Home > Comparison > Technology > ADI vs ARM

The strategic rivalry between Analog Devices, Inc. and Arm Holdings plc defines the current trajectory of the semiconductor sector. Analog Devices operates as a capital-intensive manufacturer of analog and mixed-signal integrated circuits, while Arm Holdings excels as an intellectual property licensor for CPU designs. This analysis pits Analog Devices’ hardware-centric model against Arm’s licensing-driven growth, aiming to identify which approach offers superior risk-adjusted returns for diversified portfolios.

Table of contents

Companies Overview

Analog Devices and Arm Holdings stand as influential architects in the semiconductor arena, shaping technology’s future.

Analog Devices, Inc.: Precision in Analog and Mixed-Signal Innovation

Analog Devices dominates the analog, mixed-signal, and digital signal processing semiconductor market. It generates revenue primarily by designing and manufacturing integrated circuits and subsystems that convert and manage real-world signals across automotive, industrial, and communications sectors. In 2026, the company focused strategically on enhancing power management and sensor technologies to support high-performance applications globally.

Arm Holdings plc American Depositary Shares: The IP Powerhouse in Semiconductor Design

Arm Holdings specializes in architecting and licensing CPU and system IPs critical for semiconductor companies and OEMs. Its revenue model hinges on licensing microprocessors, GPUs, and software tools used in automotive, computing infrastructure, and IoT markets. In 2026, Arm emphasized expanding its ecosystem and scaling licensing solutions to sustain growth amid rising global demand for efficient processing technologies.

Strategic Collision: Similarities & Divergences

Analog Devices pursues a product-driven model centered on hardware integration and mixed-signal precision, while Arm thrives on a licensing model that fosters an open IP ecosystem. Their primary battleground lies in embedded system innovation, where Analog Devices supplies components and Arm delivers the underlying architecture. This contrast defines their investment profiles: one anchored in manufacturing excellence, the other in scalable intellectual property licensing.

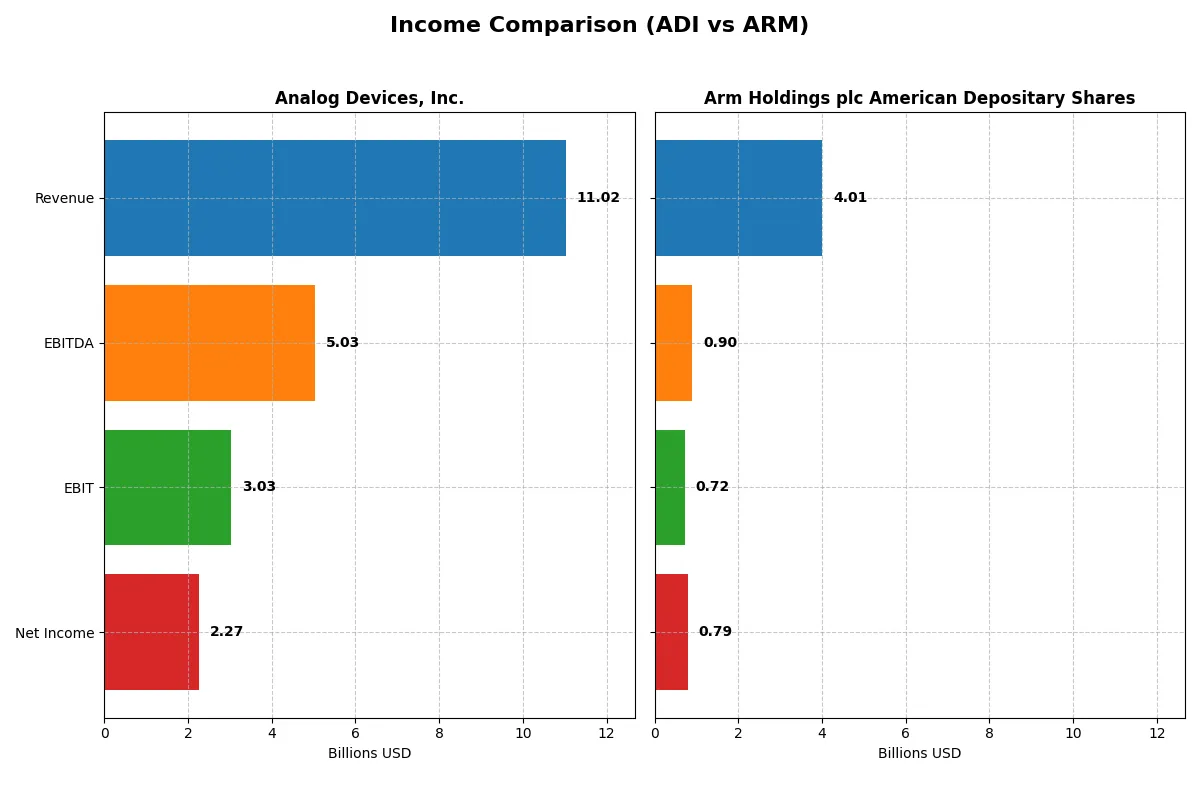

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Analog Devices, Inc. (ADI) | Arm Holdings plc ADS (ARM) |

|---|---|---|

| Revenue | 11.0B | 4.0B |

| Cost of Revenue | 5.0B | 206M |

| Operating Expenses | 3.0B | 2.97B |

| Gross Profit | 6.0B | 3.8B |

| EBITDA | 5.0B | 903M |

| EBIT | 3.0B | 720M |

| Interest Expense | 318M | 0 |

| Net Income | 2.27B | 792M |

| EPS | 4.59 | 0.75 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

The upcoming income statement comparison reveals which company turns revenue into profit more efficiently and sustains strong financial momentum.

Analog Devices, Inc. Analysis

Analog Devices demonstrates a steady revenue climb from $7.3B in 2021 to $11B in 2025, with net income surging from $1.39B to $2.27B. Its gross margin holds firm at 54.7%, while net margin improves to 20.6%. The company’s EBIT margin jumped 44% year-over-year, signaling robust operational efficiency and strong bottom-line growth.

Arm Holdings plc Analysis

Arm Holdings nearly doubled revenue from $2B in 2021 to $4B in 2025, with net income rising from $388M to $792M. Its exceptional gross margin of 94.9% contrasts with a lower EBIT margin of 18%. Arm’s net margin improved sharply by 109% year-over-year, driven by explosive EBIT growth, indicating accelerating profitability despite lower operating leverage.

Margin Strength vs. High Growth Momentum

Analog Devices leads with superior margin stability and consistent profit expansion, delivering a higher net margin and EBITDA scale. Arm impresses with faster revenue and net income growth, supported by a near 95% gross margin but lower EBIT efficiency. For investors, Analog Devices offers reliable margin power, while Arm presents a high-growth profile with operational leverage yet to fully mature.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Analog Devices, Inc. (ADI) | Arm Holdings plc ADS (ARM) |

|---|---|---|

| ROE | 6.7% | 11.6% |

| ROIC | 5.5% | 10.3% |

| P/E | 51.1 | 141.6 |

| P/B | 3.42 | 16.40 |

| Current Ratio | 2.19 | 5.20 |

| Quick Ratio | 1.68 | 5.20 |

| D/E | 0.26 | 0.05 |

| Debt-to-Assets | 18.1% | 4.0% |

| Interest Coverage | 9.45 | 0.00 |

| Asset Turnover | 0.23 | 0.45 |

| Fixed Asset Turnover | 3.32 | 5.61 |

| Payout ratio | 85% | 0% |

| Dividend yield | 1.66% | 0% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, exposing hidden risks and revealing operational excellence critical for investment insights.

Analog Devices, Inc.

ADI operates with a solid net margin of 20.58% but suffers from a low 6.7% ROE, indicating modest profitability. Its valuation appears stretched, with a high P/E of 51.05 and P/B of 3.42. The company balances shareholder returns through a moderate 1.66% dividend yield, maintaining favorable liquidity and conservative debt levels.

Arm Holdings plc American Depositary Shares

Arm delivers a higher ROE of 11.58% with a strong net margin near 19.77%, but its valuation is extremely elevated, featuring a P/E of 141.58 and P/B of 16.4. The stock offers no dividends, instead reinvesting heavily in R&D, reflected in its high capex ratios and intangible assets, while maintaining a very strong quick ratio despite a weak current ratio.

Premium Valuation vs. Operational Safety

ADI offers a more balanced risk-reward profile with reasonable profitability, conservative leverage, and shareholder returns. Arm’s premium valuation and reinvestment strategy come with higher risk due to stretched multiples. Investors seeking stability may prefer ADI, while growth-focused profiles might consider Arm’s aggressive expansion.

Which one offers the Superior Shareholder Reward?

Analog Devices, Inc. (ADI) maintains a balanced distribution strategy, paying a 1.66% dividend yield with a high payout ratio near 85%, supported by strong free cash flow (8.65/share). ADI also executes disciplined buybacks enhancing total return sustainably. Arm Holdings (ARM) pays no dividend, reinvesting heavily in growth and innovation, but its free cash flow yield is negligible (0.17/share), and buyback activity is minimal. Historically, ADI’s model offers more stable and attractive shareholder rewards for 2026 investors, combining yield, buybacks, and cash flow sustainability. I conclude ADI delivers the superior total shareholder return profile.

Comparative Score Analysis: The Strategic Profile

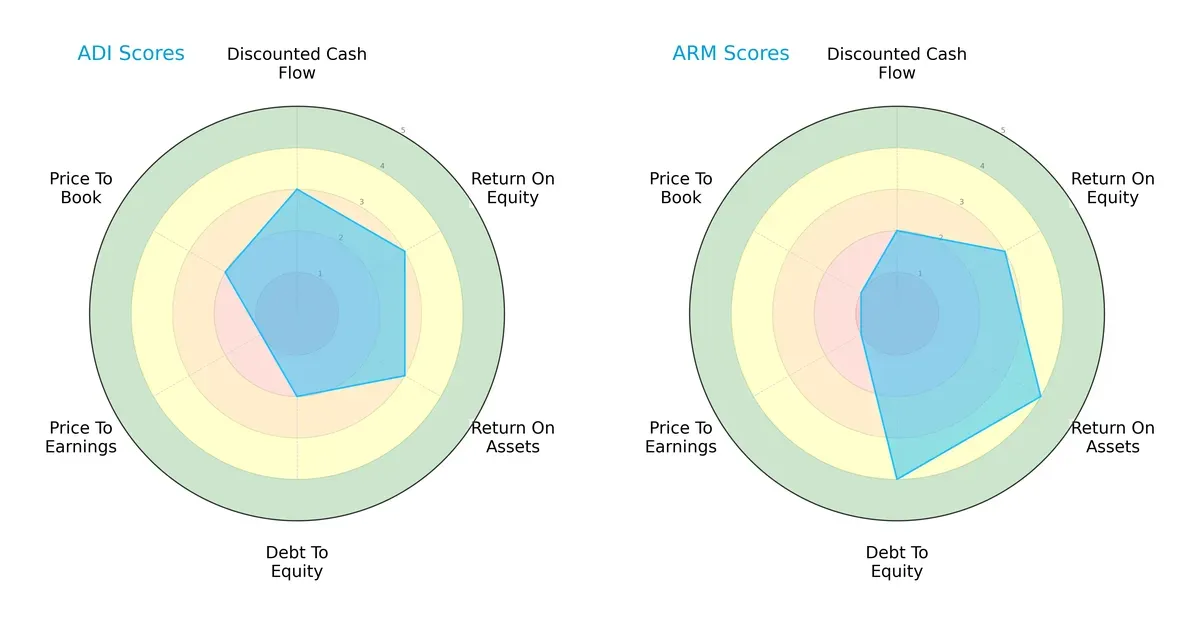

The radar chart reveals the fundamental DNA and trade-offs of both firms, highlighting their operational strengths and valuation challenges:

Analog Devices, Inc. (ADI) delivers a balanced profile with moderate scores in DCF, ROE, ROA, and debt-to-equity, but faces valuation headwinds with low P/E and P/B scores. Arm Holdings plc (ARM) excels in asset efficiency and leverage management but shows valuation risks even more pronounced than ADI. ARM relies on stronger operational metrics, while ADI maintains steadier valuation appeal.

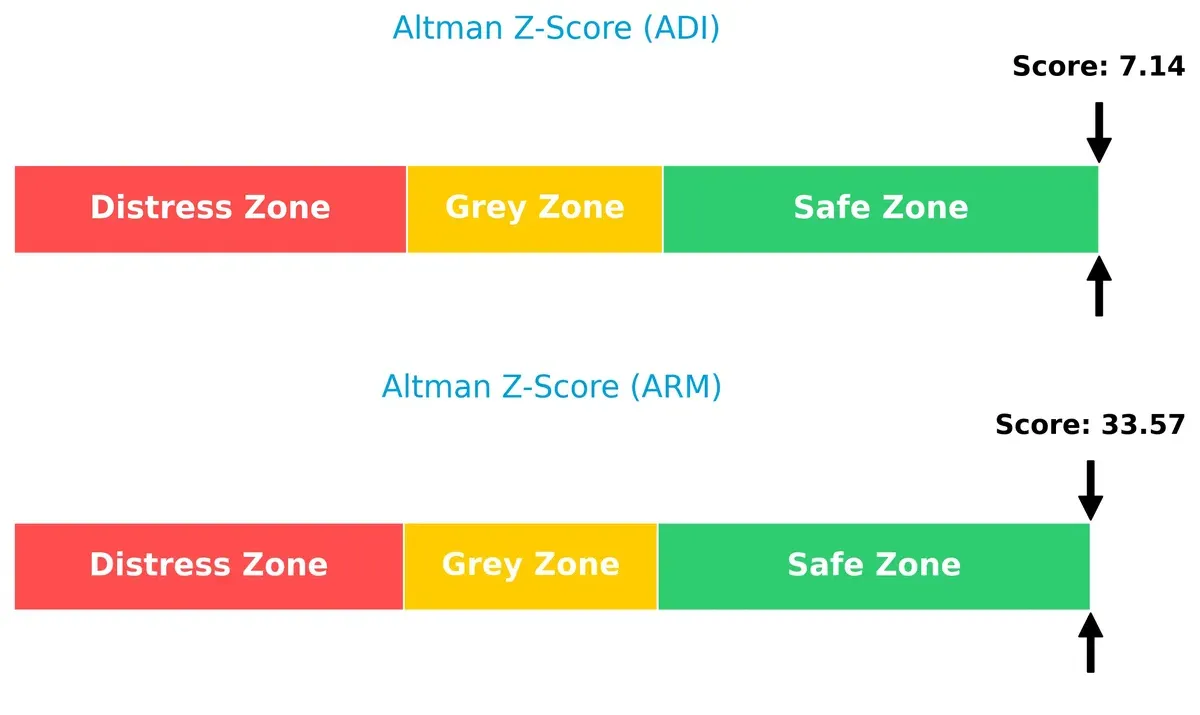

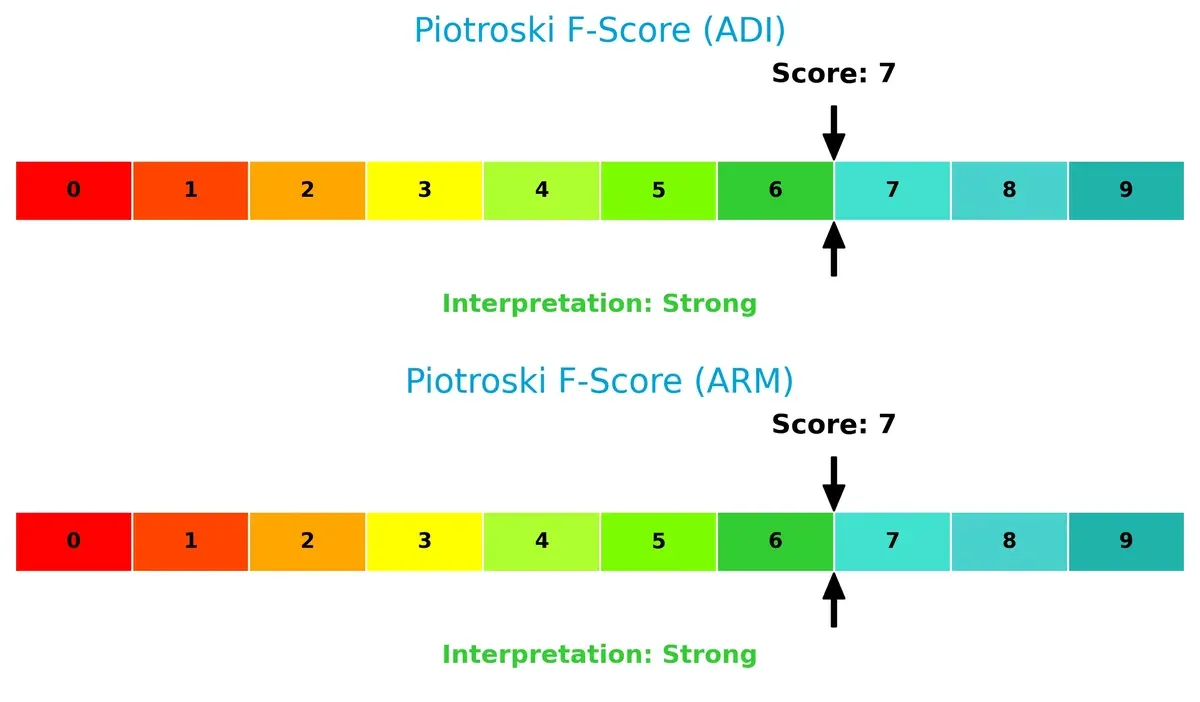

Bankruptcy Risk: Solvency Showdown

Arm’s Altman Z-Score of 33.57 vastly outperforms Analog Devices’ 7.14, signaling a significantly stronger solvency position and much lower bankruptcy risk in this cycle:

Financial Health: Quality of Operations

Both companies score a solid 7 on the Piotroski F-Score, reflecting strong financial health and operational quality with no immediate red flags detected:

How are the two companies positioned?

This section dissects the operational DNA of ADI and ARM by comparing revenue distribution and internal dynamics, including strengths and weaknesses. The goal is to confront their economic moats to reveal which model offers the most resilient, sustainable advantage today.

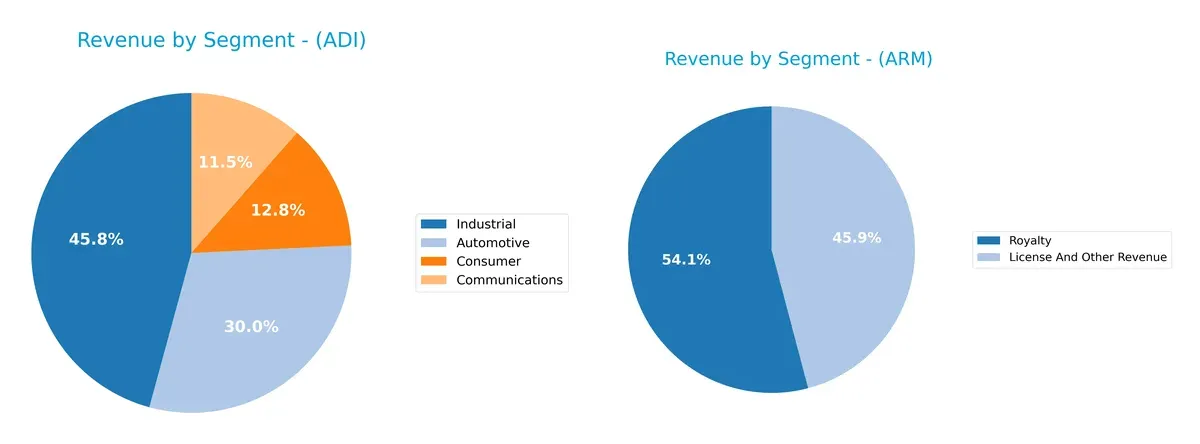

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Analog Devices and Arm Holdings diversify their income streams and reveals where their primary sector bets lie:

Analog Devices anchors its revenue in Industrial at $4.3B and Automotive at $2.8B for 2024, showing a moderately diversified mix across four segments. In contrast, Arm Holdings depends heavily on two segments—Royalty at $2.2B and License at $1.8B—highlighting a concentrated model focused on IP monetization. Analog Devices’ broader diversification reduces sector risk, while Arm’s reliance on licensing revenue pivots on sustained ecosystem dominance.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Analog Devices, Inc. and Arm Holdings plc American Depositary Shares:

ADI Strengths

- Diversified revenue streams across Automotive, Industrial, Communications, Consumer sectors

- Favorable net margin of 20.58%

- Strong liquidity with current ratio of 2.19 and quick ratio of 1.68

- Low debt-to-equity ratio of 0.26 supports financial stability

- Significant global presence, notably in the United States and China

- Favorable fixed asset turnover at 3.32

ARM Strengths

- Solid net margin at 19.77%

- Very low debt-to-equity ratio of 0.05 reduces financial risk

- Infinite interest coverage indicates strong ability to meet interest obligations

- High fixed asset turnover of 5.61 shows asset efficiency

- Growing global footprint with substantial revenue from the United States and Asia

- Favorable quick ratio of 5.2 indicates strong short-term liquidity

ADI Weaknesses

- Unfavorable return on equity at 6.7% signals weak shareholder returns

- Price-to-earnings ratio at 51.05 is high, suggesting overvaluation risk

- Unfavorable asset turnover of 0.23 indicates lower efficiency in asset usage

- Price-to-book ratio of 3.42 is elevated compared to industry norms

- Neutral ROIC at 5.55% slightly below WACC at 8.38% questions capital allocation efficiency

- Moderate dividend yield at 1.66% may limit income appeal

ARM Weaknesses

- High weighted average cost of capital at 24.32% raises capital expense concerns

- Unfavorable price-to-earnings ratio of 141.58 indicates market premium

- Poor price-to-book ratio at 16.4 suggests market overvaluation

- Current ratio at 5.2 is flagged unfavorable, hinting at possible asset management inefficiency

- Unfavorable return on invested capital at 10.28% below WACC

- Zero dividend yield limits investor income opportunities

Overall, ADI presents a balanced profile with solid profitability and liquidity but faces challenges in shareholder returns and valuation metrics. ARM shows strong asset efficiency and low leverage but suffers from high capital costs and valuation concerns, which may affect its strategic financial flexibility.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the sole barrier protecting long-term profits from relentless competition erosion. Let’s dissect the moats of these two semiconductor giants:

Analog Devices, Inc.: Diversified Innovation Moat

Analog Devices leverages intangible assets and product integration to sustain its moat. Its stable margins and rising profitability reflect this. Expansion into automotive and industrial markets in 2026 should deepen its advantage.

Arm Holdings plc American Depositary Shares: Licensing Network Moat

Arm’s moat hinges on its dominant licensing model and ecosystem network effects. Despite a less favorable ROIC vs. WACC, Arm commands high gross margins and explosive revenue growth. Its expansion into AI and IoT chips offers strong upside.

Verdict: Diversified Innovation vs. Licensing Dominance

Analog Devices holds a slightly deeper moat due to improving ROIC and margin stability. Arm’s network moat excels in growth but struggles with capital efficiency. Analog Devices is better positioned to defend market share amid evolving semiconductor demands.

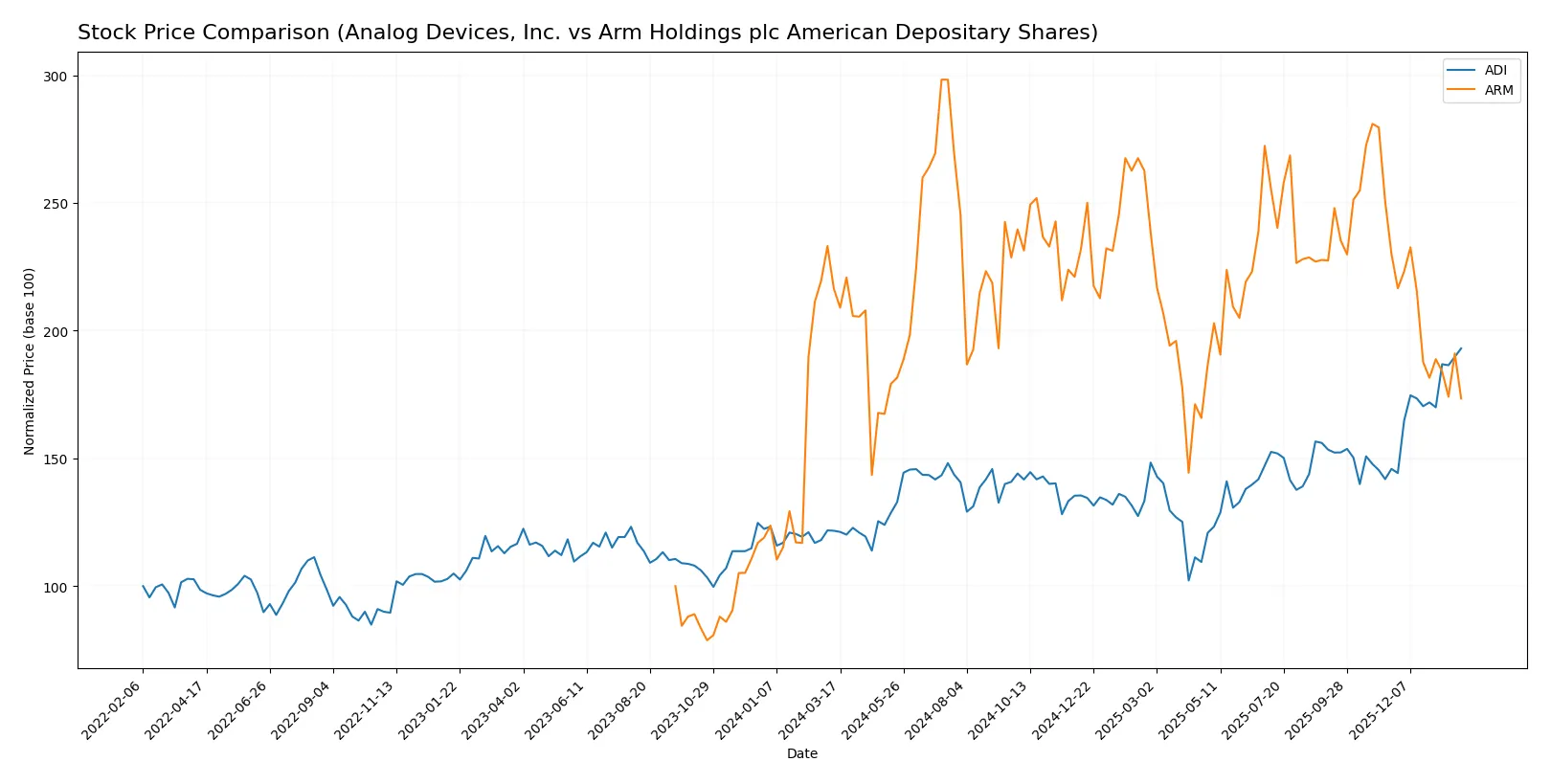

Which stock offers better returns?

Over the past year, Analog Devices, Inc. showed strong price appreciation with accelerating momentum, while Arm Holdings plc experienced a notable decline and decelerating trend.

Trend Comparison

Analog Devices, Inc. delivered a bullish trend with a 58.66% price increase over 12 months, showing acceleration and a high volatility level (std dev 26.38). Its price ranged from 164.6 to 310.88.

Arm Holdings plc showed a bearish trend, falling 19.87% over the same period with deceleration and lower volatility (std dev 19.62). Its price fluctuated between 87.19 and 181.19.

Analog Devices outperformed Arm Holdings significantly, with clear upward momentum versus Arm’s sustained downward trajectory.

Target Prices

Analysts set a clear consensus on target prices for Analog Devices, Inc. and Arm Holdings plc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Analog Devices, Inc. | 270 | 375 | 316 |

| Arm Holdings plc American Depositary Shares | 120 | 190 | 154 |

The consensus target for Analog Devices stands slightly above its current price of 311, signaling modest upside. Arm’s target consensus at 154 suggests significant potential gains from its 105 current price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Analog Devices, Inc. Grades

The following table summarizes recent grades from established grading firms for Analog Devices, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | Maintain | Positive | 2026-01-22 |

| B of A Securities | Maintain | Buy | 2026-01-21 |

| Stifel | Maintain | Buy | 2026-01-16 |

| Oppenheimer | Maintain | Outperform | 2026-01-16 |

| Wells Fargo | Upgrade | Overweight | 2026-01-15 |

| Citigroup | Maintain | Buy | 2026-01-15 |

| Keybanc | Maintain | Overweight | 2026-01-13 |

| Truist Securities | Maintain | Hold | 2025-12-19 |

| UBS | Maintain | Buy | 2025-12-08 |

| Truist Securities | Maintain | Hold | 2025-11-26 |

Arm Holdings plc American Depositary Shares Grades

Below is a summary of recent grades from reputable grading firms for Arm Holdings plc American Depositary Shares:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-01-26 |

| Wells Fargo | Maintain | Overweight | 2026-01-26 |

| Morgan Stanley | Maintain | Overweight | 2026-01-23 |

| Susquehanna | Upgrade | Positive | 2026-01-21 |

| B of A Securities | Downgrade | Neutral | 2026-01-13 |

| B of A Securities | Maintain | Buy | 2025-12-16 |

| Goldman Sachs | Downgrade | Sell | 2025-12-15 |

| Loop Capital | Maintain | Buy | 2025-11-12 |

| Benchmark | Maintain | Hold | 2025-11-06 |

| Needham | Maintain | Hold | 2025-11-06 |

Which company has the best grades?

Analog Devices, Inc. consistently holds Buy and Positive ratings, with one recent upgrade to Overweight. Arm Holdings shows mixed grades, including a downgrade to Sell by Goldman Sachs. Analog Devices holds a stronger, more stable consensus, potentially indicating greater institutional confidence.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Analog Devices, Inc.

- Established in analog and mixed-signal ICs with broad industrial and automotive exposure.

Arm Holdings plc American Depositary Shares

- Focuses on CPU architecture licensing, facing rapid innovation and fierce IP competition.

2. Capital Structure & Debt

Analog Devices, Inc.

- Moderate debt-to-equity ratio (0.26) with solid interest coverage (9.54).

Arm Holdings plc American Depositary Shares

- Very low debt (0.05 debt-to-equity) and infinite interest coverage, showing low leverage risk.

3. Stock Volatility

Analog Devices, Inc.

- Beta near 1.03 indicates market-level volatility.

Arm Holdings plc American Depositary Shares

- High beta of 4.36 signals elevated stock price volatility and market sensitivity.

4. Regulatory & Legal

Analog Devices, Inc.

- U.S.-based with exposure to semiconductor export controls and tech regulations.

Arm Holdings plc American Depositary Shares

- UK-based with international exposure, subject to complex cross-border IP and trade regulations.

5. Supply Chain & Operations

Analog Devices, Inc.

- Operates extensive global manufacturing and distribution; vulnerable to component shortages.

Arm Holdings plc American Depositary Shares

- Relies heavily on licensing model; operational risk tied to partner ecosystem and geopolitical supply constraints.

6. ESG & Climate Transition

Analog Devices, Inc.

- Strong operational footprint with increasing focus on energy-efficient products.

Arm Holdings plc American Depositary Shares

- ESG risks linked to IP licensing and indirect environmental impact through partners.

7. Geopolitical Exposure

Analog Devices, Inc.

- Significant U.S.-China exposure amid rising tech tensions and export restrictions.

Arm Holdings plc American Depositary Shares

- Broad international footprint including China and Taiwan, heightening geopolitical risks.

Which company shows a better risk-adjusted profile?

Analog Devices faces its biggest risk in geopolitical tensions impacting supply chains and market access. Arm’s most pressing risk is extreme stock volatility amplified by high valuation multiples and regulatory complexities. I see Analog Devices as having a more balanced risk profile due to stronger capital structure and lower market volatility, despite geopolitical challenges. Arm’s high beta and stretched valuation raise caution amid uncertain global tech dynamics.

Final Verdict: Which stock to choose?

Analog Devices, Inc. (ADI) excels as a cash-generating powerhouse with robust operational efficiency and solid balance sheet health. Its main point of vigilance remains its modest return on invested capital, which currently trails its cost of capital. ADI suits investors targeting steady, aggressive growth with a premium on financial discipline.

Arm Holdings plc (ARM) commands a strategic moat through its intellectual property and recurring licensing revenue, underpinning a durable competitive edge. Though its valuation and capital costs appear stretched, ARM presents a safer profile regarding leverage and liquidity compared to ADI. It fits well in portfolios focused on growth at a reasonable price (GARP).

If you prioritize disciplined cash flow and operational resilience, ADI is the compelling choice due to its accelerating growth and stable financial footing. However, if you seek exposure to cutting-edge technology with recurring revenue and can tolerate valuation risk, ARM offers superior strategic moat and balance sheet safety. Both demand careful risk management given distinct valuation challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Analog Devices, Inc. and Arm Holdings plc American Depositary Shares to enhance your investment decisions: