In the fast-evolving semiconductor industry, Analog Devices, Inc. (ADI) and Onto Innovation Inc. (ONTO) stand out as key players shaping technology’s future. Both companies specialize in cutting-edge semiconductor solutions but focus on different aspects of innovation and market needs, from integrated circuits to process control tools. This comparison aims to help investors identify which company offers the most compelling opportunity for growth and stability in their portfolio. Let’s explore which one deserves your attention.

Table of contents

Companies Overview

I will begin the comparison between Analog Devices, Inc. and Onto Innovation Inc. by providing an overview of these two companies and their main differences.

Analog Devices, Inc. Overview

Analog Devices, Inc. focuses on designing, manufacturing, and marketing integrated circuits and subsystems that use analog, mixed-signal, and digital signal processing technologies. The company serves diverse markets including industrial, automotive, consumer, and communications, offering products like data converters, power management ICs, amplifiers, and MEMS technology. Based in Wilmington, Massachusetts, ADI is a well-established player in the semiconductor industry with a market cap of approximately 149B USD.

Onto Innovation Inc. Overview

Onto Innovation Inc. specializes in process control tools for semiconductor manufacturing, including macro defect inspection, optical metrology, lithography systems, and analytical software. The company provides solutions for process and yield management, device packaging, and test facilities. Also headquartered in Wilmington, Massachusetts, Onto Innovation has a market cap near 10.7B USD and serves semiconductor and advanced packaging device manufacturers worldwide.

Key similarities and differences

Both companies operate within the semiconductor industry and are headquartered in Wilmington, Massachusetts, yet they target different market segments. Analog Devices develops a broad range of integrated circuits and signal processing technologies, while Onto Innovation focuses on manufacturing process control and metrology tools. ADI is significantly larger by market capitalization and employee count, reflecting its diversified product portfolio compared to Onto’s specialized solutions.

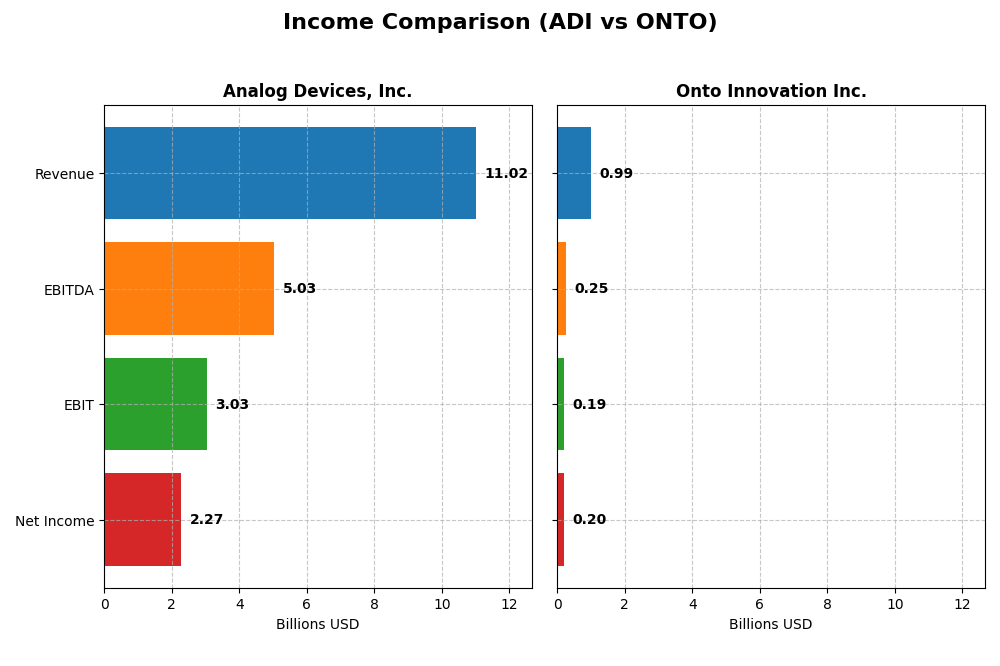

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for Analog Devices, Inc. and Onto Innovation Inc. for their most recent fiscal years.

| Metric | Analog Devices, Inc. (ADI) | Onto Innovation Inc. (ONTO) |

|---|---|---|

| Market Cap | 149.4B | 10.7B |

| Revenue | 11.0B | 987M |

| EBITDA | 5.03B | 249M |

| EBIT | 3.03B | 187M |

| Net Income | 2.27B | 202M |

| EPS | 4.59 | 4.09 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Analog Devices, Inc.

Analog Devices showed strong upward trends in revenue and net income from 2021 to 2025, with revenue rising from $7.3B to $11B and net income growing from $1.4B to $2.3B. Margins remained robust, with a favorable gross margin at 54.66% and net margin above 20%. In 2025, revenue growth accelerated by 16.9%, and net margin improved by 18.6%, signaling enhanced profitability.

Onto Innovation Inc.

Onto Innovation experienced consistent revenue growth from $557M in 2020 to $987M in 2024, with net income surging from $31M to $202M. Margins have remained stable, boasting a gross margin around 52% and net margin near 20%. The 2024 results showed a revenue increase of 21%, EBIT growth of 61%, and a significant 37.5% net margin expansion, reflecting strong operational gains.

Which one has the stronger fundamentals?

Both companies exhibit favorable financial trends and improving profitability metrics. Analog Devices benefits from larger scale and stable margin expansion, while Onto Innovation demonstrates higher relative growth rates in revenue, net income, and margins. The choice depends on preference for size and stability versus rapid growth, as both present solid fundamentals in their income statements.

Financial Ratios Comparison

The table below presents the most recent financial ratios for Analog Devices, Inc. (ADI) and Onto Innovation Inc. (ONTO), illustrating key performance metrics for fiscal year 2025.

| Ratios | Analog Devices, Inc. (ADI) | Onto Innovation Inc. (ONTO) |

|---|---|---|

| ROE | 6.7% | 10.5% |

| ROIC | 5.5% | 8.8% |

| P/E | 51.1 | 41.8 |

| P/B | 3.42 | 4.37 |

| Current Ratio | 2.19 | 8.69 |

| Quick Ratio | 1.68 | 7.00 |

| D/E | 0.26 | 0.008 |

| Debt-to-Assets | 18.1% | 0.7% |

| Interest Coverage | 9.45 | 0 |

| Asset Turnover | 0.23 | 0.47 |

| Fixed Asset Turnover | 3.32 | 7.16 |

| Payout ratio | 84.9% | 0% |

| Dividend yield | 1.66% | 0% |

Interpretation of the Ratios

Analog Devices, Inc.

Analog Devices shows a balanced profile with half of its ratios favorable, including a strong current ratio of 2.19 and low debt-to-equity at 0.26, indicating solid liquidity and manageable leverage. However, its price-to-earnings ratio of 51.05 and return on equity of 6.7% are less attractive, signaling valuation concerns and moderate profitability. The company pays dividends, with a 1.66% yield considered neutral, balancing payout sustainability and shareholder returns.

Onto Innovation Inc.

Onto Innovation presents mixed ratios, with favorable metrics like a minimal debt-to-assets ratio of 0.72% and excellent interest coverage, reflecting low financial risk. Yet, high valuation multiples (PE at 41.76) and an unusually high current ratio of 8.69 may indicate inefficiency in asset use. The firm does not pay dividends, likely prioritizing reinvestment or growth, consistent with its neutral overall ratio evaluation.

Which one has the best ratios?

Analog Devices holds a slightly favorable edge with half its ratios positive and better leverage and liquidity measures, despite some valuation drawbacks. Onto Innovation, while financially conservative with low debt, faces more unfavorable ratios and lacks dividend returns. Overall, Analog Devices shows a more balanced and stable ratio set compared to Onto’s neutral stance.

Strategic Positioning

This section compares the strategic positioning of Analog Devices, Inc. and Onto Innovation Inc. based on Market position, Key segments, and Exposure to technological disruption:

Analog Devices, Inc.

- Leading semiconductor firm with $149B market cap amid competitive industry pressure.

- Diverse segments: automotive, industrial, consumer, communications drive revenue growth.

- Exposure through analog, mixed-signal ICs and MEMS technologies in multiple markets.

Onto Innovation Inc.

- Smaller semiconductor equipment maker with $10.7B market cap facing strong industry competition.

- Focused on process control tools and software for semiconductor manufacturing and packaging.

- Exposure via advanced lithography and metrology tools critical for semiconductor process control.

Analog Devices, Inc. vs Onto Innovation Inc. Positioning

ADI pursues a diversified strategy across automotive, industrial, consumer, and communications markets, offering broad product lines. Onto Innovation concentrates on semiconductor process control tools and software, providing specialized solutions but with narrower market scope.

Which has the best competitive advantage?

Both companies show slightly unfavorable MOAT evaluations, shedding value but with growing ROIC trends. Neither currently demonstrates a strong competitive advantage based on the available MOAT data.

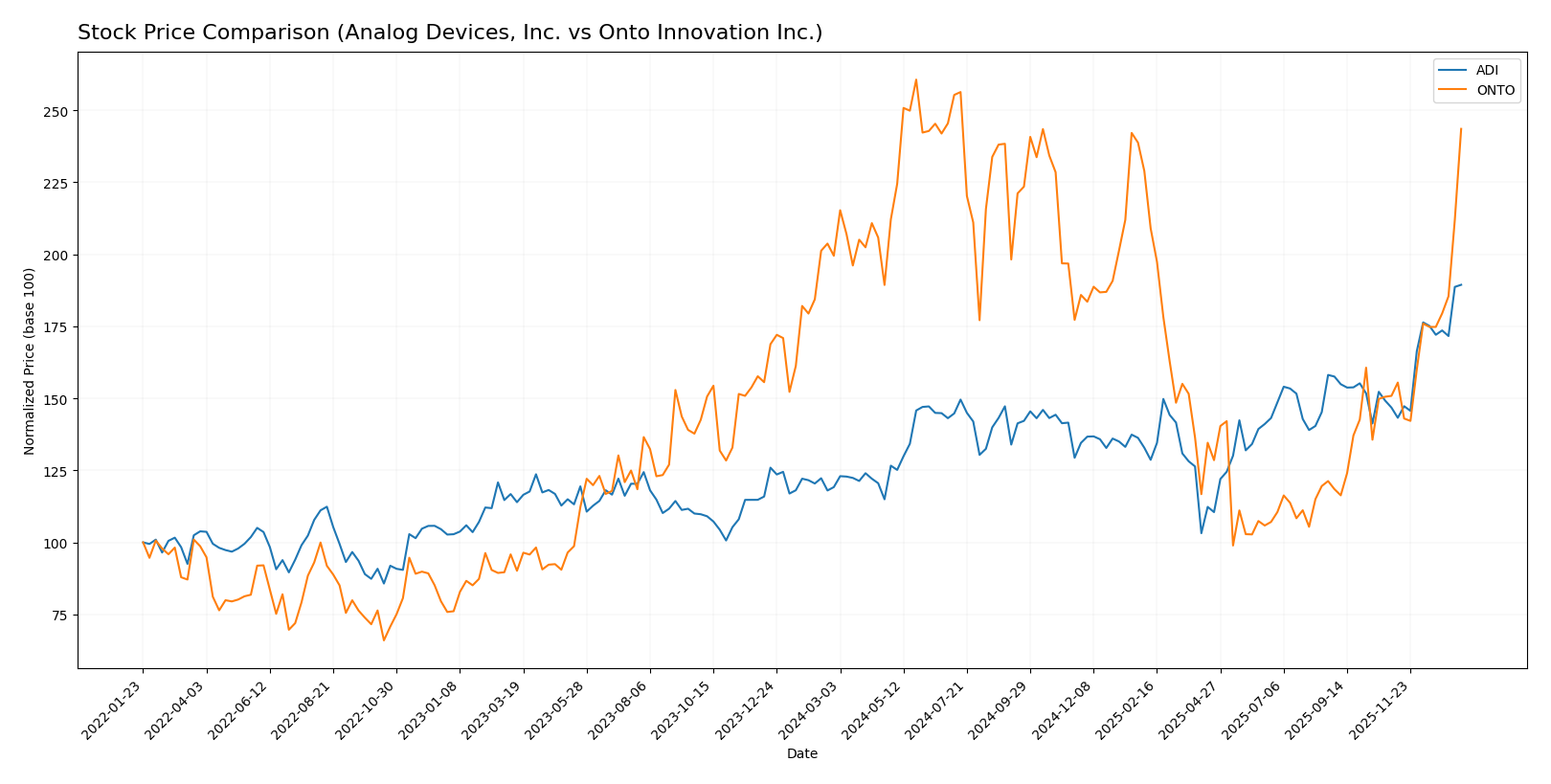

Stock Comparison

The stock price chart over the past year reveals strong bullish momentum for both Analog Devices, Inc. (ADI) and Onto Innovation Inc. (ONTO), with notable acceleration in price gains and increasing trading volumes.

Trend Analysis

Analog Devices, Inc. (ADI) shows a bullish trend with a 58.91% price increase over the past 12 months, marked by acceleration and a price range between 164.6 and 302.1. Recent months confirm continued upward momentum.

Onto Innovation Inc. (ONTO) also exhibits a bullish trend, with a 22.07% price rise over the year and acceleration. It features higher volatility and a wider price range from 88.5 to 233.14, with significant recent gains.

Comparing both, ADI delivered the highest market performance overall with a 58.91% increase, outperforming ONTO’s 22.07% over the same 12-month period.

Target Prices

The current target price consensus reflects moderate upside potential for these semiconductor companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Analog Devices, Inc. | 375 | 270 | 304.73 |

| Onto Innovation Inc. | 200 | 160 | 178 |

Analysts expect Analog Devices’ stock to trade slightly above its current price of 302.1 USD, while Onto Innovation’s consensus target is below its current 217.85 USD price, suggesting mixed market sentiment.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Analog Devices, Inc. (ADI) and Onto Innovation Inc. (ONTO):

Rating Comparison

ADI Rating

- Rating: B-, considered very favorable by analysts.

- Discounted Cash Flow Score: 4, indicating a favorable valuation.

- ROE Score: 3, reflecting moderate efficiency in profit generation.

- ROA Score: 3, moderate asset utilization efficiency.

- Debt To Equity Score: 2, moderate financial risk.

- Overall Score: 3, a moderate overall financial standing.

ONTO Rating

- Rating: B+, also rated very favorable by analysts.

- Discounted Cash Flow Score: 3, a moderate valuation assessment.

- ROE Score: 3, also showing moderate profitability efficiency.

- ROA Score: 4, indicating favorable asset utilization.

- Debt To Equity Score: 4, low financial risk and strong balance sheet.

- Overall Score: 3, similarly a moderate overall financial standing.

Which one is the best rated?

Based strictly on provided data, ONTO has a higher rating (B+) than ADI (B-). ONTO scores better in return on assets and debt to equity, while ADI has a better discounted cash flow score. Overall scores are equal.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Analog Devices, Inc. (ADI) and Onto Innovation Inc. (ONTO):

ADI Scores

- Altman Z-Score of 6.99, indicating a safe financial zone.

- Piotroski Score of 7, reflecting strong financial health.

ONTO Scores

- Altman Z-Score of 34.16, indicating a safe financial zone.

- Piotroski Score of 4, indicating average financial strength.

Which company has the best scores?

Based on the provided scores, ONTO has a higher Altman Z-Score, suggesting stronger financial stability, while ADI has a higher Piotroski Score, indicating better financial health. Each company excels in one of the two key financial scores.

Grades Comparison

Here is a comparison of the recent grades assigned to Analog Devices, Inc. and Onto Innovation Inc.:

Analog Devices, Inc. Grades

The following table summarizes recent grades assigned by reputable grading companies to Analog Devices, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | maintain | Overweight | 2026-01-13 |

| Truist Securities | maintain | Hold | 2025-12-19 |

| UBS | maintain | Buy | 2025-12-08 |

| Wells Fargo | maintain | Equal Weight | 2025-11-26 |

| B of A Securities | maintain | Buy | 2025-11-26 |

| Evercore ISI Group | maintain | Outperform | 2025-11-26 |

| JP Morgan | maintain | Overweight | 2025-11-26 |

| Baird | maintain | Outperform | 2025-11-26 |

| Benchmark | maintain | Buy | 2025-11-26 |

| Truist Securities | maintain | Hold | 2025-11-26 |

Analog Devices has consistently maintained positive grades, mostly in the Buy to Outperform range, with some Hold and Equal Weight ratings.

Onto Innovation Inc. Grades

The following table presents grades recently assigned by recognized grading companies to Onto Innovation Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | maintain | Hold | 2026-01-14 |

| Needham | maintain | Buy | 2026-01-06 |

| Jefferies | maintain | Buy | 2025-12-15 |

| B. Riley Securities | maintain | Buy | 2025-11-18 |

| Needham | maintain | Buy | 2025-11-18 |

| Evercore ISI Group | maintain | Outperform | 2025-11-05 |

| Oppenheimer | maintain | Outperform | 2025-10-14 |

| Stifel | maintain | Hold | 2025-10-13 |

| B. Riley Securities | maintain | Buy | 2025-10-10 |

| Jefferies | upgrade | Buy | 2025-09-23 |

Onto Innovation shows a strong trend toward Buy and Outperform ratings, with a few Hold grades, and a recent upgrade from Hold to Buy.

Which company has the best grades?

Both companies have consensus Buy ratings, but Analog Devices has a larger volume of Buy and Outperform grades from multiple established firms. Onto Innovation also shows positive momentum, with several Buy and Outperform ratings and recent upgrades. This suggests investors may view Analog Devices as having a more broadly supported positive outlook, while Onto Innovation demonstrates growing confidence among analysts.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses of Analog Devices, Inc. (ADI) and Onto Innovation Inc. (ONTO) based on their recent financial and operational data.

| Criterion | Analog Devices, Inc. (ADI) | Onto Innovation Inc. (ONTO) |

|---|---|---|

| Diversification | Highly diversified with strong Industrial ($4.3B) and Automotive ($2.8B) segments; also Communications and Consumer sectors present | Less diversified; revenue heavily reliant on Systems and Software ($850M) with smaller Parts and Services segments |

| Profitability | Solid net margin (20.58%) but ROIC (5.55%) below WACC (8.36%), indicating value destruction despite improving profitability | Comparable net margin (20.43%) with better ROIC (8.77%) but WACC (10.66%) higher, also value destroying though improving |

| Innovation | Strong fixed asset turnover (3.32) suggests efficient use of assets in innovation and production | Higher fixed asset turnover (7.16) indicates very efficient asset use aligned with innovation focus |

| Global presence | Large scale global industrial footprint with significant revenue in multiple sectors | More niche market presence focused on automated and integrated systems, less global diversification |

| Market Share | Established leader in analog and mixed-signal semiconductors with broad market coverage | Smaller market player with focus on semiconductor process control and related software |

Key takeaways: ADI shows strength in diversification and steady profitability, though it currently struggles to create value above its capital cost. ONTO exhibits rapid ROIC growth and asset efficiency but remains more concentrated and faces challenges in cost of capital and liquidity. Both companies demonstrate improving profitability trends but require careful risk assessment before investment.

Risk Analysis

Below is a comparison of key risk factors for Analog Devices, Inc. (ADI) and Onto Innovation Inc. (ONTO) based on the most recent data available.

| Metric | Analog Devices, Inc. (ADI) | Onto Innovation Inc. (ONTO) |

|---|---|---|

| Market Risk | Beta 1.03 (moderate) | Beta 1.46 (higher volatility) |

| Debt level | Debt/Equity 0.26 (low) | Debt/Equity 0.01 (very low) |

| Regulatory Risk | Moderate (semiconductor industry regulation) | Moderate (semiconductor equipment sector) |

| Operational Risk | Medium (24K employees, global footprint) | Medium (smaller scale, 1.5K employees) |

| Environmental Risk | Medium (manufacturing impact) | Medium (manufacturing and software) |

| Geopolitical Risk | Exposure to China and Asia markets | Exposure to global supply chains |

The most impactful risks are market volatility and geopolitical exposure. ONTO’s higher beta indicates greater sensitivity to market swings, while ADI’s larger scale presents more regulatory and operational complexity. Both companies face moderate environmental and geopolitical risks due to their international operations and semiconductor industry dependencies.

Which Stock to Choose?

Analog Devices, Inc. (ADI) shows a favorable income evolution with 17% revenue growth last year and consistent profitability reflected in a 20.6% net margin. Its financial ratios are slightly favorable overall, supported by a strong current ratio of 2.19 and low debt levels, yet it has an unfavorable ROE of 6.7% and high P/E at 51.05. The company’s rating is very favorable (B-), with strong scores in Altman Z (6.99) and Piotroski (7), though its MOAT status is slightly unfavorable due to ROIC below WACC despite a growing trend.

Onto Innovation Inc. (ONTO) reports robust income growth of 21% last year and a similarly strong 20.4% net margin. Its financial ratios are neutral overall, with excellent liquidity shown by an 8.69 current ratio and minimal debt, but a higher WACC and moderate valuation ratios. ONTO holds a very favorable rating (B+) with a safe Altman Z-Score (34.16) but a moderate Piotroski score (4). Its MOAT is also slightly unfavorable, with ROIC trailing WACC despite marked improvement over time.

For investors prioritizing growth, ONTO’s higher income growth and improving profitability might appear attractive, especially with strong liquidity and a safer bankruptcy risk. Conversely, ADI’s solid profitability and balanced financial ratios may appeal to those valuing stability and quality, despite its slightly less favorable MOAT. Ultimately, the choice could depend on the investor’s risk tolerance and investment strategy preferences.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Analog Devices, Inc. and Onto Innovation Inc. to enhance your investment decisions: