In the competitive world of semiconductors, two giants, Applied Materials, Inc. (AMAT) and ASML Holding N.V. (ASML), stand out for their innovative contributions and market strategies. Both companies play critical roles in the semiconductor manufacturing ecosystem, yet they specialize in different segments—AMAT focuses on manufacturing equipment and services, while ASML leads in lithography technology. As we delve into this comparison, I aim to uncover which of these companies presents a more compelling investment opportunity for you.

Table of contents

Company Overview

Applied Materials, Inc. Overview

Applied Materials, Inc. is a leading provider of manufacturing equipment and services for the semiconductor, display, and related industries. With a market capitalization of approximately $201B, the company operates through three primary segments: Semiconductor Systems, Applied Global Services, and Display and Adjacent Markets. Its cutting-edge technologies enable the production of semiconductor chips and enhance the efficiency of manufacturing processes across the globe. Headquartered in Santa Clara, California, Applied Materials serves key markets in the U.S., China, Korea, Taiwan, Japan, and Europe, positioning itself as a critical player in the technology sector.

ASML Holding N.V. Overview

ASML Holding N.V. is a prominent player in the semiconductor equipment industry, specializing in advanced lithography systems essential for chipmakers. With a substantial market cap of around $411B, ASML leads in providing extreme ultraviolet lithography solutions, which are vital for manufacturing the latest semiconductor technologies. Founded in 1984 and based in Veldhoven, the Netherlands, the company operates globally, delivering innovative solutions that enhance chip production efficiency. ASML’s commitment to technological advancement solidifies its position as a cornerstone in the semiconductor supply chain.

Key similarities and differences

Both Applied Materials and ASML operate within the semiconductor industry, providing essential manufacturing equipment and services. However, Applied Materials focuses on a broader range of technologies, including display manufacturing, while ASML specializes in high-precision lithography systems crucial for chip production. This distinction highlights their unique contributions and market positioning within the semiconductor ecosystem.

Income Statement Comparison

The following table presents a comparative overview of key income metrics for Applied Materials, Inc. (AMAT) and ASML Holding N.V. (ASML) for their most recent fiscal years.

| Metric | Applied Materials (AMAT) | ASML Holding (ASML) |

|---|---|---|

| Market Cap | 201B | 411B |

| Revenue | 28.37B | 28.26B |

| EBITDA | 9.65B | 10.12B |

| EBIT | 9.54B | 9.21B |

| Net Income | 6.99B | 7.57B |

| EPS | 8.71 | 19.25 |

| Fiscal Year | 2025 | 2024 |

Interpretation of Income Statement

Analyzing the income statements, Applied Materials reported a revenue increase to 28.37B, reflecting a strong growth trajectory compared to previous periods. In contrast, ASML also maintained steady revenue at 28.26B, showing resilience in a competitive market. Profit margins are stable for both companies, with AMAT’s EBITDA margin slightly lower than ASML’s, indicating that ASML is managing its costs more efficiently. Notably, AMAT’s EPS growth reflects effective capital management, but ASML’s higher EPS suggests a premium in valuation. Overall, while both companies exhibit solid performance, ASML appears to have a slight edge in profitability metrics.

Financial Ratios Comparison

In this section, I present a comparative overview of key financial metrics for Applied Materials, Inc. (AMAT) and ASML Holding N.V. (ASML) to assist investors in making informed decisions.

| Metric | AMAT | ASML |

|---|---|---|

| ROE | 34.28% | 40.98% |

| ROIC | 22.03% | 24.93% |

| P/E | 26.78 | 34.77 |

| P/B | 9.18 | 14.25 |

| Current Ratio | 2.61 | 1.53 |

| Quick Ratio | 1.87 | 0.95 |

| D/E | 0.32 | 0.27 |

| Debt-to-Assets | 18.06% | 12.18% |

| Interest Coverage | 30.81 | 56.20 |

| Asset Turnover | 0.78 | 0.58 |

| Fixed Asset Turnover | 6.15 | 3.91 |

| Payout ratio | 19.26% | 33.84% |

| Dividend yield | 0.72% | 0.97% |

Interpretation of Financial Ratios

AMAT exhibits strong operational efficiency with a higher asset turnover, indicating effective use of assets to generate revenue. However, ASML outperforms in ROE and interest coverage, indicating stronger profitability and financial health despite its higher P/E and P/B ratios. The lower current and quick ratios for ASML suggest potential liquidity concerns, while AMAT’s ratios reflect a more robust short-term financial position. Investors should weigh these factors carefully against their risk tolerance and investment strategies.

Dividend and Shareholder Returns

Applied Materials, Inc. (AMAT) has consistently paid dividends, with a 2025 payout ratio of 19.3% and a dividend yield of approximately 0.72%. The company has a history of stable dividends, supported by robust free cash flow. In contrast, ASML Holding N.V. (ASML) also pays dividends, with a 2024 payout ratio of 29.4% and a yield of about 0.97%. Both companies engage in share buybacks, enhancing shareholder value. Their dividend policies indicate a commitment to sustainable long-term value creation.

Strategic Positioning

Applied Materials, Inc. (AMAT) holds a substantial market share in the semiconductor manufacturing equipment sector, competing closely with ASML Holding N.V. (ASML). While AMAT focuses on a range of equipment and services, ASML specializes in advanced lithography technologies, positioning itself as a leader in extreme ultraviolet lithography. The competitive pressure between these companies is heightened by rapid technological advancements and increasing demand for smaller, more efficient chips. Both firms are navigating a landscape marked by significant technological disruption.

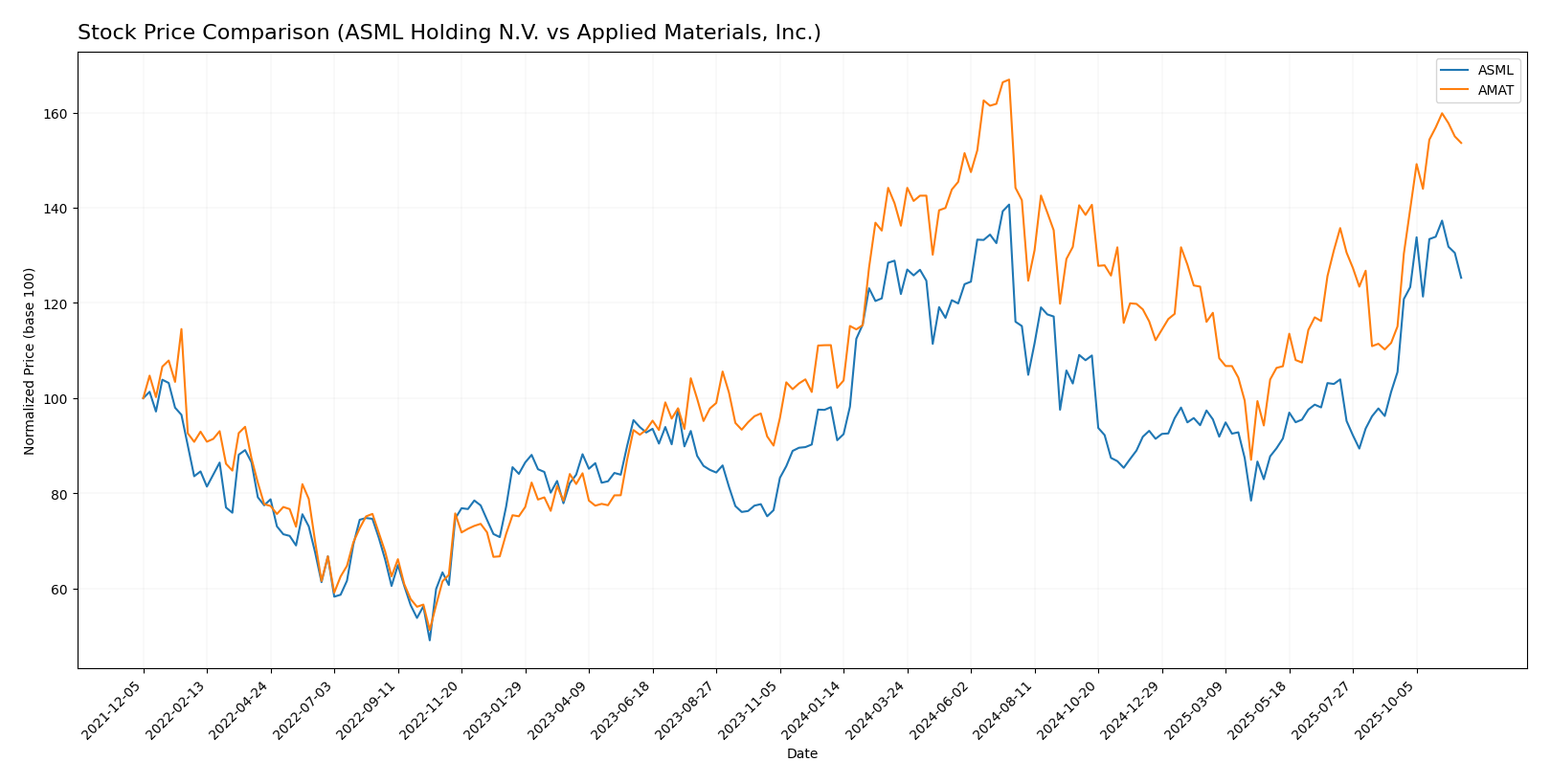

Stock Comparison

Over the past year, both Applied Materials, Inc. (AMAT) and ASML Holding N.V. (ASML) have demonstrated significant price movements, reflecting their robust trading dynamics and investor interest.

Trend Analysis

Applied Materials, Inc. (AMAT) has experienced a remarkable price increase of 69.3% over the past year. The stock trend is classified as bullish, with acceleration observed in the price movement. Notably, the stock reached a high of $252.25 and a low of $126.95, indicating strong volatility with a standard deviation of 26.55. The recent trend from September 14, 2025, to November 30, 2025, shows a 50.33% increase, further supporting the bullish outlook, with a trend slope of 5.33 and a standard deviation of 21.15.

ASML Holding N.V. (ASML) has also shown a substantial price increase of 50.71% over the last year, categorizing its trend as bullish. The stock reached a high of $1085.26 and a low of $605.55, with a higher volatility reflected in its standard deviation of 126.46. In the recent period from September 14, 2025, to November 30, 2025, ASML’s stock rose by 30.24%, demonstrating acceleration as well with a trend slope of 12.94 and a standard deviation of 67.72.

Both companies are on an upward trajectory, with strong buyer dominance and increasing volumes, indicating positive market sentiment and potential for continued growth.

Analyst Opinions

Recent analyst recommendations for both Applied Materials, Inc. (AMAT) and ASML Holding N.V. (ASML) indicate a consensus rating of “B+”. Analysts highlight solid return on equity and assets, scoring 5 in both categories, which suggests strong operational efficiency. However, they note concerns regarding the debt-to-equity ratio, scoring 2 for AMAT and 3 for ASML. Overall, the sentiment for both stocks leans towards a “buy” for the current year, reflecting optimism about their growth potential despite some financial risks.

Stock Grades

The latest stock ratings for Applied Materials, Inc. (AMAT) and ASML Holding N.V. (ASML) indicate some interesting trends in investor sentiment.

Applied Materials, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | upgrade | Buy | 2025-11-25 |

| Citigroup | maintain | Buy | 2025-11-14 |

| Mizuho | maintain | Neutral | 2025-11-14 |

| Needham | maintain | Buy | 2025-11-14 |

| Craig-Hallum | downgrade | Hold | 2025-11-14 |

| JP Morgan | maintain | Overweight | 2025-11-14 |

| Wells Fargo | maintain | Overweight | 2025-11-14 |

| B. Riley Securities | maintain | Buy | 2025-11-14 |

| Cantor Fitzgerald | maintain | Overweight | 2025-11-14 |

| Morgan Stanley | maintain | Overweight | 2025-11-14 |

ASML Holding N.V. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | maintain | Overweight | 2025-10-16 |

| Susquehanna | maintain | Positive | 2025-10-10 |

| JP Morgan | maintain | Overweight | 2025-10-06 |

| UBS | upgrade | Buy | 2025-09-05 |

| Wells Fargo | maintain | Overweight | 2025-07-08 |

| Jefferies | downgrade | Hold | 2025-06-26 |

| Barclays | downgrade | Equal Weight | 2025-06-03 |

| Wells Fargo | maintain | Overweight | 2025-04-17 |

| Susquehanna | maintain | Positive | 2025-04-17 |

| Raymond James | maintain | Strong Buy | 2025-04-16 |

Overall, both companies exhibit a mix of upgrades and consistent grades, suggesting a generally positive outlook among analysts, particularly for AMAT, which received an upgrade to “Buy” from UBS. However, ASML’s recent downgrade from Jefferies indicates some caution, reflecting the need for investors to remain vigilant in their assessments.

Target Prices

The consensus target prices for the companies are as follows:

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Applied Materials | 290 | 205 | 249.27 |

| ASML Holding | 1200 | 800 | 1045 |

For Applied Materials, the consensus target price of 249.27 is slightly below its current stock price of 252.31. In contrast, ASML Holding’s target consensus of 1045 is well below its current price of 1059.92, indicating a generally positive sentiment around both stocks.

Strengths and Weaknesses

The following table outlines the key strengths and weaknesses of Applied Materials, Inc. (AMAT) and ASML Holding N.V. (ASML) based on the most recent financial data.

| Criterion | AMAT | ASML |

|---|---|---|

| Diversification | Strong in semiconductor equipment | Highly specialized in lithography systems |

| Profitability | Net profit margin: 24.67% | Net profit margin: 28.44% |

| Innovation | Leading advancements in semiconductor technologies | Pioneer in extreme ultraviolet lithography |

| Global presence | Operations in multiple regions including USA and Asia | Strong global footprint, particularly in Europe and Asia |

| Market Share | Approx. 30% in semiconductor equipment | Approx. 60% in advanced lithography systems |

| Debt level | Low debt-to-equity ratio: 0.32 | Very low debt-to-equity ratio: 0.27 |

Key takeaways indicate that both companies excel in profitability and innovation, but with ASML leading in market share and profit margins. Applied Materials shows strong diversification, making it a solid investment choice depending on market conditions.

Risk Analysis

In the following table, I outline the key risks associated with Applied Materials, Inc. (AMAT) and ASML Holding N.V. (ASML) based on the most recent data.

| Metric | AMAT | ASML |

|---|---|---|

| Market Risk | High | High |

| Regulatory Risk | Medium | High |

| Operational Risk | Medium | Medium |

| Environmental Risk | Low | Medium |

| Geopolitical Risk | High | High |

Both companies face significant market and geopolitical risks, primarily due to their reliance on global supply chains and fluctuating demand in the semiconductor industry. Recent tensions in trade relations have added to this volatility, making investor caution essential.

Which one to choose?

When comparing Applied Materials, Inc. (AMAT) and ASML Holding N.V. (ASML), both companies exhibit strong fundamentals with a B+ rating from analysts. AMAT shows a higher net profit margin of 24.67% compared to ASML’s 26.79%, indicating efficient cost management. However, ASML’s gross profit margin is slightly better at 51.28%. AMAT’s price-to-earnings ratio stands at 26.78, suggesting it may be more attractive for value investors, while ASML trades at a higher P/E of 34.77, indicating growth expectations.

AMAT’s recent stock trend is bullish, with a 69.3% price increase over the past year, while ASML has gained 50.71%. Investors focused on growth may prefer ASML for its robust gross margin, while those prioritizing potential value may find AMAT appealing.

Risk Factors: Both companies face industry competition and potential supply chain disruptions.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Applied Materials, Inc. and ASML Holding N.V. to enhance your investment decisions: