Home > Comparison > Technology > CRUS vs AMBA

The strategic rivalry between Cirrus Logic, Inc. and Ambarella, Inc. defines the current trajectory of the semiconductor sector. Cirrus Logic operates as a fabless semiconductor company focused on mixed-signal processing solutions, while Ambarella specializes in system-on-chip designs for high-definition video and AI-driven vision applications. This analysis explores their contrasting operational models and growth strategies to determine which stock offers superior risk-adjusted returns for a diversified portfolio.

Table of contents

Companies Overview

Cirrus Logic and Ambarella anchor key segments of the semiconductor market with distinct yet complementary technology focuses.

Cirrus Logic, Inc.: Audio and Mixed-Signal Innovator

Cirrus Logic dominates the low-power mixed-signal semiconductor space. It generates revenue primarily from integrated circuit sales that combine ADCs and DACs for audio applications. In 2026, its strategic focus centers on enhancing user experience through proprietary SoundClear technology, targeting smartphones, AR/VR, and automotive audio, reinforcing its competitive edge in high-fidelity sound processing.

Ambarella, Inc.: Vision Processing Specialist

Ambarella leads in semiconductor solutions for HD and ultra-HD video processing. It earns revenue by selling system-on-a-chip designs that integrate AI, video, and image processing to OEMs and ODMs. The company’s 2026 strategy emphasizes expanding its footprint in automotive cameras and autonomous vehicle systems, leveraging artificial intelligence for advanced driver assistance and robotics applications.

Strategic Collision: Similarities & Divergences

Both companies excel in semiconductor innovation but differ sharply in focus—Cirrus Logic emphasizes audio and mixed-signal integration, while Ambarella targets video and AI vision processing. Their competition converges on high-tech consumer electronics and automotive markets. Cirrus offers stability through diversified audio solutions; Ambarella presents growth potential tied to AI-driven video technology, crafting distinct investment profiles.

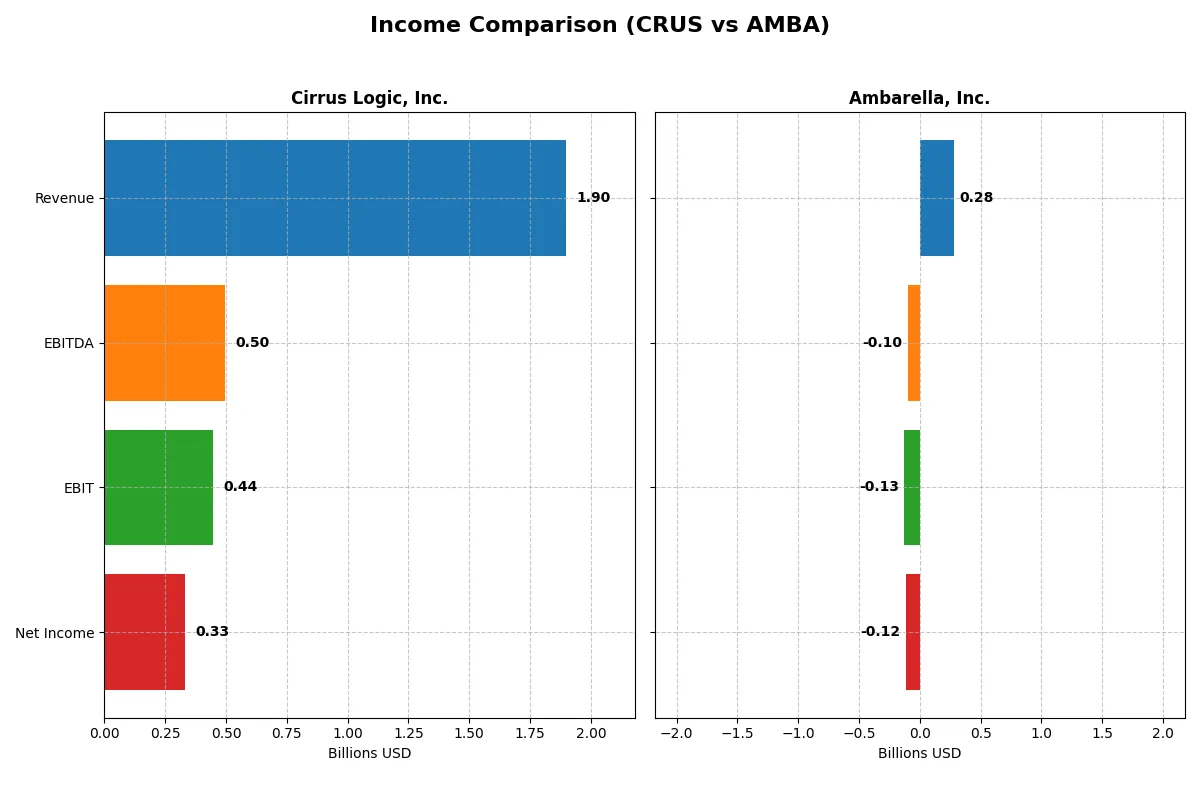

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Cirrus Logic, Inc. (CRUS) | Ambarella, Inc. (AMBA) |

|---|---|---|

| Revenue | 1.90B | 285M |

| Cost of Revenue | 900M | 113M |

| Operating Expenses | 586M | 299M |

| Gross Profit | 996M | 172M |

| EBITDA | 497M | -101M |

| EBIT | 445M | -127M |

| Interest Expense | 0.9M | 0 |

| Net Income | 332M | -117M |

| EPS | 6.24 | -2.84 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs a more efficient and profitable corporate engine through recent fiscal trends and margins.

Cirrus Logic, Inc. Analysis

Cirrus Logic’s revenue advanced steadily to 1.9B in 2025, with net income surging 52.5% over five years to 331M. Gross margin remains robust at 52.5%, while net margin improved to 17.5%, highlighting disciplined cost control. The latest year shows strong momentum, with EBIT up 21.9% and EPS growth surpassing 22%, underscoring operational efficiency.

Ambarella, Inc. Analysis

Ambarella grew revenue 25.8% year-over-year to 285M in 2025, yet it still posted a net loss of 117M. Despite a healthy gross margin of 60.5%, negative EBIT and net margins (-44.4% and -41.1%) indicate ongoing profitability challenges. While recent margin improvement is evident, cumulative net income declined nearly 96% over five years, reflecting structural issues.

Margin Strength vs. Profitability Trajectory

Cirrus Logic clearly outperforms Ambarella with consistent revenue growth coupled with expanding profitability and strong margin health. Ambarella’s higher gross margin cannot offset its persistent losses and negative net income trajectory. For investors prioritizing sustainable profits, Cirrus Logic’s profile offers greater fundamental appeal.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Cirrus Logic, Inc. (CRUS) | Ambarella, Inc. (AMBA) |

|---|---|---|

| ROE | 17.0% | -20.9% |

| ROIC | 14.2% | -21.9% |

| P/E | 15.9 | -27.1 |

| P/B | 2.7 | 5.6 |

| Current Ratio | 6.4 | 2.6 |

| Quick Ratio | 4.8 | 2.4 |

| D/E | 0.07 | 0.01 |

| Debt-to-Assets | 6.2% | 0.8% |

| Interest Coverage | 457 | 0 |

| Asset Turnover | 0.81 | 0.41 |

| Fixed Asset Turnover | 6.6 | 20.0 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, exposing hidden risks and illuminating operational excellence that raw numbers often conceal.

Cirrus Logic, Inc.

Cirrus Logic displays strong profitability with a 17.01% ROE and a solid 17.48% net margin, signaling efficient operations. Its P/E of 15.95 and P/B of 2.71 indicate a fairly valued stock, neither expensive nor cheap. The firm retains earnings to fuel R&D, reflecting a growth-oriented reinvestment strategy without paying dividends.

Ambarella, Inc.

Ambarella struggles with a negative ROE of -20.86% and a -41.12% net margin, indicating operational challenges. Despite a favorable negative P/E (reflecting losses), its P/B of 5.64 signals an expensive valuation relative to book value. The company does not pay dividends, focusing heavily on R&D, but risks remain high amid poor profitability.

Balanced Strength vs. High-Risk Innovation

Cirrus Logic offers a healthier balance of profitability and valuation stability, reflecting operational efficiency and prudent capital allocation. Ambarella carries elevated risk with weak returns and stretched valuation, fitting investors seeking speculative growth despite financial strain.

Which one offers the Superior Shareholder Reward?

Cirrus Logic (CRUS) eschews dividends but generates strong free cash flow—7.8/share in 2025—supporting aggressive buybacks that enhance shareholder value. Ambarella (AMBA) pays no dividends and suffers persistent losses, limiting buybacks and free cash flow. I see CRUS’s capital return strategy as sustainable and superior, promising a more attractive total return in 2026.

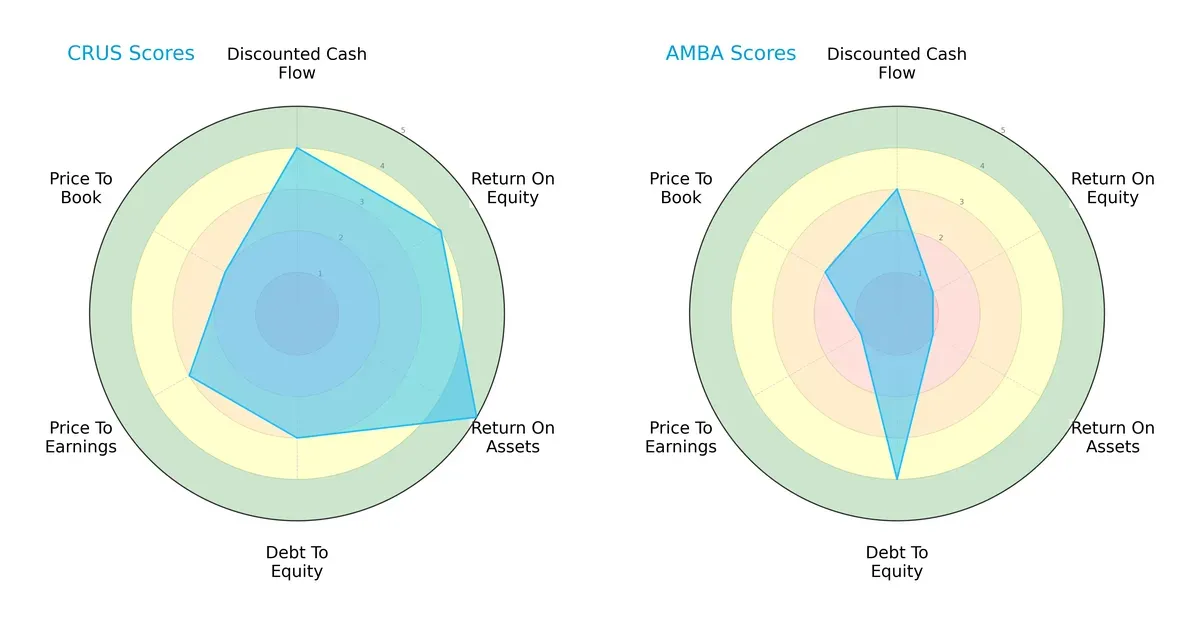

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Cirrus Logic and Ambarella, highlighting their financial strengths and strategic positioning:

Cirrus Logic shows a balanced profile with strong returns on equity (4) and assets (5), moderate leverage (3), and reasonable valuation scores. Ambarella leans heavily on a conservative balance sheet (debt/equity score 4) but suffers from weak profitability (ROE 1, ROA 1) and poor valuation metrics (P/E 1). Cirrus delivers a more consistent and diversified financial advantage, while Ambarella relies primarily on low leverage.

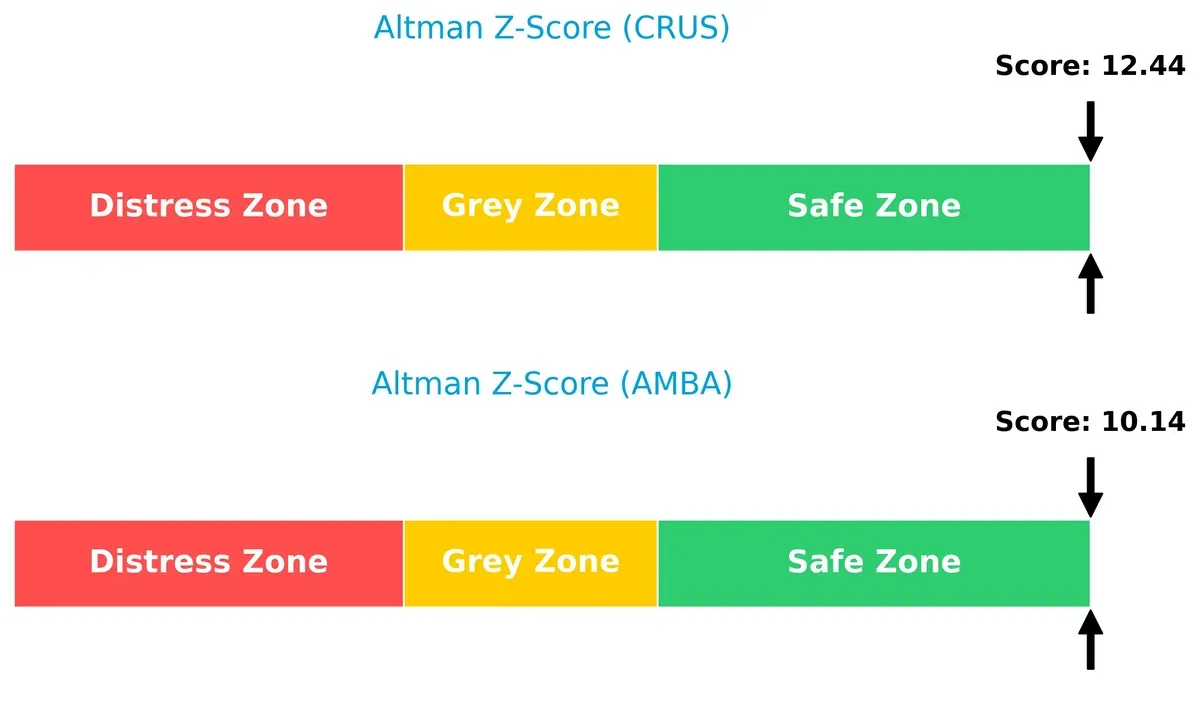

Bankruptcy Risk: Solvency Showdown

Cirrus Logic’s Altman Z-Score stands at 12.44, while Ambarella’s is 10.14; both reside comfortably in the safe zone. This suggests both firms have strong solvency buffers and low bankruptcy risk in the current economic cycle:

Financial Health: Quality of Operations

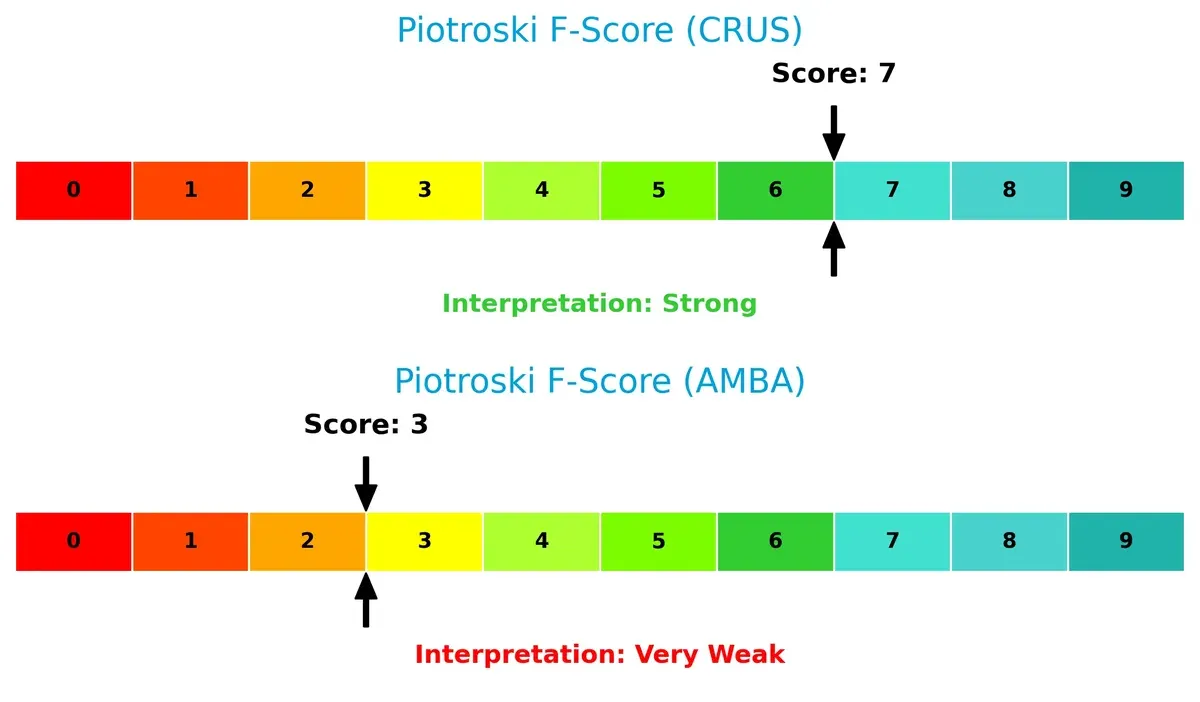

Cirrus Logic scores 7 on the Piotroski F-Score, indicating robust financial health and operational quality. Ambarella’s score of 3 signals potential red flags and weaker internal metrics, raising concerns about its financial resilience:

How are the two companies positioned?

This section dissects CRUS and AMBA’s operational DNA by comparing revenue distribution and internal dynamics. The goal is to confront their economic moats and identify the more resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

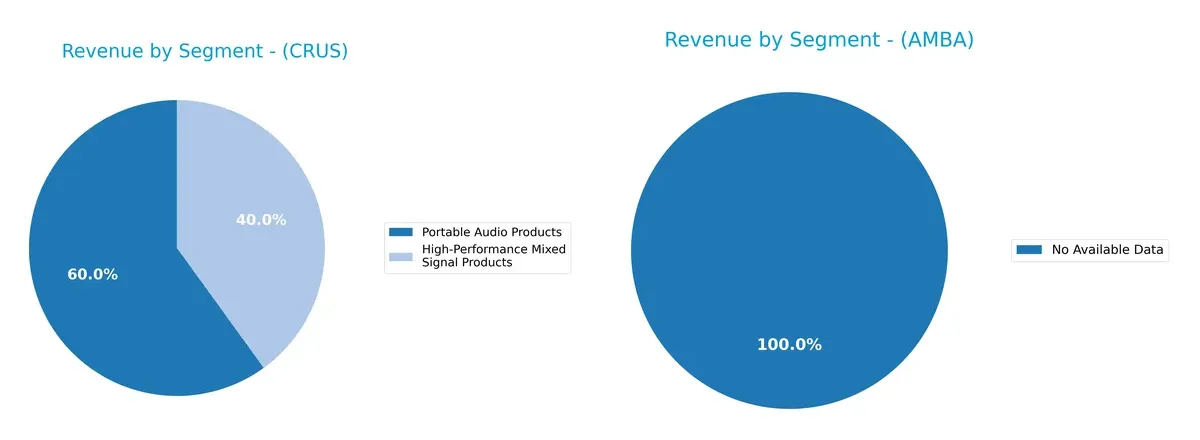

This visual comparison dissects how Cirrus Logic, Inc. and Ambarella, Inc. diversify their income streams and where their primary sector bets lie:

Cirrus Logic anchors its revenue in Portable Audio Products with $1.14B in 2025, dwarfing its High-Performance Mixed Signal segment at $759M. Ambarella shows no available data, so I cannot assess its diversification. Cirrus’s dominance in audio reflects a strategic bet on consumer electronics. This concentration risks exposure to market shifts but also signals strong ecosystem lock-in and specialized R&D focus.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Cirrus Logic and Ambarella based on diversification, profitability, financials, innovation, global presence, and market share:

Cirrus Logic Strengths

- Strong profitability with 17.48% net margin

- Favorable ROE at 17.01%

- Low debt-to-assets at 6.18%

- High interest coverage at 495x

- Diverse revenue from mixed signal and portable audio products

- Significant sales in China and Asia

Ambarella Strengths

- Favorable price-to-earnings despite negative earnings

- Low leverage with 0.76% debt-to-assets

- Positive current and quick ratios indicating liquidity

- High fixed asset turnover at 19.96

- Established presence in Taiwan and Asia Pacific

- Some geographic revenue diversification

Cirrus Logic Weaknesses

- Unfavorable current ratio at 6.35, suggesting working capital concerns

- Zero dividend yield

- Neutral asset turnover at 0.81

- Moderate P/B at 2.71

Ambarella Weaknesses

- Negative profitability with -41.12% net margin

- Negative ROE and ROIC

- High WACC at 12.97%

- Unfavorable interest coverage at 0

- Low asset turnover at 0.41

- Zero dividend yield

Cirrus Logic demonstrates robust profitability and conservative leverage but shows liquidity management risks. Ambarella struggles with profitability and operational efficiency yet maintains strong liquidity and asset utilization. These profiles imply different strategic focuses on financial health and market positioning.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat protects long-term profits from competitors’ erosion. Only a durable advantage secures sustainable returns in semiconductors:

Cirrus Logic, Inc.: Precision Audio & Mixed-Signal Moat

I see Cirrus’s moat in its specialized mixed-signal processing and proprietary SoundClear technology. Its 5% ROIC premium over WACC and stable 23% EBIT margin prove efficient capital use. New audio and sensing markets in 2026 could deepen this lead.

Ambarella, Inc.: AI-Driven Video Processing Moat

Ambarella’s competitive edge lies in AI-enhanced video SoCs, contrasting Cirrus’s audio niche. However, a steeply negative ROIC trend and -44% EBIT margin signal value destruction. Growth in automotive cameras offers upside but risks remain high.

Moat Strength Showdown: Precision Audio vs. AI Video Processing

Cirrus commands a wider, more durable moat with growing ROIC and robust margins. Ambarella struggles to convert innovation into profit, facing a shrinking moat. Cirrus stands better poised to defend market share through efficient capital allocation.

Which stock offers better returns?

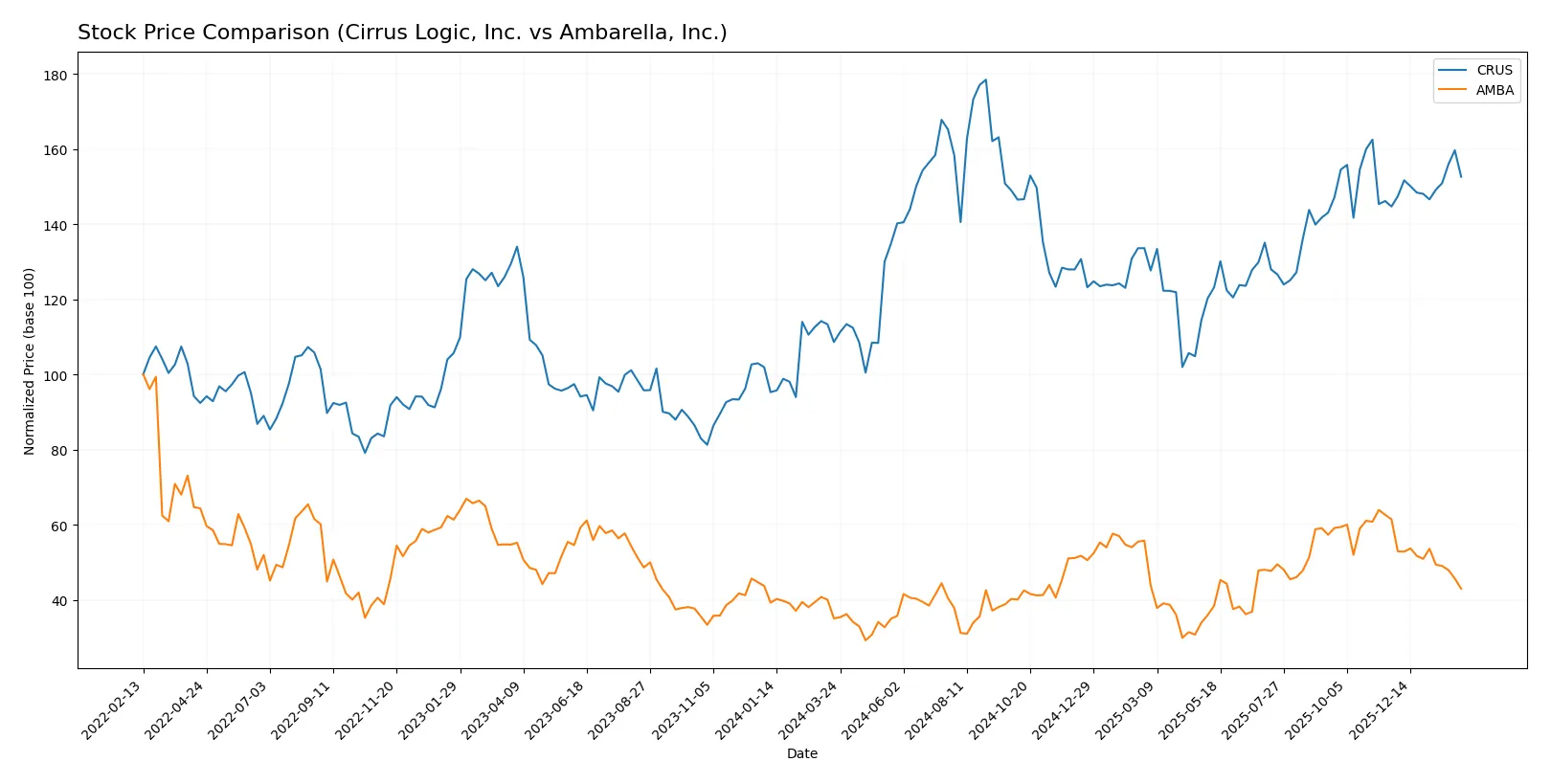

Over the past year, Cirrus Logic, Inc. (CRUS) and Ambarella, Inc. (AMBA) showed distinct price movements. CRUS gained significant ground with accelerating momentum, while AMBA’s gains slowed and recently reversed sharply.

Trend Comparison

Cirrus Logic’s stock rose 40.5% over the past year, marking a bullish trend with accelerating gains. It ranged between $82.02 and $145.69, showing strong volatility (14.36 std dev).

Ambarella’s stock gained 22.54% over the year, also bullish but with decelerating momentum. Notably, it faced a recent 30.08% drop, indicating short-term weakness and higher recent volatility (6.26 std dev).

CRUS outperformed AMBA with stronger overall returns and accelerating gains, while AMBA showed weaker recent performance and deceleration.

Target Prices

Analysts present a cautiously optimistic consensus on target prices for Cirrus Logic and Ambarella.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Cirrus Logic, Inc. | 100 | 155 | 138.75 |

| Ambarella, Inc. | 80 | 115 | 97.5 |

Target prices for Cirrus Logic suggest a potential upside from the current 124.58, reflecting confidence in its semiconductor niche. Ambarella’s consensus at 97.5 also implies significant room for growth from its 60.23 price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Cirrus Logic, Inc. Grades

Here are recent institutional grades for Cirrus Logic, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Benchmark | Maintain | Buy | 2025-11-05 |

| Keybanc | Maintain | Overweight | 2025-11-05 |

| Stifel | Maintain | Buy | 2025-11-05 |

| Barclays | Maintain | Equal Weight | 2025-11-05 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

Ambarella, Inc. Grades

Here are recent institutional grades for Ambarella, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Maintain | Neutral | 2025-11-26 |

| Rosenblatt | Maintain | Buy | 2025-11-26 |

| Stifel | Maintain | Buy | 2025-11-26 |

| Needham | Maintain | Buy | 2025-11-26 |

| Northland Capital Markets | Maintain | Outperform | 2025-08-29 |

Which company has the best grades?

Ambarella holds a stronger consensus with multiple “Buy” and “Outperform” ratings versus Cirrus Logic’s mix of “Buy,” “Overweight,” and “Equal Weight.” This suggests Ambarella might attract more bullish investor sentiment.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Cirrus Logic, Inc.

- Operates in a mature semiconductor segment with steady demand but intense competition from diversified chipmakers.

Ambarella, Inc.

- Faces fierce competition in video processing chips amid rapid tech shifts and high innovation demands.

2. Capital Structure & Debt

Cirrus Logic, Inc.

- Maintains a low debt-to-equity ratio (0.07), signaling conservative leverage and low financial risk.

Ambarella, Inc.

- Extremely low debt level (0.01 debt-to-equity) but interest coverage is zero, indicating vulnerability to financing costs.

3. Stock Volatility

Cirrus Logic, Inc.

- Beta of 1.14 suggests moderate volatility, closely tracking the broader tech market swings.

Ambarella, Inc.

- Higher beta of 1.94 implies greater share price volatility, increasing investor risk exposure.

4. Regulatory & Legal

Cirrus Logic, Inc.

- Exposure to global semiconductor regulations and export controls; manageable due to diversified end-markets.

Ambarella, Inc.

- Faces regulatory scrutiny in AI and video surveillance applications, elevating compliance costs and risks.

5. Supply Chain & Operations

Cirrus Logic, Inc.

- Strong operational efficiency with favorable fixed asset turnover (6.62) but supply chain disruptions remain industry-wide.

Ambarella, Inc.

- Lower asset turnover (0.41) signals operational inefficiencies; supply chain risks amplified by niche product focus.

6. ESG & Climate Transition

Cirrus Logic, Inc.

- No direct ESG red flags; moderate carbon footprint expected given semiconductor fabless model.

Ambarella, Inc.

- Increasing pressure to address sustainability in AI hardware production; currently lacks robust ESG initiatives.

7. Geopolitical Exposure

Cirrus Logic, Inc.

- US-based but sells globally; vulnerable to China-US tech tensions but diversified sales mitigate single-market risk.

Ambarella, Inc.

- Similar global exposure but higher dependency on automotive and security sectors affected by geopolitical shifts.

Which company shows a better risk-adjusted profile?

Cirrus Logic’s low leverage, solid profitability, and moderate volatility create a safer risk-adjusted profile. Ambarella’s negative margins, weak returns on capital, and high volatility raise caution. Cirrus’s Altman Z-Score (12.44) and Piotroski Score (7) confirm robust financial health; Ambarella’s scores (10.14 and 3) highlight operational fragility. The stark contrast in interest coverage—495.45 for Cirrus versus zero for Ambarella—signals a critical risk for Ambarella.

Final Verdict: Which stock to choose?

Cirrus Logic’s superpower lies in its durable competitive advantage and consistent value creation, driven by a rising ROIC well above its cost of capital. Its strong cash conversion cycle and robust profitability support steady growth. The point of vigilance remains its unusually high current ratio, which could signal inefficient asset use. This stock fits best in an Aggressive Growth portfolio seeking stability with growth potential.

Ambarella’s strategic moat is its cutting-edge R&D investment, though it currently struggles with significant value destruction and declining profitability. Its lighter debt load and moderate liquidity offer some safety compared to Cirrus Logic. This profile suits investors inclined toward GARP – Growth at a Reasonable Price – with a tolerance for turnaround risk and valuation volatility.

If you prioritize resilient profitability and efficient capital deployment, Cirrus Logic outshines Ambarella with a proven moat and improving fundamentals. However, if you seek high growth fueled by innovation and can accept elevated risk, Ambarella offers potential upside despite financial headwinds. Both scenarios require careful risk management aligned with your investment horizon.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cirrus Logic, Inc. and Ambarella, Inc. to enhance your investment decisions: