Investors seeking opportunities in the oil and gas sector often face the challenge of choosing between companies with diverse strategies and footprints. Expand Energy Corporation (EXE) and APA Corporation (APA) both operate in oil and gas exploration and production but differ in scale, geographic reach, and innovation focus. This comparison will explore their strengths and risks, helping you identify which company aligns best with your investment goals. Let’s dive into the details to find the most compelling choice for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Expand Energy Corporation and APA Corporation by providing an overview of these two companies and their main differences.

Expand Energy Corporation Overview

Expand Energy Corporation operates as an independent exploration and production company in the United States, focusing on acquiring, exploring, and developing properties to produce oil, natural gas, and natural gas liquids. It holds interests in natural gas resource plays such as the Marcellus Shale and Haynesville/Bossier Shales. Founded in 1989 and based in Oklahoma City, Expand Energy manages a portfolio of approximately 5,000 natural gas wells, emphasizing unconventional onshore U.S. assets.

APA Corporation Overview

APA Corporation, founded in 1954 and headquartered in Houston, Texas, explores, develops, and produces oil and gas properties across the United States, Egypt, and the United Kingdom. It also has exploration activities offshore Suriname and operates gathering, processing, and transmission infrastructure in West Texas. APA owns interests in four Permian-to-Gulf Coast pipelines, reflecting its integrated approach within the oil and gas sector.

Key similarities and differences

Both Expand Energy and APA operate within the oil and gas exploration and production industry in the U.S. but differ in geographic scope and asset diversification. Expand Energy focuses primarily on unconventional natural gas assets domestically, while APA extends its operations internationally and includes midstream assets such as pipelines. Their scale varies, with Expand Energy having a market cap of $24.2B and APA at $8.9B, and APA employs more staff, reflecting broader operational breadth.

Income Statement Comparison

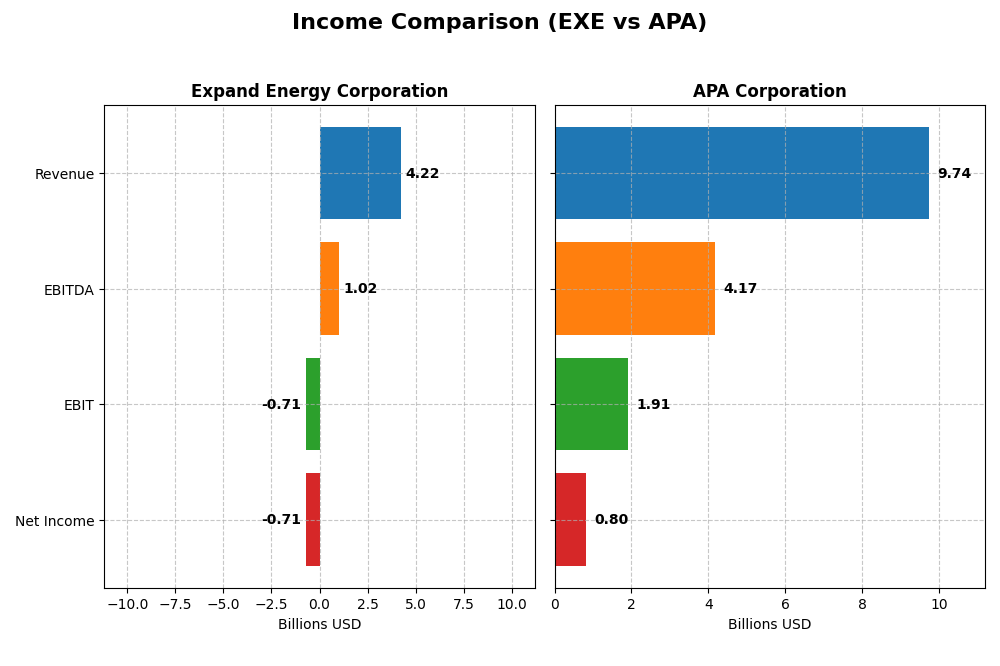

The table below compares key income statement metrics for Expand Energy Corporation and APA Corporation for the fiscal year 2024, providing a snapshot of their financial performance.

| Metric | Expand Energy Corporation | APA Corporation |

|---|---|---|

| Market Cap | 24.2B | 8.9B |

| Revenue | 4.22B | 9.74B |

| EBITDA | 1.02B | 4.17B |

| EBIT | -711M | 1.91B |

| Net Income | -714M | 804M |

| EPS | -4.55 | 2.28 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Expand Energy Corporation

Expand Energy Corporation experienced a revenue decline from $11.44B in 2022 to $4.22B in 2024, accompanied by a net income drop from $4.87B to a loss of $714M in 2024. Gross margin remained favorable at 27.03%, but EBIT and net margins turned unfavorable, reflecting operational challenges. The latest year saw significant contraction in revenue and profitability, with margins deteriorating sharply.

APA Corporation

APA Corporation showed consistent revenue growth from $4.44B in 2020 to $9.74B in 2024, with net income rising from a loss of $478M to $804M. The company maintained favorable gross margin at 44.18% and positive EBIT and net margins, though recent EBIT and net margin growth slowed. The 2024 results indicate solid fundamentals despite a recent decline in profitability metrics.

Which one has the stronger fundamentals?

APA Corporation presents stronger fundamentals, with favorable gross, EBIT, and net margins and consistent revenue and net income growth over the period. Conversely, Expand Energy Corporation faces unfavorable EBIT and net margins with a severe earnings decline in the most recent year. APA’s income statement reflects more resilience and profitability in this comparison.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Expand Energy Corporation (EXE) and APA Corporation (APA) based on their most recent fiscal year 2024 data.

| Ratios | Expand Energy Corporation (EXE) | APA Corporation (APA) |

|---|---|---|

| ROE | -4.06% | 15.23% |

| ROIC | -2.70% | 14.03% |

| P/E | -21.89 | 10.14 |

| P/B | 0.89 | 1.54 |

| Current Ratio | 0.64 | 1.15 |

| Quick Ratio | 0.64 | 1.01 |

| D/E (Debt-to-Equity) | 0.33 | 1.17 |

| Debt-to-Assets | 20.88% | 31.78% |

| Interest Coverage | -6.53 | 8.44 |

| Asset Turnover | 0.15 | 0.50 |

| Fixed Asset Turnover | 0.17 | 0.77 |

| Payout ratio | -54.34% | 43.91% |

| Dividend yield | 2.48% | 4.33% |

Interpretation of the Ratios

Expand Energy Corporation

Expand Energy shows several weak financial ratios, including negative net margin (-16.92%), return on equity (-4.06%), and return on invested capital (-2.7%), reflecting profitability challenges. Liquidity ratios are also low, with a current ratio of 0.64. However, its dividend yield of 2.48% is supported, indicating the company pays dividends despite some operational weaknesses, though coverage risks remain given negative returns.

APA Corporation

APA Corporation presents a more balanced profile, with favorable return on equity (15.23%) and return on invested capital (14.03%). Net margin is neutral at 8.26%, and liquidity ratios are moderate to favorable. APA pays dividends with a 4.33% yield, supported by generally positive earnings and cash flow metrics, though its high debt-to-equity ratio (1.17) signals some financial leverage concerns.

Which one has the best ratios?

APA Corporation holds the advantage with more favorable profitability and coverage ratios, moderate liquidity, and a supportive dividend yield. Expand Energy faces significant profitability and liquidity challenges, despite a reasonable dividend yield. Overall, APA’s ratios appear stronger and more balanced compared to Expand Energy’s predominantly unfavorable metrics.

Strategic Positioning

This section compares the strategic positioning of Expand Energy Corporation and APA Corporation in terms of market position, key segments, and exposure to technological disruption:

Expand Energy Corporation

- Leading independent U.S. exploration firm focused on unconventional natural gas in key shale basins.

- Primarily generates revenue from natural gas sales and gathering, with additional oil and liquids production.

- Limited explicit data on technological disruption exposure provided.

APA Corporation

- Mid-sized global explorer and producer with operations in U.S., Egypt, UK, and Suriname.

- Revenue mainly from oil and gas exploration and production, including purchased volumes.

- No explicit information on exposure to technological disruption given.

Expand Energy Corporation vs APA Corporation Positioning

Expand Energy focuses on a concentrated portfolio of U.S. unconventional natural gas assets, while APA pursues a more diversified geographical presence including international operations. Expand Energy’s niche in shale gas contrasts with APA’s broader oil and gas exploration and production activities, reflecting different market and segment focuses.

Which has the best competitive advantage?

APA Corporation shows a very favorable moat with growing ROIC above WACC, indicating strong value creation and durable competitive advantage. Expand Energy’s moat is slightly unfavorable despite improving profitability, signaling value destruction but positive ROIC trend.

Stock Comparison

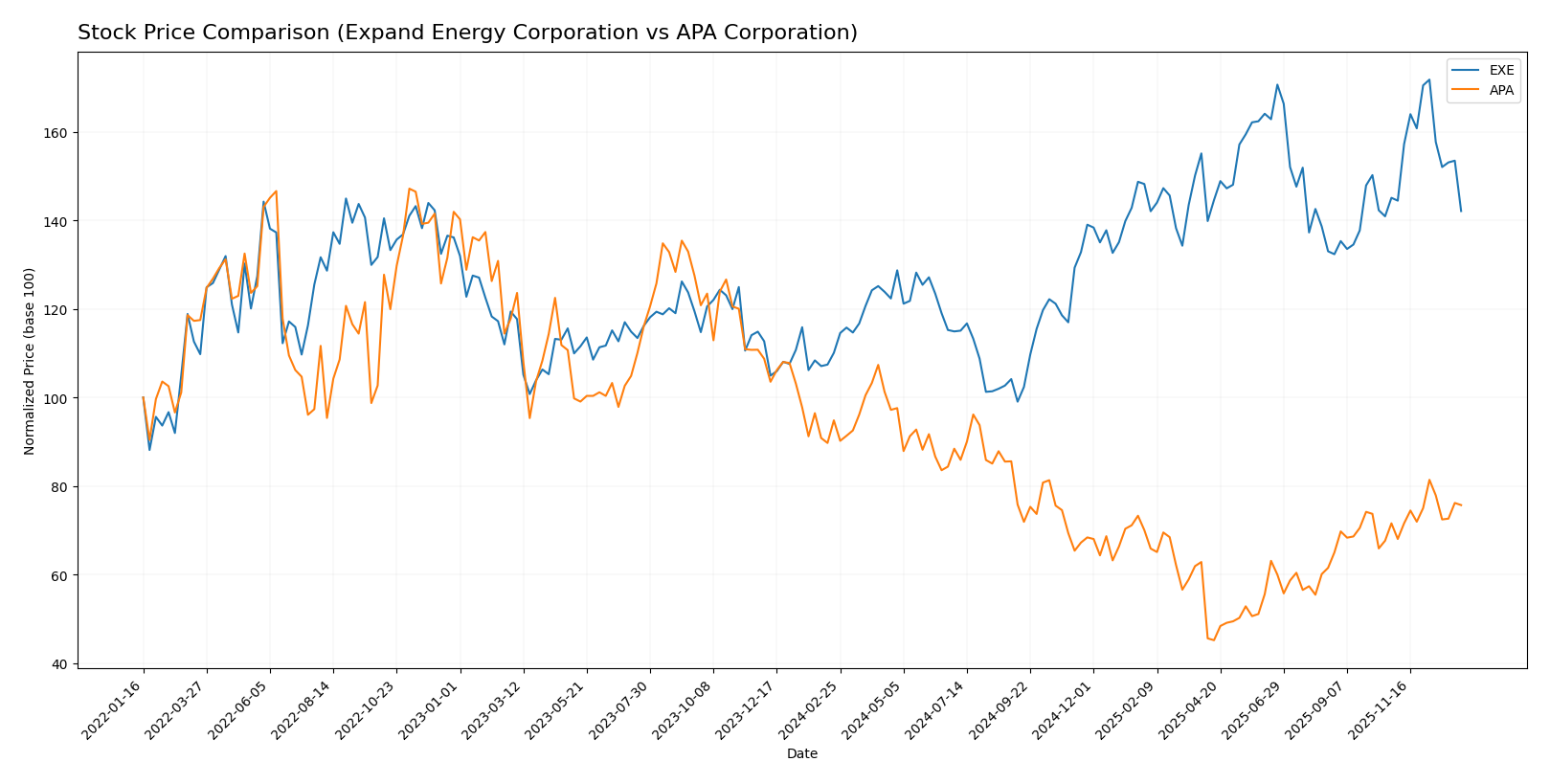

The stock price developments of Expand Energy Corporation (EXE) and APA Corporation (APA) over the past year reveal contrasting trajectories, with EXE showing a strong overall gain despite recent softening, while APA experienced a significant decline but has recently gained momentum.

Trend Analysis

Expand Energy Corporation (EXE) exhibited a bullish trend over the past 12 months with a 29.09% price increase, although this growth has decelerated recently, showing a slight negative change of -2.06% from late 2025 to early 2026. Volatility remains notable with a standard deviation of 12.95.

APA Corporation (APA) faced a bearish trend over the past year with a 20.18% price decrease, but it has accelerated recently, recording a 5.75% rise from October 2025 to January 2026. The stock shows lower volatility, with a standard deviation of 4.79.

Comparing the two, EXE delivered the highest market performance over the past year with a substantial price increase, while APA’s overall decline was partially offset by a recent upward trend.

Target Prices

Analysts provide a varied but constructive set of target prices for Expand Energy Corporation and APA Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Expand Energy Corporation | 150 | 125 | 140.63 |

| APA Corporation | 40 | 21 | 26.75 |

For Expand Energy Corporation, the consensus target price at 140.63 suggests a strong upside potential from its current price of 101.63. APA Corporation’s consensus target of 26.75 is slightly above its current trading price of 25.2, indicating modest expected gains.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Expand Energy Corporation and APA Corporation:

Rating Comparison

Expand Energy Corporation Rating

- Rating: B, considered very favorable by evaluators.

- Discounted Cash Flow Score: 4, favorable assessment.

- ROE Score: 3, moderate performance in generating shareholder returns.

- ROA Score: 4, favorable use of assets to generate earnings.

- Debt To Equity Score: 2, moderate financial risk.

- Overall Score: 3, moderate overall financial standing.

APA Corporation Rating

- Rating: A-, also considered very favorable by evaluators.

- Discounted Cash Flow Score: 3, moderate assessment.

- ROE Score: 5, very favorable, efficiently generating profits.

- ROA Score: 5, very favorable, excellent asset utilization.

- Debt To Equity Score: 1, very unfavorable, higher financial risk.

- Overall Score: 4, favorable overall financial standing.

Which one is the best rated?

APA Corporation holds a higher overall rating (A-) and superior scores in ROE and ROA, reflecting stronger profitability and asset management. However, its debt-to-equity score indicates higher financial risk compared to Expand Energy, which has a more moderate risk profile.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

EXE Scores

- Altman Z-Score: 2.43, indicating a grey zone with moderate risk

- Piotroski Score: 6, reflecting average financial strength

APA Scores

- Altman Z-Score: 1.48, indicating a distress zone with high risk

- Piotroski Score: 6, reflecting average financial strength

Which company has the best scores?

EXE has a higher Altman Z-Score, placing it in a grey zone versus APA’s distress zone, while both have the same average Piotroski Score of 6.

Grades Comparison

Here is a comparison of the recent grades assigned to Expand Energy Corporation and APA Corporation by reputable grading firms:

Expand Energy Corporation Grades

The following table summarizes recent grades from major financial institutions for Expand Energy Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-01-08 |

| Jefferies | Maintain | Buy | 2026-01-08 |

| Bernstein | Maintain | Outperform | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-19 |

| Mizuho | Maintain | Outperform | 2025-12-12 |

| UBS | Maintain | Buy | 2025-12-12 |

| Piper Sandler | Maintain | Overweight | 2025-11-18 |

| Morgan Stanley | Maintain | Overweight | 2025-10-30 |

| UBS | Maintain | Buy | 2025-10-30 |

| Morgan Stanley | Maintain | Overweight | 2025-10-14 |

Grades for Expand Energy Corporation consistently indicate positive sentiment, predominantly “Buy,” “Outperform,” or “Overweight,” reflecting a strong consensus on growth potential.

APA Corporation Grades

The following table summarizes recent grades from major financial institutions for APA Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Bernstein | Maintain | Market Perform | 2026-01-05 |

| UBS | Maintain | Neutral | 2025-12-12 |

| Mizuho | Maintain | Underperform | 2025-12-12 |

| Johnson Rice | Upgrade | Accumulate | 2025-12-05 |

| Citigroup | Maintain | Neutral | 2025-11-26 |

| Goldman Sachs | Maintain | Sell | 2025-11-21 |

| Piper Sandler | Maintain | Neutral | 2025-11-18 |

| RBC Capital | Maintain | Sector Perform | 2025-11-17 |

| Susquehanna | Maintain | Positive | 2025-11-12 |

| UBS | Maintain | Neutral | 2025-11-10 |

Grades for APA Corporation are more mixed, ranging from “Underperform” and “Sell” to “Accumulate” and “Positive,” indicating a less uniform outlook among analysts.

Which company has the best grades?

Expand Energy Corporation has received notably stronger and more consistent grades, with multiple “Buy” and “Outperform” ratings, compared to APA Corporation’s mixed ratings centering around “Neutral” and “Hold.” This suggests a clearer positive analyst consensus for Expand Energy, which may influence investor confidence differently for each company.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Expand Energy Corporation (EXE) and APA Corporation (APA) based on their latest financial and operational data.

| Criterion | Expand Energy Corporation (EXE) | APA Corporation (APA) |

|---|---|---|

| Diversification | Moderate: Focused mainly on natural gas and related services; limited oil sales (69M in 2024). | Moderate: Primarily oil and gas exploration and production, with some purchased oil and gas. |

| Profitability | Weak: Negative net margin (-16.9%), negative ROE (-4.1%), ROIC below WACC indicating value destruction. | Strong: Positive net margin (8.3%), ROE (15.2%), ROIC well above WACC indicating value creation. |

| Innovation | Limited data on innovation; ROIC trend is improving but still unfavorable overall. | Positive: Demonstrates durable competitive advantage with growing ROIC and profitability. |

| Global presence | Not explicitly detailed; mainly natural gas gathering and marketing in North America. | Not explicitly detailed; oil and gas operations focused on exploration and production, likely broader footprint. |

| Market Share | Significant in natural gas liquids and gathering sectors, with 2.686B in natural gas sales (2024). | Strong in oil and gas production with 8.196B in core oil and gas sales (2024). |

Key takeaways: APA Corporation demonstrates stronger profitability and value creation with a durable competitive advantage and expanding returns on invested capital. Expand Energy Corporation faces profitability challenges but shows improving ROIC trends, suggesting potential for turnaround if operational efficiency improves.

Risk Analysis

Below is a comparison of key risks affecting Expand Energy Corporation (EXE) and APA Corporation (APA) based on the most recent data from 2024–2026.

| Metric | Expand Energy Corporation (EXE) | APA Corporation (APA) |

|---|---|---|

| Market Risk | Low beta (0.45) reduces volatility risk | Moderate beta (0.74) implies higher sensitivity to market swings |

| Debt level | Low debt-to-equity (0.33), debt-to-assets 20.9% (favorable) | Higher debt-to-equity (1.17), debt-to-assets 31.8% (neutral) |

| Regulatory Risk | US-focused operations, moderate regulatory exposure | Global exposure including US, Egypt, UK; higher complexity and regulatory risk |

| Operational Risk | Focus on US shale gas with ~5,000 wells; operational risks tied to production efficiency | Diverse operations including offshore Suriname; higher operational complexity |

| Environmental Risk | Dependence on fossil fuels with potential regulatory and social pressures | Similar fossil fuel exposure, plus international environmental compliance risks |

| Geopolitical Risk | Primarily US-based, limited geopolitical risk | Exposure to Egypt, UK, Suriname increases geopolitical uncertainties |

In summary, APA faces higher debt and geopolitical risks due to its international presence, while EXE has lower market volatility exposure but struggles with operational efficiency and unfavorable profitability metrics. APA’s distress zone Altman score signals financial distress risk, demanding cautious monitoring.

Which Stock to Choose?

Expand Energy Corporation (EXE) shows a declining income trend with unfavorable profitability ratios and a growing debt burden. Its 2024 financial ratios mostly appear unfavorable, and the company’s rating is very favorable despite mixed score evaluations. The MOAT assessment is slightly unfavorable, indicating value destruction but improving profitability.

APA Corporation (APA) demonstrates favorable income growth and profitability metrics with mostly favorable or neutral financial ratios in 2024. Its rating is very favorable, supported by solid return measures despite a high debt-to-equity score. APA’s MOAT rating is very favorable, showing durable competitive advantage and increasing profitability.

Investors with a growth orientation might view APA as more favorable, given its positive income evolution, solid financial ratios, and strong MOAT. Conversely, those focused on turnaround potential or value investing might find EXE’s improving profitability despite current challenges worth monitoring. The choice could depend on the investor’s risk tolerance and strategy preferences.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Expand Energy Corporation and APA Corporation to enhance your investment decisions: