Microchip Technology Incorporated and Ambarella, Inc. are two prominent players in the semiconductor industry, each with a distinct focus on innovation and market application. Microchip excels in embedded control solutions across diverse sectors, while Ambarella specializes in advanced video processing and AI-driven imaging chips. Their overlapping technological ambitions and market footprints make this comparison particularly relevant. Join me as we analyze which company presents the most compelling opportunity for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Microchip Technology Incorporated and Ambarella, Inc. by providing an overview of these two companies and their main differences.

Microchip Technology Incorporated Overview

Microchip Technology Incorporated focuses on developing, manufacturing, and selling embedded control solutions worldwide. It offers a broad range of microcontrollers, microprocessors, analog and interface products, and memory solutions for automotive, industrial, communications, and security applications. Headquartered in Chandler, Arizona, Microchip serves diverse markets through its comprehensive product portfolio and engineering services.

Ambarella, Inc. Overview

Ambarella, Inc. specializes in semiconductor solutions for video processing, combining HD and ultra HD compression with AI-driven computer vision on single chips. Its products serve automotive cameras, security systems, robotics, and consumer electronics markets. Based in Santa Clara, California, Ambarella emphasizes advanced video quality, functionality, and low power consumption for original design and equipment manufacturers worldwide.

Key similarities and differences

Both companies operate in the semiconductor industry and cater to technology markets with specialized chips. Microchip offers a broader range of embedded control and analog products, targeting multiple sectors including industrial and automotive. Ambarella is more focused on video processing and AI-enabled vision solutions, mainly for automotive and security applications. Their product scopes and client bases reflect distinct but complementary segments of the semiconductor market.

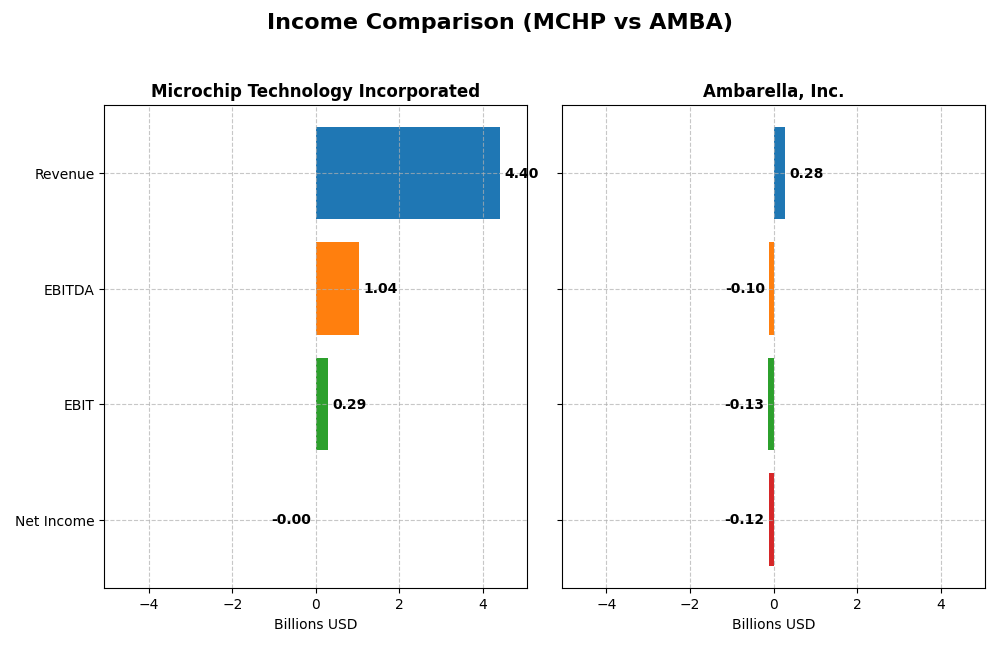

Income Statement Comparison

Below is a comparison of key income statement metrics for Microchip Technology Incorporated and Ambarella, Inc. for their most recent fiscal years.

| Metric | Microchip Technology Incorporated | Ambarella, Inc. |

|---|---|---|

| Market Cap | 40.2B USD | 2.7B USD |

| Revenue | 4.4B USD (FY 2025) | 285M USD (FY 2025) |

| EBITDA | 1.04B USD | -101M USD |

| EBIT | 290M USD | -127M USD |

| Net Income | -0.5M USD | -117M USD |

| EPS | -0.005 USD | -2.84 USD |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Microchip Technology Incorporated

Microchip Technology showed a declining trend in revenue and net income from 2021 to 2025, with revenue dropping from 5.4B to 4.4B and net income turning negative in 2025. Gross margins remained relatively strong at 56%, but net margins deteriorated to nearly zero. The most recent year saw a sharp revenue decline of 42%, with operating income and net income falling dramatically, signaling operational challenges.

Ambarella, Inc.

Ambarella experienced overall revenue growth from 223M in 2021 to 285M in 2025, alongside fluctuating but negative net income, which worsened significantly over the period. Gross margin improved to 60.5%, but EBIT and net margins remained negative, with a steep net loss margin of -41%. The latest year showed favorable revenue and gross profit growth, yet net loss persisted, reflecting ongoing profitability issues.

Which one has the stronger fundamentals?

Ambarella’s fundamentals appear stronger in terms of revenue growth and gross margin expansion, supported by favorable income statement growth metrics over the past year. Conversely, Microchip’s substantial declines in revenue and net income, along with an unfavorable net margin trend, indicate deteriorating income statement health. Ambarella’s ongoing net losses, however, temper its overall financial strength despite recent improvements.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Microchip Technology Incorporated (MCHP) and Ambarella, Inc. (AMBA) based on their most recent fiscal year data.

| Ratios | Microchip Technology Incorporated (MCHP) | Ambarella, Inc. (AMBA) |

|---|---|---|

| ROE | -0.0071% | -20.86% |

| ROIC | -0.027% | -21.96% |

| P/E | -52021.4 | -27.05 |

| P/B | 3.67 | 5.64 |

| Current Ratio | 2.59 | 2.65 |

| Quick Ratio | 1.47 | 2.36 |

| D/E (Debt-to-Equity) | 0.80 | 0.0094 |

| Debt-to-Assets | 36.85% | 0.76% |

| Interest Coverage | 1.18 | 0 |

| Asset Turnover | 0.29 | 0.41 |

| Fixed Asset Turnover | 3.72 | 19.96 |

| Payout Ratio | -1951.4% | 0 |

| Dividend Yield | 3.75% | 0 |

Interpretation of the Ratios

Microchip Technology Incorporated

Microchip Technology shows a mixed ratio profile with 35.71% favorable and 42.86% unfavorable indicators, leading to a slightly unfavorable overall assessment. Strengths include a solid current ratio of 2.59 and a favorable dividend yield of 3.75%. However, concerns arise from negative net margin, ROE, and interest coverage, indicating profitability and leverage issues. The company pays dividends supported by a stable payout ratio, but risks remain due to some weak operational returns.

Ambarella, Inc.

Ambarella’s financial ratios are predominantly unfavorable at 57.14%, with no neutral ratings and only 42.86% favorable. It exhibits weak profitability metrics such as a -41.12% net margin and -20.86% ROE, alongside a zero dividend yield reflecting no payout to shareholders. The firm maintains strong liquidity and minimal debt, supporting stability, but struggles with operational efficiency and earnings quality, consistent with its focus on reinvestment and R&D.

Which one has the best ratios?

Comparing the two, Microchip Technology holds a slight edge due to its dividend payments and stronger liquidity ratios, despite some profitability weaknesses. Ambarella’s ratios indicate more pronounced challenges with profitability, capital returns, and no dividends, reflecting a less favorable financial position in 2025. Overall, Microchip’s profile is mildly better balanced than Ambarella’s.

Strategic Positioning

This section compares the strategic positioning of Microchip Technology Incorporated and Ambarella, Inc., including market position, key segments, and exposure to technological disruption:

Microchip Technology Incorporated

- Large market cap of 40B with broad semiconductor industry presence; faces competitive pressure from diversified players.

- Key segments include general-purpose microcontrollers, embedded processors, analog and mixed-signal products, and technology licensing.

- Exposure to disruption moderate, given diverse product portfolio including embedded flash IP licensing and FPGA services.

Ambarella, Inc.

- Smaller market cap of 2.7B focusing on semiconductor solutions for video; faces niche competitive pressure.

- Concentrates on system-on-chip solutions for HD and ultra HD video, AI vision, automotive, and security cameras.

- High exposure to disruption due to focus on advanced video processing and AI computer vision technologies.

Microchip Technology Incorporated vs Ambarella, Inc. Positioning

Microchip’s approach is diversified across multiple semiconductor product lines and licensing, offering broad industry coverage. Ambarella pursues a concentrated strategy focused on video-related semiconductor solutions, driving specialization but limiting segment breadth.

Which has the best competitive advantage?

Both companies show very unfavorable MOAT evaluations with declining ROIC below WACC, indicating value destruction and weakening profitability, thus neither currently demonstrates a sustainable competitive advantage.

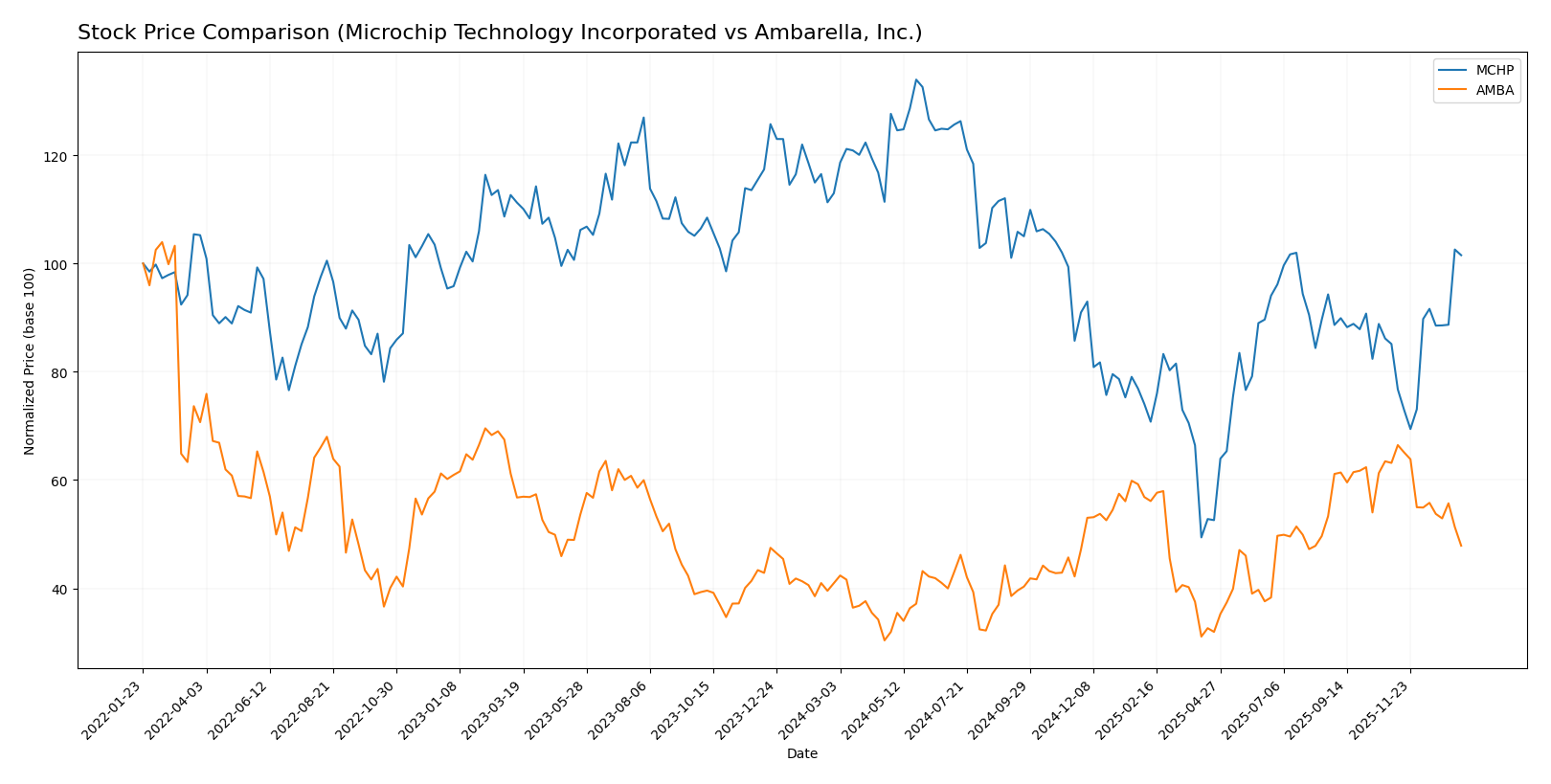

Stock Comparison

The stock price movements of Microchip Technology Incorporated (MCHP) and Ambarella, Inc. (AMBA) over the past 12 months reveal contrasting trends and recent shifts in market dynamics.

Trend Analysis

Microchip Technology Incorporated’s stock posted a bearish trend over the past year, declining by 10.13% with accelerating downward momentum and a high volatility level (14.38 std dev). The price ranged from a low of 36.22 to a high of 98.23.

Ambarella, Inc. exhibited a bullish trend over the same period, gaining 16.9% but with decelerating momentum and relatively high volatility (12.81 std dev). The stock price fluctuated between 40.99 and 89.67.

Comparing both stocks, Ambarella delivered the highest market performance with a positive 16.9% return versus Microchip’s 10.13% decline over the past 12 months.

Target Prices

The current analyst consensus presents optimistic target prices for Microchip Technology Incorporated and Ambarella, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Microchip Technology Incorporated | 85 | 60 | 77.44 |

| Ambarella, Inc. | 115 | 80 | 97.5 |

Analysts expect both stocks to appreciate, with Microchip’s consensus target about 4% above its current price of $74.45, while Ambarella’s target suggests a potential upside of around 51% from its current $64.60 price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Microchip Technology Incorporated and Ambarella, Inc.:

Rating Comparison

MCHP Rating

- Rating: C-, considered very favorable overall.

- Discounted Cash Flow Score: 3, indicating a moderate valuation.

- ROE Score: 1, reflecting very unfavorable efficiency in generating equity returns.

- ROA Score: 1, showing very unfavorable asset utilization.

- Debt To Equity Score: 1, indicating very unfavorable financial risk profile.

- Overall Score: 1, very unfavorable summary of financial standing.

AMBA Rating

- Rating: C+, also considered very favorable overall.

- Discounted Cash Flow Score: 3, indicating a moderate valuation.

- ROE Score: 1, reflecting very unfavorable efficiency in generating equity returns.

- ROA Score: 1, showing very unfavorable asset utilization.

- Debt To Equity Score: 4, indicating a favorable financial risk profile.

- Overall Score: 2, moderate summary of financial standing.

Which one is the best rated?

Based strictly on the provided data, Ambarella holds a better overall rating (C+) and a higher overall score (2) compared to Microchip’s C- rating and overall score of 1. Ambarella’s debt-to-equity profile is notably stronger.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Microchip Technology and Ambarella, Inc.:

Microchip Technology Scores

- Altman Z-Score: 3.999, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 3, categorized as very weak financial strength.

Ambarella Scores

- Altman Z-Score: 10.69, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 3, categorized as very weak financial strength.

Which company has the best scores?

Ambarella has a significantly higher Altman Z-Score than Microchip Technology, both remain in the safe zone. Both companies have equal Piotroski Scores, reflecting similarly weak financial strength.

Grades Comparison

The following presents the recent grades from reputable grading companies for Microchip Technology Incorporated and Ambarella, Inc.:

Microchip Technology Incorporated Grades

This table summarizes the latest grades assigned by established grading companies to Microchip Technology Incorporated.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Overweight | 2026-01-15 |

| B. Riley Securities | Maintain | Buy | 2026-01-12 |

| Mizuho | Maintain | Outperform | 2026-01-09 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-07 |

| JP Morgan | Maintain | Overweight | 2026-01-06 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-06 |

| Stifel | Maintain | Buy | 2026-01-06 |

| Rosenblatt | Maintain | Buy | 2026-01-06 |

| Needham | Maintain | Buy | 2026-01-06 |

| Cantor Fitzgerald | Upgrade | Overweight | 2025-12-16 |

Overall, Microchip Technology Incorporated shows a predominantly positive grading trend with multiple “Buy” and “Overweight” ratings, indicating consistent confidence among analysts.

Ambarella, Inc. Grades

This table details the recent grades issued by recognized grading companies for Ambarella, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Maintain | Neutral | 2025-11-26 |

| Needham | Maintain | Buy | 2025-11-26 |

| Stifel | Maintain | Buy | 2025-11-26 |

| Rosenblatt | Maintain | Buy | 2025-11-26 |

| Rosenblatt | Maintain | Buy | 2025-11-24 |

| Stifel | Maintain | Buy | 2025-08-29 |

| Needham | Maintain | Buy | 2025-08-29 |

| Northland Capital Markets | Maintain | Outperform | 2025-08-29 |

| Morgan Stanley | Maintain | Overweight | 2025-08-29 |

| Oppenheimer | Maintain | Perform | 2025-08-29 |

Ambarella, Inc. grades reflect a generally positive outlook with multiple “Buy” ratings, though a “Neutral” and a “Perform” grade suggest some caution among analysts.

Which company has the best grades?

Microchip Technology Incorporated has received more consistent and recent “Buy” and “Overweight” grades compared to Ambarella, Inc., which shows slightly more mixed signals. Investors may interpret Microchip’s stronger consensus as a sign of greater analyst confidence, potentially influencing portfolio decisions accordingly.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Microchip Technology Incorporated (MCHP) and Ambarella, Inc. (AMBA) based on their latest financials, profitability, innovation, market presence, and market share.

| Criterion | Microchip Technology Incorporated (MCHP) | Ambarella, Inc. (AMBA) |

|---|---|---|

| Diversification | Moderate: Primarily semiconductor products with some technology licensing revenue | Limited: Focused mainly on video processing semiconductors |

| Profitability | Weak: Negative net margin (-0.01%), declining ROIC, value destroying | Very weak: Large net loss (-41.12%), declining ROIC, strong value destruction |

| Innovation | Moderate: Steady product turnover but declining profitability | Moderate: High fixed asset turnover but declining profitability |

| Global presence | Strong: Established global semiconductor footprint | Moderate: Niche markets, less diversified globally |

| Market Share | Significant in embedded control and analog segments | Niche player in video and imaging semiconductors |

Key takeaways: Both companies are currently facing profitability challenges with declining ROIC and negative margins, indicating value destruction. Microchip benefits from broader diversification and global presence, while Ambarella is more specialized but struggling more severely with losses and financial health. Caution is advised when considering these stocks for your portfolio.

Risk Analysis

Below is a comparison of key risks for Microchip Technology Incorporated (MCHP) and Ambarella, Inc. (AMBA) based on the most recent data from 2025.

| Metric | Microchip Technology Incorporated (MCHP) | Ambarella, Inc. (AMBA) |

|---|---|---|

| Market Risk | Beta 1.445, moderate market sensitivity | Beta 1.953, higher volatility |

| Debt Level | Debt-to-equity 0.8 (neutral), interest coverage low (1.15) | Very low debt-to-equity 0.01 (favorable), zero interest coverage |

| Regulatory Risk | Moderate, operates globally with compliance requirements | Moderate, tech sector regulations, focus on AI and video tech |

| Operational Risk | Large workforce (22,300), diverse product lines increase complexity | Smaller workforce (941), niche semiconductor products |

| Environmental Risk | Standard tech industry impact, no major red flags | Standard tech industry impact, no major red flags |

| Geopolitical Risk | Exposure to Americas, Europe, Asia markets | Exposure primarily US-based, some global OEM clients |

Microchip faces moderate market and debt risks with a large operational scale that could increase complexity. Ambarella’s higher beta signals greater market volatility, but its minimal debt reduces financial risk. Both have typical regulatory and environmental risks for the semiconductor industry. The most impactful risks are Ambarella’s earnings volatility and Microchip’s interest coverage constraint.

Which Stock to Choose?

Microchip Technology Incorporated (MCHP) shows a declining income trend with a -42.35% revenue drop in 2025 and mostly unfavorable financial ratios, including negative profitability and a high net debt to EBITDA of 4.7. Its rating is very favorable overall but with several weak financial scores, and it is assessed as value-destroying with a very unfavorable MOAT.

Ambarella, Inc. (AMBA) posted favorable income growth in 2025 with a 25.78% revenue increase, but profitability remains negative and financial ratios are mostly unfavorable. The company has very low debt and a moderate overall rating. Its MOAT evaluation is very unfavorable, indicating declining returns and value destruction.

Investors seeking growth might see Ambarella’s recent revenue momentum as appealing despite weak profitability, while those prioritizing financial stability could consider Microchip’s stronger market capitalization and ratings, though both companies show signs of value destruction and deteriorating profitability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Microchip Technology Incorporated and Ambarella, Inc. to enhance your investment decisions: