with a slightly declining but positive economic moat, making it a more stable investment. In contrast, MCHP faces profitability challenges and a very unfavorable moat status, indicating higher investment risk.

Risk Analysis

Below is a comparative table summarizing key risks for Applied Materials, Inc. (AMAT) and Microchip Technology Incorporated (MCHP) as of 2025:

| Metric | Applied Materials, Inc. (AMAT) | Microchip Technology Incorporated (MCHP) |

|---|---|---|

| Market Risk | Beta 1.67 (above market volatility) | Beta 1.45 (moderate market sensitivity) |

| Debt level | Debt-to-Equity 0.35 (favorable, low leverage) | Debt-to-Equity 0.80 (neutral, higher leverage) |

| Regulatory Risk | Moderate (global semiconductor regulations) | Moderate (similar semiconductor industry exposure) |

| Operational Risk | Favorable operational efficiency | Unfavorable (low asset turnover, operational challenges) |

| Environmental Risk | Moderate (manufacturing footprint and global operations) | Moderate (manufacturing and supply chain dependencies) |

| Geopolitical Risk | High (significant exposure to Asia markets including China, Taiwan, Korea) | High (exposure to Asia, supply chain dependencies) |

The most impactful risks are market volatility and geopolitical exposure for both companies, given their heavy reliance on semiconductor markets and global supply chains. AMAT’s strong financial health and low debt mitigate risk better than MCHP, which faces operational challenges and higher leverage. Caution is advised when investing in MCHP due to its weaker profitability and financial stability indicators.

Which Stock to Choose?

Applied Materials, Inc. (AMAT) shows a generally favorable income evolution with 23% revenue growth over 2021-2025 and solid profitability metrics including a 24.67% net margin. Financial ratios mostly appear favorable, with low debt levels and strong returns on equity (34.3%) and invested capital, supported by a very favorable B+ rating.

Microchip Technology Incorporated (MCHP) exhibits unfavorable income trends, with a 19% revenue decline and negative net margin in 2025. Financial ratios are mixed to unfavorable, marked by high debt and weak returns on assets and equity. Despite some favorable valuation metrics, its overall rating is very unfavorable at C-, indicating financial challenges.

Considering ratings and comprehensive income and ratio evaluations, AMAT could be seen as more favorable for investors seeking quality and profitability, while MCHP’s profile might appeal less due to value destruction and declining income. Those with a higher risk tolerance or focused on turnaround potential might interpret MCHP differently.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Applied Materials, Inc. and Microchip Technology Incorporated to enhance your investment decisions: