In the fast-evolving semiconductor industry, Lattice Semiconductor Corporation (LSCC) and Ambarella, Inc. (AMBA) stand out for their innovative approaches and overlapping market segments. Both companies excel in delivering specialized chip solutions, with Lattice focusing on programmable logic devices and Ambarella on video processing systems. This article will carefully analyze their strengths and risks to help you decide which company offers the more compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Lattice Semiconductor Corporation and Ambarella, Inc. by providing an overview of these two companies and their main differences.

Lattice Semiconductor Corporation Overview

Lattice Semiconductor Corporation develops and sells semiconductor products globally, focusing on field programmable gate arrays across four product families. It also offers video connectivity application-specific standard products and licenses its technology through IP services and patent monetization. The company primarily serves original equipment manufacturers in communications, computing, consumer, industrial, and automotive markets. It is headquartered in Hillsboro, Oregon.

Ambarella, Inc. Overview

Ambarella, Inc. specializes in semiconductor solutions for video, integrating HD video processing, image processing, AI computer vision, and audio functions on single chips. Its products target automotive cameras, security cameras, robotics, and consumer applications like drones and wearable cameras. The company sells mainly to original design and equipment manufacturers and is based in Santa Clara, California.

Key similarities and differences

Both companies operate in the semiconductor industry and target original equipment manufacturers, but Lattice focuses on programmable gate arrays and technology licensing, while Ambarella centers on video processing SoCs with AI capabilities. Lattice serves a broad range of markets including industrial and automotive, whereas Ambarella’s products emphasize video-related applications in automotive, security, and consumer electronics. Their business models reflect these distinct technological specializations.

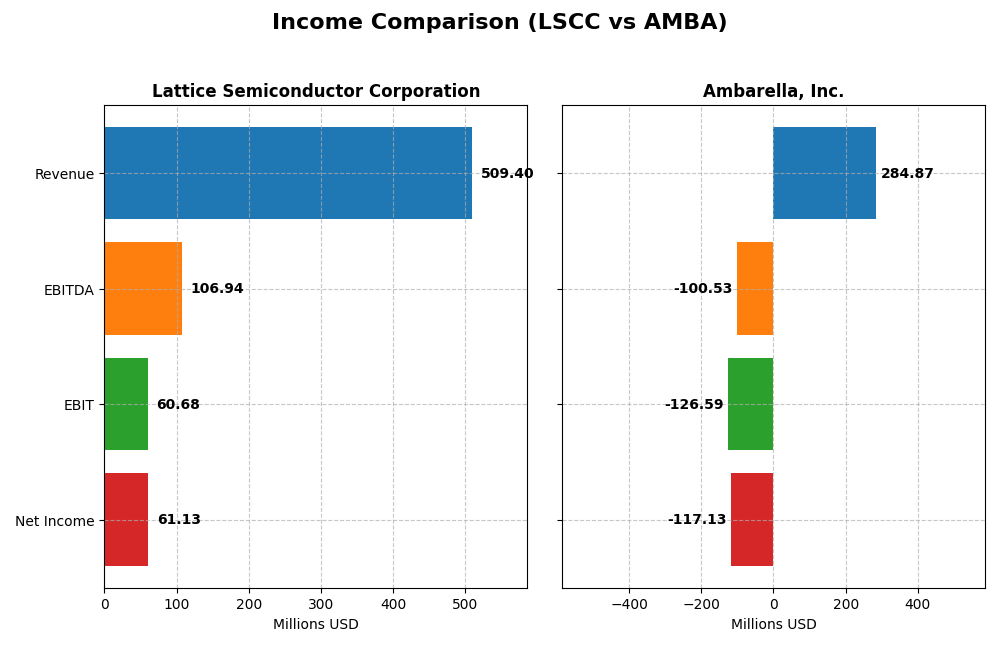

Income Statement Comparison

Below is the latest fiscal year income statement comparison between Lattice Semiconductor Corporation and Ambarella, Inc., showing key financial metrics for 2024 and 2025 respectively.

| Metric | Lattice Semiconductor Corporation (2024) | Ambarella, Inc. (2025) |

|---|---|---|

| Market Cap | 11.7B | 2.7B |

| Revenue | 509M | 285M |

| EBITDA | 107M | -101M |

| EBIT | 61M | -127M |

| Net Income | 61M | -117M |

| EPS | 0.44 | -2.84 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Lattice Semiconductor Corporation

Lattice Semiconductor’s revenue showed a 24.82% increase over 2020-2024 but declined by 30.9% in 2024 alone, with net income rising overall by 28.99% despite a 65.85% net margin drop in the last year. Margins remain favorable, with a 66.82% gross margin and a stable 12% net margin. The 2024 performance reflects a slowdown with notable margin compression.

Ambarella, Inc.

Ambarella reported a 27.75% revenue increase over 2021-2025 and a 25.78% rise in 2025, yet net income declined sharply overall by 95.91%, despite a 45.04% net margin improvement in the last year. Gross margin is favorable at 60.5%, but the company faces significant challenges with negative EBIT and net margins, reflecting persistent profitability issues despite recent operational improvements.

Which one has the stronger fundamentals?

Lattice Semiconductor demonstrates stronger fundamentals with positive overall net income growth, favorable margins, and a manageable interest expense, despite recent growth deceleration. Ambarella shows revenue growth and improving margins recently but suffers from large net losses and negative EBIT margins overall, signaling ongoing profitability risks. The comparison suggests Lattice’s fundamentals are currently more robust.

Financial Ratios Comparison

The table below presents the most recent available financial ratios for Lattice Semiconductor Corporation (LSCC) and Ambarella, Inc. (AMBA), offering a side-by-side view of their key performance metrics for fiscal year 2024 and 2025 respectively.

| Ratios | Lattice Semiconductor Corporation (LSCC) 2024 | Ambarella, Inc. (AMBA) 2025 |

|---|---|---|

| ROE | 8.60% | -20.86% |

| ROIC | 4.59% | -21.96% |

| P/E | 133x | -27.05x |

| P/B | 11.41x | 5.64x |

| Current Ratio | 3.66 | 2.65 |

| Quick Ratio | 2.62 | 2.36 |

| D/E | 0.02 | 0.01 |

| Debt-to-Assets | 1.81% | 0.76% |

| Interest Coverage | 130x | 0 (no coverage) |

| Asset Turnover | 0.60 | 0.41 |

| Fixed Asset Turnover | 7.62 | 19.96 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Lattice Semiconductor Corporation

Lattice Semiconductor displays a mix of strong and weak ratios, with favorable debt management and interest coverage but unfavorable profitability metrics like ROE and ROIC. Its valuation ratios such as PE and PB are also high, suggesting overvaluation risks. The company does not pay dividends, likely prioritizing reinvestment and growth over shareholder payouts.

Ambarella, Inc.

Ambarella shows predominantly unfavorable ratios, including negative net margin, ROE, and ROIC, indicating operational and profitability challenges. It maintains strong liquidity and low leverage, but interest coverage is zero, raising concerns. Like Lattice, Ambarella does not pay dividends, possibly due to negative earnings and investment in R&D and acquisitions.

Which one has the best ratios?

Comparing the two, Lattice Semiconductor exhibits a slightly unfavorable overall ratio profile with stronger profitability and coverage metrics than Ambarella, which has an unfavorable rating driven by negative returns and weak interest coverage. Both companies do not distribute dividends, reflecting differing stages in financial health and strategic focus.

Strategic Positioning

This section compares the strategic positioning of Lattice Semiconductor Corporation and Ambarella, Inc., including market position, key segments, and exposure to technological disruption:

Lattice Semiconductor Corporation

- Mid-sized semiconductor company with significant market cap and competitive pressure in technology sector.

- Focuses on field programmable gate arrays and video connectivity products serving communications, computing, consumer, industrial, and automotive markets.

- Exposure to technological disruption through licensing, IP services, and evolving semiconductor product families.

Ambarella, Inc.

- Smaller market cap semiconductor firm facing high beta and competitive pressure in video processing segment.

- Develops system-on-chip solutions for video compression, AI, and image processing across automotive, security, and consumer camera markets.

- High exposure to disruption via integration of AI computer vision and video processing in automotive and industrial applications.

Lattice Semiconductor Corporation vs Ambarella, Inc. Positioning

Lattice follows a diversified approach with multiple semiconductor product families and licensing revenue streams, servicing broad end markets. Ambarella concentrates on video-based semiconductor solutions integrating AI, specializing in automotive and security cameras, with a narrower product focus.

Which has the best competitive advantage?

Both companies show very unfavorable MOAT evaluations with declining ROIC below WACC, indicating value destruction and weakening competitive advantages over recent years. Neither currently demonstrates a strong sustainable competitive advantage based on ROIC trends.

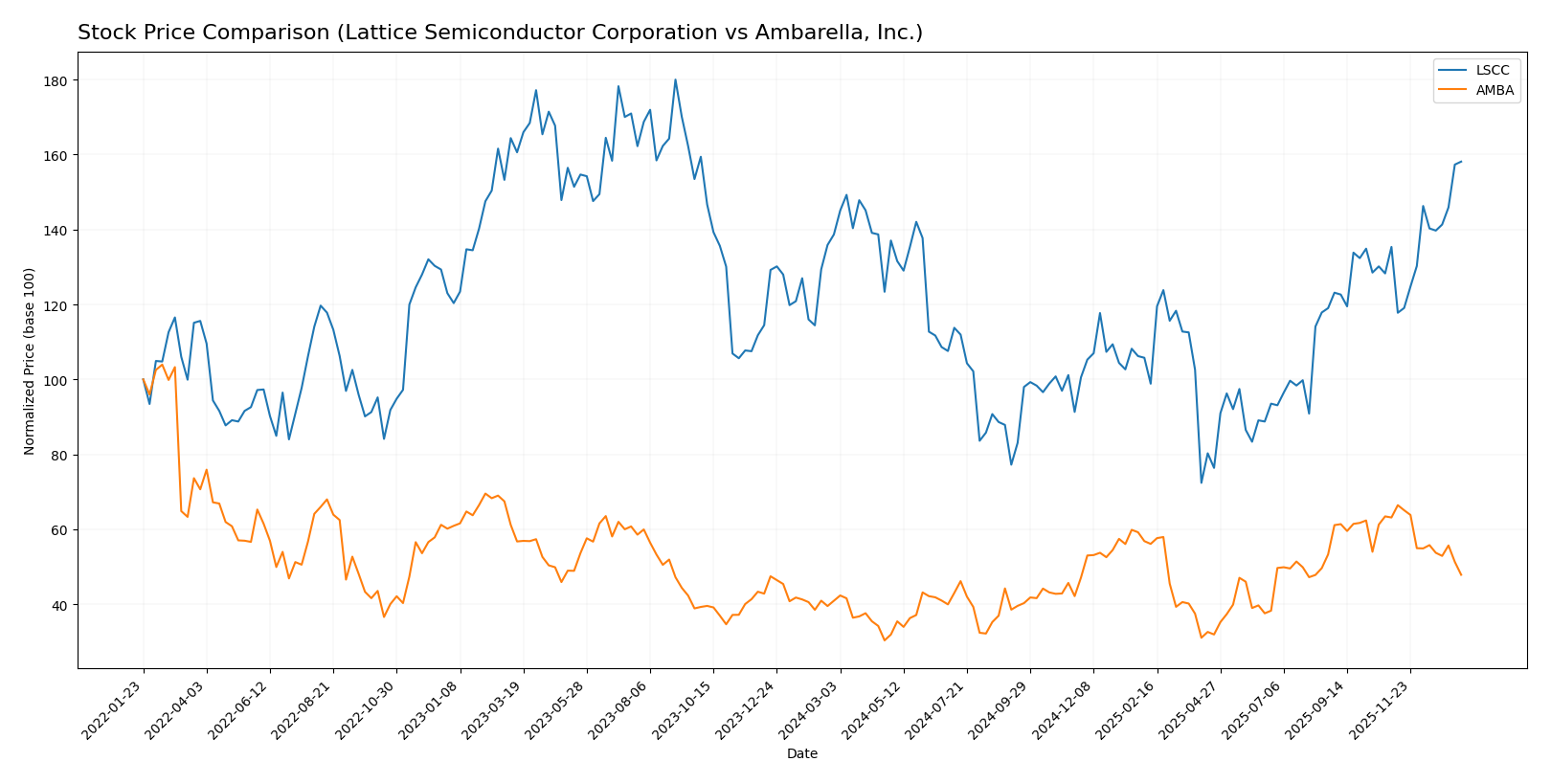

Stock Comparison

The stock price chart highlights notable bullish trends for both Lattice Semiconductor Corporation and Ambarella, Inc. over the past year, with distinct recent divergences in momentum and trading volume dynamics.

Trend Analysis

Lattice Semiconductor Corporation (LSCC) shows a 14.02% price increase over the past 12 months, indicating a bullish trend with acceleration and moderate volatility (std deviation 11.01). The stock reached a high of 85.23 and a low of 39.03.

Ambarella, Inc. (AMBA) recorded a 16.9% price increase over the same period, also bullish but with deceleration and higher volatility (std deviation 12.81). Its price ranged between 40.99 and 89.67.

Comparing recent trends, LSCC maintained a positive momentum with a 16.82% increase, while AMBA experienced a sharp 24.21% decline. LSCC delivered the highest market performance recently.

Target Prices

The current analyst consensus shows promising upside potential for both Lattice Semiconductor Corporation and Ambarella, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Lattice Semiconductor Corporation | 105 | 65 | 83 |

| Ambarella, Inc. | 115 | 80 | 97.5 |

Analysts expect Lattice Semiconductor’s stock to trade modestly above its current price of $85.23, while Ambarella’s consensus target of $97.5 suggests significant upside from its current $64.60.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Lattice Semiconductor Corporation (LSCC) and Ambarella, Inc. (AMBA):

Rating Comparison

LSCC Rating

- Rating: B-, considered Very Favorable by analysts.

- Discounted Cash Flow Score: 3, indicating a moderate valuation outlook.

- Return on Equity Score: 2, showing moderate efficiency in generating profits.

- Return on Assets Score: 3, reflecting moderate asset utilization efficiency.

- Debt To Equity Score: 4, a favorable assessment of financial stability.

- Overall Score: 2, representing a moderate overall financial standing.

AMBA Rating

- Rating: C+, also considered Very Favorable by analysts.

- Discounted Cash Flow Score: 3, also indicating a moderate valuation outlook.

- Return on Equity Score: 1, signaling very unfavorable profit generation.

- Return on Assets Score: 1, reflecting very unfavorable asset utilization.

- Debt To Equity Score: 4, equally favorable for financial stability.

- Overall Score: 2, also representing a moderate overall financial standing.

Which one is the best rated?

Based strictly on the provided data, LSCC holds a better rating with a B- compared to AMBA’s C+. LSCC performs better in return on equity and assets, while both companies share similar scores in discounted cash flow, debt to equity, and overall scores.

Scores Comparison

The following table compares the Altman Z-Score and Piotroski Score for Lattice Semiconductor Corporation and Ambarella, Inc.:

LSCC Scores

- Altman Z-Score: 52.7, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 5, reflecting an average financial strength.

AMBA Scores

- Altman Z-Score: 10.7, also in the safe zone with low bankruptcy risk.

- Piotroski Score: 3, indicating very weak financial strength.

Which company has the best scores?

LSCC has a significantly higher Piotroski Score, suggesting stronger financial health by that metric, while both companies are in the safe zone for Altman Z-Score. LSCC’s combination shows a more balanced financial profile based on the provided data.

Grades Comparison

The grades comparison for Lattice Semiconductor Corporation and Ambarella, Inc. from recognized grading companies is as follows:

Lattice Semiconductor Corporation Grades

Below is a summary of recent grades from reputable grading firms for Lattice Semiconductor Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-13 |

| Stifel | Maintain | Buy | 2025-11-04 |

| Baird | Maintain | Outperform | 2025-11-04 |

| Needham | Maintain | Buy | 2025-11-04 |

| Rosenblatt | Maintain | Buy | 2025-11-04 |

| Benchmark | Maintain | Buy | 2025-11-04 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Keybanc | Maintain | Overweight | 2025-09-30 |

| Needham | Maintain | Buy | 2025-09-22 |

| Benchmark | Maintain | Buy | 2025-09-11 |

The overall trend for Lattice Semiconductor Corporation shows consistent buy and outperform ratings, indicating a generally positive view from analysts.

Ambarella, Inc. Grades

The following table presents recent grades from reputable grading firms for Ambarella, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Maintain | Neutral | 2025-11-26 |

| Needham | Maintain | Buy | 2025-11-26 |

| Stifel | Maintain | Buy | 2025-11-26 |

| Rosenblatt | Maintain | Buy | 2025-11-26 |

| Rosenblatt | Maintain | Buy | 2025-11-24 |

| Stifel | Maintain | Buy | 2025-08-29 |

| Needham | Maintain | Buy | 2025-08-29 |

| Northland Capital Markets | Maintain | Outperform | 2025-08-29 |

| Morgan Stanley | Maintain | Overweight | 2025-08-29 |

| Oppenheimer | Maintain | Perform | 2025-08-29 |

Ambarella, Inc. also maintains mostly buy and outperform ratings, with some hold and neutral opinions, reflecting a moderately positive analyst consensus.

Which company has the best grades?

Both Lattice Semiconductor Corporation and Ambarella, Inc. hold a consensus “Buy” rating, but Lattice shows a stronger concentration of buy and outperform grades without neutral ratings. This suggests investors may see slightly higher confidence in Lattice’s prospects, potentially affecting portfolio allocation decisions accordingly.

Strengths and Weaknesses

The table below summarizes the key strengths and weaknesses of Lattice Semiconductor Corporation (LSCC) and Ambarella, Inc. (AMBA) based on the latest financial and operational data.

| Criterion | Lattice Semiconductor Corporation (LSCC) | Ambarella, Inc. (AMBA) |

|---|---|---|

| Diversification | Moderate, with a focus on licensing and product revenues primarily from distributors | Limited diversification, heavily reliant on core products |

| Profitability | Net margin positive at 12%, but ROIC (4.59%) below WACC (11.86%) signals value erosion | Negative net margin (-41.12%) and ROIC (-21.96%), indicating significant losses |

| Innovation | Stable innovation with favorable fixed asset turnover (7.62) | High fixed asset turnover (19.96) but overall declining profitability suggests innovation challenges |

| Global presence | Strong distributor network indicating broad geographic reach | Presence confirmed but less diversified compared to LSCC |

| Market Share | Significant through distributor channels, though facing profitability pressure | Smaller scale, struggling with market positioning and profitability |

In summary, both companies are currently facing profitability challenges with declining ROIC trends, indicating value destruction. LSCC shows better diversification and more stable financial ratios, while AMBA struggles with greater losses and weaker operational efficiency. Caution is advised when considering investments in either company.

Risk Analysis

Below is a comparative table outlining key risk factors for Lattice Semiconductor Corporation (LSCC) and Ambarella, Inc. (AMBA) based on the most recent data available in 2026:

| Metric | Lattice Semiconductor Corporation (LSCC) | Ambarella, Inc. (AMBA) |

|---|---|---|

| Market Risk | High beta of 1.716 indicates elevated volatility relative to the market | Very high beta of 1.953 reflects greater sensitivity to market swings |

| Debt level | Very low debt-to-equity ratio of 0.02, indicating low financial leverage | Extremely low debt ratio of 0.01, minimal financial risk from debt |

| Regulatory Risk | Moderate, semiconductor industry subject to export controls and IP regulations | Moderate, with added scrutiny on AI and video tech privacy regulations |

| Operational Risk | Relatively stable operational metrics, favorable quick ratio of 2.62 | Operational challenges reflected in negative margins and low asset turnover |

| Environmental Risk | Typical for semiconductors; no major issues reported | Similar industry exposure, no specific environmental concerns noted |

| Geopolitical Risk | Exposure to Asia-Pacific supply chains and trade tensions | Similar exposure, dependence on global supply chains and US-China dynamics |

In synthesis, both companies face significant market risk due to their high betas, making their stocks more volatile. Ambarella’s operational risk is more pronounced given its negative profitability and weak efficiency ratios, which could impact sustainability. Lattice Semiconductor boasts stronger financial stability with minimal debt and better operational metrics but carries moderate geopolitical and regulatory risks typical to the semiconductor sector. Investors should weigh these factors carefully, prioritizing risk tolerance and diversification.

Which Stock to Choose?

Lattice Semiconductor Corporation (LSCC) shows a favorable income statement with a 12% net margin but recent declines in revenue and profitability. Financial ratios are slightly unfavorable overall, though debt levels and interest coverage are strong. Its rating is very favorable, supported by a moderate overall financial score.

Ambarella, Inc. (AMBA) presents favorable revenue growth and gross margin but suffers negative profitability and returns, with an unfavorable global ratio evaluation. Its rating is also very favorable, despite weak return metrics and a very weak Piotroski score, reflecting financial challenges.

For investors prioritizing a company with a more stable income statement and stronger debt metrics, LSCC might appear more favorable; conversely, those focused on revenue growth amid profitability challenges may find AMBA intriguing. Both companies show value destruction and declining ROIC, suggesting caution in evaluating long-term capital efficiency.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Lattice Semiconductor Corporation and Ambarella, Inc. to enhance your investment decisions: