In the competitive semiconductor industry, Ambarella, Inc. (AMBA) and indie Semiconductor, Inc. (INDI) stand out by focusing on automotive and advanced video processing technologies. Both companies develop innovative solutions that power next-generation driver assistance and connected vehicle systems, highlighting their market overlap. This comparison dives into their strategies and growth potential to help you determine which stock might be the smarter addition to your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Ambarella and indie Semiconductor by providing an overview of these two companies and their main differences.

Ambarella Overview

Ambarella, Inc. develops semiconductor solutions focused on video processing, including HD and ultra HD compression, image processing, and deep neural network capabilities. The company integrates multiple functions onto single chips for automotive cameras, security systems, and various consumer and industrial applications. Founded in 2004, Ambarella is headquartered in Santa Clara, California, and operates within the semiconductor industry.

indie Semiconductor Overview

indie Semiconductor, Inc. specializes in automotive semiconductors and software aimed at advanced driver assistance, connectivity, user experience, and electrification. Their products include ultrasound sensors, in-cabin wireless charging, infotainment, LED lighting, and photonic components for optical sensing and communication. Established in 2007, indie Semiconductor is based in Aliso Viejo, California, and serves the automotive semiconductor market.

Key similarities and differences

Both Ambarella and indie Semiconductor operate in the semiconductor sector with a focus on automotive applications, particularly advanced driver assistance systems. Ambarella emphasizes video and image processing solutions, integrating AI and deep neural networks, while indie Semiconductor concentrates on a broader range of automotive system components, including photonic devices and connectivity solutions. Their product scopes reflect complementary but distinct approaches within the automotive technology space.

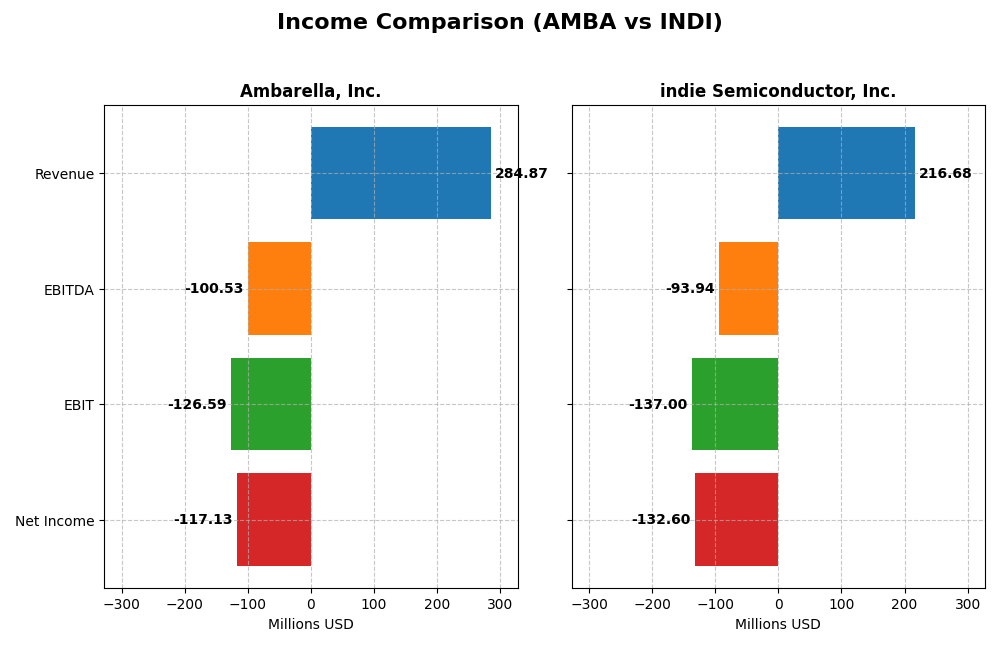

Income Statement Comparison

This table presents the latest fiscal year income statement metrics for Ambarella, Inc. and indie Semiconductor, Inc., providing a clear financial snapshot for comparison.

| Metric | Ambarella, Inc. (AMBA) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Market Cap | 3.18B | 750M |

| Revenue | 285M | 217M |

| EBITDA | -101M | -94M |

| EBIT | -127M | -137M |

| Net Income | -117M | -133M |

| EPS | -2.84 | -0.76 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Ambarella, Inc.

Ambarella’s revenue trended upwards by 27.75% overall, reaching $285M in 2025, with gross margin holding favorably at 60.5%. Despite an improving net margin growth of 45.04% in 2025, the net margin remains negative at -41.12%. The company’s latest year showed revenue growth of 25.78% and an 18.09% increase in EBIT, indicating operational improvement but persistent losses.

indie Semiconductor, Inc.

Indie Semiconductor’s revenue soared by 858.35% over the period but dipped by 2.91% in 2024 to $217M. Gross margin improved significantly with a favorable 263.85% growth year-on-year to 41.68%. However, both EBIT and net margins remain deeply negative at -63.22% and -61.2%, with a 16.11% decline in net margin in the latest year, reflecting ongoing profitability challenges.

Which one has the stronger fundamentals?

Ambarella displays stronger fundamentals with a favorable global income statement opinion and higher gross margin stability, despite ongoing net losses. Indie Semiconductor shows impressive revenue growth but suffers from deeper negative margins and a neutral overall statement evaluation. Ambarella’s consistent operational improvement contrasts with indie’s volatility and margin pressures.

Financial Ratios Comparison

The table below presents a selection of key financial ratios for Ambarella, Inc. (AMBA) and indie Semiconductor, Inc. (INDI) for their most recent fiscal years, facilitating a direct comparison of their financial metrics.

| Ratios | Ambarella, Inc. (2025) | indie Semiconductor, Inc. (2024) |

|---|---|---|

| ROE | -20.9% | -31.7% |

| ROIC | -22.0% | -19.3% |

| P/E | -27.1 | -5.35 |

| P/B | 5.64 | 1.70 |

| Current Ratio | 2.65 | 4.82 |

| Quick Ratio | 2.36 | 4.23 |

| D/E | 0.0094 | 0.95 |

| Debt-to-Assets | 0.76% | 42.3% |

| Interest Coverage | 0 | -18.4 |

| Asset Turnover | 0.41 | 0.23 |

| Fixed Asset Turnover | 19.96 | 4.30 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Ambarella, Inc.

Ambarella shows a mixed set of ratios with 43% favorable and 57% unfavorable indicators, reflecting some financial weaknesses. Key concerns include negative net margin (-41.12%), return on equity (-20.86%), and return on invested capital (-21.96%). The company has a strong liquidity position with a current ratio of 2.65 but faces challenges with asset turnover and interest coverage. Ambarella does not pay dividends, likely focusing on reinvestment and growth.

indie Semiconductor, Inc.

indie Semiconductor also presents an unfavorable overall ratio profile, with 21% favorable, 57% unfavorable, and 21% neutral metrics. The company struggles with a steep negative net margin (-61.2%) and return on equity (-31.73%), alongside a challenging interest coverage ratio (-14.8). Liquidity appears strong with a quick ratio of 4.23. Like Ambarella, indie Semiconductor does not distribute dividends, probably due to ongoing investment in development and expansion.

Which one has the best ratios?

Both companies have predominantly unfavorable financial ratios, indicating operational and profitability challenges. Ambarella has a higher proportion of favorable ratios (43% versus 21%) and better leverage metrics, while indie Semiconductor’s ratios show more neutrality in debt metrics but weaker profitability and coverage. Overall, Ambarella demonstrates a slightly stronger ratio profile compared to indie Semiconductor.

Strategic Positioning

This section compares the strategic positioning of Ambarella, Inc. and indie Semiconductor, Inc., focusing on Market position, Key segments, and Exposure to technological disruption:

Ambarella, Inc.

- Mid-sized semiconductor firm with a focus on video processing chips, facing competitive pressures in HD and AI video markets.

- Focuses on semiconductors for automotive cameras, video processing, AI, security, robotics, and consumer cameras.

- Operates in video and AI chip technology with possible risks from evolving automotive and imaging technologies.

indie Semiconductor, Inc.

- Smaller semiconductor company specializing in automotive semiconductors and software, competing in ADAS and connected car markets.

- Key segments include automotive applications like parking assistance, infotainment, user experience, and photonics.

- Exposed to disruption from emerging technologies in photonics, laser systems, and automotive electrification solutions.

Ambarella, Inc. vs indie Semiconductor, Inc. Positioning

Ambarella has a diversified product range across video, AI, and automotive sectors, while indie Semiconductor has a more concentrated focus on automotive semiconductors and photonics. Ambarella’s broader scope may diversify risks; indie targets specialized automotive innovation.

Which has the best competitive advantage?

Both companies show a very unfavorable moat with declining ROIC trends, indicating value destruction and weak competitive advantages based on their current capital efficiency and profitability.

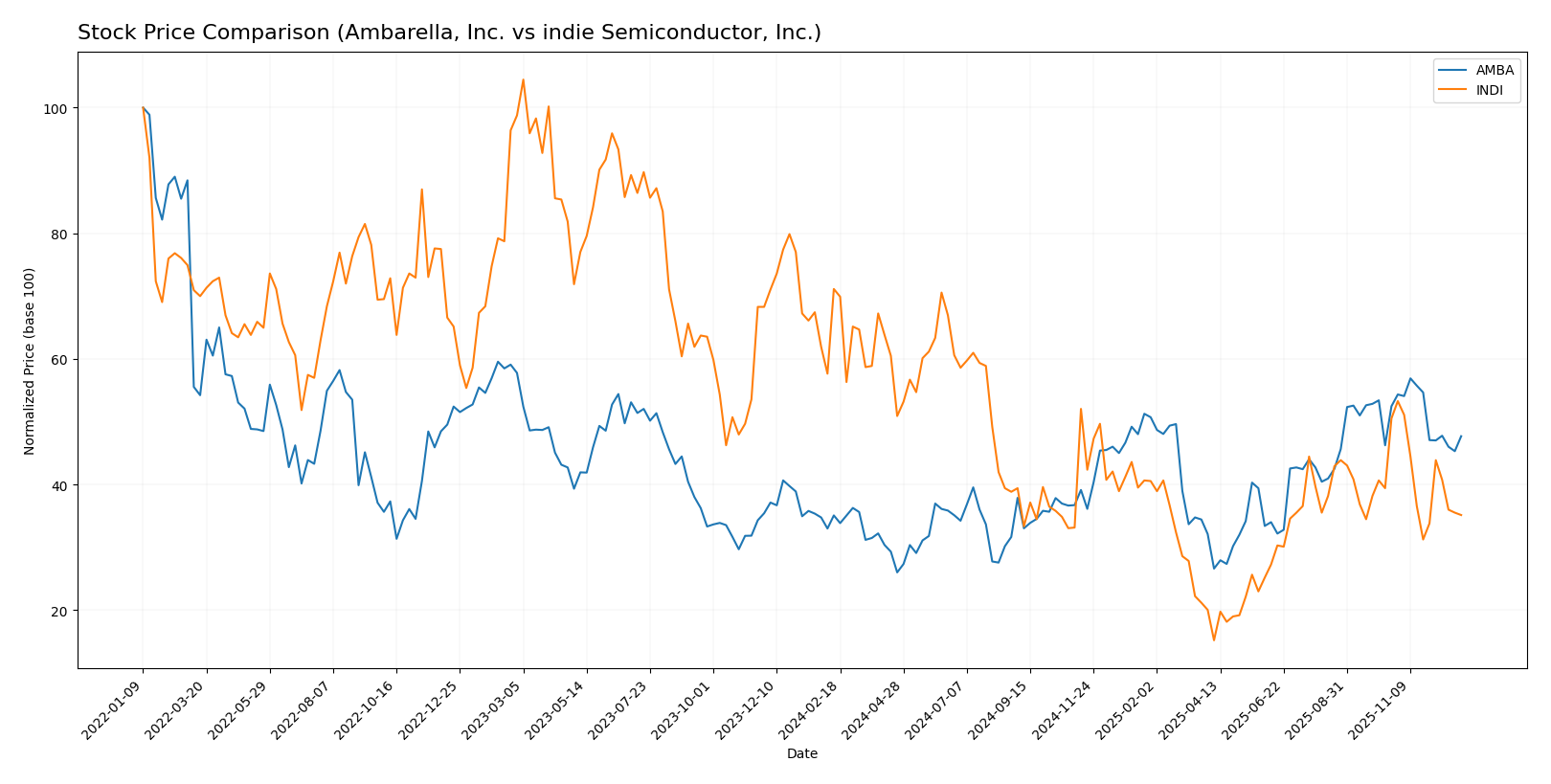

Stock Comparison

The stock price movements of Ambarella, Inc. and indie Semiconductor, Inc. over the past year reveal contrasting trends, with Ambarella showing strong gains despite recent pullbacks, while indie Semiconductor faces significant declines.

Trend Analysis

Ambarella, Inc. exhibited a bullish trend over the past 12 months with a 35.96% price increase, although momentum has decelerated. The stock ranged between $40.99 and $89.67 with a standard deviation of 12.84, indicating notable volatility.

indie Semiconductor, Inc. showed a bearish trend over the same period, with a 50.6% price decrease and decelerating losses. Price fluctuated from $1.6 to $7.49, and its lower volatility is reflected in a 1.42 standard deviation.

Comparing both, Ambarella delivered the highest market performance with its strong bullish trend, while indie Semiconductor significantly underperformed with sustained declines.

Target Prices

The current analyst consensus reveals a cautiously optimistic outlook for both Ambarella, Inc. and indie Semiconductor, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Ambarella, Inc. | 115 | 80 | 97.5 |

| indie Semiconductor, Inc. | 8 | 8 | 8 |

Analysts expect Ambarella’s stock to rise significantly from its current price of $75.16, indicating upside potential. indie Semiconductor’s target price of $8 also suggests notable appreciation from its current $3.70 market price.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Ambarella, Inc. (AMBA) and indie Semiconductor, Inc. (INDI):

Rating Comparison

AMBA Rating

- Rating: C+, considered very favorable by analysts.

- Discounted Cash Flow Score: 3, moderate status indicating balanced valuation.

- ROE Score: 1, very unfavorable, showing weak profit generation from equity.

- ROA Score: 1, very unfavorable, reflecting poor asset utilization.

- Debt To Equity Score: 4, favorable, indicating strong balance sheet with low financial risk.

- Overall Score: 2, moderate, suggesting average overall financial standing.

INDI Rating

- Rating: C, also considered very favorable by analysts.

- Discounted Cash Flow Score: 1, very unfavorable, suggesting potential overvaluation.

- ROE Score: 1, very unfavorable, indicating weak profitability from equity.

- ROA Score: 1, very unfavorable, reflecting poor asset utilization.

- Debt To Equity Score: 3, moderate, implying average financial risk.

- Overall Score: 2, moderate, implying average overall financial standing.

Which one is the best rated?

Based strictly on the data, AMBA holds a slightly better rating (C+ vs. C) and shows a stronger debt-to-equity score, indicating lower financial risk. Both companies share similar overall and profitability scores, but AMBA’s valuation metrics are moderately more favorable.

Scores Comparison

Here is a comparison of the financial scores for Ambarella, Inc. and indie Semiconductor, Inc.:

AMBA Scores

- Altman Z-Score: 10.88, indicating a safe financial zone with low bankruptcy risk.

- Piotroski Score: 3, classified as very weak financial strength.

INDI Scores

- Altman Z-Score: 0.14, indicating distress with high bankruptcy risk.

- Piotroski Score: 3, also classified as very weak financial strength.

Which company has the best scores?

Ambarella exhibits a significantly stronger financial position in terms of bankruptcy risk with a safe Altman Z-Score, while both companies share the same very weak Piotroski Score, reflecting similar financial strength levels.

Grades Comparison

Here is a comparison of recent grades assigned to Ambarella, Inc. and indie Semiconductor, Inc.:

Ambarella, Inc. Grades

This table summarizes the latest grades from established grading companies for Ambarella, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rosenblatt | Maintain | Buy | 2025-11-26 |

| Stifel | Maintain | Buy | 2025-11-26 |

| B of A Securities | Maintain | Neutral | 2025-11-26 |

| Needham | Maintain | Buy | 2025-11-26 |

| Rosenblatt | Maintain | Buy | 2025-11-24 |

| Oppenheimer | Maintain | Perform | 2025-08-29 |

| Morgan Stanley | Maintain | Overweight | 2025-08-29 |

| Northland Capital Markets | Maintain | Outperform | 2025-08-29 |

| B of A Securities | Maintain | Neutral | 2025-08-29 |

| Stifel | Maintain | Buy | 2025-08-29 |

Ambarella’s grades indicate a predominantly positive outlook, with multiple buy and outperform ratings consistently maintained.

indie Semiconductor, Inc. Grades

This table presents recent grades from recognized grading firms for indie Semiconductor, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2025-11-10 |

| Benchmark | Maintain | Buy | 2025-06-25 |

| Benchmark | Maintain | Buy | 2025-06-11 |

| Benchmark | Maintain | Buy | 2025-05-21 |

| Benchmark | Maintain | Buy | 2025-05-13 |

| Craig-Hallum | Maintain | Buy | 2025-05-13 |

| Keybanc | Maintain | Overweight | 2025-05-13 |

| Benchmark | Maintain | Buy | 2025-04-09 |

| Benchmark | Maintain | Buy | 2025-02-21 |

| Keybanc | Maintain | Overweight | 2025-02-21 |

indie Semiconductor’s grades show a strong buy rating consensus, supported by multiple repeated buy and overweight designations.

Which company has the best grades?

Both companies have received generally favorable grades, but indie Semiconductor, Inc. demonstrates a more consistent buy rating trend across multiple firms. This could influence investors by signaling stronger analyst conviction compared to Ambarella’s more mixed neutral and buy ratings.

Strengths and Weaknesses

Below is a comparison table highlighting the key strengths and weaknesses of Ambarella, Inc. (AMBA) and indie Semiconductor, Inc. (INDI) based on their latest financial and operational data.

| Criterion | Ambarella, Inc. (AMBA) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Diversification | Limited diversification; focused mainly on video processing | Moderate product-service mix; product revenue ~203M, services ~14M in 2024 |

| Profitability | Negative net margin (-41.12%), ROIC -21.96%, value destroying | Worse profitability; net margin -61.2%, ROIC -19.25%, value destroying |

| Innovation | Declining ROIC trend; very unfavorable moat assessment | Declining ROIC trend; very unfavorable moat assessment |

| Global presence | Not explicitly strong; limited data suggests moderate reach | Not explicitly strong; smaller scale but growing product sales |

| Market Share | Unfavorable financial ratios, asset turnover low (0.41) | Even lower asset turnover (0.23), weaker market efficiency |

Key takeaways: Both companies are currently value destroyers with declining profitability and unfavorable financial ratios. indie Semiconductor shows higher revenue growth in products but struggles more with profitability. Investors should exercise caution and monitor improvements before considering these stocks.

Risk Analysis

Below is a comparative risk overview for Ambarella, Inc. (AMBA) and indie Semiconductor, Inc. (INDI) based on the most recent data available.

| Metric | Ambarella, Inc. (AMBA) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Market Risk | Beta 1.98 – High volatility, sensitive to tech sector swings | Beta 2.59 – Very high volatility, more sensitive to market fluctuations |

| Debt level | Very low debt (D/E 0.01), low debt-to-assets 0.76% | Moderate debt (D/E 0.95), debt-to-assets 42.34% |

| Regulatory Risk | Moderate, automotive and security sectors face evolving standards | Moderate to high, automotive semiconductors exposed to stringent regulations |

| Operational Risk | Moderate, reliance on innovation in video processing tech | High, early-stage growth with execution risks in automotive semiconductor market |

| Environmental Risk | Low, limited exposure to heavy manufacturing | Low to moderate, semiconductor manufacturing impacts and sustainability pressures |

| Geopolitical Risk | Moderate, US-based but global supply chain dependencies | Moderate, US-based with international supply chain and market exposure |

In synthesis, indie Semiconductor faces the most impactful risks due to its high market volatility, significant debt load, and operational challenges as a younger company in a competitive industry. Ambarella’s main concern lies in market volatility despite strong balance sheet metrics and a safe bankruptcy risk profile. Investors should carefully weigh these factors with a focus on risk tolerance and growth potential.

Which Stock to Choose?

Ambarella, Inc. (AMBA) shows favorable income growth with a 25.78% revenue increase in 2025 and positive gross margin of 60.5%, despite negative net margin and declining profitability ratios. Its debt levels are low and current liquidity strong, with a C+ rating reflecting moderate overall financial health.

indie Semiconductor, Inc. (INDI) has mixed income trends, showing a slight revenue decline of -2.91% in 2024 but strong gross profit growth of 263.85%. Profitability remains weak with negative margins and high debt ratios; its C rating indicates moderate financial standing but distress in cash flow and solvency metrics.

Investors prioritizing growth and income statement improvements might find AMBA’s favorable revenue and margin trends more appealing, while those with tolerance for volatility could interpret INDI’s mixed signals and higher leverage as potential for turnaround. Both companies display unfavorable financial ratios and value destruction signs, suggesting cautious evaluation.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Ambarella, Inc. and indie Semiconductor, Inc. to enhance your investment decisions: