Home > Comparison > Industrials > AME vs PNR

The strategic rivalry between AMETEK, Inc. and Pentair plc shapes the competitive landscape of the industrial machinery sector. AMETEK operates as a diversified electronic instruments and electromechanical devices manufacturer, while Pentair focuses on water solutions through consumer and industrial fluid treatment products. This analysis explores their contrasting operational models and evaluates which company’s trajectory offers superior risk-adjusted returns for a balanced portfolio.

Table of contents

Companies Overview

AMETEK and Pentair are key players in the industrial machinery sector, shaping global market dynamics.

AMETEK, Inc.: Precision Instruments Powerhouse

AMETEK dominates as a global manufacturer of electronic instruments and electromechanical devices. Its revenue streams split between Electronic Instruments and Electromechanical segments, serving aerospace, industrial, and medical markets. In 2026, AMETEK focuses on expanding advanced instrumentation and precision motion controls to deepen its technological edge.

Pentair plc: Water Solutions Specialist

Pentair leads in providing comprehensive water treatment and fluid management solutions worldwide. It generates revenue through Consumer Solutions and Industrial & Flow Technologies segments, offering filtration, pumps, and valves. The firm’s 2026 strategy centers on enhancing water filtration technologies and expanding commercial and residential water management systems.

Strategic Collision: Similarities & Divergences

Both companies operate in industrial machinery but diverge sharply in focus—AMETEK targets high-tech instrumentation, while Pentair emphasizes water solutions. Their primary competition unfolds in specialized equipment markets servicing industrial and commercial clients. AMETEK presents a tech-driven growth profile; Pentair offers resilience through essential water infrastructure products.

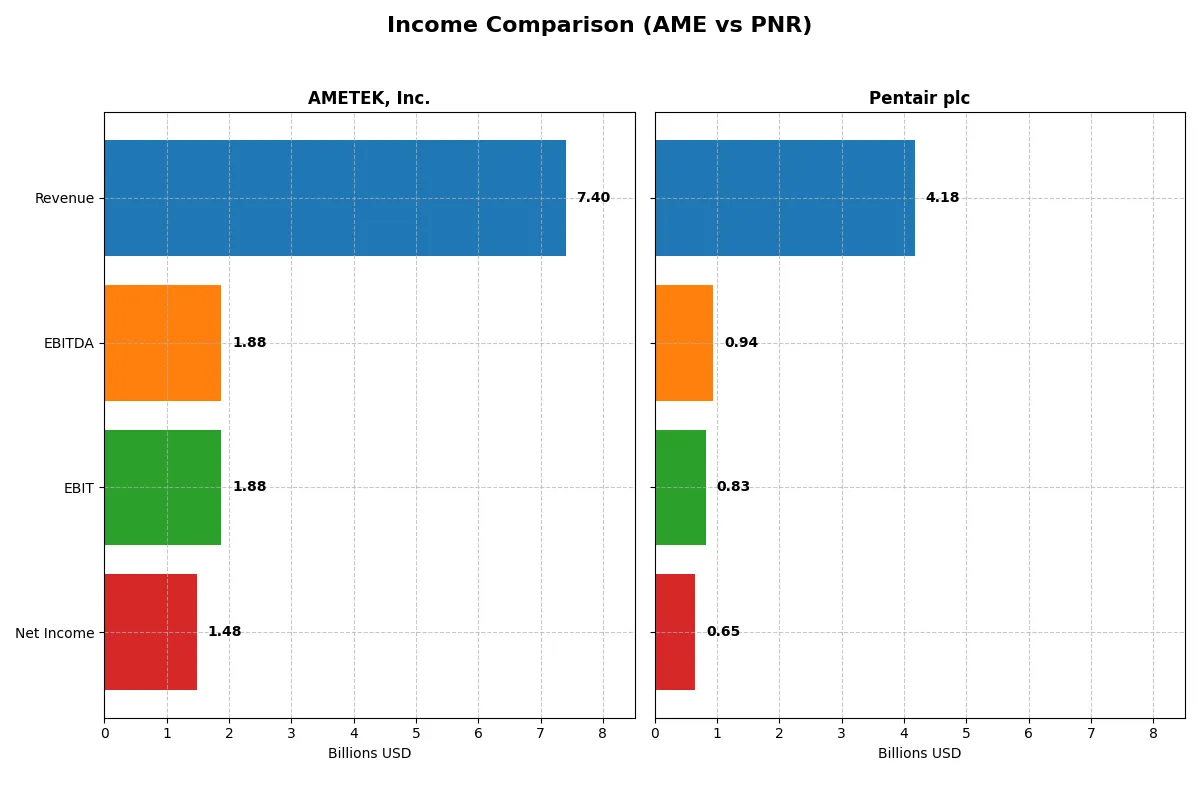

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | AMETEK, Inc. (AME) | Pentair plc (PNR) |

|---|---|---|

| Revenue | 7.4B | 4.2B |

| Cost of Revenue | 4.7B | 2.5B |

| Operating Expenses | 757M | 833M |

| Gross Profit | 2.7B | 1.7B |

| EBITDA | 1.9B | 944M |

| EBIT | 1.9B | 826M |

| Interest Expense | 81M | 69M |

| Net Income | 1.5B | 654M |

| EPS | 6.42 | 3.99 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This comparison unveils how each company converts revenue into profit, exposing the true efficiency of their corporate engines.

AMETEK, Inc. Analysis

AMETEK’s revenue climbed steadily from 5.5B in 2021 to 7.4B in 2025, with net income rising from 990M to 1.48B. Its gross margin holds strong at 36.4%, while net margin improved to 20%. The latest year shows solid momentum, with profitability growing alongside revenue, reflecting disciplined cost control despite rising operating expenses.

Pentair plc Analysis

Pentair’s revenue grew moderately from 3.76B in 2021 to 4.18B in 2025, while net income increased from 553M to 654M. It boasts a higher gross margin of 40.5% but a lower net margin of 15.7%. Recent performance shows slower revenue growth and stable net margin, indicating a more cautious expansion with consistent profitability but less aggressive margin improvement.

Margin Strength vs. Growth Momentum

AMETEK outpaces Pentair in revenue and net income growth, with superior margin expansion and EPS gains over five years. Pentair delivers higher gross margins but lags in top-line growth and net margin. For investors, AMETEK’s profile signals stronger fundamental momentum, while Pentair offers stable margins with slower growth.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | AMETEK, Inc. (AME) | Pentair plc (PNR) |

|---|---|---|

| ROE | 13.93% | 16.90% |

| ROIC | 11.04% | 12.46% |

| P/E | 31.97 | 26.14 |

| P/B | 4.45 | 4.42 |

| Current Ratio | 1.06 | 1.61 |

| Quick Ratio | 0.67 | 0.95 |

| D/E | 0.21 | 0.42 |

| Debt-to-Assets | 14.21% | 23.86% |

| Interest Coverage | 23.82 | 12.36 |

| Asset Turnover | 0.46 | 0.61 |

| Fixed Asset Turnover | 6.56 | 11.08 |

| Payout Ratio | 19.31% | 25.13% |

| Dividend Yield | 0.60% | 0.96% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios serve as a company’s DNA, exposing hidden risks and operational strengths beneath headline figures.

AMETEK, Inc.

AMETEK posts a solid 13.93% ROE and a strong 20% net margin, reflecting steady profitability. However, its P/E of 31.97 signals an expensive valuation relative to earnings. The company returns modest dividends at 0.6%, suggesting a cautious approach with some reinvestment into growth and innovation.

Pentair plc

Pentair delivers a robust 16.9% ROE and a favorable 15.66% net margin, indicating efficient capital use. Its P/E stands at 26.14, less stretched than AMETEK’s, but still on the pricey side. Pentair offers a higher 0.96% dividend yield, balancing shareholder returns with ongoing reinvestment in R&D.

Premium Valuation vs. Operational Safety

Pentair offers a better balance of efficiency and risk, with stronger returns and healthier liquidity metrics. AMETEK’s elevated valuation and weaker asset turnover caution investors seeking operational safety. Growth-focused investors may tolerate AMETEK’s premium; conservative profiles might prefer Pentair’s steadier footing.

Which one offers the Superior Shareholder Reward?

I see AMETEK, Inc. (AME) pays a modest dividend yield near 0.62% with a payout ratio around 19%, supported by strong free cash flow coverage above 90%. Its buyback program is steady but less intense. Pentair plc (PNR) yields higher at roughly 0.96%, but with a higher payout ratio near 25%, slightly pressuring sustainability. PNR also runs a meaningful buyback, enhancing total returns. Both reinvest adequately in capex, but AME’s lower leverage and consistent cash flow suggest a more durable distribution model. I conclude AMETEK offers a more sustainable and attractive total shareholder return profile in 2026.

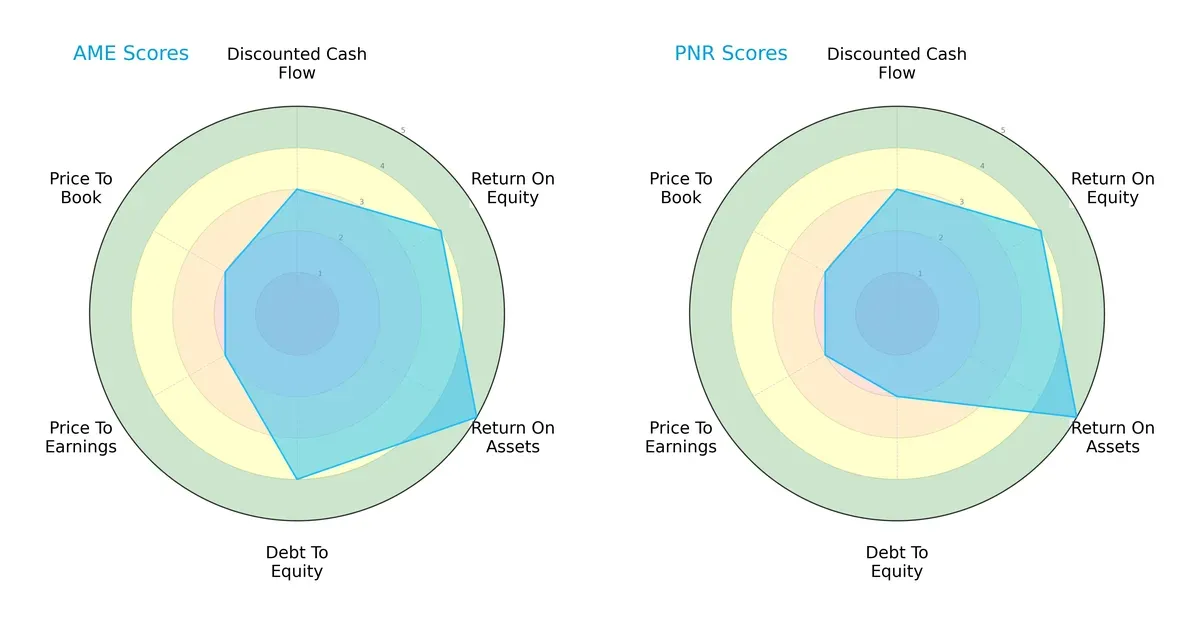

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of AMETEK, Inc. and Pentair plc, highlighting their core financial strengths and weaknesses:

AMETEK shows a more balanced profile with favorable scores in ROE (4), ROA (5), and Debt/Equity (4), reflecting solid profitability and manageable leverage. Pentair matches AMETEK in ROE (4) and ROA (5) but lags with a weaker Debt/Equity score (2), signaling higher financial risk. Both firms share moderate valuations (PE/PB scores at 2), but AMETEK’s overall score (4) edges out Pentair’s (3), indicating a sturdier strategic position.

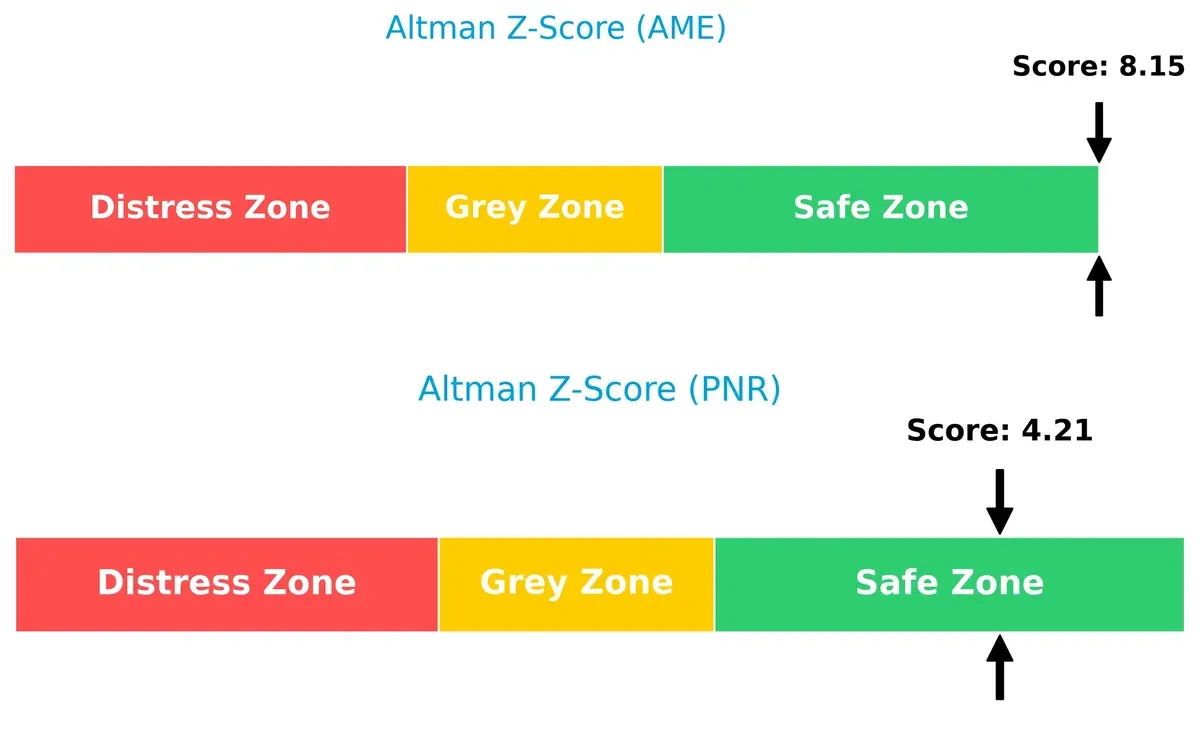

Bankruptcy Risk: Solvency Showdown

AMETEK’s Altman Z-Score (8.15) significantly exceeds Pentair’s (4.21), both safely above the distress threshold. This suggests AMETEK has a stronger buffer against bankruptcy risk in this economic cycle:

Financial Health: Quality of Operations

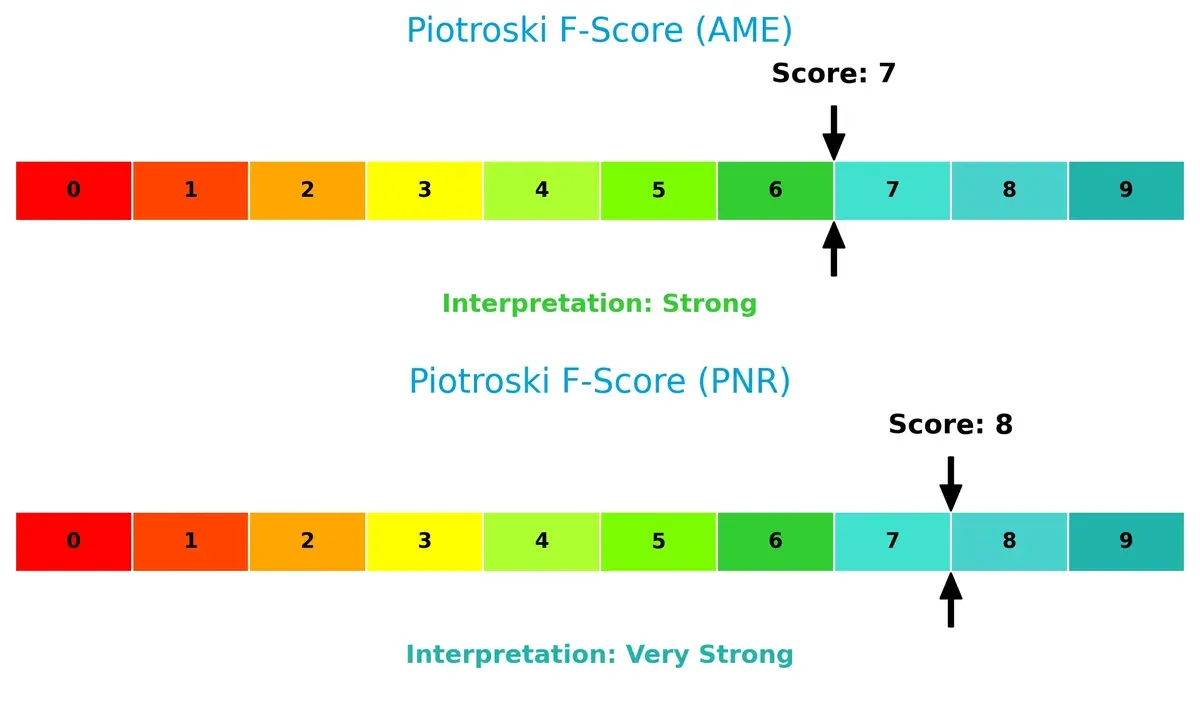

Pentair’s Piotroski F-Score (8) slightly outperforms AMETEK’s (7), indicating very strong financial health and operational quality. Neither firm shows red flags, but Pentair demonstrates marginally better internal metrics:

How are the two companies positioned?

This section dissects AMETEK and Pentair’s operational DNA by comparing revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats and identify which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

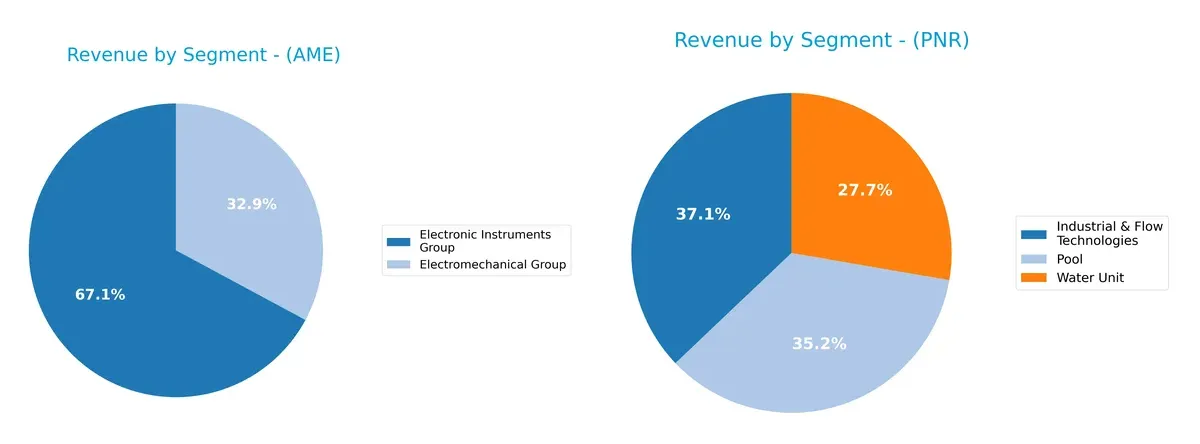

This visual comparison dissects how AMETEK, Inc. and Pentair plc diversify their income streams and where their primary sector bets lie:

AMETEK anchors its revenue in two segments, with Electronic Instruments Group at $4.66B and Electromechanical Group at $2.28B, showing a bi-segment focus. Pentair spreads its $4.08B revenue across three 2024 segments, Industrial & Flow Technologies ($1.51B), Pool ($1.44B), and Water Unit ($1.13B), indicating a more diversified portfolio. AMETEK’s concentrated model leverages specialization, while Pentair’s broader mix mitigates concentration risk in infrastructure-related markets.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of AMETEK, Inc. and Pentair plc:

AMETEK Strengths

- Strong net margin at 20%

- Favorable ROIC at 11.04%

- Low debt-to-assets at 14.21%

- High interest coverage at 23.13

- Diverse product groups including Electromechanical and Electronic Instruments

- Significant revenue from US and Asia markets

Pentair Strengths

- Favorable net margin at 15.66%

- Higher ROE at 16.9% and ROIC at 12.46%

- Strong current ratio at 1.61

- Favorable debt-to-assets at 23.86%

- Broad product segments including Industrial & Flow Technologies, Pool, and Water Units

- Large US revenue base with strong presence in Western Europe

AMETEK Weaknesses

- Unfavorable PE ratio at 31.97 and PB at 4.45

- Low quick ratio at 0.67 signals liquidity risk

- Unfavorable asset turnover at 0.46

- Dividend yield low at 0.6%

- Moderate diversification with two main product groups

- Heavy reliance on US market

Pentair Weaknesses

- Unfavorable PE ratio at 26.14 and PB at 4.42

- Quick ratio neutral at 0.95, indicating moderate liquidity

- Moderate asset turnover at 0.61

- Dividend yield low at 0.96%

- Product and geographic diversification less balanced with heavy US concentration

Overall, Pentair exhibits stronger profitability ratios and liquidity compared to AMETEK. However, AMETEK’s lower leverage and higher interest coverage provide financial stability. Both companies face valuation concerns and limited dividend yields, impacting income-focused investors.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the sole barrier protecting long-term profits from relentless competitive erosion. Let’s dissect how AMETEK and Pentair defend their turf:

AMETEK, Inc.: Precision Engineering with Growing Value Creation

AMETEK’s moat stems from its intangible assets and advanced electronic instruments. This manifests in a very favorable ROIC 2.55% above WACC and an 11.5% ROIC growth, signaling increasing profitability. Expansion into aerospace and industrial markets in 2026 should deepen this moat.

Pentair plc: Water Solutions with Cost Advantage Under Pressure

Pentair leverages cost advantages in water filtration and industrial solutions but faces a declining ROIC trend despite a 3.4% ROIC premium over WACC. Its shrinking profitability signals caution, though new technologies in water treatment may offer a turnaround opportunity.

Moat Strength Showdown: Intangible Assets vs. Cost Efficiency

AMETEK boasts a wider and deepening moat with rising ROIC and strong margin growth. Pentair’s moat, while initially wider by ROIC margin, is eroding. AMETEK stands better equipped to defend and expand its market share in 2026.

Which stock offers better returns?

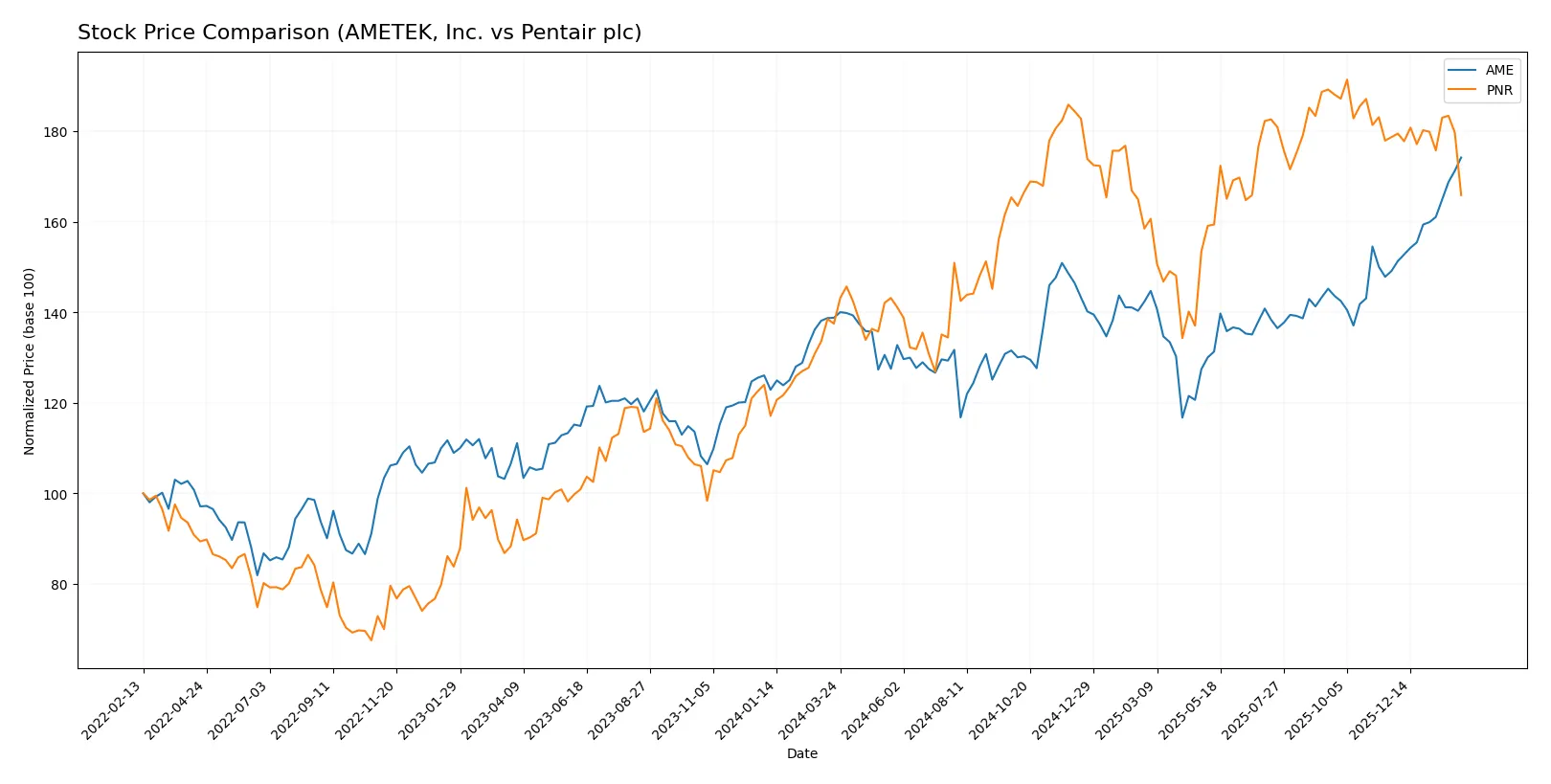

Over the past year, AMETEK, Inc. and Pentair plc exhibited distinct price movements, with AMETEK showing stronger upward momentum and Pentair experiencing recent weakness.

Trend Comparison

AMETEK, Inc. posted a bullish trend with a 25.51% price increase over 12 months, marked by accelerating gains and a high volatility of 14.42%. Its price fluctuated between 152.66 and 227.83.

Pentair plc also trended bullish over the year, gaining 20.65%, but momentum decelerated. Recently, it faced a 7.17% decline with lower volatility at 2.54%, signaling short-term weakness.

Comparing both, AMETEK delivered the highest market performance with sustained acceleration, while Pentair’s recent decline contrasts with AMETEK’s strong buyer dominance and volume increase.

Target Prices

Analysts present a clear target price consensus for AMETEK, Inc. and Pentair plc, reflecting moderate upside potential.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| AMETEK, Inc. | 204 | 271 | 237.91 |

| Pentair plc | 90 | 135 | 118.56 |

The AMETEK consensus target of $237.91 exceeds its current price of $227.83, implying modest appreciation. Pentair’s $118.56 target similarly suggests upside from its $97.28 market price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

AMETEK, Inc. Grades

The table below summarizes recent analyst grades for AMETEK, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-02-04 |

| DA Davidson | Maintain | Buy | 2026-02-04 |

| Barclays | Maintain | Equal Weight | 2026-02-04 |

| Oppenheimer | Downgrade | Perform | 2026-01-27 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-12 |

| Barclays | Maintain | Equal Weight | 2026-01-07 |

| Keybanc | Maintain | Overweight | 2026-01-07 |

| Keybanc | Maintain | Overweight | 2026-01-06 |

| Mizuho | Maintain | Outperform | 2026-01-05 |

| TD Cowen | Upgrade | Buy | 2025-12-23 |

Pentair plc Grades

The table below summarizes recent analyst grades for Pentair plc:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-02-04 |

| Oppenheimer | Maintain | Outperform | 2026-02-04 |

| JP Morgan | Maintain | Overweight | 2026-01-16 |

| Citigroup | Maintain | Buy | 2026-01-12 |

| BNP Paribas Exane | Downgrade | Underperform | 2026-01-07 |

| TD Cowen | Downgrade | Sell | 2026-01-05 |

| Jefferies | Upgrade | Buy | 2025-12-10 |

| Barclays | Downgrade | Equal Weight | 2025-12-04 |

| Oppenheimer | Maintain | Outperform | 2025-11-20 |

| Barclays | Maintain | Overweight | 2025-10-22 |

Which company has the best grades?

AMETEK, Inc. holds a generally stronger rating profile with multiple “Buy” and “Overweight” grades and fewer downgrades. Pentair shows mixed ratings, including significant downgrades to “Underperform” and “Sell.” This divergence may affect investor confidence and imply different risk profiles.

Risks specific to each company

The following risk categories identify critical pressure points and systemic threats facing AMETEK, Inc. and Pentair plc in the 2026 market environment:

1. Market & Competition

AMETEK, Inc.

- Operates in diversified industrial machinery markets with strong segments but faces stiff competition in aerospace and electronic instruments.

Pentair plc

- Focuses on water solutions with niche leadership, but highly competitive in filtration and pump markets amid evolving customer demands.

2. Capital Structure & Debt

AMETEK, Inc.

- Maintains a low debt-to-equity ratio (0.21), indicating conservative leverage and strong interest coverage (23.13x).

Pentair plc

- Higher leverage (D/E 0.42) but still manageable; interest coverage at 11.9x signals solid ability to service debt despite elevated risk.

3. Stock Volatility

AMETEK, Inc.

- Beta near 1.04 suggests market-level volatility; stable trading range with moderate volume.

Pentair plc

- Higher beta at 1.22 implies greater sensitivity to market swings, increasing investor risk in turbulent periods.

4. Regulatory & Legal

AMETEK, Inc.

- US-based with exposure to aerospace and industrial regulations; generally stable but vulnerable to tightening safety and environmental rules.

Pentair plc

- UK-headquartered, facing EU and global water treatment regulations; regulatory complexity could impact compliance costs and market access.

5. Supply Chain & Operations

AMETEK, Inc.

- Complex global supply chains for electronic components and metals pose operational risks, but diversified segments provide resilience.

Pentair plc

- Relies on global sourcing for water treatment components; operational disruptions or raw material costs could pressure margins.

6. ESG & Climate Transition

AMETEK, Inc.

- Moderate ESG risks, with opportunities in energy-efficient instruments; must enhance transparency to meet rising investor expectations.

Pentair plc

- Faces significant climate transition risks due to water resource management role; strong ESG focus could be a competitive advantage.

7. Geopolitical Exposure

AMETEK, Inc.

- Primarily US-focused with some international exposure; geopolitical tensions could affect aerospace and industrial exports.

Pentair plc

- UK-based with global footprint; Brexit and trade tensions introduce uncertainties in supply chains and international sales.

Which company shows a better risk-adjusted profile?

AMETEK’s strongest risk is supply chain complexity amid diversified industrial segments, while Pentair’s biggest concern is geopolitical exposure and regulatory complexity. Pentair’s higher beta and leverage signal greater volatility and financial risk. AMETEK’s conservative capital structure and stable market position offer a better risk-adjusted profile. Notably, AMETEK’s superior interest coverage ratio (23.13 vs. 11.9) confirms its stronger capacity to withstand economic shocks.

Final Verdict: Which stock to choose?

AMETEK, Inc. stands out with its superpower in sustaining a very favorable economic moat, driven by a growing ROIC exceeding its cost of capital. It excels in operational efficiency and value creation but demands vigilance due to its moderate liquidity ratios. This stock fits well in an aggressive growth portfolio seeking durable profitability.

Pentair plc offers a strategic moat rooted in solid capital returns and robust financial stability. Its favorable income quality and safer liquidity profile reduce risk compared to AMETEK. However, a declining ROIC trend tempers enthusiasm. Pentair suits investors aiming for Growth at a Reasonable Price (GARP) with a preference for stability.

If you prioritize durable value creation and expanding profitability, AMETEK is the compelling choice due to its accelerating financial momentum and strong moat. However, if you seek a more conservative profile with better liquidity and steady returns, Pentair offers better stability despite its slowing profitability. Both represent viable analytical scenarios tailored to distinct investor risk appetites.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of AMETEK, Inc. and Pentair plc to enhance your investment decisions: