Home > Comparison > Financial Services > ARES vs AMP

The strategic rivalry between Ares Management Corporation and Ameriprise Financial, Inc. defines the current trajectory of the asset management sector. Ares operates as a multi-asset alternative manager with a focus on credit, private equity, and real estate. Ameriprise delivers a diversified financial services platform emphasizing advice, wealth, and retirement solutions. This analysis will clarify which approach offers superior risk-adjusted returns for a balanced investment portfolio.

Table of contents

Companies Overview

Ares Management Corporation and Ameriprise Financial, Inc. stand as pivotal players in the asset management arena.

Ares Management Corporation: Alternative Asset Specialist

Ares Management Corporation dominates the alternative asset management sector across the US, Europe, and Asia. Its core revenue engine derives from managing diverse investment funds, direct lending, private equity, and real estate segments. In 2026, Ares focuses on expanding its control investments and self-originated financing within middle-market commercial real estate, leveraging its diversified asset approach.

Ameriprise Financial, Inc.: Comprehensive Wealth Manager

Ameriprise Financial, Inc. serves individual and institutional clients through a broad financial product suite. Its core revenue engine lies in Advice & Wealth Management, Asset Management, and Retirement & Protection Solutions. The 2026 strategy emphasizes integrating personalized financial planning with diversified investment products, aiming to deepen client relationships and expand asset management through institutional and retail channels.

Strategic Collision: Similarities & Divergences

Both companies operate in asset management but diverge on business philosophy: Ares pursues a control-oriented, alternative investment model, while Ameriprise emphasizes a broad, client-centric wealth management platform. Their competitive battleground centers on capturing institutional and retail assets through differentiated strategies. Investors find Ares offers specialized exposure to alternative assets; Ameriprise provides diversified wealth solutions with stable advisory revenue.

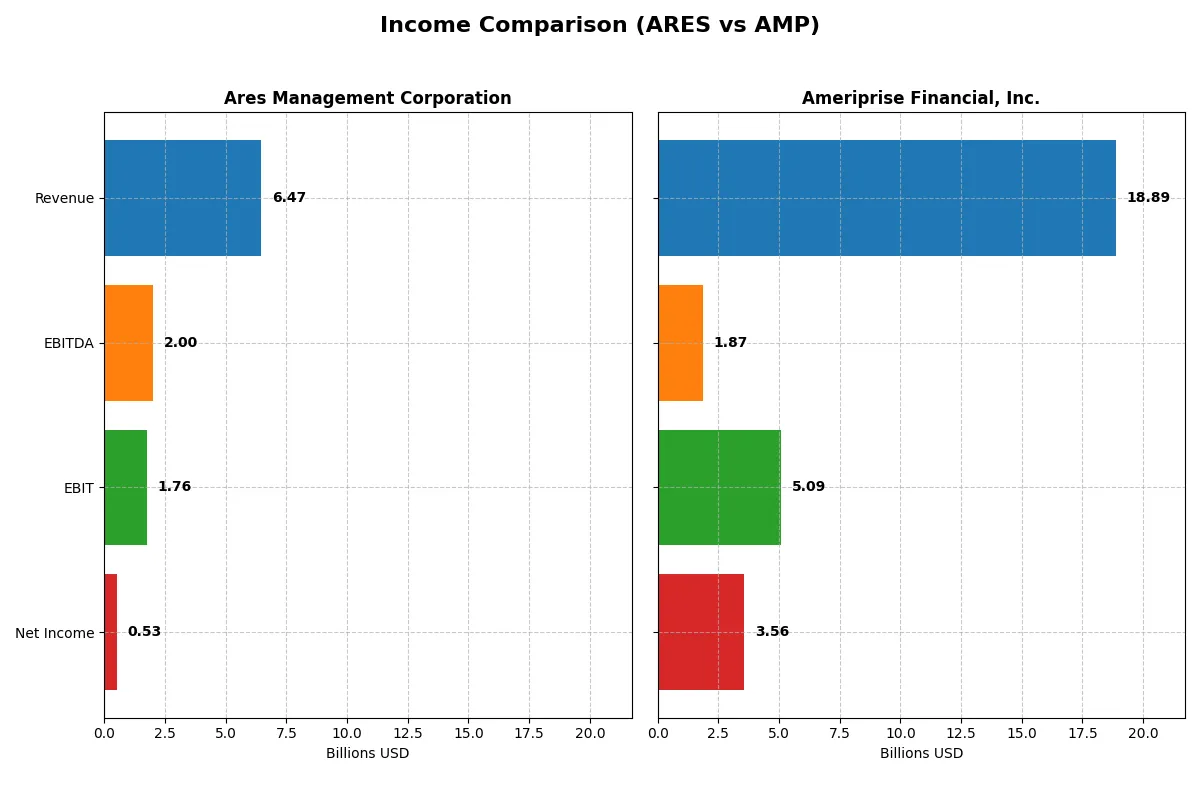

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Ares Management Corporation (ARES) | Ameriprise Financial, Inc. (AMP) |

|---|---|---|

| Revenue | 6.47B | 18.9B |

| Cost of Revenue | 1.39B | 8.68B |

| Operating Expenses | 1.05B | 5.12B |

| Gross Profit | 1.94B | 10.21B |

| EBITDA | 2.00B | 1.87B |

| EBIT | 1.76B | 5.09B |

| Interest Expense | 0 | 324M |

| Net Income | 527M | 3.56B |

| EPS | 1.96 | 36.9 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates with superior efficiency and sustainable profitability in their financial engines.

Ares Management Corporation Analysis

Ares grew revenue sharply by 67% in 2025, reaching $6.5B, but net income rose modestly to $527M. Gross margins contracted slightly, yet remained healthy at 30%. Net margin softened to 8.15%, reflecting some pressure on profitability despite strong top-line momentum. The drop in EPS contrasts with revenue growth, signaling margin and expense challenges.

Ameriprise Financial, Inc. Analysis

Ameriprise posted $18.9B revenue in 2025, growing steadily by 5.4% with a robust gross margin of 54%. Net income rose to $3.56B, generating an 18.9% net margin. EPS grew by 10%, underscoring operational efficiency amid modest revenue expansion. However, EBIT and net margin showed slight declines, hinting at margin pressure despite solid earnings growth.

Margin Resilience vs. Revenue Growth

Ameriprise delivers superior margins and higher net income, showcasing operational strength despite slower revenue gains. Ares impresses with rapid revenue growth but struggles to convert sales into proportional profits. For investors, Ameriprise’s consistent margin resilience offers a clearer path to sustainable earnings than Ares’ volatile margin profile.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies analyzed:

| Ratios | Ares Management Corporation (ARES) | Ameriprise Financial, Inc. (AMP) |

|---|---|---|

| ROE | 13.1% (2024) | 54.4% (2025) |

| ROIC | 3.96% (2024) | -135.1% (2025) |

| P/E | 75.6 (2024) | 13.0 (2025) |

| P/B | 9.89 (2024) | 7.10 (2025) |

| Current Ratio | 0.98 (2024) | 0 (2025) |

| Quick Ratio | 0.98 (2024) | 0 (2025) |

| D/E | 3.71 (2024) | 0.90 (2025) |

| Debt-to-Assets | 52.8% (2024) | 3.07% (2025) |

| Interest Coverage | 0.97 (2024) | 15.7 (2025) |

| Asset Turnover | 0.16 (2024) | 0.10 (2025) |

| Fixed Asset Turnover | 5.64 (2024) | 0 (2025) |

| Payout ratio | 283% (2024) | 17% (2025) |

| Dividend yield | 3.74% (2024) | 1.28% (2025) |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, exposing hidden risks and operational strengths essential for sound investment decisions.

Ares Management Corporation

Ares shows a neutral net margin at 8.15% but suffers from zero return on equity and invested capital, signaling weak core profitability. Its P/E ratio of 66.62 marks the stock as expensive and stretched in valuation. Shareholders gain a favorable 2.77% dividend yield, highlighting income focus amid limited reinvestment evidence.

Ameriprise Financial, Inc.

Ameriprise boasts a strong 18.86% net margin and an impressive 54.41% return on equity, reflecting efficient operations and robust profitability. The stock trades at a reasonable P/E of 13.05, suggesting fair valuation. Dividend yield stands at 1.28%, while reinvestment appears balanced despite a negative ROIC, indicating cautious capital allocation.

Balanced Profitability vs. Valuation Discipline

Ameriprise offers a compelling mix of operational efficiency and reasonable valuation, while Ares struggles with high valuation and weak returns. Investors prioritizing profitability and valuation discipline may find Ameriprise better aligned, whereas Ares suits those seeking higher dividend income amid stretched metrics.

Which one offers the Superior Shareholder Reward?

I see Ares Management offers a higher dividend yield at 3.74% versus Ameriprise’s 1.28% in 2025. Ares’s payout ratio exceeds 280%, signaling a risky distribution reliant on debt or external funding. Ameriprise maintains a prudent 17% payout, backed by strong free cash flow and a robust buyback program. Ares’s buybacks appear limited, increasing financial leverage dangerously. Historically, Ameriprise’s conservative payout and aggressive buybacks suggest a sustainable, higher total return. I conclude Ameriprise Financial delivers superior shareholder reward through disciplined capital allocation and safer distributions in 2026.

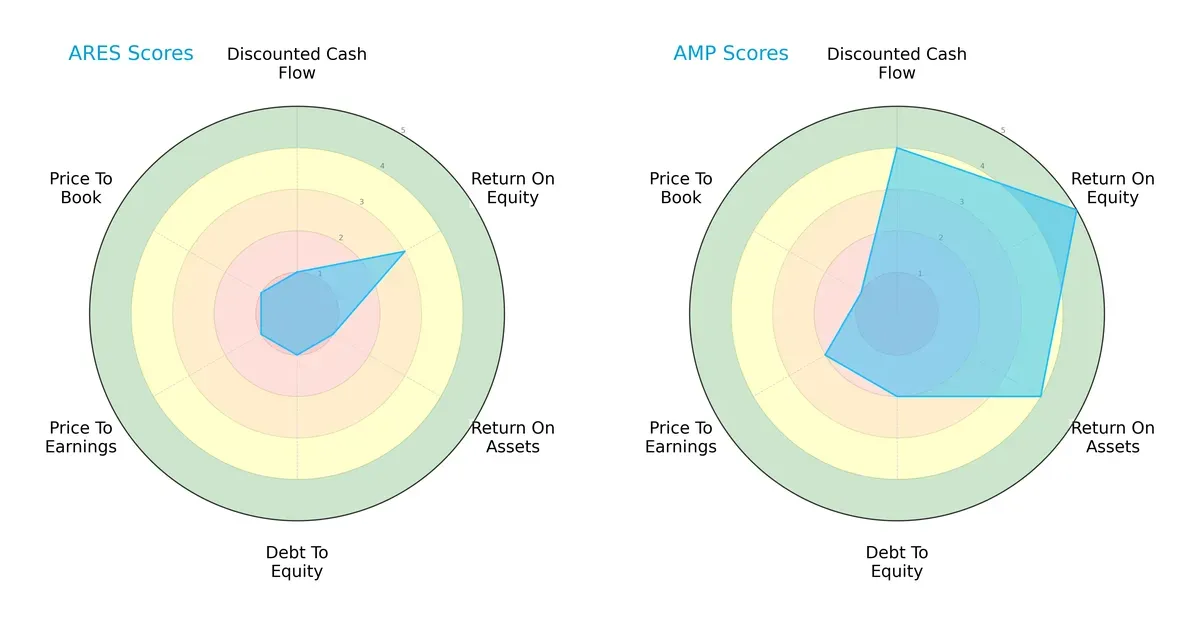

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Ares Management Corporation and Ameriprise Financial, Inc., highlighting their financial strengths and weaknesses:

Ameriprise dominates with strong DCF (4) and ROE (5) scores, signaling efficient capital allocation and profitability. Ares lags with very unfavorable scores in DCF (1), ROA (1), and leverage (1), showing financial strain. Ameriprise presents a more balanced profile, while Ares depends narrowly on moderate ROE (3) without support from asset efficiency or valuation metrics.

Bankruptcy Risk Duel (Altman Z-Score)

Altman Z-Scores are unavailable for Ares, so I omit this analysis.

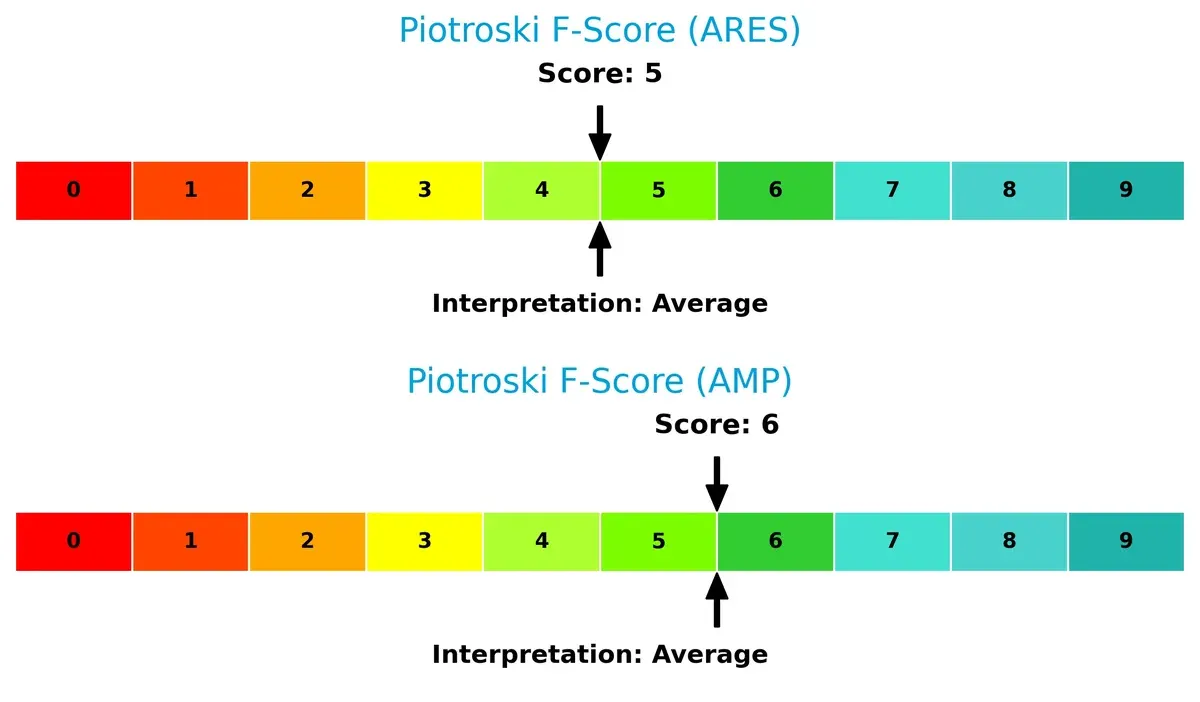

Financial Strength Showdown (Piotroski F-Score)

Financial Health: Quality of Operations

Ameriprise scores 6, slightly better than Ares’s 5, indicating marginally stronger internal financial health and operational efficiency. Both firms show average quality, with no glaring red flags, but neither reaches peak strength:

How are the two companies positioned?

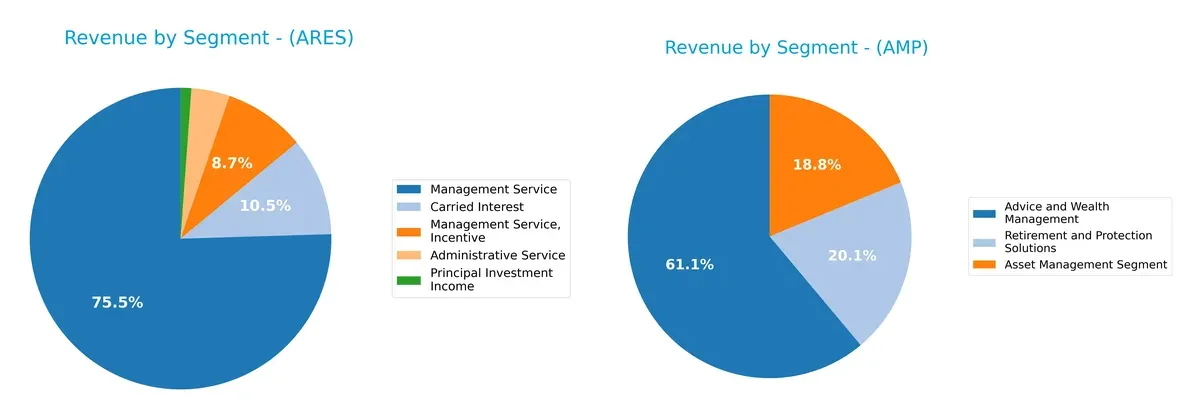

This section dissects the operational DNA of Ares and Ameriprise by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats to reveal which business model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Ares Management Corporation and Ameriprise Financial, Inc. diversify their income streams and where their primary sector bets lie:

Ares Management leans heavily on Management Service, generating $2.99B in 2024, anchoring its revenue. Carried Interest adds a $417M boost, but other segments remain modest. Conversely, Ameriprise delivers a more balanced mix with $11.44B from Advice and Wealth Management, $3.52B from Asset Management, and $3.77B from Retirement and Protection Solutions. Ameriprise’s diversified portfolio reduces concentration risk, while Ares depends on a dominant segment, exposing it to sector-specific cycles.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Ares Management Corporation and Ameriprise Financial, Inc.:

Ares Strengths

- Favorable debt-to-assets and interest coverage ratios

- Favorable dividend yield at 2.77%

- Diverse revenue streams including management and carried interest

- Favorable price-to-book ratio

- Stable administrative and management services revenue

Ameriprise Strengths

- Strong net margin at 18.86% and ROE at 54.41%

- Favorable price-to-earnings ratio at 13.05

- Favorable debt-to-assets and interest coverage ratios

- Large and growing Advice and Wealth Management segment

- Broad product segmentation and global presence with Non-US revenue

Ares Weaknesses

- Unfavorable ROE and ROIC at 0%

- Unfavorable current and quick ratios

- Unfavorable asset and fixed asset turnover

- High price-to-earnings ratio at 66.62

- Slightly unfavorable overall financial ratio profile

Ameriprise Weaknesses

- Unfavorable ROIC at -135.08%

- Unfavorable current and quick ratios

- Unfavorable asset and fixed asset turnover

- Unfavorable price-to-book ratio at 7.1

- Moderate dividend yield at 1.28% rated neutral

Both companies show strengths in leverage management and dividend policy, but each faces challenges in liquidity and asset efficiency. Ameriprise’s high profitability contrasts with Ares’s weaker returns, indicating divergent operational effectiveness impacting strategic focus.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only thing protecting long-term profits from relentless competitive erosion. Let’s dissect the true sources of defensibility for these two asset managers:

Ares Management Corporation: Diversified Alternative Asset Moat

Ares leverages its diversified strategy across credit, private equity, and real estate to build switching costs with institutional clients. This manifests in solid margin stability despite recent revenue volatility. New market expansions in Asia could deepen its moat, though declining ROIC signals caution.

Ameriprise Financial, Inc.: Integrated Wealth Management Moat

Ameriprise’s moat hinges on advice-driven client relationships and cross-selling within its wealth and asset management segments. It sustains higher gross margins than Ares, reflecting efficient capital deployment. However, a sharply declining ROIC and net margin pressure threaten its long-term value creation.

Moat Strength: Diversification vs. Client Integration

Ares’ broad alternative asset portfolio offers a wider moat through diversified income streams, but deteriorating capital returns weaken its defense. Ameriprise’s focused client integration delivers deeper value but suffers from profitability declines. Between the two, Ares currently appears better positioned to defend market share amid evolving industry dynamics.

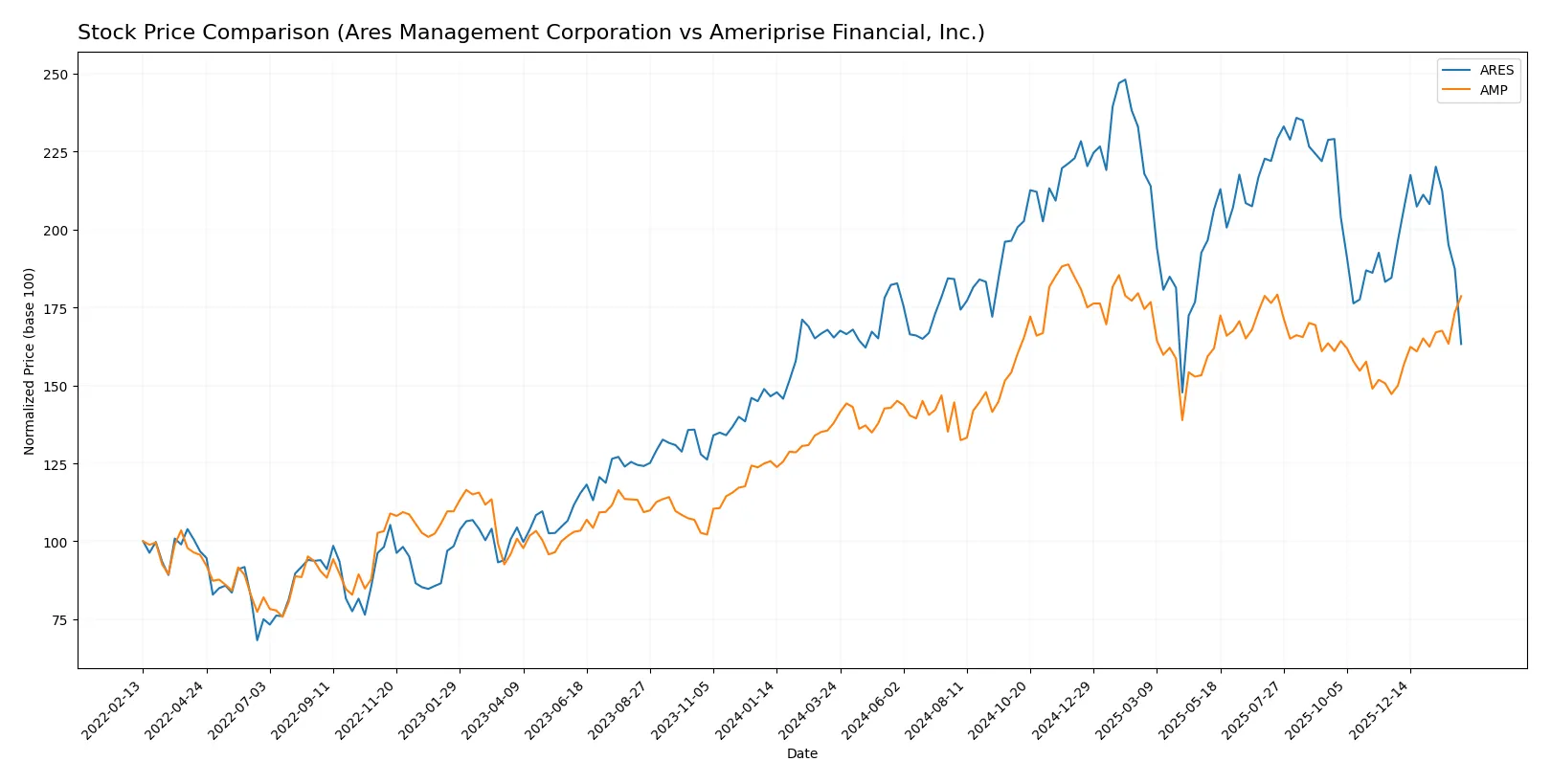

Which stock offers better returns?

The past year reveals contrasting price movements: Ares Management declines modestly while Ameriprise Financial surges with accelerating momentum.

Trend Comparison

Ares Management’s stock shows a bearish trend over the past 12 months with a -1.25% price change and decelerating decline. The price ranged between 118.04 and 198.22, with moderate volatility (18.74 std dev).

Ameriprise Financial exhibits a bullish trend over the same period, gaining 29.44% with accelerating momentum. The stock’s price fluctuated from 402.61 to 573.97, showing higher volatility (44.82 std dev).

Comparing both, Ameriprise Financial delivered the highest market performance, significantly outperforming Ares Management’s modest decline.

Target Prices

Analysts present a bullish consensus on Ares Management Corporation and Ameriprise Financial, indicating upside potential from current prices.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Ares Management Corporation | 155 | 215 | 187.29 |

| Ameriprise Financial, Inc. | 485 | 605 | 547.5 |

Both stocks trade below their target consensus, suggesting analysts expect substantial appreciation. Ares offers nearly 43% upside, while Ameriprise appears fairly valued but with room for growth.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Ares Management Corporation Grades

The following table summarizes recent grades from established financial institutions for Ares Management Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-02-06 |

| Oppenheimer | Maintain | Outperform | 2026-02-06 |

| TD Cowen | Maintain | Buy | 2026-01-14 |

| UBS | Maintain | Neutral | 2026-01-13 |

| Barclays | Maintain | Overweight | 2026-01-09 |

| Barclays | Maintain | Overweight | 2025-12-12 |

| TD Cowen | Maintain | Buy | 2025-11-04 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-11-04 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-21 |

| Oppenheimer | Upgrade | Outperform | 2025-10-14 |

Ameriprise Financial, Inc. Grades

Below are the latest grades from recognized analysts for Ameriprise Financial, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Jefferies | Maintain | Buy | 2026-02-02 |

| RBC Capital | Maintain | Outperform | 2026-02-02 |

| Piper Sandler | Upgrade | Neutral | 2026-01-30 |

| Morgan Stanley | Maintain | Underweight | 2025-12-22 |

| Argus Research | Maintain | Buy | 2025-11-13 |

| RBC Capital | Maintain | Outperform | 2025-11-03 |

| Keefe, Bruyette & Woods | Maintain | Market Perform | 2025-11-03 |

| Evercore ISI Group | Maintain | In Line | 2025-10-09 |

| Morgan Stanley | Maintain | Underweight | 2025-10-01 |

| RBC Capital | Maintain | Outperform | 2025-07-30 |

Which company has the best grades?

Ares Management Corporation consistently receives higher grades such as Overweight, Outperform, and Buy from top-tier firms. Ameriprise shows a mixed profile with Underweight and Neutral grades alongside some Buy ratings. This suggests Ares holds stronger analyst conviction, potentially signaling greater investor confidence and upside potential.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing Ares Management Corporation and Ameriprise Financial, Inc. in the 2026 market environment:

1. Market & Competition

Ares Management Corporation

- Faces intense competition in alternative asset management; niche focus may limit scale advantages.

Ameriprise Financial, Inc.

- Broad financial services with diversified segments, but faces pressure from fintech disruptors and wealth managers.

2. Capital Structure & Debt

Ares Management Corporation

- Exhibits very low debt levels, indicating conservative leverage and lower financial risk.

Ameriprise Financial, Inc.

- Moderate debt-to-equity ratio at 0.9, posing manageable but higher leverage risk.

3. Stock Volatility

Ares Management Corporation

- High beta at 1.54 signals greater stock volatility relative to the market.

Ameriprise Financial, Inc.

- Lower beta at 1.25 suggests comparatively less price fluctuation and market sensitivity.

4. Regulatory & Legal

Ares Management Corporation

- Subject to asset management regulations across multiple regions, potential compliance complexity.

Ameriprise Financial, Inc.

- Faces extensive regulatory scrutiny given broad financial product offerings and insurance businesses.

5. Supply Chain & Operations

Ares Management Corporation

- Operational risks stem from managing diverse asset portfolios across geographies and sectors.

Ameriprise Financial, Inc.

- Operational complexity heightened by multiple business lines and reliance on advisory channels.

6. ESG & Climate Transition

Ares Management Corporation

- Increasing pressure to integrate ESG in alternative investments; reputational risk if lagging peers.

Ameriprise Financial, Inc.

- ESG focus critical as insurer and wealth manager; must align with evolving client expectations and regulations.

7. Geopolitical Exposure

Ares Management Corporation

- Global footprint across US, Europe, Asia exposes it to geopolitical risks and regulatory shifts.

Ameriprise Financial, Inc.

- Primarily US-based but with international clients; geopolitical tensions could disrupt cross-border flows.

Which company shows a better risk-adjusted profile?

Ares faces its biggest risk in stock volatility due to a high beta of 1.54, increasing market sensitivity. Ameriprise contends with capital structure risk from moderate leverage but benefits from more diversified revenue streams and lower volatility. Despite Ameriprise’s distress-zone Altman Z-score, its superior profitability and operational scale support a better risk-adjusted profile. The recent surge in Ares’s stock price coupled with weak profitability metrics justifies caution. Overall, Ameriprise offers a more balanced risk-return tradeoff for 2026 investors.

Final Verdict: Which stock to choose?

Ares Management Corporation excels as a capital allocator with a proven ability to generate steady cash flow despite some headwinds in profitability metrics. Its main point of vigilance remains its stretched balance sheet and recent declines in returns on invested capital. This profile suits investors seeking exposure to alternative asset management with an aggressive growth appetite.

Ameriprise Financial, Inc. boasts a strategic moat rooted in its strong recurring revenue and brand presence in wealth management. It offers superior profitability and a more robust income quality compared to Ares, presenting a safer investment profile. This makes it attractive for investors focused on growth at a reasonable price with moderate risk tolerance.

If you prioritize dynamic capital deployment and are comfortable navigating balance sheet challenges, Ares might be the compelling choice due to its cash flow resilience. However, if you seek better income stability and a fortified competitive position, Ameriprise offers stronger profitability and risk-adjusted returns, despite commanding a premium valuation. Both demand careful risk assessment given their evolving financial dynamics.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Ares Management Corporation and Ameriprise Financial, Inc. to enhance your investment decisions: