Home > Comparison > Technology > ADI vs TER

The strategic rivalry between Analog Devices, Inc. and Teradyne, Inc. shapes the semiconductor industry’s future. Analog Devices operates as a capital-intensive innovator in analog and mixed-signal ICs, serving diverse high-tech markets. Teradyne focuses on automated test equipment and industrial automation, blending precision manufacturing with robotics. This analysis probes their contrasting growth vectors and operational moats, aiming to identify which trajectory offers superior risk-adjusted returns for a diversified portfolio in technology.

Table of contents

Companies Overview

Analog Devices and Teradyne dominate critical segments within the semiconductor industry, shaping technology’s backbone.

Analog Devices, Inc.: Precision Analog Innovator

Analog Devices leads in integrated circuits focused on analog, mixed-signal, and digital signal processing. It generates revenue by designing chips that convert real-world signals into digital data and vice versa. In 2026, its strategic focus emphasizes power management solutions and advanced sensor technologies for automotive and industrial markets.

Teradyne, Inc.: Automated Test Equipment Specialist

Teradyne excels in automatic test equipment for semiconductors and system-level testing. Its core revenue comes from selling test platforms and robotic automation systems across diverse sectors, including wireless and industrial automation. In 2026, the company prioritizes expanding its industrial automation and wireless test segments to capture growing demand.

Strategic Collision: Similarities & Divergences

Both firms operate within semiconductors but adopt contrasting philosophies: Analog Devices emphasizes component innovation, while Teradyne focuses on testing and automation infrastructure. Their primary battleground is the evolving semiconductor manufacturing ecosystem where precision and reliability are paramount. This divergence creates distinct investment profiles—Analog Devices offers exposure to chip design, Teradyne to manufacturing efficiency and robotics.

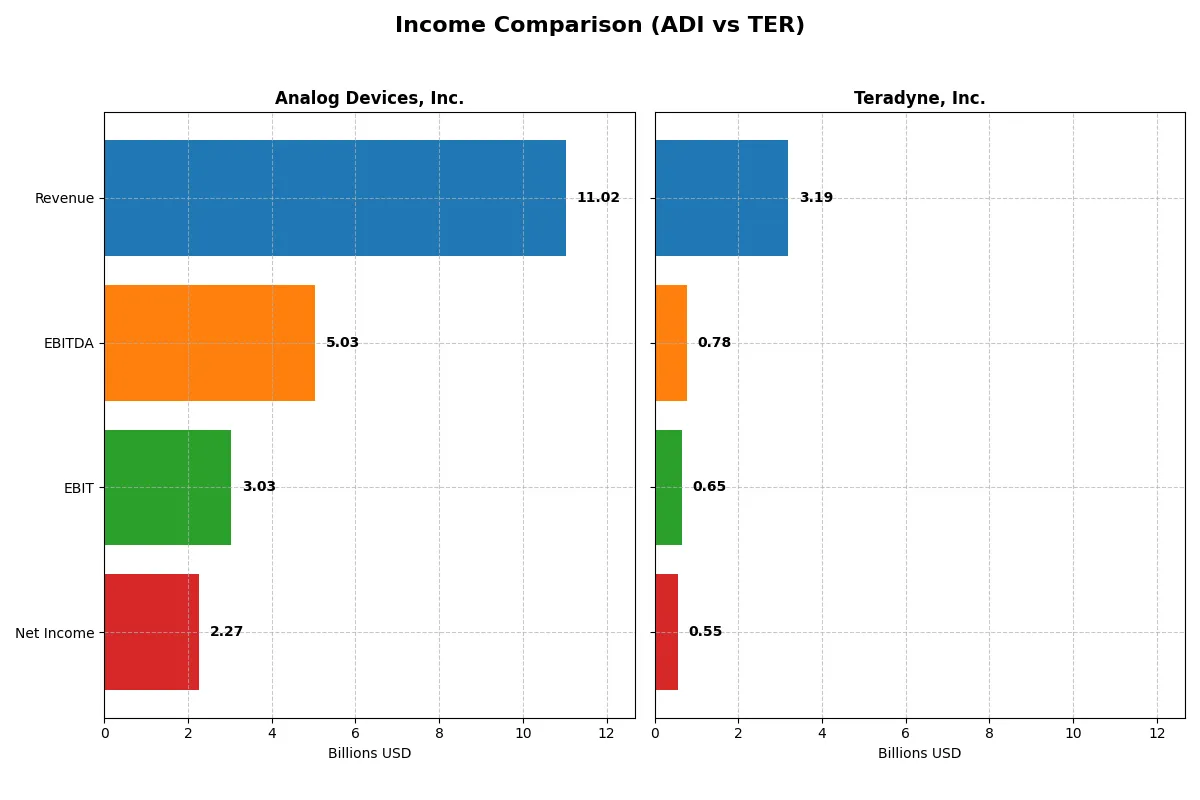

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Analog Devices, Inc. (ADI) | Teradyne, Inc. (TER) |

|---|---|---|

| Revenue | 11.0B | 3.2B |

| Cost of Revenue | 5.0B | 1.3B |

| Operating Expenses | 3.0B | 1.2B |

| Gross Profit | 6.0B | 1.9B |

| EBITDA | 5.0B | 780M |

| EBIT | 3.0B | 653M |

| Interest Expense | 318M | 8M |

| Net Income | 2.3B | 554M |

| EPS | 4.59 | 3.49 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison exposes how each company converts revenue into profit, revealing true operational efficiency and growth momentum.

Analog Devices, Inc. Analysis

Analog Devices grew revenue from 7.3B in 2021 to 11B in 2025, with net income surging from 1.39B to 2.27B. Gross margins remain strong at 54.7%, while net margins expanded to 20.6%. In 2025, ADI accelerated EBIT by 44%, showing robust profitability and efficient cost control amid rising revenues.

Teradyne, Inc. Analysis

Teradyne’s revenue peaked near 3.7B in 2021 but declined to 3.2B by 2025, dragging net income down from 1.01B to 554M. The company sustains a higher gross margin at 58.6%, yet its net margin slipped to 17.4%. Teradyne’s 2025 EBIT growth slowed to 6.6%, reflecting margin pressure and subdued top-line momentum.

Margin Power vs. Revenue Scale

ADI outpaces Teradyne with superior revenue growth (+16.9% YoY vs. +13.1%), a wider EBIT margin (27.5% vs. 20.5%), and stronger net income gains (+39% EPS growth vs. +4.8%). ADI’s scale and expanding profitability present a clearer fundamental winner. Investors seeking growth with margin expansion will find ADI’s profile more compelling.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared:

| Ratios | Analog Devices, Inc. (ADI) | Teradyne, Inc. (TER) |

|---|---|---|

| ROE | 6.7% | 19.2% |

| ROIC | 5.5% | 17.2% |

| P/E | 51.1 | 54.6 |

| P/B | 3.42 | — |

| Current Ratio | 2.19 | 2.91 |

| Quick Ratio | 1.68 | 1.84 |

| D/E (Debt-to-Equity) | 0.26 | 0 |

| Debt-to-Assets | 18.1% | 0 |

| Interest Coverage | 9.45 | 86.4 |

| Asset Turnover | 0.23 | 0.76 |

| Fixed Asset Turnover | 3.32 | 4.88 |

| Payout Ratio | 85% | 14% |

| Dividend Yield | 1.66% | 0.25% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, unveiling hidden risks and operational strengths that shape investor confidence.

Analog Devices, Inc.

Analog Devices shows a moderate ROE at 6.7% with a strong net margin of 20.6%, reflecting operational efficiency despite a stretched P/E of 51. Its P/B at 3.42 signals a premium valuation. The company balances shareholder returns via a 1.66% dividend yield and reinvests heavily in R&D (16% of revenue) to fuel growth.

Teradyne, Inc.

Teradyne presents zero ROE and ROIC data, signaling potential reporting gaps or transitional phases. Despite a high P/E of 54.6, it posts a solid net margin of 17.4%. The firm pays a low dividend yield of 0.25%, focusing on capital discipline with a strong interest coverage ratio of 81.4, yet struggles with liquidity ratios missing for 2025.

Premium Valuation vs. Operational Safety

Analog Devices offers a more balanced risk-reward profile, combining solid profitability with steady dividends and R&D investment. Teradyne’s lack of key profitability metrics and liquidity data raises concerns despite a competitive margin. Analog Devices suits investors seeking steady operational safety, while Teradyne may appeal to those comfortable with higher uncertainty.

Which one offers the Superior Shareholder Reward?

I compare Analog Devices, Inc. (ADI) and Teradyne, Inc. (TER) on dividends, payout ratios, and buybacks. ADI yields ~1.66%, with a high payout ratio near 85%, indicating strong dividend commitment but limited reinvestment. TER yields just 0.25%, with a low 14% payout ratio, signaling focus on growth or buybacks. TER’s buyback intensity appears robust, enhancing total returns despite low dividends. ADI balances dividends and buybacks but risks sustainability with its high payout. I find TER’s reinvestment and buyback model more sustainable and attractive for total shareholder reward in 2026.

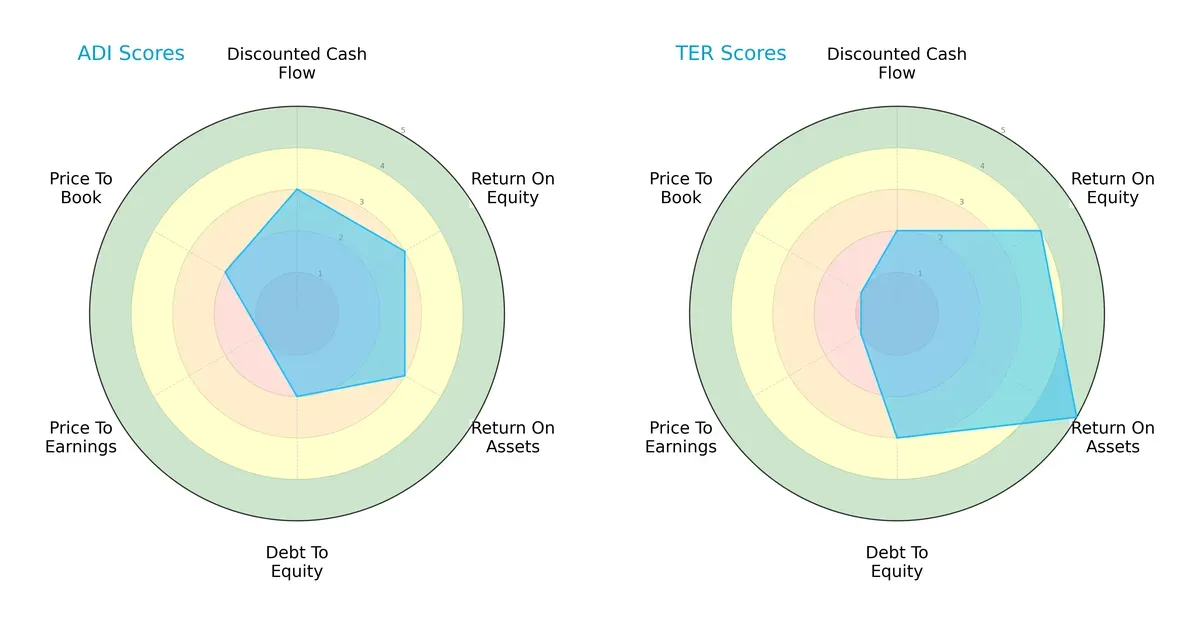

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Analog Devices, Inc. and Teradyne, Inc., highlighting their distinct financial strengths and valuation nuances:

Analog Devices presents a balanced profile with moderate scores in DCF, ROE, and ROA but lags in valuation metrics, especially P/E. Teradyne excels in operational efficiency, boasting high ROE and ROA scores, yet shows weaker valuation scores and slightly higher leverage. Teradyne relies on operational prowess, while Analog Devices offers steadier financial stability.

Bankruptcy Risk: Solvency Showdown

Teradyne’s Altman Z-Score at 21.17 vastly outperforms Analog Devices’ 7.29, both safely in the safe zone, signaling robust long-term resilience and negligible bankruptcy risk in this cycle:

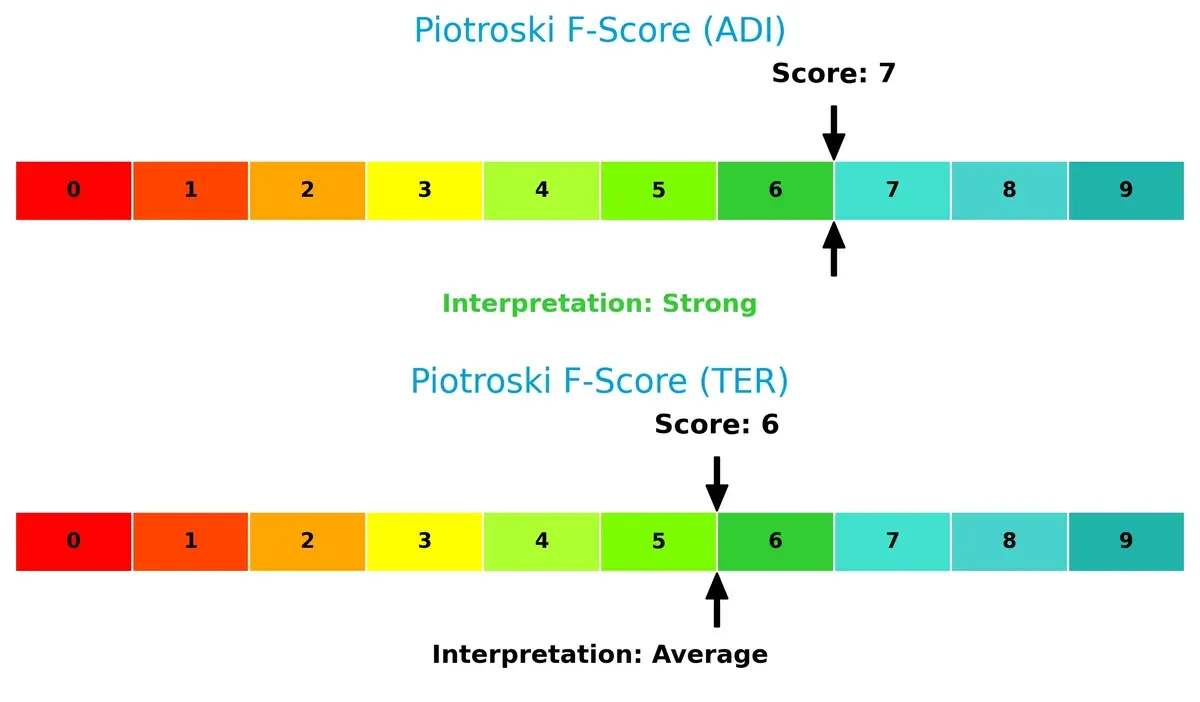

Financial Health: Quality of Operations

Analog Devices scores a strong 7 on the Piotroski scale, indicating solid health and efficient internal metrics. Teradyne’s 6 is average, suggesting some caution on operational consistency compared to its peer:

How are the two companies positioned?

This section dissects the operational DNA of ADI and TER by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats and identify which model delivers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

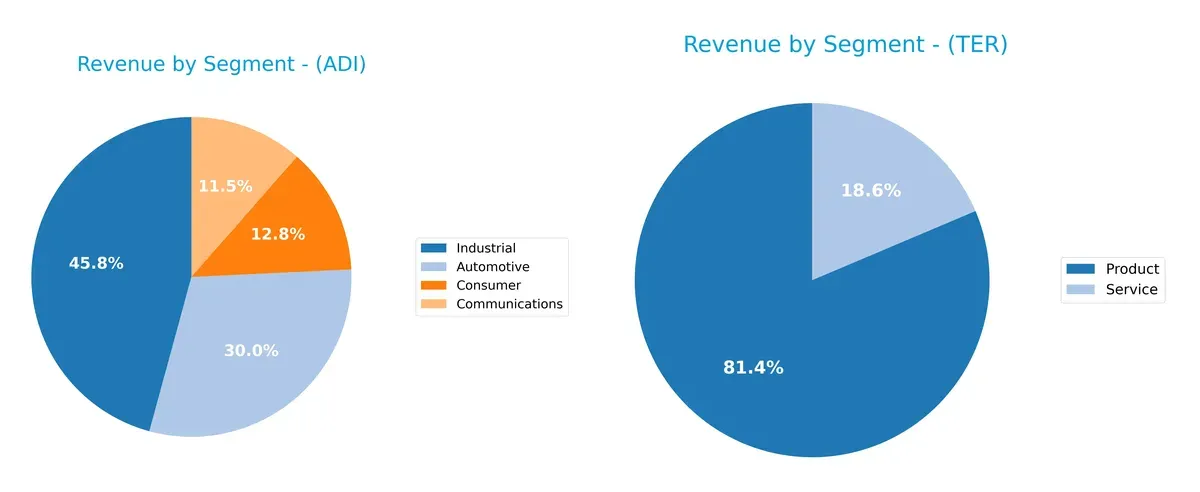

The following visual comparison dissects how Analog Devices, Inc. and Teradyne, Inc. diversify their income streams and where their primary sector bets lie:

Analog Devices anchors revenue in Industrial at $4.3B, with substantial contributions from Automotive ($2.8B), Consumer ($1.2B), and Communications ($1.1B), showing a well-spread portfolio. Teradyne relies heavily on Products at $2.3B, with Services trailing at $525M, indicating a more concentrated model. Analog Devices’ diversified mix reduces concentration risk, while Teradyne’s focus pivots on product dominance, potentially amplifying exposure to sector-specific cycles.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Analog Devices, Inc. (ADI) and Teradyne, Inc. (TER):

ADI Strengths

- Diverse revenue streams across Automotive, Industrial, Communications, Consumer segments

- Favorable net margin at 20.58%

- Strong liquidity with current ratio 2.19 and quick ratio 1.68

- Low debt levels with debt to assets 18.05%

- Solid interest coverage at 9.54x

- Global presence with significant sales in US, China, Europe, and Asia

TER Strengths

- Product and Service revenue streams provide business diversification

- Favorable interest coverage at 81.43x indicates strong debt servicing

- Favorable price-to-book ratio suggests undervaluation

- Presence in diverse geographies including US, China, Korea, Taiwan, Japan, and EMEA

ADI Weaknesses

- Unfavorable return on equity at 6.7% below cost of capital

- PE ratio high at 51.05, indicating expensive valuation

- Unfavorable asset turnover at 0.23, suggesting low efficiency

- Some unfavorable profitability ratios reduce overall financial strength

TER Weaknesses

- Zero or unavailable key ratios including ROE, ROIC, WACC impair profitability assessment

- Unfavorable current and quick ratios indicate liquidity concerns

- Unfavorable asset and fixed asset turnover suggest operational inefficiency

- Low dividend yield at 0.25% may deter income-focused investors

Overall, ADI shows balanced strengths in profitability, liquidity, and global diversification but faces valuation and efficiency challenges. TER’s strong interest coverage and geographic spread contrast with significant weaknesses in liquidity and profitability metrics. These factors highlight differing strategic focus and financial health profiles.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat shields long-term profits from relentless competitive pressure and market shifts. Without it, profits erode rapidly:

Analog Devices, Inc. (ADI): Intangible Assets and Innovation Moat

I see ADI’s moat rooted in its advanced analog and mixed-signal IC technologies, reflected in its high and stable EBIT margin of 27.5%. Despite a slightly unfavorable ROIC vs. WACC, ADI’s rising ROIC trend and product innovation in automotive and industrial markets could deepen its moat in 2026.

Teradyne, Inc. (TER): Cost Advantage and Automation Edge

TER’s moat contrasts ADI’s, built on cost-efficient automated test equipment and industrial robotics, driving a robust gross margin of 58.6%. However, declining ROIC and negative net margin growth signal pressures. Opportunities in expanding industrial automation and wireless test markets might offset risks in 2026.

Innovation Leadership vs. Automation Efficiency

ADI’s growing profitability and intangible asset moat appear wider and more durable than TER’s cost-focused moat, which shows signs of strain. I believe ADI is better positioned to defend and grow its market share amid intensifying semiconductor competition.

Which stock offers better returns?

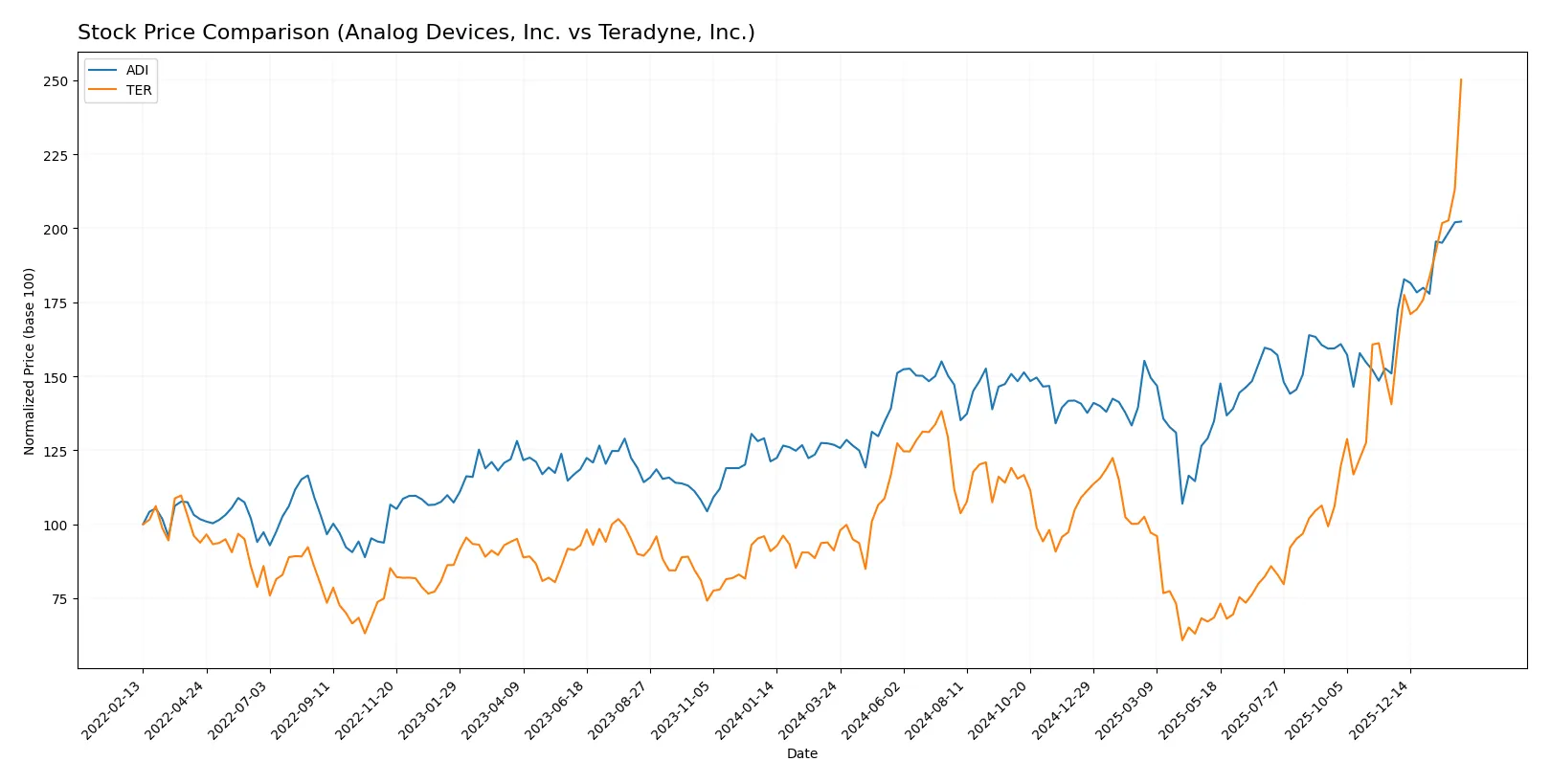

The past year shows strong bullish momentum for both stocks, with Teradyne surging sharply and Analog Devices gaining steadily amid rising buyer dominance.

Trend Comparison

Analog Devices, Inc. (ADI) posted a 59.47% gain over 12 months, marking a bullish trend with accelerating price growth and a high near 311.29. Volatility is moderate at 27.48%.

Teradyne, Inc. (TER) surged 174.58% over the same period, displaying a robust bullish trend with acceleration and higher volatility of 39.72%. It reached a peak price of 282.98.

Teradyne outperformed Analog Devices significantly, delivering the highest market performance with a nearly triple price increase and stronger buyer dominance.

Target Prices

Analysts present a cautiously optimistic target consensus for both Analog Devices, Inc. and Teradyne, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Analog Devices, Inc. | 270 | 375 | 316 |

| Teradyne, Inc. | 175 | 300 | 251.17 |

The target consensus for Analog Devices sits slightly above its current price of 311.29, signaling moderate upside potential. Teradyne’s consensus target of 251.17 is below its current price of 282.98, indicating a cautious analyst stance on further gains.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Analog Devices, Inc. Grades

The following table summarizes recent grades from reputable firms for Analog Devices, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | Maintain | Positive | 2026-01-22 |

| B of A Securities | Maintain | Buy | 2026-01-21 |

| Stifel | Maintain | Buy | 2026-01-16 |

| Oppenheimer | Maintain | Outperform | 2026-01-16 |

| Citigroup | Maintain | Buy | 2026-01-15 |

| Wells Fargo | Upgrade | Overweight | 2026-01-15 |

| Keybanc | Maintain | Overweight | 2026-01-13 |

| Truist Securities | Maintain | Hold | 2025-12-19 |

| UBS | Maintain | Buy | 2025-12-08 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-26 |

Teradyne, Inc. Grades

The following table summarizes recent grades from reputable firms for Teradyne, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Evercore ISI Group | Maintain | Outperform | 2026-02-03 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-02-02 |

| Stifel | Maintain | Buy | 2026-01-30 |

| UBS | Maintain | Buy | 2026-01-26 |

| B of A Securities | Maintain | Buy | 2026-01-22 |

| Stifel | Maintain | Buy | 2026-01-14 |

| B of A Securities | Maintain | Buy | 2026-01-13 |

| Goldman Sachs | Upgrade | Buy | 2025-12-16 |

| Stifel | Upgrade | Buy | 2025-12-02 |

| Citigroup | Maintain | Buy | 2025-11-12 |

Which company has the best grades?

Both companies receive predominantly positive grades, with multiple “Buy” and “Outperform” ratings. Analog Devices shows a slight edge with an upgraded “Overweight” from Wells Fargo, signaling growing confidence. Investors may view these grades as a sign of stable institutional support but should monitor ongoing updates closely.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Analog Devices, Inc. (ADI)

- Operates in highly competitive semiconductor sector with strong analog and mixed-signal focus. Faces pressure from integrated device manufacturers and fabless companies.

Teradyne, Inc. (TER)

- Competes in automatic test equipment market with diverse segments, including semiconductor and industrial automation, facing rapid technological shifts and competitive innovation.

2. Capital Structure & Debt

Analog Devices, Inc. (ADI)

- Maintains low debt-to-equity at 0.26 and favorable interest coverage of 9.54, indicating prudent leverage and strong debt servicing ability.

Teradyne, Inc. (TER)

- Debt metrics unavailable or zero, but interest coverage very strong at 81.43, suggesting minimal debt risk but limited capital structure transparency.

3. Stock Volatility

Analog Devices, Inc. (ADI)

- Beta near market average at 1.03, implying moderate volatility aligned with tech sector norms.

Teradyne, Inc. (TER)

- Elevated beta at 1.82, indicating significantly higher stock price volatility and greater market sensitivity.

4. Regulatory & Legal

Analog Devices, Inc. (ADI)

- Faces standard semiconductor industry regulations and export controls; geopolitical tensions could impact supply chains.

Teradyne, Inc. (TER)

- Subject to similar regulatory regimes plus increased scrutiny on industrial automation and wireless test sectors.

5. Supply Chain & Operations

Analog Devices, Inc. (ADI)

- Complex global supply chains with exposure to semiconductor material shortages and geopolitical risks impacting manufacturing.

Teradyne, Inc. (TER)

- Supply chain stability critical due to diversified segments; automation and wireless test operations sensitive to component availability.

6. ESG & Climate Transition

Analog Devices, Inc. (ADI)

- Increasing focus on energy-efficient semiconductor solutions and sustainable manufacturing processes; ESG reporting improving.

Teradyne, Inc. (TER)

- Emphasizes automation solutions that may reduce industrial emissions; ESG integration less mature compared to ADI.

7. Geopolitical Exposure

Analog Devices, Inc. (ADI)

- Significant exposure to China and Asia-Pacific markets, heightening risks from trade tensions and export restrictions.

Teradyne, Inc. (TER)

- Moderate geopolitical risk; operations concentrated more in US and allied countries but still exposed to global tech supply chains.

Which company shows a better risk-adjusted profile?

Analog Devices’ low leverage, moderate volatility, and diversified analog technology moat provide a more stable risk-adjusted profile. Teradyne’s higher beta and incomplete capital data raise caution, although its strong interest coverage and diversified tech segments offer growth potential. ADI’s measured debt and established market presence mitigate systemic risks better in 2026’s volatile semiconductor environment.

Final Verdict: Which stock to choose?

Analog Devices, Inc. (ADI) shines with its unmatched operational efficiency and consistent income quality. Its growing profitability signals a company strengthening its competitive edge. However, investors should keep an eye on its modest return on invested capital relative to cost of capital, which suggests caution. ADI suits portfolios seeking steady growth with a tolerance for moderate risk.

Teradyne, Inc. (TER) boasts a powerful strategic moat rooted in automation technology leadership, delivering strong asset returns and an enviable balance sheet. Its financial safety is superior, with high interest coverage and a solid Altman Z-score. Yet, its declining profitability trend calls for vigilance. TER aligns well with investors favoring growth at a reasonable price and financial resilience.

If you prioritize operational efficiency and improving profitability, ADI is the compelling choice due to its accelerating income growth and stable cash flow generation. However, if you seek a strategic moat with superior financial safety and are comfortable with cyclical swings, TER offers better stability and commanding growth potential. Each presents distinct risk-reward profiles requiring matching to your investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Analog Devices, Inc. and Teradyne, Inc. to enhance your investment decisions: