In the fast-evolving semiconductor industry, Ambarella, Inc. and SkyWater Technology, Inc. stand out for their innovative approaches and market focus. Ambarella specializes in advanced video processing chips with AI capabilities, while SkyWater offers customized semiconductor manufacturing services across diverse sectors. Both companies operate in overlapping markets with distinct strategies, making their comparison essential. Let’s explore which company presents the most compelling opportunity for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Ambarella and SkyWater Technology by providing an overview of these two companies and their main differences.

Ambarella Overview

Ambarella, Inc. develops semiconductor solutions focused on video technology, including HD and ultra HD compression, image processing, and AI computer vision algorithms. Its system-on-a-chip designs integrate multiple functions to deliver high video and image quality with low power consumption. Ambarella’s products serve automotive cameras, security devices, robotics, consumer electronics, and virtual reality markets. The company is headquartered in Santa Clara, California, and trades on NASDAQ with a market cap of approximately 2.93B USD.

SkyWater Technology Overview

SkyWater Technology, Inc. provides semiconductor development and manufacturing services, specializing in silicon-based analog, mixed-signal, power discrete, MEMS, and rad-hard integrated circuits. It supports engineering and process development across sectors such as aerospace, defense, automotive, bio-health, and IoT. Founded in 2017 and based in Bloomington, Minnesota, SkyWater trades on NASDAQ with a market cap near 1.62B USD, focusing on custom semiconductor solutions rather than integrated chip design.

Key similarities and differences

Both Ambarella and SkyWater operate within the semiconductor industry and serve technology-driven markets. Ambarella emphasizes semiconductor chip design with integrated video and AI processing functions, while SkyWater focuses on semiconductor manufacturing and engineering services for specialized and custom applications. Ambarella’s product lineup targets end-user devices, whereas SkyWater primarily supports industrial and defense sectors through manufacturing partnerships. Their business models differ mainly in design versus foundry services.

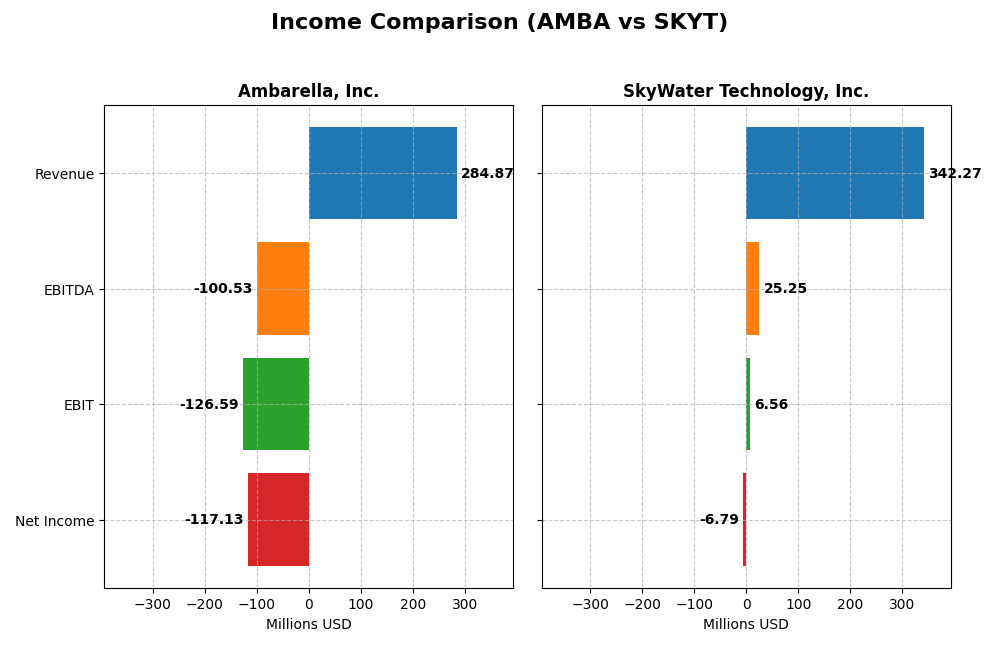

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for Ambarella, Inc. and SkyWater Technology, Inc. based on their most recent fiscal year results.

| Metric | Ambarella, Inc. (AMBA) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Market Cap | 2.93B | 1.62B |

| Revenue | 285M | 342M |

| EBITDA | -101M | 25M |

| EBIT | -127M | 7M |

| Net Income | -117M | -7M |

| EPS | -2.84 | -0.14 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Ambarella, Inc.

Ambarella experienced fluctuating revenue from 2021 to 2025, peaking at $338M in 2023 before declining to $285M in 2025. Net income remained negative throughout, worsening to -$169M in 2024 but improving to -$117M in 2025. Gross margins were strong at 60.5%, yet EBIT and net margins stayed deeply negative. The latest year saw revenue growth rebound by 25.8%, with margin improvements and reduced net losses.

SkyWater Technology, Inc.

SkyWater showed steady revenue growth from $140M in 2020 to $342M in 2024, with net income losses narrowing from -$20.6M to -$6.8M. Gross margin improved to 20.3% in 2024, while EBIT margin turned slightly positive at 1.9%. The recent year marked a 19.4% revenue increase coupled with significant EBIT growth of 144%, reflecting enhanced operational efficiency despite a still negative net margin near -2%.

Which one has the stronger fundamentals?

SkyWater demonstrates stronger fundamentals with consistent revenue growth of 144% over five years, improving profitability metrics, and narrowing net losses. Ambarella, while maintaining a higher gross margin of 60.5%, struggles with persistent negative net income and EBIT margins. SkyWater’s favorable income statement growth and improving margins contrast with Ambarella’s volatile performance and larger net losses.

Financial Ratios Comparison

The table below presents the most recent key financial ratios for Ambarella, Inc. and SkyWater Technology, Inc., allowing a clear side-by-side comparison for fiscal year 2025 and 2024 respectively.

| Ratios | Ambarella, Inc. (2025) | SkyWater Technology, Inc. (2024) |

|---|---|---|

| ROE | -20.9% | -11.8% |

| ROIC | -21.96% | 3.40% |

| P/E | -27.05 | -100.26 |

| P/B | 5.64 | 11.82 |

| Current Ratio | 2.65 | 0.86 |

| Quick Ratio | 2.36 | 0.76 |

| D/E (Debt to Equity) | 0.009 | 1.33 |

| Debt-to-Assets | 0.0076 | 0.245 |

| Interest Coverage | 0 | 0.74 |

| Asset Turnover | 0.41 | 1.09 |

| Fixed Asset Turnover | 19.96 | 2.07 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Ambarella, Inc.

Ambarella shows a mixed ratio profile with 43% favorable and 57% unfavorable indicators. Strong liquidity ratios (current 2.65, quick 2.36) and low debt levels (debt-to-assets 0.76%) contrast with weak profitability metrics including negative net margin (-41.12%) and return on equity (-20.86%). The company does not pay dividends, likely focusing on reinvestment and R&D, as reflected by high research expenditure and no dividend yield.

SkyWater Technology, Inc.

SkyWater’s ratios are predominantly unfavorable with over 71% negative indicators and only 21% favorable. Liquidity is weak (current ratio 0.86, quick ratio 0.76) and leverage is high (debt-to-equity 1.33). Profitability is also challenged, with negative net margin (-1.98%) and return on equity (-11.79%). No dividends are paid, consistent with a growth phase or reinvestment strategy in the semiconductor manufacturing sector.

Which one has the best ratios?

Both companies face profitability challenges, yet Ambarella exhibits stronger liquidity and lower leverage compared to SkyWater. Ambarella’s higher proportion of favorable ratios and superior asset efficiency contrast with SkyWater’s weaker liquidity and higher debt burden. Nonetheless, both maintain an unfavorable overall ratio profile, indicating caution in financial health assessment.

Strategic Positioning

This section compares the strategic positioning of Ambarella, Inc. and SkyWater Technology, Inc., including market position, key segments, and exposure to technological disruption:

Ambarella, Inc.

- Mid-sized semiconductor firm focused on video processing, facing competitive pressure in imaging and AI chip markets.

- Key segments include automotive cameras, security, robotics, and consumer video applications driving growth.

- Exposure to disruption through AI computer vision and integrated chips for autonomous vehicles and robotics.

SkyWater Technology, Inc.

- Smaller semiconductor developer and manufacturer with diverse customer base, competing in niche analog and mixed-signal segments.

- Revenue driven by advanced technology services and wafer manufacturing across aerospace, automotive, bio-health, and industrial sectors.

- Faces technological shifts via co-development of silicon analog, power discrete, and rad-hard ICs with customers in multiple industries.

Ambarella vs SkyWater Positioning

Ambarella pursues a concentrated strategy centered on video and AI semiconductor solutions, leveraging integrated system-on-a-chip designs. In contrast, SkyWater employs a more diversified approach with manufacturing services across multiple analog and mixed-signal applications. Ambarella’s focus offers specialized innovation, while SkyWater’s breadth targets varied industrial sectors.

Which has the best competitive advantage?

Both companies are currently shedding value, but SkyWater’s improving ROIC trend suggests increasing profitability, whereas Ambarella’s declining ROIC indicates deteriorating efficiency, resulting in a slightly more favorable competitive advantage for SkyWater.

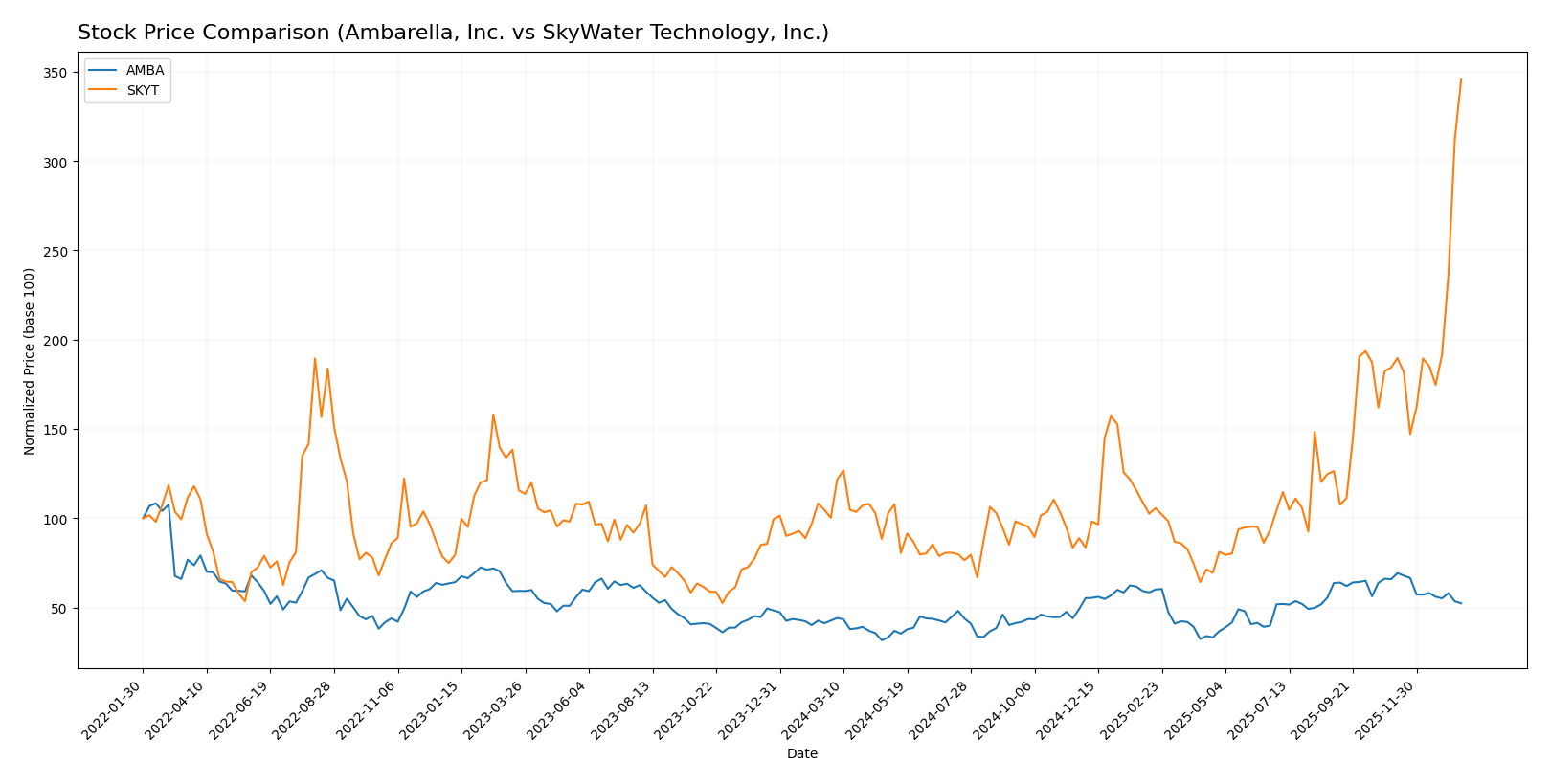

Stock Comparison

The stock price movements over the past 12 months reveal distinct trading dynamics, with Ambarella, Inc. showing a moderate bullish trend with decelerating gains, while SkyWater Technology, Inc. exhibits strong acceleration and substantial growth.

Trend Analysis

Ambarella, Inc. experienced a 22.75% price increase over the past year, indicating a bullish trend with deceleration. Volatility is higher, reflected by a 12.81 std deviation, with prices ranging from 40.99 to 89.67.

SkyWater Technology, Inc. posted a significant 244.74% rise over the same period, marking a bullish trend with acceleration. Its lower volatility of 4.45 std deviation corresponds to a price range between 6.1 and 32.78.

Comparing both, SkyWater Technology, Inc. delivered the highest market performance with a much stronger upward trend and accelerating momentum relative to Ambarella, Inc.

Target Prices

The target consensus for these semiconductor companies reflects moderate optimism from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Ambarella, Inc. | 115 | 80 | 97.5 |

| SkyWater Technology, Inc. | 25 | 25 | 25 |

Ambarella’s consensus target price of 97.5 is significantly above its current price of 69.09, suggesting potential upside. SkyWater’s target of 25 is below its current price of 33.82, indicating possible downside or market overvaluation.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Ambarella, Inc. and SkyWater Technology, Inc.:

Rating Comparison

AMBA Rating

- Rating: C+ indicating a very favorable overall evaluation from analysts.

- Discounted Cash Flow Score: Moderate at 3, suggesting fair valuation outlook.

- ROE Score: Very unfavorable at 1, showing weak efficiency in profit generation.

- ROA Score: Very unfavorable at 1, indicating poor asset utilization.

- Debt To Equity Score: Favorable at 4, implying manageable financial risk.

- Overall Score: Moderate at 2, indicating average overall financial standing.

SKYT Rating

- Rating: B+ representing a very favorable overall evaluation from analysts.

- Discounted Cash Flow Score: Very unfavorable at 1, indicating potential overvaluation concerns.

- ROE Score: Very favorable at 5, reflecting strong profitability from equity.

- ROA Score: Very favorable at 5, demonstrating efficient asset use.

- Debt To Equity Score: Very unfavorable at 1, signaling high financial leverage.

- Overall Score: Moderate at 3, suggesting somewhat better overall financial health.

Which one is the best rated?

Based strictly on the provided data, SKYT holds a better analyst rating (B+) and superior ROE and ROA scores compared to AMBA. However, AMBA shows a stronger debt-to-equity score, indicating lower financial risk. Overall, SKYT’s ratings are generally higher except for financial leverage.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Ambarella, Inc. and SkyWater Technology, Inc.:

AMBA Scores

- Altman Z-Score: 10.69, indicating a safe zone, low bankruptcy risk.

- Piotroski Score: 3, classified as very weak financial strength.

SKYT Scores

- Altman Z-Score: 2.20, in the grey zone, moderate bankruptcy risk.

- Piotroski Score: 5, indicating average financial strength.

Which company has the best scores?

Based on the provided data, AMBA has a much stronger Altman Z-Score indicating better bankruptcy safety, while SKYT shows a higher Piotroski Score reflecting better financial strength. Each company leads in one score only.

Grades Comparison

Here is a comparison of the latest available grades for Ambarella, Inc. and SkyWater Technology, Inc.:

Ambarella, Inc. Grades

The following table summarizes recent grades from reputable grading companies for Ambarella, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Maintain | Neutral | 2025-11-26 |

| Needham | Maintain | Buy | 2025-11-26 |

| Stifel | Maintain | Buy | 2025-11-26 |

| Rosenblatt | Maintain | Buy | 2025-11-26 |

| Rosenblatt | Maintain | Buy | 2025-11-24 |

| Stifel | Maintain | Buy | 2025-08-29 |

| Needham | Maintain | Buy | 2025-08-29 |

| Northland Capital Markets | Maintain | Outperform | 2025-08-29 |

| Morgan Stanley | Maintain | Overweight | 2025-08-29 |

| Oppenheimer | Maintain | Perform | 2025-08-29 |

Overall, Ambarella’s grades show a strong buy consensus with mostly “Buy” ratings and some “Outperform” and “Overweight” actions, indicating positive analyst sentiment.

SkyWater Technology, Inc. Grades

The following table presents recent grades from established grading companies for SkyWater Technology, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| TD Cowen | Maintain | Buy | 2025-11-06 |

| Needham | Maintain | Buy | 2025-08-07 |

| Needham | Maintain | Buy | 2025-05-08 |

| Needham | Maintain | Buy | 2025-02-27 |

| Needham | Maintain | Buy | 2024-11-11 |

| Piper Sandler | Maintain | Overweight | 2024-10-25 |

| Piper Sandler | Maintain | Overweight | 2024-08-08 |

| Needham | Maintain | Buy | 2024-05-09 |

SkyWater Technology consistently receives “Buy” and “Overweight” grades, reflecting continued confidence from analysts.

Which company has the best grades?

Both Ambarella, Inc. and SkyWater Technology, Inc. have received predominantly positive grades with a “Buy” consensus. Ambarella has a larger number of total buy ratings (21 vs. 5) and a broader range of positive grades including “Outperform” and “Overweight,” which may signal stronger analyst conviction. For investors, this could mean that Ambarella has slightly stronger analyst support, potentially impacting portfolio decisions regarding confidence and risk assessment.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses between Ambarella, Inc. (AMBA) and SkyWater Technology, Inc. (SKYT) based on recent financial performance and strategic positioning.

| Criterion | Ambarella, Inc. (AMBA) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Diversification | Limited product segmentation; mainly focused on semiconductor solutions | More diversified revenue streams including Advanced Technology Services and Wafer Services |

| Profitability | Negative net margin (-41.12%), declining ROIC, value destroying | Slightly negative net margin (-1.98%), improving ROIC trend but still value destroying |

| Innovation | Struggling with declining profitability and ROIC, limited signs of strong innovation | Growing ROIC indicates potential innovation gains, but overall profitability still weak |

| Global presence | Moderate presence with stable financial ratios in liquidity | Smaller scale with weaker liquidity ratios (current ratio 0.86) but expanding service offerings |

| Market Share | Facing challenges with negative returns and value destruction | Improving operational efficiency with growing asset turnover (1.09) but high debt level |

Key takeaways: Ambarella shows significant financial challenges with declining profitability and value destruction, indicating risk for investors. SkyWater, while also unprofitable, demonstrates improving profitability trends and a more diversified business model, suggesting potential for recovery but still carries financial risks. Caution and thorough risk assessment are advised.

Risk Analysis

Below is a comparative table summarizing key risks for Ambarella, Inc. (AMBA) and SkyWater Technology, Inc. (SKYT) based on the most recent available data:

| Metric | Ambarella, Inc. (AMBA) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Market Risk | High beta (1.95) indicates elevated market volatility risk. | Very high beta (3.49) suggests significant sensitivity to market swings. |

| Debt level | Very low debt-to-equity ratio (0.01), low debt-to-assets (0.76%) – low financial leverage risk. | High debt-to-equity ratio (1.33), but moderate debt-to-assets (24.46%) – elevated leverage risk. |

| Regulatory Risk | Moderate, as a US semiconductor firm subject to export controls and tech regulations. | Moderate, with exposure to aerospace/defense customers, facing stricter compliance requirements. |

| Operational Risk | Risk from product innovation demands and supply chain disruptions in semiconductor industry. | Risk in scaling manufacturing operations and reliance on specialized processes. |

| Environmental Risk | Moderate, typical for tech manufacturing with some sustainability initiatives. | Moderate to high, given manufacturing processes and regulatory environmental standards. |

| Geopolitical Risk | Exposure to global supply chains and US-China tech tensions impacting semiconductor industry. | Similar exposure with added risk due to defense sector involvement and export controls. |

Synthesis: Both companies face significant market volatility risk, with SKYT showing much higher beta. SKYT’s elevated debt and operational scaling add financial risk. Ambarella’s main risks stem from innovation demands and geopolitical tensions affecting the semiconductor sector globally. Investors should weigh SKYT’s leverage and operational risks against Ambarella’s innovation and market sensitivity.

Which Stock to Choose?

Ambarella, Inc. (AMBA) shows favorable income growth with a 25.78% revenue increase in 2025 and a 64.29% favorable income statement rating. However, profitability ratios remain largely unfavorable, with negative returns on equity and assets, and a very unfavorable moat rating due to declining ROIC versus WACC. AMBA’s debt ratios and liquidity are favorable, with a C+ rating indicating moderate overall financial health.

SkyWater Technology, Inc. (SKYT) demonstrates strong income growth, with a 19.39% revenue rise in 2024 and an 85.71% favorable income statement rating. Financial ratios are mostly unfavorable, although asset turnover is favorable and ROE improves markedly. The company has a slightly unfavorable moat rating reflecting value destruction but improving profitability, and a better B+ rating suggests stronger financial scores despite liquidity challenges.

For investors prioritizing growth and improving profitability, SKYT’s accelerating income and better rating might appear more attractive, while those focused on stable liquidity and moderate financial risk could find AMBA’s stronger balance sheet and favorable income growth more suitable. The choice could thus depend on the investor’s risk tolerance and strategy focus.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Ambarella, Inc. and SkyWater Technology, Inc. to enhance your investment decisions: