In the fast-evolving semiconductor industry, Analog Devices, Inc. (ADI) and Tower Semiconductor Ltd. (TSEM) stand out as pivotal players driving innovation and market growth. Both companies specialize in analog and mixed-signal technologies, serving diverse sectors such as automotive, communications, and industrial markets. This comparison highlights their strategic approaches and market positions to help you identify which stock could be the most compelling addition to your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Analog Devices, Inc. and Tower Semiconductor Ltd. by providing an overview of these two companies and their main differences.

Analog Devices, Inc. Overview

Analog Devices, Inc. specializes in designing, manufacturing, and marketing integrated circuits and subsystems that utilize analog, mixed-signal, and digital signal processing technologies. The company serves diverse markets such as industrial, automotive, consumer, aerospace, and communications. Headquartered in Wilmington, Massachusetts, Analog Devices has a strong global presence and a market capitalization of approximately 149B USD.

Tower Semiconductor Ltd. Overview

Tower Semiconductor Ltd. is an independent semiconductor foundry focused on analog intensive mixed-signal semiconductor devices. The company offers customizable process technologies and wafer fabrication services to integrated device manufacturers and fabless companies. Based in Migdal Haemek, Israel, Tower serves markets including consumer electronics, automotive, aerospace, and medical devices, with a market cap near 14B USD.

Key similarities and differences

Both companies operate in the semiconductor industry and provide analog and mixed-signal technology solutions. However, Analog Devices emphasizes integrated circuits and a broad portfolio including digital signal processing and power management products, while Tower Semiconductor concentrates on foundry services and wafer fabrication. Analog Devices is significantly larger by market cap and workforce, reflecting different scales and business models within the sector.

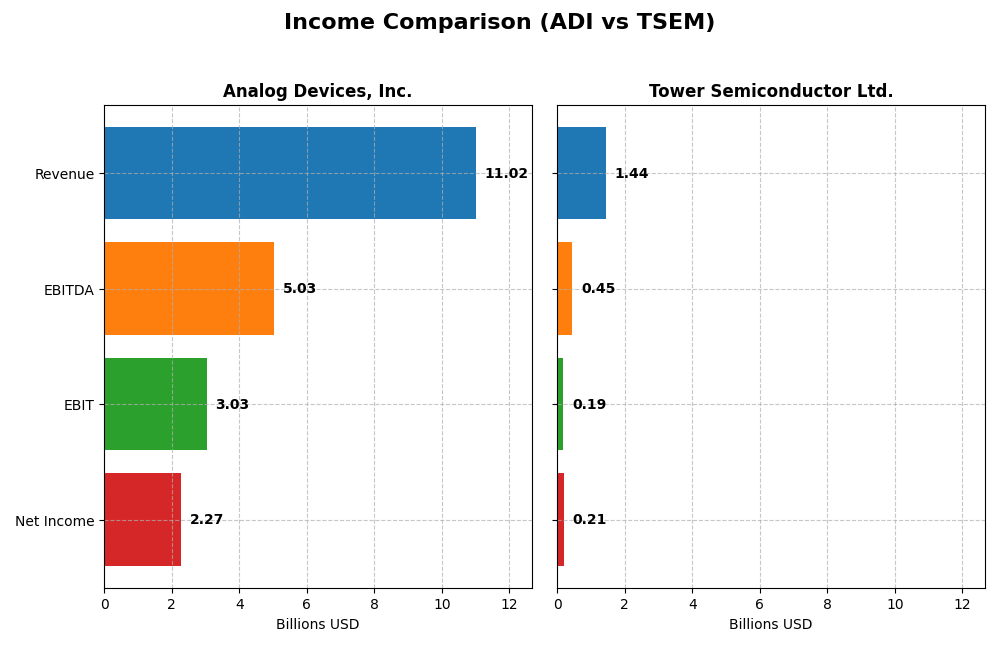

Income Statement Comparison

The table below compares key income statement metrics for Analog Devices, Inc. and Tower Semiconductor Ltd. for their most recent fiscal years, providing a snapshot of their financial performance.

| Metric | Analog Devices, Inc. (ADI) | Tower Semiconductor Ltd. (TSEM) |

|---|---|---|

| Market Cap | 149.4B | 13.9B |

| Revenue | 11.0B | 1.44B |

| EBITDA | 5.03B | 451M |

| EBIT | 3.03B | 185M |

| Net Income | 2.27B | 208M |

| EPS | 4.59 | 1.87 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Analog Devices, Inc.

From 2021 to 2025, Analog Devices, Inc. displayed strong revenue growth, increasing by 50.58%, alongside a 63.07% rise in net income. Margins remained robust, with a 54.66% gross margin and 20.58% net margin in 2025, both favorable. The latest year showed a 16.89% revenue increase and an 18.61% net margin improvement, indicating sustained operational efficiency.

Tower Semiconductor Ltd.

Tower Semiconductor’s revenue grew modestly by 13.47% over 2020–2024, with net income surging 152.56%. Margins were stable but lower than Analog Devices, with a 23.64% gross margin and 14.47% net margin in 2024. However, the last year exhibited slowing growth, with revenue up only 0.94% and net margin declining by 60.29%, reflecting recent operational challenges.

Which one has the stronger fundamentals?

Analog Devices, Inc. demonstrates stronger fundamentals with consistent high margins, broad revenue and net income growth, and positive recent-year momentum. Tower Semiconductor shows impressive net income growth over the long term but experienced a significant slowdown and margin contraction recently. Overall, Analog Devices’ income statement metrics appear more favorable and stable.

Financial Ratios Comparison

The table below presents the most recent financial ratios for Analog Devices, Inc. (ADI) and Tower Semiconductor Ltd. (TSEM) based on their fiscal year 2025 and 2024 data respectively, providing a snapshot for comparison.

| Ratios | Analog Devices, Inc. (2025) | Tower Semiconductor Ltd. (2024) |

|---|---|---|

| ROE | 6.7% | 7.8% |

| ROIC | 5.5% | 6.4% |

| P/E | 51.1 | 27.5 |

| P/B | 3.42 | 2.16 |

| Current Ratio | 2.19 | 6.18 |

| Quick Ratio | 1.68 | 5.23 |

| D/E (Debt-to-Equity) | 0.26 | 0.07 |

| Debt-to-Assets | 18.1% | 5.9% |

| Interest Coverage | 9.45 | 32.64 |

| Asset Turnover | 0.23 | 0.47 |

| Fixed Asset Turnover | 3.32 | 1.11 |

| Payout ratio | 84.9% | 0% |

| Dividend yield | 1.66% | 0% |

Interpretation of the Ratios

Analog Devices, Inc.

Analog Devices shows a balanced ratio profile with strong liquidity indicated by a current ratio of 2.19 and low debt levels, reflecting good financial health. However, return on equity is low at 6.7%, and valuation multiples like P/E and P/B ratios appear high, signaling potential overvaluation concerns. Dividend yield stands at 1.66%, suggesting moderate shareholder returns with a stable payout.

Tower Semiconductor Ltd.

Tower Semiconductor exhibits favorable leverage and interest coverage ratios, with low debt-to-assets at 5.87% and a strong interest coverage ratio of 31.57, indicating solid debt-servicing capacity. However, the company does not pay dividends, likely due to a reinvestment focus or growth strategy. Its current ratio is unusually high at 6.18, which can signal inefficient asset use.

Which one has the best ratios?

Both companies have a slightly favorable overall rating, but Analog Devices offers stronger liquidity and more balanced leverage, while Tower Semiconductor’s exceptionally high current ratio and lack of dividends may concern some investors. Analog Devices’ higher valuation multiples contrast with Tower’s lower debt and reinvestment approach.

Strategic Positioning

This section compares the strategic positioning of Analog Devices, Inc. and Tower Semiconductor Ltd., focusing on market position, key segments, and exposure to technological disruption:

Analog Devices, Inc.

- Leading semiconductor company with large market cap of 149B, facing typical industry competitive pressures.

- Diverse revenue streams across automotive, industrial, communications, and consumer markets.

- Exposure includes analog, mixed-signal, RF, power management, and MEMS technologies, supporting innovation.

Tower Semiconductor Ltd.

- Smaller foundry with 13.9B market cap, operating in competitive semiconductor manufacturing.

- Focused on analog intensive mixed-signal devices and foundry services for various sectors.

- Offers customizable process technologies including SiGe, BiCMOS, RF CMOS, MEMS, and design services.

Analog Devices, Inc. vs Tower Semiconductor Ltd. Positioning

ADI pursues a diversified business model across multiple end markets with broad product lines, while TSEM concentrates on foundry and mixed-signal niche technologies. ADI’s scale provides broader market reach, whereas TSEM’s focus targets specialized manufacturing segments.

Which has the best competitive advantage?

Both companies show slightly unfavorable MOATs, shedding value but with growing profitability. ADI and TSEM face challenges in sustaining economic profits despite improving ROIC trends, reflecting competitive semiconductor industry dynamics.

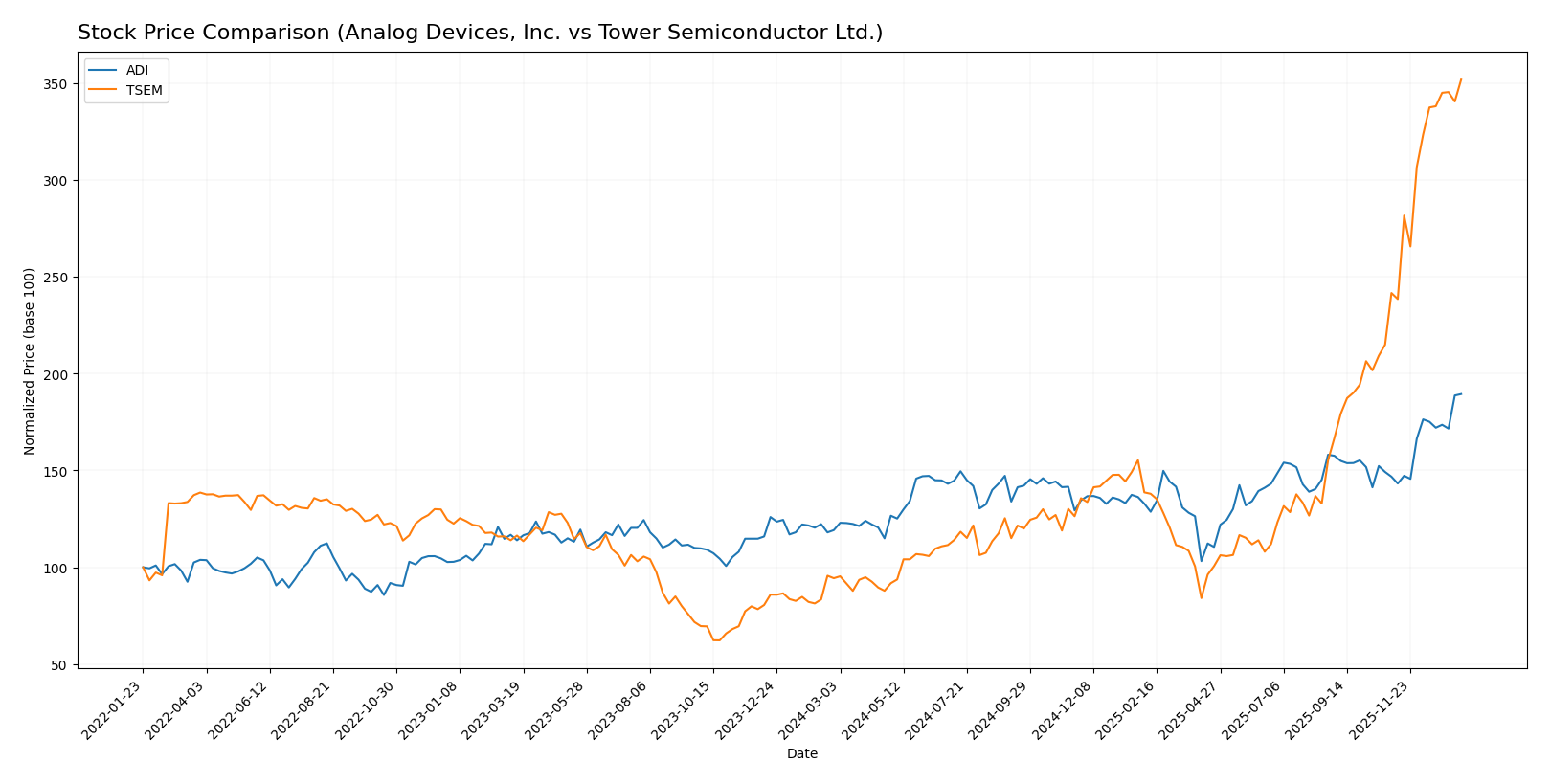

Stock Comparison

The stock price trends of Analog Devices, Inc. (ADI) and Tower Semiconductor Ltd. (TSEM) over the past 12 months reveal significant gains with accelerating momentum, highlighting strong bullish dynamics and notable price appreciation.

Trend Analysis

Analog Devices, Inc. (ADI) showed a 58.91% price increase over the past year, indicating a bullish trend with acceleration. The stock experienced highs of 302.1 and lows of 164.6, with volatility reflected by a 24.21 standard deviation.

Tower Semiconductor Ltd. (TSEM) recorded a 272.71% rise in stock price over the same period, also reflecting a bullish trend with acceleration. Its price fluctuated between 29.65 and 124.0, supported by a 23.67 standard deviation indicating comparable volatility.

Comparing both, TSEM delivered the highest market performance with a substantially larger percentage gain than ADI, demonstrating stronger bullish momentum and a more pronounced price surge.

Target Prices

The consensus target prices reflect a cautiously optimistic outlook from analysts for both Analog Devices, Inc. and Tower Semiconductor Ltd.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Analog Devices, Inc. | 375 | 270 | 304.73 |

| Tower Semiconductor Ltd. | 125 | 66 | 96 |

Analysts expect Analog Devices’ price to hover slightly above its current 302.1 USD, while Tower Semiconductor’s consensus target of 96 USD is below its current 124 USD, indicating mixed sentiment.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Analog Devices, Inc. (ADI) and Tower Semiconductor Ltd. (TSEM):

Rating Comparison

ADI Rating

- Rating: B-, categorized as Very Favorable overall.

- Discounted Cash Flow Score: 4, indicating a Favorable valuation outlook.

- ROE Score: 3, reflecting moderate efficiency in generating profit from equity.

- ROA Score: 3, moderate asset utilization efficiency.

- Debt To Equity Score: 2, moderate financial risk with some leverage.

TSEM Rating

- Rating: B+, also categorized as Very Favorable overall.

- Discounted Cash Flow Score: 3, indicating a Moderate valuation outlook.

- ROE Score: 3, showing moderate efficiency in generating profit from equity.

- ROA Score: 4, indicating favorable asset utilization efficiency.

- Debt To Equity Score: 4, indicating favorable financial stability with low risk.

Which one is the best rated?

TSEM holds a higher rating (B+) compared to ADI’s B-, with stronger scores in return on assets and debt to equity, suggesting better asset use and financial stability. Both have the same overall score of 3.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Analog Devices, Inc. and Tower Semiconductor Ltd.:

ADI Scores

- Altman Z-Score: 6.99, indicating a safe zone for financial stability.

- Piotroski Score: 7, reflecting strong financial strength.

TSEM Scores

- Altman Z-Score: 21.06, indicating a strong safe zone status.

- Piotroski Score: 7, reflecting strong financial strength.

Which company has the best scores?

Both companies show strong financial health with Piotroski Scores of 7. However, TSEM’s Altman Z-Score is significantly higher at 21.06, indicating a stronger position in avoiding bankruptcy risk compared to ADI’s 6.99.

Grades Comparison

Here is a comparison of the recent grades and ratings assigned to Analog Devices, Inc. and Tower Semiconductor Ltd.:

Analog Devices, Inc. Grades

This table summarizes recent grades from verified grading companies for Analog Devices, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-13 |

| Truist Securities | Maintain | Hold | 2025-12-19 |

| UBS | Maintain | Buy | 2025-12-08 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-26 |

| B of A Securities | Maintain | Buy | 2025-11-26 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-26 |

| JP Morgan | Maintain | Overweight | 2025-11-26 |

| Baird | Maintain | Outperform | 2025-11-26 |

| Benchmark | Maintain | Buy | 2025-11-26 |

| Truist Securities | Maintain | Hold | 2025-11-26 |

Analog Devices, Inc. maintains a generally positive rating trend, with a majority of buy and outperform grades, indicating sustained confidence from analysts.

Tower Semiconductor Ltd. Grades

This table summarizes recent grades from verified grading companies for Tower Semiconductor Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Benchmark | Maintain | Buy | 2026-01-09 |

| Wedbush | Downgrade | Neutral | 2025-12-31 |

| Benchmark | Maintain | Buy | 2025-11-11 |

| Susquehanna | Maintain | Positive | 2025-11-11 |

| Wedbush | Maintain | Outperform | 2025-11-11 |

| Barclays | Maintain | Equal Weight | 2025-11-11 |

| Benchmark | Maintain | Buy | 2025-09-08 |

| Susquehanna | Maintain | Positive | 2025-08-05 |

| Benchmark | Maintain | Buy | 2025-08-05 |

| Benchmark | Maintain | Buy | 2025-08-04 |

Tower Semiconductor Ltd. shows a strong presence of buy and positive ratings but with a recent downgrade to neutral by Wedbush, suggesting some cautious reassessment.

Which company has the best grades?

Analog Devices, Inc. holds a stronger consensus with more consistent buy and outperform ratings than Tower Semiconductor Ltd., whose grades include a recent neutral downgrade. This difference may influence investor perception of relative stability and growth potential.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Analog Devices, Inc. (ADI) and Tower Semiconductor Ltd. (TSEM) based on the most recent financial and operational data.

| Criterion | Analog Devices, Inc. (ADI) | Tower Semiconductor Ltd. (TSEM) |

|---|---|---|

| Diversification | Strongly diversified across Automotive (2.8B), Industrial (4.3B), Consumer (1.2B), and Communications (1.1B) segments | Less diversified; primarily focused on semiconductor manufacturing |

| Profitability | Net margin favorable at 20.58%; ROIC neutral at 5.55%, but ROIC below WACC (8.36%) indicating value destruction | Net margin favorable at 14.47%; ROIC neutral at 6.41%, ROIC below WACC (7.85%) indicating value destruction |

| Innovation | Solid investment in analog and signal processing innovation, supported by growing ROIC trend (+64%) | Improving profitability with growing ROIC trend (+45%), but less established innovation moat |

| Global presence | Extensive global market reach with strong industrial and automotive customer base | Moderate global presence, more niche in semiconductor foundry services |

| Market Share | Leading position in analog and mixed-signal semiconductor markets | Smaller market share with focus on specialized manufacturing |

Key takeaways: Both ADI and TSEM are currently shedding value as their ROIC remains below WACC despite increasing profitability trends. ADI benefits from greater diversification and market leadership, while TSEM shows potential with improving margins but has a narrower focus. Investors should weigh ADI’s broader portfolio against TSEM’s growth trajectory carefully.

Risk Analysis

Below is a risk comparison table for Analog Devices, Inc. (ADI) and Tower Semiconductor Ltd. (TSEM) based on the most recent data available in 2026:

| Metric | Analog Devices, Inc. (ADI) | Tower Semiconductor Ltd. (TSEM) |

|---|---|---|

| Market Risk | Moderate (Beta 1.03) | Lower (Beta 0.88) |

| Debt Level | Low (D/E 0.26, Favorable) | Very Low (D/E 0.07, Favorable) |

| Regulatory Risk | Moderate (US & global tech regulations) | Moderate (Israel & global trade regulations) |

| Operational Risk | Moderate (Complex supply chains) | Moderate (Custom manufacturing complexity) |

| Environmental Risk | Moderate (Industry-wide concerns on semiconductor waste) | Moderate (Similar industry impact) |

| Geopolitical Risk | Moderate (Exposure to China, Europe) | Higher (Israel-based, geopolitical tensions) |

The most likely and impactful risks involve geopolitical challenges, especially for TSEM given its base in Israel, and market volatility reflected in ADI’s beta. Both companies maintain low debt levels, reducing financial risk, but regulatory and operational risks remain steady concerns due to the global semiconductor industry’s complexity and evolving regulations.

Which Stock to Choose?

Analog Devices, Inc. (ADI) shows a strong income evolution with favorable growth in revenue (+16.9% in 1 year) and net margin (20.58%), supported by solid profitability and manageable debt levels. Its financial ratios are slightly favorable overall, despite some unfavorable valuation metrics, and it holds a very favorable B- rating. However, the company is shedding value according to its slightly unfavorable MOAT status, though its ROIC is trending upwards.

Tower Semiconductor Ltd. (TSEM) displays mixed income growth with a recent unfavorable one-year revenue and margin decline but favorable long-term net income growth (+153%). Financial ratios are slightly favorable overall, with low debt and strong liquidity, reflected in a very favorable B+ rating. Like ADI, TSEM is shedding value but shows improving profitability with a slightly unfavorable MOAT status.

Investors prioritizing growth and recent income momentum might find ADI’s stable and favorable income metrics and strong rating suggestive of potential, while those focusing on long-term value creation and strong liquidity could view TSEM’s improving profitability and very favorable rating as indicative of opportunity. The choice might depend on the investor’s risk tolerance and investment horizon.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Analog Devices, Inc. and Tower Semiconductor Ltd. to enhance your investment decisions: