Home > Comparison > Technology > ADI vs LSCC

The competitive dynamic between Analog Devices, Inc. and Lattice Semiconductor Corporation shapes the semiconductor industry’s evolution. Analog Devices operates as a capital-intensive leader with a broad portfolio in analog and mixed-signal ICs, while Lattice focuses on niche programmable logic devices with a lighter asset base. This analysis pits scale and diversification against specialization, aiming to identify which strategy offers superior risk-adjusted returns for a well-diversified portfolio.

Table of contents

Companies Overview

Analog Devices, Inc. and Lattice Semiconductor Corporation lead innovation in the semiconductor industry with distinct market roles and ambitions.

Analog Devices, Inc.: Analog and Mixed-Signal Powerhouse

Analog Devices dominates the analog, mixed-signal, and digital signal processing semiconductor markets. It generates revenue through integrated circuits, power management products, and microelectromechanical systems serving automotive, industrial, and communications sectors. In 2026, it focuses strategically on high-performance analog technologies and expanding its footprint in automotive and industrial applications.

Lattice Semiconductor Corporation: FPGA and IP Specialist

Lattice Semiconductor specializes in field programmable gate arrays (FPGAs) and video connectivity products. Its revenue stems from selling programmable logic devices and licensing IP across communications, computing, and automotive markets. The 2026 strategy centers on broadening its IP portfolio and enhancing FPGA offerings to capture growth in industrial and consumer electronics sectors.

Strategic Collision: Similarities & Divergences

Analog Devices embraces a broad analog and mixed-signal integration philosophy, while Lattice pursues a niche in programmable logic and IP licensing. Their primary battleground lies in serving industrial and automotive end markets with differentiated technology stacks. Investors face distinct profiles: Analog Devices offers scale and diversification, whereas Lattice provides focused innovation with higher volatility.

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

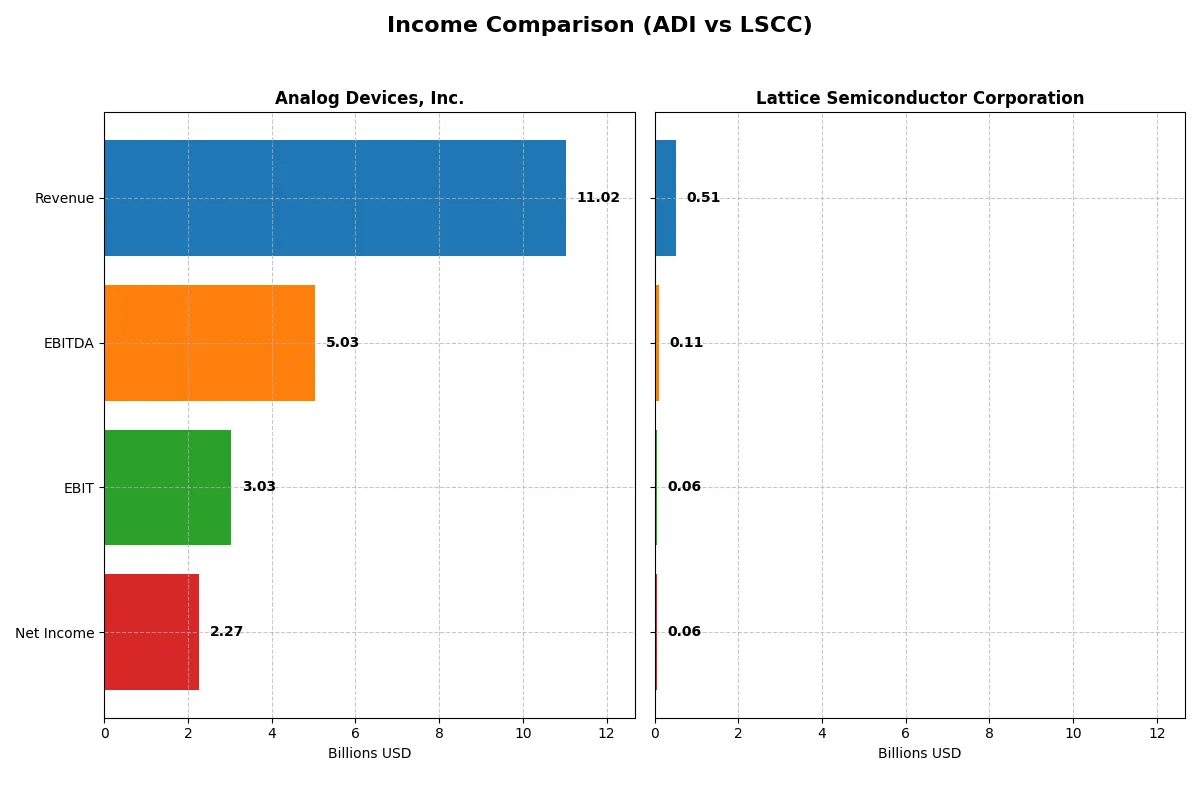

| Metric | Analog Devices, Inc. (ADI) | Lattice Semiconductor Corporation (LSCC) |

|---|---|---|

| Revenue | 11.0B | 509M |

| Cost of Revenue | 5.0B | 169M |

| Operating Expenses | 3.0B | 306M |

| Gross Profit | 6.0B | 340M |

| EBITDA | 5.0B | 107M |

| EBIT | 3.0B | 61M |

| Interest Expense | 318M | 0.3M |

| Net Income | 2.3B | 61M |

| EPS | 4.59 | 0.44 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs a more efficient and profitable corporate engine amid market cycles.

Analog Devices, Inc. Analysis

Analog Devices shows a strong revenue climb from 7.3B in 2021 to 11B in 2025. Net income surged from 1.39B to 2.27B, reflecting robust bottom-line growth. Margins remain healthy with a 54.7% gross margin and a 20.6% net margin in 2025. The 16.9% revenue growth and 44.3% EBIT growth in the latest year underscore accelerating operational efficiency.

Lattice Semiconductor Corporation Analysis

Lattice Semiconductor’s revenue grew moderately from 408M in 2020 to 509M in 2024 but dipped 31% year-on-year recently. Net income rose overall to 61M in 2024 but fell sharply by 76% in the latest year. Despite a strong 66.8% gross margin, the net margin stands at 12%, signaling thinner profitability. The steep decline in recent profitability signals a momentum challenge.

Margin Strength vs. Revenue Momentum

Analog Devices exhibits superior margin expansion and accelerating revenue growth, while Lattice Semiconductor struggles with recent profit contraction. Analog Devices clearly leads in operational efficiency and scale, offering a more resilient profit profile. Investors seeking steady margin power and growth momentum find Analog Devices more compelling.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Analog Devices, Inc. (ADI) | Lattice Semiconductor Corporation (LSCC) |

|---|---|---|

| ROE | 6.7% | 8.6% |

| ROIC | 5.5% | 4.6% |

| P/E | 51.1 | 132.7 |

| P/B | 3.42 | 11.41 |

| Current Ratio | 2.19 | 3.66 |

| Quick Ratio | 1.68 | 2.62 |

| D/E (Debt-to-Equity) | 0.26 | 0.02 |

| Debt-to-Assets | 18.1% | 1.8% |

| Interest Coverage | 9.45 | 129.5 |

| Asset Turnover | 0.23 | 0.60 |

| Fixed Asset Turnover | 3.32 | 7.62 |

| Payout Ratio | 84.9% | 0% |

| Dividend Yield | 1.66% | 0% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, revealing hidden risks and operational excellence through profitability, valuation, and financial health metrics.

Analog Devices, Inc.

Analog Devices shows solid net margins at 20.58%, but a low 6.7% ROE flags efficiency concerns. Its P/E of 51.05 suggests an expensive valuation. The firm maintains a healthy current ratio of 2.19, indicating liquidity strength. It offers a modest 1.66% dividend yield, balancing shareholder returns with significant R&D reinvestment at 16%.

Lattice Semiconductor Corporation

Lattice Semiconductor posts a favorable 12% net margin and a higher ROE of 8.6%, yet its P/E ratio of 132.74 marks it as highly stretched. Its balance sheet shows strong quick ratio and low debt levels, but a zero dividend yield implies full reinvestment into growth and R&D at over 31%, signaling aggressive expansion.

Premium Valuation vs. Operational Safety

Analog Devices balances valuation and liquidity with moderate shareholder returns, while Lattice trades at a steep premium with aggressive growth investment. ADI appeals more to conservative investors valuing operational safety. LSCC suits risk-tolerant investors chasing growth despite stretched multiples.

Which one offers the Superior Shareholder Reward?

I observe Analog Devices, Inc. (ADI) pays a consistent dividend with a 1.66% yield and high payout ratio near 85%. Its buybacks complement distributions, supported by strong free cash flow (~8.65/share). Lattice Semiconductor (LSCC) pays no dividend, reinvesting aggressively in growth and R&D, but trades at a steep premium (P/E ~133 in 2024). LSCC’s buybacks are minimal or absent. ADI’s balanced dividend and buyback strategy offers more sustainable, attractive total returns for income-focused investors in 2026.

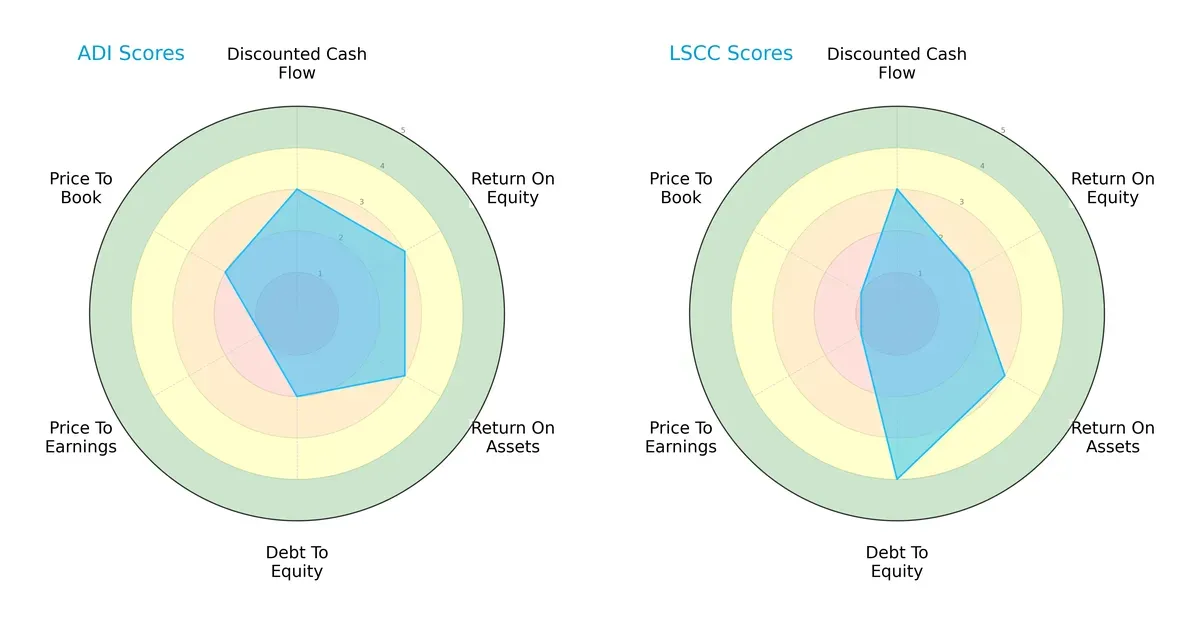

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs between Analog Devices, Inc. and Lattice Semiconductor Corporation:

Both companies score equally on discounted cash flow (3) and return on assets (3), reflecting solid asset utilization and valuation alignment. Analog Devices leads in return on equity (3 vs. 2) and maintains a stronger debt profile (2 vs. 4), while Lattice Semiconductor shows weakness in price-to-book (1 vs. 2). Analog Devices offers a more balanced profile, blending profitability with moderate financial leverage. Lattice relies heavily on a low debt-to-equity ratio but suffers from valuation concerns, indicating a niche edge rather than broad strength.

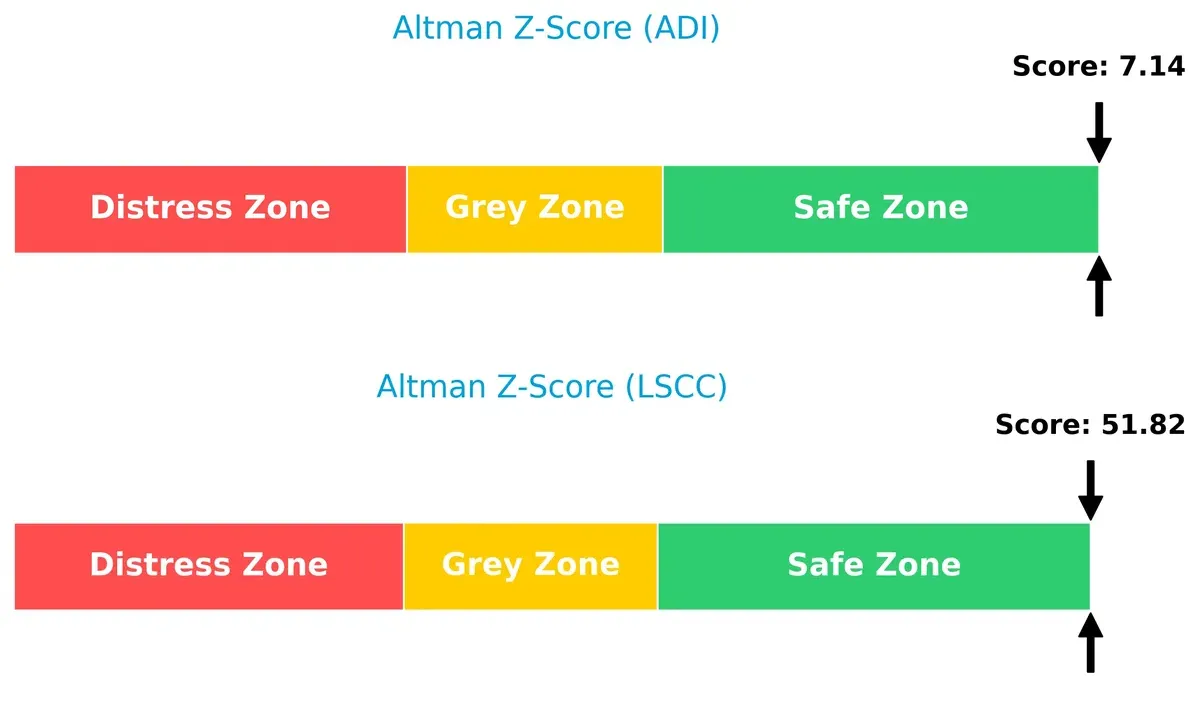

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap strongly favors Lattice Semiconductor’s extreme safety margin, implying negligible bankruptcy risk in this cycle:

Lattice’s Z-Score of 51.8 far exceeds Analog Devices’ already safe 7.1, signaling exceptional solvency and financial resilience. This vast difference suggests Lattice operates with a fortress-like balance sheet, minimizing default risk even under severe market stress.

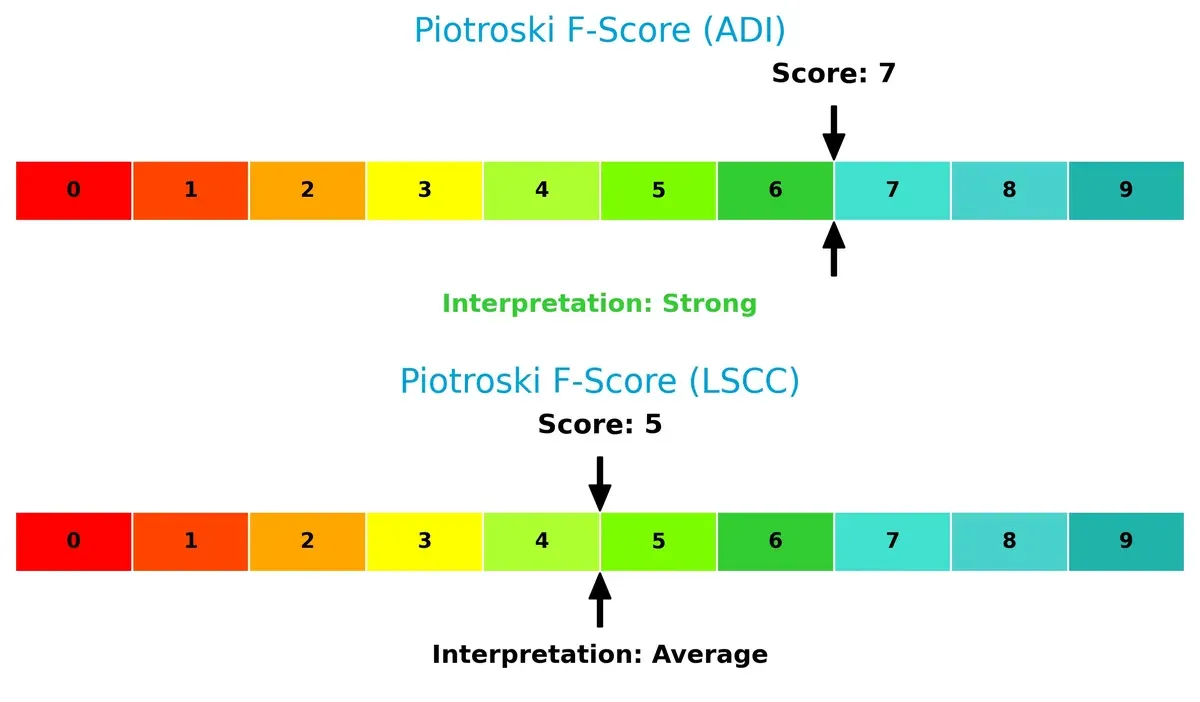

Financial Health: Quality of Operations

Analog Devices demonstrates stronger operational health with a Piotroski F-Score of 7 versus Lattice Semiconductor’s 5, highlighting more robust internal metrics:

Analog Devices’ higher score signals superior profitability, liquidity, and efficiency. Lattice’s average score raises caution about its operational consistency and financial quality, potentially exposing investors to hidden risks. I view Analog Devices as the safer choice for stability-focused portfolios.

How are the two companies positioned?

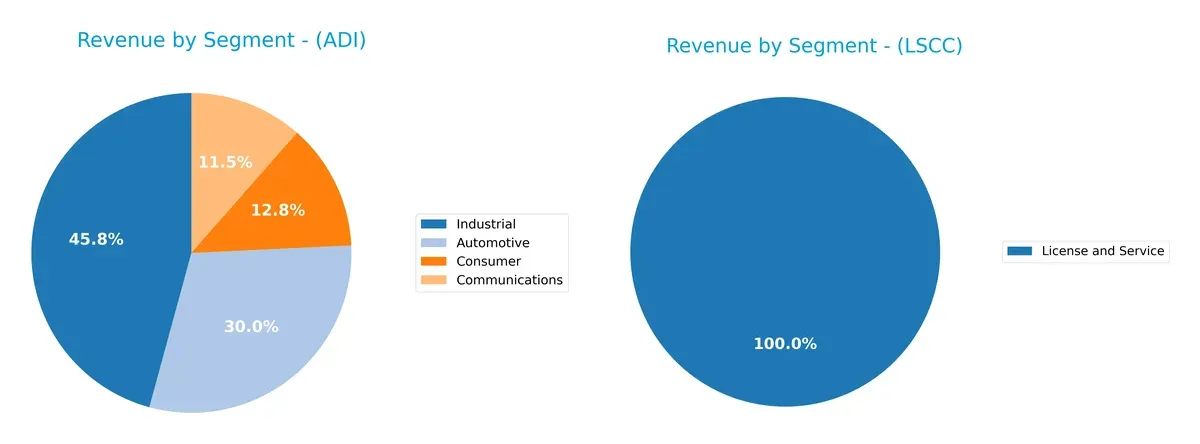

This section dissects the operational DNA of ADI and LSCC by comparing their revenue distribution and internal dynamics. The final objective is to confront their economic moats to determine which model offers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

This side-by-side comparison dissects how Analog Devices and Lattice Semiconductor diversify their income streams and reveals their primary sector bets:

Analog Devices anchors its revenue in Industrial ($4.3B) and Automotive ($2.8B), offering a balanced exposure across four sectors. In contrast, Lattice Semiconductor relies heavily on Product Revenue from Distributors ($331M), signaling concentration risk in a single channel. Analog Devices’ diversified portfolio supports resilience and ecosystem lock-in, while Lattice’s dependency on one segment increases vulnerability to market shifts. This contrast highlights Analog Devices’ superior strategic diversification.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Analog Devices, Inc. (ADI) and Lattice Semiconductor Corporation (LSCC):

ADI Strengths

- Diversified revenue across Automotive, Industrial, Communications, and Consumer sectors

- Strong global presence with significant sales in US, China, and Europe

- Favorable net margin at 20.58%

- Solid liquidity ratios: current ratio 2.19, quick ratio 1.68

- Low debt-to-assets at 18.05% supports financial stability

LSCC Strengths

- Favorable net margin at 12% despite smaller scale

- Extremely low debt-to-assets at 1.81% indicates conservative leverage

- Very high interest coverage ratio at 228.11, signaling strong ability to service debt

- High fixed asset turnover of 7.62 suggests efficient use of fixed assets

- Growing geographic presence in Americas and Asia

ADI Weaknesses

- Return on equity at 6.7% is below ideal levels

- ROIC at 5.55% below WACC at 8.38% signals value destruction

- High P/E of 51.05 and P/B of 3.42 may indicate overvaluation

- Unfavorable asset turnover at 0.23 points to less efficient asset use

- Market concentration risk with Industrial segment dominating revenue

LSCC Weaknesses

- ROE of 8.6% and ROIC of 4.59% both below WACC of 11.88%, indicating weak capital returns

- Very high P/E of 132.74 and P/B of 11.41 reflect extreme valuations

- Current ratio of 3.66 flagged unfavorable, suggesting possible working capital management issues

- No dividend yield, limiting income for investors

- Less diversified revenue, heavily reliant on License and Service segment

Both companies show strengths in profitability and financial conservatism but face challenges in generating returns above their cost of capital. ADI’s broad product and geographic diversification contrasts with LSCC’s narrower focus. Each must address valuation concerns and improve capital efficiency to strengthen long-term value creation.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only true shield protecting a company’s long-term profits from relentless competitive pressure:

Analog Devices, Inc. (ADI): Innovation-Driven Intangible Assets

ADI’s moat stems from deep intangible assets and specialized analog technology. Its high gross margin (55%) and stable EBIT margin (27%) reflect pricing power. Growing profitability in 2026 suggests new product expansions could reinforce its moat.

Lattice Semiconductor Corporation (LSCC): Niche Cost Advantage

LSCC competes with a cost advantage in field-programmable gate arrays, but its moat is weaker. Margins are thinner (EBIT 12%) and recent profitability declines signal mounting pressure. Expansion into emerging markets might offer upside but risks remain high.

Intangible Assets vs. Cost Efficiency: The Moat Showdown

ADI’s intangible asset moat is deeper and more durable, supported by growing ROIC despite current value shedding. LSCC’s shrinking ROIC and narrowing margins expose a fragile moat. ADI is better positioned to defend its market share over the medium term.

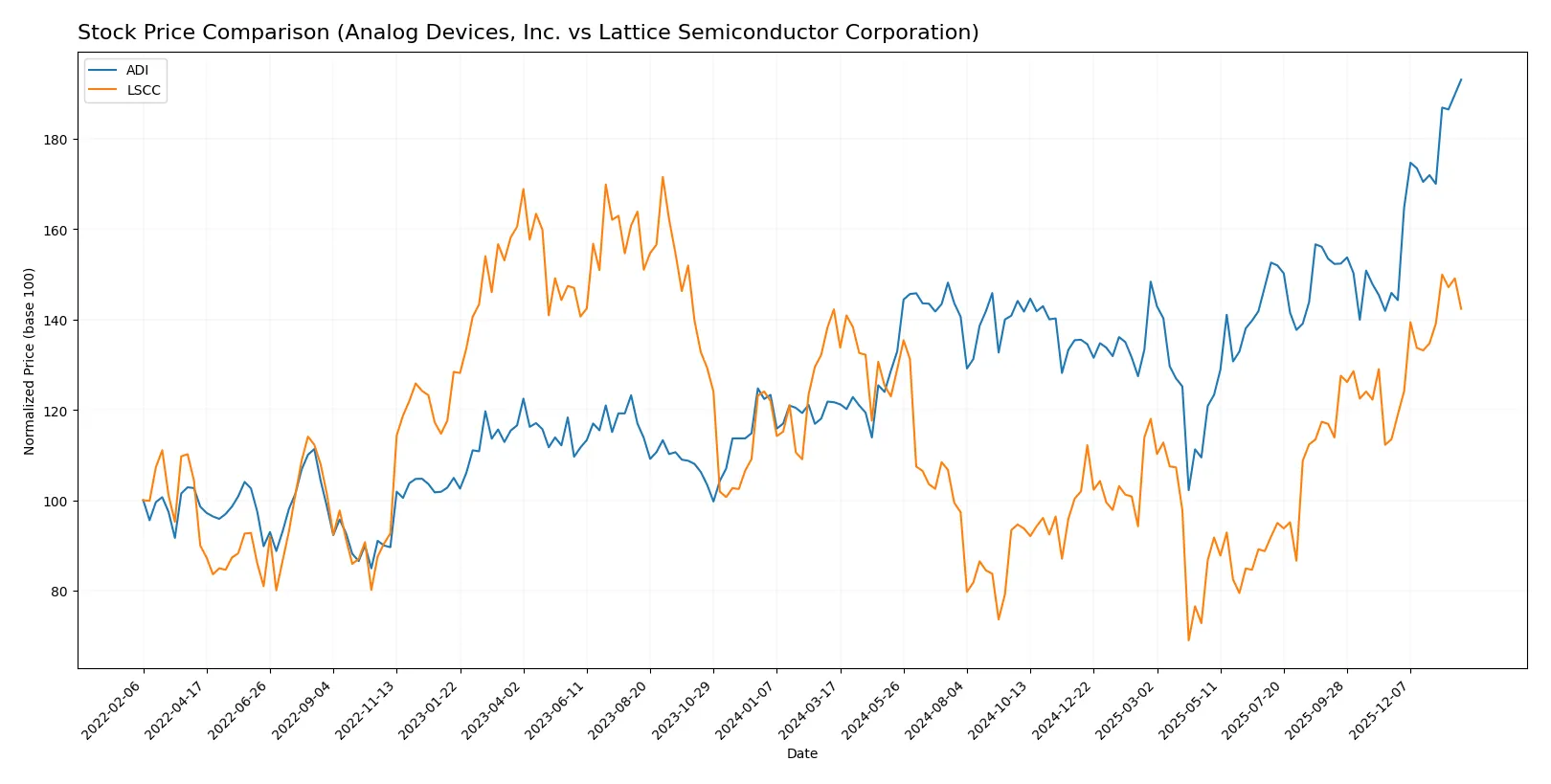

Which stock offers better returns?

Over the past year, Analog Devices, Inc. and Lattice Semiconductor Corporation have shown distinct price movements and trading dynamics, with ADI demonstrating strong upward momentum and LSCC exhibiting near stability.

Trend Comparison

Analog Devices, Inc. (ADI) posted a 58.66% price increase over the past 12 months, indicating a bullish trend with accelerating gains and a high volatility level (std dev 26.38). The stock ranged from 164.6 to 310.88.

Lattice Semiconductor Corporation (LSCC) recorded a marginal 0.09% price increase, also bullish but effectively neutral by threshold standards, with acceleration and lower volatility (std dev 11.16). The price fluctuated between 39.03 and 84.8.

ADI’s trend significantly outperforms LSCC’s, delivering the highest market returns and notable acceleration over the 12-month period.

Target Prices

Analysts present a clear target price range and consensus for both Analog Devices, Inc. and Lattice Semiconductor Corporation.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Analog Devices, Inc. | 270 | 375 | 316 |

| Lattice Semiconductor Corporation | 65 | 105 | 84.67 |

The target consensus for Analog Devices slightly exceeds the current price of $310.88, implying moderate upside potential. Lattice Semiconductor’s consensus target of $84.67 aligns closely with its current price of $80.52, reflecting balanced analyst expectations.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Analog Devices, Inc. Grades

The following table summarizes recent grades from reputable institutions for Analog Devices, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | Maintain | Positive | 2026-01-22 |

| B of A Securities | Maintain | Buy | 2026-01-21 |

| Stifel | Maintain | Buy | 2026-01-16 |

| Oppenheimer | Maintain | Outperform | 2026-01-16 |

| Wells Fargo | Upgrade | Overweight | 2026-01-15 |

| Citigroup | Maintain | Buy | 2026-01-15 |

| Keybanc | Maintain | Overweight | 2026-01-13 |

| Truist Securities | Maintain | Hold | 2025-12-19 |

| UBS | Maintain | Buy | 2025-12-08 |

| Truist Securities | Maintain | Hold | 2025-11-26 |

Lattice Semiconductor Corporation Grades

The following table summarizes recent grades from reputable institutions for Lattice Semiconductor Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | Maintain | Positive | 2026-01-22 |

| Keybanc | Maintain | Overweight | 2026-01-13 |

| Needham | Maintain | Buy | 2025-11-04 |

| Benchmark | Maintain | Buy | 2025-11-04 |

| Stifel | Maintain | Buy | 2025-11-04 |

| Baird | Maintain | Outperform | 2025-11-04 |

| Rosenblatt | Maintain | Buy | 2025-11-04 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Keybanc | Maintain | Overweight | 2025-09-30 |

| Needham | Maintain | Buy | 2025-09-22 |

Which company has the best grades?

Both companies receive mainly positive to buy ratings from institutions. Analog Devices shows consistent buy and overweight ratings with a recent upgrade. Lattice Semiconductor also has strong buy and outperform grades. Analog Devices’ more frequent recent upgrades may indicate stronger institutional confidence. This can influence investor sentiment and liquidity in the near term.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Analog Devices, Inc. (ADI)

- Established player with broad product portfolio serving diverse markets, facing intense competition in semiconductors.

Lattice Semiconductor Corporation (LSCC)

- Smaller scale with niche FPGA products, competing against larger firms and pressure to innovate rapidly.

2. Capital Structure & Debt

Analog Devices, Inc. (ADI)

- Moderate leverage (D/E 0.26) with solid interest coverage at 9.54, signaling manageable debt risk.

Lattice Semiconductor Corporation (LSCC)

- Very low leverage (D/E 0.02) and extremely high interest coverage (228), reflecting strong balance sheet safety.

3. Stock Volatility

Analog Devices, Inc. (ADI)

- Beta near 1.03 indicates market-level volatility, relatively stable for a tech stock.

Lattice Semiconductor Corporation (LSCC)

- High beta of 1.72 signals elevated stock price swings, increasing investor risk exposure.

4. Regulatory & Legal

Analog Devices, Inc. (ADI)

- Large multinational footprint exposes ADI to complex regulatory environments, including export controls.

Lattice Semiconductor Corporation (LSCC)

- Smaller global presence but still vulnerable to semiconductor export restrictions and IP litigation risks.

5. Supply Chain & Operations

Analog Devices, Inc. (ADI)

- Diversified supply chain with industrial scale but exposed to global semiconductor shortages and geopolitical tensions.

Lattice Semiconductor Corporation (LSCC)

- More concentrated supply base; supply chain disruptions could disproportionately impact production.

6. ESG & Climate Transition

Analog Devices, Inc. (ADI)

- Established ESG policies and energy-efficient product lines, but faces pressure to reduce carbon footprint further.

Lattice Semiconductor Corporation (LSCC)

- ESG efforts less mature; risks of investor backlash if climate transition is not accelerated.

7. Geopolitical Exposure

Analog Devices, Inc. (ADI)

- Significant exposure to Asia-Pacific markets, making it vulnerable to US-China trade tensions.

Lattice Semiconductor Corporation (LSCC)

- Also exposed to geopolitical risks but at a smaller scale given its size and market reach.

Which company shows a better risk-adjusted profile?

Analog Devices’ moderate leverage, diversified operations, and stable beta create a more balanced risk profile. Lattice Semiconductor’s high stock volatility and concentrated supply chain increase its risk exposure. ADI’s Altman Z-score and Piotroski score reflect stronger financial stability and operational strength. The most impactful risk for ADI is geopolitical exposure in Asia. For LSCC, steep stock volatility driven by market sentiment and high P/E ratios poses a major risk. Overall, ADI shows a superior risk-adjusted profile supported by solid financial health and risk diversification.

Final Verdict: Which stock to choose?

Analog Devices, Inc. (ADI) stands out as a cash machine with strong operating margins and growing profitability. Its main point of vigilance is a return on invested capital below its cost of capital, signaling some value destruction. ADI suits portfolios aiming for steady, long-term growth with moderate risk tolerance.

Lattice Semiconductor Corporation (LSCC) commands a strategic moat through its high R&D intensity and asset turnover, reflecting innovation potential. It offers better liquidity and lower leverage, presenting a safer balance sheet than ADI. LSCC fits investors seeking growth at a reasonable price with a preference for capital discipline.

If you prioritize consistent profitability and operational efficiency, ADI is the compelling choice due to its robust income growth and prudent capital management. However, if you seek innovation-driven growth with a stronger balance sheet, LSCC offers better stability, despite recent profitability challenges and a fading ROIC trend. Each stock appeals to distinct investor profiles, emphasizing the need for tailored portfolio alignment.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Analog Devices, Inc. and Lattice Semiconductor Corporation to enhance your investment decisions: