Home > Comparison > Technology > ADI vs MPWR

The strategic rivalry between Analog Devices, Inc. and Monolithic Power Systems, Inc. shapes the semiconductor industry’s future. Analog Devices operates as a diversified, capital-intensive leader in analog and mixed-signal ICs, while Monolithic Power Systems focuses on high-margin power electronics solutions. This analysis examines their contrasting operational models and growth vectors. I will determine which company offers a superior risk-adjusted return for a diversified portfolio amid evolving technology demands.

Table of contents

Companies Overview

Analog Devices and Monolithic Power Systems hold pivotal roles in the semiconductor industry, shaping power and signal processing technologies.

Analog Devices, Inc.: Leader in Analog and Mixed-Signal ICs

Analog Devices dominates the analog, mixed-signal, and digital signal processing market. It generates revenue by designing integrated circuits that convert and condition signals across automotive, industrial, and consumer sectors. In 2026, its strategic focus sharpened on enhancing power management and high-performance amplifiers to support cellular infrastructure and aerospace applications.

Monolithic Power Systems, Inc.: Specialist in Power Electronics Solutions

Monolithic Power Systems excels in semiconductor-based power electronics, focusing on DC-to-DC integrated circuits. Its core revenue comes from supplying voltage conversion and control ICs for computing, automotive, and communications markets. The company’s 2026 strategy prioritizes expanding lighting control ICs and power solutions in portable devices and industrial systems.

Strategic Collision: Similarities & Divergences

Both companies leverage semiconductor innovation but differ in approach: Analog Devices pursues a broad analog and mixed-signal ecosystem, while Monolithic Power hones in on power IC specialization. They compete mainly in power management and signal processing ICs. Investors face distinct profiles: Analog Devices offers scale and diversification; Monolithic Power offers niche focus and higher beta risk.

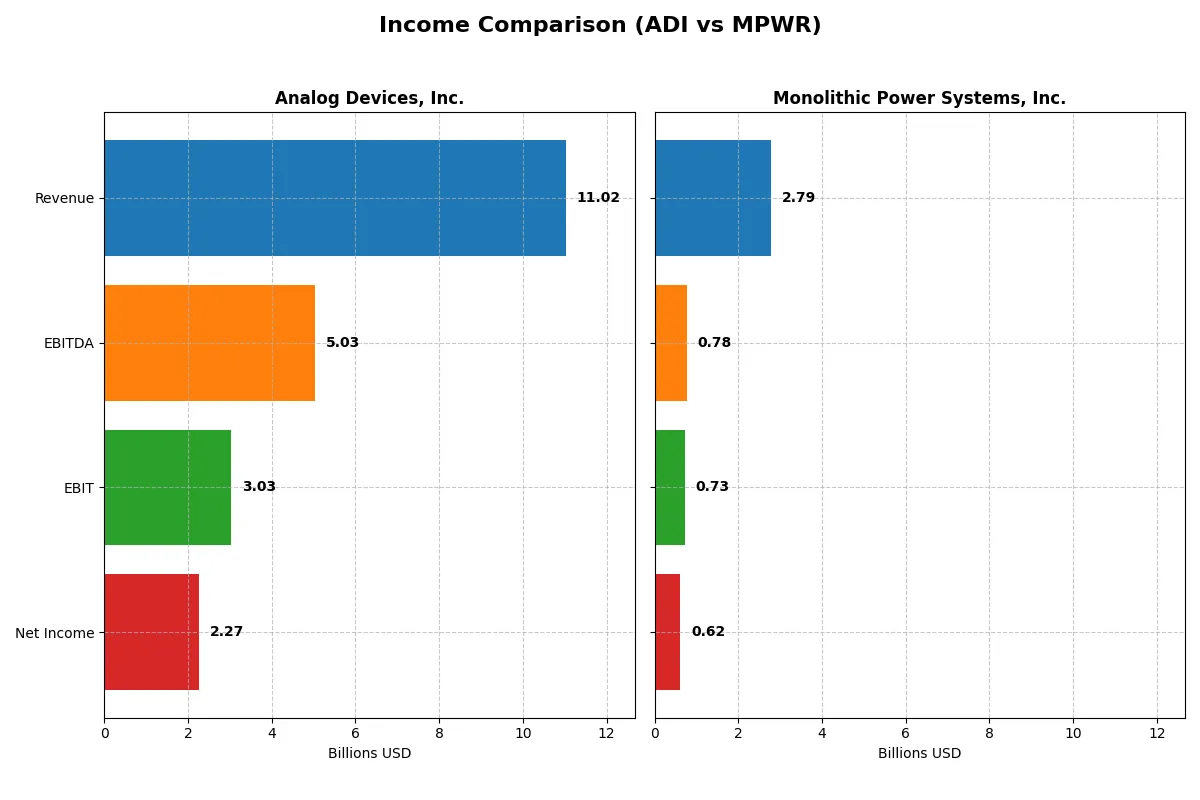

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Analog Devices, Inc. (ADI) | Monolithic Power Systems, Inc. (MPWR) |

|---|---|---|

| Revenue | 11.0B | 2.79B |

| Cost of Revenue | 5.00B | 1.25B |

| Operating Expenses | 3.02B | 811M |

| Gross Profit | 6.02B | 1.54B |

| EBITDA | 5.03B | 780M |

| EBIT | 3.03B | 729M |

| Interest Expense | 318M | 0 |

| Net Income | 2.27B | 616M |

| EPS | 4.59 | 12.82 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true operational efficiency and profitability momentum behind two semiconductor leaders.

Analog Devices, Inc. Analysis

Analog Devices shows a steady revenue climb from 7.3B in 2021 to 11B in 2025, with net income rising from 1.39B to 2.27B. Gross margin remains robust at 54.7%, while net margin advances to 20.6%, reflecting tight cost control. The 2025 year highlights strong EBIT growth of 44%, signaling improving operational efficiency.

Monolithic Power Systems, Inc. Analysis

Monolithic Power scales revenue impressively from 1.21B in 2021 to 2.79B in 2025, with net income jumping from 242M to 616M. Gross margin holds steady near 55%, and net margin improves to 22.1%. Despite a recent net margin dip in 2025, the firm’s 26% revenue growth and 35% EBIT increase demonstrate solid momentum and disciplined cost management.

Margin Power vs. Revenue Scale

Analog Devices delivers a more consistent margin expansion and higher absolute profits, while Monolithic Power boasts faster revenue growth and a slightly superior net margin. Analog Devices’ scale and margin stability create a clear fundamental advantage. Investors favoring steady profit growth may find Analog Devices’ profile more attractive.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Analog Devices, Inc. (ADI) | Monolithic Power Systems, Inc. (MPWR) |

|---|---|---|

| ROE | 6.7% | 16.6% |

| ROIC | 5.5% | 14.9% |

| P/E | 51.1 | 70.7 |

| P/B | 3.42 | 11.70 |

| Current Ratio | 2.19 | 5.91 |

| Quick Ratio | 1.68 | 4.38 |

| D/E | 0.26 | 0.00 |

| Debt-to-Assets | 18.1% | 0.0% |

| Interest Coverage | 9.45 | 0.00 |

| Asset Turnover | 0.23 | 0.65 |

| Fixed Asset Turnover | 3.32 | 4.45 |

| Payout Ratio | 84.9% | 46.2% |

| Dividend Yield | 1.66% | 0.65% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, uncovering hidden risks and spotlighting operational excellence in the competitive landscape.

Analog Devices, Inc.

Analog Devices posts a modest ROE of 6.7% against a favorable net margin of 20.58%. The valuation appears stretched with a P/E of 51.05 and P/B at 3.42, signaling premium pricing. Shareholders receive a 1.66% dividend yield, while the company balances reinvestment in R&D to fuel growth.

Monolithic Power Systems, Inc.

Monolithic Power boasts a robust ROE of 16.55% and a healthy net margin of 22.07%, reflecting operational efficiency. However, its P/E ratio of 70.69 and P/B of 11.7 denote an expensive valuation. The firm forgoes dividends, opting to channel capital into innovation and expansion.

Premium Valuation vs. Operational Safety

Monolithic Power demonstrates superior profitability but trades at a significantly higher valuation, increasing risk. Analog Devices offers a more balanced risk-reward profile with moderate returns and shareholder dividends. Growth seekers may prefer Monolithic’s aggressive stance; conservative investors might lean toward Analog Devices’ steadier footing.

Which one offers the Superior Shareholder Reward?

I compare Analog Devices, Inc. (ADI) and Monolithic Power Systems, Inc. (MPWR) by analyzing their dividend yields, payout ratios, and buyback intensity in 2025. ADI yields 1.66% with an 85% payout ratio, signaling a mature distribution approach backed by solid free cash flow (FCF). ADI’s dividend plus buybacks offer consistent returns, supported by a dividend paid and capex coverage ratio near 2. MPWR yields just 0.65%, with a lighter 46% payout and no debt, suggesting conservative cash returns but a strong reinvestment focus. MPWR’s buyback program is less visible, but its exceptionally high current ratio and cash per share indicate financial flexibility. Historically, ADI’s dividend-plus-buyback model suits income-focused investors, while MPWR prioritizes growth with modest dividends. In 2026, I find ADI’s balanced distribution strategy more sustainable and attractive for total shareholder return.

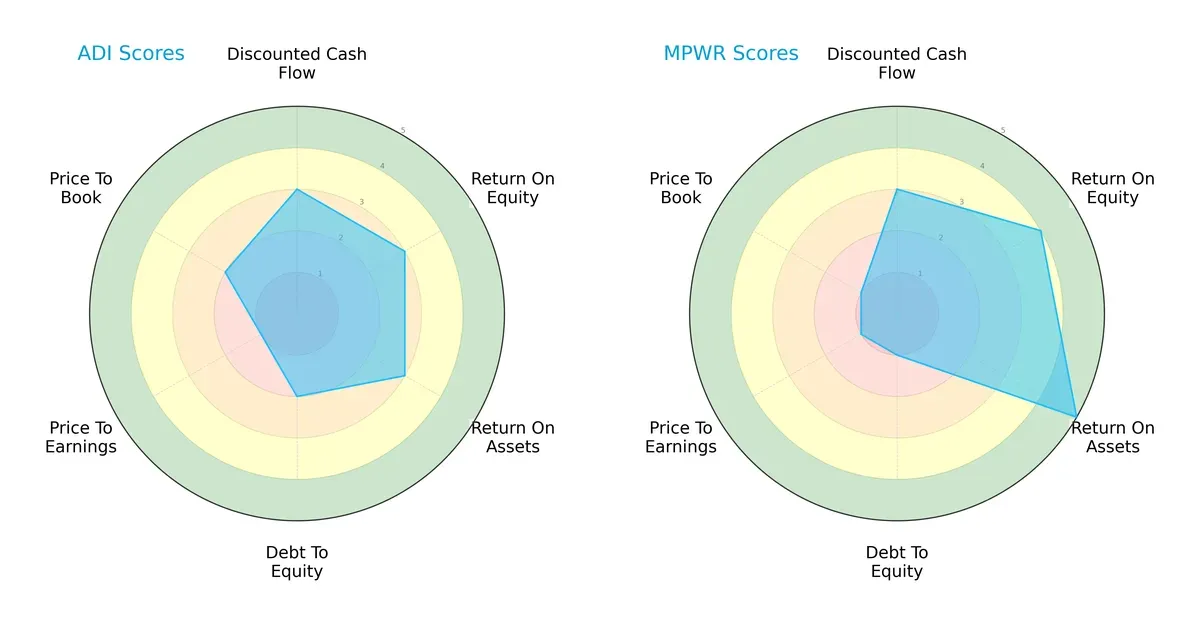

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Analog Devices, Inc. and Monolithic Power Systems, Inc., highlighting their key financial strengths and weaknesses:

Monolithic Power Systems scores higher in profitability metrics, with a 4 in ROE and 5 in ROA, demonstrating superior asset and equity efficiency. Conversely, Analog Devices maintains a more balanced yet moderate profile, scoring 3 across these metrics. Both companies share moderate DCF scores of 3, but Analog Devices holds a slight edge in debt management (Debt/Equity score 2 vs. 1). Valuation metrics (P/E and P/B) remain weak for both, with Analog Devices slightly better on Price-to-Book. Overall, Monolithic Power leverages profitability as its core edge, while Analog Devices exhibits steadier financial balance.

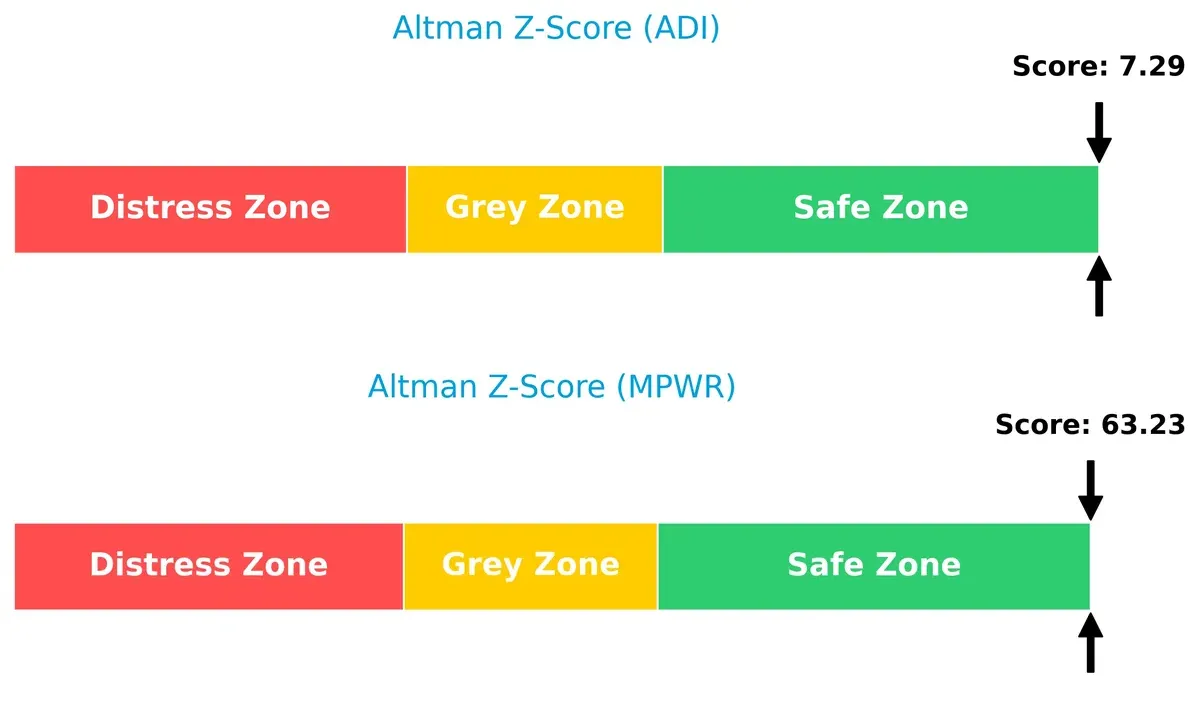

Bankruptcy Risk: Solvency Showdown

Monolithic Power’s Altman Z-Score of 63.2 vastly exceeds Analog Devices’ 7.3, both well into the safe zone, signaling robust long-term solvency and minimal bankruptcy risk in this cycle:

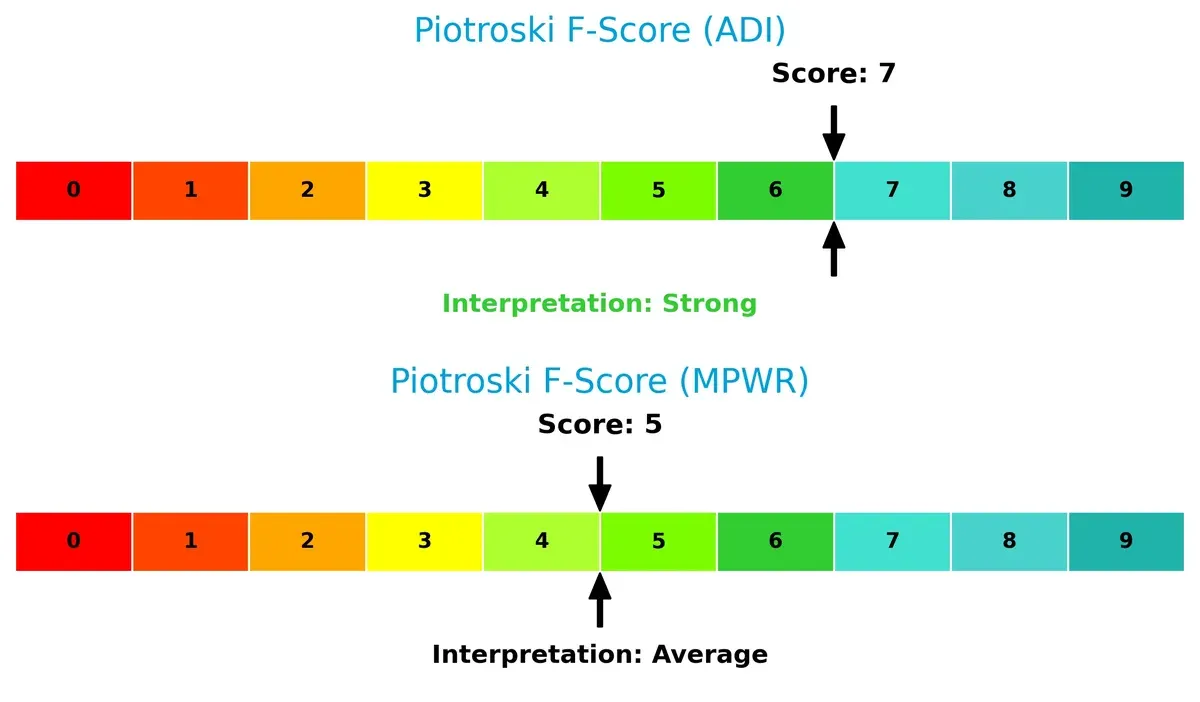

Financial Health: Quality of Operations

Analog Devices posts a stronger Piotroski F-Score of 7, indicating solid financial health and operational quality, whereas Monolithic Power’s score of 5 suggests average internal metrics with potential red flags:

How are the two companies positioned?

This section dissects the operational DNA of ADI and MPWR by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which model offers the most resilient, sustainable advantage today.

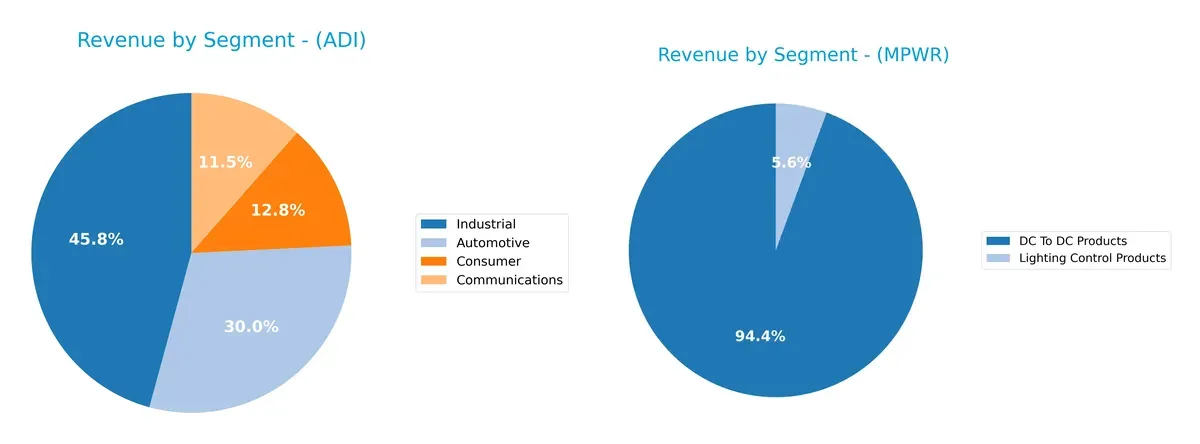

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Analog Devices, Inc. and Monolithic Power Systems, Inc. diversify their income streams and where their primary sector bets lie:

Analog Devices anchors revenue in Industrial at $4.3B, supported by Automotive $2.8B and Communications $1.1B, showing a balanced four-segment mix. Monolithic Power Systems pivots almost entirely on DC To DC Products with $1.7B, dwarfing $102M from Lighting Control. ADI’s diversified portfolio reduces concentration risk and leverages multiple industry ecosystems. MPWR’s heavy reliance on one segment heightens vulnerability but signals focused infrastructure dominance in power management.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Analog Devices, Inc. (ADI) and Monolithic Power Systems, Inc. (MPWR):

ADI Strengths

- Diversified revenue across Automotive, Communications, Consumer, and Industrial segments

- Favorable net margin at 20.58%

- Strong current and quick ratios indicate solid liquidity

- Low debt-to-assets ratio at 18.05% with favorable interest coverage

- Established global presence, especially in the US, China, and Europe

MPWR Strengths

- Higher net margin at 22.07% and strong ROE at 16.55%

- Favorable ROIC at 14.93% exceeding WACC

- Zero debt and infinite interest coverage enhance financial stability

- Higher fixed asset turnover at 4.45 indicates efficient asset use

- Global presence with growing exposure in China and Taiwan

ADI Weaknesses

- ROE at 6.7% below sector expectations

- Unfavorable P/E at 51.05 and P/B at 3.42 suggest valuation concerns

- Asset turnover low at 0.23, implying underutilized assets

- Moderate dividend yield at 1.66% may not attract income-focused investors

MPWR Weaknesses

- Unfavorable P/E at 70.69 and very high P/B at 11.7 signal stretched valuation

- Current ratio unusually high at 5.91, potentially indicating inefficient working capital

- WACC at 10.63% higher than ADI, increasing capital cost

- Dividend yield very low at 0.65% limits income appeal

Both companies exhibit strong profitability and global reach, yet ADI shows more diversified revenue streams. MPWR demonstrates superior capital efficiency and financial leverage management but faces valuation risks and working capital inefficiencies. These contrasts reflect differing strategic priorities and operational execution in their market segments.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat protects long-term profits from relentless competitive erosion. Without it, gains vanish quickly. Here’s the moat face-off between two semiconductor leaders:

Analog Devices, Inc. (ADI): Intangible Assets Forge Technical Excellence

ADI’s moat stems from deep intangible assets—proprietary analog and mixed-signal technologies. This translates into stable margins (27.5% EBIT) and growing profitability despite a slight value destruction signal. New industrial and automotive applications in 2026 could deepen ADI’s expertise moat but watch for rising competition in digital transitions.

Monolithic Power Systems, Inc. (MPWR): Cost Advantage Powers Rapid Growth

MPWR’s moat relies on cost-efficient power IC designs that fuel aggressive market share gains and a strong 55% gross margin. Unlike ADI, MPWR creates clear value (ROIC > WACC by 4.3%) but faces a declining ROIC trend. Expansion into automotive and computing markets in 2026 offers upside but demands careful margin management.

Moat Battle: Intangible Assets vs. Cost Leadership

ADI’s moat is deeper due to growing ROIC and technological specialization, despite current value erosion. MPWR creates value but risks margin pressure from its fast growth. ADI stands better poised to defend its market share long term.

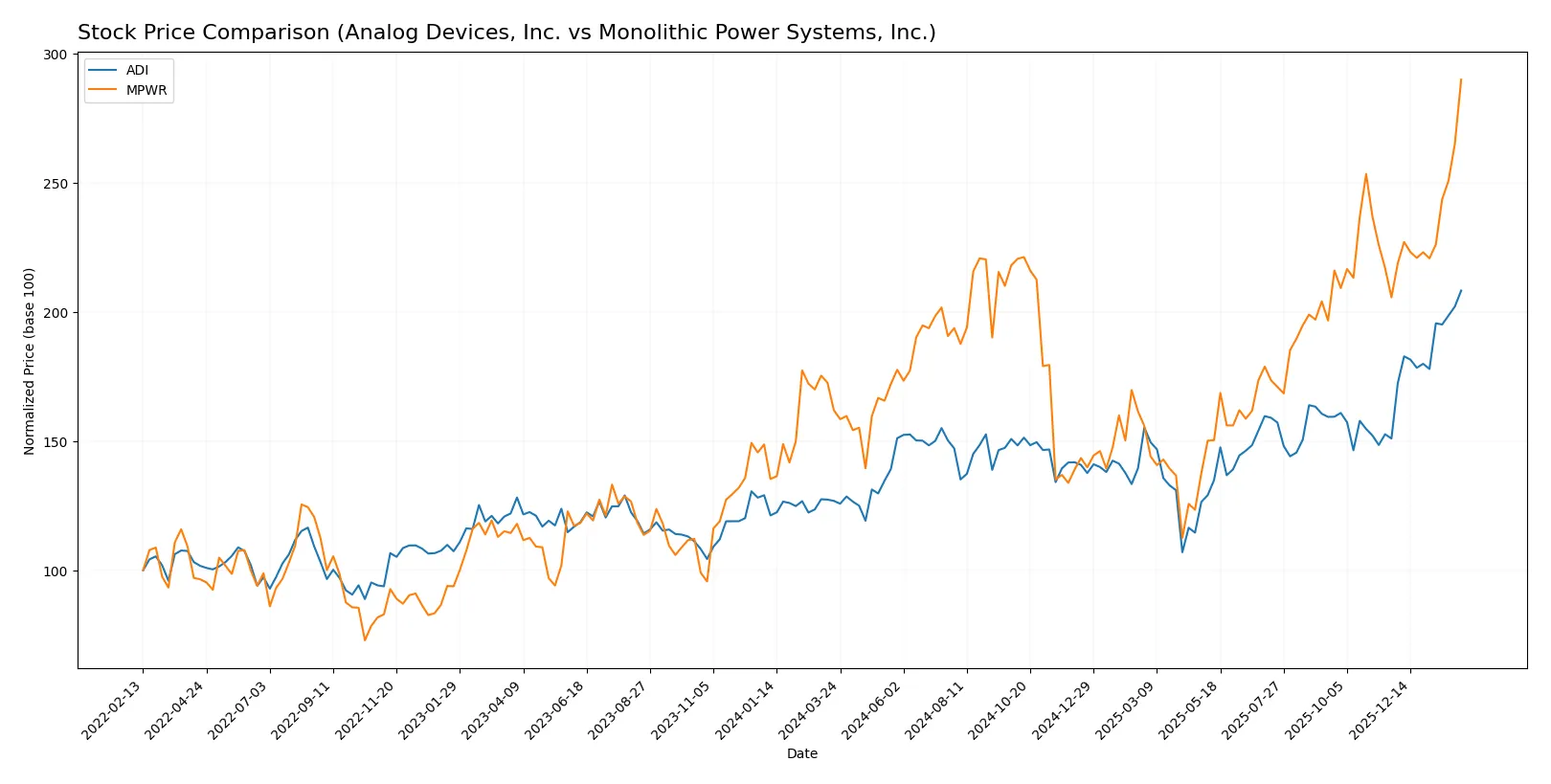

Which stock offers better returns?

Both Analog Devices, Inc. and Monolithic Power Systems, Inc. show strong bullish trends over the past year, with significant price gains and accelerating momentum.

Trend Comparison

Analog Devices, Inc. (ADI) posted a 64.16% price increase over the past 12 months, showing bullish acceleration and a high of 320.45. Volatility is moderate with a 27.77 standard deviation.

Monolithic Power Systems, Inc. (MPWR) gained 79.02% in the same period, also bullish with accelerating momentum. It exhibits higher volatility, with a 150.74 standard deviation and a peak price of 1229.82.

MPWR outperformed ADI with a larger price gain and stronger recent upward slope, despite its higher volatility and wider price range.

Target Prices

Analysts present a bullish consensus for both Analog Devices, Inc. and Monolithic Power Systems, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Analog Devices, Inc. | 270 | 375 | 316 |

| Monolithic Power Systems, Inc. | 1200 | 1500 | 1313.71 |

The consensus targets for ADI and MPWR suggest upside potential of roughly -16% and +7% versus current prices, respectively. Analysts expect MPWR to outperform ADI over the medium term.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here is a summary of recent grades from reputable firms for both companies:

Analog Devices, Inc. Grades

The table below lists recent grades from well-known financial institutions for Analog Devices, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | Maintain | Positive | 2026-01-22 |

| B of A Securities | Maintain | Buy | 2026-01-21 |

| Stifel | Maintain | Buy | 2026-01-16 |

| Oppenheimer | Maintain | Outperform | 2026-01-16 |

| Wells Fargo | Upgrade | Overweight | 2026-01-15 |

| Citigroup | Maintain | Buy | 2026-01-15 |

| Keybanc | Maintain | Overweight | 2026-01-13 |

| Truist Securities | Maintain | Hold | 2025-12-19 |

| UBS | Maintain | Buy | 2025-12-08 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-26 |

Monolithic Power Systems, Inc. Grades

Below is a table summarizing the latest grades issued by credible firms for Monolithic Power Systems, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Buy | 2026-02-06 |

| Keybanc | Maintain | Overweight | 2026-02-06 |

| Rosenblatt | Maintain | Neutral | 2026-02-06 |

| Wells Fargo | Maintain | Overweight | 2026-02-06 |

| Needham | Maintain | Buy | 2026-02-06 |

| Stifel | Maintain | Buy | 2026-02-04 |

| Wells Fargo | Maintain | Overweight | 2026-01-26 |

| Wells Fargo | Upgrade | Overweight | 2026-01-15 |

| Truist Securities | Maintain | Buy | 2025-12-19 |

| Citigroup | Maintain | Buy | 2025-11-03 |

Which company has the best grades?

Both companies receive predominantly positive assessments, but Analog Devices has a broader mix including “Outperform” and multiple “Buy” ratings. Monolithic Power Systems also holds strong “Buy” and “Overweight” grades. Investors may view the consistent higher-tier grades for Analog Devices as a sign of slightly stronger institutional confidence.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Analog Devices, Inc.

- Faces intense competition in analog and mixed-signal ICs with slower asset turnover signaling potential efficiency challenges.

Monolithic Power Systems, Inc.

- Competes in power electronics with higher asset turnover but elevated valuation multiples pose competitive pressure.

2. Capital Structure & Debt

Analog Devices, Inc.

- Maintains a conservative debt level with favorable interest coverage, supporting financial stability.

Monolithic Power Systems, Inc.

- Operates debt-free with excellent interest coverage, but high current ratio may indicate inefficient asset use.

3. Stock Volatility

Analog Devices, Inc.

- Beta near 1 suggests market-aligned volatility and moderate trading volume.

Monolithic Power Systems, Inc.

- Higher beta of 1.455 indicates greater volatility and risk, albeit with strong price momentum recently.

4. Regulatory & Legal

Analog Devices, Inc.

- Exposed to global semiconductor regulations; established compliance track record.

Monolithic Power Systems, Inc.

- Vulnerable to evolving power electronics standards globally; smaller scale may increase regulatory risk.

5. Supply Chain & Operations

Analog Devices, Inc.

- Larger scale and global footprint reduce supply chain risk but complexity remains.

Monolithic Power Systems, Inc.

- Smaller workforce and concentrated operations increase operational risk amid global supply disruptions.

6. ESG & Climate Transition

Analog Devices, Inc.

- Focus on energy-efficient power management aligns with climate goals; ESG disclosures improving.

Monolithic Power Systems, Inc.

- Power conversion focus supports green transition; ESG rating likely positive but less mature.

7. Geopolitical Exposure

Analog Devices, Inc.

- Global presence exposes it to US-China tensions but diversified markets mitigate risk.

Monolithic Power Systems, Inc.

- Geographic concentration in Asia-Pacific elevates geopolitical risk amid trade uncertainties.

Which company shows a better risk-adjusted profile?

Analog Devices’ most impactful risk is competitive pressure reflected in weaker asset turnover and valuation concerns. Monolithic Power’s key risk lies in its higher stock volatility and geopolitical exposure. I find Analog Devices offers a better risk-adjusted profile with stronger balance sheet metrics and lower beta. Its stable debt levels and diversified operations provide resilience despite competitive headwinds. The recent surge in Monolithic Power’s stock price, driven by elevated beta and narrow market focus, raises caution on volatility risk in 2026.

Final Verdict: Which stock to choose?

Analog Devices, Inc. (ADI) shines with its robust cash generation and operational efficiency, supported by a strong balance sheet. Its key point of vigilance lies in modest returns on equity, which could temper upside potential. ADI suits investors targeting steady, slightly conservative growth in a diversified portfolio.

Monolithic Power Systems, Inc. (MPWR) commands a strategic moat through its superior return on invested capital and debt-free structure, showcasing clear value creation. While carrying higher valuation multiples, it offers better safety margins than ADI. MPWR aligns well with GARP investors seeking growth paired with financial strength.

If you prioritize consistent value creation and balance sheet resilience, MPWR is the compelling choice due to its superior ROIC and low financial leverage. However, if you seek a more established player with steady cash flow and moderate growth, ADI offers better stability and a proven operational track record.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Analog Devices, Inc. and Monolithic Power Systems, Inc. to enhance your investment decisions: