Home > Comparison > Utilities > AEP vs EXC

The strategic rivalry between American Electric Power Company, Inc. and Exelon Corporation shapes the Utilities sector’s evolution. AEP operates as a vertically integrated electric utility, focusing on generation, transmission, and distribution. Exelon, meanwhile, combines regulated electric and gas services with extensive nuclear and renewable assets. This analysis probes their contrasting operational models to identify which company’s trajectory offers superior risk-adjusted returns for a diversified portfolio in today’s energy landscape.

Table of contents

Companies Overview

American Electric Power and Exelon dominate the regulated electric sector with expansive generation and distribution networks.

American Electric Power Company, Inc.: Vertically Integrated Electricity Giant

American Electric Power operates as a regulated electric utility, generating and distributing electricity across the U.S. Its revenue stems from vertically integrated utilities, transmission, and wholesale power sales. In 2026, AEP focuses strategically on expanding its transmission infrastructure and diversifying energy sources, including renewables, to strengthen grid reliability and sustainability.

Exelon Corporation: Comprehensive Energy Services Leader

Exelon specializes in energy generation, delivery, and marketing across the U.S. and Canada. Its core revenue comes from a diversified portfolio of nuclear, fossil, wind, and solar generation combined with regulated electricity and natural gas distribution. In 2026, Exelon prioritizes expanding renewable assets and enhancing customer solutions while maintaining regulated utility operations for stable cash flow.

Strategic Collision: Similarities & Divergences

Both companies emphasize regulated electric utilities but diverge in scope and strategy. AEP focuses on vertical integration and transmission expansion, while Exelon adopts a broader energy services approach including natural gas and customer-centric solutions. Their primary battleground lies in renewable energy adoption and grid modernization. Each presents distinct investment profiles—AEP leans on infrastructure growth, Exelon on diversified energy delivery and services.

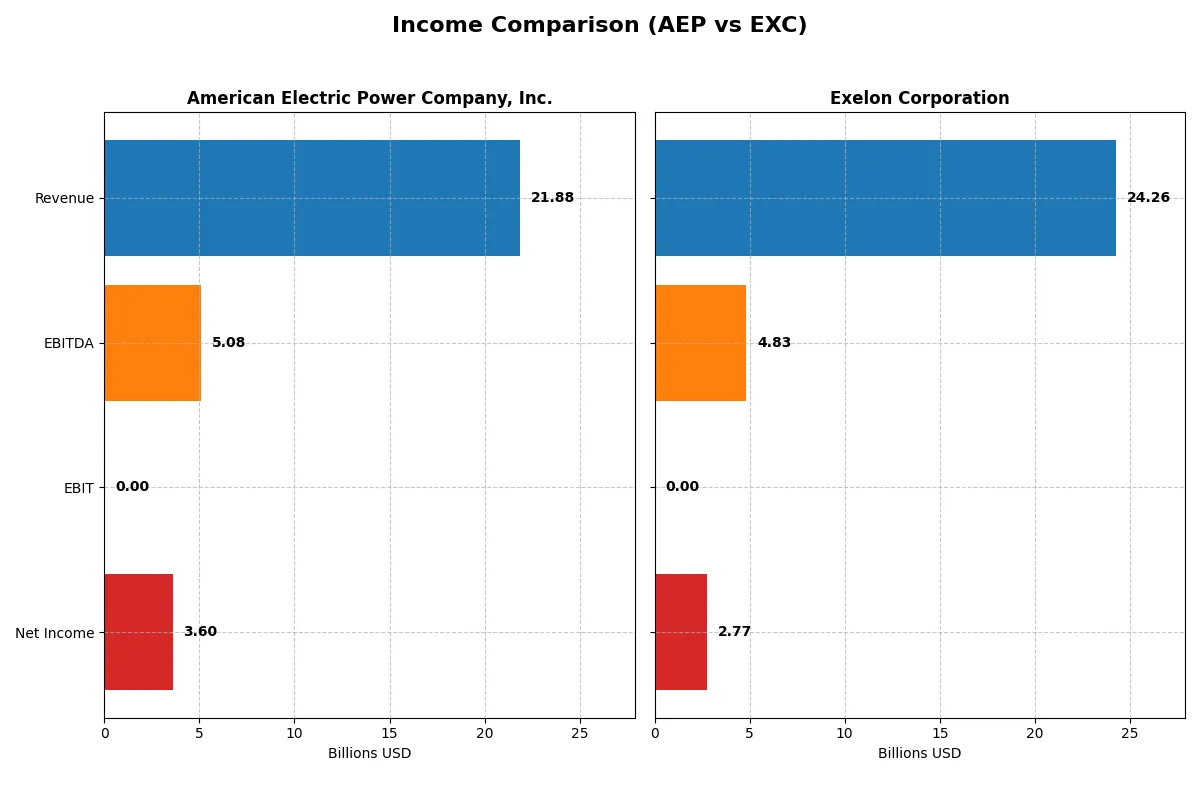

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | American Electric Power Company, Inc. (AEP) | Exelon Corporation (EXC) |

|---|---|---|

| Revenue | 21.9B | 24.3B |

| Cost of Revenue | 0 | 13.1B |

| Operating Expenses | 0 | 19.1B |

| Gross Profit | 0 | 11.1B |

| EBITDA | 5.1B | 4.8B |

| EBIT | 0 | 0 |

| Interest Expense | -2.0B | -2.1B |

| Net Income | 3.6B | 2.8B |

| EPS | 6.66 | 2.74 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals how efficiently each company converts revenue into profit, spotlighting their operational strengths and weaknesses.

American Electric Power Company, Inc. (AEP) Analysis

AEP’s revenue climbed steadily from 16.6B in 2021 to 21.9B in 2025, driving net income growth from 2.49B to 3.60B. Despite a missing gross profit figure in 2025, net margin improved to a healthy 16.4%, signaling stronger bottom-line efficiency. The company’s EPS surged 19% in the latest year, reflecting solid momentum.

Exelon Corporation (EXC) Analysis

EXC posted revenue growth from 17.9B in 2021 to 24.3B in 2025, with net income rising from 1.71B to 2.77B. Gross margin remains robust at nearly 46% in 2025, but EBIT margin data is unavailable, clouding full margin analysis. EPS growth of 11.4% last year highlights steady profitability improvement, albeit at lower margin levels than AEP.

Margin Strength vs. Top-Line Expansion

AEP leads with superior net margin and EPS growth, showcasing more efficient profit conversion. EXC outpaces in revenue scale and gross margin but trails in net margin and EBIT visibility. Investors seeking margin resilience may prefer AEP’s profile, while those favoring top-line expansion might lean towards EXC’s broader scale.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of each company:

| Ratios | American Electric Power Company, Inc. (AEP) | Exelon Corporation (EXC) |

|---|---|---|

| ROE | 11.5% | 17.7% |

| ROIC | -54.6% | -53.8% |

| P/E | 16.6 | 15.9 |

| P/B | 1.92 | 2.82 |

| Current Ratio | 0 | 0 |

| Quick Ratio | 0 | 0 |

| D/E | 0.144 | 3.18 |

| Debt-to-Assets | 0 | 0 |

| Interest Coverage | -2.63 | -2.45 |

| Asset Turnover | 0 | 0 |

| Fixed Asset Turnover | 0 | 0 |

| Payout ratio | 55.9% | 58.4% |

| Dividend yield | 3.36% | 3.67% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, exposing hidden risks and operational strengths critical for investment decisions.

American Electric Power Company, Inc.

AEP posts a solid 11.55% ROE and a robust 16.43% net margin, reflecting operational efficiency. Its P/E of 16.64 and P/B of 1.92 signal a fairly valued stock, neither cheap nor stretched. The 3.36% dividend yield rewards shareholders, underlining steady cash returns amid moderate reinvestment.

Exelon Corporation

EXC delivers a strong 17.74% ROE, slightly higher than AEP, with an 11.41% net margin. Its P/E of 15.92 and P/B of 2.82 suggest a neutral valuation, though the higher leverage ratio (D/E 3.18) raises risk. A 3.67% dividend yield offers steady income, balancing growth and shareholder returns.

Balanced Valuation Meets Leverage Risk

Both companies present favorable dividend yields and neutral valuations, but AEP’s lower leverage offers more financial stability. EXC’s higher ROE comes with greater debt risk. Investors prioritizing risk management may lean toward AEP, while those seeking higher return potential might consider EXC’s profile.

Which one offers the Superior Shareholder Reward?

I see American Electric Power (AEP) offers a 3.36% dividend yield with a sustainable 56% payout ratio backed by strong free cash flow of 13.1/share. Its buyback program is steady but modest. Exelon (EXC) yields 3.67%, with a 58% payout ratio, but negative free cash flow pressures sustainability. EXC’s buybacks are limited given capex demands. AEP’s robust cash flow coverage and disciplined capital allocation make it the superior choice for reliable, long-term total shareholder return in 2026.

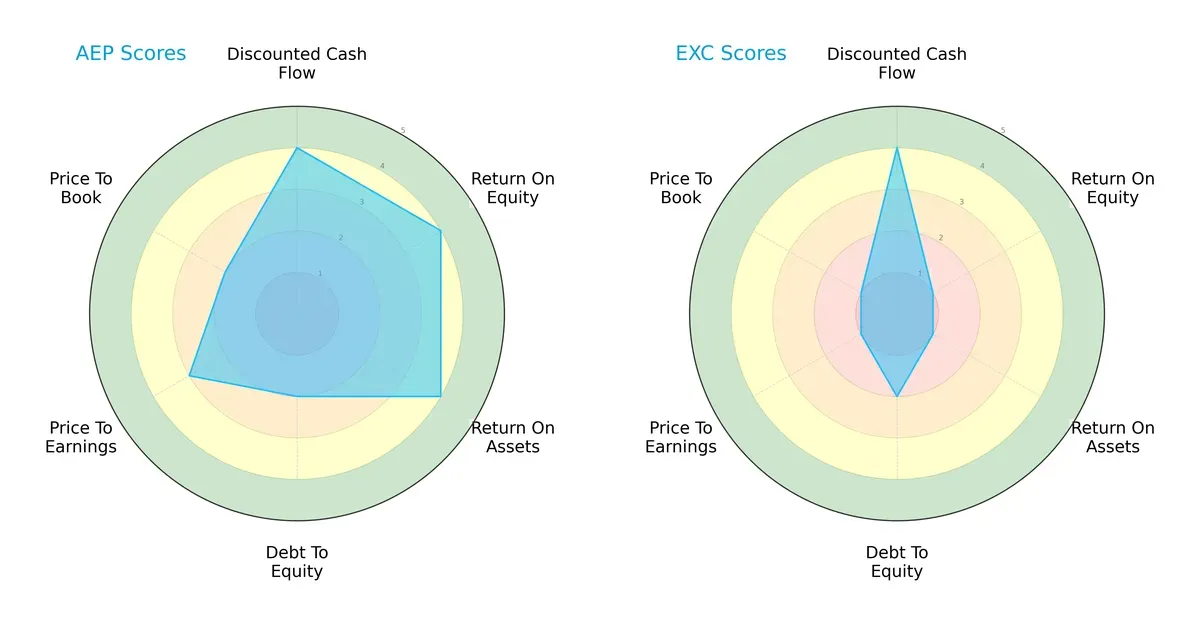

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of American Electric Power Company, Inc. and Exelon Corporation:

American Electric Power (AEP) showcases a balanced profile with solid DCF (4), ROE (4), and ROA (4) scores, but a weaker debt-to-equity (2) and price-to-book (2) score. Exelon (EXC) relies heavily on its DCF strength (4) but suffers from very low profitability scores—ROE (1) and ROA (1)—and poor valuation metrics (P/E 1, P/B 1). AEP’s diversified strengths suggest better operational efficiency and valuation discipline, while EXC depends on future cash flow optimism despite weak current profitability.

Bankruptcy Risk: Solvency Showdown

American Electric Power’s Altman Z-Score of 1.05 places it in the distress zone, signaling elevated bankruptcy risk in this economic cycle:

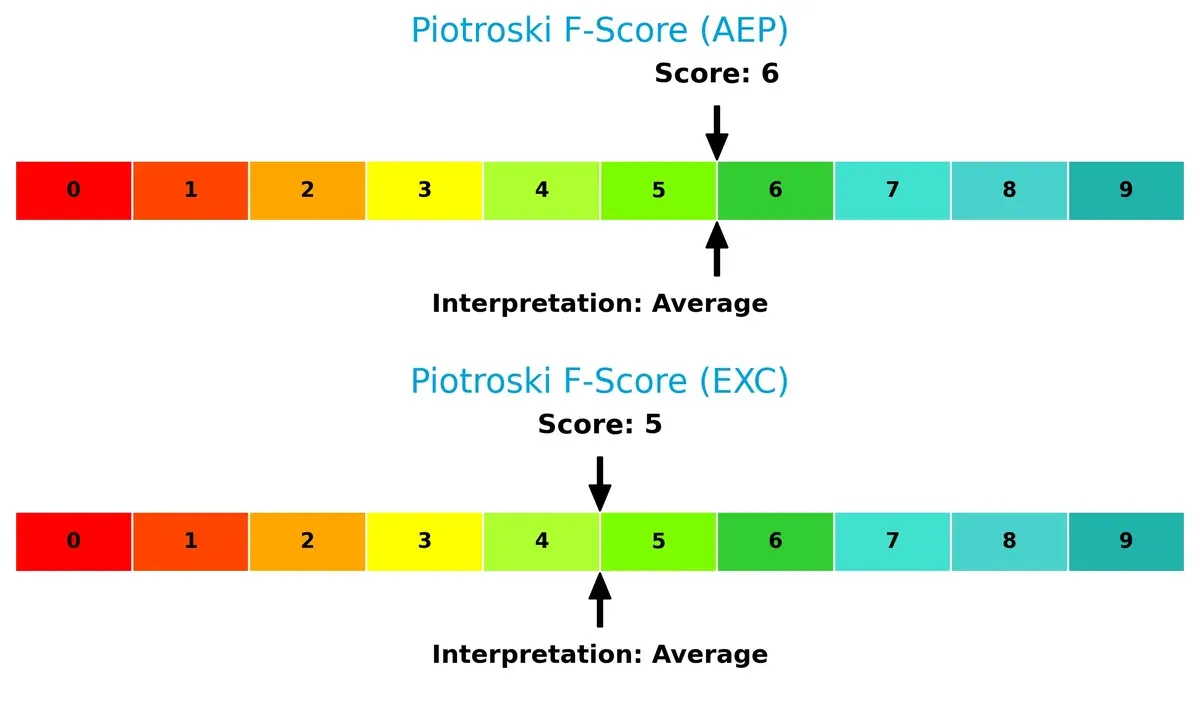

Financial Health: Quality of Operations

American Electric Power’s Piotroski F-Score of 6 slightly edges out Exelon’s 5, indicating marginally stronger financial health, yet both companies show only average operational quality and some red flags:

How are the two companies positioned?

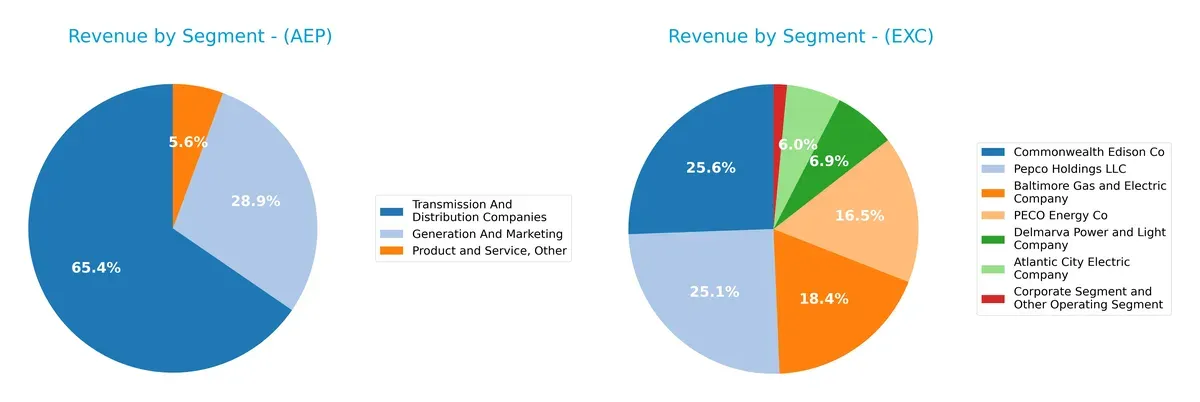

This section dissects the operational DNA of AEP and EXC by comparing their revenue distribution by segment and internal dynamics. The goal is to confront their economic moats and identify which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how American Electric Power Company, Inc. and Exelon Corporation diversify their income streams and reveals where their primary sector bets lie:

American Electric Power pivots heavily on Transmission and Distribution Companies with $6.1B in 2025, anchoring its revenue. Generation and Marketing contributes $2.7B, showing some diversity but with a clear infrastructure dominance. Exelon spreads revenue across multiple regulated utilities, such as Commonwealth Edison Co ($7.3B) and Pepco Holdings LLC ($7.1B), reflecting a broader geographic and operational diversification. Exelon’s segmented approach reduces concentration risk, while AEP’s focus signals strong ecosystem lock-in but higher exposure to infrastructure cycles.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of American Electric Power Company, Inc. and Exelon Corporation:

AEP Strengths

- Diversified revenue across generation, transmission, and distribution

- Favorable net margin at 16.43%

- Low debt-to-equity ratio at 0.14

- Dividend yield of 3.36%

- Neutral valuation multiples

EXC Strengths

- Favorable net margin at 11.41%

- Strong ROE at 17.74%

- Lower WACC at 4.47% supports capital efficiency

- Dividend yield of 3.67%

- Neutral valuation multiples

AEP Weaknesses

- Negative ROIC at -54.56% indicates poor capital returns

- Zero current and quick ratios signal liquidity issues

- Negative interest coverage

- Low asset turnover ratios

- Slightly unfavorable global ratio profile

EXC Weaknesses

- Negative ROIC at -53.76% similarly weak capital returns

- Poor liquidity with zero current and quick ratios

- High debt-to-equity ratio at 3.18 increases financial risk

- Negative interest coverage

- Slightly unfavorable global ratio profile

Both companies exhibit strong profitability metrics but struggle with capital efficiency and liquidity. AEP maintains lower leverage, while EXC shows higher financial risk from debt. These factors shape their strategic priorities in balancing growth and risk management.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only true shield protecting long-term profits from relentless competition erosion. Let’s examine how American Electric Power and Exelon defend theirs:

American Electric Power Company, Inc.: Infrastructure-Heavy Regulatory Moat

AEP’s moat stems from its regulated utility status and vast transmission assets. Despite a shrinking ROIC well below WACC, its stable net margins and steady revenue growth reflect regulatory protections. However, declining profitability pressures its ability to deepen this moat in 2026.

Exelon Corporation: Diversified Generation and Regulatory Moat

Exelon’s moat combines regulated operations with a diverse generation mix including nuclear and renewables. Like AEP, it suffers negative ROIC trends, but stronger gross margins and faster net income growth indicate better operational leverage. Future expansion into clean energy could bolster its competitive edge.

Regulated Utility Moats Under Pressure: Scale and Diversification in Focus

Both firms exhibit deteriorating ROICs, signaling value destruction despite regulatory moats. Exelon’s broader generation portfolio and superior margin expansion give it a slightly deeper moat. I see Exelon better positioned to defend market share amidst evolving energy landscapes.

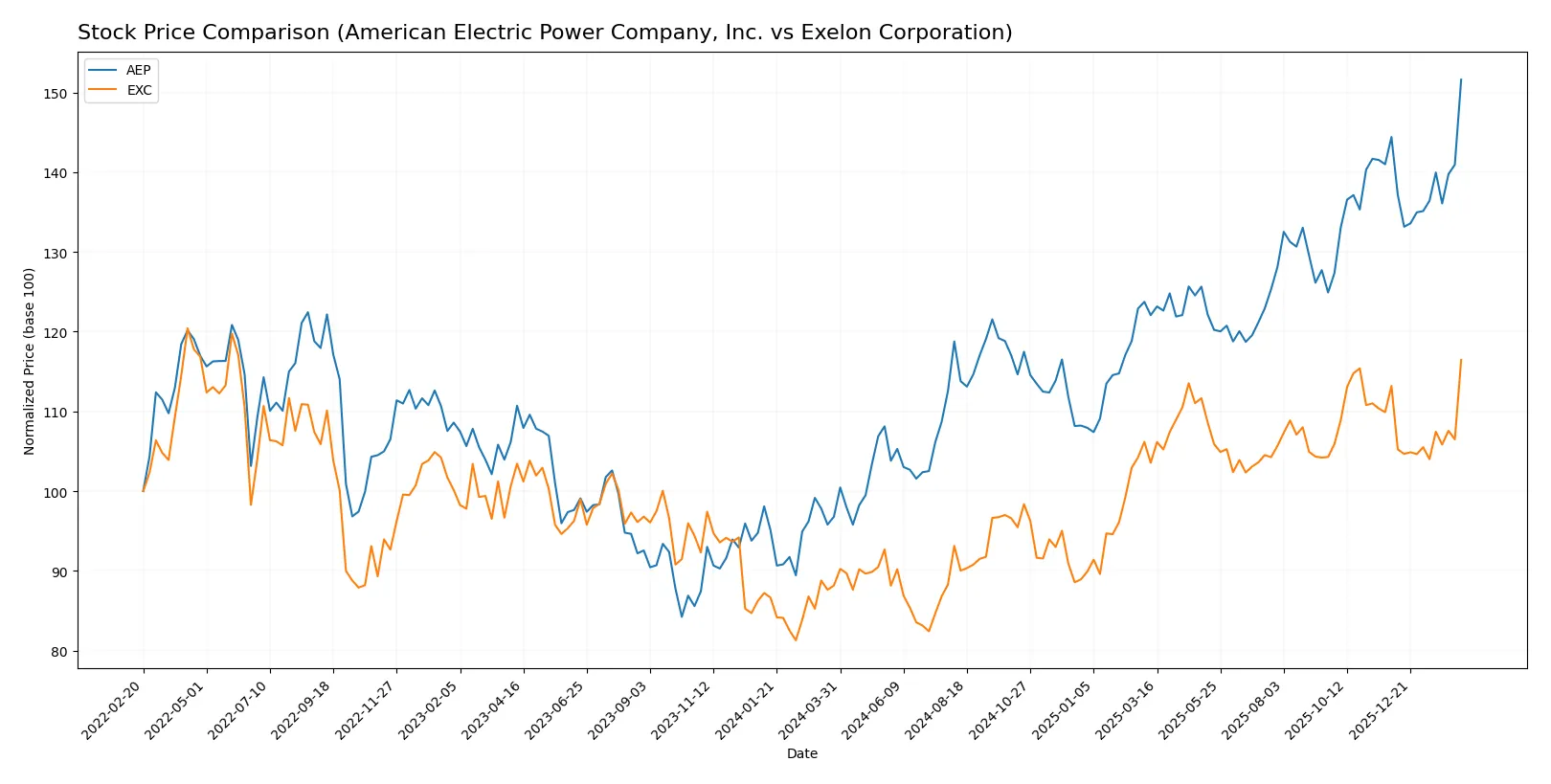

Which stock offers better returns?

The past year shows strong price appreciation for both stocks, with American Electric Power Company, Inc. demonstrating sharper gains and more pronounced trading momentum.

Trend Comparison

American Electric Power Company, Inc. rose 56.65% over the past 12 months, a bullish trend with acceleration and notable volatility (std dev 10.66). The stock hit a high of 129.94 and a low of 82.1.

Exelon Corporation gained 32.1% in the same period, also bullish with accelerating momentum but lower volatility (std dev 3.69). The price ranged between 34.31 and 48.48.

Comparing trends, AEP outperformed EXC with a stronger price surge and higher volatility, delivering the highest market return over the last year.

Target Prices

Analysts present a cautiously optimistic target consensus for American Electric Power Company, Inc. and Exelon Corporation.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| American Electric Power Company, Inc. | 107 | 142 | 130.17 |

| Exelon Corporation | 39 | 57 | 50.27 |

The consensus target for AEP slightly exceeds its current price of 129.94, suggesting modest upside potential. Exelon’s target consensus at 50.27 also implies a moderate increase from its current 48.48 price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here are the latest institutional grades for American Electric Power Company, Inc. and Exelon Corporation:

American Electric Power Company, Inc. Grades

The table below summarizes recent grades from major institutions for AEP:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-02-13 |

| Wolfe Research | Upgrade | Outperform | 2026-02-13 |

| Mizuho | Maintain | Neutral | 2026-02-13 |

| Barclays | Maintain | Equal Weight | 2026-01-22 |

| Wells Fargo | Maintain | Overweight | 2026-01-20 |

| B of A Securities | Downgrade | Neutral | 2026-01-12 |

| UBS | Maintain | Sell | 2025-12-17 |

| JP Morgan | Maintain | Neutral | 2025-12-12 |

| Jefferies | Upgrade | Buy | 2025-11-17 |

| Citigroup | Maintain | Neutral | 2025-10-31 |

Exelon Corporation Grades

Below is a summary of recent institutional grades for EXC:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Scotiabank | Maintain | Sector Perform | 2026-02-13 |

| BMO Capital | Maintain | Outperform | 2026-02-13 |

| Wells Fargo | Maintain | Overweight | 2026-02-13 |

| Mizuho | Maintain | Outperform | 2026-02-13 |

| Jefferies | Maintain | Buy | 2026-01-27 |

| Barclays | Maintain | Overweight | 2026-01-22 |

| Wells Fargo | Maintain | Overweight | 2026-01-20 |

| UBS | Maintain | Neutral | 2025-12-17 |

| JP Morgan | Maintain | Neutral | 2025-12-12 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-22 |

Which company has the best grades?

Exelon Corporation consistently receives stronger grades, including multiple Outperform and Buy ratings. American Electric Power shows a wider range, including a Sell grade by UBS, signaling mixed sentiment. Investors may interpret Exelon’s steadier institutional support as a sign of higher confidence.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

American Electric Power Company, Inc.

- Operates in a mature, regulated electric sector with stable demand but faces rising renewable energy competition.

Exelon Corporation

- Similar regulated electric market exposure but competes more aggressively in diversified energy products and services.

2. Capital Structure & Debt

American Electric Power Company, Inc.

- Maintains low debt-to-equity (0.14), favorable leverage, but poor interest coverage signals potential liquidity stress.

Exelon Corporation

- High debt-to-equity (3.18) indicates elevated financial risk; interest coverage also unfavorable, increasing refinancing concerns.

3. Stock Volatility

American Electric Power Company, Inc.

- Beta 0.61 suggests moderate stock volatility, reflecting relative stability in turbulent markets.

Exelon Corporation

- Lower beta at 0.44 indicates less volatility, implying a defensive positioning but limited upside in growth cycles.

4. Regulatory & Legal

American Electric Power Company, Inc.

- Subject to U.S. utility regulations with exposure to environmental compliance costs and rate-setting scrutiny.

Exelon Corporation

- Faces U.S. and Canadian regulatory frameworks, adding complexity and risk from cross-border legal compliance.

5. Supply Chain & Operations

American Electric Power Company, Inc.

- Vertically integrated utility with coal, gas, nuclear, and renewables; operational risk from fuel mix transition.

Exelon Corporation

- Diverse generation portfolio including nuclear and renewables; operational complexity may affect cost efficiency.

6. ESG & Climate Transition

American Electric Power Company, Inc.

- Transition risk from coal reliance amid increasing climate regulations; investing in renewables to mitigate.

Exelon Corporation

- Stronger focus on renewables but burdened by legacy fossil assets; ESG pressures on nuclear safety standards.

7. Geopolitical Exposure

American Electric Power Company, Inc.

- Primarily U.S.-focused operations limit geopolitical risks to national policy shifts.

Exelon Corporation

- U.S. and Canadian presence introduces moderate geopolitical risk from trade policies and energy cross-border regulations.

Which company shows a better risk-adjusted profile?

American Electric Power’s most impactful risk lies in its operational transition from coal to cleaner energy, posing asset and regulatory risks. Exelon’s largest threat is its high leverage, which strains financial flexibility amid market uncertainty. Despite both facing unfavorable ROIC and liquidity issues, AEP’s stronger capital structure and lower stock volatility suggest a better risk-adjusted profile. The widening debt-to-equity gap for Exelon underlines my concern about its financial stability going forward.

Final Verdict: Which stock to choose?

American Electric Power Company, Inc. (AEP) stands out as a resilient cash generator with solid dividend appeal. Its key strength lies in consistent revenue growth and a stable return on equity. However, its declining return on invested capital warns of potential value erosion. AEP suits income-focused or moderate growth portfolios seeking steady cash flow.

Exelon Corporation (EXC) benefits from a strategic moat rooted in its scale and recurring revenue streams. Its higher return on equity and strong income quality suggest superior profitability. Compared to AEP, EXC carries more debt and volatility, implying a need for careful risk tolerance. It fits Growth at a Reasonable Price (GARP) investors targeting upside with some safety.

If you prioritize stable income and proven cash flow, AEP is the compelling choice due to its robust dividend yield and steady earnings growth. However, if you seek growth with a stronger profitability profile and can tolerate higher leverage, EXC offers better upside potential but demands vigilance. Both face challenges in capital efficiency, making risk management paramount.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of American Electric Power Company, Inc. and Exelon Corporation to enhance your investment decisions: