In the fast-evolving semiconductor industry, Taiwan Semiconductor Manufacturing Company Limited (TSM) and Analog Devices, Inc. (ADI) stand out as leaders with distinct yet overlapping market focuses. TSM excels in wafer fabrication and high-performance computing chips, while ADI specializes in analog and mixed-signal integrated circuits for diverse applications. This article will analyze both companies’ strategies and performance to help you identify the most promising investment opportunity in this critical technology sector.

Table of contents

Companies Overview

I will begin the comparison between Taiwan Semiconductor Manufacturing Company Limited and Analog Devices, Inc. by providing an overview of these two companies and their main differences.

Taiwan Semiconductor Manufacturing Company Limited Overview

Taiwan Semiconductor Manufacturing Company Limited (TSM) is a leading player in the semiconductor industry, specializing in manufacturing, packaging, testing, and selling integrated circuits worldwide. Founded in 1987 and headquartered in Hsinchu City, Taiwan, TSM offers diverse wafer fabrication processes and supports high-performance computing, smartphones, IoT, automotive, and digital consumer electronics markets.

Analog Devices, Inc. Overview

Analog Devices, Inc. (ADI), established in 1965 and based in Wilmington, Massachusetts, focuses on designing and manufacturing integrated circuits, software, and subsystems with analog, mixed-signal, and digital signal processing technologies. ADI’s products serve automotive, industrial, consumer, instrumentation, aerospace, and communications sectors, with a global presence through direct sales and distributors.

Key similarities and differences

Both companies operate in the semiconductor sector, providing essential technologies that power various electronic applications worldwide. TSM concentrates on semiconductor manufacturing and wafer fabrication services, while ADI emphasizes designing and marketing integrated circuits and signal processing solutions. Their business models complement each other, with TSM focusing on production and ADI on innovation and system integration.

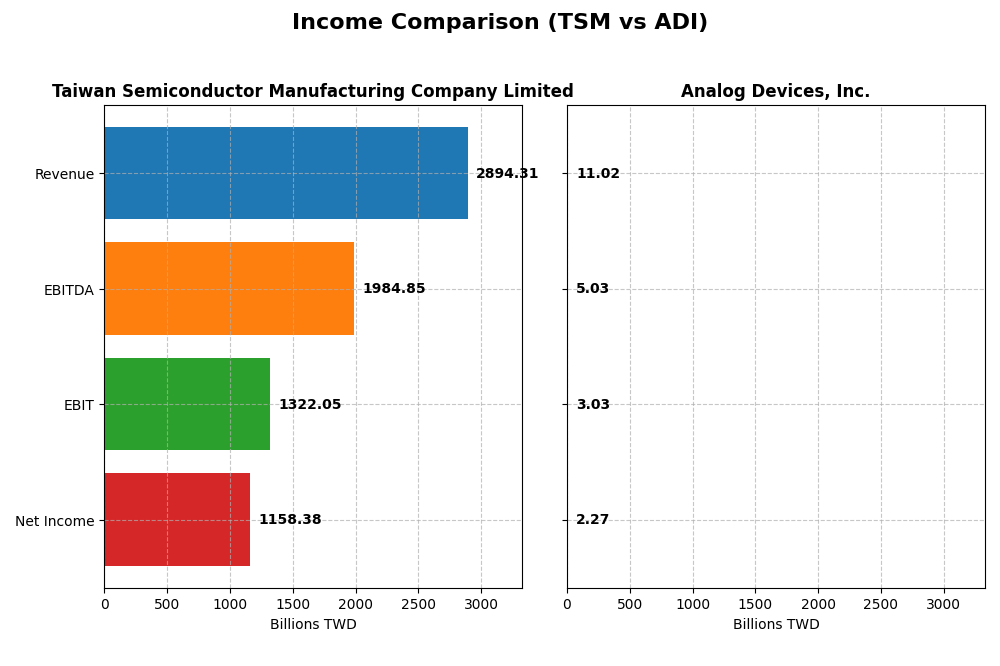

Income Statement Comparison

The table below compares key income statement metrics for Taiwan Semiconductor Manufacturing Company Limited (TSM) and Analog Devices, Inc. (ADI) based on their most recent fiscal year results.

| Metric | Taiwan Semiconductor Manufacturing Company Limited (TSM) | Analog Devices, Inc. (ADI) |

|---|---|---|

| Market Cap | 1.70T TWD | 147.3B USD |

| Revenue | 2.89T TWD | 11.02B USD |

| EBITDA | 1.98T TWD | 5.03B USD |

| EBIT | 1.32T TWD | 3.03B USD |

| Net Income | 1.16T TWD | 2.27B USD |

| EPS | 223.4 TWD | 4.59 USD |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Taiwan Semiconductor Manufacturing Company Limited

TSMC exhibited robust revenue growth from 2020 to 2024, increasing from 1.34T to 2.89T TWD, with net income nearly doubling from 511B to 1.16T TWD. Margins remained strong and stable, with a gross margin at 56.12% and net margin at 40.02% in 2024. The latest year showed favorable revenue and profit growth, while net margin growth was neutral but steady.

Analog Devices, Inc.

ADI demonstrated consistent revenue growth from 7.3B USD in 2021 to 11B USD in 2025, with net income rising from 1.39B to 2.27B USD. Margins improved, with a gross margin of 54.66% and net margin of 20.58% in 2025. The most recent year featured favorable growth across revenue, net income, and margins, with net margin growth particularly notable at 18.61%.

Which one has the stronger fundamentals?

Both companies show favorable income statement trends, but TSMC leads with higher margins, stronger absolute growth, and a larger scale. ADI posts solid improvements with consistent margin expansion and growth. TSMC’s net margin is nearly double ADI’s, reflecting more efficient profitability. The fundamentals favor TSMC’s scale and margin strength, while ADI shows steady, broad-based improvement.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Taiwan Semiconductor Manufacturing Company Limited (TSM) and Analog Devices, Inc. (ADI), based on their most recent fiscal year data.

| Ratios | Taiwan Semiconductor Manufacturing Company Limited (TSM) | Analog Devices, Inc. (ADI) |

|---|---|---|

| ROE | 27.3% | 6.7% |

| ROIC | 20.0% | 5.5% |

| P/E | 29.0 | 51.1 |

| P/B | 7.92 | 3.42 |

| Current Ratio | 2.36 | 2.19 |

| Quick Ratio | 2.14 | 1.68 |

| D/E (Debt to Equity) | 0.25 | 0.26 |

| Debt-to-Assets | 15.6% | 18.1% |

| Interest Coverage | 126.0 | 9.45 |

| Asset Turnover | 0.43 | 0.23 |

| Fixed Asset Turnover | 0.88 | 3.32 |

| Payout ratio | 31.3% | 84.9% |

| Dividend yield | 1.08% | 1.66% |

Interpretation of the Ratios

Taiwan Semiconductor Manufacturing Company Limited

Taiwan Semiconductor Manufacturing Company Limited (TSM) shows generally strong financial ratios with a favorable net margin of 40.02% and return on equity at 27.29%, indicating efficient profitability and capital use. However, valuation ratios like PE (29.04) and PB (7.92) are marked unfavorable, suggesting a potentially high market price relative to earnings and book value. The company pays dividends with a moderate yield of 1.08%, reflecting a stable but not overly generous shareholder return policy.

Analog Devices, Inc.

Analog Devices, Inc. (ADI) presents mixed ratio results, with a favorable net margin of 20.58% but an unfavorable return on equity at 6.7%, implying less effective equity utilization. Its PE ratio is high at 51.05, raising valuation concerns. The company offers dividends with a yield of 1.66%, indicating modest returns to shareholders. The coverage by free cash flow and share buyback details are not provided, limiting further dividend sustainability assessment.

Which one has the best ratios?

TSM’s ratios are globally more favorable, with stronger profitability and capital efficiency metrics despite some valuation concerns. ADI shows some favorable liquidity and asset turnover but weaker profitability and higher valuation multiples. Overall, TSM’s financial metrics suggest a more robust operational and financial position relative to ADI based on the provided data.

Strategic Positioning

This section compares the strategic positioning of Taiwan Semiconductor Manufacturing Company Limited (TSM) and Analog Devices, Inc. (ADI) in terms of market position, key segments, and exposure to technological disruption:

Taiwan Semiconductor Manufacturing Company Limited (TSM)

- Leading global semiconductor manufacturer with strong competitive pressure in wafer fabrication.

- Key business drivers include wafer fabrication and other semiconductor products used in high-performance computing, smartphones, automotive, and IoT.

- Exposure to technological disruption due to rapid innovation in semiconductor fabrication processes and emerging technologies.

Analog Devices, Inc. (ADI)

- Focused semiconductor design and manufacturing with moderate competitive pressure in analog and mixed-signal ICs.

- Diverse segments: automotive, industrial, communications, and consumer markets drive revenues.

- Faces technological disruption from advances in analog, mixed-signal, and digital signal processing technologies.

TSM vs ADI Positioning

TSM is heavily concentrated in semiconductor wafer fabrication, giving it scale advantages but higher exposure to fabrication technology shifts. ADI operates a more diversified business across multiple end markets, balancing risk but with less scale in any single segment.

Which has the best competitive advantage?

TSM shows a slightly favorable moat with value creation despite declining profitability, reflecting efficient capital use. ADI’s moat is slightly unfavorable as it currently destroys value, though its profitability is improving, indicating emerging competitive strength.

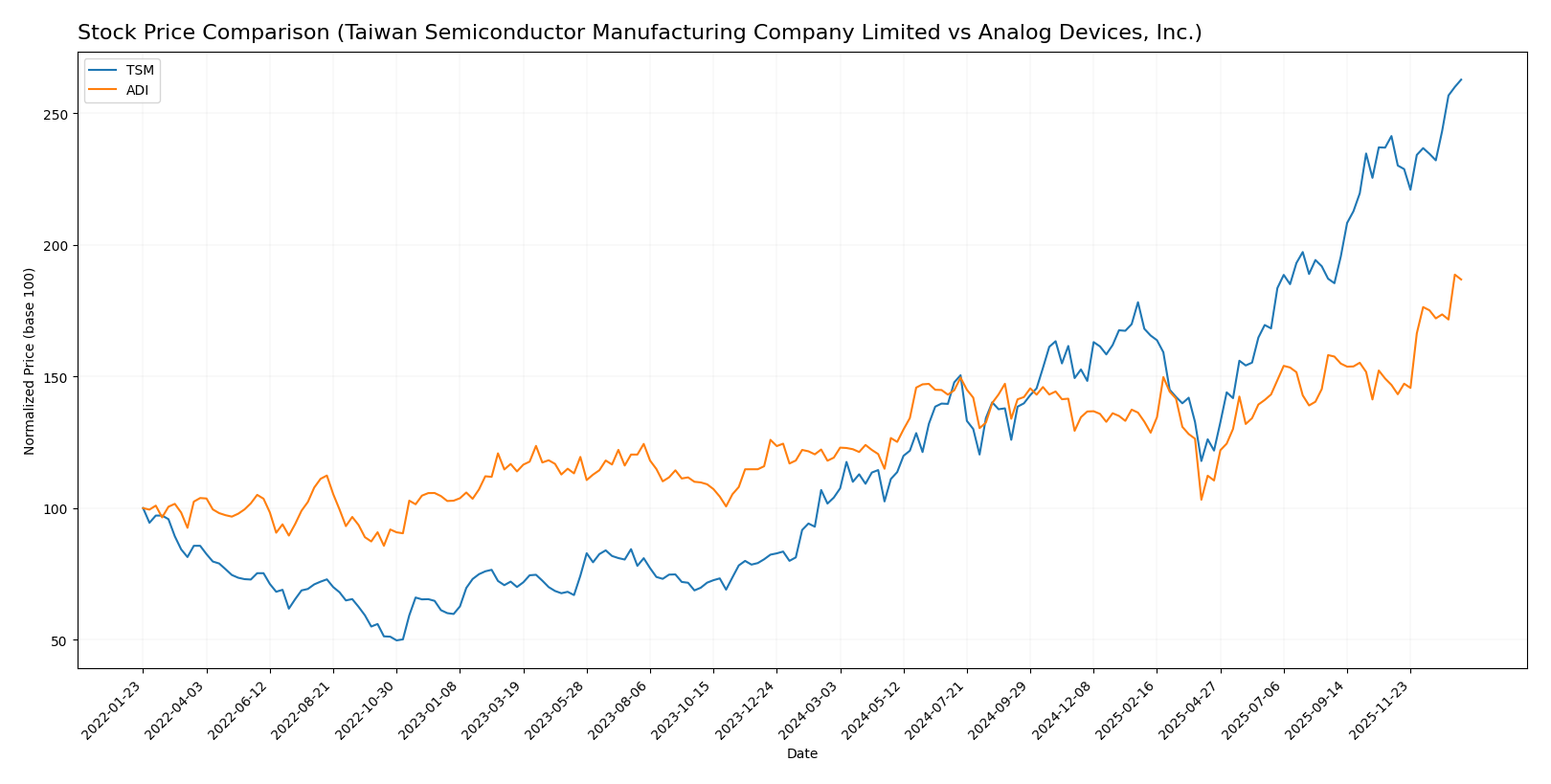

Stock Comparison

The stock price chart depicts significant bullish momentum for both Taiwan Semiconductor Manufacturing Company Limited (TSM) and Analog Devices, Inc. (ADI) over the past 12 months, with TSM showing accelerated gains and higher volatility compared to ADI.

Trend Analysis

Taiwan Semiconductor Manufacturing Company Limited’s stock rose by 152.54% over the past year, indicating a strong bullish trend with acceleration and notable volatility (std deviation 51.25). The price reached a high of 327.11 and a low of 127.7.

Analog Devices, Inc.’s stock increased by 56.75% over the same period, confirming a bullish trend with acceleration but lower volatility (std deviation 24.08). The stock price ranged from 164.6 to 300.93.

Comparing the two, TSM delivered the highest market performance with a more pronounced price increase and greater recent acceleration than ADI.

Target Prices

The consensus target prices for Taiwan Semiconductor Manufacturing Company Limited and Analog Devices, Inc. indicate moderate upside potential based on analyst estimates.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Taiwan Semiconductor Manufacturing Company Limited | 400 | 330 | 361.25 |

| Analog Devices, Inc. | 375 | 265 | 298.64 |

Analysts expect TSM’s stock to rise moderately above its current price of 327.11 USD, while ADI’s consensus target price aligns closely with its current price of 297.99 USD, suggesting limited near-term upside.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Taiwan Semiconductor Manufacturing Company Limited and Analog Devices, Inc.:

Rating Comparison

TSM Rating

- Rating: A- indicating a very favorable overall assessment.

- Discounted Cash Flow Score: 5, rated very favorable, suggests undervaluation.

- ROE Score: 5, very favorable, shows excellent profit generation efficiency.

- ROA Score: 5, very favorable, demonstrates highly effective asset use.

- Debt To Equity Score: 3, moderate level of financial risk is present.

- Overall Score: 4, favorable overall financial standing.

ADI Rating

- Rating: B- reflecting a very favorable overall assessment.

- Discounted Cash Flow Score: 4, favorable, indicates good future cash flow.

- ROE Score: 3, moderate, indicates average profit generation from equity.

- ROA Score: 3, moderate, shows average effectiveness in asset utilization.

- Debt To Equity Score: 2, moderate, indicates somewhat lower financial risk.

- Overall Score: 3, moderate overall financial standing.

Which one is the best rated?

Based strictly on the provided data, TSM holds a superior rating with higher scores in discounted cash flow, ROE, ROA, and overall metrics, indicating stronger financial performance and lower risk compared to ADI.

Scores Comparison

Here is the comparison of the financial scores for TSM and ADI companies:

TSM Scores

- Altman Z-Score: 2.94, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 8, classified as very strong financial health.

ADI Scores

- Altman Z-Score: 6.99, in the safe zone indicating low bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

Which company has the best scores?

Based strictly on provided data, ADI shows a safer Altman Z-Score than TSM, while TSM has a slightly higher Piotroski Score. Overall, ADI has a stronger safety profile, but TSM scores better on financial strength.

Grades Comparison

Here is a detailed comparison of the latest grades assigned to Taiwan Semiconductor Manufacturing Company Limited and Analog Devices, Inc.:

Taiwan Semiconductor Manufacturing Company Limited Grades

The following table summarizes recent grades from verified grading companies for TSM:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Bernstein | Maintain | Outperform | 2025-12-08 |

| Needham | Maintain | Buy | 2025-10-27 |

| Barclays | Maintain | Overweight | 2025-10-17 |

| Needham | Maintain | Buy | 2025-10-16 |

| Susquehanna | Maintain | Positive | 2025-10-10 |

| Barclays | Maintain | Overweight | 2025-10-09 |

| Barclays | Maintain | Overweight | 2025-09-16 |

| Needham | Maintain | Buy | 2025-07-17 |

| Susquehanna | Maintain | Positive | 2025-07-14 |

| Needham | Maintain | Buy | 2025-07-01 |

Grades for TSM consistently indicate a positive outlook with repeated Buy and Overweight ratings, reflecting confidence in its performance.

Analog Devices, Inc. Grades

The following table summarizes recent grades from verified grading companies for ADI:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-13 |

| Truist Securities | Maintain | Hold | 2025-12-19 |

| UBS | Maintain | Buy | 2025-12-08 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-26 |

| B of A Securities | Maintain | Buy | 2025-11-26 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-26 |

| JP Morgan | Maintain | Overweight | 2025-11-26 |

| Baird | Maintain | Outperform | 2025-11-26 |

| Benchmark | Maintain | Buy | 2025-11-26 |

| Truist Securities | Maintain | Hold | 2025-11-26 |

ADI’s grades show a mixture of Buy, Outperform, and Overweight ratings, tempered by some Hold and Equal Weight assessments, indicating a generally positive but more varied sentiment.

Which company has the best grades?

Both TSM and ADI have received predominantly positive grades with a consensus Buy rating; however, TSM’s grades show a more consistent Buy/Outperform pattern, whereas ADI’s include several Hold ratings. This might suggest a slightly stronger analyst confidence in TSM’s near-term outlook, potentially influencing investor sentiment towards steadier performance expectations.

Strengths and Weaknesses

Below is a comparative overview of the strengths and weaknesses of Taiwan Semiconductor Manufacturing Company Limited (TSM) and Analog Devices, Inc. (ADI) based on recent financial and operational data.

| Criterion | Taiwan Semiconductor Manufacturing Company Limited (TSM) | Analog Devices, Inc. (ADI) |

|---|---|---|

| Diversification | Highly focused on wafer manufacturing, with limited other product lines | Diversified across automotive, communications, consumer, and industrial segments |

| Profitability | Strong profitability with 40.02% net margin and 27.29% ROE | Moderate profitability: 20.58% net margin, but lower ROE at 6.7% |

| Innovation | Slightly favorable moat; declining ROIC trend suggests innovation pressure | Slightly unfavorable moat; improving ROIC trend indicates growing innovation |

| Global presence | Global leader in semiconductor foundry with broad international footprint | Solid presence in specialized analog and mixed-signal markets worldwide |

| Market Share | Dominant in wafer foundry market with substantial revenue growth | Niche market leader in analog semiconductors but smaller scale than TSM |

Key takeaways: TSM excels in profitability and market dominance in wafer manufacturing but faces a declining ROIC trend, signaling potential competitive pressures. ADI shows improving profitability trends and diversification, though it currently destroys value relative to its cost of capital. Both companies present investment opportunities with differing risk profiles.

Risk Analysis

Below is a table summarizing key risks for Taiwan Semiconductor Manufacturing Company Limited (TSM) and Analog Devices, Inc. (ADI) based on the most recent data from 2025-2026.

| Metric | TSM | ADI |

|---|---|---|

| Market Risk | Beta 1.274; exposure to global tech cycles and chip demand volatility | Beta 1.032; moderate market sensitivity in industrial and automotive sectors |

| Debt level | Low debt-to-equity 0.25; debt/assets 15.65% – financially stable | Low debt-to-equity 0.26; debt/assets 18.05% – manageable leverage |

| Regulatory Risk | High due to geopolitical tensions between Taiwan and China affecting supply chains | Moderate; US-based but exposed to global trade policies |

| Operational Risk | Complex manufacturing process with high capital expenditure | Risk from supply chain disruptions and integration of advanced technologies |

| Environmental Risk | Moderate; semiconductor manufacturing has environmental footprint and regulatory scrutiny | Moderate; industrial production with environmental compliance needs |

| Geopolitical Risk | High; Taiwan-China tensions could impact operations and market access | Moderate; exposure through global markets but less concentrated geopolitical exposure |

TSM faces the most impactful risks from geopolitical tensions affecting Taiwan, which could disrupt supply and increase market volatility. ADI’s risks are more diversified but include exposure to trade policies and supply chain challenges. Both companies maintain strong balance sheets, but market and geopolitical risks warrant cautious monitoring.

Which Stock to Choose?

Taiwan Semiconductor Manufacturing Company Limited (TSM) shows strong income growth with a favorable global income statement evaluation, supported by high profitability and solid financial ratios. Its debt levels are low, and the company holds a very favorable A- rating, despite some unfavorable valuation multiples and a slightly declining ROIC.

Analog Devices, Inc. (ADI) also presents favorable income growth and a solid income statement, though profitability ratios like ROE are lower and its valuation multiples remain unfavorable. The company has moderate debt, a slightly favorable rating of B-, and a slightly unfavorable moat evaluation due to ROIC below WACC, albeit with improving profitability.

TSM might appear more attractive for investors prioritizing strong profitability and financial stability, while ADI could appeal to those valuing improving returns and growth potential despite current challenges. The choice may depend on whether an investor favors established value creation or potential recovery in profitability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Taiwan Semiconductor Manufacturing Company Limited and Analog Devices, Inc. to enhance your investment decisions: