Home > Comparison > Technology > ADI vs STM

The strategic rivalry between Analog Devices, Inc. and STMicroelectronics N.V. shapes the semiconductor sector’s evolution. Analog Devices operates as a high-performance analog and mixed-signal technology leader, while STMicroelectronics offers a diversified portfolio spanning automotive, industrial, and digital ICs. This face-off highlights a contrast between specialized innovation and broad-market reach. This analysis aims to determine which corporate path delivers superior risk-adjusted returns for a balanced portfolio in 2026.

Table of contents

Companies Overview

Analog Devices and STMicroelectronics stand as formidable players in the global semiconductor arena.

Analog Devices, Inc.: Master of Signal Processing

Analog Devices dominates the analog, mixed-signal, and digital signal processing market. It generates revenue primarily through integrated circuits that convert and manage real-world signals for industrial, automotive, and communications sectors. In 2026, the company sharpens its focus on high-performance amplifiers and power management solutions, reinforcing its leadership in precision and energy-efficient technologies.

STMicroelectronics N.V.: Diverse Semiconductor Innovator

STMicroelectronics commands a strong position through its diversified portfolio spanning automotive ICs, MEMS sensors, and microcontrollers. Revenue streams flow from its Automotive and Discrete Group, Analog, MEMS and Sensors Group, and Microcontrollers and Digital ICs Group. The 2026 strategy zeroes in on integrating GaN power transistors and expanding wireless charging and optical sensing capabilities to capture emerging industrial and consumer demand.

Strategic Collision: Similarities & Divergences

Both companies thrive on innovation in analog and mixed-signal technologies but diverge in business scope. Analog Devices emphasizes precision and power management within a high-performance niche. STMicroelectronics pursues breadth with a multi-segment approach and diverse applications. They compete fiercely in automotive and industrial markets. Investors face contrasting profiles: Analog Devices offers focused technical excellence, while STMicroelectronics presents broader market exposure with higher operational scale.

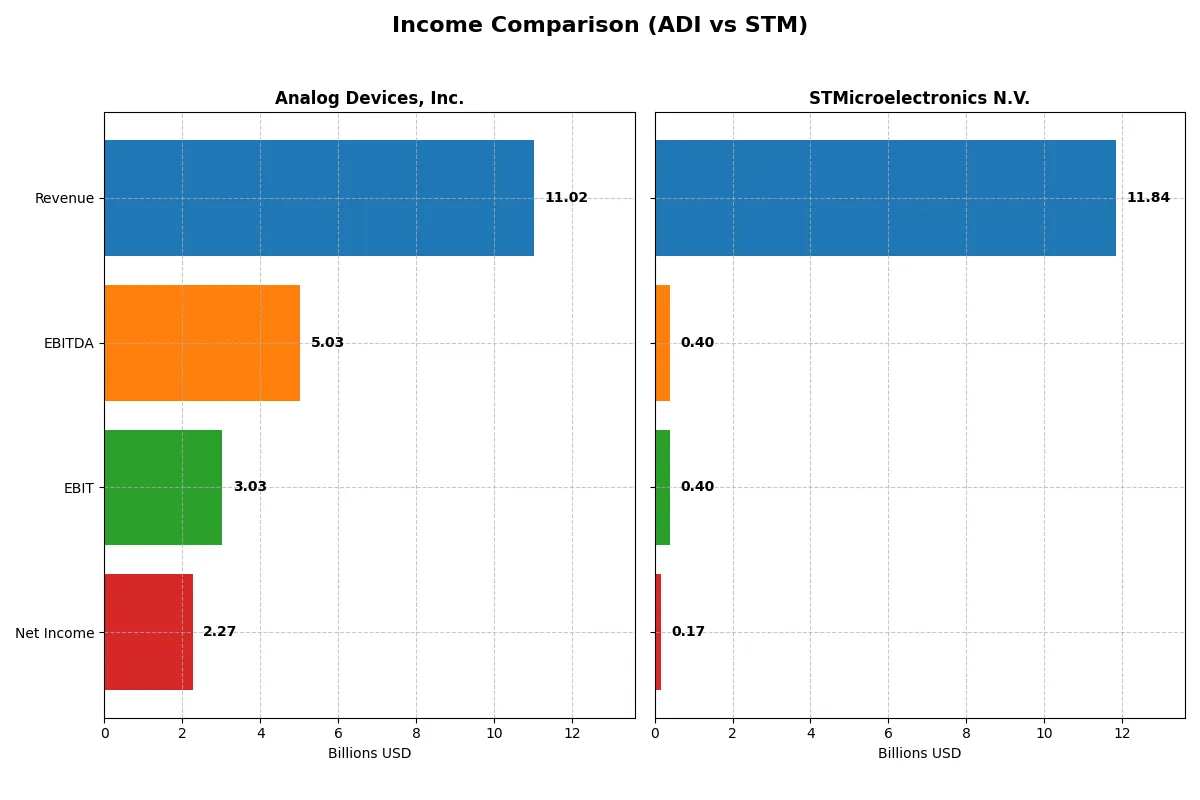

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Analog Devices, Inc. (ADI) | STMicroelectronics N.V. (STM) |

|---|---|---|

| Revenue | 11.0B | 11.8B |

| Cost of Revenue | 5.0B | 7.8B |

| Operating Expenses | 3.0B | 3.7B |

| Gross Profit | 6.0B | 4.0B |

| EBITDA | 5.0B | 401M |

| EBIT | 3.0B | 401M |

| Interest Expense | 318M | 0 |

| Net Income | 2.3B | 0 |

| EPS | 4.59 | 0.19 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates with superior efficiency and profitability in their core business engines.

Analog Devices, Inc. Analysis

Analog Devices (ADI) shows a strong revenue growth from $7.3B in 2021 to $11B in 2025, alongside net income rising from $1.39B to $2.27B. Gross margins hold a robust 54.7%, while net margins reach a healthy 20.6%. The latest year reflects momentum with a 16.9% revenue increase and a 44.3% surge in EBIT, signaling improved operational efficiency.

STMicroelectronics N.V. Analysis

STMicroelectronics (STM) posted a revenue decline from $12.8B in 2021 to $11.8B in 2025, with net income plunging from $2B to just $167M. Gross margin contracts to 33.9%, and net margin shrinks to 1.4%. The latest fiscal year shows a troubling 10.8% revenue drop and an 89.2% EPS decline, indicating weakening profitability and margin pressure.

Margin Strength vs. Revenue Retraction

ADI outperforms STM with superior margin profiles and sustained revenue growth, reflected in its 20.6% net margin versus STM’s 1.4%. ADI’s efficient cost management and expanding earnings highlight fundamental robustness. Investors seeking stable profitability and growth will find ADI’s profile more attractive compared to STM’s pronounced margin compression and earnings decline.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies analyzed below:

| Ratios | Analog Devices, Inc. (ADI) | STMicroelectronics N.V. (STM) |

|---|---|---|

| ROE | 6.7% | 0.9% |

| ROIC | 5.5% | 0.7% |

| P/E | 51.1 | 0 |

| P/B | 3.42 | 0 |

| Current Ratio | 2.19 | 3.36 |

| Quick Ratio | 1.68 | 2.43 |

| D/E | 0.26 | 0.12 |

| Debt-to-Assets | 18.1% | 8.6% |

| Interest Coverage | 9.45 | 0 |

| Asset Turnover | 0.23 | 0.48 |

| Fixed Asset Turnover | 3.32 | 1.07 |

| Payout ratio | 85% | 0% |

| Dividend yield | 1.66% | 0% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios serve as the company’s DNA, unveiling hidden risks and operational strengths crucial for informed investing decisions.

Analog Devices, Inc.

Analog Devices reports a solid net margin of 20.58%, yet its ROE at 6.7% trails expectations, signaling moderate profitability. The stock appears expensive, with a high P/E of 51.05 and P/B of 3.42. Its 1.66% dividend yield indicates a balanced shareholder return, combining dividends with reinvestment into R&D, supporting sustainable growth.

STMicroelectronics N.V.

STMicroelectronics shows weak profitability with a 1.41% net margin and a mere 0.93% ROE, reflecting operational challenges. Valuation metrics appear favorable with zero reported P/E and P/B, suggesting undervaluation or reporting anomalies. The absence of dividends shifts focus to its reinvestment in R&D, aiming to enhance future returns despite current financial headwinds.

Premium Valuation vs. Operational Safety

Analog Devices balances risk and reward with strong margins but stretched valuation, while STMicroelectronics offers a cheaper yet less profitable profile. Investors prioritizing operational safety may prefer Analog Devices; those seeking potential turnaround plays might consider STMicroelectronics.

Which one offers the Superior Shareholder Reward?

I compare Analog Devices (ADI) and STMicroelectronics (STM) focusing on dividends, payout ratios, and buybacks. ADI yields ~1.66% with a high 85% payout ratio, supported by robust free cash flow (FCF) coverage near 1.96x. STM yields ~1.28% with a low 18% payout and weak FCF, often negative, signaling limited dividend sustainability. ADI’s consistent buybacks complement dividends, enhancing total returns. STM shows restrained buybacks amid uneven cash flow, relying more on reinvestment. I find ADI’s balanced distributions and strong cash flow deliver superior, sustainable shareholder rewards in 2026.

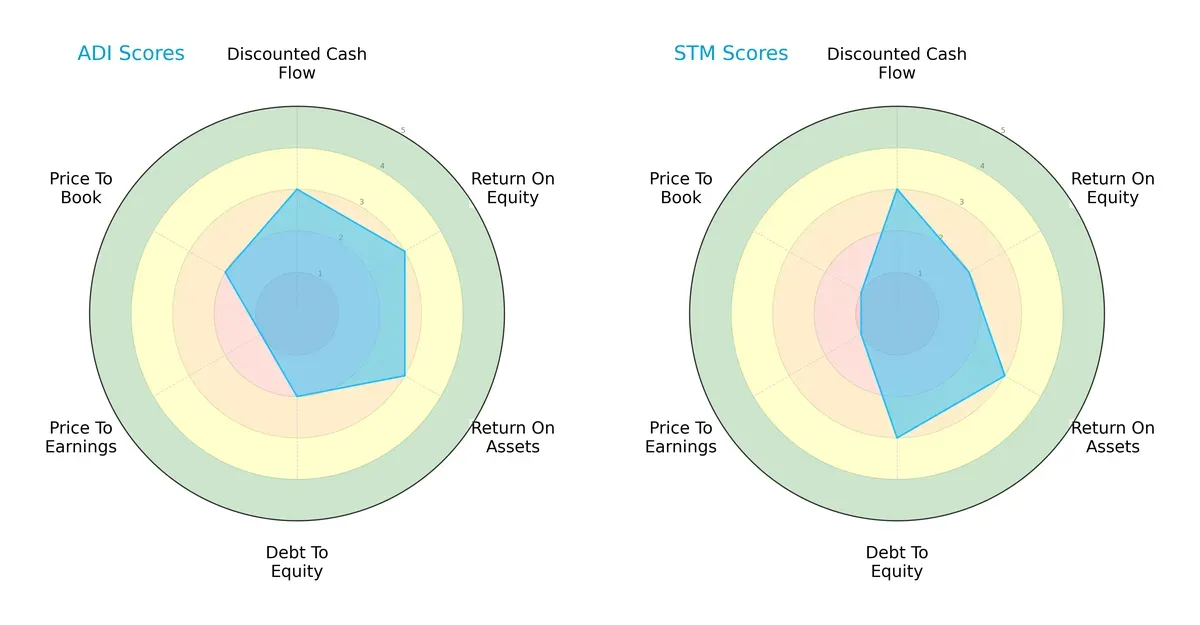

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Analog Devices, Inc. and STMicroelectronics N.V., highlighting their strategic strengths and weaknesses:

Analog Devices shows a more balanced profile with moderate scores across DCF, ROE, and ROA, but a weaker debt-to-equity position. STMicroelectronics relies on stronger debt management and asset efficiency but lags in ROE and valuation metrics. Analog Devices’ edge lies in equity returns, whereas STMicroelectronics excels in leverage control.

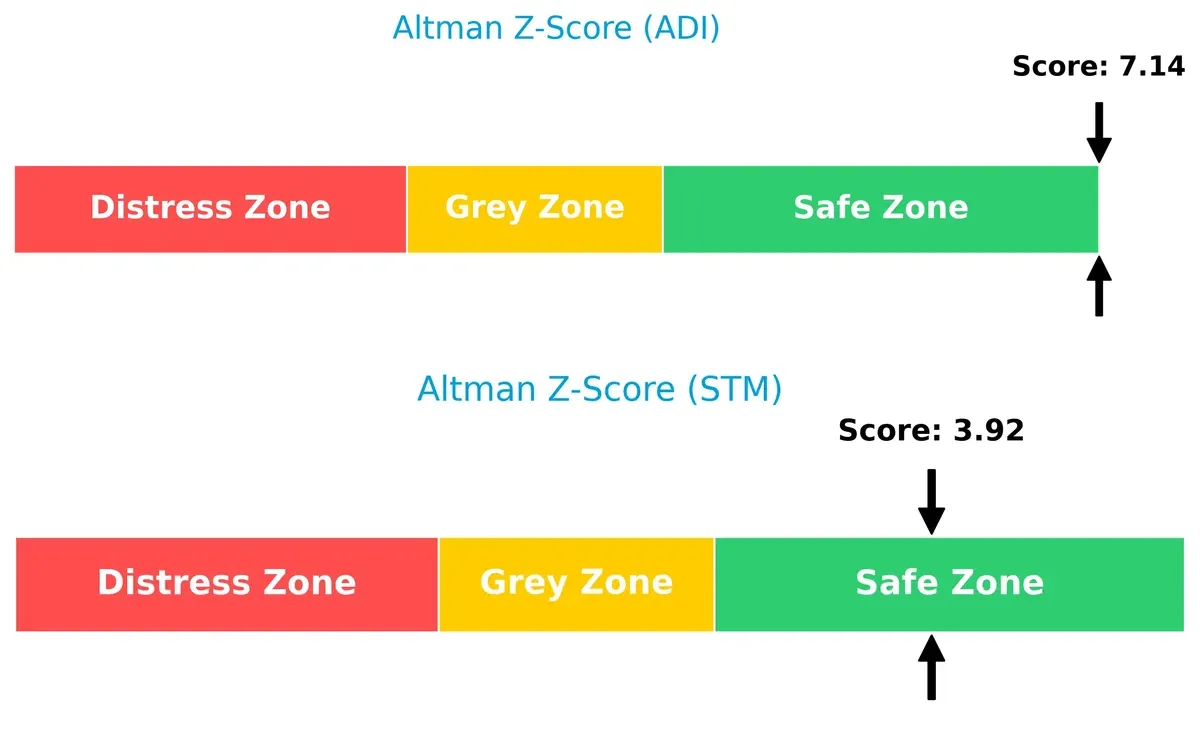

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap indicates both companies sit comfortably in the safe zone, with Analog Devices’ score (7.14) signaling a stronger buffer against bankruptcy than STMicroelectronics (3.92):

Financial Health: Quality of Operations

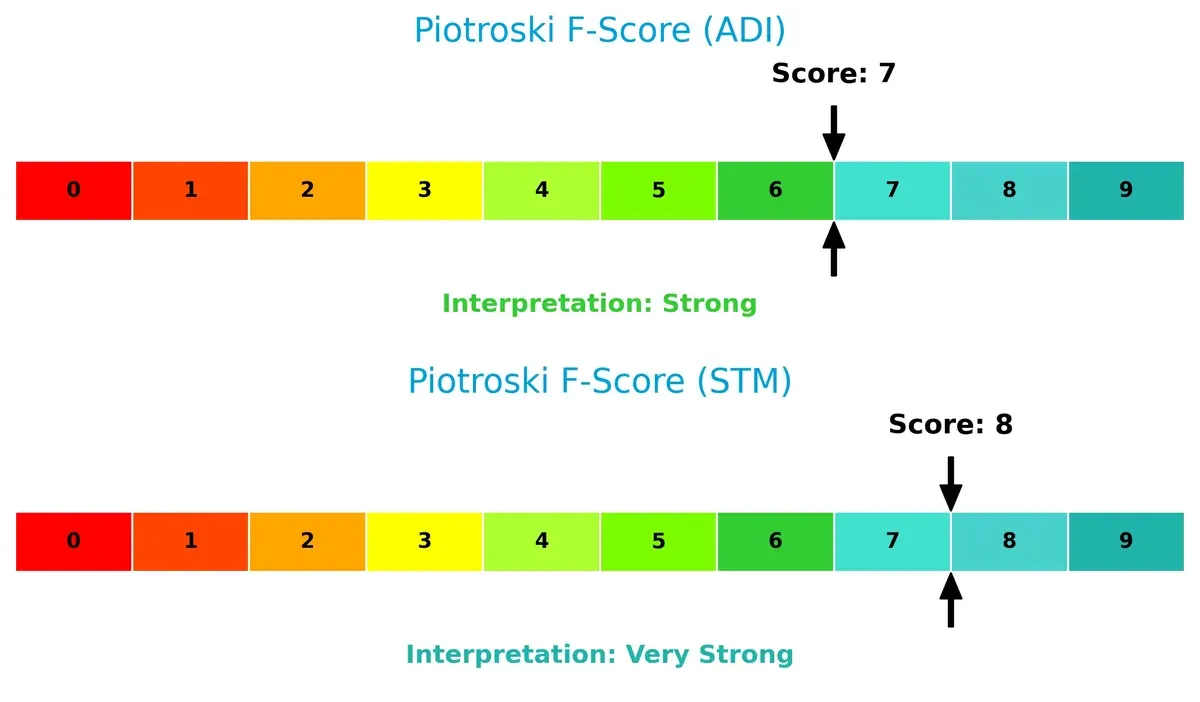

STMicroelectronics scores an 8 on the Piotroski F-Score, reflecting very strong financial health, slightly outperforming Analog Devices’ strong 7, which suggests minor internal metric weaknesses:

How are the two companies positioned?

This section dissects the operational DNA of ADI and STM by comparing their revenue distribution and internal dynamics, including strengths and weaknesses. The goal is to confront their economic moats and identify which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

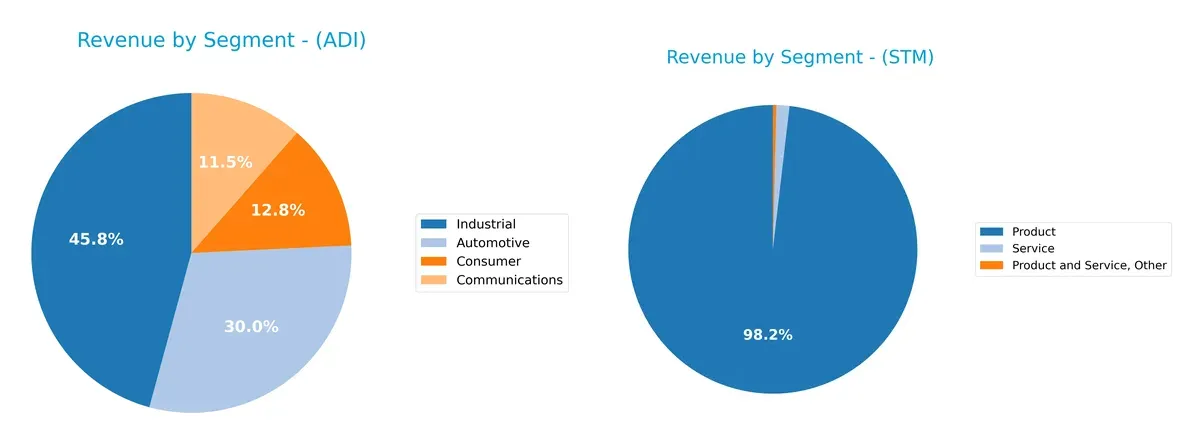

This visual comparison dissects how Analog Devices, Inc. and STMicroelectronics N.V. diversify their income streams and where their primary sector bets lie:

Analog Devices anchors its revenue in Industrial ($4.3B) and Automotive ($2.8B), showing a balanced, diversified model across four key sectors. STMicroelectronics relies heavily on a single Product segment ($13.2B), dominating its revenue base. This concentration signals higher dependence on product sales, exposing STM to market shifts, while ADI’s spread across Automotive, Communications, Consumer, and Industrial sectors reduces concentration risk and enhances ecosystem resilience.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Analog Devices, Inc. (ADI) and STMicroelectronics N.V. (STM):

ADI Strengths

- Diverse product segments including Automotive, Industrial, Communications, Consumer

- Strong net margin at 20.58%

- Favorable liquidity ratios with current ratio 2.19 and quick ratio 1.68

- Low debt-to-equity at 0.26 and strong interest coverage at 9.54

- Global revenue spread across US, China, Europe, and Asia with significant US market

STM Strengths

- Broad product portfolio with strong revenue in Product segment at $13.2B

- Favorable debt ratios with debt-to-equity 0.12 and debt-to-assets 8.6%

- Infinite interest coverage indicating strong earnings relative to interest expenses

- Solid geographic presence in Singapore, Switzerland, US, and Japan

- Favorable valuation metrics with P/E and P/B considered attractive

ADI Weaknesses

- Unfavorable return on equity at 6.7% and high P/E of 51.05 indicating expensive valuation

- Asset turnover low at 0.23, showing less efficient asset use

- Some unfavorable valuation ratios like P/B at 3.42

- ROIC below WACC implying limited value creation on invested capital

STM Weaknesses

- Low profitability with net margin at 1.41% and ROE at 0.93%

- ROIC at 0.67% below WACC of 9.36%, reflecting weak capital efficiency

- Unfavorable current ratio of 3.36 signals possible liquidity management concerns

- Zero dividend yield indicating no income return to shareholders

Both companies show global diversification and solid balance sheets, but ADI demonstrates stronger profitability and liquidity metrics. STM’s valuation looks more attractive, yet its profitability and capital efficiency remain weak, potentially impacting long-term competitiveness.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat shields long-term profits from relentless competitive erosion. Without it, sustainable returns quickly vanish. Let’s analyze the moats of two chipmakers:

Analog Devices, Inc. (ADI): Niche Expertise and Innovation Edge

ADI’s moat stems from its intangible assets and specialized analog technology. This manifests in robust 27.5% EBIT margins and stable revenue growth. Its expanding product portfolio in industrial and automotive sectors could deepen this advantage through 2026.

STMicroelectronics N.V. (STM): Broad Market Reach with Thin Margins

STM relies on cost advantage and diversified offerings across analog, MEMS, and microcontrollers. However, its weak 3.4% EBIT margin and declining ROIC signal a fragile moat. Market pressures and stagnant profitability threaten long-term defensibility despite geographic diversity.

Moat Durability: Innovation Focus vs. Margin Pressure

ADI’s growing ROIC and high margins reveal a deeper, more sustainable moat than STM’s deteriorating profitability and shrinking returns. ADI is better positioned to defend market share amid intensifying semiconductor competition.

Which stock offers better returns?

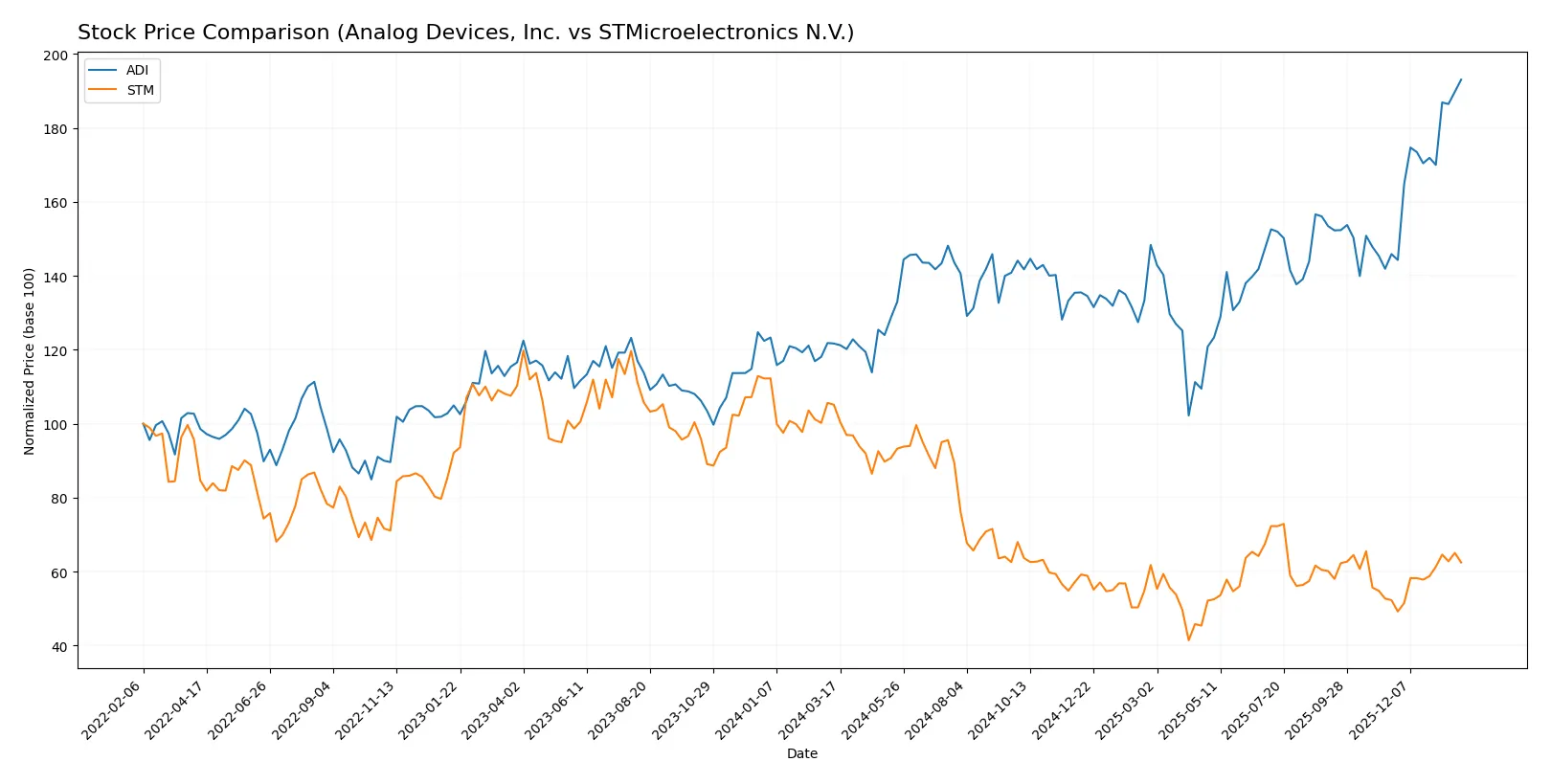

Over the past year, Analog Devices, Inc. surged with strong upward momentum, while STMicroelectronics N.V. faced a notable decline despite recent signs of recovery.

Trend Comparison

Analog Devices, Inc. shows a bullish trend with a 58.66% price increase over 12 months, accelerating upward from a low of 164.6 to a high near 311. Volatility is significant at 26.38%.

STMicroelectronics N.V. exhibits a bearish trend, dropping 40.6% over the same period, despite a recent 19.49% rebound. The trend accelerates downward, with lower volatility at 6.77%.

Analog Devices clearly outperforms STMicroelectronics, delivering the highest market returns and stronger sustained momentum during the past year.

Target Prices

Analysts present a measured target consensus for Analog Devices and STMicroelectronics, reflecting cautious optimism.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Analog Devices, Inc. | 270 | 375 | 316 |

| STMicroelectronics N.V. | 28 | 45 | 37.67 |

The consensus target for Analog Devices at $316 slightly exceeds its current price of $310.88, signaling moderate upside potential. STMicroelectronics’ consensus target of $37.67 stands well above its current $27.89, indicating stronger expected growth.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize recent institutional grades for Analog Devices, Inc. and STMicroelectronics N.V.:

Analog Devices, Inc. Grades

The table below shows recent grades from notable financial institutions for Analog Devices, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | maintain | Positive | 2026-01-22 |

| B of A Securities | maintain | Buy | 2026-01-21 |

| Stifel | maintain | Buy | 2026-01-16 |

| Oppenheimer | maintain | Outperform | 2026-01-16 |

| Wells Fargo | upgrade | Overweight | 2026-01-15 |

| Citigroup | maintain | Buy | 2026-01-15 |

| Keybanc | maintain | Overweight | 2026-01-13 |

| Truist Securities | maintain | Hold | 2025-12-19 |

| UBS | maintain | Buy | 2025-12-08 |

| Truist Securities | maintain | Hold | 2025-11-26 |

STMicroelectronics N.V. Grades

Below is a summary of recent institutional grades for STMicroelectronics N.V.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | maintain | Buy | 2025-10-24 |

| Susquehanna | maintain | Positive | 2025-10-22 |

| Susquehanna | maintain | Positive | 2025-07-25 |

| Susquehanna | maintain | Positive | 2025-07-22 |

| Baird | upgrade | Outperform | 2025-07-22 |

| Jefferies | upgrade | Buy | 2025-02-19 |

| Bernstein | downgrade | Market Perform | 2025-02-05 |

| Susquehanna | maintain | Positive | 2025-01-31 |

| Barclays | downgrade | Underweight | 2025-01-22 |

| JP Morgan | downgrade | Neutral | 2024-12-09 |

Which company has the best grades?

Analog Devices holds a consistent Buy and Positive stance with several upgrades, showing strong institutional confidence. STMicroelectronics shows mixed ratings with notable downgrades, indicating more cautious investor sentiment. This difference could influence portfolio positioning based on risk tolerance.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Analog Devices, Inc. (ADI)

- Strong market presence but premium valuation risks margin pressure.

STMicroelectronics N.V. (STM)

- Faces fierce competition with lower margins and slower profit growth.

2. Capital Structure & Debt

Analog Devices, Inc. (ADI)

- Low debt-to-equity (0.26) with healthy interest coverage (9.54x).

STMicroelectronics N.V. (STM)

- Even lower leverage (0.12) and infinite interest coverage, indicating strong financial stability.

3. Stock Volatility

Analog Devices, Inc. (ADI)

- Beta near market average (1.03) implies moderate volatility.

STMicroelectronics N.V. (STM)

- Higher beta (1.29) signals greater stock price swings and market sensitivity.

4. Regulatory & Legal

Analog Devices, Inc. (ADI)

- US-based, exposed to stringent domestic tech regulations and export controls.

STMicroelectronics N.V. (STM)

- EU-based with exposure to evolving European regulations and global trade tensions.

5. Supply Chain & Operations

Analog Devices, Inc. (ADI)

- Global footprint helps diversify supply risks but complexity remains.

STMicroelectronics N.V. (STM)

- Larger workforce and regional exposure heighten operational and supply chain risks.

6. ESG & Climate Transition

Analog Devices, Inc. (ADI)

- Increasing ESG focus with ongoing efforts, yet carbon footprint challenges persist.

STMicroelectronics N.V. (STM)

- Stronger sustainability initiatives, but regulatory compliance costs may rise.

7. Geopolitical Exposure

Analog Devices, Inc. (ADI)

- Significant exposure to US-China tensions impacting supply and sales.

STMicroelectronics N.V. (STM)

- Broad European and Asia-Pacific exposure increases geopolitical uncertainty.

Which company shows a better risk-adjusted profile?

Analog Devices faces its most impactful risk in its premium valuation and US regulatory pressures. STMicroelectronics struggles with weaker profitability and higher stock volatility amid geopolitical complexities. I see ADI’s stronger balance sheet and moderate beta as markers of a superior risk-adjusted profile, despite valuation concerns. Notably, STM’s thin net margin (1.41%) signals operational strain, reinforcing my caution.

Final Verdict: Which stock to choose?

Analog Devices, Inc. (ADI) excels as a cash-generating powerhouse with solid operational efficiency and a strong balance sheet. Its rising profitability amid a slight value destruction signals an improving business model. A point of vigilance remains its premium valuation, fitting an Aggressive Growth portfolio targeting quality at a cost.

STMicroelectronics N.V. (STM) competes with a strategic moat rooted in its tangible asset base and conservative leverage. Despite weaker profitability and a shrinking moat, STM offers better liquidity and financial stability than ADI. It suits a GARP (Growth at a Reasonable Price) portfolio focused on resilience amid uncertainty.

If you prioritize dynamic cash generation and growth momentum, ADI outshines with accelerating earnings and robust financial health. However, if you seek better stability and balance sheet strength amid cyclical headwinds, STM offers a safer harbor despite profitability challenges. Both scenarios warrant careful risk assessment aligned with your investment horizon.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Analog Devices, Inc. and STMicroelectronics N.V. to enhance your investment decisions: