Home > Comparison > Technology > ADI vs MXL

The strategic rivalry between Analog Devices, Inc. and MaxLinear, Inc. shapes the semiconductor industry’s evolution. Analog Devices operates as a capital-intensive leader with a broad portfolio in analog and mixed-signal processing. MaxLinear, by contrast, focuses on integrated communication SoCs in high-growth networking segments. This analysis will evaluate which firm offers superior risk-adjusted returns, balancing scale and innovation for diversified portfolios amid ongoing technological shifts.

Table of contents

Companies Overview

Analog Devices and MaxLinear stand as pivotal players in the semiconductor industry, shaping modern connectivity and signal processing.

Analog Devices, Inc.: Leader in Analog and Mixed-Signal ICs

Analog Devices dominates the analog, mixed-signal, and digital signal processing semiconductor market. It generates revenue by designing and selling integrated circuits and subsystems that convert and manage real-world signals. In 2026, the company’s strategy focused on advancing high-performance amplifiers, power management, and microelectromechanical systems to serve industrial, automotive, and communications sectors globally.

MaxLinear, Inc.: Specialist in RF and Communications SoCs

MaxLinear specializes in radiofrequency, high-performance analog, and mixed-signal SoCs for connected home and infrastructure markets. Its revenue stems from integrated communication platforms for broadband modems, routers, and 4G/5G base stations. In 2026, MaxLinear prioritized expanding its end-to-end communication solutions, targeting OEMs and module makers with innovative RF front ends and power management products.

Strategic Collision: Similarities & Divergences

Both firms focus on mixed-signal semiconductors but differ in scope; Analog Devices emphasizes broad industrial and automotive applications, while MaxLinear zeroes in on communications infrastructure. Their battleground lies in delivering integrated, high-performance signal processing solutions. Analog Devices boasts a massive scale and diversified portfolio, whereas MaxLinear carries a sharper niche focus, reflecting distinct risk and growth profiles for investors.

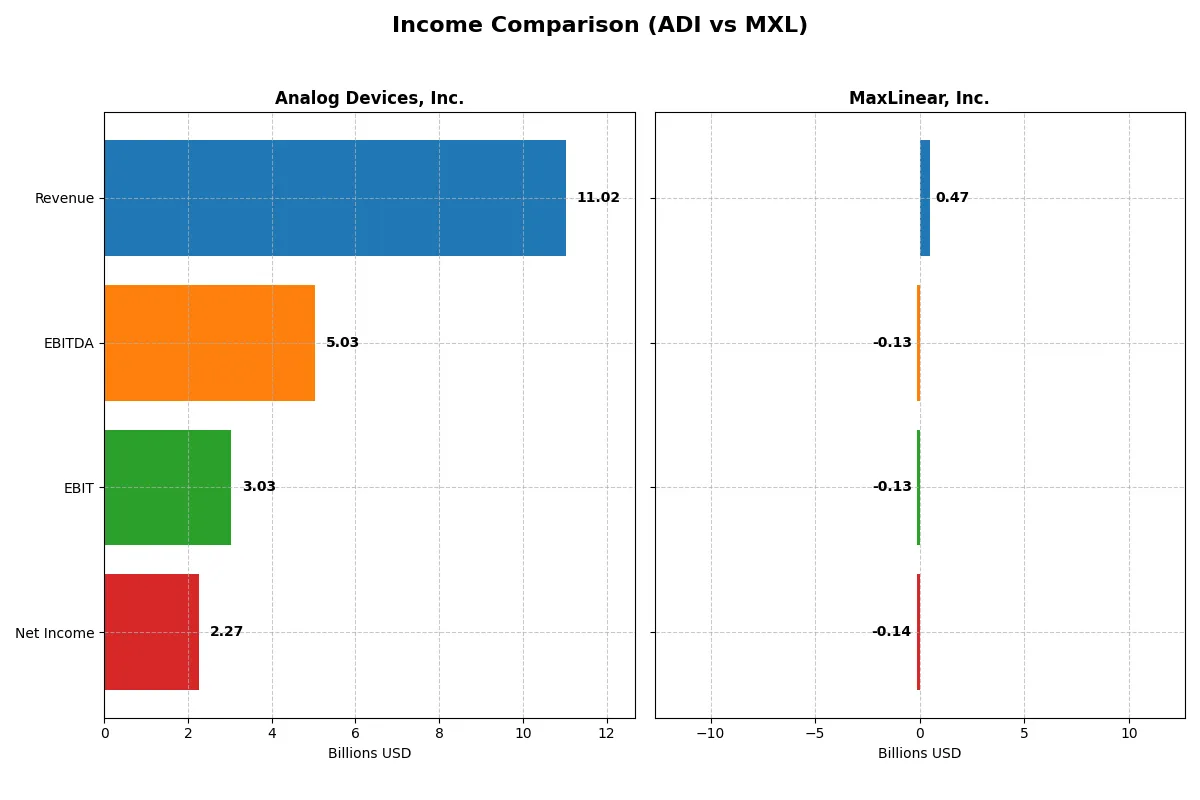

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Analog Devices, Inc. (ADI) | MaxLinear, Inc. (MXL) |

|---|---|---|

| Revenue | 11.0B | 468M |

| Cost of Revenue | 5.0B | 202M |

| Operating Expenses | 3.0B | 393M |

| Gross Profit | 6.0B | 266M |

| EBITDA | 5.0B | -131M |

| EBIT | 3.0B | -131M |

| Interest Expense | 318M | 10M |

| Net Income | 2.3B | -137M |

| EPS | 4.59 | -1.58 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals how efficiently each company converts sales into profits and manages costs under varying market conditions.

Analog Devices, Inc. Analysis

Analog Devices (ADI) shows a robust revenue growth from $7.3B in 2021 to $11B in 2025, with net income climbing from $1.39B to $2.27B. The company sustains healthy gross and net margins, around 54.7% and 20.6%, respectively, in 2025. ADI’s EBIT margin improved sharply to 27.5%, reflecting strong operational efficiency and momentum.

MaxLinear, Inc. Analysis

MaxLinear (MXL) exhibits volatile revenue, peaking at $1.12B in 2022 then declining to $468M in 2025. Despite a solid gross margin near 56.8%, MXL posts negative EBIT and net margins (-28.0% and -29.2%) in 2025, signaling operating losses. Recent revenue and gross profit growth rates are positive, but net income remains deep in the red, indicating persistent profitability challenges.

Growth and Margin Strength: Stability vs. Volatility

ADI clearly outperforms with consistent revenue and net income growth, paired with strong profitability metrics. MXL’s revenue contraction and negative margins undermine its earnings stability. For investors seeking durable margin strength and growth, ADI’s profile offers greater confidence than MXL’s fluctuating top line and losses.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Analog Devices, Inc. (ADI) | MaxLinear, Inc. (MXL) |

|---|---|---|

| ROE | 6.7% | -47.5% |

| ROIC | 5.5% | -24.3% |

| P/E | 51.1 | -6.7 |

| P/B | 3.42 | 3.20 |

| Current Ratio | 2.19 | 1.77 |

| Quick Ratio | 1.68 | 1.28 |

| D/E (Debt-to-Equity) | 0.26 | 0.29 |

| Debt-to-Assets | 18.1% | 17.2% |

| Interest Coverage | 9.45 | -15.5 |

| Asset Turnover | 0.23 | 0.42 |

| Fixed Asset Turnover | 3.32 | 4.65 |

| Payout ratio | 85% | 0% |

| Dividend yield | 1.66% | 0% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, exposing hidden risks, operational strengths, and valuation nuances crucial for investment decisions.

Analog Devices, Inc.

Analog Devices shows solid net margins of 20.58%, reflecting strong operational efficiency, yet its ROE at 6.7% lags behind expectations. The stock trades at a stretched P/E of 51.05 and P/B of 3.42, signaling premium valuation. Shareholders receive a modest 1.66% dividend yield, balancing income with reinvestment in R&D (16% of revenue).

MaxLinear, Inc.

MaxLinear struggles with deeply negative profitability metrics: net margin at -68% and ROE plunging to -47.5%. Despite a low or negative P/E, this reflects severe earnings distress rather than value. The company avoids dividends, instead channeling over 62% of revenue into R&D, aiming to fuel future growth amid operational challenges.

Premium Valuation vs. Operational Struggles

Analog Devices offers a balanced profile with efficient margins and a premium valuation justified by stable dividends and R&D investment. MaxLinear’s unfavorable profitability and high R&D intensity pose higher risk. Investors seeking operational safety might prefer Analog Devices, while those tolerating risk might watch MaxLinear’s turnaround potential.

Which one offers the Superior Shareholder Reward?

I see Analog Devices, Inc. (ADI) pays a consistent dividend yield near 1.6–2.1%, with payout ratios around 50–110%, supported by strong free cash flow coverage above 0.7x. ADI also executes steady share buybacks, enhancing total returns. MaxLinear, Inc. (MXL) pays no dividend and grapples with losses and negative margins in recent years. MXL reinvests cash into growth rather than distributions but faces cash flow challenges and leveraged balance sheets. I judge ADI’s balanced dividend and buyback model more sustainable and rewarding for 2026 investors than MXL’s high-risk reinvestment strategy. ADI offers the superior total return profile.

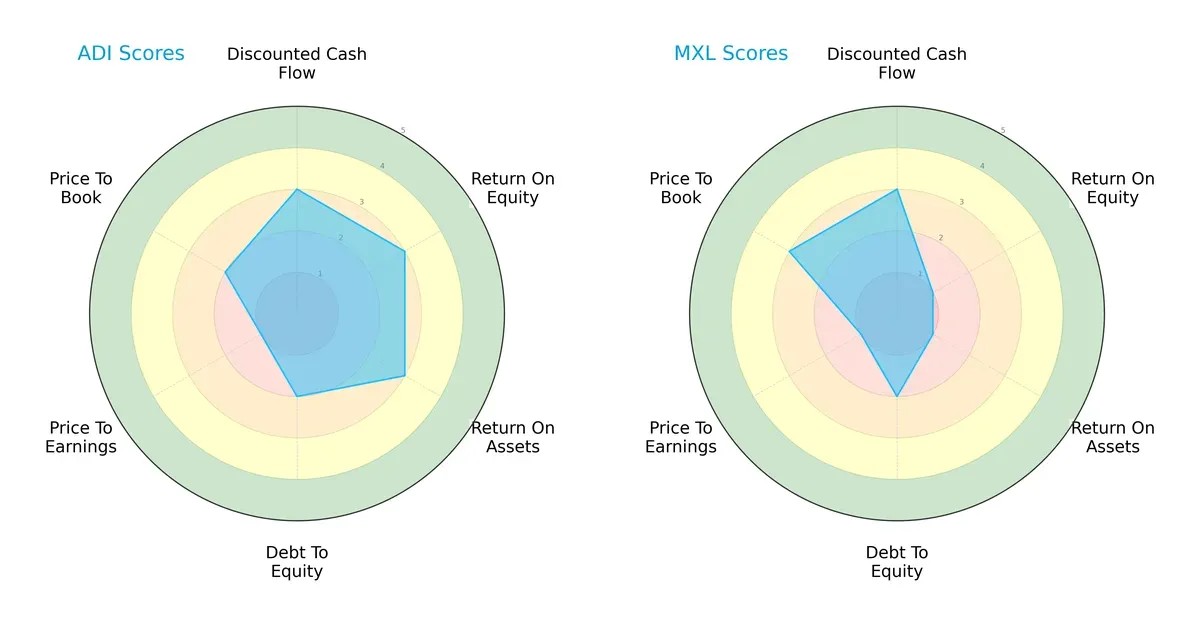

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Analog Devices, Inc. and MaxLinear, Inc., highlighting core financial strengths and vulnerabilities:

Analog Devices shows a balanced profile with moderate scores across DCF, ROE, ROA, and debt-to-equity, but suffers from a very unfavorable P/E score. MaxLinear relies heavily on valuation metrics with a stronger P/B score but lags significantly in profitability indicators like ROE and ROA. Analog Devices offers more consistent operational strength, while MaxLinear depends on selective valuation advantages.

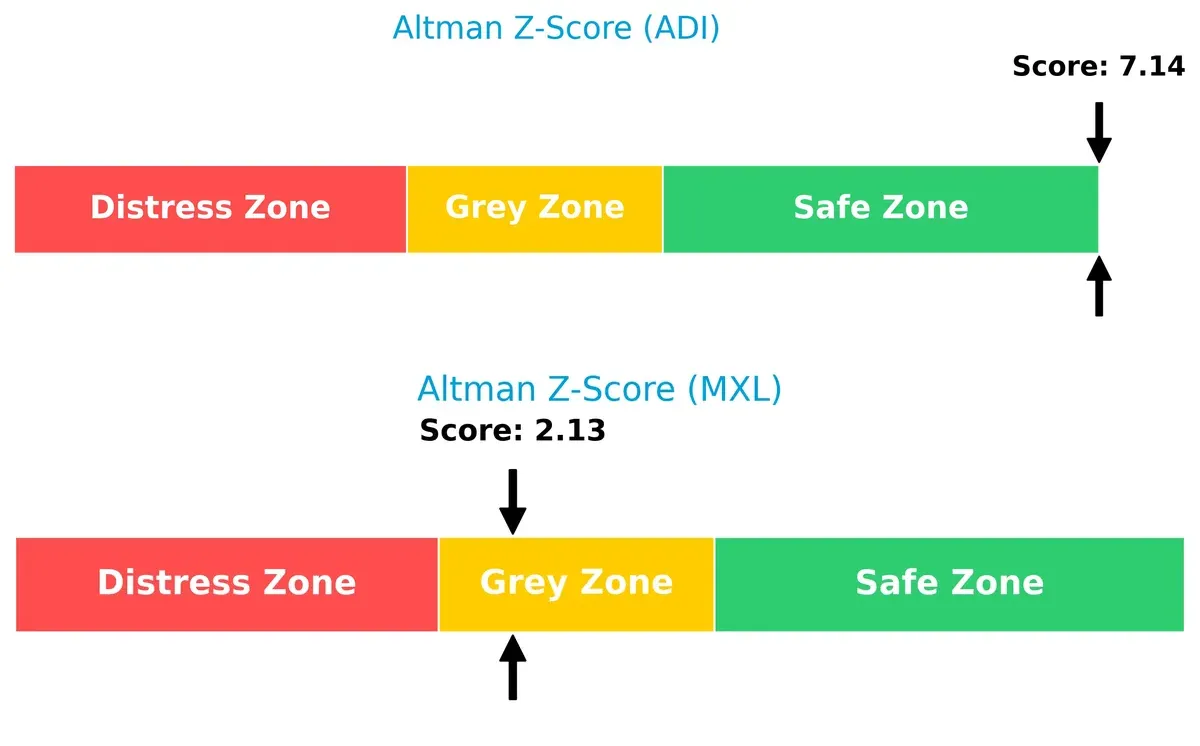

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap underscores Analog Devices’ robust solvency versus MaxLinear’s moderate distress risk in this cycle:

Analog Devices scores 7.14, firmly in the safe zone, signaling low bankruptcy risk and stable financial footing. MaxLinear’s 2.13 places it in the grey zone, implying moderate risk and caution for long-term investors given current market pressures.

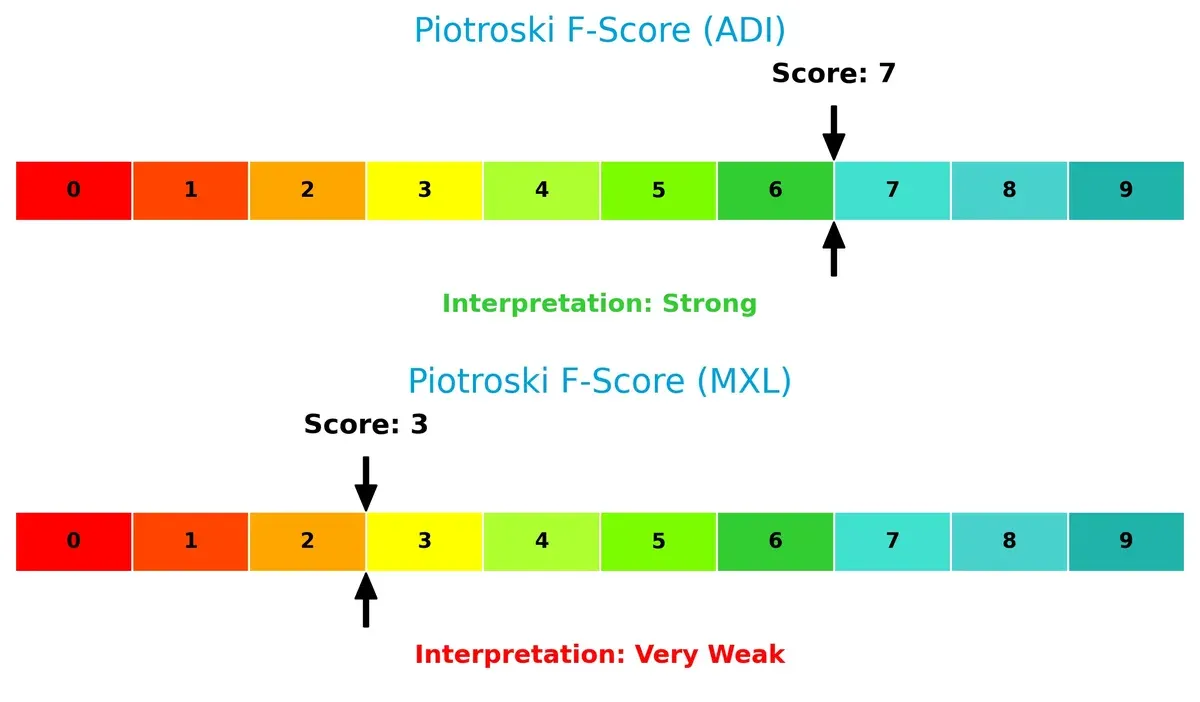

Financial Health: Quality of Operations

Piotroski F-Scores reveal Analog Devices’ superior operational quality compared to MaxLinear’s weaker internal financial health:

With a strong score of 7 versus MaxLinear’s very weak 3, Analog Devices demonstrates solid profitability, liquidity, and efficiency. MaxLinear’s low score flags red alerts in financial quality, warranting careful scrutiny before investment.

How are the two companies positioned?

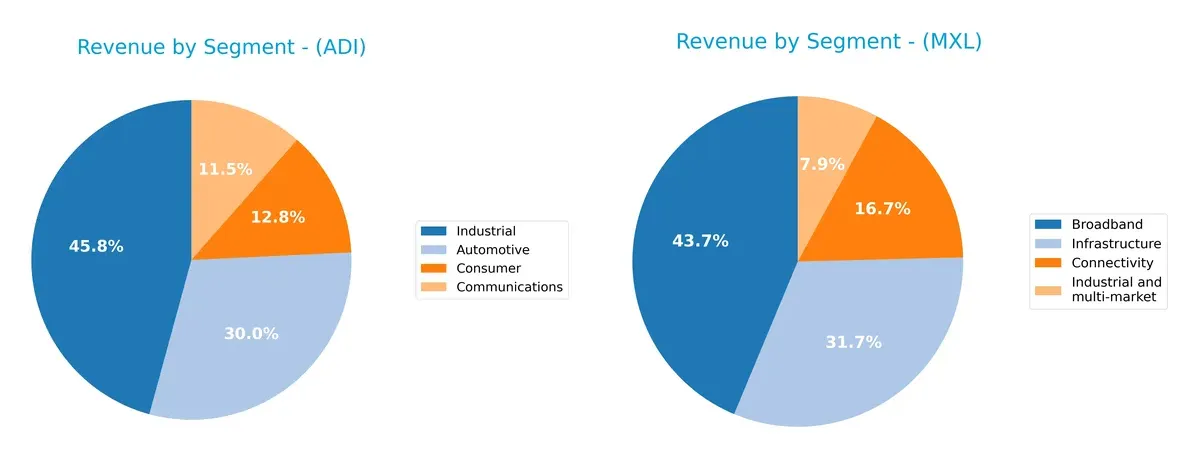

This section dissects the operational DNA of ADI and MXL by comparing their revenue distribution by segment alongside their internal strengths and weaknesses. The final objective confronts their economic moats to identify which business model offers the most resilient and sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

The following visual comparison dissects how Analog Devices, Inc. and MaxLinear, Inc. diversify their income streams and where their primary sector bets lie:

Analog Devices, Inc. anchors its revenue heavily in Industrial at $4.3B, with significant contributions from Automotive ($2.8B) and Consumer ($1.2B). This mix reflects a broad industrial and automotive ecosystem lock-in. MaxLinear, Inc. shows a more balanced profile, with Broadband ($204M) and Infrastructure ($148M) as key drivers, complemented by Connectivity and Industrial segments. MaxLinear’s diversification mitigates concentration risk but lacks Analog Devices’ scale and infrastructure dominance.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Analog Devices, Inc. (ADI) and MaxLinear, Inc. (MXL):

ADI Strengths

- Highly diversified revenue across Automotive, Industrial, Communications, and Consumer sectors

- Favorable net margin of 20.58% indicating profitability

- Strong liquidity with current ratio of 2.19 and quick ratio of 1.68

- Low leverage with debt to assets at 18.05% and high interest coverage ratio of 9.54

- Significant global presence with revenues from US, China, Europe, Japan, and Asia

- Favorable fixed asset turnover of 3.32 showing efficient asset use

MXL Strengths

- Diversified revenue streams including Broadband, Connectivity, Industrial, and Infrastructure

- Favorable price-to-earnings ratio despite negative earnings, signaling market expectation

- Adequate liquidity with current ratio of 1.77 and quick ratio of 1.28

- Low leverage with debt to assets at 17.23%

- Favorable fixed asset turnover of 4.65 demonstrating strong asset productivity

ADI Weaknesses

- Return on equity at 6.7% is unfavorable compared to sector averages

- Price-to-book ratio of 3.42 is high, indicating overvaluation risk

- Unfavorable asset turnover of 0.23 reflects lower efficiency in asset use

- Price-to-earnings ratio at 51.05 signals expensive valuation

- Neutral return on invested capital relative to weighted average cost of capital

- No dividend yield advantage compared to peers

MXL Weaknesses

- Negative net margin of -68.01% reflecting heavy losses

- Unfavorable return on equity of -47.49% and return on invested capital at -24.31%

- High weighted average cost of capital at 11.7%, increasing capital costs

- Negative interest coverage ratio at -13.01 raises financial risk

- Unfavorable asset turnover of 0.42 despite asset efficiency

- Zero dividend yield implies no income return for investors

Overall, ADI demonstrates solid profitability, liquidity, and global diversification but faces valuation and efficiency concerns. MXL shows asset productivity and moderate liquidity but struggles with profitability, high costs, and financial risk. These factors shape each company’s strategic focus on operational efficiency and capital management.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only thing protecting long-term profits from the erosion of competition. Let’s dissect the core moats of two semiconductor players:

Analog Devices, Inc. (ADI): Innovation-Driven Intangible Assets

ADI’s moat stems from its deep expertise in analog and mixed-signal ICs, reflected in stable gross margins near 55% and growing profitability. Despite currently shedding value versus WACC, its rising ROIC trend and ongoing product innovation in industrial and automotive markets suggest potential moat strengthening by 2026.

MaxLinear, Inc. (MXL): Cost-Driven Integration Challenges

MXL relies on integrating RF and mixed-signal SoCs for communication systems, representing a cost advantage moat. However, it suffers negative margins and a sharply declining ROIC, indicating a weakening moat. Its faster recent revenue growth hints at market opportunities, but operational inefficiencies threaten durable competitive advantage.

Innovation Moat vs. Cost Moat: The Battle for Semiconductor Supremacy

ADI’s intangible asset moat is deeper and more durable, supported by superior margin stability and improving capital returns. MXL’s cost advantage faces erosion from poor profitability and value destruction. Analog Devices is better equipped to defend and expand its market share in 2026’s competitive landscape.

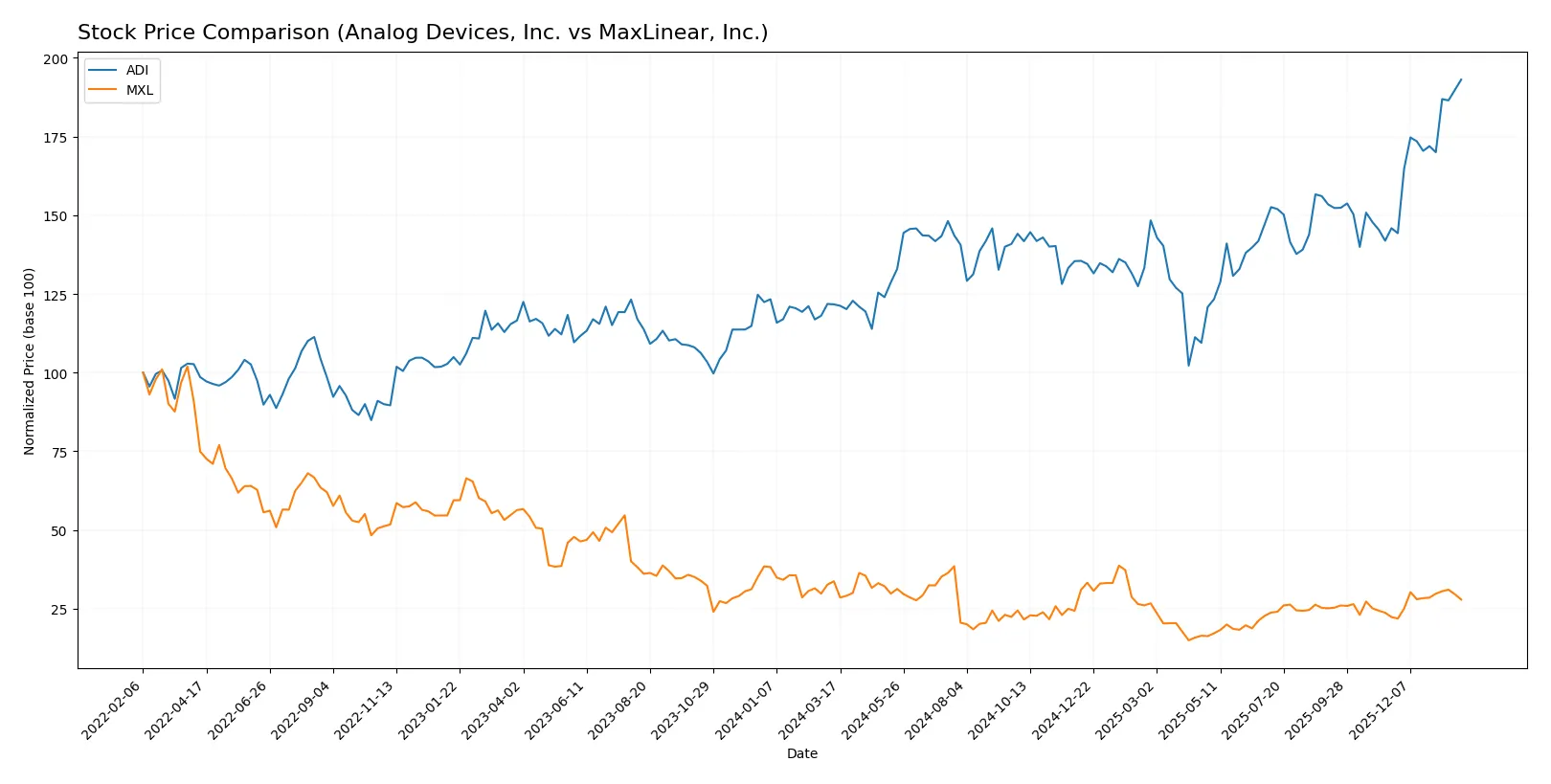

Which stock offers better returns?

The past year saw Analog Devices, Inc. surge with strong upward momentum, while MaxLinear, Inc. faced a notable decline before showing recent recovery signs.

Trend Comparison

Analog Devices, Inc. surged 58.66% over the past 12 months, showing a bullish trend with accelerating gains and high volatility. Its price ranged from 164.6 to 310.88.

MaxLinear, Inc. declined 17.26% over the same period, reflecting a bearish trend despite acceleration. It traded between 9.31 and 24.05 with comparatively low volatility.

Analog Devices delivered the highest market performance, outperforming MaxLinear by a wide margin despite recent positive momentum in MaxLinear’s stock.

Target Prices

Analysts present a moderate upside potential for both Analog Devices, Inc. and MaxLinear, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Analog Devices, Inc. | 270 | 375 | 316 |

| MaxLinear, Inc. | 15 | 25 | 21 |

The consensus target for Analog Devices at 316 slightly exceeds its current price of 311, suggesting modest growth expectations. MaxLinear’s consensus target of 21 also indicates potential upside from its current 17.35 price, reflecting cautious optimism among analysts.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Analog Devices, Inc. Grades

The following table summarizes recent grades from established financial institutions for Analog Devices:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | Maintain | Positive | 2026-01-22 |

| B of A Securities | Maintain | Buy | 2026-01-21 |

| Stifel | Maintain | Buy | 2026-01-16 |

| Oppenheimer | Maintain | Outperform | 2026-01-16 |

| Wells Fargo | Upgrade | Overweight | 2026-01-15 |

| Citigroup | Maintain | Buy | 2026-01-15 |

| Keybanc | Maintain | Overweight | 2026-01-13 |

| Truist Securities | Maintain | Hold | 2025-12-19 |

| UBS | Maintain | Buy | 2025-12-08 |

| Truist Securities | Maintain | Hold | 2025-11-26 |

MaxLinear, Inc. Grades

Below are the latest grades from reputable grading companies for MaxLinear:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-30 |

| Benchmark | Maintain | Buy | 2026-01-16 |

| Benchmark | Maintain | Buy | 2025-10-24 |

| Benchmark | Maintain | Buy | 2025-10-17 |

| Benchmark | Maintain | Buy | 2025-09-02 |

| Loop Capital | Maintain | Hold | 2025-08-04 |

| Wells Fargo | Maintain | Equal Weight | 2025-07-24 |

| Benchmark | Maintain | Buy | 2025-07-24 |

| Susquehanna | Maintain | Neutral | 2025-07-24 |

| Susquehanna | Maintain | Neutral | 2025-07-22 |

Which company has the best grades?

Analog Devices consistently earns higher grades, including multiple “Buy” and “Outperform” ratings, plus a recent upgrade to “Overweight.” MaxLinear’s grades lean toward “Buy” and “Equal Weight,” lacking any upgrades. Investors may view Analog Devices as having stronger institutional confidence, potentially signaling better market sentiment.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Analog Devices, Inc.

- Dominates with a $152B market cap in semiconductors, but faces high P/E ratio risk.

MaxLinear, Inc.

- Smaller $1.5B market cap, struggles with negative margins and intense competition.

2. Capital Structure & Debt

Analog Devices, Inc.

- Maintains conservative debt-to-equity (0.26) and strong interest coverage (9.54).

MaxLinear, Inc.

- Debt manageable (0.29 D/E), but negative interest coverage (-13.01) signals financial stress.

3. Stock Volatility

Analog Devices, Inc.

- Beta near market average (1.03), implying moderate volatility.

MaxLinear, Inc.

- Beta high at 1.77, indicating elevated stock price swings and risk.

4. Regulatory & Legal

Analog Devices, Inc.

- Operates globally with exposure to evolving tech regulations, but diversified markets mitigate risk.

MaxLinear, Inc.

- Smaller scale and niche could heighten regulatory impact, especially in communications tech.

5. Supply Chain & Operations

Analog Devices, Inc.

- Large, complex supply chain with some operational inefficiencies (low asset turnover 0.23).

MaxLinear, Inc.

- More agile operations but vulnerable to supply disruptions affecting niche products.

6. ESG & Climate Transition

Analog Devices, Inc.

- Established ESG policies likely, but semiconductor production remains resource intensive.

MaxLinear, Inc.

- Limited disclosure; smaller size may hinder rapid ESG adaptation.

7. Geopolitical Exposure

Analog Devices, Inc.

- Global footprint exposes it to US-China tensions but provides geographic diversification.

MaxLinear, Inc.

- Concentrated markets increase sensitivity to regional geopolitical risks.

Which company shows a better risk-adjusted profile?

Analog Devices faces its biggest risk from valuation stretched beyond fundamentals, evidenced by a high P/E of 51. MaxLinear’s most critical risk is severe profitability weakness with a -68% net margin and negative interest coverage. Overall, Analog Devices presents a better risk-adjusted profile, supported by a robust Altman Z-score (7.14, safe zone) and strong Piotroski score (7). MaxLinear languishes in the grey zone on bankruptcy risk (Altman Z 2.13) and has a weak Piotroski score (3). The stark contrast in financial health and market capitalization justifies concern for MaxLinear’s vulnerability amid sector pressures.

Final Verdict: Which stock to choose?

Analog Devices, Inc. (ADI) shines with its unmatched ability to generate robust free cash flow and sustain impressive revenue growth. Its rising profitability amid a challenging environment signals disciplined capital allocation. A point of vigilance is its high valuation, which demands continued execution. It suits portfolios aiming for aggressive growth with a tolerance for premium pricing.

MaxLinear, Inc. (MXL) offers a strategic moat centered on its niche in high-growth connectivity solutions and heavy R&D investment. Relative to ADI, it presents a more volatile profile with weaker profitability but less exposure to valuation risk. This stock might fit investors seeking GARP—growth at a reasonable price—with a higher risk appetite.

If you prioritize strong cash generation and proven operational discipline, ADI outshines due to its scalable moat and solid financial footing. However, if you seek potential turnaround plays or exposure to emerging technologies at lower valuations, MXL offers better growth optionality but with significantly higher execution risk. Both require cautious monitoring of their evolving fundamentals.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Analog Devices, Inc. and MaxLinear, Inc. to enhance your investment decisions: