In today’s fast-evolving semiconductor landscape, IPG Photonics Corporation and Ambarella, Inc. stand out as innovative leaders driving technological progress. Both companies specialize in cutting-edge solutions—IPG in high-performance fiber lasers and Ambarella in advanced video processing chips—targeting diverse markets from industrial to automotive and security. This comparison highlights their strategic strengths and market positioning, helping you decide which company presents the most compelling investment opportunity. Let’s dive in to uncover which may best fit your portfolio.

Table of contents

Companies Overview

I will begin the comparison between IPG Photonics Corporation and Ambarella, Inc. by providing an overview of these two companies and their main differences.

IPG Photonics Corporation Overview

IPG Photonics Corporation focuses on developing and manufacturing high-performance fiber lasers, amplifiers, and diode lasers for materials processing and communications worldwide. Founded in 1990 and based in Massachusetts, the company serves original equipment manufacturers and system integrators with a broad range of laser products and integrated systems. IPG operates in the semiconductor industry with a market cap of approximately 3.37B USD.

Ambarella, Inc. Overview

Ambarella, Inc. specializes in semiconductor solutions for video processing, including HD and ultra-HD compression and AI-driven computer vision. Founded in 2004 and headquartered in California, Ambarella provides system-on-chip designs for automotive cameras, security systems, robotics, and consumer electronics. The company operates in the semiconductor sector with a market cap near 2.74B USD and a smaller workforce compared to IPG.

Key similarities and differences

Both companies operate in the semiconductor industry and target original equipment manufacturers and system integrators through direct sales and distributors. IPG Photonics emphasizes fiber laser technologies primarily for industrial and communications applications, while Ambarella focuses on video processing and AI for automotive, security, and consumer markets. IPG has a significantly larger employee base and broader laser product portfolio, contrasting with Ambarella’s niche in video-centric semiconductor solutions.

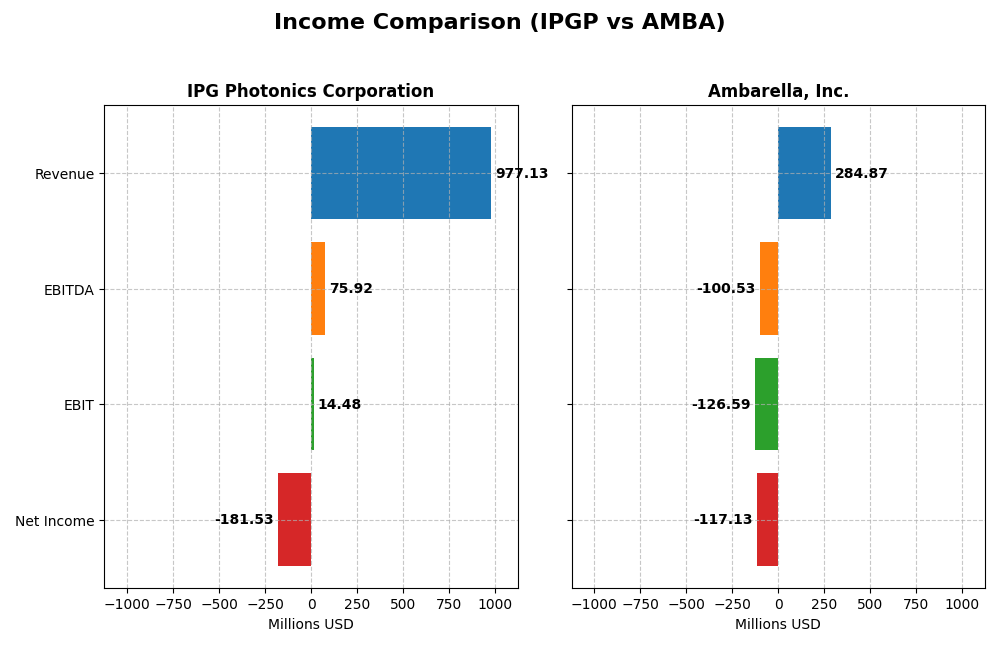

Income Statement Comparison

The table below presents a side-by-side comparison of the most recent fiscal year income statement metrics for IPG Photonics Corporation and Ambarella, Inc.

| Metric | IPG Photonics Corporation | Ambarella, Inc. |

|---|---|---|

| Market Cap | 3.37B | 2.74B |

| Revenue | 977M | 285M |

| EBITDA | 76M | -101M |

| EBIT | 14M | -127M |

| Net Income | -182M | -117M |

| EPS | -4.09 | -2.84 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

IPG Photonics Corporation

IPGP’s revenue declined by 24.1% from 2023 to 2024, with net income turning sharply negative to -181.5M in 2024 from a positive 218.9M in 2023. Gross margin remained relatively favorable at 34.6%, but net margins fell to -18.6%, reflecting significant operational challenges. The recent year showed steep declines in profitability and earnings per share.

Ambarella, Inc.

AMBA experienced a revenue increase of 25.8% in 2025, reaching 285M, with gross margin holding strong at 60.5%. Nevertheless, the company reported a net loss of -117.1M, though it improved from prior years. EBIT margin stayed unfavorable at -44.4%, but there was a notable recovery trend in growth and margin improvements in the latest fiscal year.

Which one has the stronger fundamentals?

AMBA demonstrates stronger fundamentals with favorable revenue growth, improving margins, and a positive trajectory in earnings growth over the latest year despite continued net losses. Conversely, IPGP shows declining revenues and sharply worsening net income, with mostly unfavorable income statement trends, signaling weaker recent operational performance.

Financial Ratios Comparison

The table below compares key financial ratios for IPG Photonics Corporation and Ambarella, Inc. based on their most recent fiscal year data, providing a snapshot of their profitability, liquidity, valuation, and efficiency.

| Ratios | IPG Photonics Corporation (2024) | Ambarella, Inc. (2025) |

|---|---|---|

| ROE | -8.97% | -20.86% |

| ROIC | -9.97% | -21.96% |

| P/E | -17.76 | -27.05 |

| P/B | 1.59 | 5.64 |

| Current Ratio | 6.98 | 2.65 |

| Quick Ratio | 5.59 | 2.36 |

| D/E | 0.009 | 0.009 |

| Debt-to-Assets | 0.78% | 0.76% |

| Interest Coverage | 0 | 0 |

| Asset Turnover | 0.43 | 0.41 |

| Fixed Asset Turnover | 1.66 | 19.96 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

IPG Photonics Corporation

IPGP shows mixed financial health with a slight tilt towards unfavorable. Key profitability ratios like net margin (-18.58%) and ROE (-8.97%) are negative, signaling operational challenges. However, liquidity appears strong with a quick ratio of 5.59, and leverage is low with a debt-to-equity ratio of 0.01. The company pays no dividends, likely focusing on reinvestment or growth.

Ambarella, Inc.

AMBA’s ratios reflect more pronounced difficulties, including a steep negative net margin of -41.12% and ROE at -20.86%, indicating significant losses. Its liquidity ratios are favorable, with a current ratio of 2.65 and low debt levels. Like IPGP, Ambarella does not pay dividends, probably prioritizing R&D and acquisitions during its high growth phase.

Which one has the best ratios?

Comparing both, IPGP’s ratios are slightly unfavorable but show better profitability and coverage ratios than AMBA, which faces stronger negative returns and a higher weighted average cost of capital. IPGP’s balance of liquidity and leverage metrics is more stable, whereas AMBA’s financials suggest greater risk and operational strain.

Strategic Positioning

This section compares the strategic positioning of IPG Photonics Corporation and Ambarella, Inc., including market position, key segments, and exposure to technological disruption:

IPGP

- Established player in fiber lasers within semiconductors, facing moderate competitive pressure.

- Focused on fiber lasers, amplifiers, laser systems mostly for materials processing and communications.

- Exposure to laser technology disruption in materials processing and communications markets.

AMBA

- Developer of semiconductor video solutions with high beta, indicating elevated competitive risk.

- Concentrated on HD video processing chips for automotive, security, robotics, and consumer cameras.

- Faces disruption from evolving AI, computer vision, and semiconductor integration technologies.

IPGP vs AMBA Positioning

IPGP offers diversified laser products mainly for materials processing and communications, while AMBA concentrates on video processing semiconductors for automotive and security. IPGP’s broader segment base contrasts with AMBA’s specialized chip solutions focus.

Which has the best competitive advantage?

Both IPGP and AMBA show very unfavorable MOAT evaluations with declining ROIC and value destruction, indicating neither currently sustains a strong competitive advantage.

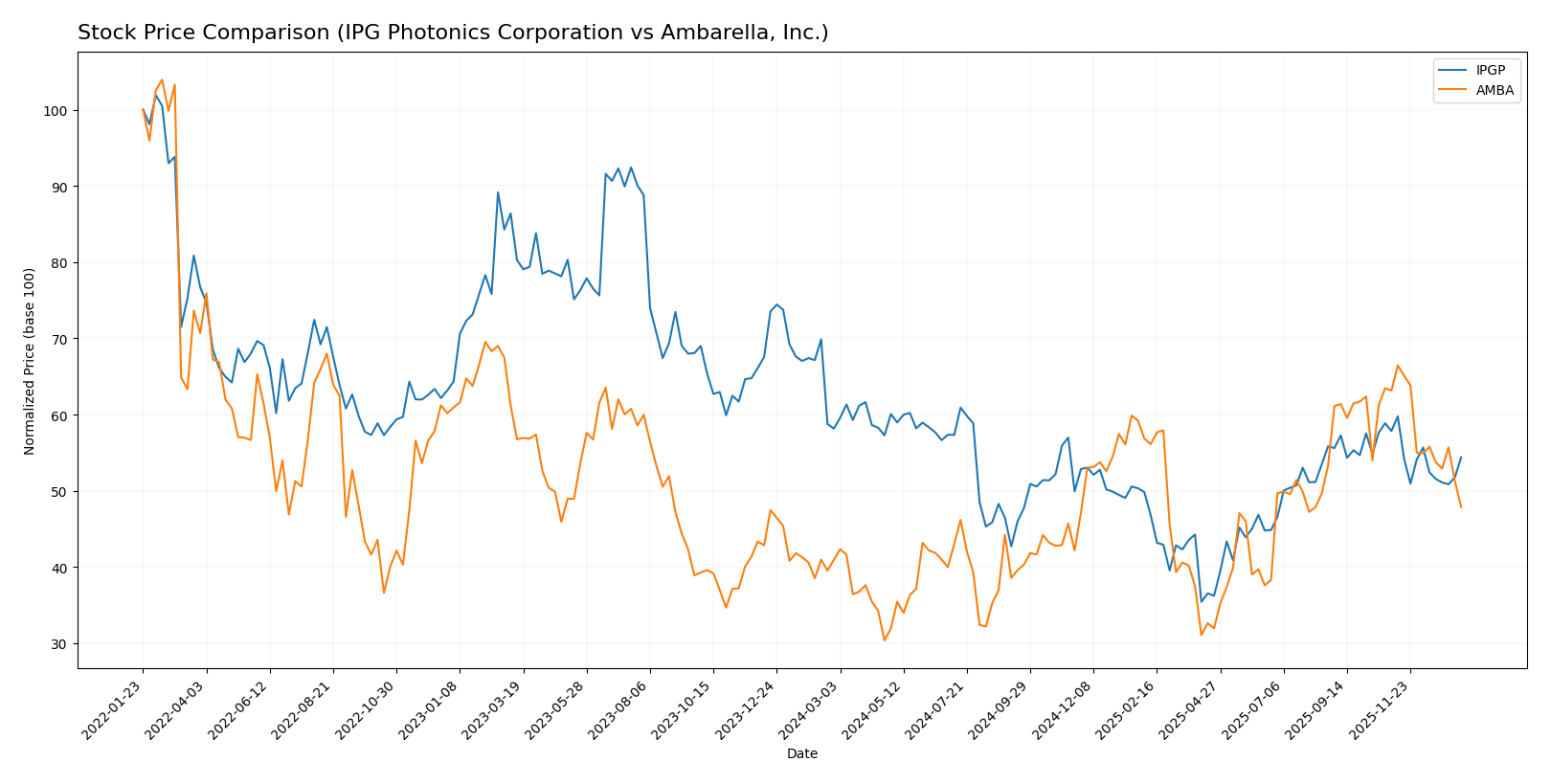

Stock Comparison

The stock prices of IPG Photonics Corporation and Ambarella, Inc. over the past year reveal contrasting dynamics, with IPGP showing a steady decline and AMBA experiencing overall gains despite recent sharp drops in trading activity.

Trend Analysis

IPG Photonics Corporation’s stock exhibited a bearish trend with a -6.49% decline over the past 12 months, showing a deceleration phase and a standard deviation of 9.27. The price ranged from a high of 90.69 to a low of 52.12.

Ambarella, Inc. demonstrated a bullish trend with a 16.9% gain over the same period, though recent months showed a sharp -24.21% drop and decelerating momentum. Volatility was higher, with a standard deviation of 12.81 and price extremes between 89.67 and 40.99.

Comparatively, Ambarella delivered the highest market performance over the past year despite recent volatility, whereas IPG Photonics faced a consistent bearish trend with moderate volatility.

Target Prices

The current analyst consensus reflects moderate upside potential for both IPG Photonics Corporation and Ambarella, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| IPG Photonics Corporation | 96 | 92 | 94 |

| Ambarella, Inc. | 115 | 80 | 97.5 |

Analysts expect IPG Photonics’ stock to rise from $80.03 to around $94, indicating a cautious optimism. Ambarella’s consensus target of $97.5 suggests a significant upside from its current $64.60 price, reflecting stronger growth expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for IPG Photonics Corporation and Ambarella, Inc.:

Rating Comparison

IPGP Rating

- Rating: B+ indicating a very favorable status.

- Discounted Cash Flow Score: 4, favorable rating.

- ROE Score: 2, moderate rating.

- ROA Score: 3, moderate rating.

- Debt To Equity Score: 4, favorable rating.

- Overall Score: 3, moderate rating.

AMBA Rating

- Rating: C+ indicating a very favorable status.

- Discounted Cash Flow Score: 3, moderate rating.

- ROE Score: 1, very unfavorable rating.

- ROA Score: 1, very unfavorable rating.

- Debt To Equity Score: 4, favorable rating.

- Overall Score: 2, moderate rating.

Which one is the best rated?

Based strictly on the provided data, IPGP holds higher ratings and scores compared to AMBA, particularly in discounted cash flow, return on equity, and return on assets, indicating a comparatively stronger financial standing.

Scores Comparison

The scores comparison between IPG Photonics Corporation and Ambarella, Inc. is as follows:

IPGP Scores

- Altman Z-Score: 9.65, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial strength and investment appeal.

AMBA Scores

- Altman Z-Score: 10.69, also in the safe zone with very low bankruptcy risk.

- Piotroski Score: 3, indicating very weak financial strength and low investment appeal.

Which company has the best scores?

Both IPGP and AMBA show strong Altman Z-Scores in the safe zone, suggesting low bankruptcy risk. However, IPGP’s Piotroski Score is much stronger at 7 compared to AMBA’s very weak score of 3, indicating better overall financial health for IPGP.

Grades Comparison

Here is a detailed comparison of the recent grades assigned to IPG Photonics Corporation and Ambarella, Inc.:

IPG Photonics Corporation Grades

The following table summarizes recent grades from verifiable grading companies for IPG Photonics Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Upgrade | Buy | 2025-11-05 |

| Bernstein | Upgrade | Outperform | 2025-08-07 |

| Raymond James | Maintain | Strong Buy | 2025-05-07 |

| CL King | Upgrade | Buy | 2025-03-18 |

| Citigroup | Maintain | Sell | 2025-02-18 |

| Stifel | Maintain | Buy | 2025-02-12 |

| Needham | Maintain | Hold | 2025-02-12 |

| Seaport Global | Downgrade | Neutral | 2024-08-01 |

| Stifel | Maintain | Buy | 2024-07-31 |

| Raymond James | Maintain | Strong Buy | 2024-07-31 |

IPG Photonics shows a general trend of upgrades and maintained strong buy or buy ratings, with only a few hold or sell ratings.

Ambarella, Inc. Grades

The table below presents recent grades from recognized grading firms for Ambarella, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Maintain | Neutral | 2025-11-26 |

| Needham | Maintain | Buy | 2025-11-26 |

| Stifel | Maintain | Buy | 2025-11-26 |

| Rosenblatt | Maintain | Buy | 2025-11-26 |

| Rosenblatt | Maintain | Buy | 2025-11-24 |

| Stifel | Maintain | Buy | 2025-08-29 |

| Needham | Maintain | Buy | 2025-08-29 |

| Northland Capital Markets | Maintain | Outperform | 2025-08-29 |

| Morgan Stanley | Maintain | Overweight | 2025-08-29 |

| Oppenheimer | Maintain | Perform | 2025-08-29 |

Ambarella has consistently maintained buy or better ratings, with no downgrades reported in the latest data.

Which company has the best grades?

Both IPG Photonics Corporation and Ambarella, Inc. hold a consensus “Buy” rating, with many buy and outperform recommendations. Ambarella’s grades lean more consistently toward “Buy” without recent downgrades, while IPG Photonics includes some upgrades and a few hold or sell ratings, reflecting a slightly more mixed but positive outlook. This dynamic may influence investor confidence and portfolio positioning differently.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses of IPG Photonics Corporation (IPGP) and Ambarella, Inc. (AMBA) based on the most recent financial and operational data.

| Criterion | IPG Photonics Corporation (IPGP) | Ambarella, Inc. (AMBA) |

|---|---|---|

| Diversification | Moderate: Focused mainly on laser systems with some product variety across laser types. | Limited diversification; primarily semiconductor solutions for video processing. |

| Profitability | Weak: Negative net margin (-18.58%) and ROIC (-9.97%), value destroying. | Weak: Larger negative net margin (-41.12%) and ROIC (-21.96%), also value destroying. |

| Innovation | Moderate: Offers advanced laser technologies but faced declining profitability. | Moderate: Strong in video processing innovation but profitability declining sharply. |

| Global presence | Established global sales in industrial laser markets. | Focused on niche video semiconductor markets, global reach less clear. |

| Market Share | Strong in fiber laser market but challenged by declining returns. | Growing market share in AI video chips, but financials suggest operational challenges. |

Key takeaways: Both companies struggle with profitability and are currently value destroyers, showing declining returns on invested capital. IPG Photonics has a more diversified laser product portfolio and stronger market presence, while Ambarella focuses on specialized semiconductor innovation but faces steeper financial challenges. Caution is advised when considering investments in either company due to their unfavorable financial trends.

Risk Analysis

Below is a comparative overview of key risks facing IPG Photonics Corporation (IPGP) and Ambarella, Inc. (AMBA) as of the latest fiscal years.

| Metric | IPG Photonics Corporation (IPGP) | Ambarella, Inc. (AMBA) |

|---|---|---|

| Market Risk | Moderate beta of 1.02; cyclical semiconductor sector exposure | High beta of 1.95; volatile semiconductor and AI markets |

| Debt Level | Very low debt-to-equity (0.01), strong balance sheet | Very low debt-to-equity (0.01), solid leverage position |

| Regulatory Risk | Moderate; US tech regulations and export controls | Moderate; US and global tech and AI regulations |

| Operational Risk | Supply chain disruptions possible; manufacturing complexity | High dependence on advanced AI chip development; execution risks |

| Environmental Risk | Low; limited direct environmental impact | Low; primarily semiconductor design, limited manufacturing footprint |

| Geopolitical Risk | Moderate; global supply chain and trade tensions | Elevated; reliance on global markets and geopolitical AI export concerns |

IPGP shows moderate market risk with a stable financial structure and strong Altman Z-Score indicating low bankruptcy risk. AMBA faces higher market and operational risk due to its exposure to volatile AI markets and weaker Piotroski score, signaling financial fragility. Investors should focus on AMBA’s elevated execution and market volatility risks, while IPGP’s main concerns involve industry cyclicality.

Which Stock to Choose?

IPG Photonics Corporation (IPGP) shows a declining income trend with a -24.1% revenue drop in 2024 and unfavorable profitability ratios including -18.58% net margin and negative ROE and ROIC. It maintains very low debt and favorable liquidity, earning a B+ rating with a moderate overall score, but its economic moat is very unfavorable due to value destruction.

Ambarella, Inc. (AMBA) presents a more favorable income growth of 25.78% in 2025, yet suffers from a steep negative net margin of -41.12% and weak profitability ratios. The company carries low debt and a C+ rating with a moderate overall score, but it also displays a very unfavorable economic moat with declining ROIC and value loss.

Considering ratings and financials, IPGP might appear more financially stable with better debt management and a stronger rating, while AMBA’s recent revenue growth could attract risk-tolerant investors focused on growth despite weaker profitability. Conversely, risk-averse investors might see IPGP as relatively more favorable due to its higher rating and steadier financial ratios.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of IPG Photonics Corporation and Ambarella, Inc. to enhance your investment decisions: