Home > Comparison > Technology > ADI vs CRUS

The strategic rivalry between Analog Devices, Inc. and Cirrus Logic, Inc. shapes the semiconductor landscape’s evolution. Analog Devices operates as a capital-intensive leader in mixed-signal and analog ICs, while Cirrus Logic excels as a nimble fabless innovator in audio and precision processing. This contest pits scale and integration against specialization and agility. This analysis will identify which company offers the more compelling risk-adjusted growth opportunity for diversified portfolios.

Table of contents

Companies Overview

Analog Devices, Inc. and Cirrus Logic, Inc. are pivotal players in the semiconductor sector, shaping diverse technology markets.

Analog Devices, Inc.: Integrated Circuit Innovator

Analog Devices dominates as a semiconductor designer and manufacturer specializing in analog, mixed-signal, and digital signal processing ICs. Its revenue hinges on data converters, power management products, and high-performance amplifiers serving industrial, automotive, and communications sectors. In 2026, the company emphasizes advanced power ICs and microelectromechanical systems to sustain its competitive edge globally.

Cirrus Logic, Inc.: Fabless Mixed-Signal Specialist

Cirrus Logic excels as a fabless semiconductor provider focused on low-power, high-precision mixed-signal processing solutions. Its core sales derive from audio codecs, digital signal processors, and SoundClear technology embedded in mobile and consumer electronics. The 2026 strategy prioritizes audio innovation and diversified industrial applications, including power control and haptic sensing, to expand its market footprint.

Strategic Collision: Similarities & Divergences

Both companies compete in semiconductors but differ fundamentally: Analog Devices integrates manufacturing with broad analog-digital solutions, while Cirrus Logic pursues a fabless, niche audio-centric approach. Their battleground lies in mixed-signal IC innovation for consumer and industrial use. Analog Devices offers scale and vertical integration; Cirrus Logic presents focused agility, defining distinct investment risk and growth profiles.

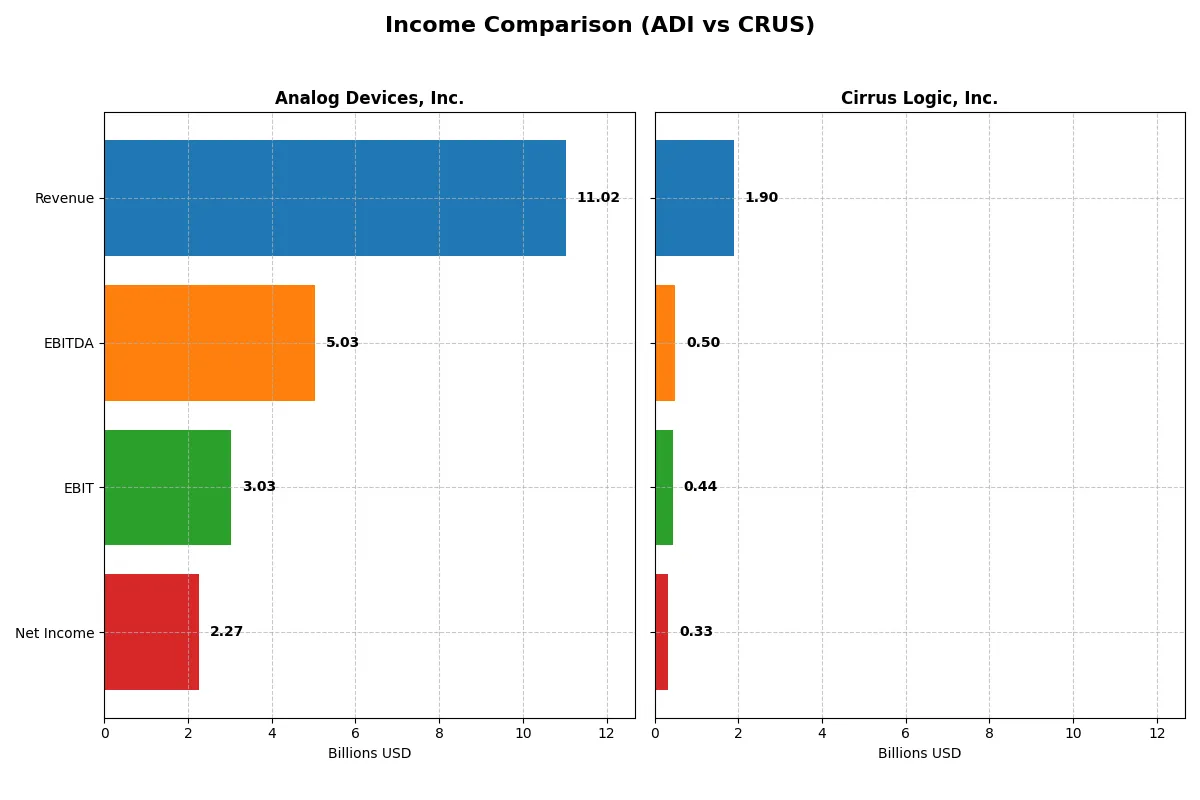

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Analog Devices, Inc. (ADI) | Cirrus Logic, Inc. (CRUS) |

|---|---|---|

| Revenue | 11B | 1.9B |

| Cost of Revenue | 5B | 900M |

| Operating Expenses | 3B | 586M |

| Gross Profit | 6B | 1B |

| EBITDA | 5B | 497M |

| EBIT | 3B | 445M |

| Interest Expense | 318M | 898K |

| Net Income | 2.3B | 332M |

| EPS | 4.59 | 6.24 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true efficiency and growth momentum of each company’s core business engine.

Analog Devices, Inc. Analysis

Analog Devices grows revenue from 7.3B in 2021 to 11B in 2025, with net income rising from 1.4B to 2.3B. Its gross margin remains strong at 54.7%, while net margin climbs to 20.6%. The latest year shows robust efficiency, with EBIT surging 44% and EPS up nearly 40%, signaling accelerating profitability.

Cirrus Logic, Inc. Analysis

Cirrus Logic’s revenue grows steadily from 1.4B in 2021 to 1.9B in 2025, with net income increasing from 217M to 332M. Its gross margin holds at 52.5%, and net margin improves to 17.5%. The company’s EBIT grows 22% in 2025, supported by controlled expenses, while EPS rises 22%, reflecting solid operational momentum.

Margin Strength vs. Growth Velocity

Analog Devices delivers higher absolute revenue and net income with superior margins, showcasing scale and profitability leadership. Cirrus Logic posts healthy growth rates and margin improvements but on a smaller base. For investors prioritizing strong earnings power and consistent margin expansion, Analog Devices offers a more compelling income profile.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of each company:

| Ratios | Analog Devices, Inc. (ADI) | Cirrus Logic, Inc. (CRUS) |

|---|---|---|

| ROE | 6.7% | 17.0% |

| ROIC | 5.5% | 14.2% |

| P/E | 51.1 | 15.9 |

| P/B | 3.42 | 2.71 |

| Current Ratio | 2.19 | 6.35 |

| Quick Ratio | 1.68 | 4.82 |

| D/E | 0.26 | 0.07 |

| Debt-to-Assets | 18.1% | 6.2% |

| Interest Coverage | 9.45 | 457 |

| Asset Turnover | 0.23 | 0.81 |

| Fixed Asset Turnover | 3.32 | 6.62 |

| Payout Ratio | 85% | 0% |

| Dividend Yield | 1.66% | 0% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as the company’s DNA, exposing hidden risks and operational excellence critical for strategic investment decisions.

Analog Devices, Inc.

Analog Devices posts a strong net margin at 20.58% but suffers from a low 6.7% ROE, signaling limited equity efficiency. The P/E ratio is high at 51.05, indicating an expensive valuation stretch. Its 1.66% dividend yield suggests moderate shareholder returns while reinvesting heavily in R&D, supporting long-term growth.

Cirrus Logic, Inc.

Cirrus Logic delivers robust profitability with a 17.48% net margin and a 17.01% ROE, reflecting efficient capital use. The P/E ratio of 15.95 shows a fairly priced stock with value appeal. Despite no dividend, it allocates significant resources to R&D, fueling innovation and growth potential for shareholders.

Premium Valuation vs. Operational Safety

Cirrus Logic balances higher returns and reasonable valuation better than Analog Devices’ stretched multiples and weaker ROE. Risk-averse investors may prefer Cirrus for operational efficiency, while growth seekers might tolerate Analog’s premium for its R&D focus.

Which one offers the Superior Shareholder Reward?

I compare Analog Devices, Inc. (ADI) and Cirrus Logic, Inc. (CRUS) on shareholder distributions. ADI pays a consistent dividend with a 1.66% yield in 2025, supported by a high dividend payout ratio near 85% and free cash flow coverage close to 1.9x, signaling a mature, shareholder-friendly policy. ADI also executes modest share buybacks, enhancing total returns sustainably. CRUS, by contrast, does not pay dividends but reinvests heavily in growth, evidenced by a low payout ratio of zero and a strong free cash flow yield with a robust buyback program. Historically, firms like ADI with balanced dividends and buybacks reward income-focused investors well, while CRUS suits growth investors seeking capital appreciation. Given 2026’s market environment favoring steady income amid volatility, I find ADI’s combined dividend and buyback strategy offers more reliable and sustainable shareholder rewards than CRUS’s growth-only approach.

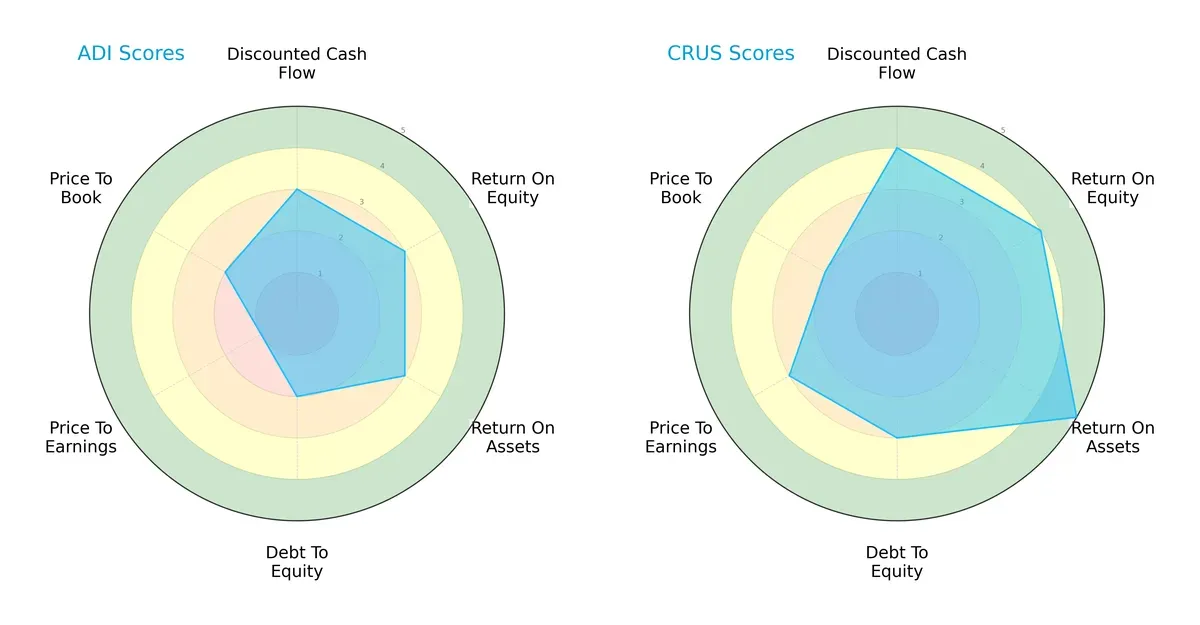

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of both firms, highlighting their financial strengths and valuation nuances:

Cirrus Logic, Inc. (CRUS) outperforms Analog Devices, Inc. (ADI) on DCF, ROE, and ROA scores, reflecting superior cash flow and operational efficiency. CRUS maintains a moderately better debt position but trades at higher valuations (P/E and P/B). ADI shows a more fragmented profile, with a very unfavorable P/E score indicating potential overvaluation. CRUS displays a balanced strength across metrics, while ADI relies heavily on moderate returns with valuation concerns.

Bankruptcy Risk: Solvency Showdown

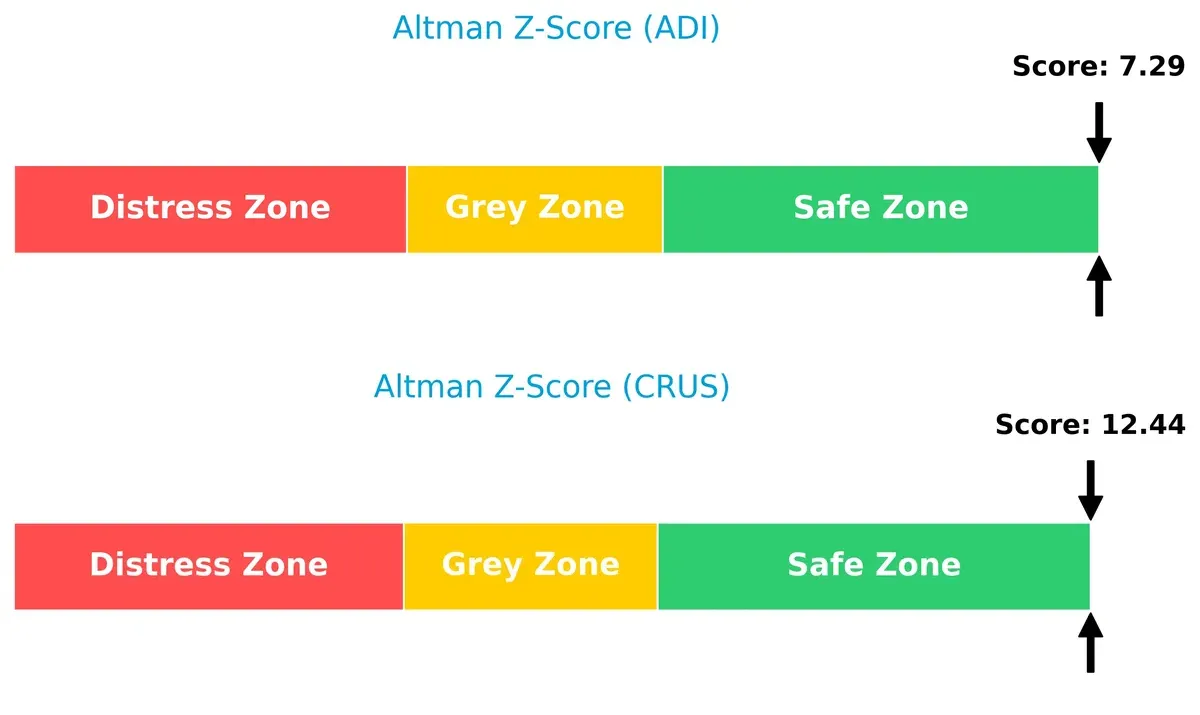

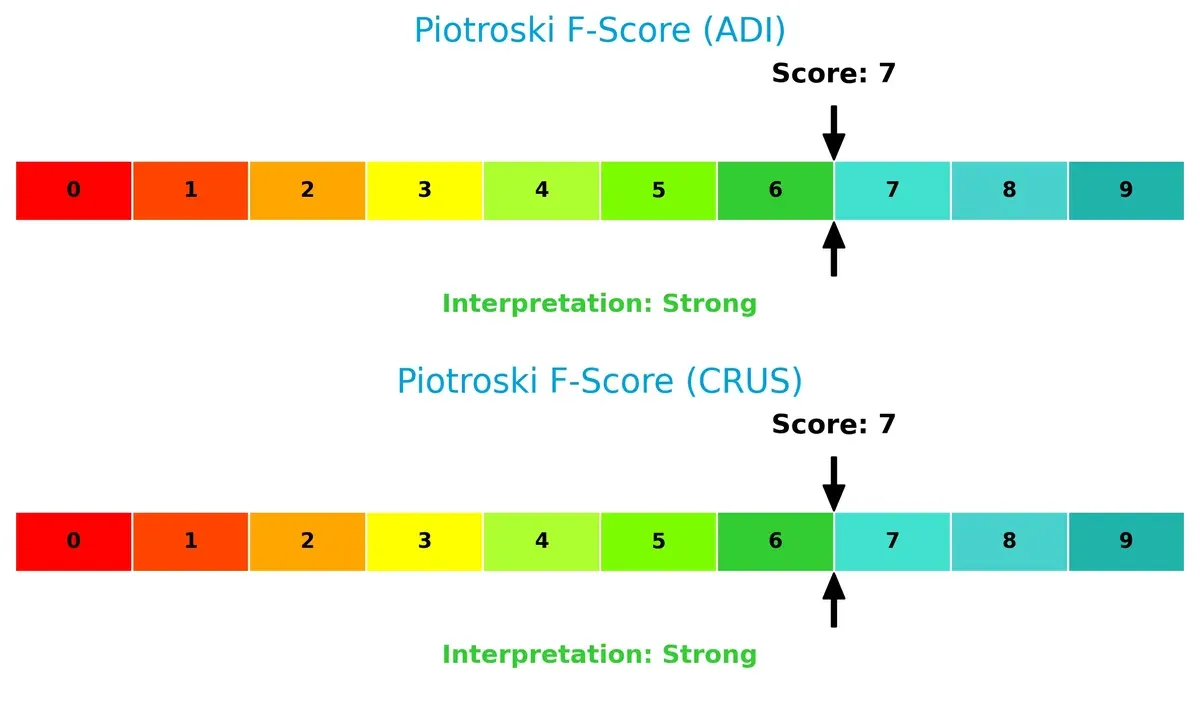

The Altman Z-Score gap favors CRUS, signaling a stronger solvency buffer and lower bankruptcy risk in this cycle:

CRUS scores 12.44, well within the safe zone, implying solid financial resilience. ADI’s 7.29 also sits comfortably in the safe zone but reflects a less robust cushion against downturns. Historically, firms with higher Z-scores better withstand economic contractions, making CRUS more reliable for long-term survival.

Financial Health: Quality of Operations

Both companies score equally strong with a Piotroski F-Score of 7, indicating robust financial health and operational quality:

A score of 7 suggests both firms exhibit strong profitability, liquidity, and efficiency metrics. Neither shows immediate red flags internally, but continuous monitoring is essential. This parity signals solid internal controls and operational discipline across both businesses.

How are the two companies positioned?

This section dissects the operational DNA of ADI and CRUS by comparing their revenue distribution by segment and internal dynamics. The goal is to confront their economic moats and identify which model offers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

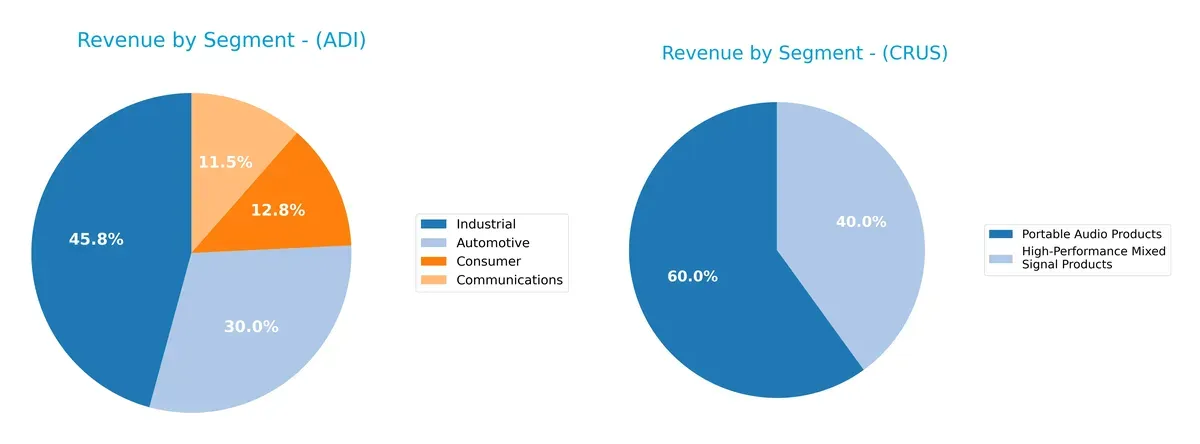

This visual comparison dissects how Analog Devices, Inc. and Cirrus Logic, Inc. diversify their income streams and where their primary sector bets lie:

Analog Devices leans heavily on its Industrial segment, which dwarfs other categories with $4.3B in 2024, anchoring its revenue mix. Automotive and Consumer segments add solid layers at $2.8B and $1.2B, respectively, reflecting a balanced, multi-industry approach. Cirrus Logic relies predominantly on Portable Audio Products, generating $1.1B, while High-Performance Mixed Signal Products trail at $759M, indicating concentration risk but strong niche dominance. Analog Devices’ broader diversification suggests resilience against sector-specific downturns.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Analog Devices, Inc. (ADI) and Cirrus Logic, Inc. (CRUS):

ADI Strengths

- Diversified revenue across Automotive, Industrial, Communications, and Consumer segments

- Favorable net margin of 20.58%

- Strong current and quick ratios indicate solid liquidity

- Low debt-to-equity of 0.26 supports financial stability

- Global presence with significant sales in US, China, Europe

- Favorable fixed asset turnover of 3.32 demonstrates asset efficiency

CRUS Strengths

- Favorable profitability metrics: net margin 17.48%, ROE 17.01%, ROIC 14.2%

- Low debt-to-equity of 0.07 and high interest coverage ratio of 495.45

- Strong fixed asset turnover of 6.62 reflects operational efficiency

- Focused product segments with solid Portable Audio and Mixed Signal sales

- Geographic revenue concentrated in China and Asia markets

- Favorable overall financial ratios with 57.14% favorable ratings

ADI Weaknesses

- Unfavorable ROE at 6.7%, below weighted average cost of capital of 8.42%

- High P/E ratio of 51.05 may indicate overvaluation risk

- Unfavorable asset turnover of 0.23 suggests lower asset utilization

- Unfavorable price-to-book ratio of 3.42 compared to sector norms

- Neutral dividend yield of 1.66% may limit income appeal

CRUS Weaknesses

- Unfavorable current ratio of 6.35 may indicate inefficient working capital management

- Zero dividend yield could reduce attractiveness for income-focused investors

- Neutral P/E and P/B ratios reflect moderate valuation support

- Less diversified revenue focused mainly on audio products

- Smaller US revenue base compared to ADI, limiting domestic market exposure

Overall, ADI presents a diversified revenue base and strong liquidity but faces challenges with asset efficiency and valuation metrics. CRUS boasts superior profitability and operational efficiency yet shows potential liquidity management concerns and a narrower product focus. These factors shape each company’s strategic positioning in competitive markets.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat alone protects long-term profits from erosion by competition. Let’s dissect where each company’s strength lies:

Analog Devices, Inc. (ADI): Intangible Assets and Product Integration

ADI’s moat stems from its strong intangible assets and integrated analog-mixed signal technology. Despite shedding value (ROIC below WACC), its rising ROIC and robust 27.5% EBIT margin signal improving profitability. Expanding industrial and automotive markets in 2026 could reinforce this moat but global competition remains a threat.

Cirrus Logic, Inc. (CRUS): Cost Advantage and Niche Focus

CRUS’s moat centers on a cost advantage in low-power, high-precision audio chips, differing from ADI’s broader tech moat. With ROIC exceeding WACC by 5.1% and growing, CRUS delivers efficient capital use and healthy 23.5% EBIT margin. Its focus on emerging AR/VR audio markets offers promising expansion in 2026.

Moat Strength Showdown: Intangible Assets vs. Cost Leadership

Cirrus Logic boasts a wider moat, consistently creating value with positive ROIC trends. Analog Devices shows potential but currently sheds value despite growth momentum. CRUS is better positioned to defend and expand market share amid intensifying competition.

Which stock offers better returns?

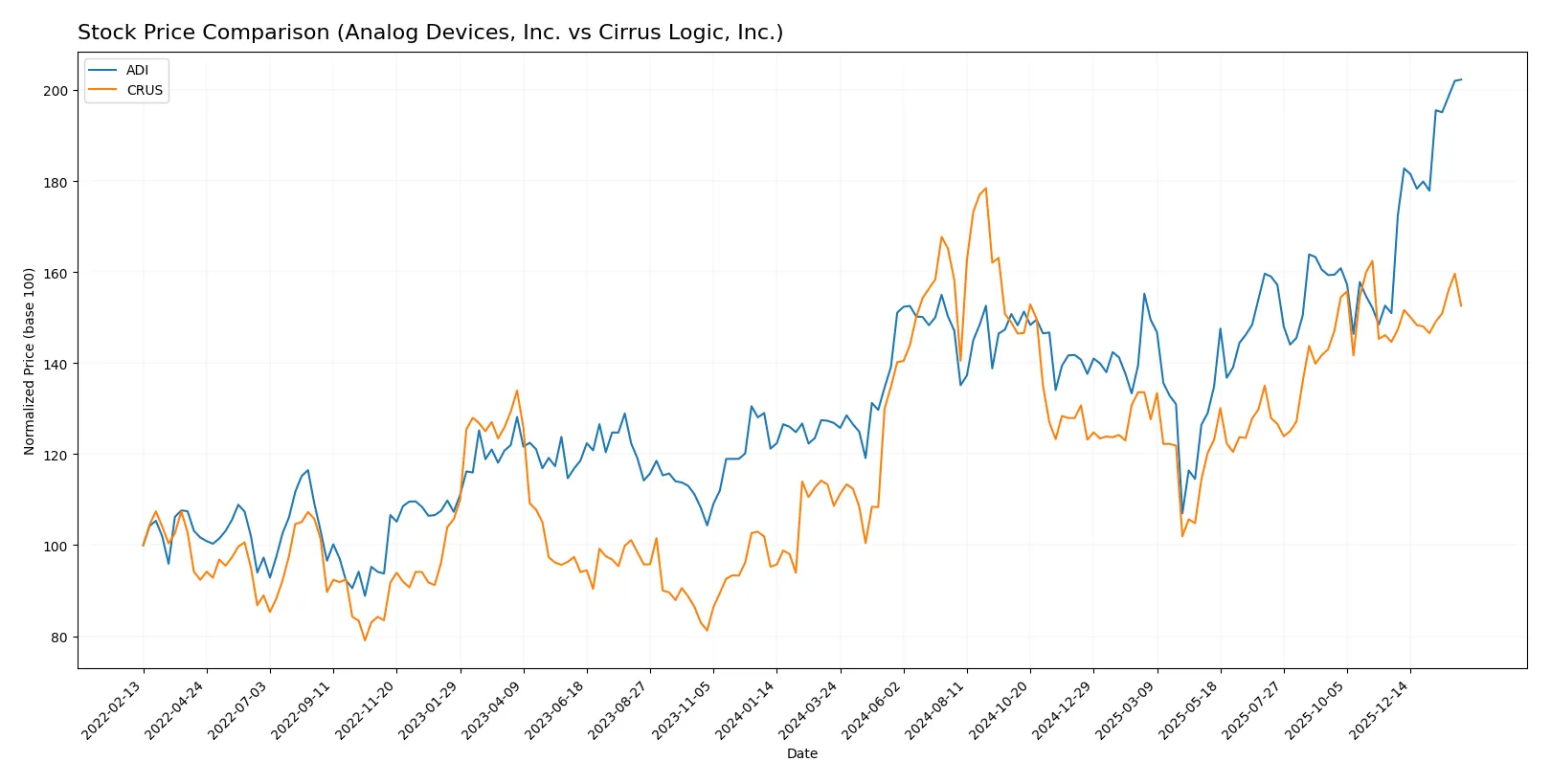

Over the past 12 months, both Analog Devices, Inc. and Cirrus Logic, Inc. displayed strong bullish momentum, with notable price increases and steady buyer dominance in trading volumes.

Trend Comparison

Analog Devices, Inc. (ADI) shows a 59.47% price increase over the past year, confirming a bullish trend with accelerating momentum and high volatility, peaking at $311.29 and bottoming at $164.6.

Cirrus Logic, Inc. (CRUS) gained 40.5% over the same period, also bullish with acceleration but lower volatility than ADI, reaching a high of $145.69 and a low of $82.02.

Between the two, ADI outperformed CRUS with a stronger price appreciation and higher market volatility, delivering the highest market returns in the last 12 months.

Target Prices

Analysts present a cautiously optimistic consensus on Analog Devices, Inc. and Cirrus Logic, Inc. for 2026.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Analog Devices, Inc. | 270 | 375 | 316 |

| Cirrus Logic, Inc. | 100 | 155 | 138.75 |

The target consensus for Analog Devices sits slightly above its current price of 311.29, indicating moderate upside potential. Cirrus Logic’s consensus of 138.75 exceeds its current price of 124.58, reflecting positive analyst expectations despite recent volatility.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Analog Devices, Inc. Grades

The table below summarizes recent grades from reliable institutions for Analog Devices, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | Maintain | Positive | 2026-01-22 |

| B of A Securities | Maintain | Buy | 2026-01-21 |

| Stifel | Maintain | Buy | 2026-01-16 |

| Oppenheimer | Maintain | Outperform | 2026-01-16 |

| Citigroup | Maintain | Buy | 2026-01-15 |

| Wells Fargo | Upgrade | Overweight | 2026-01-15 |

| Keybanc | Maintain | Overweight | 2026-01-13 |

| Truist Securities | Maintain | Hold | 2025-12-19 |

| UBS | Maintain | Buy | 2025-12-08 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-26 |

Cirrus Logic, Inc. Grades

The table below summarizes recent grades from reliable institutions for Cirrus Logic, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Benchmark | Maintain | Buy | 2025-11-05 |

| Keybanc | Maintain | Overweight | 2025-11-05 |

| Stifel | Maintain | Buy | 2025-11-05 |

| Barclays | Maintain | Equal Weight | 2025-11-05 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Stifel | Maintain | Buy | 2025-10-17 |

| Stifel | Maintain | Buy | 2025-09-12 |

| Barclays | Maintain | Equal Weight | 2025-05-07 |

| Barclays | Maintain | Equal Weight | 2025-04-22 |

| Stifel | Maintain | Buy | 2025-04-17 |

Which company has the best grades?

Analog Devices, Inc. holds a stronger consensus with multiple “Buy” and “Outperform” ratings, including a recent upgrade to “Overweight.” Cirrus Logic, Inc. consistently receives “Buy” and “Overweight” grades but also several “Equal Weight” ratings. Investors may interpret Analog Devices’ upgrades and higher-grade frequency as greater institutional confidence.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Analog Devices, Inc.

- Large market cap and diversified semiconductor portfolio offer resilience but face intense sector rivalry.

Cirrus Logic, Inc.

- Smaller cap with niche in audio and mixed-signal ICs, vulnerable to rapid tech shifts and competitor innovation.

2. Capital Structure & Debt

Analog Devices, Inc.

- Maintains low debt-to-equity (0.26), strong interest coverage (9.54), indicating prudent leverage management.

Cirrus Logic, Inc.

- Very low debt (0.07 D/E) and exceptional interest coverage (495.45) signal conservative capital structure and financial strength.

3. Stock Volatility

Analog Devices, Inc.

- Beta of 1.03 suggests market-aligned volatility but higher absolute price range implies potential downside risk.

Cirrus Logic, Inc.

- Higher beta at 1.14 indicates greater sensitivity to market swings; price range shows notable fluctuation risk.

4. Regulatory & Legal

Analog Devices, Inc.

- Operates globally across complex regulatory regimes, especially in automotive and communications sectors, increasing compliance costs.

Cirrus Logic, Inc.

- Faces regulatory scrutiny in consumer electronics and industrial markets, though smaller scale limits exposure magnitude.

5. Supply Chain & Operations

Analog Devices, Inc.

- Extensive global operations can strain supply chain resilience amid geopolitical tensions and semiconductor shortages.

Cirrus Logic, Inc.

- Supply chain concentrated on specialized mixed-signal components, increasing operational risk from supplier disruptions.

6. ESG & Climate Transition

Analog Devices, Inc.

- Larger footprint demands more robust ESG policies; transition risks in power management and automotive sectors are material.

Cirrus Logic, Inc.

- Smaller firm with emerging ESG frameworks; less exposed but must adapt to climate regulations affecting energy-related products.

7. Geopolitical Exposure

Analog Devices, Inc.

- Significant international sales expose it to US-China tensions and export restrictions impacting semiconductor supply.

Cirrus Logic, Inc.

- Limited geographic diversification intensifies risk from regional instability and trade policy shifts.

Which company shows a better risk-adjusted profile?

Analog Devices’ primary risk lies in its broad geopolitical exposure and complex global supply chain, which could disrupt operations. Cirrus Logic faces significant market and competitive pressure due to its smaller scale and product niche vulnerability. However, Cirrus Logic’s superior capital structure and stronger financial ratios enhance its risk-adjusted profile. The steep drop in Cirrus Logic’s stock price (-4.56%) versus Analog Devices’ smaller decline (-1.76%) underscores market sensitivity to its competitive risks. Overall, Cirrus Logic offers a more balanced risk-reward setup given its financial strength despite higher volatility.

Final Verdict: Which stock to choose?

Analog Devices, Inc. (ADI) excels as a cash-generating powerhouse with a robust gross margin and impressive operating leverage. Its superpower lies in delivering consistent profitability growth despite a challenging ROIC versus WACC dynamic. The main point of vigilance is its relatively high valuation multiples, which could pressure returns. ADI suits aggressive growth portfolios willing to pay a premium for scalability.

Cirrus Logic, Inc. (CRUS) stands out with a durable moat driven by efficient capital allocation and strong ROIC well above its cost of capital. Its strategic advantage centers on operational efficiency and a clean balance sheet, offering greater financial safety than ADI. CRUS fits well with GARP investors seeking steady earnings growth at a reasonable valuation.

If you prioritize aggressive growth and are comfortable with valuation risk, ADI offers strong momentum and expanding margins. However, if you seek better stability coupled with a proven economic moat, CRUS outshines ADI by delivering superior capital returns and financial resilience. Both companies reflect strong fundamentals but appeal to distinct investor profiles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Analog Devices, Inc. and Cirrus Logic, Inc. to enhance your investment decisions: