American Tower Corporation (AMT) and SBA Communications Corporation (SBAC) are two prominent players in the specialty REIT sector, focusing on wireless communications infrastructure. Both companies operate extensive portfolios of communication sites and serve as critical enablers of the growing demand for mobile connectivity and data transmission. This comparison explores their market positioning and innovation strategies to help you identify the most compelling investment opportunity in this evolving industry.

Table of contents

Companies Overview

I will begin the comparison between American Tower Corporation and SBA Communications Corporation by providing an overview of these two companies and their main differences.

American Tower Corporation Overview

American Tower Corporation is a leading independent owner, operator, and developer of multitenant communications real estate, with a portfolio of approximately 219,000 communications sites. As one of the largest global REITs in the specialty real estate sector, it focuses on providing infrastructure for wireless communication across multiple regions, positioning itself as a key player in the market.

SBA Communications Corporation Overview

SBA Communications Corporation is a prominent owner and operator of wireless communications infrastructure across the Americas and South Africa. The company generates revenue primarily through site leasing and site development services, focusing on leasing antenna space on multi-tenant communication sites to wireless service providers under long-term contracts, making it a preferred provider in its sector.

Key similarities and differences

Both American Tower and SBA Communications operate within the specialty REIT sector, focusing on wireless communications infrastructure and leasing antenna space on multi-tenant sites. However, American Tower has a significantly larger portfolio and workforce, while SBA emphasizes its geographic reach in the Americas and South Africa, with a more concentrated employee base and a dual revenue model including site development services.

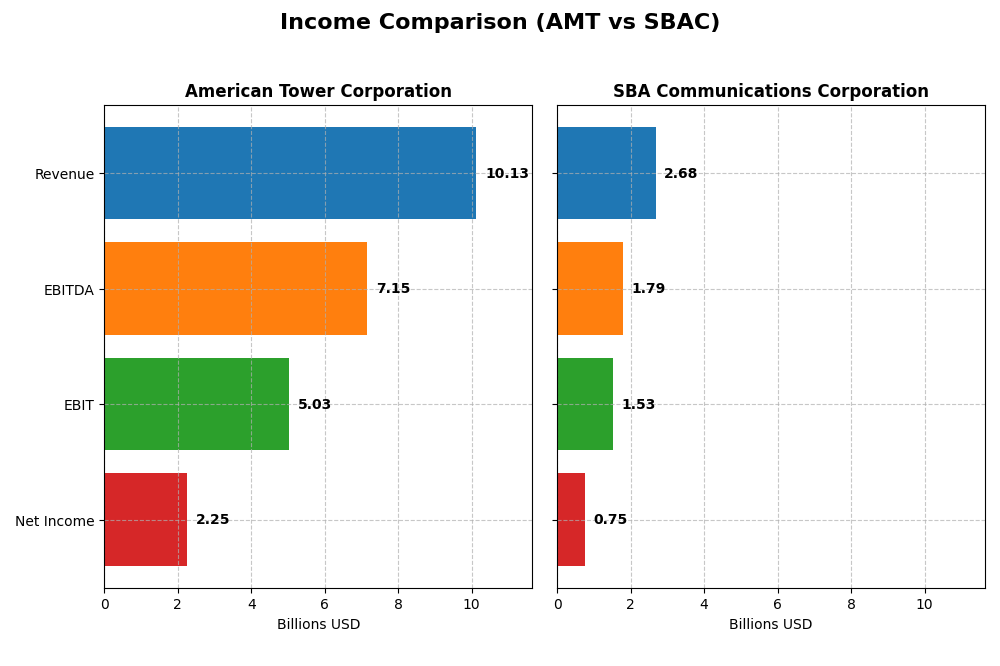

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for American Tower Corporation (AMT) and SBA Communications Corporation (SBAC) for the fiscal year 2024.

| Metric | American Tower Corporation (AMT) | SBA Communications Corporation (SBAC) |

|---|---|---|

| Market Cap | 79.7B | 19.5B |

| Revenue | 10.13B | 2.68B |

| EBITDA | 7.15B | 1.79B |

| EBIT | 5.03B | 1.53B |

| Net Income | 2.26B | 750M |

| EPS | 4.83 | 6.96 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

American Tower Corporation

American Tower Corporation’s revenue grew steadily by 25.94% over 2020-2024, with net income rising 33.38%. Margins remained largely stable, supported by a favorable gross margin of 74.58% and a strong net margin of 22.27%. In 2024, revenue growth slowed to 1.15%, but EBIT surged 72.38%, lifting net margin and EPS by over 50%, indicating improved profitability despite moderate top-line gains.

SBA Communications Corporation

SBA Communications saw revenue increase by 28.63% over the five-year span, while net income experienced a remarkable 3009.59% growth, reflecting significant margin expansion. Its gross margin of 77.32% and net margin of 27.97% are favorable, with EBIT margin at 56.91%. In 2024, revenue declined slightly by 1.18%, but EBIT grew 41.85%, and net margin and EPS increased by about 50%, signaling operational leverage despite minor revenue contraction.

Which one has the stronger fundamentals?

Both companies exhibit favorable income statement fundamentals, with SBA Communications outperforming American Tower in net income and margin expansion. SBA’s zero interest expense and higher EBIT margin contrast with American Tower’s unfavorable interest expense ratio. However, American Tower shows more consistent revenue growth. Overall, SBA’s stronger margin improvements and exceptional net income growth weigh positively against American Tower’s steadier top-line gains.

Financial Ratios Comparison

The table below compares key financial ratios for American Tower Corporation (AMT) and SBA Communications Corporation (SBAC) based on their latest fiscal year 2024 data.

| Ratios | American Tower Corporation (AMT) | SBA Communications Corporation (SBAC) |

|---|---|---|

| ROE | 66.7% | -14.7% |

| ROIC | 7.0% | 12.6% |

| P/E | 38.0 | 29.4 |

| P/B | 25.3 | -4.31 |

| Current Ratio | 0.45 | 1.10 |

| Quick Ratio | 0.45 | 1.10 |

| D/E (Debt to Equity) | 13.0 | -3.08 |

| Debt-to-Assets | 72.0% | 138.0% |

| Interest Coverage | 3.22 | 0 |

| Asset Turnover | 0.166 | 0.235 |

| Fixed Asset Turnover | 0.373 | 0.419 |

| Payout Ratio | 136% | 56.6% |

| Dividend Yield | 3.59% | 1.93% |

Interpretation of the Ratios

American Tower Corporation

American Tower shows strong net margin (22.27%) and exceptional return on equity (66.67%), but faces concerns with high debt levels (debt-to-assets at 71.96%) and liquidity ratios below 1. The price multiples (PE 37.98, PB 25.33) appear stretched. The company pays dividends with a 3.59% yield, suggesting a stable shareholder return despite some leverage risks.

SBA Communications Corporation

SBA Communications displays favorable net margin (27.97%) and return on invested capital (12.57%), yet suffers from negative return on equity (-14.67%) and very high debt-to-assets (138%). Liquidity ratios are neutral to favorable, and interest coverage is strong. The dividend yield is moderate at 1.93%, reflecting modest shareholder returns amid financial imbalances.

Which one has the best ratios?

SBA Communications has a more balanced ratio profile with half favorable and fewer unfavorable metrics, while American Tower’s high leverage and weak liquidity weigh on its overall rating. SBA’s stronger operating returns contrast with its negative equity returns, making its ratios slightly more favorable than American Tower’s predominantly unfavorable evaluations.

Strategic Positioning

This section compares the strategic positioning of American Tower Corporation and SBA Communications Corporation, including market position, key segments, and exposure to technological disruption:

American Tower Corporation

- One of the largest global REITs with 219K communication sites; faces competitive pressure in multitenant communications real estate.

- Revenue mainly from property leasing (~9.9B in 2024); smaller services revenue (~194M); focus on multitenant communications real estate.

- No explicit data on exposure; operates in communications real estate with gradual technological evolution risks.

SBA Communications Corporation

- Leading owner/operator in Americas and South Africa; competes in wireless infrastructure leasing and site development services.

- Revenue from domestic and international site leasing (~2.5B total in 2024) and site development construction (~153M).

- Exposure linked to wireless infrastructure development; impacted by advances in wireless technology and network demands.

American Tower Corporation vs SBA Communications Corporation Positioning

American Tower pursues a more diversified global footprint with a larger asset base, while SBA focuses on concentrated geographic regions with dual revenue from leasing and development. American Tower’s scale offers breadth, SBA’s model integrates development services but with smaller market cap.

Which has the best competitive advantage?

Based on MOAT evaluation, SBA demonstrates a very favorable competitive advantage with strong value creation and growing ROIC, while American Tower shows a slightly favorable moat with increasing profitability but less value creation.

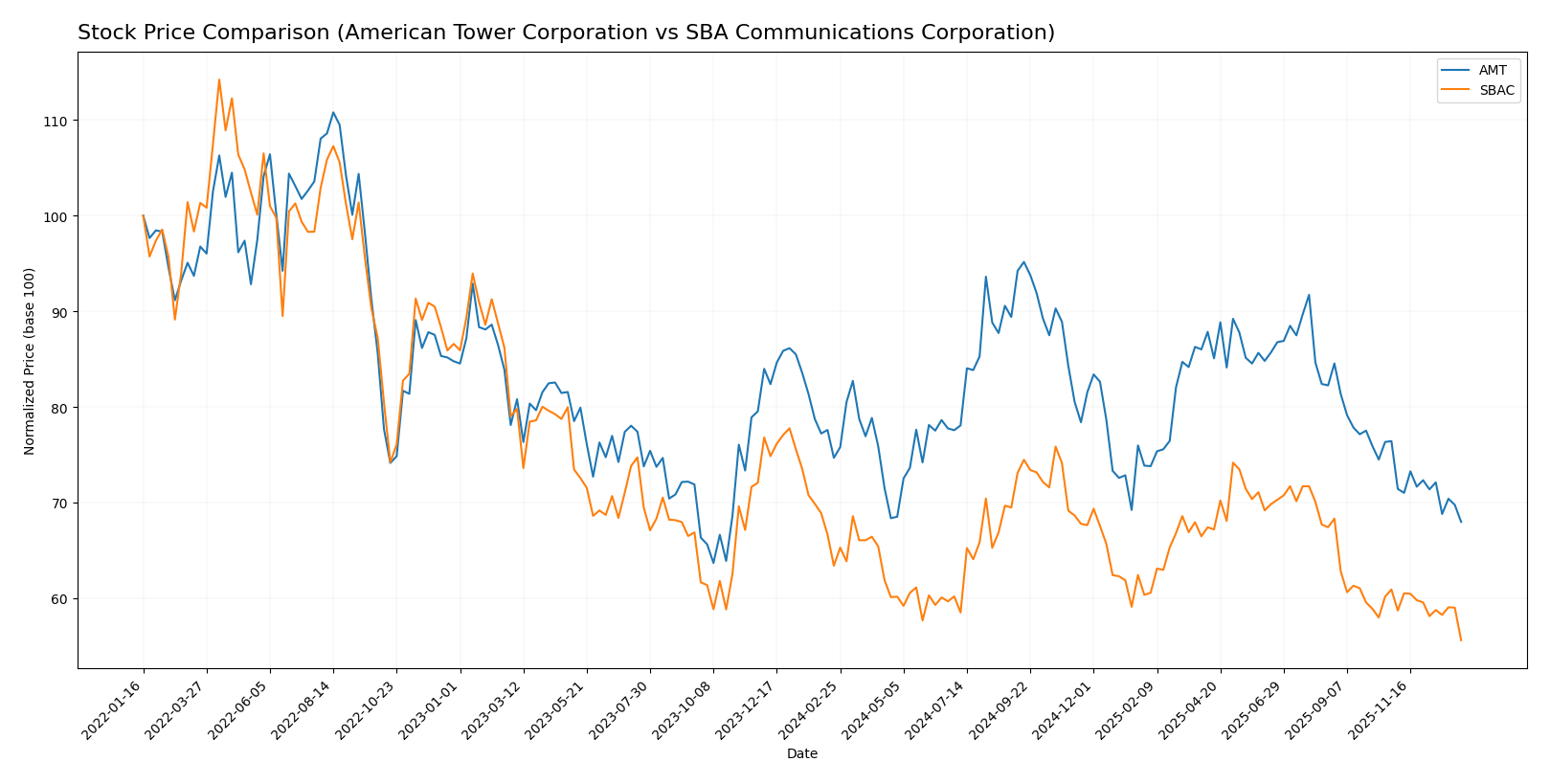

Stock Comparison

The stock price movements of American Tower Corporation (AMT) and SBA Communications Corporation (SBAC) over the past year reveal significant bearish trends with notable price declines and decelerating momentum.

Trend Analysis

American Tower Corporation’s stock shows a bearish trend over the past 12 months with a price decline of 8.98%, decelerating momentum, and high volatility indicated by a 17.37 std deviation. The stock ranged between 170.33 and 238.5.

SBA Communications Corporation’s stock also experienced a bearish trend, dropping 12.3% over the same period with decelerating momentum and a 16.35 std deviation. Its price fluctuated from 181.36 to 247.47.

Comparing both stocks, SBA Communications exhibited a larger price decline, thus underperforming American Tower in market performance over the past year.

Target Prices

Analysts present a favorable target price consensus for both American Tower Corporation and SBA Communications Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| American Tower Corporation | 260 | 200 | 226 |

| SBA Communications Corporation | 280 | 205 | 240.57 |

The target consensus for American Tower (226) and SBA Communications (240.57) significantly exceeds their current stock prices of 170.33 and 181.36 respectively, indicating positive analyst expectations for future growth.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for American Tower Corporation and SBA Communications Corporation:

Rating Comparison

AMT Rating

- Rating: B, classified as Very Favorable.

- Discounted Cash Flow Score: 4, Favorable.

- ROE Score: 5, Very Favorable.

- ROA Score: 4, Favorable.

- Debt To Equity Score: 1, Very Unfavorable.

- Overall Score: 3, Moderate.

SBAC Rating

- Rating: B-, also Very Favorable.

- Discounted Cash Flow Score: 5, Very Favorable.

- ROE Score: 1, Very Unfavorable.

- ROA Score: 5, Very Favorable.

- Debt To Equity Score: 1, Very Unfavorable.

- Overall Score: 3, Moderate.

Which one is the best rated?

Based on the data, AMT has stronger ROE performance, while SBAC excels in discounted cash flow and ROA scores. Both have identical overall and debt-to-equity scores, indicating a balanced but different financial profile.

Scores Comparison

Here is the comparison of the Altman Z-Score and Piotroski Score for American Tower Corporation and SBA Communications Corporation:

AMT Scores

- Altman Z-Score: 1.18, in distress zone indicating high risk

- Piotroski Score: 6, average financial strength

SBAC Scores

- Altman Z-Score: 0.49, in distress zone indicating very high risk

- Piotroski Score: 6, average financial strength

Which company has the best scores?

Both AMT and SBAC are in the distress zone for Altman Z-Score, but AMT’s score is higher, indicating relatively lower bankruptcy risk. Both have the same average Piotroski Score of 6, showing comparable financial strength.

Grades Comparison

Here is a detailed comparison of the latest grades for American Tower Corporation and SBA Communications Corporation:

American Tower Corporation Grades

The following table summarizes recent grades and actions from reputable financial institutions for American Tower Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Sector Perform | 2025-12-19 |

| Morgan Stanley | Maintain | Overweight | 2025-12-05 |

| Barclays | Downgrade | Equal Weight | 2025-12-01 |

| Barclays | Maintain | Overweight | 2025-11-17 |

| Raymond James | Maintain | Strong Buy | 2025-10-29 |

| JP Morgan | Maintain | Overweight | 2025-10-29 |

| Wells Fargo | Maintain | Overweight | 2025-10-29 |

| BMO Capital | Maintain | Outperform | 2025-10-29 |

| Wells Fargo | Maintain | Overweight | 2025-10-20 |

| Barclays | Maintain | Overweight | 2025-10-17 |

American Tower’s grades mostly indicate a positive outlook, with multiple “Overweight” and “Outperform” ratings, alongside a “Strong Buy” from Raymond James and a recent downgrade only by Barclays.

SBA Communications Corporation Grades

Below are the recent grades and actions from established grading companies for SBA Communications Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2025-12-16 |

| Barclays | Maintain | Overweight | 2025-12-01 |

| Barclays | Maintain | Overweight | 2025-11-17 |

| RBC Capital | Maintain | Outperform | 2025-11-10 |

| BMO Capital | Maintain | Market Perform | 2025-11-04 |

| TD Cowen | Maintain | Buy | 2025-11-04 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-20 |

| Citigroup | Maintain | Buy | 2025-10-16 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-16 |

| UBS | Maintain | Buy | 2025-10-14 |

SBA Communications shows a mixed but generally positive rating profile, with several “Buy” and “Overweight” grades, complemented by “Equal Weight” and “Market Perform” ratings, with no recent downgrades.

Which company has the best grades?

Both American Tower and SBA Communications hold predominantly positive grades with consensus “Buy” ratings; however, American Tower exhibits a slightly stronger rating profile with more “Overweight” and “Outperform” grades. This could imply relatively higher analyst confidence in American Tower’s growth prospects, potentially impacting investor sentiment.

Strengths and Weaknesses

Below is a summary table highlighting the key strengths and weaknesses of American Tower Corporation (AMT) and SBA Communications Corporation (SBAC) based on their latest financial and operational data.

| Criterion | American Tower Corporation (AMT) | SBA Communications Corporation (SBAC) |

|---|---|---|

| Diversification | Moderate: Primarily property leasing with limited services | Good: Mix of domestic/international site leasing and development |

| Profitability | Moderate net margin (22.3%), high ROE (66.7%), neutral ROIC | Higher net margin (28.0%), favorable ROIC (12.6%), but negative ROE |

| Innovation | Limited innovation focus; steady property revenue growth | Strong growth in site development construction revenues |

| Global presence | Strong global footprint with property assets worldwide | Expanding international leasing with growing global sites |

| Market Share | Large property base with $9.9B in property revenue in 2024 | Growing market share with $1.86B domestic and $665M international leasing |

Key takeaways: SBA Communications demonstrates a very favorable competitive advantage with a growing ROIC and diversified revenue streams, especially in site development. American Tower shows increasing profitability but still sheds value compared to capital costs, with a more concentrated revenue base and some financial weaknesses. Investors should weigh SBA’s growth potential against AMT’s stability and dividend yield.

Risk Analysis

Below is a comparison of key risks for American Tower Corporation (AMT) and SBA Communications Corporation (SBAC) based on the most recent 2024 data:

| Metric | American Tower Corporation (AMT) | SBA Communications Corporation (SBAC) |

|---|---|---|

| Market Risk | Moderate (Beta 0.93) | Moderate (Beta 0.87) |

| Debt level | High (Debt/Assets 72%, D/E 13.0) | Very High (Debt/Assets 138%, D/E -3.08) |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | Moderate | Moderate |

| Environmental Risk | Low to Moderate | Low to Moderate |

| Geopolitical Risk | Moderate (Global portfolio) | Moderate (Americas & South Africa) |

The most pressing risks are the very high debt levels for both companies, especially SBA Communications with debt exceeding assets, signaling elevated financial risk. Both firms face moderate market and geopolitical risks due to their global infrastructure operations. American Tower shows signs of financial distress per Altman Z-score, warranting cautious risk management.

Which Stock to Choose?

American Tower Corporation (AMT) shows a favorable income statement with consistent growth in net margin and EPS. Its financial ratios are mixed, exhibiting strong profitability but high debt and weak liquidity. The company’s overall rating is very favorable, supported by a slightly favorable moat despite an Altman Z-Score in the distress zone.

SBA Communications Corporation (SBAC) presents a strong income growth profile and favorable margins, with better free cash flow yield and a very favorable moat indicating a durable competitive advantage. However, it displays negative return on equity and high debt-to-assets, resulting in a very favorable rating with some caution due to a distress zone Altman Z-Score.

Investors focused on durable competitive advantages and strong income growth might find SBAC appealing, while those prioritizing profitability and overall rating stability could see AMT as a potential option. The choice may depend on tolerance for debt levels and preference for financial ratio profiles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of American Tower Corporation and SBA Communications Corporation to enhance your investment decisions: